A U.S. Biorefinery Industry Is Emerging 27-01-2015

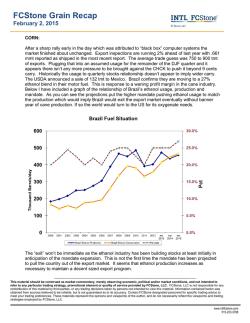

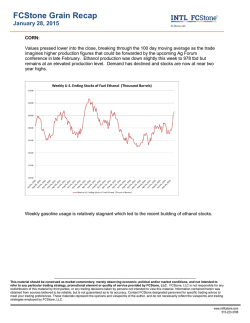

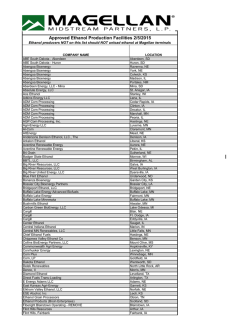

A U.S. Biorefinery Industry Is Emerging January 28, 2015 | Jim Lane In 2014, more than 85 million gallons of cellulosic ethanol capacity started up in the United States, along with commercial facilities to produce advanced biofuels and chemical intermediates. By B.A. THORP, HARRY SEAMANS and MASOOD AKHTAR Republished by courtesy of the authors and Paper360º, where the article originally appeared. For decades, Brazil and the United States were the major countries producing biofuels. In Brazil, sugarcane was the raw material and ethanol producers simply fermented the extracted sugars. The spent cane (bagasse) was fed into solid fuel boilers to produce steam and power, and the excess was sold as bedding or became waste. In the United States, corn was the raw material; the starch was converted to sugar and fermented. Dried distillers grain was a by-product and was sold as animal feed. The cornhusks and stover were usually left in the fields to maintain soil fertility and structure. Most U.S. corn ethanol producers used natural gas to supply process heat. Sugarcane and corn for both processesis renewable. More important, the feedstock continues to be replanted and harvested—a key ingredient to sustainability. However, both processes have been criticized for using land or product that displaced food-growing capacity (the food versus fuel issue).1 In addition, corn ethanol has been criticized for inefficiency and for not being sustainable. The industry is improving land use by increasing yield, gaining 30 to 50 percent yield through using spent crops. Energy required per gallon has decreased from 37,000 BTU per gallon in 1994 to 23,862 BTU per gallon in 2012. Similar gains have been made in reducing water consumption. As industries mature, they typically become more efficient. In the United States, corn ethanol may not have been the best gasoline replacement, but it has brought significant benefits. In particular, it became a profitable, commercial business segment with steady employment that provided financial benefit to farmers, helped lower the price of gasoline by about a dollar per gallon, deferred the importation of about 450 million barrels of oil in 2013, and helped the U.S. balance of trade by about $45 billion annually. ADVANCED BIOFUELS The Energy Independence and Security Act (EISA), enacted in 2007, included a renewable fuel standard. Since there was already an established corn ethanol industry, the focus was on “advanced fuels,” and a target was set to produce 36 billion gallons of renewable fuel per year in the United States by 2022. EISA authorized EPA to set up a method for monitoring and enforcing compliance. In 2009, EPA established Renewable Fuel Standard 2 (RFS2) and enacted mandates. To encourage the use of more diverse feedstocks, corn ethanol could only be counted to a maximum of 15 billion annual gallons of the 36 billion annual gallons. The remaining 21 billion annual gallons would be vegetable-oil based diesel and cellulosic biofuels.3 Based on EISA and other congressional directives, the U.S. Department of Energy (DOE) and the U.S. Department of Agriculture (USDA) developed strategies to support development of technologies and demonstration plants with initial focus on cellulosic ethanol and later a focus of additional “advanced biofuels.” DOE and USDA’s support included research, whitepapers, models, databases, competitively bid grants and competitively selected loan guarantees. Many thought that the milestone goals and the 36 billion annual gallon goals could be met.4 Renewable Identification Numbers were established under RFS2 to validate production and facilitate the issuance of tax credits. Four things happened: 1. Commercialization proved difficult and fell behind targeted schedules. Some projects failed to gain financing and a couple failed to perform. 2. Federal support lacked required time consistency which created uncertainty for investors. 3. RFS2 mandates are issued late and are at a huge discount to EISA targets. Lawsuits have further reduced the certainty of mandates. RFS2 has become problematic.5 4. Dissonance arising from the preceding points overshadowed belated, but promising, results. ADVANCED FUEL PROGRESSES Despite these issues, real progress was being made in the United States on the “advanced fuel” part of EISA’s goals and on a portion of the RFS2 mandates. DOE and USDA used key learning and tightened their control to improve project execution. For example, they often required a complete pilot line with all critical recirculation lines (integrated biorefinery pilot), and further required 1,000 continuous hours of operation. The leadership of projects not receiving funding also incorporated key learnings. The Bioenergy Deployment Consortium (BDC) gathered key information from the public DOE peer reviews held every two years and communicated them to all members. Lending institutions incorporated new requirements into their criteria. Project execution slowed but improved. Meanwhile, progress continued in other countries, some of which had more stable policies, and projects and vendors brought their developments and insights to the United States. Real and significant progress is now emerging. In 2014, facilities in the United States provided 85 million gallons of cellulosic ethanol capacity. The year also saw the start of commercial production of “advanced” biofuels and chemical intermediates. Finally, there is an important recognition that bioindustry needs to have facilities that focus on high-value-added bioproducts such as chemical intermediates and specialty chemicals to be economically viable. CURRENT CELLULOSIC ETHANOL CAPACITY The 85 million gallon annual cellulosic ethanol capacity is dominated by the agriculture community, which is making significant commercial progress through working with farmers, agronomists and harvesting equipment suppliers to achieve low-cost, sustainable feedstocks. A variety of technical approaches have been developed, and more are emerging to improve the economics of operations: POET-DSM Advanced Biofuels, which held a grand opening in September 2014 in Emmetsburg, Iowa, will produce 20 million annual gallons (growing to 25 million) of cellulosic ethanol from corn stover. The plant is located adjacent to a POET 55 million annual gallon corn ethanol plant. The stover feedstock is gathered after corn harvest. Seventy-five percent of the corn crop residue is left in the field, which studies have shown is sufficient to maintain soil fertility. The smaller size for the cellulosic ethanol plant was selected in part to be able to gather biomass from a nominal 45-mile radius. The process for the corn stover after harvest involves pretreatment, enzymatic hydrolysis to sugars, fermentation to ethanol and, finally, distillation. The effluent stream from the cellulosic plant is sent to an anaerobic digester to produce biogas that is used in both plants. The solid stream of lignin is burned in a solid fuel boiler to produce steam for both plants. In Hugoton, Kansas, Abengoa will produce 25 million annual gallons of cellulosic ethanol and 18 megawatts (MW) of power from wheat straw and agricultural waste. The process is similar to that of POET-DSM. Residuals are sent to a solid fuel boiler to produce process heat and power. At the time of writing, DuPont was slated to start up a 29 million annual gallon cellulosic ethanol plant from corn stover in Nevada, Iowa, in late 2014. The process will be similar to the two described above. INEOS Bio, based in Vero Beach, Fla., has eliminated forest waste as a feedstock and is supplementing citrus waste with sorted municipal solid waste (SMSW); they will continue to make 8 million annual gallons of cellulosic ethanol and generate 6 MW of power. The process includes pretreatment, gasification, syngas cleanup, anaerobic fermentation to ethanol and distillation. Steam recovered from the gasification/cleanup stage is passed through a turbine to generate power, and the extracted steam from the turbine is used for process heat. Quad County Corn Processors is producing 2 million gallons of cellulosic ethanol per year using corn kernel cellulose (a corn fiber waste product) as feedstock. The corn kernel cellulose is a byproduct of the firm’s 35 million gallon per year corn ethanol plant. Quad County invented and patented Cellerate technology and recently granted Syngenta an exclusive license to market the process to other ethanol plants in the United States and Canada. Cellerate technology has the ability to generate 1 billion gallons of additional ethanol by adding the bolt-on technology to the existing dry grind ethanol plants without using any more corn. In Alpena, Mich., American Process, Inc. (API) is producing about 1 million annual gallons of cellulosic ethanol per year from the hemicellulose in the effluent obtained from an adjacent hardboard mill. The mill washes its fiber to remove some hemicellulose to prevent the hardboard sticking to the plates during hot pressing. Previously, these hemicellulose materials wound up in the mill’s effluent stream. BDC maintains metrics on these and other plants and can estimate capital cost, operating cost, time to construct, federal and state incentives and details about technology and commercial potential. There are a number of organizations that track and report developments. However, BDC may be the only one that validates and develops metrics for projects across all industries. BDC has created a critical success model that can be used to judge commercial potential.6 These and other metrics are available to all BDC members. UNIQUE CAPACITY Documented progress is also occurring outside the United States as well as in emerging facilities within the U.S.: Beta Renewables established a 12 million annual gallon cellulosic ethanol facility in Italy, licensed a second plant in Brazil (Gran Bio) and is licensing its third and fourth plants in North Carolina and the Slovak Republic. GranBio in Brazil is producing 21.6 million annual gallons of cellulosic ethanol from bagasse using the Beta Renewables technology. Enerkem, in Alberta, Canada, is producing 10 million annual gallons of bio-methanol from SMSW. Fiberight, in Iowa, is restarting 6 million annual gallons of cellulosic ethanol from SMSW and paper mill sludge. Dong Energy in Denmark has a demonstration plant with a capacity of 0.8 tons of cellulosic ethanol and 1.5 tons of bio-pellets per hour. If the plant were to run full time this would amount to 1.8 million gallons of cellulosic ethanol and 13,000 tonnes of biopellets per year. Husky Energy in Alberta, Canada, is very interesting because it captures and sells or uses 250 tons of CO2 from its corn ethanol fermenters. CHEMICAL INTERMEDIATE OR SPECIALIST CHEMICAL CAPACITY Comparative BDC metrics indicate that due to a relatively low selling price, extremely low-cost feedstock and a capital expenditure (CapEx) of about $7 per annual gallon are needed to make commercially viable transportation fuels in the United States.7 Others studying or struggling with project economics have come to a similar position.8 Some will achieve these metrics or will find business synergies that make transportation fuel biorefineries economical. However, these facilities will not utilize all of the existing sources of low cost biomass. A group of companies has focused on producing higher value chemicals or chemical intermediates for the chemical and food industries, in order to achieve feedstock flexibility and an acceptable return on investment. The list below provides a few examples that are in production or are close to startup: • Amyris is making 2 million annual gallons of farnesene in Brazil. • BioAmber is making 17,000 annual tons of succinic acid in France and has announced a 30,000 ton per year plant in Sarnia, Ontario, Canada. Myriant is making 30 million pounds of succinic acid in Lake Providence, La. • Solazyme currently has three renewable oil and bioproducts facilities in operation, including a large-scale commercial demonstration foods facility in Peoria, Ill., a 20,000 metric tpy facility in Clinton, Iowa, and a 100,000 metric tpy facility in Brazil. • Go has converted one-third of the capacity of a corn ethanol plant in Minnesota to make isobutanol and will convert the remainder later. • Green Biologics will conduct a demonstration scale conversion of corn into n-butanol in a plant in Iowa, then quickly follow that by converting a corn ethanol plant in Minnesota to a commercial scale plant producing n-butanol. • Segetis has a pilot plant in Minnesota making levulinic acid and has converted this into a plasticizer; the firm has a comprehensive economic development package to construct a 21.1 million pound per year facility in Hoyt Lakes, Minn. • Virent received an additional investment from Coca-Cola to expand its pilot plant to a demonstration scale facility to produce paraxylene from purchased sugars. Plant based para-xylene is expected to pave the way for 100 percent bio PET bottles. PROMISING APPROACHES FOR WOODY BIOMASS Progress has been slower and more difficult for developers who selected wood as the feedstock. The high lignin content and the tightly bound structure of wood, as well as the higher cost of feedstock, present greater techno-economic challenges than do crops, spent crops or SMSW, which can be an exceedingly low cost feedstock under many circumstances.9 While there has been significant pain with the closure of Choren in Germany, along with Range Fuels and KiOR, there has also been significant learning. Most of those who chose to use woody biomass as a feedstock have abandoned the hydrolysis approach. Low-cost thermal or thermochemical approaches have been developed. Several projects that are moving forward have been able to keep CapEx under $7 per annual gallon. Those moving forward with higher CapEx have moved to very-low-cost feedstock. There are currently several promising approaches demonstrated at the laboratory or pilot scale: Cool Planet is constructing a $56 million facility in Louisiana that will use unique pyrolysis techniques to produce 5 million annual gallons of high-octane gasoline and a bio-char that enhances plant growth. Licella (Ignite Energy Resources) has won a grant to build a commercial-scale module with a capacity of 2 million annual gallons in Australia. The module will use a catalytic hydrothermal upgrading approach to liquefy wet wood into bio-crude, which can be coblended with fossil crude for petroleum refinery feedstock to produce drop-in fuels. This high-temperature and high-pressure facility will have dual feedstock capability (lignite and woody biomass). This dual feedstock facility has a higher CapEx, but facilities with one feedstock can have CapEx of under $7 per annual gallon. Proton Power has a pilot/demonstration facility that can transform available switchgrass directly into a blendable biodiesel. The unique thermal process avoids Fischer- Tropsch gas-to-liquid conversion. Funding of $35 million has been obtained to build a 5 million annual gallon facility adjacent to the pilot/demonstration plant. Borregaard developed the BALI process to economically produce commercial grade lignin and cellulosic ethanol. The firm built a demonstration plant to prove that this lignin would satisfy growing customer demand. As a “by-product” of the current operation, the firm produces 5.3 million annual gallons of cellulosic ethanol. It is estimated that a possible first-of-its-kind BALI plant in the United States will produce about 27 million annual gallons of cellulosic ethanol. Clearly, the high lignin content and dense growth of woody biomass have presented a greater challenge than anticipated, but unique approaches to overcome these challenges have emerged. Announcements for other emerging technologies and commercial facilities are expected in the near term. CONCLUSIONS It is clear that despite regulatory uncertainty, a biorefinery industry for “advanced biofuels and bioproducts” is emerging in the United States. However, it is difficult to track its progress because of its newness, the confidentiality inherent in any new technology, confusing bioenergy/biorefinery announcements and the lack of organizations that can perform objective analyses across all technologies and industries. Eighty-five million annual gallons of cellulosic ethanol and a similar amount of chemical intermediates can be easily dismissed as unique or trivial when the 2022 EISA goal is 21 billion annual gallons of “advanced” renewable biofuels. However, the techno-economic development that produced the current quantities cannot be dismissed. Biorefineries have begun to arrive. Social, political and economic trends will only add to the driving forces. It is clear that those who are interested in or who will be impacted by biorefineries need to be allocating more resources to assembling an objective analysis of opportunities, to learn what they can about the bio-industry progress and pending announcements. To paraphrase what Edward Deming said at his conferences on statistical process control: “It is not necessary to do any of this; failure to remain competitive is always an option.” Ben Thorp, Harry Seamans and Masood Akhtar are cofounders of the Bioenergy Deployment Consortium (BDC), which has its website here. REFERENCES 1. For more information, please consult Michael Carus and Laura Dammer, “Food or Non-food: Which Agriculture Feedstocks are Best for Industrial Uses?” Nova Paper 2, July 2013. 2. Renewable Fuels Association, 2014 Ethanol Industry Outlook. 3. Sugarcane-based ethanol was to be counted as an “advanced fuel,” but is not generally available in the United States. 4. At a 2008 Platt’s Energy Conference, BDC members said that unless changes were made quickly, those goals would not be achieved. Changes needed were included in a 2009 article authored by B.A. (Ben) Thorp, Butch Johnson and Masood Akhtar: “An Open Letter to President Obama on Biofuels,” Renewable Energy World, April 27, 2009. 5. As one peer reviewer noted, “One of the original interns of RFS2 was to lay the foundation for private investments in the U.S. biofuels Industry. Proposed 2014 reductions from EISA goals will likely impede future cellulosic biofuel investments. Some may go overseas.” 6. B.A. (Ben) Thorp, Harry Seamans and Masood Akhtar, “Bioenergy Critical Success Factors,” Biofuels Digest 17, November 2011. 7. This conclusion comes from a three-year analysis of metrics collected by BDC. It starts with the CapEx of corn ethanol plants being in the $2 to $3 per annual gallon range. At the other end, there are several projects with a CapEx of over $15 per annual gallon that have failed or failed to finance. The majority of the facilities moving forward in the United States fall within single-digit CapEx metrics or exceedingly low-cost feedstocks. BDC has concluded that one success criteria is a CapEx of about $7 per annual gallon for feedstocks with typical costs. 8. One operating facility recently switched from wood biomass waste to SMSW. Another technology developer with a higher CapEx found ways to lower it and also switched to a lower cost feedstock. They subsequently won federal awards. Finally, there are three projects with a CapEx in the $7 range that are being commercialized. 9. This focuses on conversion of wood. Excluded are important and effective uses of extractives such as tall oil. In Europe, incentives are driving Stora and UPM to convert extractives to transportation fuels. In the United States and many parts of the EU, Arizona Chemical, Georgia Pacific, Forchem, Kamara, DRT and MWV are converting tall oil to value added biochemicals.

© Copyright 2026