Feb 02, 2015 - Moneycontrol

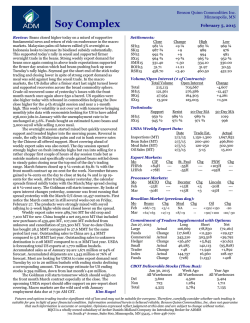

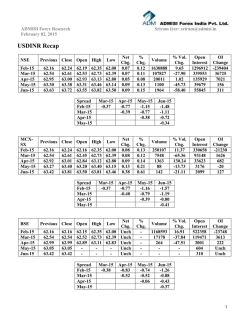

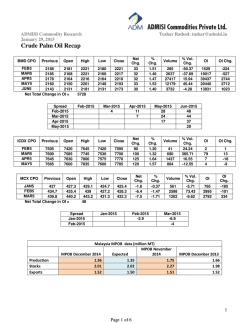

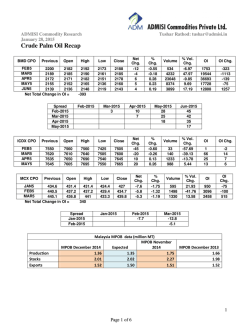

ADMISI Commodities Research February 02, 2015 Sriram Iyer: [email protected] Economic Data January 30, 2015 Country NZD JPY JPY JPY JPY JPY GBP AUD JPY CHF EUR GBP GBP EUR EUR EUR CAD USD USD USD USD USD Economic Data Building Permits M/M Dec Unemployment Rate Dec Household Spending Y/Y Dec National CPI Core Y/Y Dec Tokyo CPI Core Y/Y Jan Industrial Production M/M Dec P GfK Consumer Sentiment Jan PPI Q/Q Q4 Housing Starts Y/Y Dec KOF Leading Indicator Jan Italian Unemployment Rate Dec P Mortgage Approvals Dec M4 Money Supply M/M Dec Eurozone Unemployment Rate Dec Eurozone CPI Estimate Y/Y Jan Eurozone CPI - Core Y/Y Jan A GDP M/M Nov Employment Cost Index Q4 GDP (Annualized) Q4 A GDP Price Index Q4 A Chicago PMI Jan U. of Michigan Confidence Jan F Actual -2.10% 3.40% -3.40% 2.50% 2.20% 1.00% 1 0.10% -14.70% 97 12.90% 60.0K 0.10% 11.40% -0.60% 0.50% -0.20% 0.60% 2.60% 0.00% 59.4 98.1 Expected Actual 0.10% 49.7 Expected 3.50% -2.30% 2.60% 2.20% 1.20% -2 0.30% -14.80% 94.7 13.50% 59.0K 0.50% 11.50% -0.50% 0.70% 0.10% 0.70% 3.10% 0.90% 58 98.2 Previous 10.00% 3.50% -2.50% 2.70% 2.30% -0.50% -4 0.20% -14.30% 98.7 13.40% 59.0K 0.00% 11.50% -0.20% 0.70% 0.30% 0.70% 5.00% 1.40% 58.3 98.2 February 02, 2015 Country AUD CNY CHF EUR EUR GBP USD USD USD USD USD USD USD USD USD Economic Data TD Securities Inflation M/M Jan HSBC Manufacturing PMI Jan F SVME-PMI Jan Italy Manufacturing PMI Jan Eurozone Manufacturing PMI Jan F PMI Manufacturing Jan Personal Income Dec Personal Spending Dec PCE Deflator M/M Dec PCE Deflator Y/Y Dec PCE Core M/M Dec PCE Core Y/Y Dec Construction Spending M/M Dec ISM Manufacturing Jan ISM Prices Paid Jan 49.8 54.5 49.3 51 52.9 0.20% -0.30% -0.30% 0.00% 1.40% 0.70% 55 40 Previous 0.00% 49.8 54 48.4 51 52.5 0.40% 0.60% -0.20% 1.20% 0.00% 1.40% -0.30% 55.5 38.5 1 ADMISI Commodities Research February 02, 2015 Sriram Iyer: [email protected] International Market Recap LME Previous Close Open High Net Chg. 66.50 245.00 39.00 Unch 27.00 Low Copper 5427.50 5494.00 5422.50 5507.00 5365.00 Nickel 14925.00 15170.00 14930.00 15170.00 14710.00 Aluminium 1821.00 1860.00 1823.50 1867.00 1817.00 Lead 1858.50 1858.50 1864.00 1874.00 1846.00 Zinc 2093.00 2120.00 2093.00 2125.25 2080.00 Comex Copper FEB5 MAR5 APR5 MAY5 JUN5 Previous Close Open High Low 2.471 2.452 2.455 2.452 2.454 2.528 2.495 2.496 2.491 2.492 2.465 2.456 2.435 2.459 2.481 2.540 2.519 2.514 2.513 2.500 2.465 2.430 2.435 2.428 2.459 Spread FEB5 MAR5 APR5 MAY5 MAR5 0.034 APR5 0.033 -0.001 MAY5 0.038 0.004 0.005 % Chg. 1.23 1.64 2.14 1.29 Net Chg. 0.058 0.043 0.041 0.039 0.037 Volume 18507 5265 13346 4265 7485 % Vol. Chg. 0.71 65.00 11.09 24.85 -6.67 % Chg. 2.33 1.75 1.67 1.59 1.53 JUN5 0.037 0.003 0.004 -0.001 Indian Market Recap Copper Previous Close Feb-15 Apr-15 342.85 336.00 343.80 334.00 347.05 340.50 347.85 338.50 337.25 341.75 Open High Low Spread Feb-15 % Chg. 1.66 1.55 Volume 51438 1095 % Vol. Chg. -13.43 7.88 OI 15675 1564 OI Chg. -864 106 Apr-15 -4.20 Nickel Previous Close Open High Low Jan-15 Feb-15 Mar-15 921.10 926.20 931.30 918.30 941.90 949.60 918.00 922.90 928.80 925.60 945.00 951.90 912.00 914.10 921.80 Spread Jan-15 Feb-15 Net Chg. 5.60 5.30 Feb-15 -23.60 Net Chg. -2.80 15.70 18.30 % Chg. -0.30 1.70 1.96 Volume 9743 22470 227 % Vol. Chg. -56.31 736.56 980.95 OI 1898 2565 122 OI Chg. -1557 1333 68 Mar-15 -31.30 -7.70 2 ADMISI Commodities Research February 02, 2015 Aluminium Previous Close Jan-15 Feb-15 Mar-15 113.40 112.00 113.50 111.60 115.35 112.25 115.50 112.00 115.95 112.70 116.00 112.70 112.25 112.45 113.10 Open Sriram Iyer: [email protected] High Spread Jan-15 Feb-15 Lead Previous Jan-15 Feb-15 Mar-15 114.10 115.30 115.45 Close Open High Zinc Previous Jan-15 Feb-15 Mar-15 129.15 129.65 129.70 Close Open High Low Low Volume 2968 7515 162 % Vol. Chg. -61.62 403.69 2214.29 OI 890 3038 90 OI Chg. -615 1370 78 % Volume Chg. -0.13 3326 0.22 6456 1.00 76 % Vol. Chg. -61.22 264.33 590.91 OI 877 1292 31 OI Chg. -818 629 21 Mar-15 -2.65 -1.05 Net Chg. 1.15 2.30 2.80 Feb-15 -1.65 % Chg. 1.02 2.58 2.52 Mar-15 -2.55 -0.60 Net Chg. -0.15 0.25 1.15 Feb-15 -1.60 130.30 128.90 130.55 128.10 131.95 129.50 132.05 128.50 132.50 129.85 132.70 129.30 Spread Jan-15 Feb-15 Feb-15 -1.95 113.95 113.70 114.75 113.30 115.55 115.00 116.40 114.45 116.60 115.45 117.20 115.45 Spread Jan-15 Feb-15 Net Chg. 1.15 2.90 2.85 Low % Chg. 0.89 1.77 2.16 Volume 5382 8856 130 % Vol. Chg. -55.35 252.83 1344.44 OI 1004 4148 80 OI Chg. -810 1442 50 Mar-15 -2.20 -0.55 London Metal Exchange ends higher on Friday following upbeat European retail sales data and as some investors covered short positions ahead of the weekend. German retail sales posted their biggest yearly rise in 2-1/2 years in December, while sales in Spain and consumer spending in France was also stronger than expected, lifting European shares. Prices were also supported after factory growth in China shrank for the first time in more than two years, fueling hopes for increased stimulus from the world's second biggest economy. The official Purchasing Managers' Index (PMI) fell to 49.8 in January, the National Bureau of Statistics said on Sunday, a low last seen in September 2012 and a whisker below the 50-point level that separates growth from contraction on a monthly basis. Also, a private business survey on Monday showed that activity in China's factory sector shrank for a second month in January. The final HSBC Purchasing Managers' Index (PMI) fell to 49.7, a touch below its 49.8 flash reading, and after dipping to 49.6 in December. The dollar remained broadly supported as the release of tepid U.S. data failed to dampen optimism over the strength of the country's economic recovery. In a report, Bureau of Economic Analysis said U.S. gross domestic product rose 2.6% in the last quarter of 2014, down from a previous estimate of 3.0% and from a growth rate of 5.0% in the three months to September. 3 ADMISI Commodities Research February 02, 2015 Sriram Iyer: [email protected] In the week ahead, investors will be turning their attention to Friday’s U.S. nonfarm payrolls report for further indications on the strength of the recovery in the labor market. The Euro ended lower after Eurostat reported that the annual rate of euro zone inflation fell by 0.6% in January, after a 0.2% slip in December. The downside was limited after euro zone’s unemployment rate ticked down to 11.4% in December from 11.5% the previous month. Meanwhile, Greece’s new government said it will not cooperate with the International Monetary Fund and the European Union and will not seek an extension to its bailout program, underlining fears over a clash with its international creditors. The daily inventory data released by the London Metal Exchange (LME) showed a rise in the inventory levels of Copper and Nickel. Meanwhile, the inventory levels of Aluminium, Zinc and Lead fell on Friday. Data from CFTC showed that speculators are bearish on Comex Copper. Domestic base metals end with gains on MCX on Friday, tracking firm overseas prices. Commodity Aluminium Copper Nickel Lead Zinc LME Official Stocks in MT 29-Jan-15 30-Jan-15 Net Chg. 4,058,300 4,048,900 -9,400 247,450 248,125 675 425,562 426,240 678 215,050 215,000 -50 633,175 630,750 -2,425 Left – CFTC net positions of copper, Right – LME Copper % Chg. -0.23 0.27 0.16 -0.02 -0.38 Source: Reuters LME Copper - (5516.00) Trade Recommendations – None. 4 ADMISI Commodities Research February 02, 2015 Sriram Iyer: [email protected] Source: Reuters MCX Copper February - (344.90) Trade Recommendations – Sell in the range 338-340 with targets 331-330 with a stop loss at 345.00. Exit this call, stop loss triggered. Outlook – LME Copper could continue to remain range bound to weak. Downside could be limited on more stimulus hopes from China. Resistance is at 5608. Support is at 5441 and 5346. MCX could trade firm, tracking firm overseas prices. However, the Indian Rupee has appreciated today and could limit upside. Support is at of 338.85 and 332.55. Resistance is at 349.15 and 355.85. Left – LME warehouse inventories, Right – LME Nickel Source: Reuters LME Nickel - (15095.00) Trade Recommendations – None. 5 ADMISI Commodities Research February 02, 2015 Sriram Iyer: [email protected] Source: Reuters MCX Nickel February - (938.7) Trade Recommendations – None. Outlook – LME Nickel could trade firm. Support is at 15027 and 14905. Resistance is at 15150 and 15270. MCX could trade firm, tracking firm overseas prices. However, the Indian Rupee has appreciated today and could limit upside. Resistance is at 945.60 and 970.85. Support is at 924.35 and 913.95. DISCLAIMER: This document is not for public distribution and has been furnished to you solely for your information and must not be reproduced or redistributed to any other person. Persons into whose possession this document may come are required to observe these restrictions. This material is for the personal information of the authorized recipient, and we are not soliciting any action based upon it. This report is not to be construed as an offer to sell or the solicitation of an offer to buy any commodity or commodity derivative in any jurisdiction where such an offer or solicitation would be illegal. It is for the general information of clients of ADMISI Commodities Private Limited. It does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. We have reviewed the report, and in so far as it includes current or historical information, it is believed to be reliable though its accuracy or completeness cannot be guaranteed. Neither Archer Daniels Midland Company (ADM), ADM Investor Services International Limited (U.K) nor ADMISI Commodities Private Limited, nor any person/entity connected with it, accepts any liability arising from the use of this document. The recipients of this material should rely on their own investigations and take their own professional advice. Price and value of the investments referred to in this material may go up or down. Past performance is not a guide for future performance. Certain transactions including those involving futures, options and other derivatives as well as non-investment grade securities involve substantial risk and are not suitable for all investors. Reports based on technical analysis centers on studying charts of a stock's price movement and trading volume, as opposed to focusing on a commodity’s fundamentals and as such, may not match with a report on a commodity's fundamentals. Opinions expressed are our current opinions as of the date appearing on this material only. While we endeavor to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. Prospective investors and others are cautioned that any forward-looking statements are not predictions and may be subject to change without notice. Our investment businesses may make investment decisions that are inconsistent with the recommendations expressed herein. No part of this material may be duplicated in any form and/or redistributed without ADMISI Commodities Private Limited prior written consent. 6

© Copyright 2026