FC Stone Afternoon Market Recap

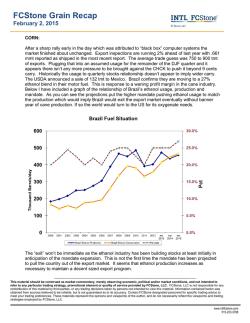

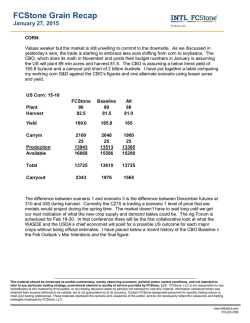

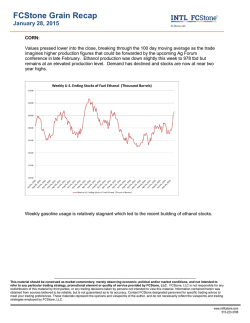

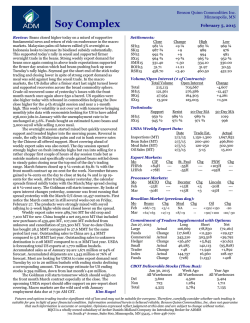

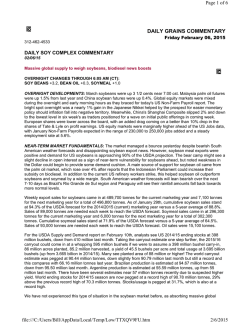

FCStone Grain Recap January 30, 2015 CORN: Values spent most of the session in the negative but rallied again into the close on heavy volume to cut the loss to only 1.5 cents on the front month. There is still lots of debate about the acreage mix for the coming year and the debate is whether these values are low enough for the moment. High volume closes that buy up the market may discourage much more selling as the feeling in the market may be geared to at least a dead cat bounce. I still believe the market is factoring in a 90 mln acre planted number for US corn but that is only 2.2% different than the 88 perceived a month or so ago. Funds sold 3000 corn today. SOYBEANS: Values broke at the open and remained weak all session. Robust production in South America weighs on the market. The grain analyst Safras & Mercado took their production estimate down to 95 mmt for Brazil but that still 8 mmt better than last year. The USDA rests at 95.5 mmt. Goias and Southern MG remain the troubled spots for soy production. The BA Exchange now estimates the Argentina soy production at 54.5 which is just under the USDA at 55 mmt and just above last year’s 54 mmt production. Production must rise in the Western Hemisphere to meet the increase of 7 mmt of demand growth per year for its soy production. A recent update in three country disposals show the pace has not deviated though the production growth projections will raise stocks in the western hemisphere high enough to justify up to $1.00 downside in the market. The better predictor of proper US soy values is now delineated in Brazilian currency as SA dominates production. Those models point to a 3+ Real drop per bu from current levels. When it comes to soy demand one has to consider the biodiesel industries of the US, Brazil and Argentina. Brazil and Argentina have been pressing forward to higher and higher production levels. Brazil has between 58 and 65 active biodiesel plants which are currently operating at nearly half of their capacity and they are putting out 2/3 of the production the US is currently producing with 93 plants. Argentina is currently putting out just under half the amount of biodiesel production the US is annually at 2800 mln liters. Brazil production is growing about 20% per year as the industry is ramping up for a 7% blend rate requirement. The demand for biodiesel is growing fast enough that there is little if any exports of biodiesel from Brazil and the country has a 14% tariff on biodiesel imports. Argentina is geared differently. Its demand has grown greatly but its market and tax structure is geared towards export with Arg exporting more than half of its production as seen in the graph below. Currently there is some profitability barriers to exporting much biodiesel from Arg to the US but the EPA’s allowances will allow more biodiesel to flow in the future. ---------------------------------------------------------------------------------------------------------------------------------This material should be construed as market commentary, merely observing economic, political and/or market conditions, and not intended to refer to any particular trading strategy, promotional element or quality of service provided by FCStone, LLC. FCStone, LLC is not responsible for any redistribution of this material by third parties, or any trading decisions taken by persons not intended to view this material. Information contained herein was obtained from sources believed to be reliable, but is not guaranteed as to its accuracy. Contact FCStone designated personnel for specific trading advice to meet your trading preferences. These materials represent the opinions and viewpoints of the author, and do not necessarily reflect the viewpoints and trading strategies employed by FCStone, LLC. www.intlfcstone.com 515-223-3788 FCStone Grain Recap January 30, 2015 Page 2 www.intlfcstone.com 515-223-3788 FCStone Grain Recap January 30, 2015 Palm oil will be a factor in biodiesel production as “mineral oils” have fallen so has the probability that Indonesia will be a great producer of biodiesel. Competing cheaper crude oil will edge out the more expensive Palm oil unless the government plans on pledging the treasury to fight economic forces. Palm oil will also switch over to finding food sources and increase its discount to soy oil and edge out soy oil in the food oils balance table. Funds sold 6000 soybeans, 4000 meal, and bought 4000 soy oil today. Crude oil rallies 3 dollars in the final minutes of trade as a late report showed the number of drilling operations had dropped significantly. WHEAT: Values finished on the weak side again with a short dip below the psychological support of 500 WH15 during the day. Weather seems to be cooperating in the Midwest for wheat. Despite a projected cold blast in the coming week a 4-8 inch snow is out ahead of it which should buffer winterkill. The system keeps shifting around even 48 hours ahead of the arrival time the weather agencies don’t know how far north or south it will hit. As I did in yesterday’s corn and soybean section I broke down my best estimate of how the all wheat demand will work out in the coming year. I have placed my best current estimate up against the CBO’s baseline table and then one alternate outcome that uses a lower abandonment rate and better yield. US Wheat 15-16 FCStone Baseline Alt Planted Harvested 55 45.1 55.5 47 55.5 48 Yield 45.4 45.5 47 Carryin Production Available 687 2048 2885 654 2139 2943 687 2256 3093 Food Seed Feed Exports Total Use 960 74 216 925 2175 967 75 200 950 2192 960 75 250 925 2210 Carryout 710 751 883 Page 3 www.intlfcstone.com 515-223-3788 FCStone Grain Recap January 30, 2015 My current feed number is higher than the CBO’s figure but not unjustified by the WN15-CN15 spread vs historical usage models. The alternative outcome uses a 250 feed usage figure which is high because the production number would be higher and I believe the competitive world export market would force more feeding domestically to keep the carryout down under 900. The attaché to Australia lowered his wheat production estimate to 23.2 mmt and an export figure to 18.1 which is different than the USDA’s 24 mmt and 17.5 mmt figures. Dryness in Queensland, NSW and Victoria were mostly cited as the reason for the decline in production. Funds sold 4000 wheat in the CME today. New adjustments from the CFTC to Managed money positions show they are shorter than previously thought with our new estimate of their position standing at 22k short. ECBOT HIGH LOW CLOSE CHANGE Mar Corn May Corn 3.73 3.81 3.6575 3.7375 3.70 3.785 - 1 1/2 - 1 1/2 Mar Beans May Beans 9.7275 9.79 9.55 9.6175 9.61 9.6775 - 7 1/4 -7 Mar wheat 5.1175 4.97 5.0275 -5 Regards Bevan Everett Page 4 www.intlfcstone.com 515-223-3788

© Copyright 2026