Morning Notes - LKP Securities

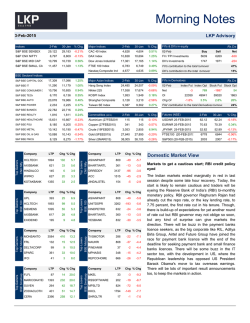

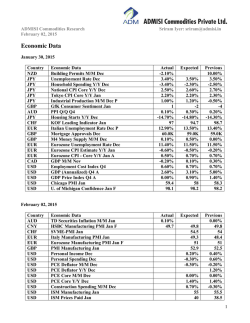

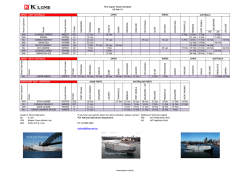

Morning Notes LKP Advisory 2-Feb-2015 Indices 30-Jan 29-Jan % Chg. Major Indices 30-Jan 29-Jan % Chg. FII's & DII's in equity S&P BSE SENSEX 29,183 29,682 -1.68% CAC 40 Index 4,604 4,631 -0.59% 30-Jan 8,809 8,952 -1.60% DAX Index 10,694 10,738 -0.41% S&P BSE MID CAP 10,739 10,771 -0.30% Dow Jones Industrial Average 17,165 S&P BSE SMALL CAP 11,329 11,379 -0.43% FTSE 100 Index S&P CNX NIFTY Rs.Crs Buy Sell Net FII / FPI Investments 6146 6917 -772 2282 2320 17,417 -1.45% DII's Investments 6,749 6,811 -0.90% FII's contribution to the total turnover 46% -38 Nasdaq Composite Index 4,635 4,683 -1.03% DII's contribution to the total turnover 16% BSE Sectoral Indices S&P BSE REALTY 1,811 1,773 2.17% Major Asian Indices 30-Jan 29-Jan % Chg. FII's in Derivatives S&P BSE POWER 2,225 2,205 0.88% Hang Seng Index 24,507 24,596 -0.36% 30-Jan 11,179 11,156 0.20% Nikkei 225 17,674 17,606 0.39% Net 6,136 6,147 -0.17% KOSPI Index 1,949 1,951 -0.09% OI 15,667 15,750 -0.53% Shanghai Composite 3,210 3,262 -1.59% Chg.OI 8,275 8,321 -0.55% Taiwan SE Index 9,362 9,427 -0.69% FIIs' contribution to the total Derivatives turnover 10,143 10,208 -0.64% S&P BSE CAPITAL GOODS 17,096 17,218 -0.71% Commodities (MCX) 30-Jan 29-Jan % Chg. Futures (NSE) 30-Jan 29-Jan % Chg. S&P BSE METAL 10,190 10,276 -0.84% Aluminium (27FEB2015) 115 112 2.58% USDINR 25-FEB-2015 70.63 70.29 0.48% S&P BSE AUTO 19,986 20,231 -1.21% Copper (27FEB2015) 343 337 1.66% EURINR 25-FEB-2015 62.24 62.16 0.12% 8,205 8,344 -1.67% Crude (19FEB2015) 2,855 2,754 3.67% JPYINR 25-FEB-2015 52.89 52.74 0.28% S&P BSE CONSUMER DURABLES 10,655 10,856 -1.85% Gold (5FEB2015) 27,895 27,419 1.74% FTSE100 (20-FEB-2015) 6844 6861 -0.25% 22,716 23,453 -3.14% Silver (5MAR015) 38,105 37,286 2.20% S&P500 (20-FEB-2015) 2007 1998 0.46% S&P BSE IT S&P BSE TECk S&P BSE HEALTHCARE S&P BSE FMCG S&P BSE OIL & GAS S&P BSE PSU LTP Chg % Chg Company LTP HCLTECH 1794 145 8.8 BANKBARODA 192 -25 -11.5 91 3 3.7 SBIN 309 -18 -5.4 TATAPOWER Top Losers CNX Nifty Company Chg % Chg DLF 171 4 2.6 ICICIBANK 360 -20 -5.3 BPCL 751 17 2.3 PNB 189 -10 -5.0 LUPIN 1580 25 1.6 DRREDDY 3227 -136 -4.1 Company LTP BANKBARODA 193 -24 -11.1 CANBK 443 -26 -5.6 SBIN 310 -17 -5.1 Company LTP HDIL Chg % Chg Chg % Chg 14 14.1 19 2 11.6 JPASSOCIAT 29 2 9.2 HCLTECH 1794 148 9.0 ICICIBANK 361 -19 -5.0 ADANIENT 630 46 7.8 BANKINDIA 267 -14 -4.9 Company LTP Company LTP INDIANB 186 Top Losers BSE 100 110 GMRINFRA HCC 35 6 19.2 HDIL 110 14 14.1 GMRINFRA 19 2 11.6 JPASSOCIAT 29 2 9.2 RTNPOWER 11 1 9.2 Company LTP CAPPL 600 78 14.9 AJMERA 104 12 12.8 MKEL 36 4 11.9 ABCIL 233 21 9.8 MEGH 24 2 8.7 Top Losers BSE Midcap Chg % Chg Chg % Chg Top Losers BSE Smallcap Top Gainers BSE Smallcap Top Gainers BSE Midcap Top Gainers BSE 100 Top Gainers CNX Nifty S&P BSE BANKEX Chg % Chg -13 -6.5 WHIRLPOOL 674 -46 -6.4 MONSANTO 3167 -216 -6.4 SPARC 328 -21 -5.9 ORIENTBANK 266 -15 -5.4 Company LTP Chg % Chg SRSREAL 27 -6 -17.8 RAJLXIN 193 -21 -10.0 VIPIND 104 -11 -9.2 MANJUSHREE 410 -41 -9.0 INDRAMEDCO 66 -6 -8.3 Rs.Crs Index Fut Index Opt Stock Fut Stock Opt 72 1318 -1608 139 22761 48248 57404 1482 0.8% 6.7% 2.1% 399% 24% Domestic Market View Markets to make soft start tailing weak global cues The Indian markets crashed like house of card in last session as investors booked profit at higher levels ahead of RBI policy meeting on February 3. Today, the start is likely to be on a soft side tracking weak global cues. Also, investors may remain worried over a huge shortfall in tax deducted at source (TDS) collections, the Central Board of Direct Taxes (CBDT) has asked the income tax department (I-T) to initiate special measures to achieve the collection target for this fnancial year. However, traders will be getting some support from report that overseas investors pumped in a staggering Rs 33,688 crore in capital markets last month, making it the highest investment in six months owing to easing inflation and rate cut by Reserve Bank of India (RBI). There will be some action in the steel sector stocks, as the Centre said it would pump Rs 1,50,000 crore for building four steel plants of 20-24 million tonnes combined capacity, in collaboration with the governments in four states. The aviation stocks too may see some action as Jet fuel prices have been cut by 11.3 per cent bringing further relief to domestic airlines. In Delhi, the price of aviation turbine has been cut from Rs 52,423 a kilolitre to Rs 46,513 a kilolitre. Domestic Market OverView Benchmarks crash like house of card; Sensex breaches 29,200 mark Friday’s trading session turned out to be a daunting one for stock markets in India and benchmarks ended below their crucial 9,850 (Nifty) and 29,200 (Sensex) levels as investors booked profit off the table amid Chinese growth concern gripped the markets. Selling was both brutal and wide-based as none of sectoral indices, barring realty, power and software, on BSE were spared. Counters, which featured in the list of worst performers, include banking, consumer durables, public sector undertaking and metal. Markets, after hitting fresh peaks in early deals, witnessed bout of selling pressure as investors booked profit at higher levels ahead of RBI policy meeting on February 3. Though, Street widely expects Central bank to pause during the February 2015 monetary policy review, while maintaining a dovish tone, and resume cutting the repo rate by a further 50 basis points (bps) after the presentation of the Union Budget. Lower than expected corporate earnings posted by blue chip companies such as Dr Reddy’s Lab, ICICI Bank and HDFC Bank also weighed on the bourses. Moreover, market participants failed to draw any sense of relief with UN report stating that, notwithstanding the decline in global foreign direct investment inflows, India’s FDI increased by 26 percent in 2014 to an estimated $35 billion with maximum growth in the services sector. Investors failed to draw any solace from report that foreign institutional investors were net buyers in Indian equities worth Rs 1,723.77 crore on January 29, 2015, as per provisional stock exchange data. Depreciation in rupee too dampened the sentiments. Rupee was trading at 61.92 per dollar at the time of equity markets closing compared with its previous close of 61.86 per dollar. Global Market Overview Asian markets end mostly in red on Friday The Asian equity benchmarks ended mostly in red on Friday, with Japanese stocks rising for a second week as investor sentiment recovered amid expectations of slower interest-rate increases in the US. The Bank of Japan has put monetary policy on hold and found backing for its wait-and-see stance from advisors to Prime Minister Shinzo Abe, who worry more easing could send the yen to damagingly low levels. Concerns about the yen, along with a belief among central bank officials including Governor Haruhiko Kuroda - that coming wage increases will support higher prices, suggest the BOJ could hold policy steady until October. US markets closed lower on disappointing data The US markets closed lower on Friday, as investors grappled with downbeat gross domestic product data, less-than-stellar earnings that overshadowed a bounce in crude-oil futures. On the economic front, the US economy grew by a 2.6% annual pace in the fourth quarter, slowing from a 5.0% pace in the third quarter. Consumer spending, which is a main source of economic activity, rose 4.3% following a 3.2% rise in the third quarter. This is the biggest gain since the first quarter of 2006. But growth slowed because of slower business and government spending and higher imports. The PCE index, the Fed’s preferred inflation gauge, fell at a 0.5% annual rate in the October-toDecember period, compared to a 1.2% gain in the third quarter. That’s the biggest drop since the first quarter of 2009.The core PCE that excludes food and energy, rose at a 1.1% clip, down from 1.4%. The Dow Jones Industrial Average lost 251.90 points or 1.45 percent to 17,164.95, the Nasdaq Composite was down by 48.17 points or 1.03 percent at 4,635.24 while, the S&P 500 dropped 26.26 points or 1.30 percent, to close at 1,994.99. LKP Advisory Index Futures (OI in '000 Shares) Future Chg Spot Chg Prem / 30-Jan (%) 30-Jan (%) Disc -1.60 63.8 NIFTY 8,873 -1.26 8,809 CNXIT BANKNIFTY 11,906 0.11 11,825 0.01 19,995 -3.80 19,844 -3.34 Total Open Interest 30-Jan Chg (%) 26,176 3.2 81.4 12 22.0 151.6 2,087 5.3 Increasing OI, Increasing Delivery Qty & Increasing Price in Stock Futures (Open Interest in '000 Shares) Symbol Total OI 30-Jan % Chg. Spot (Rs.) Fut (Rs.) Spot Chg (%.) Fut Chg (%.) Prem / Disc ANDHRABANK 20,940 30% 5,511,077 25% 29% IBREALEST 38,308 21% 10,352,807 29% 29% 4,578,180 91 92 1.1% 1.2% 0.9 5,094,517 83 84 6.3% 6.2% 3,564 15% 3,172,379 56% 0.6 59% 2,436,180 1792 1799 8.7% 8.8% JPASSOCIAT 126,912 11% 17,159,983 7.1 26% 27% 8,903,168 29 29 9.4% 9.1% APOLLOTYRE 12,534 8% 0.2 1,838,440 28% 41% 511,871 243 244 3.2% 3.2% HDIL 23,716 1.8 6% 8,382,699 13% 11% 3,064,035 110 110 14.0% 14.4% 0.4 7,298 6% 987,046 19% 18% 719,938 508 512 6.0% 6.0% 4.0 IDFC 52,398 4% 7,260,448 35% 55% 543,893 172 174 0.8% 0.8% 1.4 RELCAPITAL 12,849 3% 1,197,126 20% 25% 542,572 486 490 4.3% 4.3% 3.6 RPOWER 74,576 2% 2,247,177 26% 32% 691,546 65 66 2.6% 2.7% 0.5 Spot (Rs.) Fut (Rs.) Spot Chg (%.) Fut Chg (%.) Prem / Disc HCLTECH RELINFRA Del Qty Cash Market 30-Jan % Del. Prev % Del. Increase Del Qty Increasing OI, Increasing Delivery Qty & Decreasing Price, (Open Interest in '000 Shares) Symbol Total OI 30-Jan % Chg. BANKBARODA 22,570 24% 9,366,724 31% 46% 7,244,862 193 195 -11.1% -11.0% 1.7 1,934 20% 801,524 64% 56% 249,869 2869 2892 -1.2% -0.6% 23.0 TCS 4,842 16% 2,415,247 79% 82% 845,317 2482 2502 -2.5% -2.3% 19.5 SBIN 62,841 15% 18,565,368 55% 49% 10,697,001 309 312 -5.5% -5.3% 2.6 ICICIBANK 55,395 13% 14,824,027 48% 64% 1,537,519 361 363 -5.2% -4.8% 2.5 CANBK 5,706 10% 971,677 38% 15% 711,541 443 446 -5.9% -4.7% 3.1 TVSMOTOR 4,476 10% 726,423 29% 37% 77,924 308 309 -0.6% -0.7% 1.1 PETRONET 5,106 9% 1,180,653 60% 48% 445,429 180 181 -4.2% -4.3% 1.3 BANKINDIA 11,615 9% 1,949,228 32% 39% 544,195 266 268 -5.2% -5.2% 2.0 ASIANPAINT 6,405 7% 2,435,279 68% 39% 128,575 858 864 -2.7% -2.5% 6.6 TECHM Del Qty Cash Market 30-Jan % Del. Prev % Del. Increase in Del Qty Open Interest Break-up (Rs. in Cr.) 30-Jan 29-Jan Change in OI % Chg INDEX FUTURES 27,391 INDEX OPTIONS 82,964 26,959 432 1.60 74,807 8,157 10.90 110,355 101,766 8,589 8.44 STOCK FUTURES 67,785 65,098 2,686 4.13 STOCK OPTIONS 9,022 5,859 3,163 54.00 TOTAL INDEX TOTAL STOCKS 76,807 70,957 5,850 8.24 GRAND TOTAL 187,161 172,723 14,438 8.36 FII's 129,894 124,340 5554 4.47 57,267 48,383 8884 18.36 Others LKP Advisory Corporate News Deepak Nitrite has issued Commercial Papers (CP) for Rs 40 crore value dated January 30, 2015. This has been subscribed by HDFC Bank having maturity on March 30, 2015. The aforesaid issuance of CP is to fund working capital requirement of the Company. Strides Arcolab's Oral Dosage Facility (KRS Gardens) at Bangalore has been found acceptable by the United States Food and Drug Administration (US FDA). The inspection was carried out in August 2014. Gujarat State Fertilizers and Chemicals (GSFC) is proposing to set up 40,000 MTPA Melamine Project at an estimated cost of Rs 900 crore. The setting up of this project would be the import substitution for the company. The project is expected to be commissioned in 3rd quarter of FY 2017-18. Microsec Financial Services has received an approval to make an application to Reserve Bank of India (RBI) for Small Finance Bank through its wholly owned subsidiary (WOS) Microsec Resources. Quantum Build-Tech is considering taking up Infrastructure and Real Estate projects in alternative markets other than Hyderabad and is planning to launch a new Project at Jaihind Nagar at Hyderabad and is exploring various alternatives to raise financial resources. Indosolar has signed a major Wafer Supply Contract with its strategic partner Osung LST Co., Korea. The wafer supply contract signed as a part of this $200 million agreement covers a significant portion of Indosolar’s solar photovoltaic cell demand for FY 2015-16 of 48 million wafers valued at around $45 million. Reserve Bank of India (RBI) has increased foreign institutional investors' (FIIs) investment limit in Veritas to 100% of its paid-up capital. RBI has notified that FIIs/Registered Foreign Portfolios Investors (RFPIs) can now invest up to 100 percent of the paid up capital of Veritas under the Portfolio Investment Scheme (PIS). Inox Wind, a subsidiary of Gujarat Fluorochemicals, has been awarded two wind farm project contracts of 54 MW and 118 MW in Gujarat and Rajasthan, respectively by Tata Power Renewable Energy (TPREL). TPREL is a wholly owned subsidiary of Tata Power. Cera Sanitaryware has received an approval to increase the aggregate limit of Foreign Institutional Investors (FIIs) holding in the company from 24% to 36%. The board of directors at their meeting held on January 29, 2015 has approved for the same. Mahindra & Mahindra’s (M&M) business unit - Mahindra First Choice Wheels (MFCWL), multi-brand certified used car company, has inaugurated its new authorized dealership in state of Kerala. This is the company’s 27th outlet in the state and 7th dealership in Ernakulam. The new outlet, Kwality Kars, is spread across 2,600 square feet and is located at Amisha Arcade, Companypadi, Aluva. Tata Teleservices (Maharashtra) (TTML) has received an approval to raise funds up to an amount of Rs 2,500 crore by issue of Non-Convertible Debentures (NCDs), in one or more tranches, by way of Private Placement, subject to the approval of shareholders of the company. The board of directors at their meeting held on January 29, 2015 has approved for the same. Suryalakshmi Cotton Mills has suspended production operations at Denim division which is located near Ramtek, Nagpur District in state of Maharashtra, due to labour unrest. The company is negotiating with the Workers Union and is reasonably confident of settling the issue at an early date. Bharti Airtel’s wholly owned subsidiary Airtel M Commerce Services (AMSL) is seeking to convert its existing Prepaid Payment Instrument license into a Payments Bank license to be issued by the Reserve Bank of India. The Board of Directors of SKS Microfinance has approved its proposal for making an application to the Reserve Bank of India (RBI) for grant of a Small Finance Bank licence. LKP Advisory Palred Technologies has received an approval for the proposal of investment in the equity shares of Palred IT Services within the prescribed limits. The board of directors at their meeting held on January 29, 2015 has approved for the same. Kotak Mahindra Bank has agreed, subject to regulatory approvals, to invest 19.90% in Airtel M Commerce Services (AMSL), a subsidiary of Bharti Airtel, on AMSL obtaining the Payment Bank licence from Reserve Bank of India. Moreover, AMSL is in the process of applying for Payment Bank License to the Reserve Bank of India (RBI). Tata Power, India's largest integrated power company has been granted with ISO/IEC 17025:2005 accreditation by the National Accreditation Board (NABL) for its Meter Testing and Calibration Laboratories at Dharavi. Choice International has received an approval for capital infusion of Rs 10 crore in Choice Equity Braking, a 100% subsidiary of Choice International by subscribing equity shares. The board of directors at their meeting held on January 30, 2015 have approved for the same. PVR has entered into share purchase agreement with L Capital Eco on January 29, 2015 for purchase of their entire investment in equity and preference shares of PVR Leisure. The board of directors at their meeting held on January 30, 2015 has taken the note of it. Jet Airways, India's premier international airline, will operate 16 additional daily Boeing 737 flights effective February 1, 2015 to March 28, 2015 to meet increased demand on key domestic sectors. The Government of India has successfully offloaded 10% stake in Coal India (CIL) to raise around Rs 22,400 crore recording the highest-ever divestment proceeds in a year. The 631-million-share offer for sale (OFS) saw a total of 675 million bids at an indicative price of Rs 358.5 a share slightly higher than the floor price of Rs 358 set by the government. Zuari Agro Chemicals has resumed production at ammonia and urea plants. The plant was shut-down due to high pressure drop across the low temperature shift converter. Dewan Housing Finance Corporation (DHFL) has filed an application for seeking banking license from Reserve Bank of India (RBI) for Small Finance Bank. The board of directors at their meeting held on January 30, 2015 have approved for the same. Tribhovandas Bhimji Zaveri (TBZ), a well-known and trusted jewellery retailer in India, has been included in the coveted elite list of the Asia’s Most Promising Brands 2014. Inclusion in the first-amongst-equals list underlines TBZ-The Original’s rich business legacy, innovative designs and superlative quality, purity & craftsmanship of its products and robust commitment towards customers' satisfaction and trust. Binani Industries has received an approval to issue 0.01% non-cumulative redeemable preference shares of Rs 100 each up to an amount of Rs 120 crore in one or more tranches to the promoter company, on a Private Placement Basis. Peacock Industries is engaged in the business of Plastic Moulded Furniture and exploring opportunities through re-entering in Export business activities. The company is exporting its products to HAITI. Huhtamaki PPL has completed the acquisition of 100% of the shares of Positive Packaging Industries, India. This is in accordance with the Share Purchase Agreement dated, July 08, 2014. Economy Framework for PM’s ambitious ‘100 smart cities’ project to be ready by Feb 28: Aggarwal Union Urban Development Secretary Shankar Aggarwal unveiled that the framework for Prime Minister Narendra Modi's ambitious project of developing 100 smart cities will be finalized by next month-end. The minister further said that the government in next two days would be completing the process for identification of 100 smart cities. LKP Advisory The government’s objective is to develop cities with technology-based governance, which will enable efficient public services and have 24x7 water and power supply, 100% sewerage, drainage and solid waste management facilities, besides top class infrastructure. Further, the government expects a large contribution from the private sector in developing the cities as it plans to build this project on public private partnership basis. As per the envisaged plan, every city would on an average need investments to the tune of Rs 1,000 crore over next 10 years and the private sector is expected to contribute largely, nearly 80-85%, towards this development, according to the government. Besides, Union Urban development ministry has asked the states to ensure that the cities picked under the smart cities initiative would have to meet the broad contours listed by it, including economically viable cities, meeting the requirements of 'e-governance', 'Swachh Bharat' and 'Make in India’. India’s farming reforms key behind improving fiscal deficit: Moody’s Global rating agency Moody’s in its ‘Credit Outlook Report’ underscored that India’s farming reforms were key behind cutting country’s ballooning fiscal deficit. The rating agency highlighted that improvement in India’s sovereign rating will depend upon the government’s ability to pursue farm sector reform since this would have substantial bearing on inflation and fiscal deficit. The rating agency expects that farm sector reform would improve the efficiency of India's food supply chain, which would definitely be credit positive since this will reduce inflationary pressures and the government's fiscal deficit, two key constraints on the sovereign's credit quality. Moody's has assigned a ‘Baa3’ rating with stable outlook on India. According to Moody's, annual spending on food subsidies grew by 20% on average over the past eight years, compared with 16% overall expenditure growth during the same period. The central government spent about 0.88% of GDP on food subsidies in fiscal year 2014, which accounted for 18% of its fiscal deficit. India's FDI rises by 26% in 2014: 'Global Investment Trade Monitor' report Regardless of decline in global foreign direct investment (FDI) inflows, 'Global Investment Trade Monitor' report released by United Nations Conference on Trade and Development (UNCTAD) showed that India’s FDI increased by 26% in 2014 to an estimated $35 billion. Notably, the figure is one of the highest in recent years, though in 2008 FDI peaked in India with $47 billion investment followed by $35.6 billion in 2009. Meanwhile, the top five countries in FDI list in 2014 were China ($128 billion), followed by Hong Kong ($111 billion), the US ($86 billion), Singapore ($81 billion) and Brazil ($62 billion). Further, the report pointed that maximum growth in services sector especially in electricity, gas, water, waste management and information and communication, led to sharp surge of FDI in the country. According to UNCTAD, India still remains the brightest spot for FDI despite a global decline and FDI is at a significant historical high, if not at the highest level of investment. However, China piped US to top the FDI recipient list and emerged as world's largest recipient of FDI. The world’s largest economy, United States (US) has been holding the position of world’s largest recipient of FDI, since 1980’s despite a modest rise of 3%. However, the drop in FDI in the US has been primarily due to a fall in cross-border M&A sales, particularly due to the Verizon-Vodafone deal and stood at$ 10 billion in 2014 from $ 60 billion in 2013. It had exceeded $222 billion in 2008. Lastly, the report underscored that while the overall FDI flows to developed countries dropped by 14%, FDI in developing economies reached to new high with global share of 56%. Source: Reuters, Ace Equity & LKP Research LKP Advisory Tech View CNX Nifty Technical View Nifty witnessed a considerable fall from around 9000 levels indicating that the index is expected to face pressure at higher levels. Profit booking across the sectors was evident which implies sector specific influence will keep the index subdued for few days. The immediate support levels are now seen at 8700-8750 levels whereas resistance is seen at 8900 levels. The index is expected to open with a muted start and may test 8750 levels today. If it fails to sustain those levels then it can fall further to levels of 8700. IMPORTANT LEVELS FOR THE DAY Support BSE NSE BANKNIFTY S1 28,888 8723 19522 S2 28,297 8554 18859 R1 29,844 8997 20595 R2 30,435 9166 21259 Pivot 29,366 8,860 20,059 Resistance . LKP Advisory Tech View PIVOT POINTS Scrip Name CMP RB2 RB1 PP SB1 SB2 ACC Scrip Name CMP RB2 RB1 PP SB1 SB2 1560 1643 1600 1565 1529 1486 GAIL 423 430 426 423 420 416 ADANIENT 627 726 663 612 562 499 GLENMARK 719 744 732 722 712 700 ADANIPORTS 341 378 356 339 321 299 GMRINFRA 19 22 20 19 17 16 ADANIPOWER 52 55 53 52 50 48 GODREJIND 311 327 319 313 307 299 ALBK 116 130 124 118 113 107 GRASIM 3884 4064 3977 3907 3837 3750 AMBUJACEM 249 270 258 249 239 228 HAVELLS 258 272 265 260 255 249 ANDHRABANK 91 102 96 90 85 78 HCLTECH 1792 1881 1830 1788 1747 1696 APOLLOHOSP 1314 1457 1390 1335 1280 1213 HDFC 1263 1388 1331 1284 1238 1180 APOLLOTYRE 243 257 248 241 233 224 HDFCBANK 1077 1121 1097 1079 1060 1037 ARVIND 291 311 301 293 285 275 HDIL 110 126 115 107 99 88 ASHOKLEY 66 69 67 66 65 63 2866 2996 2936 2887 2837 2777 ASIANPAINT 858 914 888 867 846 819 HEXAWARE 226 233 229 225 221 216 1248 1279 1258 1242 1225 1204 HINDALCO 140 147 143 140 138 134 588 620 605 592 579 564 HINDPETRO 658 696 672 652 633 609 2392 2452 2420 2394 2368 2336 HINDUNILVR 933 952 942 934 926 916 BANKBARODA 193 248 222 200 178 151 HINDZINC 175 183 179 175 171 167 BANKINDIA 266 304 286 271 256 238 IBREALEST 83 90 86 83 80 76 BATAINDIA 1423 1512 1470 1436 1402 1360 ICICIBANK 361 404 383 366 349 328 BHARATFORG 1034 1077 1054 1036 1019 996 IDBI 71 77 74 72 69 67 BHARTIARTL 374 394 383 374 364 353 IDEA 155 166 160 156 152 147 BHEL 292 309 299 292 284 275 IDFC 172 189 179 171 163 153 BIOCON 415 427 420 415 409 403 IFCI 38 42 40 38 36 35 BPCL 749 792 768 748 728 703 IGL 465 485 475 467 459 449 CAIRN 233 241 237 233 230 226 INDIACEM 108 118 113 109 105 100 CANBK 443 499 474 453 433 407 INDUSINDBK 870 899 885 874 862 848 CENTURYTEX 574 603 588 576 564 550 INFY 2142 2193 2166 2144 2122 2095 CESC 731 760 742 728 713 696 IOB 57 63 60 57 55 52 CIPLA 696 713 704 697 689 681 IOC 347 365 356 349 341 333 COALINDIA 361 367 364 362 359 356 IRB 269 285 277 270 263 255 1876 1957 1918 1886 1854 1815 ITC 369 380 373 368 363 357 CROMPGREAV 190 200 195 191 187 182 JINDALSTEL 159 167 162 158 154 149 DABUR 256 272 264 257 249 241 JISLJALEQS 70 76 72 69 66 61 DISHTV 79 84 81 80 78 76 JPASSOCIAT 29 32 30 28 26 24 1742 1858 1797 1748 1698 1637 JPPOWER 12 13 12 12 11 11 170 183 176 170 165 158 JSWENERGY 121 125 123 121 119 116 DRREDDY 3233 3507 3375 3269 3163 3032 JSWSTEEL 977 1046 1010 980 951 914 EXIDEIND 186 204 196 189 182 174 JUBLFOOD 1390 1477 1434 1400 1365 1322 FEDERALBNK 142 149 145 143 140 137 JUSTDIAL 1555 1602 1574 1551 1529 1501 AUROPHARMA AXISBANK BAJAJ-AUTO COLPAL DIVISLAB DLF LKP Advisory HEROMOTOCO Tech View Scrip Name CMP RB2 RB1 PP SB1 SB2 Scrip Name CMP RB2 RB1 PP SB1 SB2 KOTAKBANK 1322 1373 1349 1329 1310 1286 TATACHEM 457 479 468 459 450 438 143 153 148 144 140 135 TATACOMM 411 424 417 412 407 401 69 72 70 69 68 66 TATAGLOBAL 159 170 164 158 153 147 479 510 495 482 470 454 TATAMOTORS 585 623 605 590 576 558 LT 1701 1788 1744 1708 1673 1629 TATAMTRDVR 364 375 369 364 359 353 LUPIN 1585 1638 1602 1574 1545 1510 TATAPOWER 91 95 92 90 88 85 M&M 1265 1334 1302 1276 1250 1218 TATASTEEL 390 402 396 391 385 379 M&MFIN 255 270 260 252 245 235 TCS 2482 2654 2574 2509 2444 2364 MARUTI 3647 3830 3742 3672 3601 3513 TECHM 2869 3112 2994 2899 2804 2686 MCDOWELL-N 3451 3691 3576 3484 3391 3277 TITAN 431 454 443 434 425 415 MCLEODRUSS 206 212 208 206 203 200 UBL 975 1046 1013 986 959 926 40037 40876 40388 39993 39598 39110 75 81 78 76 74 71 NHPC 19 21 20 19 19 18 3140 3262 3195 3141 3086 3019 NMDC 142 149 145 142 139 135 UNIONBANK 209 230 220 212 203 193 UNITECH KTKBANK L&TFH LICHSGFIN MRF NTPC 144 152 148 144 141 137 OFSS 3397 3511 3444 3390 3335 3268 ONGC 351 362 356 352 347 ORIENTBANK 266 296 282 271 PETRONET 180 198 189 PFC 298 316 PNB 190 213 POWERGRID 148 PTC RANBAXY RCOM ULTRACEMCO 19 20 19 19 18 17 UPL 368 383 375 369 363 355 341 VOLTAS 269 289 279 271 263 253 260 245 WIPRO 607 622 613 605 597 587 182 174 165 YESBANK 862 908 886 868 851 828 307 299 292 283 ZEEL 377 398 387 379 370 360 202 193 184 174 154 151 148 145 142 100 105 102 100 98 95 703 731 716 704 692 677 80 87 83 81 78 74 RECLTD 333 363 349 337 326 311 RELCAPITAL 486 510 494 481 468 451 RELIANCE 915 949 932 919 905 888 RELINFRA 508 546 521 502 482 457 RPOWER 65 68 66 65 63 62 SAIL 77 81 79 78 76 74 SBIN 309 348 330 315 301 283 SIEMENS 1042 1127 1074 1031 987 934 SRTRANSFIN 1142 1201 1171 1147 1123 1094 SSLT 202 213 206 201 196 190 SUNPHARMA 918 943 929 919 908 895 SUNTV 407 429 418 410 402 391 SYNDIBANK 117 129 123 119 114 108 LKP Advisory UCOBANK The information in this documents has been printed on the basis of publicly available information, internal data and other reliable sources believed to be true and is for general guidance only. While every effort is made to ensure the accuracy and completeness of information contained, the company makes no guarantee and assumes no liability for any errors or omissions of the information. No one can use the information as the basis for any claim, demand or cause of action. LKP Securities Ltd., and affiliates, including the analyst who have issued this report, may, on the date of this report, and from time to time, have long or short positions in, and buy or sell the securities of the companies mentioned herein or engage in any other transaction involving such securities and earn brokerage or compensation or act as advisor or have other potential conflict of interest with respect to companies mentioned herein or inconsistent with any recommendation and related information and opinions. LKP Securities Ltd., and affiliates may seek to provide or have engaged in providing corporate finance, investment banking or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in the past. LKP Securities Ltd. Ph: (91-22) 66351234 FAX: (91-22) 66351249 E Mail: [email protected] web: http://www.lkpsec.com LKP Advisory

© Copyright 2026