Soy Complex in Adobe Acrobat - Benson

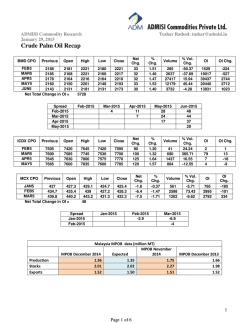

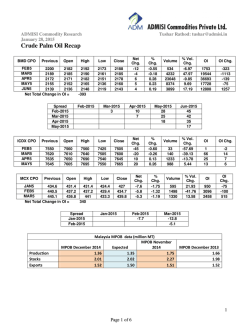

Benson Quinn Commodities Inc. Minneapolis, MN Soy Complex Review: Beans closed higher today on a mixed of supportive fundamental news and return of risk-on exuberance in the macro markets. Malaysian palm oil futures rallied 5% overnight as Indonesia looks to increase its biodiesel subsidy substantially. This supported today’s rally in soyoil and supported firmer overnight trade in the beans. Strong weekly export demand for beans once again coming in above trade expectations supported the firmer day session which had beans pushing back up near Tuesday’s rally highs. Soymeal got the short end of the stick today trading and closing lower in spite of strong export demand as meal was sold against long the soyoil trade. In the macro markets, the US dollar after a firmer start last night turned lower and supported recoveries across the broad commodity sphere. Crude oil recovered some of yesterday’s losses with the front month march once again above $50 a barrel. US equities were also higher today with rebound in commodities helping the Dow close higher for the 4-th straight session and near a 1-month high. This week’s volatility is not over yet with tomorrow bringing monthly jobs data with economists looking for US to have added 236,000 jobs in January with the unemployment rate to be unchanged at 5.6%. Funds bought an estimated 6,000 beans and 3,000 soyoil while selling 2,000 meal. The overnight session started mixed but quickly uncovered support and trended higher into the morning pause. Reversal in crude, the rally in Malaysian palm and cut in bank reserve rates by the Chinese all offered support. Short covering ahead of weekly export sales was also noted. The day session opened strongly higher on fresh intraday highs but ran into selling for a rather choppy first couple of hours of day session trade but as outside markets and specifically crude gained beans settled down to steady gains closing near the top end of the day’s trading range. March futures closed up 9 ¼-cents at $9.81 ¼ with the front month contract up 20-cent for the week. November futures gained 9 ¾-cents on the day to close at $9.64 ¾ and is up 19cents for the week. After trading easier yesterday, the calendar spreads firmed mildly today with the March/May spread closing at 6 ½-cent carry. The Goldman roll starts tomorrow. By looks of open interest changes yesterday, someone was front running that spread yesterday with the March O/I down 12,457 contracts. First notice the March contract in still several weeks out on Friday, February 27. The products were strongly mixed with soyoil rallying to 2-week highs while meal closed lower on the spread. Weekly export sales were 489,700 MT for old crop and 7,100 MT for new. China bought a net 225,000 MT that included new purchases of 439,400 MT, 107,000 MT switched from unknown and cancellation of 321,300 MT. Year-to-date China has bought 28.5 MMT compared to 27.6 MMT for the same period last year. Outstanding sales to China are 3.4 MMT compared to 5.8 MMT last year. Outstanding sales to unknown destination is 2.08 MMT compared to 2.11 MMT last year. USDA is forecasting total US exports at 1,770 million bushels. Accumulated sales as of January 29 are 1,671 million or 94% of forecast. Accumulated shipments are 1,343 million or 76% of forecast. Most are looking for USDA to raise export demand next Tuesday by 10 to 20 million bushels with ending stocks declining a corresponding amount. The average estimate for US ending stocks is 394 million, down from last month’s 410 million. The Goldman roll starts tomorrow which should weigh on the front month March contract especially at the close. The upcoming USDA report should offer support on pre-report short covering. Macro markets are the wild card with January employment data due at 7:30 AM CST. Kim Rugel February 5, 2015 Settlements: Close SH15 981 ¼ SK15 987 ¾ SN15 992 ¾ SX15 964 ¾ SMH15 331.40 BOH15 31.71 RSH15 458.70 Change +9 ¼ +9 +9 +9 ¾ -1.30 +1.21 +3.40 High 982 ¾ 989 994 965 ½ 334.10 31.97 460.50 Low 969 ¼ 976 981 952 ¾ 330.00 30.55 452.20 Volume/Open Interest (# of Contracts): Total Volume Open Interest Total 215,113 703,667 SH15 121,561 276,386 SK15 47,954 164,303 SX15 13,502 125,005 Change -4,607 -12,457 +4,261 +1,501 Technicals: Support SH15 959 ½ SX15 945 ½ 50-Day MA 1019 996 Resist 989 ¼ 971 ¾ 20-Day MA 989 ¼ 971 ¾ USDA Weekly Export Data: Date Inspections (MT) 2/2/15 Bean Sales (MT) 2/5/15 Meal Sales (MT) 2/5/15 Oil Sales (MT) 2/5/15 Export Markets: Mo CIF FHFeb +84H LHFeb +78H Chg ----- Processor Markets: Mo MKTO Chg Feb -25H --Mar -30H --- Trade Est. 1,150-1,300 200-400 120-250 5-15 Actual 1,697,852 496,800 302,300 15,100 St. Paul -55H -55H Chg ----- PNW +103H +95H Chg ----- Decatur +15H +15H Chg +3 +3 Lincoln -20H -25H Chg ----- Brazilian Market (previous day): Mo Beans Chg Meal Chg Feb +68/+75 +3/-1 NA --Mar +61/+63 +2/+3 +8/+9 -- Oil +130/+150 +90/+100 Chg -20 -20/-30 Commitment of Traders Supplemental with Options: Jan 27, 2013 Long Short Net Large Actual 106,669 178,830 (72,161) Funds Change (17,608) +11,550 +29,157 Commercial Actual 343,310 303,518 +39,792 Hedger Change +36,467 +5,845 +30,621 Small Actual 46,285 142,113 (95,828) Trader Change +48 +1,940 +1,892 Index Actual 144,757 16,560 128.197 Funds Change (728) (1,155) +428 CBOT Deliverable Stocks (Thou Bus): Jan 30, 2015 Week Ago All Warehouses All Warehouses Del 3,602 4,500 Non 723 1,284 Total 4,325 5,784 Year Ago All Warehouses 5,424 1,711 7,135 Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. Information contained herein is believed reliable. Benson Quinn Commodities, Inc. does not guarantee that such information is accurate or complete. Opinions expressed reflect judgment at this date and are subject to change without notice. BQCI is a wholly owned subsidiary of Archer Daniels Midland Company An Introducing Broker for ADMIS 701 South 4th Avenue, Suite 800, Minneapolis, MN 55415, 1-800-438-7070

© Copyright 2026