Maruti Suzuki India Ltd

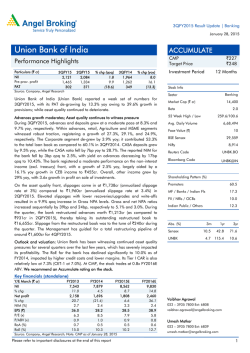

3QFY2015 Result Update | Automobile January 28, 2015 Maruti Suzuki ACCUMULATE Performance Highlights CMP Target Price Y/E March (` cr) Net Sales EBITDA EBITDA Margin (%) Adj. PAT 3QFY15 12,576 1,593 12.7 802 3QFY14 10,894 1,355 12.4 681 % chg (yoy) 15.4 17.6 30bp 17.8 2QFY15 12,304 1,521 12.4 863 % chg (qoq) 2.2 4.7 30bp (7.0) `3,725 `4,135 Investment Period 12 Months Stock Info Automobile Sector 1,12,517 Market Cap (` cr) Source: Company, Angel Research Operating performance inline despite one-time charge; lower other income impacts profitability: Maruti Suzuki India Ltd (MSIL)’s 3QFY2015 results were below our estimates due to lower other income, even as the operating performance was inline. Revenues grew strongly by 15% yoy, led by a healthy 12% volume growth. Volume growth was boosted by improved consumer sentiments and success of new launches. Realisation/vehicle improved marginally by 3% yoy due to a better product mix. The EBIDTA margin at 12.7%, improved marginally by 30bp both on yoy as well as sequential basis and was in line with our estimates. Margins improved despite a one-time charge of `80cr on account of excise duty on sales tax subsidy received from the year 2000 to year 2015. Soft commodity prices and weakening of the JPY led to the improvement in margins. However, lower other income at `129cr (33% qoq decline), impacted profitability. The net profit, at `802cr, grew 18% yoy but was lower than our estimate of `857cr. Outlook and valuation: The passenger vehicle industry is well poised to post a double-digit growth over the next two years, given the improved consumer sentiment, better economic outlook and softer fuel prices. Further, MSIL is focusing on larger cars (two new product launches scheduled over the next one year) which would boost market share and profitability. Also, the AMT technology is gaining acceptance which would further enhance the revenues of MSIL. We also believe discounting levels would come down sharply from 2HFY2016 as demand picks up and MSIL launches new products. Discount reduction coupled with operating leverage and the recent weakening of JPY (due to monetary easing by Japan) would lead to margin expansion. We view MSIL as the best play on passenger vehicle demand recovery and expect 36% earnings CAGR over FY2015-2017. We maintain our positive view on the company and retain our Accumulate rating on the stock with a revised price target of `4,135 (based on a PE multiple of 19x FY2017 EPS). Net Debt (` cr) (9,063) 0.9 Beta 3,758/1,541 52 Week High / Low 69,792 Avg. Daily Volume 5 Face Value (`) 29,559 BSE Sensex 8,914 Nifty Reuters Code MRTI.BO Bloomberg Code MSIL@IN Shareholding Pattern (%) Promoters 56.2 MF / Banks / Indian Fls 19.5 FII / NRIs / OCBs 22.1 2.2 Indian Public / Others Abs. (%) 3m 1yr 3yr Sensex 10.0 42.9 71.5 Maruti Suzuki 18.2 138.3 208.4 Key financials (post SPIL merger) Y/E March (` cr) Net Sales % chg Net Profit % chg EBITDA (%) EPS (`) P/E (x) P/BV (x) RoE (%) RoCE (%) EV/Sales (x) EV/EBITDA (x) FY2014 43,701 1.4 2,783 21.0 11.6 92.1 40.4 5.4 13.3 16.2 2.4 20.6 FY2015E 50,232 14.9 3,614 29.9 12.7 119.6 31.1 4.8 15.4 18.8 2.1 16.2 FY2016E 60,257 20.0 5,468 51.3 14.8 181.0 20.6 4.1 20.1 24.8 1.7 11.3 Source: Company, Angel Research; Note: CMP as of January 28, 2015 Please refer to important disclosures at the end of this report FY2017E 70,931 17.7 6,574 20.2 14.5 217.6 17.1 3.4 20.7 25.8 1.3 9.3 Bharat Gianani 022-3935 7800 Ext: 6817 [email protected] 1 Maruti Suzuki | 3QFY2015 Result Update Exhibit 1: Quarterly financial performance Y/E March (` cr) Net Sales Raw-material cost 3QFY15 3QFY14 % chg (yoy) 2QFY15 % chg (qoq) 9MFY15 9MFY14 % chg (yoy) 12,576 10,894 15.4 12,304 2.2 36,249 31,599 14.7 13.1 8,775 0.6 25,785 22,436 14.9 71.1 71.0 1.4 1,098 967 3.0 3.1 8.8 4,924 4,354 8,826 7,804 (% of Sales) 70.2 71.6 Staff cost 375 300 (% of Sales) Other Expenses (% of Sales) 3.0 2.8 1,782 1,435 71.3 25.1 370 24.2 1,638 3.0 13.1 14.2 13.2 13.6 13.8 Total Expenditure 10,983 9,539 15.1 10,783 1.9 31,808 27,757 14.6 Operating Profit 1,593 1,355 17.6 1,521 4.7 4,442 3,842 15.6 12.7 12.4 30 45 (33.0) 35 Depreciation 628 541 16.0 Other Income 129 117 10.3 1,064 886 20.1 OPM (%) Interest PBT (excl. Extr. Items) Extr. Income/(Expense) PBT (incl. Extr. Items) (% of Sales) 13.3 13.6 12.4 12.3 12.2 (13.7) 103 132 (21.9) 599 4.8 1,810 1,521 19.0 193 (33.3) 619 422 46.5 1,080 (1.6) 3,147 2,612 20.5 - - - - - - - - 1,064 886 20.1 1,080 (1.6) 3,147 2,612 20.5 8.7 8.3 27.9 218 20.0 720 629 22.9 24.1 8.5 8.1 Provision for Taxation 262 204 (% of PBT) 24.6 23.1 Reported PAT 802 681 17.8 863 (7.0) 2,427 1,983 22.4 Adj PAT 802 681 17.8 863 (7.0) 2,427 1,983 22.4 Adj. PATM 8.8 20.2 6.4 6.3 7.0 6.7 6.3 Equity capital (cr) 151.0 151.0 151.0 151.0 151.0 Reported EPS (`) 26.6 22.5 80.3 65.6 17.8 28.6 (7.0) 14.5 22.4 Source: Company, Angel Research Exhibit 2: 3QFY2015 – Actual vs Angel estimates Y/E March (` cr) Actual Estimates Variation (%) 12,576 12,462 0.9 1,593 1,578 0.9 EBITDA margin (%) 12.7 12.7 - Adj. PAT 802 857 (6.4) Net Sales EBITDA Source: Company, Angel Research January 28, 2015 2 Maruti Suzuki | 3QFY2015 Result Update Exhibit 3: Quarterly volume performance Volume (units) 3QFY15 3QFY14 % chg (yoy) 2QFY15 % chg (qoq) 9MFY15 9MFY14 % chg (yoy) A: Mini: M800, Alto, WagonR 108,124 115,705 (6.6) 98,992 9.2 309,845 320,040 A: Compact: Swift, Ritz, Celerio,Dzire 121,027 107,405 12.7 136,402 (11.3) 380,726 314,141 21.2 15,308 733 1,988.4 1,658 823.3 17,485 3,199 446.6 244,459 223,843 9.2 237,052 3.1 708,056 637,380 11.1 B: Utility Vehicles: Gypsy, Grand Vitara 17,316 18,222 (5.0) 17,102 1.3 49,685 44,626 11.3 C: Vans: Omni, Eeco 33,427 26,119 28.0 33,533 (0.3) 95,791 73,086 31.1 A: Mid-Size: Ciaz Total Passenger cars Total Domestic (3.2) 295,202 268,184 10.1 287,687 2.6 853,532 755,092 13.0 Total Exports 28,709 19,966 43.8 34,211 (16.1) 92,171 75,078 22.8 Total Volume 323,911 288,150 12.4 321,898 0.6 945,703 830,170 13.9 Source: Company, Angel Research MSIL maintained its double digit growth trend, reporting a volume growth of 12% in 3QFY2015. Improved consumer sentiment, better economic outlook and declining fuel prices boosted sales. Realisation/vehicle grew 3% yoy despite higher discounts, owing to improvement in the product mix (higher volumes of Ciaz and Celerio). Further, the Contribution/vehicle improved 8% due to soft commodity prices and benefit of JPY depreciation on direct imports. MSIL continued to outperform the passenger vehicle industry, registering a growth of 14% yoy in YTD FY2015 as compared to industry growth of 4%. Consequently, MSIL’s market share improved from 41.3% in 9MFY2014 to 45% in 9MFY2015. Exhibit 4: Volumes grow strongly by 12% yoy Exhibit 5: Realisation & contribution per vehicle 4,00,000 30 3,50,000 25 3,00,000 3,50,000 80,000 3,40,000 70,000 3,30,000 60,000 0 1,00,000 (5) 50,000 (10) 0 Volumes (units) Source: Company, Angel Research January 28, 2015 growth yoy (%) 3QFY15 2QFY15 1QFY15 4QFY14 3QFY14 2QFY14 1QFY14 4QFY13 3QFY13 2QFY13 1QFY13 (15) Realisation/vehicle (LHS) 3QFY15 90,000 2QFY15 3,60,000 5 1,50,000 1QFY15 2,00,000 4QFY14 1,00,000 3QFY14 3,70,000 10 2QFY14 15 1QFY14 1,10,000 4QFY13 3,80,000 3QFY13 20 2QFY13 1,20,000 1QFY13 2,50,000 3,90,000 Contribution/vehicle (RHS) Source: Company, Angel Research 3 Maruti Suzuki | 3QFY2015 Result Update Exhibit 6: Domestic PV market share trend Exhibit 7: Discounting per vehicle trend 50 20,000 50 15,000 30 10,000 10 5,000 (10) 0 (30) Discounting/vehicle Source: Company, Angel Research 3QFY15 2QFY15 1QFY15 1QFY13 3QFY15 2QFY15 1QFY15 4QFY14 3QFY14 2QFY14 1QFY14 4QFY13 3QFY13 2QFY13 1QFY13 30 4QFY14 34.4 34 3QFY14 40.7 2QFY14 45.2 1QFY14 38 40.4 40.0 44.0 4QFY13 40.2 44.2 3QFY13 42 42.8 42.6 70 2QFY13 46 25,000 45.9 Growth (%) Source: Company, SIAM, Angel Research Exhibit 8: Quarterly revenue and realization performance 1QFY2014 2QFY2014 3QFY2014 4QFY2014 1QFY2015 2QFY2015 3QFY2015 9,088 8,693 9,691 10,696 9,831 10,595 11,039 (3.6) 31.5 0.6 (7.2) 8.2 21.9 13.9 370,421 359,859 361,343 358,214 363,228 368,294 373,952 3.4 14.3 0.8 (4.0) (1.9) 2.3 3.5 1,224 Domestic revenue (` cr) Change yoy (%) Domestic realization (`) Change yoy (%) Export revenue (` cr) Change yoy (%) Export realization (`) 907 1,519 929 1,122 1,243 1,401 (17.5) 84.3 (29.6) (26.7) 37.0 (7.8) 31.8 430,102 446,450 465,291 427,038 424,943 409,517 426,347 27.6 10.6 14.5 (2.8) (1.2) (8.3) (8.4) Change yoy (%) Source: Company, Angel Research The EBIDTA margin, at 12.7%, grew marginally by 30bp on both yoy as well as sequential basis. Softer raw material prices coupled with benefit of JPY depreciation on direct imports boosted margins. Lower other income at `129cr (33% qoq decline) and higher taxation negated the benefits of improved operating performance. Net profit at `802.2cr grew 18% yoy. Exhibit 9: EBITDA margins in line Exhibit 10: Lower other income impacts PAT 1,800 1,600 1,400 1,200 14 1,400 12 1,200 10 1,000 1,000 800 600 8 800 6 6 600 4 4 400 2 200 0 0 EBIDTA (`cr; LHS) Source: Company, Angel Research January 28, 2015 EBIDTA Margin (%; RHS) 8 2 PAT (`cr; LHS) 3QFY15 2QFY15 1QFY15 4QFY14 3QFY14 2QFY14 1QFY14 4QFY13 3QFY13 2QFY13 0 1QFY13 3QFY15 2QFY15 1QFY15 4QFY14 3QFY14 2QFY14 1QFY14 4QFY13 3QFY13 2QFY13 1QFY13 400 200 0 10 PAT Margin (%; RHS) Source: Company, Angel Research 4 Maruti Suzuki | 3QFY2015 Result Update Conference call – Key highlights January 28, 2015 MSIL has received an encouraging response for its new products, enabling it to gain market share. MSIL’s market share improved from 42% in FY2014 to 45% in 9MFY2015 on back of successful launches of Celerio, Ciaz, refreshed Swift and Alto K10 with AMT. MSIL has planned two new launches viz a compact UV and a crossover vehicle over the next one year which will enable it to retain market share amid rising competition. MSIL is witnessing robust demand for its automatic transmission variants. MSIL earlier introduced the AMT technology in the Celerio and the new Alto K10. The company’s current AMT capacity stands at 4,000 units/month, while it’s planning to raise capacity. The passenger vehicle industry is witnessing a surge in demand for petrol vehicles given the narrowing gap between petrol and diesel. In 3QFY2015, petrol vehicle volumes grew 20% yoy while diesel vehicle volumes declined 13%. The share of petrol variants improved from 45% in 3QFY2014 to 53% in 3QFY2015. During the quarter, MSIL recognized a one-time charge of `70cr on account of excise duty on sales tax subsidy received between year 2000 to year 2015. MSIL is currently operating at 83% capacity utilization. The construction of the Gujarat plant has already commenced and is expected to be fully operational by the middle of 2017. Shareholder approval for the proposed manufacturing facility by Suzuki Motor Corporation, at Gujarat, would be taken within the next four to six months. Discounting levels continued to remain high as the passenger vehicle industry is still in early stages of recovery. Discounting/vehicle at `21,000 grew 10% yoy but remained flat on a sequential basis. MSIL expects higher discounting to continue upto 2HFY2016. MSIL expects 4QFY2015 sales to be under pressure on account of withdrawal of excise reduction benefits and high base of the corresponding period last year. The proportion of first time buyers has improved from 37% in 3QFY2014 and from 42% in 1HFY2015 to 44% in 3QFY2015, thus resulting in a recovery in the passenger vehicle space. MSIL expects higher economic growth and lower inflation and interest rates to boost passenger vehicle industry over the next one to two years. MSIL is targeting an export volume growth of 18-20% in FY2015, led by the launch of new models. MSIL is planning a capital expenditure of `3,500cr for FY2015. 5 Maruti Suzuki | 3QFY2015 Result Update Investment arguments January 28, 2015 Per capita car penetration near inflexion point: In FY2009, car penetration in India was estimated at around 12 vehicles/1,000 people compared to around 21 vehicles/1,000 people in China. Moreover, India’s PPP-based per capita is estimated to approach US$7,000 over the next four to five years, which is expected to be the inflexion point for the country’s car demand. Further, MSIL has a sizeable competitive advantage over new foreign entrants due to its widespread distribution network (nearly 3,000 and 1,200 service and sales outlets, respectively), which is not easy to replicate. Suzuki focusing to make Maruti a small car manufacturing hub: Suzuki Japan is focusing to make MSIL a global small car manufacturing hub to cater to the increasing global demand for small cars due to rising fuel prices and stricter emission standards. Thus, we believe there is a huge potential for the company to increase its market share in the export market. Moreover, R&D capabilities, so far largely housed at Suzuki Japan, are progressively moving to MSIL. The company is aiming to achieve full model change capabilities over the next couple of years, which will enable it to launch new models and variants at a much faster pace. This is expected to reduce its royalty payment in the medium-term (2-3 years). Merger with SPIL to be a positive in the long run: MSIL has merged its associate company, Suzuki Powertrain India (SPIL) with itself. SPIL manufactures and supplies diesel engines and transmission components for vehicles. SPIL currently supplies ~90% of its production to MSIL. We believe the merger of SPIL with MSIL is a positive for MSIL given that MSIL itself is setting up a new diesel engine facility (capacity of 300,000 units by FY2015) in Gurgaon. Further, with foray increased product introductions in the diesel segment (LCV and compact utility vehicle), the integration of SPIL will result in better control over diesel engine sourcing, flexibility in production planning, and managing fluctuations in market demand. Additionally, single management control of diesel engine operations will result in better sourcing, localization and cost-reduction. 6 Maruti Suzuki | 3QFY2015 Result Update Outlook and valuation The passenger vehicle industry is well poised to post a double-digit growth over the next two years, given the improved consumer sentiment, better economic outlook and softer fuel prices. Further, MSIL is focusing on larger cars (two new product launches scheduled over the next one year) which would boost market share and profitability. Also, the AMT technology is gaining acceptance which would further enhance the revenues of MSIL. We also believe discounting levels would come down sharply from 2HFY2016 as the demand picks up and MSIL launches new products. Discount reduction coupled with operating leverage and the recent weakening of the JPY (due to monetary easing by Japan) would lead to margin expansion. We view MSIL as the best play on the passenger vehicle demand recovery and expect 36% earnings CAGR over FY2015-2017 . We maintain our positive view on the company and retain our Accumulate rating on the stock with a revised price target of `4,135 (based on a PE multiple of 19x FY2017 EPS). Exhibit 11: Volume assumptions Y/E March FY2011 FY2012 FY2013 FY2014 FY2015E FY2016E FY2017E Mini: M800, Alto, WagonR 573,238 491,389 429,569 436,032 415,584 443,972 488,269 Compact: Swift, Ritz, Celerio, Dzire 369,754 345,886 424,873 450,393 535,968 621,722 683,895 12,000 36,000 57,000 69,000 Compact Utility Vehicle Mid-Size: Ciaz, Crossover Executive: Kizashi Total passenger cars UV - Gypsy, Vitara, Ertiga Vans - Omni, Versa, Eeco Total passenger vehicles - domestic Total passenger vehicles - exports 23,317 17,997 6,707 4,029 27,000 138 458 188 1 - 966,447 855,730 861,337 890,455 978,552 1,134,694 1,277,164 5,666 6,525 79,192 61,119 67,231 75,299 82,828 160,626 144,061 110,517 102,115 132,750 150,007 165,008 1,132,739 1,006,316 1,051,046 1,053,689 1,178,532 1,360,000 1,525,000 138,266 127,379 120,388 101,352 119,171 125,000 151,000 1,271,005 1,133,695 1,171,434 1,155,041 1,297,703 1,485,000 1,697,000 24.8 (10.8) 3.3 (1.4) 12.4 14.4 14.3 Light Commercial Vehicle Total sales (domestic + exports) % chg 21,000 Source: Company, Angel Research Company background Maruti Suzuki (MSIL), a subsidiary of Suzuki Motor Corporation (SMC), Japan (which holds a 56% stake), is the largest passenger car company in India, accounting for ~50% of the domestic passenger car market. MSIL derives ~60% of its overall sales from the small car segment and has a dominant position in the segment with a market share of ~50%, led by popular models like Alto, Wagon R and Swift. The company operates from two facilities in India (Gurgaon and Manesar) with an installed capacity of 1.5mn units. Also, MSIL has steadily increased its presence internationally and exports now account for ~10% of its overall sales volume. January 28, 2015 7 Maruti Suzuki | 3QFY2015 Result Update Profit and loss statement (post SPIL merger) Y/E March (` cr) FY2012 FY2013 FY2014 FY2015E FY2016E FY2017E Total operating income 35,587 % chg 43,701 50,232 60,257 70,931 (2.8) 22.5 1.4 14.9 20.0 17.7 Total expenditure 33,074 39,358 38,611 43,849 51,362 60,656 Net raw material costs 28,108 32,559 31,314 35,449 41,647 49,062 Employee expenses 844 1,070 1,368 1,520 1,781 2,095 Other expenditure 4,122 5,730 5,928 6,880 7,934 9,500 EBITDA 2,513 4,230 5,090 6,384 8,895 10,275 % chg (30.9) 68.3 44.8 25.4 39.3 15.5 7.1 9.7 11.6 12.7 14.8 14.5 Depreciation & amortization 1,138 1,861 2,084 2,460 2,640 2,790 EBIT 1,375 2,368 3,834 4,867 7,355 8,790 % chg (% of total op. income) (47.6) 72.3 27.7 26.9 51.1 19.5 (% of total op. income) 3.9 5.4 8.8 9.7 12.2 12.4 Interest and other charges 55 190 176 148 160 140 Other income 827 812 829 944 1,100 1,305 Recurring PBT 2,146 2,991 3,659 4,719 7,195 8,650 % chg (31.0) 39.4 27.7 29.0 52.5 20.2 - - - - - - 2,146 2,991 3,659 4,719 7,195 8,650 Extraordinary income/ (exp.) PBT Tax 511 599 876 1,105 1,727 2,076 (% of PBT) 23.8 20.0 23.9 23.4 24.0 24.0 PAT (reported) 1,635 2,392 2,783 3,614 5,468 6,574 ADJ. PAT 1,635 2,392 2,783 3,614 5,468 6,574 % chg (28.6) 46.3 21.0 29.9 51.3 20.2 (% of total op. income) Basic EPS (`) Adj. EPS (`) % chg January 28, 2015 43,588 4.6 5.5 6.4 7.2 9.1 9.3 54.1 79.2 92.1 119.6 181.0 217.6 54.1 79.2 92.1 119.6 181.0 217.6 (28.6) 46.3 15.8 29.9 51.3 20.2 8 Maruti Suzuki | 3QFY2015 Result Update Balance sheet statement (post SPIL merger) Y/E March (` cr) FY2012 FY2013 FY2014 FY2015E FY2016E FY2017E SOURCES OF FUNDS Equity share capital 145 151 151 151 151 151 Reserves & surplus 15,043 18,428 20,827 23,357 27,075 31,545 Shareholders’ Funds 15,187 18,579 20,978 23,508 27,226 31,696 1,078 1,389 1,685 1,400 1,400 1,300 302 409 587 587 587 587 Total loans Deferred tax liability Other long term liabilities 97 104 239 239 239 239 169 226 198 198 198 198 16,834 20,706 23,686 25,931 29,649 34,019 14,735 19,801 22,702 26,202 29,202 31,702 Less: Acc. depreciation 7,214 10,002 11,911 14,372 17,012 19,802 Net Block 7,521 9,799 10,790 11,830 12,190 11,900 942 1,942 2,621 2,500 2,500 2,500 Investments 6,147 7,078 10,118 8,849 9,849 10,849 Long term loans and adv. 1,341 1,279 1,638 1,712 2,050 2,418 26 895 9 9 9 9 Current assets 6,325 5,695 5,359 8,168 11,289 16,036 Cash 2,436 775 630 3,303 5,590 9,279 Long term provisions Total Liabilities APPLICATION OF FUNDS Gross block Capital work-in-progress Other noncurrent assets Loans & advances 778 1,115 1,251 1,380 1,620 1,924 Other 3,111 3,805 3,478 3,485 4,079 4,834 Current liabilities 5,468 5,982 6,849 7,137 8,238 9,692 Net current assets Total Assets 857 (287) (1,491) 1,031 3,052 6,344 16,834 20,706 23,686 25,931 29,649 34,019 Note: Cash and bank balance includes term deposits with banks January 28, 2015 9 Maruti Suzuki | 3QFY2015 Result Update Cash flow statement (post SPIL merger) Y/E March (` cr) FY2012 FY2013 FY2014 FY2015E FY2016E FY2017E Profit before tax 2,146 2,991 3,659 4,719 7,195 8,650 Depreciation 1,138 1,861 1,910 2,460 2,640 2,790 227 512 2,112 152 266 397 (251) (533) (876) (1,105) (1,727) (2,076) Change in working capital Direct taxes paid Others (700) (447) (242) - - - 2,560 4,384 6,563 6,226 8,375 9,760 (Inc.)/Dec. in fixed assets (2,963) (3,810) (3,580) (3,379) (3,000) (2,500) (Inc.)/Dec. in investments (782) (916) (3,040) 1,269 (1,000) (1,000) 649 1,152 - - - - (3,096) (3,574) (6,620) (2,109) (4,000) (3,500) - - - - - - Cash Flow from Operations Others Cash Flow from Investing Issue of equity Inc./(Dec.) in loans 911 (514) 296 (285) - (100) (217) (217) (696) (1,084) (1,750) (2,104) Others (78) (235) 312 - - - Cash Flow from Financing 617 (966) (88) (1,369) (1,750) (2,204) 81 (156) (145) 2,747 2,625 4,057 Opening Cash balances 96 281 775 630 3,303 5,590 Closing Cash balances 176 125 630 3,303 5,590 9,279 Dividend paid (Incl. Tax) Inc./(Dec.) in cash Note: Closing Cash balances excludes term deposits with banks and unclaimed dividend accounts January 28, 2015 10 Maruti Suzuki | 3QFY2015 Result Update Key ratios Y/E March FY2012 FY2013 FY2014 FY2015E FY2016E FY2017E Valuation Ratio (x) P/E (on FDEPS) 68.9 47.0 40.4 31.1 20.6 17.1 P/CEPS 40.6 26.5 23.1 18.5 13.9 11.5 7.4 6.1 5.4 4.8 4.1 3.4 P/BV Dividend yield (%) 0.2 0.2 0.6 1.0 1.6 1.9 EV/Sales 3.1 2.5 2.4 2.1 1.7 1.3 44.2 30.7 20.6 16.2 11.3 9.3 6.6 5.3 4.4 4.0 3.4 2.8 EPS (Basic) 54.1 79.2 92.1 119.6 181.0 217.6 EPS (fully diluted) 54.1 79.2 92.1 119.6 181.0 217.6 Cash EPS 91.8 140.8 161.1 201.1 268.4 310.0 7.5 8.0 23.0 35.9 57.9 69.6 502.8 615.0 694.5 778.2 901.3 1049.3 3.9 5.4 8.8 9.7 12.2 12.4 Tax retention ratio 76.2 80.0 0.8 0.8 0.8 0.8 Asset turnover (x) 2.7 2.5 1.9 2.2 2.5 2.9 ROIC (Post-tax) 7.9 11.0 12.7 16.5 23.2 27.0 EV/EBITDA EV / Total Assets Per Share Data (`) DPS Book Value Du-pont Analysis EBIT margin Cost of Debt (Post Tax) Leverage (x) Operating ROE 6.1 12.3 7.9 8.1 8.7 8.2 (0.5) (0.3) (0.4) (0.5) (0.5) (0.6) 7.0 11.5 10.6 12.7 15.7 15.8 8.8 12.6 16.2 18.8 24.8 25.8 Returns (%) ROCE (Pre-tax) Angel ROIC (Pre-tax) 18.3 25.1 16.6 21.5 30.6 35.5 ROE 11.3 14.2 13.3 15.4 20.1 20.7 2.7 2.5 1.9 1.9 2.1 2.2 16 15 14 13 13 13 Turnover ratios (x) Asset Turnover (Gross Block) Inventory / Sales (days) Receivables (days) Payables (days) WC cycle (ex-cash) (days) 9 10 12 11 11 11 37 39 52 47 45 45 (12) (11) (25) (22) (21) (21) (0.5) (0.3) (0.4) (0.5) (0.5) (0.6) Solvency ratios (x) Net debt to equity January 28, 2015 Net debt to EBITDA (3.0) (1.5) (1.8) (1.7) (1.6) (1.8) Interest Coverage (EBIT / Int.) 24.9 12.5 21.8 32.8 46.0 62.8 11 Maruti Suzuki | 3QFY2015 Result Update Research Team Tel: 022 - 39357800 E-mail: [email protected] Website: www.angelbroking.com DISCLAIMER This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment. Angel Broking Pvt. Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this document are those of the analyst, and the company may or may not subscribe to all the views expressed within. Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals. The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel Broking Pvt. Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed or passed on, directly or indirectly. Angel Broking Pvt. Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in the past. Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in connection with the use of this information. Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may have investment positions in the stocks recommended in this report. Disclosure of Interest Statement 1. Analyst ownership of the stock Maruti Suzuki No 2. Angel and its Group companies ownership of the stock No 3. Angel and its Group companies' Directors ownership of the stock No 4. Broking relationship with company covered No Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors Ratings (Returns): January 28, 2015 Buy (> 15%) Reduce (-5% to -15%) Accumulate (5% to 15%) Sell (< -15%) Neutral (-5 to 5%) 12

© Copyright 2026