Coal India (COALIN)

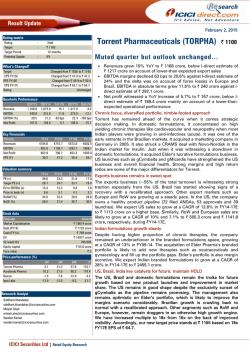

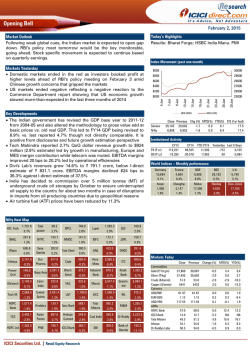

Offer for Sale Note January 29, 2015 Rating matrix Coal India (COALIN) Rating : Floor Price | 358 Subscribe Maharatna available at fair valuation… Issue Details Auction Date Issue Size January 30, 2015 | 22613 crore* No of Shares on offer 63.16 crore * Fresh Issue Nil *Based on floor price, considering 10% equity stake sale Objects of the Issue Objects of the Issue It is an offer for sale wherein the entire proceeds will go to the promoters of the company ie GoI by way of disinvestment and no proceeds shall go to the company Shareholding Pattern Pre -Issue Post - Issue# No Of Shares (in Crore) 631.6 631.6 Promoters(%) 89.65 79.65 10.35 20.35 Non-Promoter (%) #Considering 10% equity stake sale Stock Data Particular Market Capitalization Total Debt (FY14) Amount | 236863.7 Crore | 171.5 Crore Cash and Investments (FY14) EV 52 week H/L Equity capital | 52389.5 Crore | 184645.6 Crore 424 / 238 | 6316.4 Crore Face value | 10 Research Analyst Dewang Sanghavi [email protected] Isha Bansal [email protected] ICICI Securities Ltd | Retail Equity Research The Government of India (GoI) has launched an offer for sale (OFS) of 31.58 crore equity shares (5% stake) of Coal India (CIL) with an option to sell an additional 31.58 crore equity shares (5% stake) collectively aggregating to approximately 10% of the total paid-up equity share capital of the company. Retail investors will be allocated shares at a discount of 5%. Government’s thrust on augmenting output augurs well for company One of the key thrust areas of the new government has been on augmenting domestic coal production to ease the crippling fuel scarcity in the power sector. The Coal Ministry has highlighted CIL’s production target at 1 billion tonnes by FY20 from the current level of 462 MT in FY14. Though the government’s target is significantly optimistic and aggressive, it reinforces its strong focus on enhancing CIL’s production. We believe it is too early to model such aggressive assumptions. However, easing of norms and simultaneous removal of offtake bottlenecks could help realise the full potential performance of CIL. Furthermore, most of the production growth is likely to be back-ended as projects get implemented. Healthy volume growth in Q3FY15 reiterates positive stance Over the last couple of years, coal production at CIL has been sluggish with FY13 and FY14 coal production growth at 3.7% and 2.3%, respectively. However, with the increased thrust of the new government on augmenting coal production, CIL was able to report healthy growth in production volumes in the current fiscal year. In Q3FY15, CIL reported double digit growth in its production volume, reiterating our positive stance on the company. During Q3FY15, CIL’s production volume stood at 131.7 MT, up 10.9% YoY. Sales volume in Q3FY15 was healthy at 124.6 MT, up 6.3% YoY. During April-December 2014, CIL’s production and offtake stood at 342.4 million tonnes (MT) and 354.6 MT, respectively, up 7.3% and 3.8%, respectively, YoY. Margins likely to increase, going forward We believe Coal India will be a key beneficiary of declining diesel cost. Hence, we expect EBITDA margins to improve, going forward, from ~19.0% reported in H1FY15 to ~22.5% in FY15E and ~22.1% in FY16E. Furthermore, CIL is also likely to enjoy economies of scale on account of increase in volumes. Going forward, on the back of strong demand from key user industries, we also expect domestic prices to remain firm with an upward bias. Long term growth story intact, recommend subscribe CIL has a strong balance sheet with robust cash flows and a healthy liquidity position. At floor prices of | 358, the stock is quoting at FY16E adjusted EV/EBITDA of 7.0x. We remain positive on the long term prospects of the company. With a stable government in place at the Centre, we believe the stock will be a key beneficiary of reforms in the sector. Going forward, CIL is well poised to deliver a healthy performance and is a priced asset worth holding in one’s portfolio. We recommend SUBSCRIBE on the stock in the OFS. Operational Highlights Exhibit 1: Coal sales volume & realisations trend 1463 1500 1452 1400 1183 1200 400 1000 300 200 1600 423 464 433 525 498 472 800 600 | per tonne million tonne (MT) 500 1472 1441 600 400 100 200 0 0 FY11 FY12 FY13 Sales FY14 FY15E FY16E Blended Realizations Source: Company, ICICIdirect.com Research 26.5 22.1 23.2 22.5 30 25 20 15,963 16,571 17,382 10 FY12 FY13 FY14 FY15E FY16E EBITDA EBITDA Margin 5 (5) % 15 | per tonne 25.1 18,084 18,500 18,000 17,500 17,000 16,500 16,000 15,500 15,000 14,500 14,000 Exhibit 3: … corresponding EBITDA/tonne 15,668 | crore Exhibit 2: EBITDA margins trend 1600 1400 1200 1000 800 600 400 200 0 1443 1472 1463 1452 1500 317 362 389 339 333 335 FY11 FY12 FY13 FY14 FY15E FY16E 1187 Realization EBITDA/tonne Source: Company, ICICIdirect.com Research Source: Company, ICICIdirect.com Research ICICI Securities Ltd | Retail Equity Research Page 2 Financial Summary Profit & Loss Account Cash flow statement [ (Year-end March) Net Sales Other Operating Income Total Operating Income Growth (%) Raw Materials Consumed Employee Expenses Contractual Expenses Overburden removal adjustment Power & Fuel Others Total Operating Expenditure EBITDA Growth (%) Depreciation Interest Other Income Exceptional Item PBT Total Tax PAT Growth (%) Adj EPS (|) FY13 68302.7 68302.7 9.4 6,556.0 27,320.8 5,802.0 3,201.7 2,333.5 5,005.1 50219.1 18083.6 15.4 1813.0 45.2 8746.7 -6.9 24979.0 7622.7 17356.4 17.4 27.5 FY14 68810.0 68810.0 0.7 7,114.7 27,769.4 6,827.5 3,286.6 2,282.2 5,566.4 52846.9 15963.2 (11.7) 1996.4 58.0 8969.3 -1.4 22879.5 7767.9 15111.6 -12.9 23.9 FY15E 73704.1 73704.1 7.1 9,308.0 29,852.1 7,450.0 2,755.3 2,344.7 5,423.4 57133.5 16570.6 3.8 2115.3 4.4 8080.5 (20.6) 22552.0 7592.9 14959.1 -1.0 23.7 (Year-end March) Profit after Tax Add: Depreciation Add: Interest (Inc)/dec in Current Assets Inc/(dec) in CL and Prov. CF from operating activities (Inc)/dec in Investments (Inc)/dec in Fixed Assets Others CF from investing activities Issue/(Buy back) of Equity Inc/(dec) in loan funds Interest Paid Dividend paid & dividend tax Others CF from financing activities Net Cash flow Opening Cash Closing Cash FY16E 78750.6 78750.6 6.8 8,660.5 32,091.0 8,398.1 3,096.8 2,624.4 6,498.0 61368.9 17381.8 4.9 2325.5 4.8 11188.6 26240.1 8659.2 17580.8 17.5 27.8 FY13 17356.4 1813.0 45.2 -8492.4 5878.6 16600.7 -413.6 -2430.4 -722.1 -3566.0 0.0 381.7 -45.2 -10166.1 828.7 -9000.9 4033.8 58202.8 62236.6 FY14 15111.6 1996.4 58.0 10710.9 -9517.2 18359.6 -1237.3 -4278.0 283.3 -5232.1 0.0 -1737.6 -58.0 -21156.6 -22.4 -22974.7 -9847.1 62236.6 52389.5 FY15E 14959.1 2115.3 4.4 -21864.8 25917.1 21131.2 -100.0 -3500.0 0.0 -3600.0 0.0 0.0 -4.4 -8868.2 10.4 -8862.1 8669.0 52389.5 61058.5 FY16E 17580.8 2325.5 4.8 16018.0 -3658.6 32270.5 -100.0 -4000.0 0.0 -4100.0 0.0 0.0 -4.8 -8868.2 0.0 -8873.0 19297.5 61058.5 80356.0 [ Source: Company, ICICIdirect.com Research Source: Company, ICICIdirect.com Research [ Balance sheet (Year-end March) Liabilities Equity Share Capital Reserve and Surplus Total Shareholders funds Total Debt Minority Interest & Others Total Liabilities Assets Gross Block Less: Acc Depreciation Net Block CWIP Investments Inventory Debtors Loans and Advances Other Current Assets Cash Total Current Assets Current Liabilities Provisions Current Liabilities & Prov Net Current Assets others Application of Funds Ratio Analysis FY13 FY14 FY15E FY16E 6,316.4 42,155.6 48472.0 1909.1 2369.5 52750.6 6,316.4 36,088.1 42404.5 171.5 2369.5 44945.5 6,316.4 42,189.5 48505.9 171.5 2369.5 51046.8 6,316.4 50,902.1 57218.5 171.5 2369.5 59759.5 39010.0 25544.9 13465.1 3496.0 2395.0 5617.8 10480.2 17370.1 4248.9 62236.6 99953.7 17222.9 51591.3 68814.2 31139.5 2255.0 52750.6 39010.0 27398.8 11611.3 7631.4 3632.3 5558.1 8241.0 7769.6 5437.5 52389.5 79395.7 18883.1 40413.9 59296.9 20098.7 1971.7 44945.5 41510.0 29514.1 11995.9 8631.4 3732.3 6557.7 9086.8 28640.3 4586.2 61058.5 109929.5 20192.9 65021.2 85214.1 24715.4 1971.7 51046.8 47010.0 31839.6 15170.4 7131.4 3832.3 8976.7 8198.7 9475.0 6202.6 80356.0 113209.1 19418.0 62137.5 81555.4 31653.6 1971.7 59759.5 (Year-end March) Per share data (|) Adj EPS Cash EPS BV DPS Cash Per Share Operating Ratios (%) EBITDA Margin PBT / Total Operating income PAT Margin Inventory days Debtor days Creditor days Return Ratios (%) Adj RoE Adj RoCE RoA Valuation Ratios (x) P/E EV / EBITDA EV / Net Sales Market Cap / Sales Price to Book Value Solvency Ratios Debt/EBITDA Debt / Equity Current Ratio Quick Ratio [ Source: Company, ICICIdirect.com Research FY13 FY14 FY15E FY16E 27.5 30.3 76.7 14.0 98.5 23.9 27.1 67.1 29.0 82.9 23.7 27.0 76.8 12.0 96.7 27.8 31.5 90.6 12.0 127.2 26.5 36.6 25.4 31 56 92 23.2 33.3 22.0 30 44 100 22.5 30.6 20.3 30 45 100 22.1 33.3 22.3 36 38 90 35.8 32.3 32.9 35.6 32.8 33.6 30.8 29.7 29.3 30.7 26.2 29.4 12.7 8.9 2.4 3.2 4.6 14.6 10.6 2.5 3.2 5.2 14.8 9.7 2.2 3.0 4.6 12.6 8.1 1.8 2.8 3.9 0.1 0.0 1.5 1.4 0.0 0.0 1.3 1.2 0.0 0.0 1.3 1.2 0.0 0.0 1.4 1.3 [ Source: Company, ICICIdirect.com Research ICICI Securities Ltd | Retail Equity Research Page 3 RATING RATIONALE ICICIdirect.com endeavours to provide objective opinions and recommendations. ICICIdirect.com assigns ratings to its stocks according to their notional target price vs. current market price and then categorises them as Strong Buy, Buy, Hold and Sell. The performance horizon is two years unless specified and the notional target price is defined as the analysts' valuation for a stock. Strong Buy: >15%/20% for large caps/midcaps, respectively, with high conviction; Buy: >10%/15% for large caps/midcaps, respectively; Hold: Up to +/-10%; Sell: -10% or more; Pankaj Pandey Head – Research [email protected] ICICIdirect.com Research Desk, ICICI Securities Limited, 1st Floor, Akruti Trade Centre, Road No 7, MIDC, Andheri (East) Mumbai – 400 093 [email protected] ICICI Securities Ltd | Retail Equity Research Page 4 Disclaimer ANALYST CERTIFICATION We /I, Dewang Sanghavi, MBA (FIN) and Isha Bansal, MBA (FIN) research analysts, authors and the names subscribed to this report, hereby certify that all of the views expressed in this research report accurately reflect our views about the subject issuer(s) or securities. We also certify that no part of our compensation was, is, or will be directly or indirectly related to the specific recommendation(s) or view(s) in this report. Terms & conditions and other disclosures: ICICI Securities Limited (ICICI Securities) is a full-service, integrated investment banking and is, inter alia, engaged in the business of stock brokering and distribution of financial products. ICICI Securities is a wholly-owned subsidiary of ICICI Bank which is India’s largest private sector bank and has its various subsidiaries engaged in businesses of housing finance, asset management, life insurance, general insurance, venture capital fund management, etc. (“associates”), the details in respect of which are available on www.icicibank.com. ICICI Securities is one of the leading merchant bankers/ underwriters of securities and participate in virtually all securities trading markets in India. We and our associates might have investment banking and other business relationship with a significant percentage of companies covered by our Investment Research Department. ICICI Securities generally prohibits its analysts, persons reporting to analysts and their relatives from maintaining a financial interest in the securities or derivatives of any companies that the analysts cover. The information and opinions in this report have been prepared by ICICI Securities and are subject to change without any notice. The report and information contained herein is strictly confidential and meant solely for the selected recipient and may not be altered in any way, transmitted to, copied or distributed, in part or in whole, to any other person or to the media or reproduced in any form, without prior written consent of ICICI Securities. While we would endeavour to update the information herein on a reasonable basis, ICICI Securities is under no obligation to update or keep the information current. Also, there may be regulatory, compliance or other reasons that may prevent ICICI Securities from doing so. Non-rated securities indicate that rating on a particular security has been suspended temporarily and such suspension is in compliance with applicable regulations and/or ICICI Securities policies, in circumstances where ICICI Securities might be acting in an advisory capacity to this company, or in certain other circumstances. This report is based on information obtained from public sources and sources believed to be reliable, but no independent verification has been made nor is its accuracy or completeness guaranteed. This report and information herein is solely for informational purpose and shall not be used or considered as an offer document or solicitation of offer to buy or sell or subscribe for securities or other financial instruments. Though disseminated to all the customers simultaneously, not all customers may receive this report at the same time. ICICI Securities will not treat recipients as customers by virtue of their receiving this report. Nothing in this report constitutes investment, legal, accounting and tax advice or a representation that any investment or strategy is suitable or appropriate to your specific circumstances. The securities discussed and opinions expressed in this report may not be suitable for all investors, who must make their own investment decisions, based on their own investment objectives, financial positions and needs of specific recipient. This may not be taken in substitution for the exercise of independent judgment by any recipient. The recipient should independently evaluate the investment risks. The value and return on investment may vary because of changes in interest rates, foreign exchange rates or any other reason. ICICI Securities accepts no liabilities whatsoever for any loss or damage of any kind arising out of the use of this report. Past performance is not necessarily a guide to future performance. Investors are advised to see Risk Disclosure Document to understand the risks associated before investing in the securities markets. Actual results may differ materially from those set forth in projections. Forward-looking statements are not predictions and may be subject to change without notice. ICICI Securities or its associates might have managed or co-managed public offering of securities for the subject company or might have been mandated by the subject company for any other assignment in the past twelve months. ICICI Securities or its associates might have received any compensation from the companies mentioned in the report during the period preceding twelve months from the date of this report for services in respect of managing or co-managing public offerings, corporate finance, investment banking or merchant banking, brokerage services or other advisory service in a merger or specific transaction. ICICI Securities or its associates might have received any compensation for products or services other than investment banking or merchant banking or brokerage services from the companies mentioned in the report in the past twelve months. ICICI Securities encourages independence in research report preparation and strives to minimize conflict in preparation of research report. ICICI Securities or its analysts did not receive any compensation or other benefits from the companies mentioned in the report or third party in connection with preparation of the research report. Accordingly, neither ICICI Securities nor Research Analysts have any material conflict of interest at the time of publication of this report. It is confirmed that Dewang Sanghavi, MBA (FIN) and Isha Bansal, MBA (FIN), research analysts of this report have not received any compensation from the companies mentioned in the report in the preceding twelve months. Compensation of our Research Analysts is not based on any specific merchant banking, investment banking or brokerage service transactions. ICICI Securities or its subsidiaries collectively or Research Analysts do not own 1% or more of the equity securities of the Company mentioned in the report as of the last day of the month preceding the publication of the research report. Since associates of ICICI Securities are engaged in various financial service businesses, they might have financial interests or beneficial ownership in various companies including the subject company/companies mentioned in this report. It is confirmed that Dewang Sanghavi, MBA (FIN) and Isha Bansal, MBA (FIN), research analysts do not serve as an officer, director or employee of the companies mentioned in the report. ICICI Securities may have issued other reports that are inconsistent with and reach different conclusion from the information presented in this report. Neither the Research Analysts nor ICICI Securities have been engaged in market making activity for the companies mentioned in the report. We submit that no material disciplinary action has been taken on ICICI Securities by any Regulatory Authority impacting Equity Research Analysis activities. This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction, where such distribution, publication, availability or use would be contrary to law, regulation or which would subject ICICI Securities and affiliates to any registration or licensing requirement within such jurisdiction. The securities described herein may or may not be eligible for sale in all jurisdictions or to certain category of investors. Persons in whose possession this document may come are required to inform themselves of and to observe such restriction. ICICI Securities Ltd | Retail Equity Research Page 5

© Copyright 2026