Dabur India (DABIND)

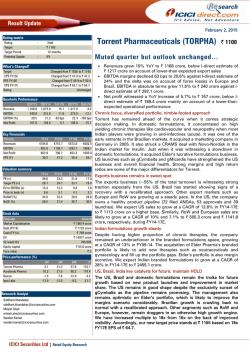

Result Update February 2, 2015 Rating matrix Rating Target Target Period Potential Upside : : : : Dabur India (DABIND) Hold 263 12 months 2% Volume growth remains strong… What’s changed? Target EPS FY15E EPS FY16E EPS FY17E Rating Changed from | 222 to |263 Unchanged Unchanged Unchanged Unchanged Quarterly performance Sales EBITDA EBITDA (%) PAT Q3FY15 2073.6 346.4 16.9 283.7 Q3FY14 YoY (%) 1904.3 8.9 292.5 18.4 15.4 156 bps 243.6 16.5 Q2FY15 QoQ (%) 1924.1 7.8 345.4 0.3 17.9 -102 bps 288.3 -1.6 Key financials | Crore Net Sales EBITDA Net Profit EPS (|) FY14 7,073.2 1,156.4 916.5 5.2 FY15 7,923.9 1,391.1 1,120.4 6.4 FY16E 9,412.9 1,671.5 1,302.5 7.5 FY17E 10,354.6 1,849.5 1,437.1 8.2 FY15 40.2 34.9 0.8 5.7 36.8 43.4 FY16E 34.5 30.0 1.0 4.8 33.7 42.3 FY17E 31.3 32.0 1.2 4.3 30.2 38.4 Valuation summary P/E Target P/E Div. Yield Mcap/Sales RoNW (%) RoCE (%) FY14 49.2 42.8 0.7 6.4 38.3 42.4 Stock data Particular Market Capitalization (| Crore) Total Debt (FY14) (| Crore) Cash and Investments (FY14) (| Crore) EV (| Crore) 52 week H/L Equity capital Face value Amount 44,990.0 392.4 1,171.2 44,211.3 262 / 166 | 174.3 Crore |1 Price performance Dabur Marico GCPL HUL 1M 10.3 9.2 11.2 22.8 3M 16.0 16.4 9.6 27.5 | 258 6M 27.9 41.1 25.4 34.7 12M 50.7 69.5 48.6 63.5 Research Analyst Sanjay Manyal [email protected] Parineeta Rajgarhia [email protected] ICICI Securities Ltd | Retail Equity Research • Dabur India’s Q3FY15 results were below our estimate on sales front with 8.9% growth to | 2073.6 crore (I-direct estimate: | 2196.4 crore) on the back of slower growth of 3.6% in international business. However, domestic volume growth remains healthy at 7.4% led by strong growth in health supplement, home care & oral care • Skin care sales growth was impacted by loss in sales due to fire in its Baddi plant. Foods business growth slowed down to 11.8% from ~20% in last four quarters mainly due to high base affect • Operating margins improved 156 bps to 16.9% mainly on account of 100 bps savings in raw material cost and 70 bps savings in other overheads. Advertisement spends increased marginally by 20 bps as % to sales. Net profit increased 16.5% to | 283.7 crore (I-direct estimate: | 283.2 crore) led by higher operating profit Presence in niche categories to keep revenue growth healthy Dabur India (DIL) has a strong portfolio of brands (Dabur Chyawanprash, Real, Fem, Honey, Meswak, Dabur Red) with focus largely on ayurvedic and healthcare offerings. The company’s diverse product portfolio (hair care, oral care, skin care, home care, health supplements, digestives, OTC & ethicals) and presence in niche categories has aided revenue growth at a robust 21% CAGR in FY08-13. Though hair care, skin care and OTC & ethicals have been seeing softening growth (7-10%) from FY13 onwards, other categories (juices, health supplements, digestives & oral care) are continuing to witness robust 15-20% growth. We believe led by DIL’s brand strength in higher growth niche segments & further strengthening of portfolio through new launches focusing on healthcare, revenue growth would continue to remain healthy at 13.5% CAGR (FY14-17E). On track to capture reviving urban growth In the last few years (FY11-13), DIL more than doubled its rural reach from ~15,000 villages to ~38,000 villages through its ‘Project Double’. The initiative played out extremely well for the company by increasing contribution of booming rural demand in DIL’s revenues to 45-50% from ~30% earlier. It also aided in maintaining its volume growth at 8-11%. Going ahead, with rural growth witnessing signs of flagging, DIL plans to consolidate its presence by increasing number of SKUs at these rural distribution points, rather than expanding reach further. Also, with DIL planning to increase its healthcare offerings, it is aiming to increase its urban coverage by capturing the untapped chemist network through a new initiative called ‘Project CORE’. The company has increased its chemist network reach from ~31,000 (FY13) to ~51,000 currently. Sustains volume growth Led by DIL’s niche portfolio and constant distribution expansion DIL’s volume growth has maintained its 9-11% trajectory since FY11. Even in FY13, when the FMCG industry overall was seeing a slowdown, DIL’s volume growth was a healthy 8-11%. Going ahead, volume growth may modest at 7-9%, with reviving demand scenario, expected from FY16E onwards, resulting in higher volume growth of ~10% in FY16E and FY7E. Volume growth remains healthy; fairly valued DIL is sustaining well for the future by increasing its presence to capture the revival in urban growth after establishing a strong presence in rural markets. We expect the expansion to augur healthy revenue and earnings CAGR (FY14-17E) of 14.5% and 16.2%, respectively. We value the stock at 32x FY17E EPS of | 8.2 and arrive at a target price of | 263. Variance analysis Q3FY15 Q3FY15E Q3FY14 YoY (%) Q2FY15 QoQ (%) 2,073.6 2,196.4 1,904.3 8.9 1,924.1 7.8 Net Sales Operating Income 5.5 5.3 5.0 8.8 5.5 -0.7 Raw Material Expenses 988.1 961.9 927.5 6.5 903.4 9.4 Employee Expenses SG&A Expenses Other operating Expenses 177.8 319.4 241.8 177.9 329.5 190.8 158.0 289.6 236.6 12.5 10.3 2.2 182.5 253.4 239.5 -2.6 26.1 1.0 EBITDA EBITDA Margin (%) 346.4 16.7 352.2 16.0 292.5 18.4 15.4 134 bps 30.9 9.5 38.6 33.3 5.3 35.1 25.5 7.2 33.9 20.9 32.7 13.6 29.2 10.2 38.4 5.7 -6.4 0.5 PBT 350.0 Tax Outgo 66.3 PAT 283.7 Key Metrics YoY growth (%) Volume Growth 7.4 Standalone sales growth 11.8 Subsidiary's sales growth 1.8 Source: Company, ICICIdirect.com Research 318.9 70.8 283.2 298.2 54.6 243.6 17.4 21.5 16.5 349.8 61.6 288.3 0.1 7.7 -1.6 8.0 15.5 15.0 9.0 12.6 27.9 Depreciation Interest Other Income 345.4 0.3 17.9 -124 bps 8.7 12.0 6.2 Comments Net sales growth was lower at 8.9% on the back of 7.4% volume growth led by strong growth in home care, oral care & health supplements Raw material cost for the company dipped 100 bps as percentage of sales as packaging cost dipped due to a sharp fall in crude prices Operating margins improved 134 bps mainly due to saving in RM cost Net proffit increased 16.5% in line with our estimates Domestic volume growth remained strong at 7.4% International business witnessed subduded growth of 3.6% Change in estimates Std. Sales (| crore) Volume Growth (%) Subs. Sales (| crore) FY13 FY14 4,349.4 4,860.4 10.6 9.3 1,797.3 2,212.9 RM exp. To sales % 49.1 48.1 Adex to sales % 13.6 14.1 Interest Cost (| crore) 58.9 54.2 Source: Company, ICICIdirect.com Research Current Earlier FY15E FY16E FY17E FY15E FY16E 5,438.2 6,286.0 6912.6 5,486.4 6,286.0 NA NA NA NA NA 2,485.7 3,126.9 3,442.0 2,560.4 3,126.9 47.7 14.1 38.7 46.4 14.4 18.6 46.6 14.3 18.6 47.9 14.0 34.5 46.4 14.4 18.6 Comments FY17E 6,912.6 We have not changed our estimates NA 3,442.0 46.6 14.3 18.6 Assumptions (| Crore) Old Sales 8,158.0 EBITDA 1,356.6 16.6 EBITDA Ma PAT 1,075.1 EPS (|) 6.2 FY15E New 7,923.9 1,391.1 17.5 1,120.4 6.4 % Change -2.9 2.5 88 bps 4.2 4.2 Old 9,412.9 1,648.8 17.5 1,289.8 7.4 FY16E FY17 Old New % Change Comments New % Change 9,412.9 0.0 10354.6 10354.6 0.0 We have not changed our estimates 1,671.5 1.4 1825.7 1825.7 0.0 17.7 20 bps 17.6 17.8 1.1 1,302.5 1.0 1437.1 1437.1 0.0 7.5 1.0 8.2 8.2 0.0 Source: Company, ICICIdirect.com Research ICICI Securities Ltd | Retail Equity Research Page 2 Company Analysis Revenue growth to remain healthy largely led by volumes DIL’s revenue growth has remained robust at 20.3% CAGR (FY09-14) buoyed by its diverse & niche product portfolio, a slew of product launches and synergistic inorganic acquisitions (Fem in FY09, Namaste in FY11, Hobi in FY11) both in the domestic and international markets. Even in a slowing consumer demand scenario from H2FY13, DIL has managed to maintain its healthy revenue growth of 12-16% led by volume growth of 8-11%. The slowdown has, however, largely impacted the company’s hair oil (segment as a whole witnessing stagnation in growth) and skin care (impacted by lower discretionary demand following the slowdown in the economy) growth while keeping the oral care (Meswak & Dabur Red), health supplements (Dabur Chyawanprash, Dabur Honey), home care (Odonil, Odomos), foods (Real, Real Activ), digestive (Hajmola) and OTC & ethicals portfolio growth healthy. Going ahead, we believe that aided by the company’s increasing focus on the healthcare portfolio (new launches expected by DIL in healthcare space) and strengthening presence both in rural and urban India, revenue growth would continue to remain strong at 13.5% CAGR in FY14-17E, aided by a higher mix of volumes. Though FY15E is witnessing some moderation in growth following concerns of a slower recovery in urban demand, we believe that if the economy bounces back to a healthy growth phase, Dabur would follow the trend. Exhibit 1: DIL’s revenues (| crore) and revenue growth (%) 12000 35 30.1 30 10000 8000 18.8 20.9 20.3 15.9 6000 15.1 12.0 0 20 10.0 4000 2000 25 18.8 15 10 2805.4 3390.5 4077.4 5305.4 6146.7 7073.2 7923.9 9412.9 10354.6 FY09 FY10 FY11 FY12 FY13 FY14 FY15E FY16E FY17E Sales (| crore) 5 0 Sales growth (%) Source: Company, ICICIdirect.com Research Exhibit 2: Category wise revenue growth in % (YoY) Hair Care Oral Care Health Supp. Digestives Skin Care Home Care Foods OTC & Ethicals Retail Q1FY12 Q2FY12 Q3FY12 Q4FY12 9.0 15.9 19.6 19.8 12.5 6.0 11.4 7.8 -0.3 7.7 13.4 11.0 16.7 0.7 1.3 19.4 15.6 -1.9 5.1 17.8 24.9 0.6 17.7 18.1 31.5 27.6 17.3 30.4 5.8 -8.0 21.6 13.8 162.5 97.9 131.0 83.6 FY12 Q1FY13 Q2FY13 Q3FY13 Q4FY13 16.0 10.4 13.2 13.9 9.6 9.5 8.2 7.0 13.6 12.3 9.4 18.0 15.7 12.0 22.6 9.9 9.9 -3.5 -5.4 1.3 9.0 13.3 25.8 15.7 11.1 14.4 14.6 23.0 30.5 33.3 26.5 34.5 17.9 22.2 22.6 8.2 12.7 37.2 15.6 13.7 106.8 58.3 48.4 32.8 28.5 FY13 Q1FY14 Q2FY14 Q3FY14 Q4FY14 11.7 11.8 3.9 7.0 6.0 10.4 8.6 18.8 10.4 17.3 16.2 7.5 16.7 19.5 17.6 3.9 15.2 12.0 17.7 23.3 15.3 13.3 17.5 13.4 10.1 25.3 25.6 25.1 16.0 12.8 24.5 18.7 22.0 17.6 20.6 16.1 11.8 11.2 13.2 10.9 43.9 27.1 17.7 14.7 20.4 FY14 Q1FY15 Q2FY15 7.1 8.4 10.2 13.8 8.0 8.1 16.4 21.6 10.1 17.2 11.3 12.3 13.2 4.4 9.7 19.8 14.7 10.2 19.7 21.6 29.0 11.8 4.4 7.5 19.6 NA NA Source: Company, ICICIdirect.com Research ICICI Securities Ltd | Retail Equity Research Page 3 Q3FY15 12.1 11.3 13.5 11.6 4.0 16.2 11.8 8.8 NA EBITDA margins to improve to 17.8% by FY17E… DIL’s margins have remained at higher levels of 16-18% since FY08 led by the company’s strong brand equity in the healthcare space of the FMCG segment. Along with a changing sales mix (more towards the products witnessing constant demand than seasonal demand), Dabur has efficiently managed its raw material expenses and marketing expenses to sustain its margins. Going ahead, with continued focus on the healthcare portfolio and DIL expected to get aggressive in segment through new launches and expansion in reach, we believe margins would improve further to 17.8% by FY17E. We believe that aided by the company’s ability to sustain a high brand equity in its segments, fluctuations in raw material cost will be absorbed efficiently without impacting margins. However, any savings in raw material costs would be directed towards higher advertisement and promotion expenses. Exhibit 3: EBITDA margins (%), RM cost to sales (%) and adex to sales (%) 60 50 25 18.0 19.7 19.8 17.7 17.6 14.7 40 16.8 17.7 18.8 16.7 15.6 16.7 14.5 16.3 17.5 17.7 17.8 20 15 30 10 20 5 10 0 0 FY09 FY10 FY11 FY12 Q1FY13 Q2FY13 Q3FY13 Q4FY13 RM Cost to Sales FY13 EBITDA Margins Q1FY14 Q2FY14 Q3FY14 Q4FY14 FY14 FY15E FY16E FY17E Adex to Sales Source: Company, ICICIdirect.com Research Expansion in distribution network to bode well for future DIL has efficiently expanded its distribution network in rural India through ‘Project Double’ since FY11. Through Project Double, DIL expanded its reach from ~15000 villages in FY11 to ~38000 villages in FY13. The extension in rural India paid off well for the company in capturing the booming rural demand in the country in FY11-FY13. With initial signs of softening rural demand following a weak economic scenario and slow urban demand recovery, going ahead, the company plans to limit its rural reach at current levels, and consolidate its position further. It plans to increase the number of SKUs in existing rural distribution centres and increase its offerings in existing rural markets along with a few new launches. On the urban front, DIL is aiming to increase its presence in the chemist channels of distribution considering the healthcare focus of the company’s portfolio. Following the target to increase chemist coverage DIL has launched ‘Project CORE – Chemist Outlet and Range Expansion’ launched in FY14. Until FY12, the company had a direct presence in ~55,000 chemists (~10% of chemists in India), which it has already increased to ~2,00,000 outlets by FY14. Further, the company increased its chemist distribution points from 31,300 outlets (FY13) to ~51,000 outlets in currently, which it is planning to increase to 75000 by the end of FY15. Considering DIL’s strength of implementation, we believe the company’s constant focus on managing sales and distribution efficiently in both urban and rural markets along with a strong innovation pipeline, revenue and margin growth would continue to remain healthy. ICICI Securities Ltd | Retail Equity Research Page 4 Outlook & valuation We believe DIL’s strong and niche product portfolio would continue to record healthy revenue and earnings growth at 14.9% and 18.8% CAGR, respectively, in FY14-16E. Further, the increase in distribution expansion and constant innovation would be catalysed if there is a revival in consumer demand. We believe that given the diverse product portfolio, the company’s margins would remain sustainable and are less prone to fluctuations in raw material prices. Hence, we remain positive on the long term outlook of the company. The only concern for us remains the challenging near term consumer demand scenario. Also, the looming risk of a weak monsoon and high inflation could moderate consumer demand further. Hence, we remain wary of growth in H1FY15E. Though until H1FY15, DIL could face some margin and sales growth pressures in domestic business, we believe that as higher price increases (5-6%) are induced and the expansion of distribution network starts playing out for urban demand, growth would gain traction. DIL is currently trading at 31.2x FY17E EPS of | 8.2. We believe that with margins expected to remain above ~17-18% by FY17E and sales growth in the domestic business to revive given DIL’s strong brands in niche segments, market development of niche segments (packaged foods & juices, health supplements) and revival in urban demand, valuation multiples will command a premium to its historic averages. We value the stock at 32x FY17E EPS of | 8.2 and arrive at a target price of | 263 with a HOLD recommendation. Exhibit 4: Valuations FY14 FY15E FY16E FY17E Sales Growth (| cr) (%) 7073.2 15.1 8048.1 13.8 9412.9 17.0 10354.6 10.0 EPS Growth (|) (%) 5.2 19.3 6.4 22.6 7.5 16.0 8.2 10.3 PE EV/EBITDA (x) (x) 42.9 33.7 35.0 27.9 30.2 23.2 31.3 24.3 RoNW (%) 38.3 36.8 33.7 30.2 Source: Company, ICICIdirect.com Research ICICI Securities Ltd | Retail Equity Research Page 5 RoCE (%) 42.4 43.4 42.3 38.4 Company snapshot 250 200 Target Price | 263 150 100 50 Jan-17 Oct-16 Jul-16 Apr-16 Jan-16 Oct-15 Jul-15 Apr-15 Jan-15 Oct-14 Jul-14 Apr-14 Jan-14 Oct-13 Jul-13 Apr-13 Jan-13 Oct-12 Jul-12 Apr-12 Jan-12 Oct-11 Jul-11 Apr-11 Jan-11 Oct-10 Jul-10 Apr-10 Jan-10 0 Source: Bloomberg, Company, ICICIdirect.com Research Key events Date Nov-08 Jul-09 Apr-10 Jul-10 Sep-10 Jan-11 Mar-11 May-12 Event Acquisition of the company's largest skin care brand 'Fem' from Fem Care Pharma marking its entry in the high growth skin care segment Rise in stock price following the increase in FMCG Index led by attractiveness of defensives in the economic downturn Consistent 18-20% revenue growth with improvement in margins to ~20% tapping the revival in consumption demand Entered Turkey through acquisition Hobi Kozmetik for | 324 crore. Acquisition is in line with the company's strategy of strengthening its presence in Middle East & North Africa Dabur issued bonus in the ratio od 1:1 Acquired US based personal care firm Namaste Laboratories LLC for | 451 crore. Acquisition marked Dabur's entry into US$1.5 billion hair care markets of US, Europe and Africa Launched 'Project Double' to double its direct reach in villages and to tap the growing aspirational demand of rural consumers Stock performance remained lacklusture due to falling domestic revenues, declining margins and no significant innovations In a grim economic scenario, ability to grow in double digits (volume) along with improvement in margins and market share gains across categories made it the top preferrd stock in the FMCG pack May-13 Source: Company, ICICIdirect.com Research Top 10 Shareholders Rank 1 2 3 4 5 6 7 8 9 10 Name Chowdhry Associates Chowdhry Associates VIC Enterprises Pvt. Ltd. Gyan Enterprises Pvt. Ltd. Puran Associates Pvt. Ltd. Ratna Commercial Enterprises Pvt. Ltd. Milky Investment & Trading Company Life Insurance Corporation of India Burmans Finvest Pvt. Ltd. Genesis Investment Management, LLP Shareholding Pattern Latest Filing Date 30-Sep-14 30-Jun-14 30-Jun-14 30-Jun-14 30-Jun-14 30-Jun-14 30-Jun-14 30-Jun-14 30-Jun-14 30-Jun-14 % O/S Position (m) Change (m) 12.41 217.9 0.0 12.41 217.9 0.0 12.40 217.7 0.0 11.52 202.2 0.0 10.77 189.2 0.0 8.84 155.3 0.1 6.04 106.1 0.0 4.01 70.5 1.2 3.02 53.0 0.0 2.05 36.0 0.0 (in %) Promoter FII DII Others Dec-13 Mar-14 Jun-14 Sep-14 Dec-14 68.64 68.64 68.16 68.16 68.16 19.94 19.24 19.69 20.54 19.69 4.47 5.64 5.56 5.03 5.56 6.95 6.48 6.59 6.27 6.59 Source: Reuters, ICICIdirect.com Research Recent Activity Buys Investor name Matthews International Capital Management, L.L.C. 1832 Asset Management L.P. BlackRock Institutional Trust Company, N.A. Henderson Global Investors Ltd. Norges Bank Investment Management (NBIM) Value 15.74m 7.15m 6.00m 4.67m 3.83m Shares 5.04m 2.30m 2.24m 1.57m 1.23m Sells Investor name Life Insurance Corporation of India Vontobel Asset Management, Inc. HDFC Asset Management Co., Ltd. Manulife Asset Management (Europe) Limited Manulife Asset Management (US) LLC Value -29.72m -6.46m -5.44m -4.99m -3.74m Shares -8.29m -2.56m -2.05m -1.81m -1.36m Source: Reuters, ICICIdirect.com Research ICICI Securities Ltd | Retail Equity Research Page 6 Financial summary Profit and loss statement (Year-end March) Net Sales Growth (%) Raw Material Expenses Employee Expenses Marketing Expenses Administrative Expenses Other expenses Total Operating Expenditure EBITDA Growth (%) Depreciation Interest Other Income PBT Others Total Tax PAT Growth (%) Adjusted EPS (|) | Crore FY14 7073.2 15.1 3,400.0 607.7 999.7 642.9 287.7 5,938.0 1135.2 13.5 97.5 54.2 131.5 1,135.5 0.7 219.1 916.5 19.7 5.2 FY15E 7923.9 12.0 3,776.0 688.4 1,118.9 0.0 971.1 6,554.4 1369.6 20.6 120.1 38.7 148.0 1,380.4 0.0 260.0 1120.4 22.3 6.4 FY16E 9412.9 18.8 4,366.0 767.2 1,355.5 0.0 1,275.4 7,764.1 1648.8 20.4 138.5 18.6 155.4 1,669.8 0.0 367.4 1302.5 16.3 7.5 FY17E 10354.6 10.0 4,822.0 828.4 1,480.7 0.0 1,397.9 8,528.9 1825.7 10.7 151.6 18.6 163.2 1,842.4 0.0 405.3 1437.1 10.3 8.2 Source: Company, ICICIdirect.com Research (Year-end March) Profit before Tax Add: Depreciation (Inc)/dec in Current Assets Inc/(dec) in CL and Provisions Others CF from operating activities (Inc)/dec in Investments (Inc)/dec in Fixed Assets Others CF from investing activities Issue/(Buy back) of Equity Inc/(dec) in loan funds Dividend paid & dividend tax Inc/(dec) in Sec. premium Others CF from financing activities Net Cash flow Opening Cash Closing Cash | Crore FY14 1,135.5 97.5 -314.9 397.4 -214.4 1,101.1 10.5 -213.1 95.3 -107.3 0.1 -443.2 -278.8 0.0 -81.7 -803.7 190.1 329.3 519.4 FY15E 1,380.4 120.1 -329.4 -144.1 -221.3 805.6 -35.0 -350.0 0.0 -385.0 0.0 -115.0 -348.8 0.0 -38.7 -502.4 -81.9 519.4 437.5 FY16E 1,669.8 138.5 -821.0 125.9 -348.8 764.4 -35.0 -140.0 0.0 -175.0 0.0 -110.0 -436.0 0.0 -18.6 -564.5 24.9 437.5 462.4 FY17E 1,842.4 151.6 -1,015.4 120.8 -386.7 712.7 -110.0 -270.0 0.0 -380.0 0.0 -20.0 -523.1 0.0 -18.6 -561.7 -229.1 462.4 233.3 FY14 FY15E FY16E FY17E 5.2 5.8 15.2 1.8 3.0 6.4 7.1 19.7 2.0 2.5 7.5 8.3 24.6 2.5 2.7 8.2 9.1 29.9 3.0 1.3 16.3 14.2 13.0 49 34 56 17.5 15.6 14.1 50 35 36 17.7 16.1 13.8 60 36 29 17.8 16.2 13.9 70 45 25 38.3 42.4 30.8 36.8 43.4 30.2 33.7 42.3 29.4 30.2 38.4 27.1 49.2 38.7 6.3 6.4 16.9 40.2 32.1 5.6 5.7 13.1 34.5 26.7 4.7 4.8 10.5 31.3 24.3 4.3 4.3 8.6 0.2 0.1 1.3 0.9 0.1 0.0 1.5 1.0 0.0 0.0 1.8 1.1 0.1 0.0 2.1 1.2 Source: Company, ICICIdirect.com Research Balance sheet (Year-end March) Liabilities Equity Capital Reserve and Surplus Total Shareholders funds Long Term Loans Long Term Provisions Minority Interest / Others Total Liabilities Assets Gross Block Less: Acc Depreciation Net Block Capital WIP Non- Current Investments LT loans & advances Other Non-current Assets Current Assets Inventory Debtors Cash & Bank ST Loans & Advances Other Current Assets Current Liabilities Creditors ST Borrowings Other CL Net Current Assets Total Assets Cash flow statement | Crore FY14 FY15E FY16E FY17E 174.4 2,481.6 2,656.0 260.4 44.8 56.8 3018.0 174.4 3,253.2 3,427.6 160.4 44.8 56.8 3689.6 174.4 4,119.7 4,294.1 60.4 44.8 56.8 4456.1 174.4 5,033.6 5,208.0 100.4 44.8 56.8 5410.1 2,412.8 645.9 1,766.9 21.7 424.7 24.5 18.1 2,662.8 766.0 1,896.8 121.7 449.7 39.5 28.1 2,782.8 904.4 1,878.4 141.7 474.7 49.5 38.1 3,032.8 1,056.1 1,976.7 161.7 574.7 109.5 48.1 972.3 675.3 519.4 132.0 756.9 1,100.5 770.4 437.5 198.1 796.9 1,568.8 941.3 462.4 339.9 836.9 2,013.4 1,294.3 233.3 517.7 876.9 1,096.5 447.7 749.5 762.1 3,018.0 792.4 547.7 809.5 1,153.8 3,689.6 758.3 647.7 869.5 1,873.8 4,456.1 719.1 747.7 929.5 2,539.3 5,410.1 Source: Company, ICICIdirect.com Research Key ratios (Year-end March) Per share data (|) Adjusted EPS Cash EPS BV DPS Cash Per Share Operating Ratios (%) PBITDA Margin PBT / Total Operating income PAT Margin Inventory days Debtor days Creditor days Return Ratios (%) RoE RoCE RoIC Valuation Ratios (x) P/E EV / EBITDA EV / Net Sales Market Cap / Sales Price to Book Value Solvency Ratios Debt/EBITDA Debt / Equity Current Ratio Quick Ratio Source: Company, ICICIdirect.com Research . ICICI Securities Ltd | Retail Equity Research Page 7 ICICIdirect.com coverage universe (FMCG) CMP M Cap EPS (|) (|) TP(|) Rating (| Cr) FY15E FY16E FY17E Sector / Company 1,843 1,919 Hold 25,526 41.3 47.9 54.9 Colgate (COLPAL) 258 263 Hold 44,990 6.4 7.5 8.2 Dabur India (DABIND) 907 902 Hold 193,544 19.9 20.8 24.8 Hindustan Unilever (HINLEV) 360 387 Hold 280,748 11.5 12.7 14.5 ITC Limited (ITC) 288 272 Hold 5,159 8.7 9.8 10.1 Jyothy Lab (JYOLAB) 359 367 Buy 21,540 8.7 10.8 12.8 Marico (MARIN) 7,019 6,123 Hold 59,084 120.7 137.2 153.1 Nestle (NESIND) 163 182 Buy 9,802 6.6 8.7 9.1 Tata Global Bev (TATTEA) 1,848 1,962 Hold 2,924 89.7 95.8 109.0 VST Industries (VSTIND) Source: Company, ICICIdirect.com Research ICICI Securities Ltd | Retail Equity Research P/E (x) EV/EBITDA (x) RoCE (%) RoE (%) FY15E FY16E FY17E FY15E FY16E FY17E FY15E FY16E FY17E FY15E FY16E FY17E 44.6 40.0 33.6 31.1 26.3 22.8 103.5 99.6 96.6 78.8 74.5 71.1 40.2 35.2 31.3 32.1 26.7 24.3 43.4 42.3 38.4 38.3 36.8 33.7 45.6 43.3 36.6 36.6 32.4 27.0 124.6 126.2 126.9 118.0 109.3 101.7 31.3 30.4 24.8 20.6 19.3 17.3 43.3 45.4 48.7 33.5 32.1 34.6 33.2 27.8 28.5 29.7 28.0 25.6 12.1 12.0 12.6 11.1 19.2 19.7 41.2 34.0 27.9 25.8 20.3 17.1 49.1 50.2 46.9 29.0 35.3 33.0 58.1 44.6 45.9 28.6 25.8 23.0 66.2 71.2 75.9 47.2 44.9 49.3 24.9 20.9 18.0 12.4 11.1 10.5 8.3 8.7 9.0 8.2 6.7 8.3 20.6 20.5 16.9 13.0 11.7 10.3 56.1 59.2 62.0 45.8 40.7 42.0 Page 8 RATING RATIONALE ICICIdirect.com endeavours to provide objective opinions and recommendations. ICICIdirect.com assigns ratings to its stocks according to their notional target price vs. current market price and then categorises them as Strong Buy, Buy, Hold and Sell. The performance horizon is two years unless specified and the notional target price is defined as the analysts' valuation for a stock. Strong Buy: >15%/20% for large caps/midcaps, respectively, with high conviction; Buy: >10%/15% for large caps/midcaps, respectively; Hold: Up to +/-10%; Sell: -10% or more; Head – Research Pankaj Pandey [email protected] ICICIdirect.com Research Desk, ICICI Securities Limited, 1st Floor, Akruti Trade Centre, Road No 7, MIDC, Andheri (East) Mumbai – 400 093 [email protected] ICICI Securities Ltd | Retail Equity Research Page 9 ANALYST CERTIFICATION We /I, Sanjay Manyal, MBA (Finance) and Parineeta Rajgarhia, MBA (Finance), Research Analysts, authors and the names subscribed to this report, hereby certify that all of the views expressed in this research report accurately reflect our views about the subject issuer(s) or securities. We also certify that no part of our compensation was, is, or will be directly or indirectly related to the specific recommendation(s) or view(s) in this report. Terms & conditions and other disclosures: ICICI Securities Limited (ICICI Securities) is a full-service, integrated investment banking and is, inter alia, engaged in the business of stock brokering and distribution of financial products. ICICI Securities is a wholly-owned subsidiary of ICICI Bank which is India’s largest private sector bank and has its various subsidiaries engaged in businesses of housing finance, asset management, life insurance, general insurance, venture capital fund management, etc. (“associates”), the details in respect of which are available on www.icicibank.com. ICICI Securities is one of the leading merchant bankers/ underwriters of securities and participate in virtually all securities trading markets in India. We and our associates might have investment banking and other business relationship with a significant percentage of companies covered by our Investment Research Department. ICICI Securities generally prohibits its analysts, persons reporting to analysts and their relatives from maintaining a financial interest in the securities or derivatives of any companies that the analysts cover. The information and opinions in this report have been prepared by ICICI Securities and are subject to change without any notice. The report and information contained herein is strictly confidential and meant solely for the selected recipient and may not be altered in any way, transmitted to, copied or distributed, in part or in whole, to any other person or to the media or reproduced in any form, without prior written consent of ICICI Securities. While we would endeavour to update the information herein on a reasonable basis, ICICI Securities is under no obligation to update or keep the information current. Also, there may be regulatory, compliance or other reasons that may prevent ICICI Securities from doing so. Non-rated securities indicate that rating on a particular security has been suspended temporarily and such suspension is in compliance with applicable regulations and/or ICICI Securities policies, in circumstances where ICICI Securities might be acting in an advisory capacity to this company, or in certain other circumstances. This report is based on information obtained from public sources and sources believed to be reliable, but no independent verification has been made nor is its accuracy or completeness guaranteed. This report and information herein is solely for informational purpose and shall not be used or considered as an offer document or solicitation of offer to buy or sell or subscribe for securities or other financial instruments. Though disseminated to all the customers simultaneously, not all customers may receive this report at the same time. ICICI Securities will not treat recipients as customers by virtue of their receiving this report. Nothing in this report constitutes investment, legal, accounting and tax advice or a representation that any investment or strategy is suitable or appropriate to your specific circumstances. The securities discussed and opinions expressed in this report may not be suitable for all investors, who must make their own investment decisions, based on their own investment objectives, financial positions and needs of specific recipient. This may not be taken in substitution for the exercise of independent judgment by any recipient. The recipient should independently evaluate the investment risks. The value and return on investment may vary because of changes in interest rates, foreign exchange rates or any other reason. ICICI Securities accepts no liabilities whatsoever for any loss or damage of any kind arising out of the use of this report. Past performance is not necessarily a guide to future performance. Investors are advised to see Risk Disclosure Document to understand the risks associated before investing in the securities markets. Actual results may differ materially from those set forth in projections. Forward-looking statements are not predictions and may be subject to change without notice. ICICI Securities or its associates might have managed or co-managed public offering of securities for the subject company or might have been mandated by the subject company for any other assignment in the past twelve months. ICICI Securities or its associates might have received any compensation from the companies mentioned in the report during the period preceding twelve months from the date of this report for services in respect of managing or co-managing public offerings, corporate finance, investment banking or merchant banking, brokerage services or other advisory service in a merger or specific transaction. ICICI Securities or its associates might have received any compensation for products or services other than investment banking or merchant banking or brokerage services from the companies mentioned in the report in the past twelve months. ICICI Securities encourages independence in research report preparation and strives to minimize conflict in preparation of research report. ICICI Securities or its analysts did not receive any compensation or other benefits from the companies mentioned in the report or third party in connection with preparation of the research report. Accordingly, neither ICICI Securities nor Research Analysts have any material conflict of interest at the time of publication of this report. It is confirmed that Sanjay Manyal, MBA (Finance) and Parineeta Rajgarhia, MBA (Finance), Research Analysts of this report have not received any compensation from the companies mentioned in the report in the preceding twelve months. Compensation of our Research Analysts is not based on any specific merchant banking, investment banking or brokerage service transactions. ICICI Securities or its subsidiaries collectively or Research Analysts do not own 1% or more of the equity securities of the Company mentioned in the report as of the last day of the month preceding the publication of the research report. Since associates of ICICI Securities are engaged in various financial service businesses, they might have financial interests or beneficial ownership in various companies including the subject company/companies mentioned in this report. It is confirmed that Sanjay Manyal, MBA (Finance) and Parineeta Rajgarhia, MBA (Finance), Research Analysts do not serve as an officer, director or employee of the companies mentioned in the report. ICICI Securities may have issued other reports that are inconsistent with and reach different conclusion from the information presented in this report. Neither the Research Analysts nor ICICI Securities have been engaged in market making activity for the companies mentioned in the report. We submit that no material disciplinary action has been taken on ICICI Securities by any Regulatory Authority impacting Equity Research Analysis activities. This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction, where such distribution, publication, availability or use would be contrary to law, regulation or which would subject ICICI Securities and affiliates to any registration or licensing requirement within such jurisdiction. The securities described herein may or may not be eligible for sale in all jurisdictions or to certain category of investors. Persons in whose possession this document may come are required to inform themselves of and to observe such restriction. ICICI Securities Ltd | Retail Equity Research Page 10

© Copyright 2026