Grain and Soy Market Morning Comments - Benson

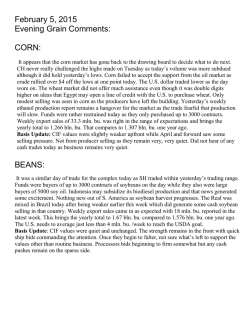

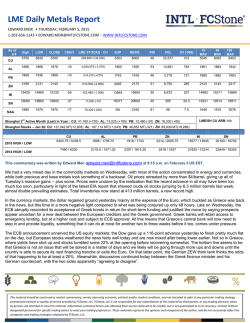

Grain and Soy Market Morning Comments Benson Quinn Commodities Inc. Minneapolis, MN February 6, 2015 Morning Comments: Macro markets continue to influence the trade in the Ag complex with corn, beans and wheat all higher overnight as technical short covering seems to be the theme across a much oversold commodity complex. The back and forth volatility we have seen this week seems to be settling down a touch today with macro markets firmer for second day in a row. Global economic and political headlines have been big drives of market direction and sentiment this week. This morning it is US jobs data that is driving support with January jobs data much better than expected adding 257,000 vs. estimate of 236,000. Crude oil has firmed on the news with the March contract up $1.30 at $51.79 a barrel. The US dollar has surged higher on the data rallying 675 points. US equity futures are pointing to a strong start with not only Jan jobs data but upward revisions to Nov and Dec data bullish the US economy. Grain and soybean prices have eased though on the news with the strong reaction in the dollar offering resistance. Fresh fundamental news is lacking this morning but we do have the February WASDE report coming up next Tuesday to get tongues wagging a bit and keep the funds covering shorts. The report is not expected to offer many changes. Average analysts’ estimates peg the US soybean ending stocks at 398 million vs. 410 in January, US corn ending stocks at 1,879 million vs. 1,877 in Jan, and all-wheat ending stocks at 689 million vs. 687 million. World ending stocks are seen mostly unchanged as well with average estimate for beans at 90.44 MMT, down slightly from 90.78 MMT in January, corn global carryout at 189.28 MMT, up slightly from 189.15 MMT, while global wheat is seen at 195.83 MMT, down slightly from 196.00 MMT in January. The Goldman fund roll starts today with funds rolling long March positions to the May on the close. It looks like the grains and beans are poised for a choppy two-sided session with firmer US dollar offering resistance while higher crude and fund positioning ahead of next Tuesday’s WASDE report offer support. Overnight Trade: Symbol @ 7:45 CH SH MWH WH KWH 386 ¾ 981 ½ 584 529 ½ 568 ¼ Daily Trading Limits: Net Change +1 ½ +¼ +5 +3 ¾ +4 ¼ High Low Initial 389 ½ 387 ½ 585 534 573 ¼ 384 979 ¾ 578 ¾ 524 ¾ 563 ¾ Corn Beans MWheat CWheat KWheat Expanded Good Thru 25 cts 70 cts 60 cts 35 cts 40 cts Weather: 24 Hour Rainfall Est. 1-3 Day Precip Outlook 6-10 Day Temp Outlook 6-10 Day Precip Outlook Export News/World Trade: There are no new export tenders to report. Palm Oil/Chinese Dalian/French Wheat: Malaysian palm oil closed higher for a second session on Indonesia’s plan to increase its biodiesel subsidy from 1,500 rupiah to 4,000 rupiah. The benchmark April contract closed up 34 MYR a tonne to settle at 2,346 MYR. Chinese Dalian futures were mostly higher with corn the exception settling lower. French milling wheat futures are trading higher this morning with the March contract up 2.50 euro at 189.50 euro a tonne. Global Equities: The Dow Jones Industrial Average closed up 212 points in its prior session settling at 17,885. China’s Shanghai Composite closed down 61 points to settle at 3,076. Hong Kong’s Hang Seng Index was down 86 points to close at 24,679. The Japanese Nikkei Index was up 144 points to close at 17,649. European markets are trading lower this morning. US equity futures are pointing to a steady to better start. Technical Support & Resistance: Symbol 1st Support 2nd Support CH 379 373 ¾ SH 974 ½ 955 MWH 576 566 ½ WH 525 ¾ 513 KWH 564 550 ½ 1st Resistance 393 ½ 990 ¼ 589 ¾ 535 ¾ 574 2nd Resistance 396 ½ 999 601 544 ½ 583 ¼ Point of Interest: The first bar code on a commercial product was on a packet of Wrigley's Juicy Fruit chewing gum. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. These observations include information from sources believed to be reliable, but no independent verification has been made and therefore their accuracy and completeness cannot be guaranteed. Benson Quinn Commodities, Inc. does not guarantee that such information is accurate or complete. Opinions expressed reflect judgment at this date and are subject to change without notice. BQCI is a wholly owned subsidiary of Archer Daniels Midland and An Introducing Broker for ADMIS, 701 South 4th Avenue, Suite 800, Minneapolis, MN 55415, 1-800-438-7070.0

© Copyright 2026