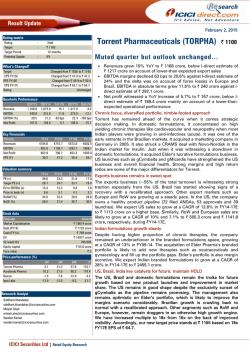

Torrent Pharmaceuticals_Q3FY15 First Cut Analysis

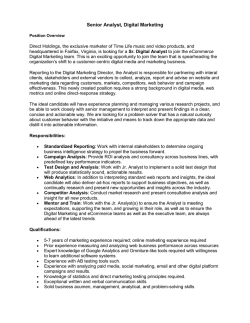

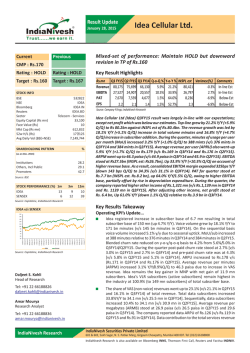

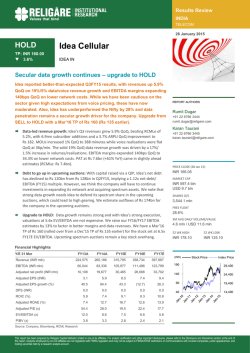

First Cut Analysis January 29, 2015 Torrent Pharmaceuticals Ltd. Previous A subdued performance impacted by relatively lower sales growth and higher interest outgo Rating : HOLD Rating : HOLD Target : Rs.1,010 Target : Rs.1,010 Torrent Pharmaceuticals (TRP IN) reported below-expectation PAT at Rs1.67bn, led by y-y sales de-growth in Europe and higher interest cost. EBITDA margin improved by 53bps y-y to 19.7%, despite gross margin remaining stable for the quarter on y-y basis. At CMP of Rs1,209, the stock trades at 22.5x FY15E EPS of Rs53.6 and 21.5x FY16E EPS of Rs56. We have HOLD rating with PT of Rs1,010, based on 18x FY16 earnings. We will review our estimates, PT and rating post concall scheduled today at 5pm. Current CMP : Rs.1,209 Rs.mn Revenue EBIDTA Adjusted PAT PAT Q3FY15 11,560 2,280 Q3FY14 9,900 1,900 Q2FY15 12,030 2,590 Y-O-Y % 16.8 20.0 Q-o-Q % (3.9) (12.0) INSPL Est Variance(%) 12,962 (10.8) 2,845 (19.9) 1,670 1,580 1,980 5.7 (15.7) 2,045 (18.3) 1,670 1,580 1,980 5.7 (15.7) 2,045 (18.3) Source: IndiaNivesh Research Domestic formulation and US sales drive overall sales growth for the quarter: TRP’s sales came in at Rs11.6bn, up 16.8% y-y, led by addition of Elder portfolio, decent growth in remaining domestic formulation (DF) segment. Excluding Elder portfolio, the DF sales grew by 15% y-y. Even the Elder portfolio grew at healthy rate of 15% y-y compared to market contraction of 5% on rolling quarter basis. There has been moderate growth of 14% y-y in US sales to US$27mn. The y-y growth has been on downtrend for third consecutive quarter now. This has been mainly due to lack of potential approvals and high base of past quarters. Europe sales declined by 9% to Rs2.3bn. Brazil sales grew at modest rate of 6% to Rs1.6bn. After two consecutive quarters of strong y-y growth in Brazil, the y-y growth dipped in Q3FY15, mainly due to currency fluctuations. In constant currency terms, Brazil sales grew by 19% on y-y basis for the quarter. ROW sales at Rs1.1bn grew by 12% y-y for the quarter. Though sales up 16.8% y-y, PAT is up only 5.7% y-y: Gross margin at 67.8% was stable y-y and down 51bps q-q. The sequential drop in gross margin is due to increased competition in few products in US market. However, EBITDA margin grew by 53 bps y-y to 19.7% y-y. This is mainly due to improved productivity resulting in employee cost as % of sales reducing from 18.1% to 17.2% for the quarter. The improvement in EBITDA margin and higher other income was offset by higher depreciation and higher interest cost. This resulted in moderate growth of 5.7% y-y in adjusted PAT to Rs1.7bn. Daljeet S. Kohli Head of Research Tel: +91 22 66188826 [email protected] Tushar Manudhane Research Analyst Tel: +91 22 66188835 [email protected] IndiaNivesh Research Inorganic growth on cards: Board of TRP has decided to obtain enabling approval from shareholders for issue of equity shares including convertible bonds or debentures through qualified institutional placement (QIP) or depository receipt or any other mode for amount not exceeding Rs30bn. Board has decided to obtain approval for private placement of unsecured/secured redeemable non-convertible debentures/bonds for amount not exceeding Rs75bn, subject to overall borrowing not exceeding Rs100bn. Raising maximum amount of Rs30bn as equity would have dilution of equity to the extent of 15% on pre-dilution outstanding equity shares. The amount of money to be raised indicates acquisition in medium term. We would give more details post clarification in the concall scheduled today. Valuation: At CMP of Rs1,209, the stock trades at 22.5x FY15E EPS of Rs53.6 and 21.5x FY16E EPS of Rs56. We will review our estimates, PT and rating post concall scheduled today at 5pm. We have HOLD rating with PT of Rs1,010, based on 18x FY16 earnings. IndiaNivesh Securities Private Limited 601 & 602, Sukh Sagar, N. S. Patkar Marg, Girgaum Chowpatty, Mumbai 400 007. Tel: (022) 66188800 IndiaNivesh Research is also available on Bloomberg INNS, Thomson First Call, Reuters and Factiva INDNIV. First Cut Analysis (contd...) Quarterly financial summary Rs mn Net Sales Other operating income Consumption of raw material Employee Cost Manufacturing & Other Expenditure Operating Expenses EBITDA Other income Depreciation and Amortization EBIT Net Interest Expenses Profit Before Tax Tax Net Profit After Tax Minority Interest Adj. PAT Adj. EPS (Rs) EO items Reported PAT Rep. EPS (Rs) Q3FY15 11,560 120 3,720 1,990 3,570 9,280 2,280 650 540 2,510 500 2,010 340 1,670 1,670 9.9 1,670 9.9 Q3FY14 9,900 250 3,180 1,790 3,030 8,000 1,900 100 210 2,040 160 1,880 300 1,580 1,580 9.3 1,580 9.3 Y-y (%) 16.8 (52.0) 17.0 11.2 17.8 16.0 20.0 550.0 157.1 23.0 212.5 6.9 13.3 5.7 NA 5.7 5.7 5.7 5.7 Q2FY15 12,030 140 3,810 2,240 3,390 9,440 2,590 720 560 2,890 540 2,350 370 1,980 1,980 11.7 1,980 11.7 Q-q (%) (3.9) (14.3) (2.4) (11.2) 5.3 (1.7) (12.0) (9.7) (3.6) (13.1) (7.4) (14.5) (8.1) (15.7) NA (15.7) (15.7) (15.7) (15.7) 9MFY15 9MFY14 34,510 28,290 480 1,300 10,540 9,230 6,070 5,330 9,800 9,010 26,410 23,570 8,100 4,720 1,860 640 1,310 640 9,130 6,020 1,280 390 7,850 5,630 1,640 1,070 6,210 4,560 6,210 4,560 36.7 26.9 (360.0) 6,210 4,200 36.7 24.8 Y-y (%) 22.0 (63.1) 14.2 13.9 8.8 12.0 71.6 190.6 104.7 51.7 228.2 39.4 53.3 36.2 NA 36.2 36.2 47.9 47.9 Key ratios Ratios Adj Gross Margins Adj EBITDA margin Net Margin Material cost/Net Sales Employee Cost/ Net Sales Other Expenditure/ Net Slaes Tax Rate 67.8 19.7 14.3 32.2 17.2 30.9 16.9 67.9 19.2 15.6 32.1 18.1 30.6 16.0 (6) 53 (127) 6 (87) 28 96 68.3 21.5 16.3 31.7 18.6 28.2 15.7 (51) (181) (197) 51 (141) 270 117 69.5 23.5 17.7 30.5 17.6 28.4 20.9 67.4 16.7 15.4 32.6 18.8 31.8 19.0 208 679 234 (208) (125) (345) 189 Sales breakdown ( Rs Mn) Q3FY15 Q3FY14 Y-y (%) Q2FY15 Q-q (%) 9MFY15 9MFY14 Y-y (%) Branded business 4,203 881 5,084 1,558 1,717 2,257 1,064 11,680 2,960 760 3,720 1,470 1,480 2,480 1,000 10,150 42.0 15.9 36.7 6.0 16.0 (9.0) 6.4 15.1 4,420 980 5,440 1,600 1,670 2,480 980 12,170 (4.9) (10.1) (6.5) (2.6) 2.8 (9.0) 8.6 (4.0) 12,143 2,121 14,314 4,648 6,077 7,037 2,914 34,990 9,050 2,430 11,510 4,050 3,760 6,790 3,470 29,580 34.2 (12.7) 24.4 14.8 61.6 3.6 (16.0) 18.3 Contract Manufacture Total Domestic Sales Brazil USA Europe ROW Net Sales Source: Company Filings; IndiaNivesh Research IndiaNivesh Research Torrent Pharmaceuticals Ltd|First Cut Analysis January 29, 2015| 2 First Cut Analysis (contd...) Financial Summary Profit & Loss Y E March (Rs m) Net sales Growth % Other Operating Income Total sales Expenditure Raw Material Employee cost Other expenses EBITDA Growth % EBITDA Margin % Depreciation EBIT EBIT Margin % Other Income Interest PBT Tax Effective tax rate % Extraordinary items Minority Interest Adjusted PAT Growth% PAT margin % Reported PAT Growth% Balance sheet FY12 FY13 FY14 FY15E FY16E 25,944 22.3% 1,015 26,959 30,540 17.7% 1,580 32,120 40,360 32.2% 1,480 41,840 49,334 22.2% 1,562 50,896 57,643 16.8% 1,722 59,365 9,260 12,430 6,230 7,410 9,700 12,480 6,930 9,520 38.4% 37.4% 22.7% 23.6% 830 870 6,100 8,650 20.0% 21.4% 430 380 340 590 6,190 8,440 1,470 1,800 23.7% 21.3% (370) (20) 4,700 6,640 34.5% 41.3% 15.4% 16.5% 4,330 6,640 52.4% 53.3% 14,677 9,425 14,251 12,543 31.8% 25.4% 1,030 11,513 23.3% 1,810 1,788 11,535 2,457 21.3% 9,078 36.7% 18.4% 9,078 36.7% 18,302 11,040 16,401 13,622 8.6% 23.6% 1,125 12,497 21.7% 1,000 1,474 12,023 2,525 21.0% 9,498 4.6% 16.5% 9,498 4.6% 8,631 5,337 7,984 5,007 22.4% 19.3% 817 4,189 16.1% 445 395 4,240 723 17.1% (654) (23) 3,494 29.3% 13.5% 2,840 5.1% Y E March (Rs m) FY12 FY13 FY14 FY15E FY16E Share Capital Reserves & Surplus Net Worth Minority Interest 423 11,803 12,226 40 423 13,796 14,219 4 846 18,178 19,024 4 846 25,562 26,409 4 846 33,081 33,927 4 Secured Loans Unsecured Loans Total debt Net defered tax liability Total Liabilities 3,220 2,520 5,740 510 18,516 5,474 1,587 7,061 258 21,542 8,890 19,890 17,890 2,464 2,464 2,464 11,354 22,354 20,354 (182) (182) (182) 30,201 48,586 54,104 Gross Block Less: Depreciation Net Block Capital Work in Progress Investments Current Assets Inventories Sundry Debtors Cash & Bank Balance Other Current Assets Loans & advances 12,650 4,105 9,160 1,070 666 12,955 4,757 8,198 3,273 844 14,200 5,447 8,753 6,177 2,464 37,654 6,477 31,177 6,177 2,464 41,689 7,602 34,087 6,177 2,464 5,320 5,230 7,610 1,150 560 19,870 9,239 6,878 6,270 1,859 968 25,213 10,060 10,994 7,694 2,590 1,209 32,547 14,192 11,083 3,819 2,590 1,216 32,901 16,582 12,950 5,934 2,590 1,421 39,477 11,550 700 12,250 7,620 18,516 12,266 3,720 15,986 9,227 21,542 16,202 3,538 19,740 12,807 30,201 20,595 3,538 24,133 8,768 48,586 24,564 3,538 28,102 11,376 54,104 FY12 16.8 21.6 4.3 72.2 FY13 25.6 30.5 11.5 84.0 FY14 39.2 44.4 10.0 112.4 FY15E 53.6 59.7 8.6 156.0 FY16E 56.1 62.8 10.0 200.5 ROCE ROE 12.6% 23.2% 13.4% 30.5% 16.9% 34.9% 14.1% 34.4% 14.3% 28.0% EBITDA Margin % Net Margin % 19.3% 13.5% 22.7% 15.4% 23.6% 16.5% 25.4% 18.4% 23.6% 16.5% PER (x) P/BV (x) P/CEPS (x) EV/EBITDA (x) Dividend Payout (%) 72.04 16.7 55.9 40.5 23.6 47.25 14.4 39.7 29.64 45.6 30.81 10.8 27.2 21.88 27.0 22.54 7.7 20.2 17.79 20.0 21.54 6.0 19.3 16.08 20.0 7.9 (0.2) (0.4) 6.7 0.1 0.1 5.1 0.2 0.4 4.1 0.7 1.5 3.5 0.4 1.1 Current Liabilities & provisions Current Liabilities Provisions Net Current Assets Total assets Key ratios Cash Flow Y E March (Rs m) PBT Depreciation Interest Other non cash charges Changes in working capital Tax Cash flow fromoperations Capital expenditure Free Cash Flow Other income Investments Cash flow from investments Equity capital raised Loans availed or (repaid) Interest paid Dividend paid (incl tax) Cash flow from Financing Net change in cash Cash at the beginning of the year Foreign currency exchange impact Cash at the end of the year FY12 3,586 817 66 (87) 1,436 (827) 4,991 (1,613) 3,378 305 (62) (1,370) (248) (307) (1,373) (1,927) 1,694 6,048 (134) 7,610 FY13 5,820 827 430 (4,218) (1,325) 1,535 (2,929) (1,394) 425 87 (2,417) 1,343 (312) (834) 197 (685) 7,608 (49) 6,270 FY14 8,440 870 312 186 (1,197) (2,617) 5,994 (4,001) 1,994 337 106 (3,558) 4,149 (610) (2,674) 865 3,301 6,270 (624) 7,694 FY15E FY16E 9,679 12,023 1,030 1,125 1,788 1,474 164 (493) (2,457) (2,525) 10,204 11,604 (3,453) (4,035) 6,751 7,569 (20,000) (23,453) (4,035) 11,000 (2,000) (1,788) (1,474) (1,693) (1,980) 7,518 (5,454) (5,731) 2,115 9,550 3,819 3,819 5,934 Y E March EPS (Rs) Cash EPS (Rs) DPS (Rs) BVPS m cap/sales (x) net debt/equity (x) net debt/ebitda (x) Source: Company Filings; IndiaNivesh Research IndiaNivesh Research Torrent Pharmaceuticals Ltd|First Cut Analysis January 29, 2015| 3 First Cut Analysis (contd...) Disclaimer: This document has been prepared by IndiaNivesh Securities Private Limited (“INSPL”), for use by the recipient as information only and is not for circulation or public distribution. INSPL includes subsidiaries, group and associate companies, promoters, employees and affiliates. INSPL researches, aggregates and faithfully reproduces information available in public domain and other sources, considered to be reliable and makes them available for the recipient, though its accuracy or completeness has not been verified by INSPL independently and cannot be guaranteed. The third party research material included in this document does not represent the views of INSPL and/or its officers, employees and the recipient must exercise independent judgement with regard to such content. This document has been published in accordance with the provisions of Regulation 18 of the Securities and Exchange Board of India (Research Analysts) Regulations, 2014. This document is not to be altered, transmitted, reproduced, copied, redistributed, uploaded or published or made available to others, in any form, in whole or in part, for any purpose without prior written permission from INSPL. This document is solely for information purpose and should not to be construed as an offer to sell or the solicitation of an offer to buy any security. Recipients of this document should be aware that past performance is not necessarily a guide for future performance and price and value of investments can go up or down. The suitability or otherwise of any investments will depend upon the recipients particular circumstances. INSPL does not take responsibility thereof. The research analysts of INSPL have adhered to the code of conduct under Regulation 24 (2) of the Securities and Exchange Board of India (Research Analysts) Regulations, 2014. This document is based on technical and derivative analysis center on studying charts of a stock’s price movement, outstanding positions and trading volume, as opposed to focusing on a company’s fundamentals and, as such, may not match with a report on a company’s fundamentals. Nothing in this document constitutes investment, legal, accounting and/or tax advice or a representation that any investment or strategy is suitable or appropriate to recipients’ specific circumstances. INSPL does not accept any responsibility or whatever nature for the information, assurances, statements and opinion given, made available or expressed herein or for any omission or for any liability arising from the use of this document. Opinions expressed are our current opinions as of the date appearing on this document only. The opinions are subject to change without any notice. INSPL directors/employees and its clients may have holdings in the stocks mentioned in the document. This report is based / focused on fundamentals of the Company and forward-looking statements as such, may not match with a report on a company’s technical analysis report Each of the analysts named below hereby certifies that, with respect to each subject company and its securities for which the analyst is responsible in this report, (1) all of the views expressed in this report accurately reflect his or her personal views about the subject companies and securities, and (2) no part of his or her compensation was, is, or will be, directly or indirectly, related to the specific recommendations or views expressed in this report: Daljeet S Kohli, Amar Maurya, Abhishek Jain, Yogesh Hotwani, Prerna Jhunjhunwala, Kaushal Patel, Rahul Koli, Tushar Manudhane & Dharmesh Kant. Following table contains the disclosure of interest in order to adhere to utmost transparency in the matter: Disclosure of Interest Statement 1. Details of business activity of IndiaNivesh Securities Private Limited (INSPL) INSPL is a Stock Broker registered with BSE, NSE and MCX - SX in all the major segments viz. Cash, F & O and CDS segments. INSPL is also a Depository Participant and registered with both Depository viz. CDSL and NSDL. Further, INSPL is a Registered Portfolio Manager and is registered with SEBI. 2. Details of Disciplinary History of INSPL No disciplinary action is / was running / initiated against INSPL 3. Details of Associates of INSPL Please refer to the important 'Stock Holding Disclosure' report on the IndiaNivesh website (investment Research Section - http://www.indianivesh.in/Research/Holding_Disclosure.aspx?id=10- link). Also, please refer to the latest update on respective stocks for the disclosure status in respect of those stocks. INSPL and its affiliates may have investment positions in the stocks recommended in this report. 4. Research analyst or INSPL or its relatives'/associates' financial interest in the subject No (except to the extent of shares held by Research analyst or INSPL or its relatives'/associates') company and nature of such financial interest 5. Research analyst or INSPL or its relatives'/associates' actual/beneficial ownership of 1% or more Please refer to the important 'Stock Holding Disclosure' report on the IndiaNivesh website (investment in securities of the subject company, at the end of the month immediately preceding the date Research Section - http://www.indianivesh.in/Research/Holding_Disclosure.aspx?id=10- link). of publication of the document. Also, please refer to the latest update on respective stocks for the disclosure status in respect of those stocks. INSPL and its affiliates may have investment positions in the stocks recommended in this report. 6. Research analyst or INSPL or its relatives'/associates' any other material conflict of interest at the time of publication of the document No 7. Has research analyst or INSPL or its associates received any compensation from the subject company in the past 12 months No 8. Has research analyst or INSPL or its associates managed or co-managed public offering of securities for the subject company in the past 12 months No 9. Has research analyst or INSPL or its associates received any compensation for investment banking or merchant banking or brokerage services from the subject company in the past 12 months No 10. Has research analyst or INSPL or its associates received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past 12 months No 11. Has research analyst or INSPL or its associates received any compensation or other benefits from the subject company or third party in connection with the document. No 12. Has research analyst served as an officer, director or employee of the subject company No 13. Has research analyst or INSPL engaged in market making activity for the subject company No 14. Other disclosures No INSPL, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this document are those of the analyst, and the company may or may not subscribe to all the views expressed within. This information is subject to change, as per applicable law, without any prior notice. INSPL reserves the right to make modifications and alternations to this statement, as may be required, from time to time. Definitions of ratings BUY. We expect this stock to deliver more than 15% returns over the next 12 months. HOLD. We expect this stock to deliver -15% to +15% returns over the next 12 months. SELL. We expect this stock to deliver <-15% returns over the next 12 months. Our target prices are on a 12-month horizon basis. Other definitions NR = Not Rated. The investment rating and target price, if any, have been arrived at due to certain circumstances not in control of INSPL CS = Coverage Suspended. INSPL has suspended coverage of this company. UR=Under Review. Such e invest review happens when any developments have already occurred or likely to occur in target company & INSPL analyst is waiting for some more information to draw conclusion on rating/target. NA = Not Available or Not Applicable. The information is not available for display or is not applicable. NM = Not Meaningful. The information is not meaningful and is therefore excluded. Research Analyst has not served as an officer, director or employee of Subject Company One year Price history of the daily closing price of the securities covered in this note is available at www.nseindia.com and www.economictimes.indiatimes.com/markets/stocks/stock-quotes. (Choose name of company in the list browse companies and select 1 year in icon YTD in the price chart) IndiaNivesh Securities Private Limited 601 & 602, Sukh Sagar, N. S. Patkar Marg, Girgaum Chowpatty, Mumbai 400 007. Tel: (022) 66188800 / Fax: (022) 66188899 e-mail: [email protected] | Website: www.indianivesh.in Home IndiaNivesh Research Torrent Pharmaceuticals Ltd|First Cut Analysis January 29, 2015| 4 IndiaNivesh Research is also available on Bloomberg INNS, Thomson First Call, Reuters and Factiva INDNIV.

© Copyright 2026