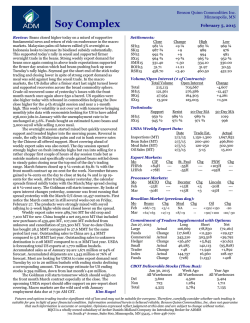

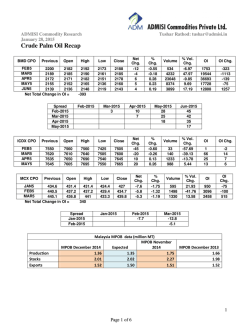

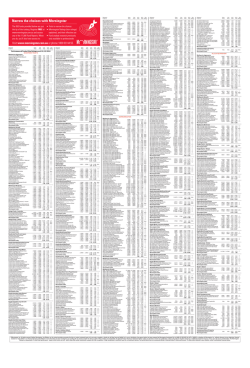

consolidated stock listings - AP Markets

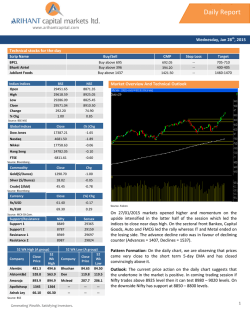

Today Racking up debt 17,920 17,460 17,000 Monthly jobs snapshot Investing in growth D $78.69 $82 Dominion Resources reports $65.85 fourth-quarter financial results today. 72 Wall Street expects the company’s earnings improved from ’14 a year earlier. Dominion has been 62 spending heavily on power projects, est. Operating $0.80 $0.84 including development of a new EPS nuclear reactor in Virginia, offshore 4Q ’13 4Q ’14 wind power operations and solar Price-earnings ratio: 31 energy projects. Investors will be based on past 12-month results listening for an update on when the Dividend: $2.40 Div. yield: 3.0% company expects the various Source: FactSet projects to contribute to its earnings. Economists predict that U.S. consumers took on more debt in December. The Federal Reserve is expected to report today that consumer borrowing climbed $15 billion last month. That would be a bigger increase than the $14.1 billion gain that pushed consumer debt excluding real estate loans to a record $3.3 trillion in November. An improving economy and strong employment gains may be making consumers more comfortable with racking up debt. Dow Jones industrials 2,080 Close: 17,884.88 Change: 211.86 (1.2%) 2,020 NAME Close: 2,062.52 Change: 21.01 (1.0%) 18,000 10 DAYS 2,080 17,500 2,000 17,000 1,920 16,500 16,000 A S O N stocks recap DOW DOW Trans. DOW Util. NYSE Comp. NASDAQ S&P 500 S&P 400 Wilshire 5000 Russell 2000 D 1,840 J HIGH 17889.58 8972.56 640.69 10901.22 4767.38 2063.55 1482.71 21785.25 1209.90 LOW 17677.26 8892.59 632.00 10820.57 4722.80 2043.45 1470.02 21536.44 1195.41 CLOSE 17884.88 8966.58 639.32 10896.06 4765.10 2062.52 1482.04 21774.50 1208.71 NYSE NASD Vol. (in mil.) 3,694 Pvs. Volume 4,005 Advanced 2388 Declined 773 New Highs 148 New Lows 15 1,974 2,084 2022 713 93 37 foreign exchange 1YR. MAJORS CLOSE CHG %CHG AGO USD per British Pound 1.5332 +.0110 +.72% 1.6312 Canadian Dollar 1.2442 -.0124 -1.00% 1.1077 USD per Euro 1.1472 +.0054 +.47% 1.3535 Japanese Yen 117.57 +.21 +.18% 101.31 Mexican Peso 14.7948 -.0384 -.26% 13.2818 The dollar slumped against the euro, British pound and Canadian dollar. It was more resilient against the Japanese yen. EUROPE/AFRICA/MIDDLE EAST Israeli Shekel 3.8545 +.0025 +.96% Norwegian Krone 7.5272 +.0009 +.68% South African Rand 11.2783 +.0015 +1.69% Swedish Krona 8.2535 +.0003 +.25% Swiss Franc .9229 +.0010 +.09% 3.5358 6.2321 11.1446 6.5258 .9034 ASIA/PACIFIC Australian Dollar Chinese Yuan Hong Kong Dollar Indian Rupee Singapore Dollar South Korean Won Taiwan Dollar 1.1225 6.0605 7.7619 62.590 1.2683 1077.66 30.38 1.2814 -.0038 6.2524 +.0061 7.7515 -.0005 61.683 -.078 1.3442 -.0035 1086.15 -2.14 31.46 -.01 -.30% +.10% -.01% -.13% -.26% -.20% -.03% A CHG. +211.86 +81.64 +5.47 +121.02 +48.40 +21.01 +14.60 +238.06 +17.27 S O N %CHG. WK MO QTR YTD +1.20% s t s +0.35% +0.92% s s s -1.90% +0.86% t s s +3.44% +1.12% s s s +0.52% +1.03% s s s +0.61% +1.03% s s s +0.18% +0.99% s s s +2.04% +1.11% s s s +0.48% +1.45% s s s +0.33% commodities The price of crude oil rose by more than $2 per barrel, recouping nearly half its loss from the prior day. It was the fifth straight day that oil has moved at least $1 per barrel. D PE Vol. Last ABB Ltd ... 25343 ACE Ltd 12 13545 AFLAC 9 26744 ANI Phm 38 2056 ASML Hld ... 5398 AT&T Inc 29 188183 AbbottLab 31 63163 AbbVie 53 187862 Accenture 19 20698 Actavis cc 42213 ActivsBliz 25 106714 AdobeSy cc 14053 Aegon ... 4717 Aetna 17 31494 Agrium g 19 6221 AirProd 32 11926 Alcoa 90 227375 Alexion 55 13075 Alibaba n ... 286199 Allergan 39 57575 Allete 19 2040 AlliData 26 18489 AlliantTch 14 6080 Allstate 12 47863 Altria 21 83733 Amazon dd 71514 AMovilL 18 49242 AMovilA ... 25 AmAirlines 12 x91337 AEP 19 21326 AmExp 15 38480 AmIntlGrp 8 62715 AmTower 54 18799 Ameriprise 16 x9082 AmeriBrgn cc 10387 Amgen 23 34933 Amphenol s25 7819 Anadarko dd 46165 AnalogDev 24 21793 ABInBev ... 15173 Anthem 15 22756 Aon plc 22 12861 Apache dd 37134 ApogeeE 29 1331 Apple Inc s 16x407166 ApplRecyc 5 25 ApldMatl 27 131034 ArcelorMit dd 53599 ArchDan 15 77618 ArcticCat 18 1415 ArmHld ... 20239 AstraZen 85 34715 AutoData 29 21079 AutoZone 19 3598 AvagoTch cc 16336 AvalonBay 34 7651 Aviva ... 768 BB&T Cp 13 38618 BCE g ... 11241 BHP BillLt ... 27354 BHPBil plc ... 15069 BP PLC 7 75934 BRF SA ... 13997 BT Grp ... 2841 Baidu 37 19565 BakrHu 15 59881 BcBilVArg ... 20708 BcoBrades ... 14 BcoBrad pf ... 85686 BcoSantSA ... 67998 BcoSBrasil ... 10322 BkofAm 46 748490 BkMont g ... 9369 BkNYMel 14 46997 BkNova g 10 7003 Barclay ... 14832 BarrickG 32 106044 Baxter 16 32942 BectDck 24 17700 BedBath 16 24454 Bemis 25 13190 BerkHa A 18 z437 Chg. Name 20.36 +.52 113.10 +1.48 60.98 +.30 56.92 +1.44 103.10 +1.26 34.54 +.13 45.65 +.48 57.99 +1.08 88.47 +1.13 274.67 +8.44 21.82 +.30 73.10 +.82 7.48 +.08 u96.59 +.54 106.40 +.76 u151.52 +3.10 17.07 +.65 178.17 -.12 87.00 -3.00 224.69 +5.27 57.47 +.53 279.73 -12.59 140.01 +1.97 72.30 -.28 53.67 -.36 373.89 +9.14 21.73 +.19 21.66 +.20 48.81 -.55 62.45 +.23 84.73 +1.12 51.62 +.11 99.59 +1.74 132.48 +1.18 96.34 +.47 153.36 +1.91 55.24 +.67 83.68 +.61 54.95 +1.17 124.19 +.53 137.23 -.42 93.72 +.60 68.37 +1.06 44.34 -.16 119.94 +.85 2.96 +.07 23.96 +.34 10.14 +.29 48.68 +2.53 35.86 +1.31 50.11 +1.21 69.25 -1.81 u87.17 +.59 614.88+13.25 106.20 +1.40 175.00 +1.66 16.34 +.21 37.09 +.72 u47.42 +.61 49.63 +.82 47.18 +.86 41.38 +.93 23.72 +.02 67.89 +3.88 216.80 -.44 62.28 +1.30 9.31 +.15 12.86 +.88 13.08 -.17 7.02 +.06 4.88 -.02 15.97 +.18 61.86 +1.92 37.73 +.56 51.95 +1.46 15.26 +.22 13.06 +.15 71.36 +1.29 145.29 +5.37 79.00 +.49 46.34 +.29 224560 +3533 PE Vol. BerkH B 18 BestBuy 13 Bio-Techne 29 BiogenIdc 32 BioMarin dd BlkHillsCp 18 BlackRock 19 Blackstone 14 Boeing 20 BostProp 51 BostonSci 80 BrMySq 50 BritATob ... Broadcom 41 BrkfldAs g 13 BuffaloWW 36 CA Inc 18 CBS B 18 CF Inds 11 CH Robins 23 CME Grp 30 CNOOC ... CRH ... CSX 18 CVS Health 26 CampSp 17 CIBC g 8 CdnNR gs ... CdnNRs gs ... CP Rwy g ... Canon ... CantbryPk 22 CapellaEd 26 CapOne 10 CardnlHlth 24 CardiovSys dd Carnival 28 CarnUK ... Caterpillar 14 Celgene s 50 CenovusE 11 CntryLink 27 Cerner 54 CharterCm dd ChkPoint 22 CheniereEndd ChesEng 23 Chevron 11 ChinaLife ... ChinaMble ... ChinaPet ... ChinaTel ... ChinaUni ... Chipotle 47 ChrisBnk 14 Chubb 12 ChungTel ... Cigna 15 Cisco 19 Citigroup 22 Clearfield 40 Clorox 27 CCFemsa ... CocaCola 23 CognizTc s 24 ColgPalm 30 Comcast 18 Comc spcl 18 CommSys 39 ConAgra cc ConocoPhil 12 ConEd 17 ConstellA 28 ContlRes s 17 Corning 17 Costco 31 CredSuiss ... CrwnCstle 83 Cummins 16 CybrOpt dd 29744 39953 1563 15383 8463 2146 7391 x60234 41714 7038 207341 38120 2556 69367 4103 7092 27412 69170 5992 32285 22930 2229 5434 49905 34182 13180 4331 9504 29606 6803 2850 264 996 x29574 21738 1608 31878 2117 64952 44712 22564 53642 18309 21332 13509 23228 93973 73244 1932 11773 1209 266 9347 8234 1531 9492 1449 18896 200639 150916 581 18134 1247 106842 54359 33393 116274 46840 83 17579 86194 14448 7961 54237 85845 x68095 7124 43974 43417 90 D-E-F DTE 21 9465 Last Chg. 149.67 +2.14 36.09 -.12 91.25 +1.19 u401.79+10.67 95.64 +1.28 51.12 +.66 358.82 +8.04 36.28 -.14 u148.60 +1.38 143.79 +2.66 15.13 +.17 60.23 +.99 113.46 +.02 u44.31 +.55 u52.86 +1.21 180.29 -.77 31.78 +.27 56.00 -.74 299.60 +2.54 70.97 +.47 90.84 +1.59 142.82 -.19 26.72 -.03 35.20 +.63 100.76 +.30 u47.92 +.49 74.73 +2.08 70.09 +1.20 31.32 +1.32 187.58 +3.05 31.57 +.09 10.08 +.18 72.86 -.98 75.78 +.78 84.43 +.56 35.17 +.54 43.70 +.24 44.43 +.38 83.57 +1.62 120.02 +3.45 20.46 +.53 38.43 -.98 67.01 +.23 u174.30+11.11 77.24 +.40 72.00 +.68 20.85 +.33 109.31 +.96 60.39 -1.86 u69.47 +1.26 81.02 -.84 61.97 -.27 16.82 +.50 670.91 -5.09 5.37 +.16 100.82 +.91 30.80 +.09 u112.22 +2.12 27.26 +.57 48.54 +.14 13.06 -.29 108.05 -1.56 82.81 +.81 41.79 +.11 57.64 -.25 69.79 +.59 56.97 +.07 56.42 +.03 10.22 -.01 36.45 +.19 67.57 +1.70 68.81 +.58 112.66 +.60 46.33 +2.07 24.48 +.21 149.09 -1.83 21.95 +.14 86.73 +.46 138.11 -6.05 11.04 +.09 89.57 +.95 Name PE Vol. Danaher 24 Datalink 21 DaVitaHlt 23 Deere 10 DelphiAuto 18 DeltaAir 19 Deluxe 17 DeutschBk ... DevonE 12 Diageo ... DigiIntl cc DigRiver dd DirecTV 16 Discover 12 DishNetw h 43 Disney 23 DollarGen 21 DollarTree 26 DomRescs 24 Donaldson 21 DowChm 17 DrPepSnap 21 DuPont 19 DukeEngy 28 eBay dd EMC Cp 21 ENI 8 EOG Res s 17 Eaton 19 Ecolab 28 Ecopetrol ... EdisonInt 15 EdwLfSci 18 ElectroSen 13 Electrmed dd ElectArts 21 EmersonEl 18 Enbridge ... EngyTrEq 89 EngyTsfr cc Enersis ... Entegris 91 Entergy 15 EnteroMed dd EntPrdPt s 24 EqtyRsd 46 Ericsson ... EssexPT cc EsteeLdr 25 EvineLive ... Exelon 15 ExpScripts 33 ExxonMbl 12 Facebook 69 FairIsaac 29 FDaves h 31 Fastenal 25 FedExCp 22 FidNatInfo 26 FifthThird 11 FstRep pfD ... FirstEngy 25 Fiserv 26 FEMSA ... FordM 20 FrankRes 14 FrptMcM dd FresenMd ... FullerHB 23 18995 782 7748 17047 27207 111770 4194 12465 52297 2557 692 2826 25896 55272 17834 136455 44175 48312 17528 5738 140195 18806 75849 25113 60003 163907 3374 55678 25037 12096 13563 9202 10422 31 102 48658 88328 11508 19403 13462 3115 7128 21922 6336 30543 21592 29960 4313 61869 1006 54592 17641 124909 146161 1973 134 47170 11307 18176 98839 498 37319 16027 4160 249527 15033 351906 783 2209 Last Chg. 85.48 12.00 76.77 89.12 u75.88 46.14 u67.34 31.09 65.00 117.59 10.20 25.84 87.73 57.50 76.75 u102.64 68.49 u75.92 78.69 37.53 47.80 77.36 u76.00 86.72 54.29 27.08 35.98 96.19 69.22 106.38 18.86 67.73 134.83 4.09 2.24 u56.39 57.15 50.76 57.16 60.77 16.02 13.60 86.52 1.21 35.68 80.27 12.33 230.48 u78.40 6.67 36.60 82.70 92.36 75.61 78.39 30.25 42.06 173.37 64.01 18.63 24.68 41.03 u77.12 87.50 15.85 53.45 19.59 37.34 43.56 +1.14 +.16 +.81 +.44 +3.13 -.82 +.92 +.46 +1.00 +.79 -.03 +.01 -.23 +.74 +.21 +1.36 -.32 +.92 +1.06 +.64 +1.58 -1.29 +2.26 +.74 +.58 +.24 +1.24 +1.00 +.74 +1.94 +.53 +.23 -.02 +.10 +.06 +1.84 -.18 +.78 +.70 +.44 +.28 +.24 -.95 +.05 +.92 +1.33 +.11 +2.32 +5.85 +.02 +.41 +.36 +.90 -.01 +.38 +.43 -.16 +1.29 -.48 +.28 +.03 +.87 +1.33 +1.85 -.02 +.51 +1.30 +.42 +1.17 G-H-I G&K 23 960 u72.59 +.38 Gap 15 44166 41.50 -.69 GenDynam 19 13828 138.69 +.16 GenElec 16 250902 24.50 +.34 GenGrPrp 78 53660 30.60 +.07 GenMills 19 19139 53.40 +.18 GenMotors 22 201101 36.25 +.42 GenuPrt 21 13167 95.95 +.45 GileadSci 14 203026 99.90 +1.47 GlaxoSKln ... 48691 45.95 +1.00 Goldcrp g dd 64193 24.53 +.36 GoldmanS 11 23910 180.77 +1.99 seasonally adjusted change 360 thousand 271 255 HIGH 8598.53 10926.73 6870.10 25048.26 4705.10 17619.34 1952.84 5765.50 15172.32 261 252 est. 230 D J 203 150 A S O N 2014 Source: FactSet national losers CHG. %CHG. 3.06 +1.36 8.54 +2.43 87.64 +22.84 5.02 +1.18 10.27 +2.24 20.72 +4.07 5.25 +.97 2.20 +.36 26.82 +4.32 17.90 +2.80 98.73 +14.52 5.39 +.78 3.31 +.46 7.20 +.96 18.72 +2.41 2.15 +.27 12.73 +1.57 65.70 +8.08 50.69 +6.12 5.14 +.62 LOW 8598.53 10822.75 6808.19 24642.81 4648.07 17484.67 1952.84 5765.50 14995.65 353 +79.6 +39.8 +35.2 +30.7 +27.9 +24.4 +22.7 +19.6 +19.2 +18.5 +17.2 +16.9 +16.1 +15.4 +14.8 +14.4 +14.1 +14.0 +13.7 +13.7 NAME CLOSE QuickLog AdeptTech ClearwPpr Imunmd FarmerBrs OneHorizn NiskaGsSt Layne GeospcT hs AmElTech MackFn MatrixSv OraSure PostRck rs Teradata PioneerPw 6D GlbT rs Transgno iRobot AxoGen CLOSE CHG. 8598.53 +171.12 10905.41 -5.91 6865.93 +5.91 24765.49 +85.73 4703.30 +7.00 17504.62 -174.12 1952.84 -9.95 5765.50 +31.80 15124.92 +129.27 CHG. %CHG. 2.19 -.74 7.06 -1.67 60.02 -13.74 4.01 -.88 25.20 -5.03 2.22 -.44 2.16 -.42 7.26 -1.10 23.42 -3.57 3.70 -.52 10.64 -1.34 18.51 -2.31 8.29 -1.00 3.97 -.48 42.19 -4.79 8.69 -.94 6.86 -.74 2.84 -.30 29.15 -2.81 3.16 -.29 -25.3 -19.1 -18.6 -17.9 -16.6 -16.5 -16.3 -13.2 -13.2 -12.3 -11.2 -11.1 -10.8 -10.8 -10.2 -9.8 -9.7 -9.6 -8.8 -8.4 %CHG. WK MO QTR YTD +2.03% s s s +0.23% -0.05% s s s +11.22% +0.09% s s s +4.57% +0.35% s s s +4.92% +0.15% s s s +10.08% -0.98% t s s +0.31% -0.51% s s t +1.94% +0.55% s s s +6.99% +0.86% s s t +3.37% FUELS CLOSE PVS. %CHG %YTD Crude Oil (bbl) 50.48 48.45 +4.19 -5.2 Ethanol (gal) 1.43 1.42 -0.70 -12.1 Heating Oil (gal) 1.81 1.77 +2.22 -2.2 Natural Gas (mm btu) 2.60 2.66 -2.33 -10.0 Unleaded Gas (gal) 1.52 1.48 +2.91 +6.2 METALS Gold (oz) Silver (oz) Platinum (oz) Copper (lb) Palladium (oz) CLOSE PVS. %CHG %YTD 1262.00 1263.80 -0.14 +6.6 17.18 17.38 -1.15 +10.4 1249.70 1238.90 +0.87 +3.4 2.61 2.61 ... -8.0 796.00 790.50 +0.70 -0.3 AGRICULTURE CLOSE PVS. %CHG %YTD Cattle (lb) 1.53 1.53 +0.27 -7.4 Coffee (lb) 1.65 1.65 -0.09 -1.1 Corn (bu) 3.85 3.84 +0.46 -3.0 Cotton (lb) 0.62 0.61 +0.91 +2.5 Lumber (1,000 bd ft) 311.90 309.60 +0.74 -5.8 Orange Juice (lb) 1.38 1.38 -0.25 -1.8 Soybeans (bu) 9.81 9.72 +0.95 -3.7 Wheat (bu) 5.26 5.11 +2.89 -10.9 Name closing prices for Thursday, February 5, 2015 A-B-C J GLOBAL Buenos Aires Merval Frankfurt DAX London FTSE 100 Hong Kong Hang Seng Paris CAC-40 Tokyo Nikkei 225 Seoul Composite Sydney All Ordinaries Toronto TSE300 consolidated stock listings Name CLOSE QKL Strs E2open Hospira GluMobile Liquidity Conns AurisMed n SandRdge DonegalB Invacare TableauA HighpwrInt AMD CallonPet CallularBio CHC Grp BostPrv ProtoLabs NuSkin Tetralogic 2,160 18,500 Nonfarm payrolls national gainers S&P 500 1,960 10 DAYS Economists anticipate that nonfarm employers added 230,000 jobs last month. That would be down from 252,000 in December and the second monthly decline in a row. The U.S. economy added nearly 3 million jobs in 2014. That helped bring down the nation’s unemployment rate to 5.6 percent in December, the lowest it’s been since 2008. Still, wage growth has lagged hiring. The Labor Department reports its January jobs data today. Name PE Google A 25 Google C n 25 Graco 20 Graingr 19 GpFnSnMx ... GpTelevisa ... HCA Hldg 15 HCP Inc 20 HDFC Bk ... HMN Fn 10 HSBC ... Hallibrtn 10 HartfdFn 11 Hawkins 22 HltCrREIT 100 Hershey 28 Hess 10 HewlettP 14 Hilton 49 HomeDp 25 Honda ... HonwllIntl 19 Hormel 24 Hospira 45 HostHotls 16 HuanPwr ... Humana 21 HutchT dd ICICI Bk s ... ING ... Ikonics 38 ITW 14 Illumina 82 ImageSens dd Imation dd ImpOil g 9 IndoTel ... Infosys s 20 IngerRd 25 Insignia 40 Intel 15 IntcntlExch 45 IBM 13 IntPap 20 IntriCon cc Intuit 32 IntSurg 41 Invesco 16 ItauUnibH ... J-K-L JD.com n JPMorgCh JohnJn JohnsnCtl Kellogg KeurigGM KimbClk KindMorg Kohls KoreaElc KraftFGp Kroger Kyocera L Brands LakeEnt rs LVSands Level3 LibGlobC s LifeTFit LillyEli LincNat LinkedIn LloydBkg LockhdM Loews Lorillard Lowes Luxottica LyonBas A Vol. Last Chg. 16277 529.83 +3.73 18163 527.58 +4.82 2780 72.37 +.80 x8296 240.02 +1.94 23190 11.71 +.31 10719 33.68 -.04 48107 68.85 -.11 x36665 45.20 +.41 74909 57.76 77 12.25 16634 47.07 +.37 149413 43.35 +.96 39822 40.01 +.26 39.89 +2.07 351 18506 81.63 +.91 8712 105.81 +.11 43685 73.17 +1.16 61851 37.95 +.05 24068 26.87 +.54 44265 u108.99 +.58 11916 31.99 +.67 25236 102.34 +1.59 8635 54.01 +.05 340937 u87.64+22.84 38612 23.42 +.35 1934 49.91 -4.70 11853 150.36 -.18 1069 3.43 -.05 137638 11.36 21945 12.81 +.12 3 17.27 +1.20 16594 97.07 +1.22 11471 194.51 +2.48 333 2.37 +.03 1061 4.07 +.18 3922 40.82 +1.37 723 44.74 +.10 22403 35.75 +.97 18723 66.84 +.03 37 3.23 -.11 202034 33.94 +.34 13616 225.85+10.85 51302 157.91 +.95 22061 54.97 +.61 27 7.24 -.18 10426 91.71 +1.17 3308 516.17+11.25 28132 38.93 +.47 167642 12.89 -.05 ... 44288 26.81 +.10 11 109815 56.77 +.39 18 65289 102.46 +1.10 26 26606 48.37 +.26 14 12912 67.03 +.39 31 98212 115.30 -5.90 27 19638 110.02 +.16 43 92831 41.49 +.69 17 48420 u67.74 +.87 ... 1992 19.27 -.08 17 27085 u66.94 -.14 22 34081 u71.55 +.20 ... 113 45.44 -.05 28 41000 u91.19 +4.68 ... 133 8.19 +.04 16 48166 56.07 +.66 43 36501 53.38 +.88 ... 15076 48.02 +.45 19 1942 55.69 +.58 32 37975 71.41 +1.19 10 44948 53.78 +.58 dd 30498 237.97 +5.94 ... 14717 4.61 +.13 17 10553 194.06 +1.78 99 9008 40.73 +.33 21 19468 66.52 +.37 28 48855 u71.47 +.80 ... 247 60.00 +1.29 10 62617 87.65 +2.30 M-N-O M&T Bk 16 MGC Diag dd 7595 27 119.46 7.07 +.87 +.10 PE Vol. MOCON 24 MTS 23 Macys 15 MagellMid 24 MagnaInt g 12 Manulife g ... MarathnO 8 MarathPet 11 MarIntA 31 MarshM 21 MasterCrd 28 McDnlds 20 McGrwH 30 McKesson 39 MeadJohn 28 Medtrnic 26 MelcoCrwn 19 Merck 14 MetLife 10 MKors 18 MicronT 10 Microsoft 17 MitsuUFJ ... MizuhoFn ... Mondelez 18 MoneyGrm 8 Monsanto 24 MonstrBev 47 Moodys 22 MorgStan 12 Mosaic 25 MotrlaSolu 28 Mylan 23 NRG Egy dd NTT DOCO ... NVE Corp 24 NXP Semi ... NatGrid ... NOilVarco 9 NetEase 20 Netflix cc NextEraEn 19 NiSource 27 Nidec s ... NielsenNV 46 NikeB 28 NipponTT ... NobleEngy 19 NokiaCp ... Nomura ... Nordstrm 21 NorflkSo 17 NorSys 17 NoestUt 23 NthnO&G 8 NthnTech 23 NorTrst 21 NorthropG 17 Novartis 24 NovoNord ... Nucor 21 OReillyAu 28 OcciPet 14 Omnicom 18 OneBeacon 20 Oracle 18 Orange ... Orix ... OtterTail 20 99 1299 46023 10703 5822 20464 72741 34598 25033 23819 53743 54905 11563 23761 9597 56691 21197 123768 91496 146273 195627 359019 24572 4893 69323 2116 23488 6449 9436 100542 23552 23136 39199 37933 1361 56 65741 2428 64918 3612 19955 12935 x21606 374 18270 27647 3541 x29247 70143 5135 9382 26413 57 12131 23453 66 9712 10747 24175 10121 37681 29587 52083 15315 485 94654 4167 189 563 P-Q-R PG&E Cp PNC POSCO PPG PPL Corp Paccar ParkerHan Patterson Paychex Pearson Pentair PepsiCo Perrigo PetChina PetrbrsA Petrobras Pfizer PhilipMor PhilLD 18 48770 12 25495 ... 2781 24 6680 16 36180 16 22712 17 8347 23 4486 27 23408 ... 2772 56 11442 22 43581 94 16113 ... 1100 ... 196607 ... 389893 23 553157 16 62454 ... 1124 regional gainers NAME CLOSE ProtoLabs Ikonics Stratasys WSI Inds Hawkins Imation EnteroMed VascSol ArcticCat Regis Cp ChrisBnk Uroplasty Last Chg. 16.75 +.03 70.51 +1.01 63.70 -1.19 82.62 +.99 99.46 +.53 17.21 +.17 28.38 +.40 u97.30 +1.11 75.70 -.24 55.82 +.49 85.82 +1.64 94.34 +.29 u95.88 +1.04 215.86 +5.02 100.11 +.62 75.32 +1.19 25.63 +.69 59.17 +.12 48.98 +.21 69.77 -1.61 29.49 +.46 42.45 +.61 5.68 +.12 3.36 +.08 36.26 +.24 9.29 +.17 120.86 +1.80 118.37 -.36 93.27 +1.05 34.93 +.16 49.79 +.45 64.00 +.06 54.30 +1.08 26.34 +.30 17.02 +.31 66.16 +1.59 78.27 -1.48 70.46 +.33 53.24 +.91 115.88 -.65 448.91 +.20 109.71 +.27 45.00 +.71 17.31 +.37 43.98 +.23 93.34 +.80 30.21 +.44 48.49 +.78 7.82 +.13 5.40 +.01 78.76 -.14 107.85 +1.50 5.46 -.10 56.28 +.67 7.78 +.07 21.19 +.09 68.51 +.76 u163.03 +1.19 97.79 -.36 43.68 +.46 47.63 +2.13 u208.24+15.53 82.12 +1.27 75.24 +1.16 16.10 +.01 43.16 +.74 18.13 +.07 61.66 +2.04 32.17 +.74 58.06 88.82 61.30 230.37 36.32 62.25 120.33 51.37 47.49 20.83 63.95 96.61 155.03 112.33 7.22 7.11 32.99 82.57 69.18 +.15 +1.07 +2.19 +2.92 +.51 -.21 +.61 +.68 +.42 +.03 +.42 +.01 +3.55 -1.79 -.17 -.15 +.92 +.49 -1.26 65.70 17.27 62.34 5.89 39.89 4.07 1.21 28.49 35.86 16.88 5.37 1.35 Name regional losers CHG. %CHG. +8.08 +1.20 +3.96 +.33 +2.07 +.18 +.05 +1.09 +1.31 +.60 +.16 +.04 PE Vol. +14.0 +7.4 +6.8 +5.9 +5.5 +4.6 +4.3 +4.0 +3.8 +3.7 +3.1 +3.1 Last NAME Chg. PhilipsNV ... 12031 28.82 +.62 Phillips66 11 29473 75.21 +.79 PioNtrl dd 21523 158.59 +1.08 PiperJaf 11 1345 55.10 +1.42 PlainsAAP 23 13532 52.17 +.76 Polaris 22 6904 147.94 +3.23 Potash 20 34330 37.01 +.61 Praxair 22 13197 124.61 +1.90 PrecCastpt 16 10618 204.95 +.21 PriceTR 18 11459 81.75 +.70 Priceline 22 6399 1044.60+16.32 PrinFncl 13 16194 48.93 +.48 ProLogis 39 36087 45.79 +.62 ProctGam 26 62349 86.70 +.91 ProgsvCp 12 33946 26.38 +.28 ProtoLabs 42 13839 65.70 +8.08 Prudentl 9 94346 d75.32 -4.57 Prud UK ... 1960 49.60 +.15 PSEG 18 20586 42.86 +.68 PubStrg 41 6322 206.76 +4.10 Qualcom 14 104747 67.95 +.99 Qumu Cp dd 39 14.63 +.08 Raytheon 16 18735 106.81 -.32 ReedElsNV ... 803 u50.72 +.52 ReedEls plc ... 262 71.86 +.42 Regenrn cc 7389 413.87+12.51 Regis Cp dd 4247 16.88 +.60 RepubSvc 19 10263 40.89 +.34 ReynAmer 23 15309 69.45 -.12 RioTinto ... 21662 47.44 +1.17 RockwlAut 18 8026 113.04 +.94 RogCm gs 13 4453 36.21 +.35 Roper 25 6316 u162.11 +3.99 RossStrs 22 9859 94.93 +.19 RoyalBk g ... 18326 60.63 +1.62 RBScotlnd ... 1682 11.54 +.06 RylCarb 22 23766 76.01 +1.67 RoyDShllB 14 9087 69.81 +1.78 RoyDShllA 13 52194 66.81 +1.39 Ryanair ... 1971 64.00 -.50 S-T-U SAP SE ... SBA Com dd SK Tlcm ... SPS Cmce cc StJude 18 Salesforce dd SanDisk 17 Sanofi ... Sasol ... Schlmbrg 21 Schwab 30 SeagateT 13 SelCmfrt 31 SempraEn 25 Sherwin 31 ShinhanFn ... Shire ... SigmaAld 33 SilvBayRT dd SimonProp 45 SiriusXM 53 SkywksSol 28 Smith&N s 81 SonyCp ... SouthnCo 23 SthnCopper18 SwstAirl 27 SpectraEn 22 SpectraEP 17 SpeedCmcedd Sprint dd StanBlkDk 22 Starbucks 27 StateStr 15 Statoil ASA ... Stratasys dd Stryker 60 SumitMitsu ... SunLfFn g ... Suncor g 9 SunTrst 12 Supvalu 15 SurModic 25 Symantec 19 Synchrny n ... Syngenta ... Sysco 26 T-MobileUS cc 10518 5079 12505 747 29573 24544 24666 22887 11453 76011 x54487 21435 7342 7124 5322 603 5690 5883 2365 10402 590617 32913 6841 34659 60805 26699 78800 78085 3900 357 366617 10575 37512 19155 29310 28256 12392 27298 5956 76824 24280 18520 792 34890 11085 7125 37592 24707 68.71 119.53 28.07 62.99 67.70 59.26 78.51 48.42 40.82 85.92 27.92 60.41 31.55 113.42 u277.90 40.14 228.42 137.80 15.81 203.22 u3.69 81.40 36.71 u26.82 49.71 29.74 44.47 36.21 54.83 2.47 4.82 96.16 u89.64 74.69 18.45 62.34 93.67 7.04 32.90 31.01 40.31 10.15 24.37 25.97 u32.00 69.10 39.87 31.21 CLOSE CHG. %CHG. Insignia 3.23 IntriCon 7.24 Clearfield 13.06 NorSys 5.46 HutchT 3.43 CapellaEd 72.86 SelCmfrt 31.55 ApogeeE 44.34 BuffaloWW 180.29 Fastenal 42.06 BestBuy 36.09 DigiIntl 10.20 +1.32 +.80 -.32 +.38 +1.17 +.27 +.61 +1.42 -.25 +1.37 +.37 +.48 -.39 +1.39 +3.80 -1.44 +4.34 +.23 +.23 +1.39 +.08 -.90 +1.54 +.88 +.25 +.52 -.17 +1.54 +.02 +.03 +.24 +.48 +.94 +.92 +.47 +3.96 +1.20 +.09 -.03 +1.17 +.72 +.07 +.05 +.37 +.75 +1.88 +.01 +.46 Name PE -.11 -.18 -.29 -.10 -.05 -.98 -.39 -.16 -.77 -.16 -.12 -.03 Vol. TCF Fncl 17 7252 TD Ameritr 24 17057 TE Connect 16 17984 TJX 23 27175 TaiwSemi ... 118748 Target 32 30927 TataMotors ... 33402 TelItalia ... 730 TelItaliaA ... 176 TelefBrasil ... 14364 TelefEsp ... 11353 Telus gs ... 3722 Tenaris ... 21275 Tennant 28 537 TeslaMot dd 35008 TevaPhrm 18 74114 TexInst 21 50150 ThermoFis 27 14441 ThomsonR 57 7852 3M Co 22 19500 TileShop 36 4028 TW Cable 21 23486 TimeWarn 17 52873 Toro Co 22 2738 TorDBk gs 10 23071 Total SA ... 14903 Toyota ... 4007 TrCda g 20 7209 Travelers 10 16841 21stCFoxA 8 287940 21stCFoxB 7 98648 Twitter dd 418915 TwoHrbInv 9 36497 TycoIntl 11 20861 UBS Grp n ... 6893 UnilevNV ... 18387 Unilever ... 14675 UnionPac s 21 33290 UtdContl 24 51400 UPS B 31 39973 US Bancrp 14 65318 UtdTech 18 46099 UtdhlthGp 19 32195 Uroplasty dd 732 -3.4 -2.4 -2.2 -1.8 -1.4 -1.3 -1.2 -0.4 -0.4 -0.4 -0.3 -0.3 Last Chg. 15.66 34.90 69.25 68.44 23.66 75.95 47.85 11.25 9.03 19.40 15.01 35.17 30.50 67.82 220.99 57.54 55.31 127.04 40.05 166.55 8.68 147.68 79.98 66.56 43.21 54.81 131.74 47.18 107.41 32.80 31.78 41.26 10.25 42.04 17.44 42.81 43.53 122.85 69.60 101.46 44.00 120.11 108.82 1.35 +.30 +.45 +1.28 +.57 +.08 +.34 -2.69 -.28 -.21 +.47 +.18 +.42 +.88 +1.61 +2.44 +1.07 +.70 +.69 +.22 +1.74 +.27 +2.15 -.16 +.75 +1.37 +.74 -.94 +.54 +.68 -1.86 -1.65 +.54 -.04 +.63 +.44 +.18 +2.41 -2.10 +.93 +.42 +2.32 +.90 +.04 V-W VF Corp 24 Vale SA ... Vale SA pf ... ValeantPh cc ValeroE 8 Valspar 21 VascSol 40 Ventas 49 VerizonCm 20 VertxPh dd ViacomB 12 Visa 29 Vodafone ... Vornado cc WPP plc ... WSI Inds 16 WalMart 18 WalgBoots 35 WsteMInc cc WellsFargo 13 WDigital 16 WestpacBk ... Weyerhsr 27 Whrlpl 26 WholeFood 34 WmsCos 64 Winmark 23 Wipro ... Wynn 20 X-Y-Z XcelEngy Xerox Yahoo YumBrnds Zimmer Zoetis 27322 70.24 +1.36 214458 7.55 -.03 106445 6.52 -.03 22341 161.45 +.58 65544 55.01 +.72 5691 85.63 +.07 1114 28.49 +1.09 31423 79.37 +.80 182595 47.86 +.06 10509 111.59 +2.32 40398 66.25 +.17 39052 u271.80 +6.91 45182 35.18 -.57 8703 113.97 +2.39 526 111.91 -.22 57 5.89 +.33 48745 87.28 +.63 40160 74.79 +.12 10635 52.60 +.38 129527 53.67 +.64 15688 104.11 +.07 1936 28.69 +.62 25718 35.51 +.22 11515 211.34 -3.54 37467 53.38 -.31 72690 46.40 +1.04 107 83.17 +2.05 10148 13.42 +.31 16805 146.64 +.53 19 19237 16 64212 6 181176 33 92702 28 9353 36 34487 37.56 +.36 13.46 +.05 43.55 -.50 75.20 +1.55 117.10 +1.58 43.40 -.06 Stock Footnotes: cld - Issue has been called for redemption by company. d - New 52-week low. ec - Company formerly listed on the American Exchange's Emerging Company Marketplace. g - Dividends and earnings in Canadian dollars. h - Does not meet continued-listing standards. lf - Late filing with SEC. n - Stock was a new issue in the last year. The 52-week high and low figures date only from the beginning of trading. pf - Preferred stock issue. pr - Preferences. pp - Holder owes installments of purchase price. rt - Right to buy security at a specified price. rs - Stock has undergone a reverse stock split of at least 50% within the past year. s - Stock has split by at least 20 percent within the last year. wi - Trades will be settled when the stock is issued. wd - When distributed. wt - Warrant, allowing a purchase of a stock. u - New 52-week high. un - Unit,, including more than one security. vj - Company in bankruptcy or receivership, or being reorganized under the bankruptcy law. Appears in front of the name. PE Footnotes: q - Stock is a closed-end fund - no P/E ratio shown. cc - P/E exceeds 99. dd - Loss in last 12 months. Volume Footnotes: x - ex-dividend - yesterday was the first day that the stock traded without the right to receive a dividend and the price change is adjusted to reflect that fact. z - sales are in total shares. Fund Footnotes: b - Fee covering market costs is paid from fund assets. d - Deferred sales charge, or redemption fee. f - front load (sales charges). m - Multiple fees are charged, usually a marketing fee and either a sales or redemption fee. NA - not available. p - previous day´s net asset value. s - fund split shares during the week. x - fund paid a distribution during the week. Souce: The Associated Press and Morningstar. mutual funds Fund NAV AMG YacktmanSvc d24.53 American Funds AMCAPA m 28.22 AmBalA m 24.96 BondA m 13.01 CapIncBuA m 60.87 CpWldGrIA m 47.27 EurPacGrA m 48.51 FnInvA m 52.53 GrthAmA m 43.27 HiIncA m 10.83 IncAmerA m 21.92 InvCoAmA m 37.32 MutualA m 37.21 Net YTD Chg. ret. +.05 -2.3 +.28 +.14 -.02 +.34 +.35 +.27 +.50 +.41 +.03 +.16 +.31 +.37 +.8 +.8 +1.7 +2.2 +2.6 +2.9 +.9 +1.4 +1.4 +1.6 +.6 +.2 Fund NAV NewPerspA m 37.01 SmCpWldA m 46.07 WAMutInvA m 41.00 Artisan Intl d 30.88 BlackRock EqDivI 24.71 GlobAlcA m 20.12 GlobAlcC m 18.48 GlobAlcI 20.23 StrIncIns 10.18 DFA EmMkCrEqI 19.51 EmMktValI 26.23 USLgValI 33.81 Net YTD Chg. ret. +.31 +2.0 +.57 +1.7 +.36 +.1 +.12 +3.1 +.23 -1.0 +.12 +1.8 +.11 +1.7 +.12 +1.8 +.9 +.09 +3.1 +.10 +1.9 +.35 -.5 Fund NAV Net YTD Chg. ret. Dodge & Cox Bal 101.72 +.60 Income 13.91 -.01 IntlStk 43.10 +.32 Stock 177.83 +1.59 FPA Cres d 33.75 +.26 Fidelity Bal 22.94 +.15 BlChGrow 69.54 +.57 Contra 99.32 +1.09 ContraK 99.25 +1.09 DivrIntl d 35.61 +.35 FrdmK2020 14.44 +.09 FrdmK2030 15.37 +.13 GrowCo 133.86 +1.68 GrthCmpK 133.70 +1.68 LowPrStkK d 50.22 +.43 LowPriStk d 50.26 +.43 Magellan 92.97 +1.07 Puritan 21.68 +.16 -.7 +.9 +2.4 -1.7 ... +.7 +1.6 +1.4 +1.4 +3.4 +1.4 +1.3 +1.7 +1.7 ... ... +.5 +.9 Fund NAV Net YTD Chg. ret. SesInmGrdBd 11.60 -.02 TotalBd 10.82 -.01 Fidelity Spartan 500IdxAdvtg 73.09 +.76 500IdxInstl 73.10 +.76 TotMktIdAg d 60.22 +.66 First Eagle GlbA m 53.59 +.24 FrankTemp-Franklin Income C m 2.45 +.02 IncomeA m 2.42 +.02 FrankTemp-Templeton GlBondA m 12.49 +.02 GlBondAdv 12.44 +.02 Harbor CapApInst 60.12 +.74 IntlInstl 66.96 +.70 Loomis Sayles BdInstl 14.76 +.05 MFS ValueI 35.04 +.32 +1.6 +1.6 +.3 +.3 +.6 +2.2 +1.6 +1.7 +.5 +.5 +2.7 +3.4 -.1 -.2 Fund NAV Metropolitan West TotRetBdI 11.04 TotRtBd b 11.04 Oakmark EqIncI 32.03 Intl I 24.01 Oakmark I 66.01 Old Westbury LgCpStr 13.12 Oppenheimer DevMktY 35.20 PIMCO AllAssetI 11.77 IncomeInl 12.30 TotRetA m 10.89 TotRetAdm b 10.89 TotRetIs 10.89 Schwab S&P500Sel d 32.26 T Rowe Price BlChpGr 69.09 Net YTD Chg. ret. -.01 +1.4 -.01 +1.3 +.21 +.4 +.09 +2.9 +.69 -.6 +.10 +1.6 +.22 +.4 +1.5 +.3 +2.2 +2.2 +2.3 +.33 +.3 +.91 +2.7 Net YTD Chg. ret. Fund NAV CapApprec EqIndex d EqtyInc GrowStk MidCpGr NewHoriz NewIncome R2025 Rtmt2020 Rtmt2030 Value Vanguard 500Adml 500Inv BalIdxAdm BdMktInstPls DivGr ExtdMktIdxIP GNMAAdml GrthIdAdm HltCrAdml 26.53 +.21 55.65 +.58 32.73 +.30 53.21 +.62 76.88 +1.22 44.73 +.55 9.71 -.01 15.98 +.13 21.04 +.14 23.42 +.19 34.53 +.43 +1.5 +.3 -.2 +2.4 +1.9 +2.2 +1.6 +1.7 +1.6 +1.7 -.3 190.52 +1.98 190.50 +1.98 29.98 +.17 11.03 -.02 23.25 +.24 167.00 +2.18 10.87 54.50 +.58 92.46 +1.33 +.3 +.3 +1.0 +1.7 +.7 +1.6 +.7 +1.5 +3.5 Fund NAV Net YTD Chg. ret. ITGradeAd 10.01 -.01 InstIdxI 189.30 +1.97 InstPlus 189.32 +1.97 InstTStPl 47.07 +.51 IntlGrAdm 70.53 +.66 IntlStkIdxAdm 26.85 +.27 IntlStkIdxI 107.39 +1.07 IntlStkIdxIPls 107.41 +1.07 MidCpAdml 155.07 +1.89 MuIntAdml 14.39 -.01 MuLtdAdml 11.11 PrmcpAdml 107.85 +1.22 REITIdxAd 124.36 +1.47 STBondAdm 10.55 -.01 STGradeAd 10.72 SmCpIdAdm 56.68 +.73 Star 24.94 +.14 TgtRe2015 15.52 +.08 TgtRe2020 28.88 +.16 TgtRe2030 29.47 +.23 TgtRe2035 18.09 +.15 +2.1 +.3 +.3 +.6 +3.0 +3.3 +3.3 +3.3 +1.4 +1.1 +.8 +1.2 +8.3 +.8 +.7 +1.4 +1.3 +1.5 +1.5 +1.5 +1.4 Fund NAV Net YTD Chg. ret. TgtRe2040 TgtRe2045 Tgtet2025 TlIntlBdIdxInv TotBdAdml TotBdInst TotIntl TotStIAdm TotStIIns TotStIdx WellsIAdm Welltn WelltnAdm WndsIIAdm WndsrII 30.18 18.91 16.77 10.75 11.03 11.03 16.05 51.90 51.91 51.88 62.70 39.38 68.01 65.97 37.18 +.29 +.18 +.11 -.01 -.02 -.02 +.16 +.57 +.57 +.57 +.14 +.18 +.31 +.60 +.34 +1.4 +1.4 +1.5 +1.5 +1.7 +1.7 +3.2 +.6 +.6 +.6 +1.2 +.6 +.6 -.3 -.3

© Copyright 2026