FCStone Grain Recap

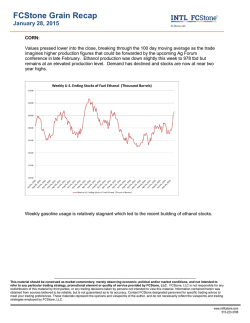

FCStone Grain Recap February 2, 2015 CORN: After a sharp rally early in the day which was attributed to “black box” computer systems the market finished about unchanged. Export inspections are running 2% ahead of last year with .661 mmt reported as shipped in the most recent report. The average trade guess was 750 to 900 tmt of exports. Plugging that into an assumed usage for the remainder of the DJF quarter and it appears there isn’t any more pressure to be brought against the CHCK to push it beyond 9 cents carry. Historically the usage to quarterly stocks relationship doesn’t appear to imply wider carry. The USDA announced a sale of 132 tmt to Mexico. Brazil confirms they are moving to a 27% ethanol blend in their motor fuel. This is response to a waning profit margin in the cane industry. Below I have included a graph of the relationship of Brazil’s ethanol usage, production and mandate. As you can see the projections put the higher mandate pushing ethanol usage to match the production which would imply Brazil would exit the export market eventually without banner year of cane production. If so the world would turn to the US for its oxygenate needs. The “exit” won’t be immediate as the ethanol industry has been building stocks at least initially in anticipation of the mandate expansion. This is not the first time the mandate has been projected to pull the country out of the export market. It seems that ethanol production increases as necessary to maintain a decent sized export program. ---------------------------------------------------------------------------------------------------------------------------------This material should be construed as market commentary, merely observing economic, political and/or market conditions, and not intended to refer to any particular trading strategy, promotional element or quality of service provided by FCStone, LLC. FCStone, LLC is not responsible for any redistribution of this material by third parties, or any trading decisions taken by persons not intended to view this material. Information contained herein was obtained from sources believed to be reliable, but is not guaranteed as to its accuracy. Contact FCStone designated personnel for specific trading advice to meet your trading preferences. These materials represent the opinions and viewpoints of the author, and do not necessarily reflect the viewpoints and trading strategies employed by FCStone, LLC. www.intlfcstone.com 515-223-3788 FCStone Grain Recap February 2, 2015 Cattle inventories surprised the trade on Friday afternoon with almost every metric used to measure herd size exceeded expectations. All cattle and calves is expected to be 101.4% over last year. The overall trend in cattle numbers is declining but this year the inventories are higher than the multi-decade lows of last year. Funds were absent in the corn futures today. SOYBEANS: After an initial rally driven most likely by an algorithm of some sort the market quieted down to close down a little more than a cent/bu. South American rains were disappointing compared to what the models were projecting. There is another couple rounds of rain in the forecast, which even conservatively interpreted will bring beneficial rains to Central and Northern Brazil. Dry weather is headed to Argentina which is needed at this time. Most crops estimates are running 93 to 95 mmt for Brazil despite the dryness in Goias, MGDS, and MG. With the bigger crop coming, the total exports of meal and soybeans from Brazil and Argentina combined is likely to be 98 mmt. Or 5 mmt over last year. Page 2 www.intlfcstone.com 515-223-3788 FCStone Grain Recap February 2, 2015 US export inspections were quite robust with a 1.7 mmt total shipment made last week. The trade was expecting at most a figure of 1.3 mmt. Shipments are running 19% ahead of last year. The trade keeps hoping for a major slowdown to offset the early season surplus of shipments but so far the reports are now showing a pace below last year’s second semester’s program. Page 3 www.intlfcstone.com 515-223-3788 FCStone Grain Recap February 2, 2015 Weather models still holding to a neutral to weak El Nino forecast for the next 6 months. El Nino or a weak one would cause favorable weather for the soybeans grown in the upper Midwest. WHEAT: Values were weak all day with good fund selling behind the break. Funds were noted as selling 6000 contracts for the session. Upper Midwest wheat areas were covered with a good depth of snow over the weekend to protect it from cold temperatures. Rains fell in the southern plains to aid soil moisture in that region during the same period. Chicago wheat futures have fallen below the psychological support of 500 and are nearing contract lows of 480. The US has yet to price itself into Egyptian business and the strength in the dollar isn’t helping. Export inspections were on the upper end of estimates though they are accumulating less shipments than are needed to meet the pace of the USDA’s estimate. If this pace is maintained then the USDA will need to trim 100 million bushels from its export number, raising carryout to 800 mln bushels. The USDA will release more of its long term projections for crops out to 2024 on Feb 11th this year. Page 4 www.intlfcstone.com 515-223-3788 FCStone Grain Recap February 2, 2015 ECBOT HIGH LOW CLOSE CHANGE Mar Corn May Corn 3.785 3.8675 3.675 3.7575 3.6975 3.7775 - 1/4 - 3/4 Mar Beans May Beans 9.705 9.77 9.565 9.63 9.595 9.6625 - 1 1/2 - 1 1/2 Mar wheat 5.054 4.9225 4.9275 - 10 Regards Bevan Everett Page 5 www.intlfcstone.com 515-223-3788

© Copyright 2026