Jan 29, 2015 - Moneycontrol

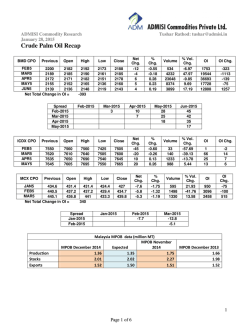

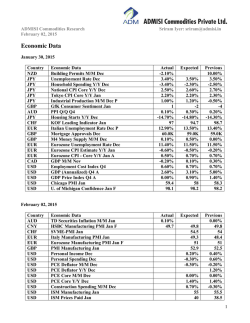

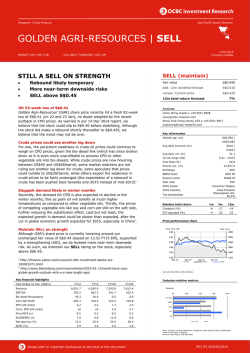

ADMISI Commodity Research January 29, 2015 Tushar Rathod: [email protected] Crude Palm Oil Recap BMD CPO Previous FEB5 2188 MAR5 2185 APR5 2178 MAY5 2160 JUN5 2143 Net Total Change in Open High Low Close 2181 2168 2164 2150 2131 OI = 2221 2221 2216 2201 2181 5728 2180 2168 2164 2148 2131 2221 2217 2210 2193 2173 Spread Feb-2015 Mar-2015 Apr-2015 May-2015 Feb-2015 Mar-2015 4 ICDX CPO Previous Open High Low Close FEB5 MAR5 APR5 MAY5 7505 7600 7645 7665 7420 7585 7630 7600 7645 7745 7800 7835 7420 7530 7575 7600 7595 7700 7770 7785 MCX CPO Previous Open High Low Close JAN5 427 427.3 FEB5 434.7 435.4 MAR5 439.8 440.2 Net Total Change in OI = 429.1 439 443.2 48 424.7 427.2 431.3 425.4 428.3 432.3 Spread Jan-2015 Feb-2015 Production Stocks Exports Net Chg. 33 32 32 33 30 % Chg. 1.51 1.46 1.47 1.53 1.40 Apr-2015 11 7 Net Chg. 90 100 125 120 Jan-2015 % Vol. Chg. -50.37 -37.69 15.94 45.44 -4.28 Volume 265 2637 27417 12179 3732 May-2015 28 24 17 % Chg. 1.20 1.32 1.64 1.57 Net Chg. -1.6 -6.4 -7.5 Feb-2015 -2.9 % Chg. -0.37 -1.47 -1.71 OI OI Chg. 1529 19017 39437 20440 13831 -224 -527 2744 2712 1023 OI OI Chg. 2 79 7 4 1 13 -18 -9 Jun-2015 48 44 37 20 % Vol. Chg. 24.24 385.71 16.55 -12.55 Volume 41 680 1437 864 Volume 561 2598 1202 % Vol. Chg. -5.71 73.43 -9.62 OI 765 2995 2792 OI Chg. -185 -101 334 Mar-2015 -6.9 -4 Malaysia MPOB data (million MT) MPOB November MPOB December 2014 Expected 2014 1.36 1.35 1.75 2.01 2.02 2.27 1.52 1.50 1.51 MPOB December 2013 1.66 1.98 1.52 1 Page 1 of 6 ADMISI Commodity Research January 29, 2015 Date 28-Jan-15 28-Jan-15 28-Jan-15 28-Jan-15 28-Jan-15 28-Jan-15 28-Jan-15 28-Jan-15 28-Jan-15 28-Jan-15 28-Jan-15 28-Jan-15 Tushar Rathod: [email protected] Physical Market Rates Commodity Malaysia CPO FOB - January Malaysia Palm Kernel FOB - January Malaysia Palm Oil RBD FOB - February Malaysia Palm olein - February Malaysia Palm Stearin - February China - Tianjin Refined Palm oil Spot Indonesia CPO FOB Spot India Mumbai C & F CPO Spot India Mumbai C & F Palm olein RBD Spot India Kakinada Palm olein RBD Spot India Kandla Palm olein RBD Spot India Mangalore Palm olein RBD Spot Rate 617.92 1323.43 630.00 630.00 635.00 4900.00 607.00 632.00 655.00 475.00 477.00 490.00 Units $ / MT $ / MT $ / MT $ / MT $ / MT CNY / MT $ / MT $ / MT $ / MT Rs. / 10 Kg Rs. / 10 Kg Rs. / 10 Kg Source: - Reuters • • • • • • • BMD CPO futures moved higher yesterday on weaker Ringgit. Ideas that the recent selling in the last few sessions was overdone likely triggered the rally yesterday. Exports of Malaysian Palm oil products during Jan. 1-25 fell 17.7% to 886,189 MT from 1,077,140 MT shipped during Dec. 1-25, cargo surveyor Intertek Testing Services said. Exports of Malaysian Palm oil products for Jan. 1-25 fell 19.0% to 877,730 MT from 1,083,151 MT shipped during Dec. 1-25, cargo surveyor Societe Generale de Surveillance said. CBOT Soy oil March closed lower by 0.87 cent yesterday at 30.34 cents/pound. Indian MCX CPO futures closed lower yesterday. Rupee closed flat yesterday. Crude oil closed lower yesterday. US Dollar index ended firm yesterday. 2 Page 2 of 6 ADMISI Commodity Research January 29, 2015 Tushar Rathod: [email protected] Spread: - CBOT Soy Oil May – BMD CPO April Source: - Reuters The CBOT Soy Oil May – BMD CPO April spread is at $62.64/MT. Spread: - NCDEX Soy Oil February – MCX CPO February Source: - Reuters The NCDEX Soy Oil February – MCX CPO February spread is at Rs.183.30/10 Kg. 3 Page 3 of 6 ADMISI Commodity Research January 29, 2015 Tushar Rathod: [email protected] Charts & Outlook BMD CPO with USDMYR Source: - Reuters BMD Crude Palm Oil April (2210) Trade Recommendation: - Sell in the range 2180 – 2200, S/L 2223, TGT 2121 - 2080. This call is on. 4 Page 4 of 6 ADMISI Commodity Research January 29, 2015 Tushar Rathod: [email protected] MCX CPO with USDINR Source: - Reuters MCX CPO February (427.90) Trade Recommendation: - Sell below 438, S/L 443, TGT 427. This call is on. Outlook: - Poor export demand is negative for prices amid negative momentum and weakness in Soy oil prices. CPO prices may move lower towards 2100 – 2050 levels. Resistance is at 2250 levels. Dalian Palmolein May (4764) Comments: - Downside towards 4600 levels may be seen. 5 Page 5 of 6 ADMISI Commodity Research January 29, 2015 Tushar Rathod: [email protected] DISCLAIMER: This document is not for public distribution and has been furnished to you solely for your information and must not be reproduced or redistributed to any other person. Persons into whose possession this document may come are required to observe these restrictions. This material is for the personal information of the authorized recipient, and we are not soliciting any action based upon it. This report is not to be construed as an offer to sell or the solicitation of an offer to buy any commodity or commodity derivative in any jurisdiction where such an offer or solicitation would be illegal. It is for the general information of clients of ADMISI Commodities Private Limited. It does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. We have reviewed the report, and in so far as it includes current or historical information, it is believed to be reliable though its accuracy or completeness cannot be guaranteed. Neither Archer Daniels Midland Company (ADM), nor ADMISI (UK) nor ADMISI Commodities Private Limited, nor any person/entity connected with it, accepts any liability arising from the use of this document. The recipients of this material should rely on their own investigations and take their own professional advice. Price and value of the investments referred to in this material may go up or down. Past performance is not a guide for future performance. Certain transactions -including those involving futures, options and other derivatives as well as noninvestment grade securities - involve substantial risk and are not suitable for all investors. Reports based on technical analysis centers on studying charts of a stock's price movement and trading volume, as opposed to focusing on a commodity’s fundamentals and as such, may not match with a report on a commodity's fundamentals. Opinions expressed are our current opinions as of the date appearing on this material only. While we endeavor to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. Prospective investors and others are cautioned that any forward-looking statements are not predictions and may be subject to change without notice. Our investment businesses may make investment decisions that are inconsistent with the recommendations expressed herein. No part of this material may be duplicated in any form and/or redistributed without ADMISI Commodities Private Limited prior written consent. 6 Page 6 of 6

© Copyright 2026