Union Bank of India - InvestmentGuruIndia

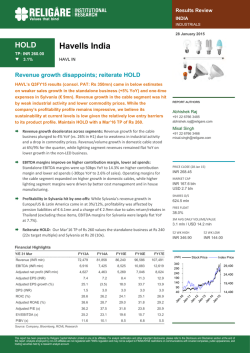

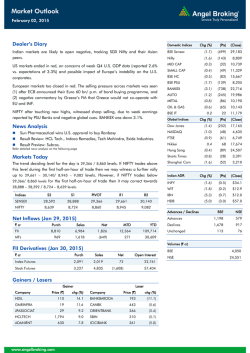

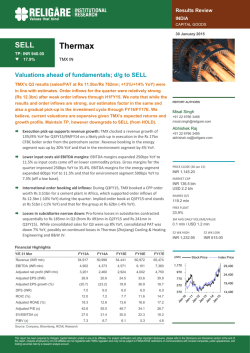

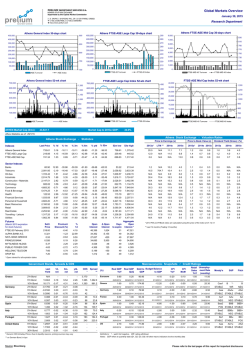

3QFY2015 Result Update | Banking January 28, 2015 Union Bank of India ACCUMULATE Performance Highlights CMP Target Price Particulars (` cr) NII Pre-prov. profit PAT 3QFY15 2,121 1,465 302 2QFY15 2,084 1,334 371 % chg (qoq) 1.8 9.9 (18.6) 3QFY14 1,964 1,262 349 % chg (yoy) 8.0 16.1 (13.3) Source: Company, Angel Research Union Bank of India (Union Bank) reported a weak set of numbers for 3QFY2015, with its PAT de-growing by 13.3% yoy owing to 39.6% growth in provisions; while asset quality continued to deteriorate. `227 `248 Investment Period 12 Months Stock Info Banking Sector Market Cap (` cr) 14,400 Beta 2.0 Advances growth moderates; Asset quality continues to witness pressure During 3QFY2015, advances and deposits grew at a moderate pace at 8.3% and 9.7% yoy, respectively. Within advances, retail, Agriculture and MSME segments witnessed robust traction, registering a growth of 27.3%, 29.1%, and 24.9%, respectively. The Corporate segment de-grew by 3.9% yoy; it contributed 53.3% to the total loan book as compared to 60.1% in 3QFY2014. CASA deposits grew by 9.5% yoy, while the CASA ratio fell by 7bp yoy to 28.7%. The reported NIM for the bank fell by 3bp qoq to 2.5%, with yield on advances decreasing by 17bp qoq to 10.43%. The bank registered a moderate performance on the non-interest income (excl. treasury) front, with a growth of 2.5% yoy, largely aided by a 16.1% yoy growth in CEB income to `455cr. Overall, other income grew by 29% yoy, with 3.6x growth in profit on sale of investments. 52 Week High / Low On the asset quality front, slippages came in at `1,738cr (annualized slippage rate at 3%) compared to `1,960cr (annualized slippage rate at 3.4%) in 2QFY2015. Elevated slippages with lower recoveries/upgrades and write-offs resulted in a 9.9% qoq increase in Gross NPA levels. Gross and net NPA ratios increased sequentially by 39bp and 24bp, respectively to 5.1% and 3.0%. During the quarter, the bank restructured advances worth `1,212cr (as compared to `931cr in 2QFY2015), thereby taking its outstanding restructured book to `16,655cr. Slippage from the restructured book was to the tune of `240cr during the quarter. The Management has guided for a total restructuring pipeline of around `1,600cr for 4QFY2015. Promoters 60.5 MF / Banks / Indian Fls 17.3 FII / NRIs / OCBs 10.0 Indian Public / Others 12.3 Outlook and valuation: Union Bank has been witnessing continued asset quality pressures for several quarters over the last few years, which has severely impacted its profitability. The RoE for the bank has declined significantly to 10.0% as of FY2014, impacted by higher credit costs and lower margins. Its Tier I CAR is also relatively low at 7.3% (CET-1 at 7.0%). At CMP, the stock trades at 0.8x FY2016E ABV. We recommend an Accumulate rating on the stock. 259.6/100.6 Avg. Daily Volume 6,68,494 Face Value (`) 10 BSE Sensex 29,559 Nifty 8,914 Reuters Code UNBK.BO Bloomberg Code UNBK@IN Shareholding Pattern (%) Abs. (%) 3m 1yr 3yr Sensex 10.5 42.8 71.6 UNBK 4.7 115.4 10.6 Key financials (standalone) Y/E March (` cr) NII % chg Net profit % chg NIM (%) EPS (`) P/E (x) P/ABV (x) RoA (%) RoE (%) FY2013 7,543 11.0 2,158 20.7 2.7 36.0 6.3 0.9 0.7 15.0 FY2014 7,879 4.5 1,696 (21.4) 2.4 28.2 8.5 1.0 0.5 10.3 FY2015E 8,562 8.7 1,808 6.6 2.3 28.5 7.9 0.9 0.5 10.2 Source: Company, Angel Research; Note: CMP as of January 28, 2015 Please refer to important disclosures at the end of this report FY2016E 9,830 14.8 2,460 36.1 2.4 38.9 5.8 0.8 0.6 12.7 Vaibhav Agrawal 022 – 3935 7800 Ext: 6808 [email protected] Umesh Matkar 022 – 3935 7800 Ext: 6839 [email protected] 1 Union Bank of India | 3QFY2015 Result Update Exhibit 1: 3QFY2015 performance (standalone) Particulars (` cr) 3QFY15 2QFY15 % chg (qoq) 3QFY14 % chg (yoy) FY2014 FY2013 % chg Interest earned 8,044 7,943 1.3 7,550 6.5 29,349 25,125 16.8 - on Advances / Bills 6,027 5,991 0.6 5,565 8.3 21,740 19,140 13.6 - on investments 1,895 1,851 2.4 1,911 (0.8) 7,270 5,671 28.2 51 53 (4.6) 36 39.5 179 199 (10.1) - on balance with RBI & Others - on others 71 49 45.6 38 86.9 160 115 39.7 Interest Expended 5,923 5,859 1.1 5,587 6.0 21,470 17,582 22.1 Net Interest Income 2,121 2,084 1.8 1,964 8.0 7,879 7,543 4.5 Other income 877 811 8.1 680 29.0 2,822 2,552 10.6 Other income excl. treasury 625 736 (15.1) 610 2.5 2,335 2,075 12.5 - Fee Income 455 448 1.6 392 16.1 1,634 1,423 14.8 - Treasury Income 252 75 236.0 70 260.0 487 477 2.1 - Recov. from written off a/cs 42 92 (54.3) 87 (51.7) 266 324 (18.0) 128 196 (34.7) 131 (2.0) 435 328 32.6 Operating income 2,998 2,896 3.5 2,643 13.4 10,701 10,095 6.0 Operating expenses 1,533 1,562 (1.8) 1,382 11.0 5,483 4,512 21.5 966 944 2.3 823 17.3 3,308 2,755 20.1 - Profit on exchange transactions - Employee expenses - Other Opex 567 618 (8.1) 559 1.5 2,175 1,757 23.8 1,465 1,334 9.9 1,262 16.1 5,218 5,583 (6.5) Provisions & Contingencies 852 785 8.5 610 39.6 3,149 2,518 25.0 - Provisions for NPAs 674 603 11.8 497 35.6 2,106 1,555 35.4 - Provisions for Investments (26) 79 (132.9) 44 (159.1) 87 198 (56.1) - Other Provisions 204 103 97.2 69 193.8 956 765 24.9 PBT 613 549 11.8 651 (5.8) 2,069 3,064 (32.5) Provision for Tax 311 177 75.5 302 2.9 373 906 (58.9) 2,158 (21.4) Pre-provision Profit PAT 302 371 (18.6) 349 (13.3) 1,696 Effective Tax Rate (%) 50.7 32.3 1840bp 46.4 428bp 18.0 29.6 (1157)bp Source: Company, Angel Research January 28, 2015 2 Union Bank of India | 3QFY2015 Result Update Exhibit 2: 3QFY2015 performance analysis (standalone) Particulars 3QFY15 2QFY15 % chg (qoq) 3QFY14 % chg (yoy) Advances (` cr) 2,41,512 2,38,393 1.3 2,23,024 8.3 Deposits (` cr) 3,12,912 3,00,165 4.2 2,85,125 9.7 77.2 79.4 (224)bp 78.2 (104)bp Current deposits (` cr) 21,891 18,789 16.5 21,008 4.2 Savings deposits (` cr) 68,019 67,400 0.9 61,104 11.3 CASA deposits (` cr) Balance sheet Credit-to-Deposit Ratio (%) 89,910 86,189 4.3 82,112 9.5 Reported CASA ratio (%) 28.7 28.7 2bp 28.8 (7)bp CAR (%) 10.3 10.3 0bp 10.1 18bp 7.3 7.3 1bp 6.8 57bp Yield on funds 8.9 9.1 (16)bp 9.0 (11)bp Cost of funds 6.6 6.7 (12)bp 6.7 (11)bp Reported NIM 2.50 2.53 (3)bp 2.5 0bp Cost-to-income ratio 51.1 53.9 (281)bp 52.3 (114)bp 12,596 11,462 9.9 8,776 43.5 5.1 4.7 39bp 3.9 123bp 7,118 3.0 57.3 6,449 2.7 58.0 10.4 24bp (72)bp 5,048 2.3 60.0 41.0 69bp (272)bp Slippage ratio (%) 3.0 3.4 (40)bp 2.2 82bp LLP to avg. assets (%) 0.7 0.7 7bp 0.6 13bp Tier 1 CAR (%) Profitability Ratios (%) Asset quality Gross NPAs (` cr) Gross NPAs (%) Net NPAs (` cr) Net NPAs (%) Prov. Coverage Ratio (%) Source: Company, Angel Research Business growth moderates; NIM falls 3bp qoq During 3QFY2015, advances grew at a moderate pace at 8.3% yoy. Within advances, retail, Agriculture and MSME witnessed robust traction, registering a growth of 27.3%, 29.1%, and 24.9%, respectively. The Corporate segment de-grew by 3.9% yoy and contributed by 53.3% to the total loan book as compared to 60.1% in 3QFY2014. Exposure to the infra sector to total advances has fallen from 17.1% to 15.7% on a qoq basis. The Management has maintained its guidance of 10-12% loan growth for FY2015 with focus on retail and SME. On the deposits front, the bank witnessed a moderate growth of 9.7% yoy. Aggregate deposits growth came in much higher than growth in CASA deposits, resulting in a 7bp yoy drop in CASA ratio to 28.7% in 3QFY2015. CASA deposits grew by 9.5% yoy with current deposits growing at a slow pace at 4.2% yoy, while saving deposits grew by 11.3% yoy. Yield on funds for the bank decreased by 16bp qoq to 8.9% due to interest reversal on slippages. Cost of funds decreased 12bp qoq to 6.6%. Consequently, the reported NIM for the bank declined by 3bp qoq to 2.5%. . January 28, 2015 3 Union Bank of India | 3QFY2015 Result Update Exhibit 3: Business grows moderates Adv. yoy chg (%) Dep. yoy chg (%) CDR (%, RHS) 79.4 80.0 30.0 78.7 78.2 20.0 Exhibit 4: CASA ratio trends CASA ratio (%) 29.6 20.0 29.4 78.0 77.2 77.0 29.2 29.0 9.8 28.8 28.7 28.7 3QFY15 29.1 2QFY15 3QFY14 4QFY14 1QFY15 2QFY15 3QFY15 28.4 74.0 6.3 29.5 17.8 9.5 8.3 9.7 10.1 12.9 1QFY15 9.7 4.6 20.0 19.1 4QFY14 - 7.6 28.6 - 28.2 Source: Company, Angel Research Source: Company, Angel Research Exhibit 5: Cost of funds lower by 12bp qoq... Exhibit 6: NIM declines by 3bp qoq (%) (%) 7.00 10.0 9.5 9.5 28.8 76.0 10.0 3QFY14 CASA yoy growth (%, RHS) 6.69 6.58 6.65 6.7 6.58 2.70 2.50 6.50 2.6 2.55 2.50 2.53 2.5 2QFY15 3QFY15 2.30 6.00 2.10 5.50 1.90 5.00 1.70 4.50 3QFY14 4QFY14 1QFY15 2QFY15 3QFY15 Source: Company, Angel Research 1.50 3QFY14 4QFY14 1QFY15 Source: Company, Angel Research Moderate growth in non-interest income (excl. treasury) The bank registered a moderate performance on the non-interest income (excl. treasury) front, with a growth of 2.5% yoy. The CEB Income for the bank grew at a healthy pace of 16.1% yoy to `455cr, while recoveries from written off accounts registered a de-growth of 51.7% yoy to `42cr. Treasury income for the bank came in at `252cr, more than three times as compared to `70cr in 3QFY2014, thereby aiding overall other income to grow strongly by 29% yoy to `877cr. Exhibit 7: CEB Income aids growth in non-interest income (excl. treasury) Particulars (` cr) 3QFY15 2QFY15 % chg (qoq) 3QFY14 % chg (yoy) CEB 455 448 1.6 392 16.1 Treasury 252 75 236.0 70 260.0 42 92 (54.3) 87 (51.7) Forex 128 196 (34.7) 131 (2.3) Other income 877 811 8.1 680 29.0 Other income excl. treasury 625 736 (15.1) 610 2.5 Recoveries Source: Company, Angel Research January 28, 2015 4 Union Bank of India | 3QFY2015 Result Update Asset quality pressure persists During the quarter, the bank continued to witness pressure on the asset quality front, as addition of stressed assets (slippages and incremental restructuring) remained at elevated levels. Slippages came in at `1,738cr (annualized slippage rate of 3%) compared to `1,968cr (annualized slippage rate of 3.4%) in 2QFY2015. Recoveries/upgrades for the bank came in lower sequentially at `604cr for the quarter. The PCR for the bank declined sequentially by 72bp to 57.3%, which resulted in a sequential increase of 10.4% in net NPA levels, higher than the sequential increase of 9.9% witnessed in gross NPA levels. On a relative basis, Gross and net NPA ratios deteriorated sequentially by 39bp and 24bp respectively to 5.1% and 3.0%. During the quarter, the bank restructured advances worth `1,212cr (as compared to `931cr in 2QFY2015), thereby taking its outstanding restructured book to `16,655cr. Slippage from the restructured book was to the tune of `240cr during the quarter. The Management has guided for a total restructuring pipeline of around `1,600cr for 4QFY2015. Exhibit 8: Slippages higher on yoy basis Slippages (%) 4.5 Credit cost (%, RHS) 0.7 0.8 3.0 Exhibit 9: NPA ratios witness pressure qoq 0.9 0.7 0.6 Gross NPAs (%) 5.0 0.6 0.5 Net NPAs (%) PCR (%, RHS) 65.0 6.0 60.0 59.9 58.9 4.0 58.0 3.0 3QFY15 - 5.08 2.95 2QFY15 4.7 2.7 3.0 1QFY15 1.0 4.3 2.5 3.4 4QFY14 55.0 4.1 2.3 2.2 3QFY14 - 2.0 3.9 2.3 2.3 0.3 2.2 1.5 3QFY14 4QFY14 1QFY15 2QFY15 3QFY15 - 50.0 Source: Company, Angel Research Source: Company, Angel Research Exhibit 10: Steady network expansion continues Exhibit 11: C-I ratio trends.. 7,000 3,888 4,003 4,034 4,000 3,871 3,800 3,752 5,000 3QFY14 4QFY14 1QFY15 2QFY15 3QFY15 3,600 Source: Company, Angel Research January 28, 2015 50.0 40.0 2.0 1.7 1.7 1.6 1.7 1.6 1.6 30.0 1.2 20.0 0.8 3,000 10.0 2,000 - 51.1 6,000 3,900 3,700 Opex to average assets (%, RHS) 53.9 5,830 Cost-to-income ratio (%) 51.2 4,000 6,429 ATMs (RHS) 6,628 6,618 53.3 4,100 6,621 52.3 Branches 60.0 57.3 3QFY14 4QFY14 1QFY15 2QFY15 3QFY15 0.4 - Source: Company, Angel Research 5 Union Bank of India | 3QFY2015 Result Update Outlook and valuation Union Bank has been witnessing continued asset quality pressures for several quarters over the last few years, which has severely impacted its profitability. The RoE for the bank has declined significantly from 20.9% in FY2011 to 10.0% as of FY2014, impacted by higher credit costs and lower margins. Its Tier I CAR is also relatively low at 7.3% (CET-1 at 7.0%). At CMP, the stock trades at 0.9x FY2016E ABV. We recommend an Accumulate rating on the stock. Exhibit 12: Recommendation summary CMP (`) Tgt. price (`) Upside (%) FY2016E P/ABV (x) FY2016E Tgt. P/ABV (x) FY2016E P/E (x) FY2014-16E EPS CAGR (%) FY2016E RoA (%) FY2016E RoE (%) 1,058 1,115 5.3 4.2 4.4 20.3 21.3 2.0 22.2 384 443 15.4 2.6 3.0 15.9 19.3 1.7 16.4 883 1,018 15.3 2.7 3.1 14.6 16.3 1.7 19.7 Buy 565 675 19.5 2.6 3.2 15.2 18.4 1.9 18.4 SBI* Accumulate 334 355 6.1 1.9 1.7 14.0 28.2 0.8 13.8 FedBk Neutral 145 - - 1.5 - 11.9 11.6 1.2 12.9 SIB Accumulate 28 31 11.2 1.0 1.1 8.0 (4.1) 0.7 12.6 BOB Buy 224 264 17.7 1.1 1.3 8.2 13.8 0.8 13.8 PNB Buy 207 256 24.0 1.0 1.2 6.7 29.6 0.9 14.1 BOI Buy 291 373 28.4 0.7 0.9 4.8 19.7 0.6 13.0 IndBk Buy 210 255 21.7 0.7 0.8 5.7 23.4 0.8 11.2 Vijaya Bank Buy 49 58 18.1 0.7 0.8 5.3 38.9 0.5 12.4 OBC Buy 313 379 20.9 0.7 0.9 7.0 8.3 0.5 9.4 Allahabad Bank Buy 127 150 17.7 0.7 0.9 6.6 (5.1) 0.4 8.7 UnionBk Accumulate 227 248 9.5 0.8 0.9 5.8 20.6 0.6 12.7 CanBk Buy 476 548 15.2 0.8 1.0 6.3 19.4 0.6 12.5 Company Reco. HDFCBk Accumulate ICICIBk* Buy YesBk Buy AxisBk Source: Company, Angel Research; Note:*Target multiples=SOTP Target Price/ABV (including subsidiaries), #Without adjusting for SASF Company Background Union Bank of India (UNBK) is one of the largest public sector banks, with a balance sheet size of around `3.7lakh cr. The bank has a reasonably large pan-India presence with 4,034 plus branches and around 6,618 ATMs. The bank was one of the early adopters of core banking technology amongst PSU banks. January 28, 2015 6 Union Bank of India | 3QFY2015 Result Update Income statement (standalone) Y/E March (` cr) NII - YoY Growth (%) Other Income - YoY Growth (%) Operating Income - YoY Growth (%) FY11 FY12 FY13 FY14 FY15E FY16E 6,216 6,793 7,543 7,879 8,562 9,830 48.3 9.3 11.0 4.5 8.7 14.8 2,039 2,448 2,552 2,822 3,318 3,525 3.2 20.1 4.2 10.6 17.6 6.2 8,255 9,241 10,095 10,701 11,880 13,355 33.9 11.9 9.2 6.0 11.0 12.4 3,950 3,988 4,512 5,483 6,201 6,666 57.5 0.9 13.2 21.5 13.1 7.5 4,305 5,254 5,583 5,218 5,679 6,688 17.6 22.0 6.3 (6.5) 8.8 17.8 1,350 2,541 2,518 3,149 2,898 3,016 63.3 88.3 (0.9) 25.0 (8.0) 4.1 2,955 2,713 3,064 2,069 2,781 3,672 - YoY Growth (%) 4.3 (8.2) 13.0 (32.5) 34.6 32.0 Prov. for Taxation 873 926 906 373 973 1,212 Operating Expenses - YoY Growth (%) Pre - Provision Profit - YoY Growth (%) Prov. & Cont. - YoY Growth (%) Profit Before Tax - as a % of PBT PAT - YoY Growth (%) 29.6 34.1 29.6 18.0 35.0 33.0 2,082 1,787 2,158 1,696 1,808 2,460 0.3 (14.2) 20.7 (21.4) 6.6 36.1 FY14 FY15E FY16E Balance sheet (standalone) Y/E March (` cr) Share Capital FY12 FY13 635 662 708 741 741 741 12,129 13,972 16,588 17,734 19,125 21,021 202,461 222,869 263,762 297,676 3,30,420 3,70,070 19.1 10.1 18.3 12.9 11.0 12.0 Borrowings 7,126 11,719 17,007 22,696 23,490 26,184 Tier 2 Capital 6,190 6,190 6,790 6,620 8,327 8,118 Other Liab & Prov. 7,443 6,800 7,006 8,282 9,390 10,269 Total Liabilities 235,984 262,211 311,861 353,750 3,91,493 4,36,404 Cash balances 17,610 11,634 10,763 18,420 16,521 18,504 Bank balances 2,488 4,042 5,447 4,653 5,872 6,546 Reserves & Surplus Deposits - Growth (%) Investments 58,399 62,364 80,830 93,723 1,08,451 1,19,567 150,986 177,882 208,102 229,104 2,52,015 2,82,257 26.5 17.8 17.0 10.1 10.0 12.0 Fixed Assets 2,293 2,336 2,479 2,608 2,800 3,027 Other Assets 4,208 3,955 4,239 5,241 5,834 6,503 235,984 262,211 311,861 353,750 3,91,493 4,36,404 20.9 11.1 18.9 13.4 10.7 11.5 Advances - Growth (%) Total Assets - Growth (%) January 28, 2015 FY11 7 Union Bank of India | 3QFY2015 Result Update Ratio analysis Y/E March FY11 FY12 FY13 FY14 FY15E FY16E 3.0 2.8 2.7 2.4 2.3 2.4 47.8 43.1 44.7 51.2 52.2 49.9 Profitability ratios (%) NIMs Cost to Income Ratio RoA 1.0 0.7 0.7 0.5 0.5 0.6 RoE 20.9 14.8 15.0 10.3 10.2 12.7 CASA Ratio 31.8 31.3 31.0 29.5 30.4 31.0 Credit/Deposit Ratio 74.6 79.8 78.9 77.0 76.3 76.3 CAR 13.0 11.9 11.4 10.7 11.3 10.8 8.7 8.4 8.2 7.7 7.9 7.8 Gross NPAs 2.4 3.0 3.0 4.1 5.3 5.7 Net NPAs 1.2 1.7 1.6 2.3 3.0 2.9 Slippages 2.4 2.5 2.2 2.6 2.8 2.3 Loan Loss Prov./Avg. Assets 0.6 0.6 0.5 0.7 0.7 0.7 67.6 62.2 65.2 59.9 57.5 60.0 39.6 32.2 36.0 28.2 28.5 38.9 203.4 217.3 247.1 248.4 241.3 271.2 8.0 8.0 8.0 4.0 5.5 7.5 PER (x) 5.7 7.0 6.3 8.5 7.9 5.8 P/ABVPS (x) 1.1 1.0 0.9 1.0 0.9 0.8 Dividend Yield 3.8 3.8 3.8 1.9 2.4 3.3 NII 2.9 2.7 2.6 2.4 2.3 2.4 (-) Prov. Exp. 0.6 1.0 0.9 0.9 0.8 0.7 Adj. NII 2.3 1.7 1.8 1.4 1.5 1.6 Treasury 0.2 0.2 0.2 0.1 0.2 0.1 Int. Sens. Inc. 2.5 1.9 1.9 1.6 1.7 1.8 Other Inc. 0.7 0.8 0.7 0.7 0.7 0.7 Op. Inc. 3.2 2.7 2.6 2.3 2.4 2.5 Opex 1.8 1.6 1.6 1.6 1.7 1.6 PBT 1.4 1.1 1.1 0.6 0.7 0.9 Taxes 0.4 0.4 0.3 0.1 0.3 0.3 RoA before pref. div. 1.0 0.7 0.8 0.5 0.5 0.6 Pref. div. 0.0 0.0 0.0 0.0 0.0 0.0 RoA 1.0 0.7 0.7 0.5 0.5 0.6 B/S ratios (%) - Tier I Asset Quality (%) Provision Coverage Per Share Data (`) EPS ABVPS DPS Valuation Ratios DuPont Analysis (%) January 28, 2015 Leverage (x) 21.7 20.7 20.0 20.5 21.2 21.5 RoE 20.9 14.8 15.0 10.3 10.2 12.7 8 Union Bank of India | 3QFY2015 Result Update Research Team Tel: 022 - 39357800 E-mail: [email protected] Website: www.angelbroking.com DISCLAIMER This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment. Angel Broking Pvt. Ltd., its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this document are those of the analyst, and the company may or may not subscribe to all the views expressed within. Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals. The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for general guidance only. Angel Broking Pvt. Ltd. or any of its affiliates/ group companies shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel Broking Pvt. Ltd. has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel Broking Pvt. Ltd. endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed or passed on, directly or indirectly. Angel Broking Pvt. Ltd. and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in the past. Neither Angel Broking Pvt. Ltd., nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in connection with the use of this information. Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Ltd. and its affiliates may have investment positions in the stocks recommended in this report. Disclosure of Interest Statement 1. Analyst ownership of the stock 2. Angel and its Group companies ownership of the stock 3. Angel and its Group companies' Directors ownership of the stock 4. Broking relationship with company covered Union Bank of India No No No No Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors Ratings (Returns): January 28, 2015 Buy (> 15%) Reduce (-5% to -15%) Accumulate (5% to 15%) Sell (< -15%) Neutral (-5 to 5%) 9

© Copyright 2026