FC Stone Afternoon Market Recap

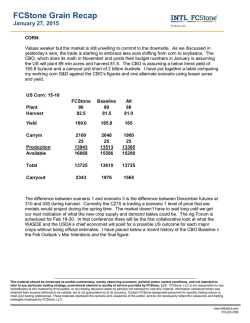

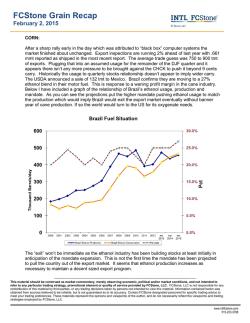

FCStone Grain Recap January 28, 2015 CORN: Values pressed lower into the close, breaking through the 100 day moving average as the trade imagines higher production figures that could be forwarded by the upcoming Ag Forum conference in late February. Ethanol production was down slightly this week to 978 tbd but remains at an elevated production level. Demand has declined and stocks are now at near two year highs. Weekly gasoline usage is relatively stagnant which led to the recent building of ethanol stocks. ---------------------------------------------------------------------------------------------------------------------------------This material should be construed as market commentary, merely observing economic, political and/or market conditions, and not intended to refer to any particular trading strategy, promotional element or quality of service provided by FCStone, LLC. FCStone, LLC is not responsible for any redistribution of this material by third parties, or any trading decisions taken by persons not intended to view this material. Information contained herein was obtained from sources believed to be reliable, but is not guaranteed as to its accuracy. Contact FCStone designated personnel for specific trading advice to meet your trading preferences. These materials represent the opinions and viewpoints of the author, and do not necessarily reflect the viewpoints and trading strategies employed by FCStone, LLC. www.intlfcstone.com 515-223-3788 FCStone Grain Recap January 28, 2015 Eyeballs will be focused on acres and yield from the upcoming Ag Forum starting Feb 19th. The USDA is allowed to borrow and shoehorn lots of different ideas into this get together with little accountability. This can give them freedom to forward some good ideas and bad. The USDA has been somewhat slavish to previous year’s experiences, when it comes to estimating the coming year’s yield for corn, up until about 5 years ago. The deviation could be associated with the USDA developing a weather and planting progress model to project yield. The USDA also leans optimistic except when previous yields were exceptional deviations. Borrowing cues from this model the USDA will likely throw a 168.2 to 171 corn yield as their estimate for the forum. See below scatter chart. Page 2 www.intlfcstone.com 515-223-3788 FCStone Grain Recap January 28, 2015 Expanding on that idea I have included a table that shows the effect of the variation of yield on carryout. I have tossed in a 2013 yield and a 2004 style yields for good measure. I am assuming a 90 mln acre number for the planted for all purposes as I believe the government will lean towards less acres loss than was previously assumed. US Corn: 90 82.5 163 Trend 90 82.5 169.5 90 82.5 174 (2004 style dev.) 90 82.5 186 Production Available 2100 25 13043 15168 2100 25 13448 15573 2100 25 13984 16109 2100 25 14355 16480 2100 26 15345 17471 Total 13725 13725 13725 13725 13725 1443 1848 2384 2755 3746 Plant Harvest Yield Carryin Carryout 15-16 90 82.5 158.1 Funds sold 11,000 contracts of corn today. SOYBEANS: Values finishing modestly lower dragged down mostly by heavy selling in corn, wheat and bean oil. Bean oil weighed down by bigger palm oil production projections and an allowance by the EPA to have imported biodiesel from Argentina participate in the RIN program and thus the RFS program. The National Biodiesel Board is at odds with the EPA over this decision as they claim there will be a real lack of oversight in the program and could undercut biodiesel production in the US. The EPA assures there will be oversight and imports will remain approximately the size they are now. Funds sold 8000 contracts of bean oil today. One waterway in Southeastern Brazil is now to remain closed during the grain shipping season as January rains were not able to recharge the Tiete-Parana waterway adequately. The waterway usually moves 2.5 mmt of soy, corn and soy products for export. That quantity will be needed to be shipped by truck to the Port of Santos. Brazil’s ship line up for soybeans has now increased to 2 mmt. China is likely to cut its growth target to 7%, down from the historical 8% the government likes to forecast. The economy came up short last year with 7.4% which could be linked with some of the declines in meat demand and feed demand domestically. China has been focusing on building various reserves for food with some announcements about nearly doubling their corn reserves. Turning to the US market the focus on more bean acres and less corn acres has reversed a bit and now we must focus on what the Ag Forum will put forward as the working S&D tables until the new crop ones are released in May. I am assuming an 85.5 mln acre planted figure to allow for corn to gain back some of the acres previously “lost”. In the below table I have arranged a Page 3 www.intlfcstone.com 515-223-3788 FCStone Grain Recap January 28, 2015 reasonable range of yields that could be a result of weather this year with the trend yield the most likely the one the Ag Forum will forecast in its upcoming data release. I tossed in a 1994 deviation from trend to show what good crop weather could do to yield as it relates to trend. US Soybeans 15-16 Planted Harvested Yield 15-16 85.5 84.7 40 Trend (1994 style dev) 85.5 85.5 85.5 85.5 84.7 84.7 84.7 84.7 43 45 47.8 50 Carryin Production Available 350 3388 3753 350 350 351 3642 3812 4049 4007 4177 4415 352 4235 4602 Total Use 3850 3850 3850 3850 3850 Carryout (Rationing) 157 327 565 752 WHEAT: The market can be summed in one word…weak. Weak world demand, weak exporter’s currencies, and weaker competing exchanges. The Matif was down 22 cents while the CME was down 14 cents/bu. The Dollar index rose a strong 57 points today. The US remains uncompetitive into Egypt. The EU vegetative index is significantly improved, in the wheat areas, compared to last year. The Chicago March contract is 25 cents away from contract lows. Funds sold 8000 contracts of Chicago wheat today. ECBOT HIGH LOW CLOSE CHANGE Mar Corn May Corn 3.815 3.8975 3.73 3.8125 3.7325 3.815 -8 - 8 1/4 Mar Beans May Beans 9.7775 8.845 9.6625 9.7375 9.7025 9.7725 - 3 1/2 -4 Mar wheat 5.205 5.03 5.5025 - 13 3/4 Regards Bevan Everett Page 4 www.intlfcstone.com 515-223-3788

© Copyright 2026