Daily Report - Moneycontrol

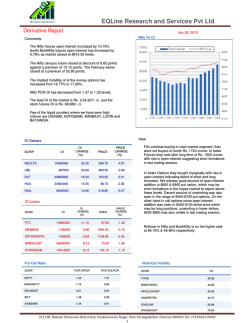

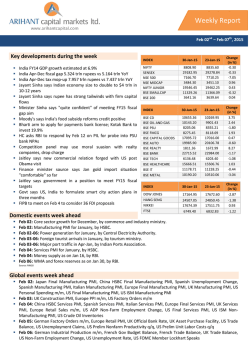

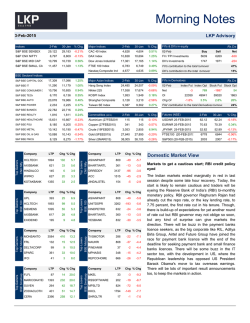

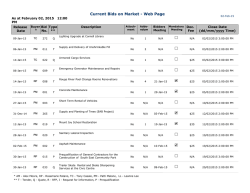

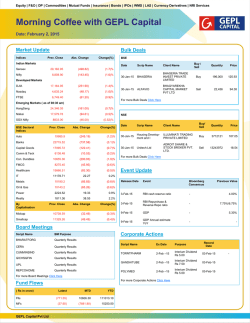

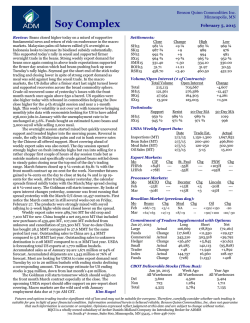

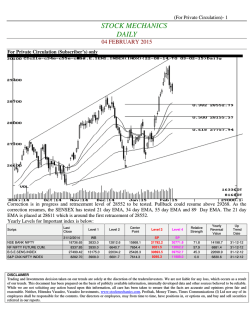

Daily Report Xf Wednesday, Jan 28th, 2015 Technical stocks for the day Scrip Name BPCL Bharti Airtel Jubilant Foods Buy/Sell Buy above 695 Buy above 396 Buy above 1437 Indian Indices Open High Low Close Change % Chg BSE 29451.65 29618.59 29286.09 29571.04 292.20 1.00 NSE 8871.35 8925.05 8825.45 8910.50 74.90 0.85 Close (% )Chg Dow Jones 17387.21 -1.65 Nasdaq 4681.50 -1.89 Nikkei 17758.63 -0.06 Hang Seng 24782.05 -0.10 FTSE 6811.61 -0.60 Close Chg Gold($/Ounce) 1290.70 -1.00 Silver ($/Ounce) 18.02 -0.05 Crude( $/bbl) 45.45 -0.78 Currency Close (%) Chg Rs/USD 61.40 -0.17 Rs/EUR 69.30 0.29 Support/Resistance Support 1 Support 2 Nifty 8849 8787 Sensex 29365 29159 Resistance 1 Resistance 2 8949 8987 29697 29824 CMP 692.05 394.20 1421.50 Stop Loss ---- Target 705-710 400-405 1460-1470 Market Overview And Technical Outlook Source: BSE NSE Global Indices Source: Bloomberg . Commodity Source: Bloomberg Source- Falcon On 27/01/2015 markets opened higher and momentum on the upside intensified in the latter half of the session which led the indices to close near days high. On the sectoral front Bankex, Capital Goods, Auto and FMCG led the rally whereas IT and Metal ended on the losing side. The advance decline ratio was in favour of declining counter (Advances = 1407, Declines = 1537). Source: MCX-SX.Com. 52 Wk High (A group) 52 Wk Low (A group) 52 Close Company Wk Price Low Bhushan 84.65 84.50 Company Close Price Alembic 481.3 52 Wk High 494.6 Alstomt&d 528.8 563.9 Den 119.8 119.5 Amaraja 893.9 894.9 Mcleod 207.7 206.1 Apollohosp 1345 1364 -- -- -- Ashok Ley 66.10 66.30 -- -- -- Pattern Formation: On the daily chart, we are observing that prices came very close to the short term 5-day EMA and has closed convincingly above it. Outlook: The current price action on the daily chart suggests that the undertone in the market is positive. In coming trading session if Nifty trades above 8925 level then it can test 8980 – 9020 levels. On the downside Nifty has support at 8850 – 8800 levels. Source: BSE Generating Wealth. Satisfying Investors. 1 Update Report Market Breadth NSE BSE Advances 720 1407 Declines 807 1537 Same 52 98 0.89:1 0.92:1 A/D Ratio Source: BSE NSE Market Turnover (Rs. in crores) Indices 27-Jan 23-Jan Chg (%)chg BSE 3890.86 4032.25 -141.39 -3.51 NSE 21480.34 21474.52 5.82 0.03 Futures 106437.5 62864.77 43572.73 69.31 Options 284636.1 287562.7 -2926.60 -1.02 416445 375934 40510.56 10.78 Total Source: BSE NSE Indices Watch Indices Bank Nifty Close 20555.25 (%) Chg 2.40 CNX IT 11693.45 -1.61 BSE Midcap 10780.47 0.79 CNX Midcap 13143.80 0.84 BSE Small Cap 11424.48 0.51 BSE Auto 20355.78 1.24 BSE Bankex 23511.76 2.30 BSE Capital Goods 17328.95 1.84 BSE Consumer Durables 10312.39 0.41 BSE FMCG 8211.12 1.14 BSE HC 15559.93 0.34 BSE IT 11042.23 -1.66 BSE Metal 10447.09 -0.60 BSE Oil & Gas 9905.97 0.05 BSE Power 2206.78 0.88 BSE PSU 8345.47 -0.12 BSE Realty 1690.25 1.03 BSE TECk 6137.12 -1.07 India VIX 18.0850 1.11 Source: BSE NSE Index PE Nifty 27-Jan 22.67 Yr high 25.91 Yr low 15.23 Sensex 20.08 24.47 15.84 Source: BSE NSE Macro Economic Data Monthly Inflation (m-o-m) IIP growth (m-o-m) Repo Rate Reverse Repo Rate CRR GDP Growth (q-o-q) Current 0.11% 3.80% 7.75% 6.75% 4.00% Previous 0.00% -4.20% 8.00% 7.00% 4.00% 5.30% 5.70% Source: Various Generating Wealth. Satisfying Investors. . Data Alert From India – N.A. Data Alert From Overseas – GfK German Consumer Climate at 12:30 pm US Crude Oil Inventories at 7:00 pm Domestic Stock Specific News – Obama says US wants to partner in India's next wave of growth Jaitley says govt in a position to meet FY15 fiscal targets Govt says US, India to formulate smart city action plans in three months Max India says to demerge company into three listed companies Revenue secretary says fighting fake currency note menace a huge challenge Court gives two weeks to CBI for final report on Hindalco coal case Moody's says Indian bond issuances to remain strong in 2015 S&P may up Tata Motors rating if JLR operations thrive, local sales revive Power minister, power producers to meet on Thursday on UMPP bid document SC says to hear West Bengal vs Tata Motors Singur land case in Mar Union Bank CMD says Oct-Dec slippages 17.38 bln rupees South Indian Bank hikes 46-90 day retail deposit rate by 250 bps to 7% JK Tyre says promoters up shareholding to 52.34% in Jan 8 from 47.35% in Dec GMR Infra says HC gave three months to tribunal to decide Delhi airport plea International News – US Dec core durable goods orders fell 0.8% from -0.7% US Dec durable goods orders fell 3.4% from -0.9% US Jan flash services PMI rose to 54 from 53.3 US Jan CB consumer confidence rose to 102.9 from 93.1 US Dec new home sales increased by 50,000 to 481,000 Macro Economic Calendar Date rd Indian Monetary Policy 03 Feb 2015 Indian GDP Data 09 Feb 2015 Indian IIP Data 12 Feb 2015 Indian Inflation Data 16 Feb 2015 th th th Source: Various 2 Update Report FII and DII Cash Activities 27-01-2015 – FIIs Purchase DII Sales Net Purchase Sales Net Total Net Date (Rs cr) (Rs cr) (Rs cr) (Rs cr) (Rs cr) (Rs cr) (Rs cr) 27/01/15 7816.20 6862.69 953.51 1449.09 2232.43 -783.34 170.17 23/01/15 7171.82 5151.84 2019.98 1320.15 2620.11 -1299.96 720.02 22/01/15 5408.39 4815.60 592.79 1781.45 2359.98 -578.53 14.26 21/01/15 7222.30 5156.81 2065.49 1528.49 2878.51 -1350.02 715.47 20/01/15 4796.00 3520.41 1275.59 1517.70 2279.30 -761.60 513.99 Month to date – Jan 83015.70 75084.84 7930.86 29472.37 34343.75 -4871.38 3059.48 (Data Source: NSE; Rs in crores) The FII’s total buying on 27-01-2015 is Rs 953.51 cr while DII total selling Rs 783.34 cr. FII Derivative Statistics 27-01-2015 – BUY SELL OPEN INTEREST No. of contracts Amt in Crores No. of contracts Amt in Crores Total No. of contracts Amt in Crores Amt. Cr. (Pre. Day) Change in OI% INDEX FUTURES 438760 10731.42 366025 8999.73 1731.69 1063069 26504.74 23694.22 11.86 INDEX OPTIONS 816881 21737.99 802518 21113.89 624.09 2977452 79997.56 78771.12 1.56 STOCK FUTURES 724306 22841.24 748685 23598.22 -756.97 1912609 58807.02 55442.93 6.07 STOCK OPTIONS 88723 3087.24 94508 3264.12 -176.88 114440 3883.74 3816.37 1.77 2068670 58397.89 2011736 56975.96 1421.92 6067570 169193.06 161724.65 4.62 Symbol TOTAL Open Interest of derivative segment increased to Rs 169193.06 cr vs Rs 161724.65 cr. FIIs net buyer in index futures to the amount of Rs 1731.69 cr and in index options net buyer to the amount of Rs 624.09 cr. Put-Call Ratio at 1.17 vs 1.28 (Bearish). Most Active Nifty Call Option Contracts – Symbol Expiry Date Strike Price No. of Contracts Traded % Change in Contracts Contract Value (Rs. Lakhs) Closing Price % Change in Price Open Interest (OI) % Change in OI NIFTY 29-Jan-15 8900 1512925 16.69 3379556.74 54.00 58.59 4004300 3.66 NIFTY 29-Jan-15 9000 874762 -13.96 1970075.56 12.45 9.69 4743525 7.84 NIFTY 29-Jan-15 8800 627845 -14.43 1395476.55 125.70 65.39 2319150 -25.90 NIFTY 29-Jan-15 8950 333771 130.61 748382.17 28.50 31.64 1989450 242.17 NIFTY 29-Jan-15 8850 282383 54.12 628823.88 87.50 54.32 1292700 -21.04 Most active Nifty call option is at 8900 with 1512925 contracts 2nd highest active Call at Strike 9000. Generating Wealth. Satisfying Investors. . 3 Update Report Most Active Nifty Put Option Contracts – Symbol Expiry Date Strike Price No. of Contracts Traded % Change in Contracts Contract Value (Rs. Lakhs) Closing Price % Change in Price Open Interest (OI) % Change in OI NIFTY 29-Jan-15 8800 1455664 17.60 3210372.33 12.40 -72.84 4210000 25.95 NIFTY 29-Jan-15 8700 777467 -29.65 1692353.24 4.75 -74.32 4705700 1.15 NIFTY 29-Jan-15 8900 672818 99.61 1506050.95 36.00 -60.07 2225950 197.31 NIFTY 29-Jan-15 8600 464058 -39.12 998090.15 2.75 -66.67 4366025 -8.17 NIFTY 29-Jan-15 8500 329398 -39.56 700136.27 1.80 -64.00 4036175 -17.78 Most active Nifty put option is at 8800 with 1455664 contracts 2nd highest active Put at Strike 8700. Most Active Stock Futures – Expiry Date No. of Contracts Traded Contract Value (Rs. Lakhs) Closing Price % Change in Price Close Open Interest (OI) % Change in OI Value of Underlying HDFCBANK 29-Jan-15 77017 203399.97 1070.40 2.22 17163000 -42.13 1068.00 HDFCBANK 26-Feb-15 72741 194438.51 1083.00 2.26 29655000 115.94 1068.00 AXISBANK 29-Jan-15 51826 150847.35 594.50 5.04 14000500 -27.15 593.25 RELIANCE 29-Jan-15 50813 113048.76 889.50 -0.02 16170500 -34.86 887.25 RELIANCE 26-Feb-15 47495 106541.97 897.30 0.07 19248500 94.03 887.25 Symbol Most active stock future is HDFCBANK JAN with 77017 contracts while 2nd active stock is HDFCBANK FEB. Open Interest Figures (Jan Month Futures) – Bullish Trend : in OI - in Price Bearish Trend : in OI - in Price Open Interest % Chg in OI Price % Chg in Price -- -- -- -- -- -- -- -- -- -- -- -- -- -- -- -- -- -- -- -- -- -- Symbol Open Interest % Chg in OI Price % Chg in Price -- -- -- -- -- -- -- -- -- -- -- -- -- -- -- -- -- -- -- -- -- -- -- -- -- -- -- -- Short Covering: In OI - In Price -- Long Position Squared Off: In OI - In Price Symbol Open Interest % Chg in OI Price % Chg in Price JUBLFOOD 772250 -61.92 1424.45 ITC 16860000 -47.05 HDFCBANK 17163000 RANBAXY JSWSTEEL Symbol Open Interest % Chg in OI Price % Chg in Price 2.01 UNIONBANK 3416000 -47.89 237.30 -5.89 360.40 2.84 -42.13 1075.20 2.68 HINDUNILVR SUNPHARMA 4491000 5903000 -42.92 -39.81 944.20 915.65 -2.17 -1.02 4307500 -41.87 707.90 0.16 HCLTECH 1595625 -38.59 1620.65 -1.88 2856750 -41.56 1015.50 0.19 HINDALCO 19496000 -38.19 142.40 -1.83 Generating Wealth. Satisfying Investors. . Symbol 4 Update Report Securities in Ban For Trade Date 28-01-2015 IBREALEST, KTKBANK Today’s Result – Aban Offshore, Accelya, Adani Ports, Adani Power, Ajanta Pharma, Alkylamine, Alstom T&D, Astral Poly, Availfc, AVTNPL, Bharat Gear, Birlamoney, BTTL, Clarus, Cniresltd, Coralfinac, Daichi, Eihotel, Emami Ltd, Envairel, Fortismlr, Foseco Ind, Geometric, Gogia Capital, Granules India, Gravissho, Havells India , Invicta, JM Financial, Just Dial, Jyothy Lab, Kalyani Forg, KGL, Lloydeleng, Ludlowjut, Lumax Tech, Maral Overseas, Maruti Sec, Monel, Nationstd, Network, Nocil, Noida Toll, Pidilite Ind, Pitti Lamination, Polyspin, Polytex, Punctrd, Ranbaxy, RJL, Rosei, SBBJ, Silinv, Sintex, Snowman, Torrent Pharma, Welspun Corp, Welinv, Wellesley, Wwtechhol EX- Dividend + Board Meeting – EX-Dividend – BEL, Supreme Ind Board Meeting (Purpose) – Accelya (Interim Dividend), AVTNPL (Interim Dividend), Cerebraint (General), Clarus (General), Foseco Ind (Final Dividend), JM Financial (Interim Dividend), Just Dial (Employee Stock Option Plan), Lloydeleng (General), Maproin (General), Monot (General), Pitti Lamination (Interim Dividend, Stock Split), Rico Auto (General), Torrent Pharma (Interim Dividend) Bulk Deals (BSE)* N.A. Bulk Deals (NSE)* Deal Date Scrip Name 27-Jan-15 EDELWEISS FIN 27-Jan-15 ZEE LEARN Client Name Deal Type Quantity Price FIDELITY INVESTMENT TRUST - FIDELITY INTL DISCOVERY FUND BUY 16341678 72.50 J P MORGAN SECURITIES LTD AC COPTHALL MAURITIUS INVESTMENT BUY 2500000 31.25 Note- Executed on 27th Jan, 2015. Bulk Deal Buy/sell done by fund house is considered. Generating Wealth. Satisfying Investors. . 5 Update Report Contact Website Email Id SMS: ‘Arihant’ to 56677 www.arihantcapital.com [email protected] Arihant is Forbes Asia’s ‘200 Best under a $Billion’ Company ‘Best Emerging Commodities Broker’ awarded by UTV Bloomberg Disclaimer: This document has been prepared by Arihant Capital Markets Limited (hereinafter called as Arihant) and its subsidiaries and associated companies. This document does not constitute an offer or solicitation for the purchase and sale of any financial instrument by Arihant. Receipt and review of this document constitutes your agreement not to circulate, redistribute, retransmit or disclose to others the contents, opinions, conclusion, or information contained herein. This document has been prepared and issued on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst meticulous care has been taken to ensure that the facts stated are accurate and opinions given are fair and reasonable, neither the analyst nor any employee of our company is in any way is responsible for its contents and nor is its accuracy or completeness guaranteed. This document is prepared for assistance only and is not intended to be and must not alone be taken as the basis for an investment decision. All recipients of this material should before dealing and or transacting in any of the products referred to in this material make their own investigation, seek appropriate professional advice. The investments discussed in this material may not be suitable for all investors. The recipient alone shall be fully responsible/are liable for any decision taken on the basis of this material. Arihant Capital Markets Ltd (including its affiliates) or its officers, directors, personnel and employees, including persons involved in the preparation or issuance of this material may; (a) from time to time, have positions in, and buy or sell or (b) be engaged in any other transaction and earn brokerage or other compensation in the financial instruments/products discussed herein or act as advisor or lender/borrower in respect of such securities/financial instruments/products or have other potential conflict of interest with respect to any recommendation and related information and opinions. The said persons may have acted upon and/or in a manner contradictory with the information contained here and may have a position or be otherwise interested in the investment referred to in this document before its publication. The user of this report assumes the entire risk of any use made of this data / Report. Arihant especially states that it has no financial liability, whatsoever, to the users of this Report. ARIHANT Capital Markets Ltd st RCH-DMU-01 #1011, Solitaire Corporate Park, Building No.10, 1 Floor, Andheri Ghatkopar Link Road, Chakala, Andheri (E), Mumbai-400093 T. 022-42254800. Fax: 022-42254880 www.arihantcapital.com Generating Wealth. Satisfying Investors. . 6

© Copyright 2026