Morning Notes - LKP Securities

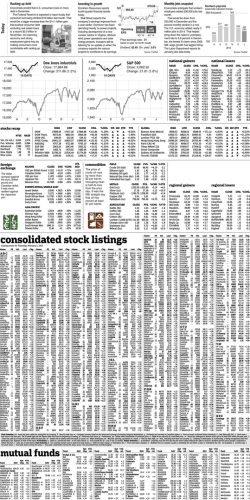

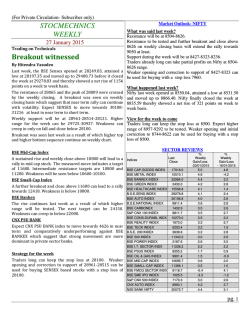

Morning Notes LKP Advisory 3-Feb-2015 Indices FII's & DII's in equity 2-Feb 30-Jan % Chg. Major Indices 2-Feb 30-Jan % Chg. 29,122 29,183 -0.21% CAC 40 Index 4,628 4,604 0.51% 02-Feb 8,797 8,809 -0.13% DAX Index 10,828 10,694 1.25% S&P BSE MID CAP 10,799 10,739 0.56% Dow Jones Industrial Average 17,361 S&P BSE SMALL CAP 11,457 11,329 1.13% FTSE 100 Index S&P BSE SENSEX S&P CNX NIFTY Rs.Crs Buy Sell Net FII / FPI Investments 5639 6269 -630 1747 1971 -224 17,165 1.14% DII's Investments 6,783 6,749 0.49% FII's contribution to the total turnover 47% Nasdaq Composite Index 4,677 4,635 0.89% DII's contribution to the total turnover 15% BSE Sectoral Indices S&P BSE CAPITAL GOODS 17,309 17,096 1.25% Major Asian Indices 2-Feb 30-Jan % Chg. FII's in Derivatives 11,290 11,179 1.00% Hang Seng Index 24,485 24,507 -0.09% 02-Feb S&P BSE CONSUMER DURABLES 10,756 10,655 0.94% Nikkei 225 17,558 17,674 -0.66% Net -3 769 -1887 54 S&P BSE TECk 6,170 6,136 0.55% KOSPI Index 1,953 1,949 0.18% OI 22359 49941 59020 1863 S&P BSE AUTO Chg.OI -1.8% 3.5% 2.8% 26% S&P BSE IT Rs.Crs Index Fut Index Opt Stock Fut Stock Opt 20,078 19,986 0.46% Shanghai Composite 3,128 3,210 -2.56% S&P BSE POWER 2,233 2,225 0.37% Taiwan SE Index 9,387 9,362 0.27% S&P BSE BANKEX 22,782 22,716 0.29% S&P BSE REALTY 1,816 1,811 0.24% Commodities (MCX) 2-Feb 30-Jan % Chg. Futures (NSE) 2-Feb 30-Jan % Chg. 15,631 15,667 -0.23% Aluminium (27FEB2015) 115 115 -0.13% USDINR 25-FEB-2015 62.12 62.24 -0.18% 8,185 8,205 -0.25% Copper (27FEB2015) 341 343 -0.57% EURINR 25-FEB-2015 70.63 70.39 0.34% S&P BSE METAL 10,142 10,190 -0.47% Crude (19FEB2015) 3,053 2,855 6.94% JPYINR 25-FEB-2015 52.82 52.89 -0.13% S&P BSE OIL & GAS 10,088 10,143 -0.54% Gold (5FEB2015) 27,840 27,895 -0.20% FTSE100 (20-FEB-2015) 6778 6844 -0.96% 8,129 8,275 -1.77% Silver (5MAR015) 38,005 38,105 -0.26% S&P500 (20-FEB-2015) 2003 2007 -0.17% S&P BSE HEALTHCARE S&P BSE PSU LTP Chg % Chg Company LTP HCLTECH 1894 102 5.7 ASIANPAINT 809 -49 -5.7 AXISBANK 621 33 5.6 BHARTIARTL 361 -13 -3.5 HINDALCO 145 6 3.9 DRREDDY 3137 -96 -3.0 WIPRO 627 20 3.3 ACC 1515 -45 -2.9 1355 33 2.5 JINDALSTEL 154 -5 -2.8 Company LTP Top Gainers BSE Midcap UPL Chg % Chg 393 25 6.9 HCLTECH 1893 99 5.5 SIEMENS 1095 55 5.3 AXISBANK 617 28 EXIDEIND 195 9 Company LTP MONSANTO FRL DELTACORP SPARC IFCI Company Top Gainers BSE Smallcap LTP FLFL MARICOKAYEL SUVEN ZODIACLOTH CERA Chg % Chg 808 -49 -5.8 -193 -5.6 HINDPETRO 632 -24 -3.6 4.8 BHARTIARTL 360 -13 -3.5 4.8 YESBANK 832 -30 -3.5 Chg % Chg Company LTP 3584 416 13.2 TVSMOTOR 286 -22 -7.1 132 15 12.5 NAUKRI 99 9 10.5 361 33 10.0 41 3 8.0 LTP Chg % Chg 87 14 20.0 1393 232 20.0 264 42 18.7 401 51 14.7 2396 258 12.1 ASIANPAINT Chg % Chg 3262 Top Losers BSE 100 Top Gainers BSE 100 Company Top Losers BSE Midcap KOTAKBANK Top Losers CNX Nifty Company Top Losers BSE Smallcap Top Gainers CNX Nifty S&P BSE FMCG UNITDSPR Chg % Chg 808 -37 -4.4 PINEANIM 37 -2 -4.4 MPHASIS 348 -15 -4.2 REPCOHOME 666 -26 -3.7 Company LTP MKEL Chg % Chg 33 -3 -9.2 RSSOFTWARE 202 -19 -8.7 MPSLTD 824 -72 -8.0 1794 -149 -7.7 17 -1 -7.6 KKCL SHRGLTR FIIs' contribution to the total Derivatives turnover 24% Domestic Market View Markets to get a cautious start; RBI credit policy eyed The Indian markets ended marginally in red in last session despite some late hour recovery. Today, the start is likely to remain cautious and traders will be eyeing the Reserve Bank of India’s (RBI) bi-monthly monetary policy. RBI governor Raghuram Rajan had already cut the repo rate, or the key lending rate, to 7.75 percent, the first rate cut in his tenure. Though, there is build-up of expectations for yet another round of rate cut but RBI governor may not oblige so soon, but any kind of surprise can give markets the direction. There will be buzz in the payment banks licence seekers, as the big corporate like RIL, Aditya Birla Group, Airtel and Future Group have joined the race for payment bank licence with the end of the deadline for seeking payment bank and small finance banks licences. There will be some buzz in the IT sector too, with the development in US, where the Republican leadership has opposed US President Barack Obama's move to tax overseas earnings. There will be lots of important result announcements too, to keep the markets in action. Domestic Market OverView Markets end slightly lower ahead of RBI policy meeting Extending their downfall, Indian equity benchmarks ended the Monday’s trade slightly in the red as investors opted to remain on sidelines ahead of Reserve Bank of India (RBI) policy meeting on February 3. Though, Street widely expects Central bank to pause during the February 2015 monetary policy review, while maintaining a dovish tone, and resume cutting the repo rate by a further 50 basis points (bps) after the presentation of the Union Budget. Markets, after a negative opening, started moving southward but sudden spurt in noon deals helped key gauges to gain their positive terrain. Though, the recovery proved short-lived and markets ended the session with a cut of around one fifth of a percent. Overall sentiments remained dampened as investors remained worried over a huge shortfall in tax deducted at source (TDS) collections, the Central Board of Direct Taxes (CBDT) has asked the income tax department (I-T) to initiate special measures to achieve the collection target for this financial year. Selling got intensified after Growth in India’s factory activity slipped in January from December’s two-year high as new orders rose at a weaker rate despite factories keeping price increases to a minimum. The HSBC India Purchasing Managers’ Index (PMI), a headline index designed to measure the overall health of the manufacturing sector, slid to three month low at 52.9 in January, down from 54.5 in the prior month. Depreciation in Indian rupee too dampened the sentiments. Rupee was trading at 61.90 per dollar at the time of equity markets closing compared with its previous close of 61.86. Meanwhile, metal stocks edged lower after downbeat Chinese factory sector data raised concerns about the world's second-largest economy. On the flip side, auto stocks remained on buyers’ radar on report that car sales in January are estimated to have risen almost 8% over the same month last year, despite an increase in prices on the back of 4-6% hike in excise duties from the month. Global Market Overview Asian markets end mostly in red on Monday The Asian equity benchmarks ended mostly in red on Monday, after the latest gauge of China’s factory sector activity raised concerns about the world’s second-largest economy. Malaysian markets were closed today on account of ‘Malaysia - FT Day’ holiday. Activity in China’s factory sector shrank for the second straight month in January, as the New Year got off to a rocky start for the world’s second-largest economy. The slack performance, including a 15th month of shrinking factory employment, will add to the debate over how and whether Beijing will accelerate policy easing, with most bank economists calling for a combination of rate cuts and increased liquidity to spur productive investment. The final HSBC/Markit Purchasing Managers’ Index (PMI) for January came in at 49.7 on a seasonally adjusted basis, just below the 50.0 level that separates growth from contraction. US markets closed choppy trade with good gains The US markets closed higher on Monday, after spending much of the trading session dipping in and out of negative territory. Investors looked past a batch of government reports that suggested that the economy may be losing steam and focused instead on rising oil prices, which juiced shares in energy companies, and upbeat quarterly earnings. On the economy front, Americans cut spending in December by the largest amount since 2009, buying fewer cars and trucks and devoting less money to energy amid a deep plunge in oil prices. Yet incomes posted another solid again and falling inflation is allowing Americans to get more bang for their buck. Personal spending fell a seasonally adjusted 0.3% last month. Personal income, meanwhile, rose 0.3%. Meanwhile, inflation as gauged by the PCE price index slipped 0.2% in December. And the core rate that excludes food and energy was unchanged. Outlays for US construction projects rose 0.4% in December to a seasonally adjusted annual rate $982.1 billion, led by public spending. LKP Advisory Index Futures (OI in '000 Shares) Future Chg Spot Chg Prem / 2-Feb (%) 2-Feb (%) Disc 62.3 NIFTY 8,860 -0.15 8,797 -0.13 CNXIT BANKNIFTY 12,022 0.97 11,944 1.01 20,052 -0.42 19,866 0.11 Total Open Interest 2-Feb Chg (%) 25,658 -2.0 77.8 14 16.6 186.2 2,356 12.9 Increasing OI, Increasing Delivery Qty & Increasing Price in Stock Futures (Open Interest in '000 Shares) Symbol Total OI 2-Feb % Chg. CESC 1,113 14% 175,643 34% PFC 6,299 13% 2,120,730 43% PETRONET 5,752 13% 2,173,185 TECHM 2,174 12% 1,227,702 WIPRO 8,356 9% KOTAKBANK 6,224 9% UPL Increase Del Qty Spot (Rs.) Fut (Rs.) Spot Chg (%.) Fut Chg (%.) 30% 86,081 734 740 0.3% 0.7% 6.5 43% 344,064 310 307 3.8% 4.5% -2.5 75% 60% 992,532 181 182 0.4% 0.7% 1.7 57% 64% 426,178 2895 2919 0.9% 0.9% 23.5 1,855,524 57% 61% 722,656 625 630 3.1% 3.1% 4.9 1,260,654 71% 68% 265,741 1352 1364 2.3% 2.5% 12.0 Del Qty Cash Market 2-Feb % Del. Prev % Del. Prem / Disc 6,498 8% 1,181,992 25% 37% 669,814 394 396 6.9% 7.1% 2.4 LICHSGFIN 10,680 8% 991,200 35% 25% 465,489 480 484 0.3% 0.5% 4.0 IFCI 56,776 7% 5,384,406 23% 29% 461,806 41 41 8.2% 8.3% 0.4 AXISBANK 26,962 7% 1,938,493 27% 25% 654,620 617 622 5.0% 5.1% 4.8 Increase in Del Qty Spot (Rs.) Fut (Rs.) Spot Chg (%.) Fut Chg (%.) Prem / Disc Increasing OI, Increasing Delivery Qty & Decreasing Price, (Open Interest in '000 Shares) Symbol YESBANK Total OI 2-Feb % Chg. Del Qty Cash Market 2-Feb % Del. Prev % Del. 8,180 28% 4,677,205 53% 37% 3,442,714 832 839 -3.5% -3.2% 7.0 COALINDIA 28,192 25% 21,946,893 65% 51% 13,748,741 355 358 -1.6% -0.8% 2.8 ICICIBANK 65,936 19% 25,249,497 72% 48% 10,425,470 352 355 -2.5% -2.3% 3.0 ASIANPAINT 7,614 19% 3,439,106 65% 68% 1,003,827 808 815 -5.8% -5.7% 6.8 TVSMOTOR 5,097 14% 1,979,091 39% 29% 1,252,668 285 286 -7.4% -7.4% 1.1 HAVELLS 6,117 11% 2,071,318 63% 39% 1,342,060 250 252 -3.2% -3.0% 2.2 15,230 11% 1,350,207 39% 37% 131,076 184 185 -2.7% -2.8% 1.1 901 10% 70,247 45% 26% 42,257 1388 1399 -2.5% -2.3% 10.6 ARVIND 9,892 7% 932,367 38% 17% 299,408 284 286 -2.5% -2.3% 2.4 COLPAL 596 7% 52,471 57% 51% 11,030 1839 1850 -1.9% -1.9% 11.4 Change in OI % Chg CROMPGREAV BATAINDIA Open Interest Break-up (Rs. in Cr.) 02-Feb 30-Jan INDEX FUTURES 27,531 27,467 64 0.23 INDEX OPTIONS 88,790 83,126 5,664 6.81 116,321 110,593 5,728 5.18 STOCK FUTURES 70,618 67,792 2,826 4.17 STOCK OPTIONS 11,010 9,071 1,940 21.38 TOTAL INDEX TOTAL STOCKS 81,629 76,863 4,766 6.20 GRAND TOTAL 197,950 187,456 10,494 5.60 FII's 133,183 129,894 3289 2.53 64,767 57,562 7205 12.52 Others LKP Advisory Corporate News As part of its expansion plans in India, Kokuyo Camlin has decided to set up a state-of-the-art factory at Patalganga, MIDC in Maharashtra. The new factory will manufacture Markers, Mechanical Pencils, Fine leads, Pens and other stationery products and is expected to commence its operations in 2016. Steel Strips Wheels (SSWL) has reported 3% growth in its total wheel rim sales to 10.03 lakh as compared to 9.70 lakh in January 2014. In terms of Value, the company has achieved gross turnover of Rs 103.3 crore in January 2015 as compared to Rs 100.2 crore in January 2014, recorded a growth of 3% and achieved a Net turnover of Rs 93.3 crore in January 2015 as against Rs 89.6 crore in January 2014, recorded a growth of 4%. However, the export volumes dropped by 4% to 1.21 lakh in January 2015 as against 1.25 lakh in January 2014. TASC Outsourcing, a Middle East's leading Contract Staffing and talent management firm, has gone live with Ramco Systems’ end-to-end ERP for Services (also called SRP - Services Resource Planning). TASC Outsourcing manages thousands of employees who are contracted to companies in industries such as IT, retail, finance, oil & gas and energy. Offering service modules such as finance, procurement, operations, human capital management (HCM) & payroll, TASC will utilize the SRP services from Ramco to automate its processes and increase efficiencies in employee care, while also reducing revenue leakage by enhancing resource productivity. Ashok Leyland, the commercial vehicle manufacturer, has reported an increase of 36% in sales in January 2015 to 10,639 units as against 7,847 units sold in the same period of last year. The company has experienced a rise of 45% in its medium and heavy commercial vehicle (M&HCV) products segment to 8,005 units in January. The company’s light commercial vehicle (LCV) witnessed a rise of 14% to 2,634 units in January 2015. Sales for April 2014-January 2015 period went up 14% over previous year period to 81,382 units. Lupin has received final approval for its Vancomycin Hydrochloride Capsules, 125 mg and 250 mg from the United States Food and Drugs Administration (USFDA) to market a generic version of ANI Pharmaceuticals, Inc’s Vancocin capsules 125 mg and 250 mg strengths. Lupin Pharmaceuticals Inc. (LPI), the company’s US subsidiary would commence marketing the product shortly. Escorts agri machinery segment (EAM), a subsidiary of Escorts, has sold 3,369 tractors in January 2015 against 4,742 tractors in January 2014. Domestic sales in January 2015 stood at 3,223 tractors against 4,695 in January 2014. Export for the month of January 2015 at 146 tractors against 47 tractors in January 2014. Tata Motors has launched its new-generation Xenon and Prima commercial vehicles in the Malaysian market, with partner DRBHICOM Commercial Vehicles (DHCV). A blend of design and performance, the Tata Prima will be available as a Prime mover, in the 4x2 and 6x4 configuration – with the Prima 4038.S and Prima 4938.S, catering to fleet owners and goods transportation companies, whereas the muscular Tata Xenon pick-up will cater to traders, small & medium industries, estate/plantation as well as individuals, in six single & dual cab pick-ups, in six variants. Alstom T&D India has successfully commissioned the Rajya Vidyut Prasaran Nigam’s (RVPN) 765 kV substation in Anta. Anta is Rajasthan’s first 765 kV substation, and the second largest with a total of twenty-six bays, ten 765 kV bays and sixteen 400 kV bays. This substation will play a significant role in pooling and evacuating the power flow from the three major power plants in the state (Kalisindh, Kawai and Chhabra) to the national grid. Aditya Birla Nuvo (ABNL) has submitted an application to the Reserve Bank of India (RBI) for obtaining license for setting-up Payments Bank, in accordance with the Guidelines for Licensing of Payments Bank issued by RBI on November 27, 2014. TVS Motor Company has recorder marginal sales growth of 1.23% in month of January 2015, with total sales increasing from 186,313 units recorded in the month of January 2014 to 188,598 units in the month of January 2015. LKP Advisory Coal India, the world’s largest coal miner by output, has reported provisional production of 46.60 million tonnes in January 2015, as against target of 50.09 million tonnes. The company’s total off-take for the month of January stood at 44.09 million tonnes as against a target of 49.93 million tonnes. Vakrangee has made an application with the Reserve Bank of India (RBI) in the capacity of Corporate Business Correspondent for Payments Bank License. The company has received its board’s approval for the same on February 02, 2015. Tata Motors’ total sales including exports of Tata commercial and passenger vehicles in January 2015 were 42,582 vehicles, a growth of 5.19% over 40,481 vehicles, sold in January 2014. The company’s domestic sales of Tata commercial and passenger vehicles for January 2015 were 38,621 units, a growth of 5.36% over 36,657 vehicles, sold in January 2014. Cumulative sales (including exports) for the company for the fiscal are 405,577 units, lower by 14.72% over 475,560 vehicles, sold last year. While market continues to remain challenged by macroeconomic trends, besides positive growth in segments such as M&HCV and Passenger Cars, Exports have grown in January 2015 by 4%, over last year. Maruti Suzuki India, country’s largest car maker, has registered a rise of 13.9% in its total car sales (Domestic + Export) for the month of January 2015 at 116606 units, as against 102416 units in January 2014. The company’s domestic sales rose by 9.3% in January 2015 at 105559 units, as against 96569 units in corresponding month last year. Mahindra Lifespace Developers (MLDL), the real estate and infrastructure development arm of the Mahindra Group, has sold 627 units worth Rs 310 crore in Q3FY15 as compared to 279 units worth Rs 131 crore in Q3FY14 amounting to 125% growth in volume and 137% growth in value. Atul Auto has registered 9.19% growth in its January 2015 sales. The company has sold 3,636 units in the month against 3,330 units sold in January 2014. Total sales from April 2014 to January 2015 were 34,974 vehicles, a rise of 11.96%, as compared to 31,238 vehicles sold in the same period a year ago. Biocon is planning to spend 10 per cent of its annual biopharma revenue on research and development (R&D) in the next fiscal year. The company, which is pursuing R&D in both novel biologics as well as biosimilars (generic versions of biologic drugs), in various stages of trials, had spent around Rs. 131 crore on R&D in the previous fiscal year which was 6 per cent of biopharma sales. Sundaram Brake Linings has temporary stopped operations in Plant 4 - located in Mahindra World City (MWC), Chengalpet in state of Tamil Nadu. This step has been taken as the company has decided to upgrade its plant. Bajaj Auto, the second-largest motorcycle manufacturer has registered 9% drop in total sales to 2,88,746 units in January 2015 against 3,18,171 units in January 2014. The sales of the motorcycles decreased by 12% and stood at 2,46,955 units in the month under review against 2,81,390 units in January 2014. However, the company has reported 14% rise in Commercial Vehicles sales which stood at 41,791 units as compared to 36,781 units in month of January 2014. US Federal Trade Commission (USFTC) has completed its review of the proposed acquisition of Ranbaxy Laboratories by Sun Pharmaceutical Industries and has granted early termination of the waiting period under the Hart-Scott-Rodino Antitrust Improvements Act of 1976 (HSR Act). The early termination of the waiting period under the HSR Act satisfies one of the essential conditions to the closing of the Ranbaxy acquisition. Indian Overseas Bank (IOB) has launched an issue of Unsecured, Non-Convertible, Additional Tier -I, Basel III Compliant Perpetual bonds to the extent of Rs 1,000 crore. This includes a green shoe option of Rs 300 crore to augment additional Tier-I capital and strengthen capital adequacy under Basel-III norms. Capital Trust has received an approval to apply for license of Small Finance Bank in accordance with the Reserve Bank of India (RBI) Guidelines dated November 27, 2014. The company has applied for the same. The board of directors at their meeting held on January 27, 2015 has approved for the same. LKP Advisory Divis Laboratories is considering setting up a third manufacturing site to augment capacities besides de-risking its business. The company made an application to the Government of Andhra Pradesh for allotment of land near Kakinada and the company is awaiting favourable response. The company proposes to make an initial investment of Rs 500 crore on this facility. SE Investments has received an approval to file an application with Reserve Bank of India (RBI) for seeking banking license and conversion of company into Small Finance Bank. The board of directors at their meeting held on February 01, 2015 has approved for the same. Dharani Sugars & Chemicals has requested the banks to re-structure the loans provided to the company under CDR Mechanism. The company expects to receive approval from individual banks approving the re-structuring proposals. Eicher Motors and Volvo Group’s joint venture firm, VE Commercial Vehicles (VECV) has reported 25.08% jump in total sales of its Eicher branded products at 3,262 units in January as against 2,608 units sold in the year-ago period. IFCI is planning to sell its 2.5% stake in stock exchange NSE in the next 15 days which may fetch the financial institution about Rs 500 crore. At present, infrastructure lender IFCI holds 5.44% stake in the premier bourse. NMDC has reduced iron ore prices by Rs 200-300 per tonne for the February as weak global prices, which nosedived to five-and-ahalf-year lows, are putting pressure on domestic rates. Economy HSBC PMI slips to three month low of 52.9 in January Raising hopes of a rate cut by the Reserve Bank of India (RBI), Indian manufacturing activity retreated from two year high in January on slower pace of order flows from domestic and global markets. The HSBC India Purchasing Managers' Index (PMI), a headline index designed to measure the overall health of the manufacturing sector, slid to three month low at 52.9 in January, down from 54.5 in the prior month. Notably, despite falling, the index remained consistent with a solid improvement in business conditions in January. Moreover, the latest expansion was the fifteenth in as many months since the index has been higher above the watershed 50 mark, which denotes growth since November 2013. The latest survey points that business conditions although have improved at a solid rate albeit more slowly than in the previous month. The overall improvement in the Indian manufacturing sector has been underlined by further output growth in January. Production has risen at a robust pace, extending the current sequence of expansion to 15 months. CBDT directs I-T dept to initiate special measures to meet direct taxes collection target Apprehensive over a massive deficit in TDS collections, Central Board of Direct Taxes (CBDT) has mandated Income Tax (IT) department to initiate special measures to achieve the direct taxes collection target for this fiscal. The board has directed I-T officials to bolster their efforts and give special emphasis on tax collections under the Tax Deducted at Source (TDS) and Advance Tax categories.This development comes on the heels of TDS collections slipping by 50% for the fiscal. For FY2013-14, the growth under this head was 16.73%, while in FY2014-15 the growth slipped to 7.84%. The budgeted target under the direct tax category has been pegged at Rs 7.36 lakh crore for the current fiscal, while the collection has summed up to Rs 5,46,661 crore till January 23, according to CBDT. Further, the apex policy making body of the I-T department, also asked the taxman to ensure that those assessees who have made handsome self-assessment tax declarations should be tapped to deposit it as advance tax so that the figures could be collated and reflected in this fiscal, which will end December 31.In order to ensure better TDS and Advance Tax collections, I-T officials have been asked to make on-spot visits to defaulting organisations and also interact with officials and individuals responsible under the established official mechanism in this regard. LKP Advisory ATF price slashed by 11.3% to cost less than diesel With international oil prices dipping to six years low, Jet fuel (ATF) prices were slashed by a steep 11.3% over the weekend. With this, price of aviation turbine fuel (ATF), or jet fuel, in Delhi was cut by Rs 5,909.9 per kilolitre, or 11.27%, to Rs 46,513.02 per kl. Notably, the reduction which followed the steepest ever cut of Rs 7,520.52 per kl or 12.5% affected from January 1, has led to ATF becoming cheaper than even diesel. With the effective rate ATF costs Rs 46.51 per litre, while diesel still costs Rs 51.52 per litre. However, the prices of diesel and petrol were kept unchanged as per the fortnightly revision. Traditionally, auto fuels being of lesser quality than ATF, should cost less, but four consecutive excise duty hikes since November -totaling Rs 7.75 a litre on petrol and Rs 7.50 on diesel, have reversed this trend. This development is definitely encouraging for Aviation industry which continues to reel under liquidity pressure since jet fuel constitutes over 40% of an airline's operating costs and the price cut will ease the financial burden of cash-strapped carriers. Notably, the latest cut marks seventh straight reduction in jet fuel rates since August. Economic growth gets revised upwards to 6.9 percent for 2013-14 under new series Government’s decision to update the base year for measuring national accounts resulted in economic growth rate getting revised upwards to 6.9 percent for 2013-14. The economic growth rate for 2012-13 has been revised upwards to 5.1 percent from earlier estimate of 4.5 percent. The previous estimates had put economic growth rate at sub-5 percent level for the past two years. The Gross Domestic Product (GDP) growth rate for 2013-14 too, following adoption of the new series with base year 2011-12 has gone up by almost 50 percent. The rate of expansion was estimated at 4.7 percent under the old series that had 2004-05 as base year. However, the size of economy marginally declined to Rs 113.45 lakh crore in 2013-14 under the new series from Rs 113.55 lakh crore under the old series. Similarly, the size of the economy in 2012-13 declined under the new series to Rs 99.88 lakh crore from Rs 101.13 lakh crore at current market prices. Also, during 2013-14, contribution of agriculture sector has declined marginally to 18.2 percent in new series from 18 percent with 2004-05 as base year. Source: Reuters, Ace Equity & LKP Research LKP Advisory Tech View CNX Nifty Technical View Nifty witnessed an increased amount of volatility yesterday which is likely to influence today’s trading session too. The outcome of RBI’s monetary policy will influence the orientation of the markets. The short term supports are seen at 8700 levels whereas near term resistances are seen at 8900 levels. IMPORTANT LEVELS FOR THE DAY Support BSE NSE BANKNIFTY S1 28,925 8741 19543 S2 28,688 8672 19217 R1 29,308 8852 20071 R2 29,544 8920 20397 Pivot 29,116 8,796 19,807 Resistance . LKP Advisory Tech View PIVOT POINTS Scrip Name CMP RB2 RB1 PP SB1 SB2 ACC Scrip Name CMP RB2 RB1 PP SB1 SB2 1525 1592 1559 1532 1505 1471 GAIL 430 443 435 429 423 415 ADANIENT 655 685 667 652 638 620 GLENMARK 716 733 725 719 713 705 ADANIPORTS 336 353 344 338 331 323 GMRINFRA 20 22 21 20 19 18 ADANIPOWER 52 54 53 52 51 50 GODREJIND 312 321 315 311 307 301 ALBK 115 119 117 115 114 111 GRASIM 3808 3937 3877 3829 3780 3721 AMBUJACEM 249 258 252 248 243 238 HAVELLS 250 267 259 253 247 239 ANDHRABANK 94 98 95 93 91 89 HCLTECH 1891 2004 1926 1863 1800 1722 APOLLOHOSP 1349 1407 1370 1340 1309 1272 HDFC 1269 1322 1291 1266 1241 1209 APOLLOTYRE 243 255 249 245 240 235 HDFCBANK 1082 1132 1101 1076 1051 1019 ARVIND 284 308 296 287 278 267 HDIL 110 119 115 111 107 102 ASHOKLEY 66 68 67 66 65 64 2833 2953 2893 2844 2795 2735 ASIANPAINT 808 887 850 821 791 755 HEXAWARE 238 253 243 235 226 216 1264 1303 1278 1257 1236 1210 HINDALCO 145 152 147 143 140 135 617 658 630 608 585 557 HINDPETRO 629 692 663 639 616 586 2349 2498 2425 2365 2306 2232 HINDUNILVR 908 949 930 914 899 879 BANKBARODA 188 199 193 188 183 176 HINDZINC 174 181 177 173 170 166 BANKINDIA 274 286 278 272 265 257 IBREALEST 84 90 87 85 82 79 BATAINDIA 1388 1456 1424 1397 1371 1338 ICICIBANK 352 369 361 354 348 339 BHARATFORG 1066 1111 1081 1057 1033 1003 IDBI 72 74 73 72 70 69 BHARTIARTL 359 386 373 363 353 340 IDEA 154 159 156 154 151 148 BHEL 294 302 297 294 290 285 IDFC 176 187 180 176 171 164 BIOCON 422 441 430 421 413 402 IFCI 41 45 43 40 38 35 BPCL 749 795 770 750 731 706 IGL 464 486 475 466 457 446 CAIRN 236 242 238 236 233 230 INDIACEM 109 114 111 109 107 105 CANBK 455 475 461 450 439 425 INDUSINDBK 875 900 883 870 856 839 CENTURYTEX 577 606 591 579 567 552 INFY 2137 2174 2154 2138 2122 2102 CESC 734 773 753 737 721 702 IOB 59 62 60 58 56 54 CIPLA 696 719 707 698 688 677 IOC 340 356 348 341 334 326 COALINDIA 355 364 358 354 350 345 IRB 269 279 274 270 266 260 1839 1969 1908 1859 1811 1750 ITC 361 377 369 363 357 350 CROMPGREAV 184 199 192 187 181 174 JINDALSTEL 155 166 160 156 152 147 DABUR 262 271 265 260 255 249 JISLJALEQS 70 74 72 70 68 66 DISHTV 80 84 82 80 78 76 JPASSOCIAT 29 30 29 29 28 27 1690 1806 1745 1695 1646 1585 JPPOWER 12 13 12 12 12 11 173 180 176 172 168 163 JSWENERGY 124 131 127 123 120 116 DRREDDY 3139 3220 3183 3153 3123 3085 JSWSTEEL 997 1040 1015 995 974 950 EXIDEIND 195 211 201 193 185 175 JUBLFOOD 1402 1437 1417 1401 1385 1366 FEDERALBNK 145 152 147 143 140 135 JUSTDIAL 1566 1619 1587 1560 1534 1502 AUROPHARMA AXISBANK BAJAJ-AUTO COLPAL DIVISLAB DLF LKP Advisory HEROMOTOCO Tech View Scrip Name CMP RB2 RB1 PP SB1 SB2 Scrip Name CMP RB2 RB1 PP SB1 SB2 KOTAKBANK 1352 1416 1373 1339 1305 1262 TATACHEM 463 486 472 461 449 435 145 149 146 144 142 139 TATACOMM 409 429 419 411 404 394 71 74 72 70 69 67 TATAGLOBAL 164 177 169 163 157 149 480 498 486 477 467 455 TATAMOTORS 593 611 599 590 580 569 LT 1735 1784 1751 1724 1697 1663 TATAMTRDVR 357 372 364 358 352 344 LUPIN 1555 1653 1606 1569 1531 1485 TATAPOWER 91 95 93 91 89 87 M&M 1241 1324 1285 1253 1222 1182 TATASTEEL 384 404 395 387 379 370 M&MFIN 249 262 256 251 245 239 TCS 2514 2581 2536 2499 2463 2417 MARUTI 3669 3817 3736 3671 3607 3526 TECHM 2895 3091 2997 2921 2845 2751 MCDOWELL-N 3262 3725 3515 3346 3176 2966 TITAN 433 447 439 433 426 418 MCLEODRUSS 209 219 214 209 204 199 UBL 976 1020 997 979 960 937 40218 41001 40558 40199 39841 39398 77 80 78 76 75 73 NHPC 20 21 20 20 19 18 3087 3278 3179 3098 3018 2919 NMDC 141 146 143 141 139 137 UNIONBANK 209 220 214 210 205 199 UNITECH KTKBANK L&TFH LICHSGFIN MRF NTPC 142 147 144 143 141 139 OFSS 3397 3475 3437 3405 3374 3336 ONGC 350 365 358 352 346 ORIENTBANK 265 278 271 266 PETRONET 181 187 183 PFC 310 327 PNB 192 199 POWERGRID 148 PTC RANBAXY RCOM ULTRACEMCO 19 21 20 19 19 18 UPL 394 434 405 383 360 332 339 VOLTAS 266 275 270 265 261 256 260 254 WIPRO 625 646 632 621 609 595 181 178 174 YESBANK 832 892 861 837 812 782 316 306 297 285 ZEEL 372 382 377 372 368 363 195 191 188 183 151 149 148 146 144 100 104 102 101 99 97 720 745 731 720 709 695 81 83 82 80 79 78 RECLTD 345 366 352 341 330 316 RELCAPITAL 490 507 497 489 481 471 RELIANCE 908 931 920 911 902 892 RELINFRA 517 540 526 514 503 489 RPOWER 66 69 67 66 64 63 SAIL 76 78 77 76 75 73 SBIN 308 318 312 308 304 299 SIEMENS 1097 1170 1120 1080 1040 990 SRTRANSFIN 1159 1203 1177 1155 1134 1108 SSLT 198 211 205 200 196 190 SUNPHARMA 929 961 945 932 918 902 SUNTV 410 424 416 410 403 395 SYNDIBANK 120 126 122 119 116 112 LKP Advisory UCOBANK The information in this documents has been printed on the basis of publicly available information, internal data and other reliable sources believed to be true and is for general guidance only. While every effort is made to ensure the accuracy and completeness of information contained, the company makes no guarantee and assumes no liability for any errors or omissions of the information. No one can use the information as the basis for any claim, demand or cause of action. LKP Securities Ltd., and affiliates, including the analyst who have issued this report, may, on the date of this report, and from time to time, have long or short positions in, and buy or sell the securities of the companies mentioned herein or engage in any other transaction involving such securities and earn brokerage or compensation or act as advisor or have other potential conflict of interest with respect to companies mentioned herein or inconsistent with any recommendation and related information and opinions. LKP Securities Ltd., and affiliates may seek to provide or have engaged in providing corporate finance, investment banking or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in the past. LKP Securities Ltd. Ph: (91-22) 66351234 FAX: (91-22) 66351249 E Mail: [email protected] web: http://www.lkpsec.com LKP Advisory

© Copyright 2026