INSIDE AGRICULTURE

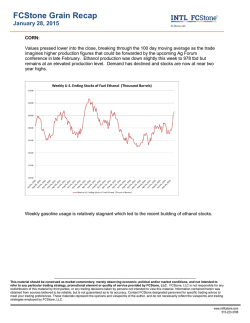

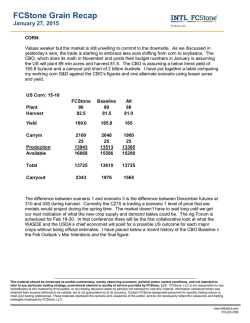

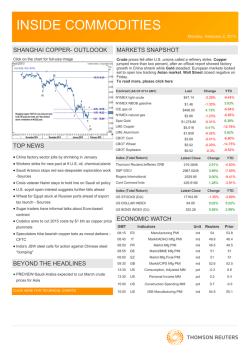

INSIDE AGRICULTURE Thursday, January 29, 2015 NEW YORK SUGAR-OUTLOOK TOP NEWS Click on the chart for full-size image Fed upbeat on U.S. economy, cites strong job gains China state corn stocks seen soaring-Industry POLL-Coffee prices seen rising as deficit forecasts widen POLL-Raw sugar price recovery will be marginal; refined market outlook better Forecasts for Brazil's coffee, sugar, grain belts turn wetter Nigerian farmers face eviction by foreign mega-plantation - TRFN NZ'S Fonterra cuts 14/15 milk volume forecast due to dry weather POLL-U.S. cattle herd seen stabilizing TODAY’S MARKETS Futures (as of 0730 GMT) Active Price Change YTD CBOT Wheat MAR5 502 6/8 -2 4/8 -14.33% 1,843 CBOT Corn MAR5 371 4/8 -1 6/8 -5.98% 7,469 CBOT Soybean MAR5 969 6/8 - 4/8 -4.81% 4,219 CBOT Soybean Oil MAR5 $30.21 -$0.13 -5.10% 2,570 CBOT Soy Meal MAR5 $337.40 $0.00 -7.46% 953 ICE Cotton MAR5 $59.43 -$0.01 -1.38% 673 Asia Contracts M3 Settle Change Volume Percent BMD Palm Oil MAR5 R2,247 -R8 -0.4% Dalian Soybean Oil MAR5 ¥5,318 -¥92 -1.7% ECONOMIC WATCH GMT Indicators Unit Reuters Prior 10:00 EZ Consumer Confid. Final ind -8.5 -10.9 10:00 EZ Economic Sentiment ind 101.5 100.7 10:00 EZ Services Sentiment ind 6.0 5.6 10:00 EZ Business Climate ind 0.1 0.04 10:00 EZ Industrial Sentiment ind -4.5 -5.2 -- 30 61 13:00 DE HICP Prelim MM pct -1.0 0.1 13:00 DE HICP Prelim YY pct -0.2 0.1 11:00 GB CBI Distributive Trades 13:30 US Initial Jobless Claims k 300,000 307,000 13:30 US Continued Jobless Claims mln 2.420 2.443 15:00 US Pending Homes Index ind -- 104.8 15:00 US Pending Sales Change MM pct 0.5 0.8 GRAINS: Chicago wheat fell for a seventh session to trade near its lowest since early October, following forecasts for rains in the U.S. Plains that are expected to boost output and add to an amply supplied world market. "It shows how the wheat market overreacted to curbs on Russian supplies in December and early January," said Paul Deane, senior agricultural economist, ANZ Bank, referring to a rally in wheat prices when Russia reduced exports. SOFTS: New York cocoa futures fell to a one-year low in heavy volume on Wednesday, extending their slide due to abundant supplies and falling demand, while raw sugar futures steadied. Arabica coffee futures fell on forecasts for substantial rain in parts of the growing region. EDIBLE OIL: Malaysian palm oil fell 1.7 percent as the market snapped two sessions of gains to trade near its lowest in five weeks, under pressure from plentiful global edible oil supplies and slowing demand. "Palm oil has been unable to hold on to gains in the face of persistent weakness in soy complexes and lower energy prices," said one Kuala Lumpur-based trader. "The bearish scenario in commodity markets will keep pressure on palm oil." STOCKS: European stocks were set to fall at open and Asian markets extended losses after the Federal Reserve took an upbeat view on the U.S. economy and signalled that it remains firmly on track to raise interest rates this year, despite an uncertain global outlook. Wall Street ended lower on Wednesday. CLICK HERE FOR TECHNICAL CHARTS CLICK HERE FOR TENDERS INSIDE AGRICULTURE January 29, 2015 TOP NEWS Fed upbeat on U.S. economy, cites strong job gains China state corn stocks seen soaring-Industry The Federal Reserve on Wednesday said the U.S. economy was expanding "at a solid pace" with strong job gains in a signal that the central bank remains on track with its plans to raise interest rates this year. The Fed repeated it would be "patient" in deciding when to raise benchmark borrowing costs from zero, though it also acknowledged a decline in certain inflation measures. After a two-day meeting of the Federal Open Market Committee, policymakers struck an upbeat tone on the U.S. economy's prospects and held to their view that energy-led weakness in inflation would dissipate. "The committee, in fact, was downright bullish on current economic conditions and the outlook," said Paul Edelstein, director of financial economics at IHS Global Insight. In making its announcement, the Fed largely skirted slumping economies in Europe and Asia, saying only that it would take "financial and international developments" into account when determining when to raise rates, adding a reference to global markets for the first time since January 2013. China's state corn stockpiles are expected to climb by a record volume this year, as Beijing's efforts to boost demand with a tax rebate for corn starch exports struggle to stimulate sales, industry officials said. Beijing's policy of subsidising corn prices has supported production and swollen stocks, pushing China to raise export tax rebates for corn starch and other corn-based products such as monosodium glutamate to 13 percent in a bid to make exports competitive. "It will be of little help as the industry is unable to export much and has been making losses over the past few years," said Fan Chunyan, an official at the China Starch Industry Association. China's corn consumption fell for a second year in 2013/14, also hit by buyers continuing to opt for cheaper substitutes, such as distillers' dried grains (DDGs). POLL-Raw sugar price recovery will be marginal; refined market outlook better Raw sugar prices are unlikely to make any substantial recovery this year even as growers cut production, reducing the excess that has punished prices for the past four years, according to a Reuters poll of 15 analysts and traders. Spot raw sugar futures on ICE Futures U.S will be at 17 cents a lb by the end of 2015, up about 12 percent from current levels, according to the median forecast of 15 analysts and traders polled by Reuters. That would be marginal relief for global sugar producers struggling with prices below estimated production costs. The market will shift to a supply-demand balance in the 2014/15 crop year which runs through end-September, ending four years of oversupply, before moving to a deficit of more than 3 million tonnes next season, they predicted. POLL-Coffee prices seen rising as deficit forecasts widen Coffee prices are expected to rise this year, with a global deficit in 2014/15 seen wider than previously anticipated, a Reuters poll of 13 traders and analysts showed on Wednesday. The survey produced a median forecast of a global coffee deficit of 6 million 60-kg bags in the 2014/15 marketing year, which ends in September. A previous survey in July had pointed to a global shortfall of 4 million bags in 2014/15 after a surplus of 2.5 million in 2013/14. Benchmark ICE arabica futures were seen rising further in the latest poll, after climbing 50 percent in calendar 2014. They were projected to increase to a median of $1.80 cents a lb at the end of the first quarter on March 31 and to $1.98 at the end of 2015. Nigerian farmers face eviction by foreign mega-plantation TRFN Thousands of small farmers in northeastern Nigeria are facing eviction from their ancestral lands without consultation or compensation to make way for a U.S.-owned rice plantation, according to a report released on Wednesday. A new 30,000 hectare rice plantation, owned by Oklahomabased Dominion Farms, will displace up to 40,000 people in Taraba state, said Mariann Bassey Orovwuje, a spokeswoman for the NGO Friends of the Earth Nigeria, one of the environmental and activist groups behind the report. "The people living on this land didn't even know the deal was happening," Orovwuje told the Thomson Reuters Foundation. "Compensation is not coming; the people were never asked and never told. Eventually, they will all be forced off the land." Forecasts for Brazil's coffee, sugar, grain belts turn wetter Forecasts for widespread rains over Brazil's coffee belt turned more intense in the past 24 hours, with expected precipitation shifting from below to above historical averages in key growing areas of Minas Gerais, the main coffee state, data from Reuters Weather Dashboard showed on Wednesday. Scattered showers over the country's agriculturally rich centersouth early this week will expand and intensify through midFebruary to bring substantial volumes of rain to parched grain, coffee and sugar cane areas, other forecasters said on Wednesday. The moisture comes after nearly three weeks of hot, dry weather over farms in the heart of the coffee, sugar and soy belts had raised concerns of another drought like the one that struck the region in early 2014. Showers are still hit or miss in many areas, but maps from local forecaster Somar showed rains gathering over a region including Brazil's top two coffee states, Minas Gerais and Espirito Santo. 2 INSIDE AGRICULTURE January 29, 2015 TOP NEWS (Continued) NZ'S Fonterra cuts 14/15 milk volume forecast due to dry weather POLL-U.S. cattle herd seen stabilizing The seven-year decline in the U.S. cattle herd appears to have slowed as of Jan. 1 compared to a year ago, suggesting ranchers are rebuilding herds while capitalizing on affordable feed and periodic livestock price spikes to record highs, according to analysts polled by Reuters. Currently, the cattle herd in the United States is at its lowest level since 1951 after several years of drought shriveled crops, forcing ranchers to downsize herds. Ron Plain, a livestock economist at the University of Missouri, expects the report to show the number of breeding animals and total inventory closer to year-ago levels. "I think 2015 will be the last year of declines in the herd or the first year of growth," he said. New Zealand's Fonterra dairy co-operative on Thursday cut its forecast on the amount of milk it will get from suppliers this season as dry weather in the world's largest dairy exporting country hits output. The company said it would collect 1.532 billion kilograms of milk solids in the year to May, 3.3 percent less than last season's record production, as a lack of rain had left pastures dry. Farmers have also been reining in milk production after a flood of supply from Europe and the United States pummeled prices, stoking economic fears in a country where milk products account for around one-third of all exports. "In the first half of the season, excellent pasture conditions resulted in milk volumes being higher than the previous season. The situation has changed significantly over the course of this month," Fonterra director of co-operative affairs Miles Hurrell said in a statement. TENDER WHEAT TENDER: Saudi Arabia's state grain buyer, the Grain Silos and Flour Mills Organization (GSFMO), said on Thursday it was seeking 660,000 tonnes of hard wheat in a tender. WHEAT TENDER: Jordan's state grain buyer has purchased 100,000 tonnes of optional-origin hard wheat in an international tender for the same volume which closed on Wednesday, European traders said. 3 INSIDE AGRICULTURE January 29, 2015 1-Month TECHNICAL CHARTS with 14 Days Moving Average CBOT Corn CBOT Wheat ICE Cocoa ICE Coffee CBOT Soybeans CBOT Soymeal (Inside Agriculture is compiled by Atiqul Habib in Bangalore) For more information: Learn more about our products and services for commodities professionals, click here Contact your local Thomson Reuters office, click here For questions and comments on Inside Agriculture, click here Your subscription: To find out more and register for our free commodities newsletters click here © 2015 Thomson Reuters. All rights reserved. This content is the intellectual property of Thomson Reuters and its affiliates. Any copying, distribution or redistribution of this content is expressly prohibited without the prior written consent of Thomson Reuters. Thomson Reuters shall not be liable for any errors or delays in content, or for any actions taken in reliance thereon. Thomson Reuters and its logo are registered trademarks or trademarks of the Thomson Reuters group of companies around the world. Privacy statement: To find out more about how we may collect, use and share your personal information please read our privacy statement here To unsubscribe to this newsletter, click here 4

© Copyright 2026