Torrent Pharmaceuticals (TORPHA) | 1100

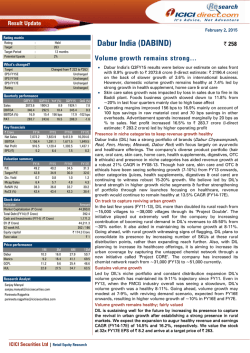

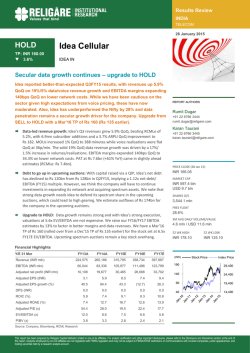

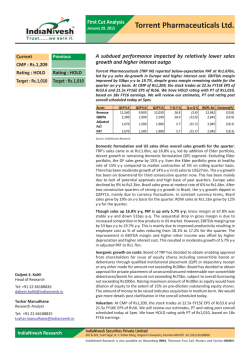

Result Update February 2, 2015 Rating matrix Rating Target Target Period Potential Upside : : : : Torrent Pharmaceuticals (TORPHA) Hold | 1165 12 months 6% Muted quarter but outlook unchanged… What’s Changed? Target EPS FY15E EPS FY16E EPS FY17E Rating Changed from | 1036 to | 1165 Changed from | 47.8 to | 47.2 Changed from | 49.9 to | 50.4 Changed from | 63.1 to | 64.7 Unchanged Quarterly Performance Revenue EBITDA EBITDA (%) Net Profit Q3FY15 1,168.0 240.0 20.5 167.0 Q3FY14 1,015.0 215.0 21.2 158.0 YoY (%) 15.1 11.6 -63 bps 5.7 Q2FY15 QoQ (%) 1,217.0 -4.0 273.0 -12.1 22.4 -188 bps 198.0 -15.7 FY14 4184.0 952.0 663.9 39.2 FY15E 4710.7 1136.7 798.7 47.2 FY16E 5573.0 1393.1 852.2 50.4 FY17E 6502.5 1666.1 1095.8 64.7 FY14 28.0 29.7 13.4 6.6 34.9 28.5 FY15E 23.3 24.7 12.3 5.1 32.4 21.4 FY16E 21.8 23.1 9.8 4.1 28.0 26.7 FY17E 17.0 18.0 7.8 3.3 28.6 30.5 Key Financials (|crore) Revenues EBITDA Net Profit EPS (|) Valuation summary PE (x) Target PE (x) EV to EBITDA (x) Price to book (x) RoNW (%) RoCE (%) Stock data Particular Market Capitalisation Debt (FY14) Cash (FY14) EV 52 week H/L Equity capital Face value Amount | 18614 crore | 1132 crore | 769 crore | 18977 crore 785/385 | 84.6 crore |5 Price performance (%) Torrent Pharma Aurobindo Pharma Biocon Ipca Labs 1M 3.1 10.2 -1.5 -13.9 3M 31.3 27.5 -7.8 -13.0 | 1100 6M 57.9 80.2 -12.0 -9.2 1Y 116.7 178.4 -4.2 -21.7 Research Analyst Siddhant Khandekar [email protected] Mitesh Shah [email protected] Nandan Kamat [email protected] ICICI Securities Ltd | Retail Equity Research • Revenues grew 15% YoY to | 1168 crore, below I-direct estimate of | 1217 crore on account of lower-than expected export sales • EBITDA margins declined 63 bps to 20.6% against I-direct estimate of 24% and the delta was on account of forex losses in Europe and Brazil. EBITDA in absolute terms grew 11.6% to | 240 crore against Idirect estimate of | 292.1 crore • Net profit witnessed a YoY increase of 5.7% to | 167 crore, below Idirect estimate of | 188.4 crore mainly on account of a lower-thanexpected operational performance Chronic focus, diversified portfolio, nimble-footed approach Torrent has remained ahead of the curve when it comes strategic decision making. In domestic formulations, it concentrated on high yielding chronic therapies like cardiovascular and neuropathy when most Indian players were growing in anti-infectives (acute). It was one of the early entrants in the Brazilian markets. It acquired a marketing company in Germany in 2005. It also struck a CRAMS deal with Novo-Nordisk in the Indian market for Insulin. Just when it was witnessing a slowdown in domestic formulations, it acquired Elder’s lucrative formulations business. US launches such as gCymbalta and gMicardis have strengthened the US business and overall financial health. Strong margins and high return ratios are some of the major differentiators for Torrent. Exports business remains in sweet spot The exports business (~55% of the total turnover) is witnessing strong traction especially from the US. Brazil has started showing signs of a recovery with a recalibrated approach. Other export markets such as Europe and RoW are growing at a steady pace. In the US, the company owns a healthy product pipeline (72 filed ANDAs, 53 approvals and 39 launches). We expect US sales to grow at a CAGR of 12.8% in FY14-17E to | 1113 crore on a higher base. Similarly, RoW and European sales are likely to grow at a CAGR of 10% and 7.1% to | 505.3 crore and | 1141.8 crore, respectively, during FY14-17E. Indian formulations growth steady Despite having higher proportion of chronic therapies, the company remained an underachiever in the branded formulations space, growing at a CAGR of 13% in FY09-14. The acquisition of Elder Pharma’s branded portfolio is likely to add new therapies such as neutraceuticals and gynaecology and fill up the portfolio gaps. Elder’s portfolio is also margin accretive. We expect Indian branded formulations to grow at a CAGR of 28% in FY14-17E to | 2455.1 crore. US, Brazil, India key catalysts for future; maintain HOLD The US, Brazil and domestic formulations remain the troika for future growth based on new product launches and improvement in market share. The US remains in good shape despite the exclusivity sunset of gCymbalta as the pipeline remains promising. The management also remains optimistic on Elder’s portfolio, which is likely to improve the margins scenario considerably. Brazilian growth is crawling back to normal with a recalibrated approach. Other segments such as RoW and Europe, however, remain draggers in an otherwise high growth engine. We have increased multiple to 18x from 16x on the back of improved visibility. Accordingly, our new target price stands at | 1165 based on 18x FY17E EPS of | 64.7. Variance analysis Q3FY15 Q3FY15E 1,168.0 1,217.0 Revenue Q3FY14 1,015.0 Q2FY15 1,217.0 YoY (%) 15.1 QoQ (%) -4.0 Raw Material Expenses Employee Expenses Other Expenditure EBITDA EBITDA (%) Interest 372.0 199.0 357.0 240.0 20.5 50.0 365.1 213.0 346.9 292.1 24.0 54.0 318.0 179.0 303.0 215.0 21.2 16.0 381.0 224.0 339.0 273.0 22.4 54.0 Depreciation Other Income PBT before EO & Forex EO PBT Tax PAT before MI MI Net Profit 54.0 65.0 201.0 0.0 201.0 34.0 167.0 0.0 167.0 55.0 59.7 242.7 0.0 242.7 53.4 189.3 0.9 188.4 21.0 10.0 188.0 0.0 188.0 30.0 158.0 0.0 158.0 56.0 72.0 235.0 0.0 235.0 37.0 198.0 0.0 198.0 157.1 550.0 6.9 0.0 6.9 13.3 5.7 0.0 5.7 -3.6 -9.7 -14.5 0.0 -14.5 -8.1 -15.7 0.0 -15.7 Key Metrics India 421.0 445.0 300.0 444.0 40.3 -5.2 80.0 155.8 171.7 106.4 225.7 77.0 161.7 170.2 90.3 260.4 70.0 147.0 148.0 95.0 248.0 96.0 160.0 167.0 97.0 247.0 14.3 6.0 16.0 12.0 -9.0 -16.7 -2.6 2.8 9.7 -8.6 Contract manufacturing Brazil USA ROW Europe (incl Germany) 17.0 -2.4 11.2 -11.2 17.8 5.3 11.6 -12.1 -63 bps -188 bps 212.5 -7.4 Comments The revenue growth was mainly driven by Domestic formulation sales growth (42%) and US growth (16%). Dent in margin was mainly on the back of forex losses. YoY spurt in interest on the back of assuming of debt of | 1400 crore for Elder Pharma acquisition. Higher other income was largely due to forex gains Muted growth on the back of lower operational performance which was partially offset by lower tax outgo. Growth was on the back of acquisition of Elder's porfolio. Excluding this the base business growth was 15%. Costant currency YoY growrth was 19%. In constant currency the growth was flat Source: Company, ICICIdirect.com Research Change in estimates (| Crore) Revenue EBITDA EBITDA Margin (%) PAT EPS (|) Old 4,846.4 1,221.7 25.2 FY15E New % Change 4,710.7 -2.8 1,136.7 -7.0 24.1 -108 bps 808.7 47.8 798.7 47.2 -1.2 -1.3 Old 5,675.0 1,390.4 24.5 845.1 49.9 FY16E New % Change 5,573.0 -1.8 1,393.1 0.2 25.0 50 bps 852.2 50.4 Comments Currency fluctuation impacted the company's FY15 operational performance Margin would be impacted in FY15 mainly due to adverse currency movement 0.8 0.8 Source: Company, ICICIdirect.com Research Assumptions (| crore) India Formulations Contract manufacturing Brazil USA RoW Europe (incl Germany) FY13 1,034.5 230.5 512.8 FY14 1,176.0 279.0 533.0 355.3 295.3 650.9 776.0 380.0 930.0 Current FY15E FY16E 1,643.5 2,054.4 276.8 349.9 624.8 718.5 787.7 397.6 943.6 890.5 459.4 1,038.0 Earlier FY15E FY16E 1,641.7 2,052.2 273.8 346.7 611.5 672.7 871.4 390.9 1,015.9 995.1 430.0 1,117.5 Comments We have increased brazil sales on the back of likely improvement in product launches and expects strong growth from Institutional and generic generic business We have altered US sales on account of likely delays in product approvals. Adverse currency movement is likely to impact the company's FY15 growth Source: Company, ICICIdirect.com Research ICICI Securities Ltd | Retail Equity Research Page 2 Company Analysis Incorporated in 1959, the company is a mid-size generic player with a strong presence in the domestic and semi-regulated markets and a growing presence in regulated markets. It is also present in the Indian CRAMS space via supply agreement with Danish pharma major Novo Nordisk for the latter’s insulin business in India. Chronic therapies such as cardiovascular, neurology and diabetology are the main focus areas for the company along with acute therapies such as anti-infectives and gastrointestinal. The company has a significant presence in the exports market in countries such Brazil, Germany and lately in the US among others. Chronic focus, financial discipline, successful M&A/deal making track record, higher return rations and higher dividend payouts are some of the USPs of Torrent Pharma. We expect sales to grow at a CAGR of 15.8% in FY14-17E to | 6502.5 crore driven by India and the US. Exhibit 1: Revenues to grow at CAGR of 15.8% in FY14-17E 7,000 6,503 5,573 6,000 (| crore) 5,000 4,184 4,000 3,000 2,000 1,631 1,916 2,226 4,711 3,211 2,696 1,000 0 FY09 FY10 FY11 FY12 FY13 Revenues FY14 FY15E FY16E FY17E Source: Company, ICICIdirect.com Research Indian Branded Formulations (34% of overall sales) - Indian branded formulations have grown at a CAGR of 13.4% in FY09-14. The chronic: acute ratio is 50:50 post the Elder acquisition. As per AIOCD (MAT December 2014), the company is ranked 15th in the IPM with a market share of 2.24%. It ranks fourth in both cardiovascular and neurology therapies in the IPM as per AIOCD. We expect domestic branded formulations to grow at a CAGR of 28% in FY14-17E to | 2455 crore. Exhibit 2: Indian branded formulations growth trend 3,000 2,455 2,500 2,054 (| crore) 2,000 1,644 1,500 1,000 628 729 842 917 FY11 FY12 1,034 1,176 500 0 FY09 FY10 FY13 FY14 FY15E FY16E FY17E India Source: Company, ICICIdirect.com Research US (18% of overall sales) - Torrent was a relatively late entrant in the US. However, during this short period the company has achieved significant ICICI Securities Ltd | Retail Equity Research Page 3 critical mass, thanks to some niche launches like gCymbalta. Cumulatively, the company has filed 72 ANDAs and received approvals for 53 products. So far, it has launched 39 products in the US. Exhibit 3: US growth piggybacking on product launches 1,200 1,113 1,000 890 (| crore) 800 776 788 FY14 FY15E 600 355 400 218 200 28 91 109 FY10 FY11 0 FY09 FY12 FY13 FY16E FY17E USA Source: Company, ICICIdirect.com Research ROW markets - (8% of overall sales) - These markets mainly cover the Middle East, Africa and South East Asian regions. The RoW markets have grown at a CAGR of 35% in FY10-14. Going ahead, we expect this segment to grow at 10% CAGR driven by new product registration. Exhibit 4: RoW markets to maintain steady growth rate 600 505 459 500 (| crore) 400 398 FY14 FY15E 295 300 200 100 380 89 114 128 FY10 FY11 152 0 FY09 FY12 FY13 FY16E FY17E RoW markets Source: Company, ICICIdirect.com Research Europe (21% of overall sales) - European sales are driven by partnership deals (excluding Germany). In Germany, the company operates through marketing company Heumann Pharma. The German business is tender based. Europe has grown at a CAGR of 26% in FY10-14. Going ahead, we expect European sales to grow at a CAGR of 7.1% in FY14-17E driven by new tenders and dossier income. ICICI Securities Ltd | Retail Equity Research Page 4 Exhibit 5: Heumann sales, dossier income to drive European growth 1,200 1,000 (| crore) 800 930 944 FY14 FY15E 651 518 600 400 1,142 1,038 358 371 FY09 FY10 423 200 0 FY11 FY12 FY13 FY16E FY17E Europe (inc. Germany) Source: Company, ICICIdirect.com Research Exhibit 6: EBITDA to grow at CAGR of 20.5% in FY14-17E 1,800 1,666 24.1 1,400 (| crore) 1,200 22.0 21.6 1,000 600 400 15.9 421 22.8 1,137 25.6 26 24 22 952 20 18.6 692 18.4 800 1,39325.0 18 501 409 (%) 1,600 28 16 14 259 200 12 0 10 FY09 FY10 FY11 FY12 EBITDA FY13 FY14 FY15E FY16E FY17E EBITDA Margins (%) Source: Company, ICICIdirect.com Research Exhibit 7: Net profit to grow at CAGR of 18.2% in FY14-17E 1,000 15.9 799 (| crore) 800 664 600 184 231 12.1 16 15.3 15 14 13 270 12.1 284 12 11.3 11 10.5 0 FY09 FY10 FY11 FY12 Net Profit 10 FY13 FY14 FY15E FY16E FY17E Net Profit Margins (%) Source: Company, ICICIdirect.com Research ICICI Securities Ltd | Retail Equity Research 18 16.9 17 852 433 13.5 400 200 1,096 17.0 Page 5 (%) 1,200 Exhibit 8: Acquisition of Elder brands to bring down return ratios 40 35 34.9 32.4 (%) 30 28.3 25 20 30.4 28.8 27.8 26.2 28.5 26.4 26.7 23.8 21.7 19.1 30.5 28.6 28.0 21.4 23.6 15 FY09 FY10 FY11 FY12 FY13 RoNW (%) FY14 FY15E FY16E FY17E ROCE (%) Source: Company, ICICIdirect.com Research Exhibit 9: Trends in quarterly financials | Crore Net sales OOI Revenues Total RM cost RM cost % Revenues Gross Profit GPM (%) Employee cost % sales Other expenditure % of sales Total Expenditure % of Revenues EBITDA EBITDA Margins (%) Depreciation Interest cost Other Income PBT before forex & EO Forex & EO PBT Tax Tax rate (%) PAT PAT (%) MI PAT after MI EPS (|) Q3FY12 675.5 21.1 696.6 222.3 31.9 474.3 68.1 119.9 17.2 232.9 33.4 575.1 82.6 121.5 17.4 19.7 0.2 2.3 104.0 0.0 104.0 20.1 19.3 83.9 12.0 0.7 83.2 4.9 Q4FY12 654.0 20.3 674.3 222.8 33.0 451.5 67.0 144.2 21.4 222.2 33.0 589.3 87.4 85.0 12.6 21.8 8.9 -52.9 1.4 0.0 1.4 2.4 169.3 -1.0 -0.1 0.7 -1.7 -0.1 Q1FY13 735.6 31.3 766.9 220.0 28.7 547.0 71.3 153.1 20.0 237.9 31.0 611.0 79.7 156.0 20.3 20.1 9.4 14.0 140.4 0.0 140.4 37.4 26.6 103.0 13.4 1.2 101.9 6.0 Q2FY13 747.0 30.0 777.0 217.0 27.9 560.0 72.1 155.0 19.9 251.0 32.3 623.0 80.2 154.0 19.8 20.0 7.0 12.0 139.0 0.0 139.0 31.0 22.3 108.0 13.9 1.0 107.0 6.3 Q3FY13 768.0 29.0 797.0 246.0 30.9 551.0 69.1 152.0 19.1 237.0 29.7 635.0 79.7 162.0 20.3 21.0 7.0 9.0 143.0 0.0 143.0 31.0 21.7 112.0 14.1 0.0 112.0 6.6 Q4FY13 803.0 68.0 871.0 243.0 27.9 628.0 72.1 164.0 18.8 244.0 28.0 651.0 74.7 220.0 25.3 22.0 10.0 8.0 196.0 -37.0 159.0 48.0 30.2 111.0 12.7 0.0 111.0 6.6 Q1FY14 903.0 69.0 972.0 304.0 31.3 668.0 68.7 172.0 17.7 288.0 29.6 764.0 78.6 208.0 21.4 21.0 8.0 8.0 187.0 0.0 187.0 38.0 20.3 149.0 15.3 0.0 149.0 8.8 Q2FY14 936.0 36.0 972.0 301.0 31.0 671.0 69.0 182.0 18.7 310.0 31.9 793.0 81.6 179.0 18.4 22.0 15.0 10.0 152.0 0.0 152.0 39.0 25.7 113.0 11.6 0.0 113.0 6.7 Q3FY14 990.0 25.0 1015.0 318.0 31.3 697.0 68.7 179.0 17.6 303.0 29.9 800.0 78.8 215.0 21.2 21.0 16.0 10.0 188.0 0.0 188.0 30.0 16.0 158.0 15.6 0.0 158.0 9.3 Q4FY14 1207.0 18.0 1225.0 320.0 26.1 905.0 73.9 208.0 17.0 347.0 28.3 875.0 71.4 350.0 28.6 23.0 20.0 10.0 317.0 0.0 317.0 73.0 23.0 244.0 19.9 0.0 244.0 14.4 Q1FY15 1092.0 22.0 1114.0 301.0 27.0 813.0 73.0 184.0 16.5 284.0 25.5 769.0 69.0 345.0 31.0 21.0 24.0 49.0 349.0 0.0 349.0 93.0 26.6 256.0 23.0 0.0 256.0 15.1 Q2FY15 1203.0 14.0 1217.0 381.0 31.3 836.0 68.7 224.0 18.4 339.0 27.9 944.0 77.6 273.0 22.4 56.0 54.0 72.0 235.0 0.0 235.0 37.0 15.7 198.0 16.3 0.0 198.0 11.7 Q3FY15 1156.0 12.0 1168.0 372.0 31.8 796.0 68.2 199.0 17.0 357.0 30.6 928.0 79.5 240.0 20.5 54.0 50.0 65.0 201.0 0.0 201.0 34.0 16.9 167.0 14.3 0.0 167.0 9.9 YoY (%) QoQ (%) 16.8 -3.9 -52.0 -14.3 15.1 -4.0 17.0 -2.4 14.2 -52 bps 11.2 -4.8 -54 bps -11.2 17.8 5.3 16.0 -1.7 11.6 -12.1 -63 bps -188 bps 157.1 -3.6 212.5 -7.4 550.0 -9.7 6.9 -14.5 6.9 13.3 -14.5 -8.1 5.7 -15.7 5.7 -15.7 Source: Company, ICICIdirect.com Research SWOT Analysis Strengths - Chronic focus, high operating margins, high return ratios, strong emerging US pipeline and one of the highest dividend payout ratios. Weakness - Brazilian market remains dicey due to frequent changes in regulations and pricing. Relatively late US entrant. Opportunities - The US Generics space. Threats - Increased USFDA scrutiny across the globe regarding cGMP issues and consolidation in the US pharmacy space. ICICI Securities Ltd | Retail Equity Research Page 6 Conference call highlights • • • • • • • • • • • ICICI Securities Ltd | Retail Equity Research The company received board approval to raise | 10000 crore for future acquisition. MR productivity – Torrent has | 4.3 lakh per person productivity while Elder has | 3 lakh. The company’s endeavour is to improve its combined per MR productivity to more than | 5 lakh by April 2015 The company has reduced domestic divisions to 15 from16 (14 divisions of Torrent and two divisions of Elder) to achieve synergy benefit In YTDFY15, the company has won highest tenders in Germany among all companies. Currently, the company is selling 130 molecules in this market. In Brazil, the company has 13 products in the pipeline for branded segment and eight products for Generic Generic segment In Q3FY15, the company filled one ANDA and got approval for three ANDAs. Till date, the company owns 53 ANDA approvals (including nine tentative approvals) and is awaiting approvals for 19 products. It expects to launch ~10 products in FY16 Capex of | 200-250 crore expected annually for next two to three years It expects its Dahej SEZ facility to be operational in FY16, which would mainly cater to developed market formulation sales The company enjoys 10% and 12% market shares in Telmisartan HCT and Telmisartan in the US, which it expects to improve to1520% for both the products. The company expects to get gNexium and gDetrol XR approvals by middle of 2015. For gAbilify, the company expects to get the approval after April 20, 2015 post exclusivity expiry. The company is facing litigation. Hence, it may launch this product at risk Page 7 Valuation The Brazilian market demonstrated meaningful traction, thanks to the recalibrated approach of adding institutional and generic generics in the branded portfolio. The management also sounded quite bullish on Elder’s portfolio, which is likely to improve the margins scenario considerably. The US remains in good shape despite the exclusivity sunset of gCymbalta as the pipeline remains healthy. Other segments such as RoW and Europe are the only draggers in an otherwise high growth engine. We have increased our multiple to 18x from 16x on the back of strong future outlook and improvement in margin on synergy benefit. Accordingly, we have enhanced our target price to | 1165 on 18x FY17E EPS of | 64.7. However, we maintain HOLD on the stock owing to sharp run up recently. Exhibit 10: One year forward PE 800 | 600 400 200 Price 15.5x 8.0x 13.6x 11.7x Sep-14 Mar-14 Sep-13 Mar-13 Sep-12 Mar-12 Sep-11 Mar-11 Sep-10 Mar-10 Sep-09 Mar-09 Sep-08 Mar-08 Sep-07 Mar-07 Sep-06 Mar-06 0 9.9x [ Source: Company, ICICIdirect.com Research Exhibit 11: One year forward PE of company vs. BSE Healthcare Index 35 30 25 (x) 20 15 10 5 0 Mar-06 Dec-06 Sep-07 Jun-08 Mar-09 Dec-09 Sep-10 Jun-11 Mar-12 Dec-12 Sep-13 Jun-14 Torrent Pharma Healthcare Index Source: Company, ICICIdirect.com Research Exhibit 12: Valuation FY14 FY15E FY16E FY17E Revenues (| crore) 4184 4711 5573 6503 Growth (%) 30 13 18 17 Adj. EPS (|) 39.2 47.2 50.4 64.7 Growth (%) 53 20 7 29 P/E EV/EBITDA (x) (X) 19.0 13.4 15.8 12.3 14.8 9.8 11.5 7.8 RoNW (%) 34.9 32.4 28.0 28.6 Source: Company, ICICIdirect.com Research ICICI Securities Ltd | Retail Equity Research Page 8 RoCE (%) 28.5 21.4 26.7 30.5 Company snapshot 1,400 Target Price:| 1165 1,200 1,000 800 600 400 200 Jan-16 Oct-15 Jul-15 Apr-15 Jan-15 Oct-14 Jul-14 Apr-14 Jan-14 Oct-13 Jul-13 Apr-13 Jan-13 Oct-12 Jul-12 Apr-12 Jan-12 Oct-11 Jul-11 Apr-11 Jan-11 Oct-10 Jul-10 Apr-10 Jan-10 Oct-09 Jul-09 Apr-09 Jan-09 0 Source: Bloomberg, Company, ICICIdirect.com Research Key events Date Nov-09 Event Starts new facility to manufacture human insulin for its partner Novo Nordisk Mar-10 Signs agreement with AstraZeneca to supply 18 finished dosage formulations for emerging markets Aug-10 Torrent Pharma enters gynaecology segment in Indian market Apr-11 Enters oncology segment in the domestic market May-13 Announces bonus shares in the ratio of 1:1 Dec-13 Launches generic Cymbalta (Duloxerine) with 180 days exclusivity in the US market Dec-13 Announces acquisition of 30 brands of Elder Pharma for | 2000 crore. The brands include big brands of Shelcal and Chymoral. Source: Company, ICICIdirect.com Research Top 10 Shareholders Shareholding Pattern Rank 1 2 3 4 5 6 7 8 9 10 (in %) Promoter FII DII Others Name Latest Filing Date % O/S Position (m) Position Chan Torrent Group 31-Dec-14 50.89 86.1 0.0 Mehta (Samir Uttamlal) 31-Dec-14 4.88 8.3 0.0 Mehta (Anita S) 31-Dec-14 3.75 6.3 0.0 Mehta (Sudhir Uttamlal) 31-Dec-14 3.48 5.9 0.0 Mehta (Sapna S) 31-Dec-14 3.17 5.4 0.0 Lavender Investments, Ltd. 31-Dec-14 2.68 4.5 0.0 Franklin Templeton Asset Management (India) Pvt. Ltd. 31-Dec-14 2.31 3.9 0.5 Franklin Advisers, Inc. 30-Nov-14 2.28 3.9 0.6 Mehta (Samir Uttamlal) HUF 31-Dec-14 1.23 2.1 0.0 HDFC Asset Management Co., Ltd. 31-Dec-14 1.19 2.0 0.0 Dec-13 Mar-14 Jun-14 Sep-14 Dec-14 71.5 71.5 71.5 71.5 71.5 10.5 12.0 12.6 12.8 12.9 8.1 7.6 7.0 6.5 6.6 9.8 8.9 8.8 9.1 9.1 Source: Reuters, ICICIdirect.com Research Recent Activity Buys Investor name Franklin Advisers, Inc. Franklin Templeton Asset Management (India) Pvt. Ltd. Axis Asset Management Company Limited Norges Bank Investment Management (NBIM) J.P. Morgan Asset Management (Hong Kong) Ltd. Value 9.15m 9.01m 2.87m 1.22m 0.70m Shares 0.55m 0.51m 0.16m 0.09m 0.07m Sells Investor name Canara Robeco Asset Management Company Ltd. Religare Invesco Asset Management Company Private Limited ICICI Prudential Asset Management Co. Ltd. Adamant Biomedical Investments AG Reliance Capital Asset Management Ltd. Value -2.58m -2.42m -1.37m -1.33m -0.82m Shares -0.30m -0.18m -0.14m -0.12m -0.07m Source: Reuters, ICICIdirect.com Research ICICI Securities Ltd | Retail Equity Research Page 9 Financial summary Profit and loss statement (Year-end March) Revenues Growth (%) Raw Material Expenses Employee Expenses Other expenses Total Operating Expenditure EBITDA Growth (%) Depreciation Interest Other Income PBT EO Taxation PAT MI Net Profit Growth (%) EPS (|) | Crore FY14 4,184.0 30.3 1243 741 1248.0 3232 952.0 37.5 87 59 38 844 0 180 664 0 663.9 53.4 39.2 FY15E 4,710.7 12.6 1436 819 1319.3 3574 1,136.7 19.4 185 178 239 1,014 0 214 800 1 798.7 20.3 47.2 FY16E 5,573.0 18.3 1742 934 1504.7 4180 1,393.1 22.6 194 145 44 1,098 0 242 856 4 852.2 6.7 50.4 FY17E 6,502.5 16.7 2024 1057 1755.7 4836 1,666.1 19.6 215 90 51 1,412 0 311 1,101 6 1,095.8 28.6 64.7 Source: Company, ICICIdirect.com Research | Crore FY14 84.6 1,817.8 1,902.4 1131.8 47.5 0.4 200.5 3,282.5 1,420.0 544.7 875.3 534.1 1,409.5 185.7 65.6 129.5 60.7 769.4 1,099.4 85.0 1,006.1 259.0 3,218.9 1,429.1 358.2 1,787.3 1,431.6 3,282.5 (Year-end March) Profit after Tax Depreciation (Inc)/Dec in Current Assets (Inc)/Dec in Current Liabilities CF from operation Purchase of Fixed Assets (Inc)/Dec in Investments (Inc)/Dec in Minority interest Others Long Term Provision CFfrom Investing Activities Inc / (Dec) in Loan Funds Inc / (Dec) in Equity Capital Dividend and dividend tax Others CF from Financing Activities Cash generation during the year Op bal Cash & Cash equivalents Closing Cash/ Cash Equivalent | Crore FY14 663.9 87.0 -577.0 316.1 490.1 -391.4 -125.2 0.0 -147.4 60.9 -603.0 438.8 0.0 -198.0 14.6 255.4 142.5 627.0 769.4 FY15E 798.7 184.7 -234.9 541.8 1,290.2 -2354.0 185.6 0.9 48.9 20.0 -2,118.6 850.0 0.0 -237.6 0.0 612.4 -216.0 769.4 553.4 FY16E 852.2 193.6 -402.4 353.4 996.8 -350.0 0.0 4.3 -2.0 20 -347.7 -530.0 0.0 -277.2 0.0 -807.2 -158.1 553.4 395.3 FY17E 1095.8 215.0 -514.8 447.4 1,243.4 -350.0 0.0 5.5 -3.8 20 -348.3 -550.0 0.0 -297.0 0.0 -847.0 48.1 395.3 443.4 Source: Company, ICICIdirect.com Research Balance sheet (Year-end March) Equity Capital Reserve and Surplus Total Shareholders funds Total Debt Deferred Tax Liability Minority Interest Other LT Liabitlies & LT Provision Total Liabilities Gross Block Less: Acc Depreciation Net Block Capital WIP Total Fixed Assets Investments Deferred tax assets Long term loans & advaces Othe non current liabilties Cash Trade Receivables Loans & Advances Inventory Other current assets Total Current Assets Creditors Provisions & other current liability Total Current Liabilities Net Current Assets Application of Funds Cash flow statement FY15E 84.6 2,378.9 2,463.5 1981.8 47.5 1.3 225.5 4,719.5 4,208.2 729.4 3,478.8 100.0 3,578.8 0.0 65.6 95.6 70.7 553.4 1,143.8 114.1 1,143.8 282.5 3,237.7 1,588.7 740.4 2,329.0 908.7 4,719.5 FY16E 84.6 2,953.9 3,038.5 1451.8 47.5 5.6 250.5 4,793.7 4,558.2 923.0 3,635.2 100.0 3,735.2 0.0 65.6 112.6 80.7 395.3 1,272.4 134.4 1,347.2 332.7 3,482.0 1,871.1 811.3 2,682.5 799.6 4,793.7 Source: Company, ICICIdirect.com Research FY17E 84.6 3,752.6 3,837.2 901.8 47.5 11.1 275.5 5,073.0 4,908.2 1,138.0 3,770.2 100.0 3,870.2 0.0 65.6 131.4 90.7 443.4 1,484.6 156.8 1,571.9 388.2 4,044.9 2,183.2 946.6 3,129.9 915.1 5,073.0 Key ratios (Year-end March) Per share data (|) EPS Cash EPS BV DPS Cash Per Share Operating Ratios (%) EBITDA margins PBT margins Net Profit margins Inventory days Debtor days Creditor days Return Ratios (%) RoE RoCE RoIC Valuation Ratios (x) P/E EV / EBITDA EV / Revenues Market Cap / Revenues Price to Book Value Solvency Ratios Debt/EBITDA Debt / Equity Current Ratio Quick Ratio FY14 FY15E FY16E FY17E 39.2 44.4 112.4 10.0 45.5 47.2 58.1 145.6 12.0 32.7 50.4 61.8 179.5 14.0 23.4 64.7 77.5 226.7 15.0 26.2 22.8 20.2 15.9 91 99 129 24.1 21.5 17.0 90 90 125 25.0 19.7 15.3 90 85 125 25.6 21.7 16.9 90 85 125 34.9 28.5 48.2 32.4 21.4 23.4 28.0 26.7 27.9 28.6 30.5 32.0 19.0 13.4 3.2 3.1 6.6 15.8 12.3 3.0 2.7 5.1 14.8 9.8 2.5 2.3 4.1 11.5 7.8 2.0 2.0 3.3 1.2 0.6 1.8 1.2 1.7 0.8 1.4 0.9 1.0 0.5 1.3 0.8 0.5 0.2 1.3 0.8 Source: Company, ICICIdirect.com Research . ICICI Securities Ltd | Retail Equity Research Page 10 ICICIdirect.com coverage universe (Healthcare) ICICIdirect Healthcare coverage Universe I-Direct CMP TP Rating M Cap EPS (|) PE(x) EV/EBITDA (x) RoCE (%) RoNW (%) Code (|) (|) (| Cr) FY14 FY15E FY16E FY14 FY15E FY16E FY14 FY15E FY16E FY14 FY15E FY16E FY14 FY15E FY16E Company Ajanta Pharma AJAPHA 2555 3220 BUY 9108.7 66.2 75.0 85.6 38.6 34.1 29.9 24.7 21.5 17.8 44.9 40.6 38.1 39.4 32.8 28.9 Apollo Hospitals APOHOS 1314 1075 HOLD 19050.0 22.8 27.5 35.1 57.7 47.8 37.4 29.7 25.4 19.4 11.6 12.7 14.9 10.6 11.8 13.6 Aurobindo Pharma AURPHA 1248 1111 HOLD 35904.5 47.3 51.8 59.7 26.4 24.1 20.9 20.0 20.3 13.4 24.1 25.7 25.9 31.3 29.4 26.0 Biocon BIOCON 414.8 410 HOLD 8256.8 20.7 20.0 22.6 20.0 20.7 18.3 12.2 12.2 10.7 13.4 11.6 12.9 13.7 12.3 12.9 Cadila Healthcare CADHEA 1640 1538 HOLD 34243.6 39.2 51.1 66.2 41.8 32.1 24.8 30.3 22.6 17.6 15.9 19.0 21.7 23.4 24.6 25.4 Cipla CIPLA 695.8 585 HOLD 56411.3 17.3 15.9 21.7 40.2 43.7 32.0 26.8 24.3 19.5 15.5 14.8 17.2 13.8 11.5 13.7 Divi's Laboratories DIVLAB 1742 1633 HOLD 23642.7 56.0 62.4 81.7 31.1 27.9 21.3 23.2 19.7 16.3 29.6 28.1 29.7 26.1 23.2 25.1 Dr Reddy's Labs DRREDD 3233 3273 HOLD 57722.1 126.7 130.7 150.5 25.5 24.7 21.5 17.4 16.5 14.2 19.2 18.6 20.0 23.7 20.2 19.4 Glenmark Pharma GLEPHA 719.2 19649.1 25.7 21.5 16.9 15.0 11.6 16.0 21.0 22.7 18.3 21.8 22.2 775 HOLD 20.0 28.0 33.4 35.9 Indoco Remedies INDREM 325.5 274 HOLD 2975.9 6.3 9.5 13.3 51.8 34.3 24.4 25.2 17.2 13.2 16.6 21.2 25.0 12.6 16.4 19.4 Ipca Laboratories IPCLAB 638.3 655 HOLD 8102.7 37.9 40.5 50.7 16.8 15.7 12.6 10.6 10.4 9.9 27.6 23.1 24.7 24.4 21.4 21.7 12.1 Jubilant Life Sciences VAMORG 172.7 123 SELL 2823.0 6.8 -6.5 20.0 25.2 -26.7 8.6 6.7 12.1 5.9 10.1 3.4 10.6 4.2 -4.2 Lupin LUPIN 1585 1590 BUY 70345.2 41.0 49.1 58.6 38.7 32.3 27.1 24.2 18.2 16.1 34.5 36.0 34.1 26.5 25.4 24.4 Sun Pharma SUNPHA 917.8 1036 BUY 191896.3 29.0 34.8 39.9 31.6 26.4 23.0 19.6 18.9 16.1 32.4 31.2 28.8 27.0 25.3 23.1 Torrent Pharma TORPHA 1100 1165 HOLD 19404.9 39.2 47.2 50.4 28.0 23.3 21.8 20.6 18.3 14.7 28.5 21.4 26.7 34.9 32.4 28.0 Unichem Laboratories UNILAB 2029.5 18.7 6.4 13.2 11.9 35.0 16.9 11.3 18.6 11.5 15.7 6.5 12.8 20.7 7.1 14.0 223 206 HOLD Source: Company, ICICIdirect.com Research ICICI Securities Ltd | Retail Equity Research Page 11 RATING RATIONALE ICICIdirect.com endeavours to provide objective opinions and recommendations. ICICIdirect.com assigns ratings to its stocks according to their notional target price vs. current market price and then categorises them as Strong Buy, Buy, Hold and Sell. The performance horizon is two years unless specified and the notional target price is defined as the analysts' valuation for a stock. Strong Buy: >15%/20% for large caps/midcaps, respectively, with high conviction; Buy: >10%/15% for large caps/midcaps, respectively; Hold: Up to +/-10%; Sell: -10% or more; Pankaj Pandey Head – Research [email protected] m ICICIdirect.com Research Desk, ICICI Securities Limited, 1st Floor, Akruti Trade Centre, Road No 7, MIDC, Andheri (East) Mumbai – 400 093 [email protected] ICICI Securities Ltd | Retail Equity Research Page 12 ANALYST CERTIFICATION We /I, Siddhant Khandekar, CA INTER and Mitesh Shah, MS (finance), Nandan Kamat MBA Research Analysts, authors and the names subscribed to this report, hereby certify that all of the views expressed in this research report accurately reflect our views about the subject issuer(s) or securities. We also certify that no part of our compensation was, is, or will be directly or indirectly related to the specific recommendation(s) or view(s) in this report. Terms & conditions and other disclosures: ICICI Securities Limited (ICICI Securities) is a full-service, integrated investment banking and is, inter alia, engaged in the business of stock brokering and distribution of financial products. ICICI Securities is a wholly-owned subsidiary of ICICI Bank which is India’s largest private sector bank and has its various subsidiaries engaged in businesses of housing finance, asset management, life insurance, general insurance, venture capital fund management, etc. (“associates”), the details in respect of which are available on www.icicibank.com. ICICI Securities is one of the leading merchant bankers/ underwriters of securities and participate in virtually all securities trading markets in India. We and our associates might have investment banking and other business relationship with a significant percentage of companies covered by our Investment Research Department. ICICI Securities generally prohibits its analysts, persons reporting to analysts and their relatives from maintaining a financial interest in the securities or derivatives of any companies that the analysts cover. The information and opinions in this report have been prepared by ICICI Securities and are subject to change without any notice. The report and information contained herein is strictly confidential and meant solely for the selected recipient and may not be altered in any way, transmitted to, copied or distributed, in part or in whole, to any other person or to the media or reproduced in any form, without prior written consent of ICICI Securities. While we would endeavour to update the information herein on a reasonable basis, ICICI Securities is under no obligation to update or keep the information current. Also, there may be regulatory, compliance or other reasons that may prevent ICICI Securities from doing so. Non-rated securities indicate that rating on a particular security has been suspended temporarily and such suspension is in compliance with applicable regulations and/or ICICI Securities policies, in circumstances where ICICI Securities might be acting in an advisory capacity to this company, or in certain other circumstances. This report is based on information obtained from public sources and sources believed to be reliable, but no independent verification has been made nor is its accuracy or completeness guaranteed. This report and information herein is solely for informational purpose and shall not be used or considered as an offer document or solicitation of offer to buy or sell or subscribe for securities or other financial instruments. Though disseminated to all the customers simultaneously, not all customers may receive this report at the same time. ICICI Securities will not treat recipients as customers by virtue of their receiving this report. Nothing in this report constitutes investment, legal, accounting and tax advice or a representation that any investment or strategy is suitable or appropriate to your specific circumstances. The securities discussed and opinions expressed in this report may not be suitable for all investors, who must make their own investment decisions, based on their own investment objectives, financial positions and needs of specific recipient. This may not be taken in substitution for the exercise of independent judgment by any recipient. The recipient should independently evaluate the investment risks. The value and return on investment may vary because of changes in interest rates, foreign exchange rates or any other reason. ICICI Securities accepts no liabilities whatsoever for any loss or damage of any kind arising out of the use of this report. Past performance is not necessarily a guide to future performance. Investors are advised to see Risk Disclosure Document to understand the risks associated before investing in the securities markets. Actual results may differ materially from those set forth in projections. Forward-looking statements are not predictions and may be subject to change without notice. ICICI Securities or its associates might have managed or co-managed public offering of securities for the subject company or might have been mandated by the subject company for any other assignment in the past twelve months. ICICI Securities or its associates might have received any compensation from the companies mentioned in the report during the period preceding twelve months from the date of this report for services in respect of managing or co-managing public offerings, corporate finance, investment banking or merchant banking, brokerage services or other advisory service in a merger or specific transaction. ICICI Securities or its associates might have received any compensation for products or services other than investment banking or merchant banking or brokerage services from the companies mentioned in the report in the past twelve months. ICICI Securities encourages independence in research report preparation and strives to minimize conflict in preparation of research report. ICICI Securities or its analysts did not receive any compensation or other benefits from the companies mentioned in the report or third party in connection with preparation of the research report. Accordingly, neither ICICI Securities nor Research Analysts have any material conflict of interest at the time of publication of this report. It is confirmed that Siddhant Khandekar, CA INTER and Mitesh Shah, MS (finance), Nandan Kamat MBA, Research Analysts of this report have not received any compensation from the companies mentioned in the report in the preceding twelve months. Compensation of our Research Analysts is not based on any specific merchant banking, investment banking or brokerage service transactions. ICICI Securities or its subsidiaries collectively or Research Analysts do not own 1% or more of the equity securities of the Company mentioned in the report as of the last day of the month preceding the publication of the research report. Since associates of ICICI Securities are engaged in various financial service businesses, they might have financial interests or beneficial ownership in various companies including the subject company/companies mentioned in this report. It is confirmed that Siddhant Khandekar, CA INTER and Mitesh Shah, MS (finance), Nandan Kamat MBA, Research Analysts do not serve as an officer, director or employee of the companies mentioned in the report. ICICI Securities may have issued other reports that are inconsistent with and reach different conclusion from the information presented in this report. Neither the Research Analysts nor ICICI Securities have been engaged in market making activity for the companies mentioned in the report. We submit that no material disciplinary action has been taken on ICICI Securities by any Regulatory Authority impacting Equity Research Analysis activities. This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction, where such distribution, publication, availability or use would be contrary to law, regulation or which would subject ICICI Securities and affiliates to any registration or licensing requirement within such jurisdiction. The securities described herein may or may not be eligible for sale in all jurisdictions or to certain category of investors. Persons in whose possession this document may come are required to inform themselves of and to observe such restriction. ICICI Securities Ltd | Retail Equity Research Page 13

© Copyright 2026