Weekly View

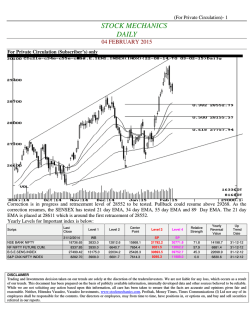

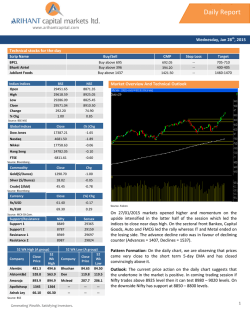

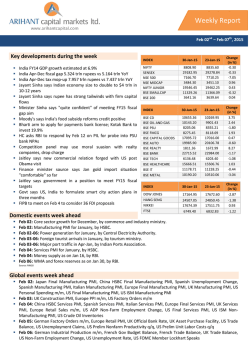

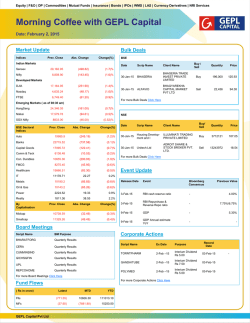

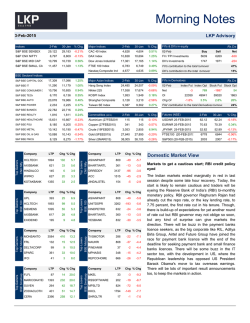

(For Private Circulation- Subscriber only) Market Outlook- NIFTY STOCMECHNICS WEEKLY What was said last week? Resistance will be at 8504-8626. Resistance to be tested and further breakout and close above 27 January 2015 8626 on weekly closing basis will extend the rally towards Trading on Technicals 9050 at least. Support during the week will be at 8427-8323-8236. Traders already long can take partial profits on Nifty at 8504By Hitendra Vasudeo 8626 range. Last week, the BSE Sensex opened at 28249.83, attained a Weaker opening and correction to support of 8427-8323 can low at 28197.35 and moved up to 29408.73 before it closed be used for buying with a stop loss 7960. the week at 29278.83 and thereby showed a net rise of 1156 points on a week to week basis. What happened last week? The resistance of 28065 and the peak of 28809 were crossed Nifty last week opened at 8550.04, attained a low at 8531.50 by the weekly closing. A breakout was seen on weekly and moved up to 8866.40. Nifty finally closed the week at closing basis which suggest that near term rally can continue 8835.59 thereby showed a net rise of 321 points on week to with volatility. Expect SENSEX to move towards 30188- week basis. 31216 at least in near term to short term. Weekly support will be at 28961-28514-28121. Higher View for the week to come range for the week can be 29725-30937. Weakness can Traders long can keep the stop loss at 8500. Expect higher creep in only on fall and close below 28100. range of 8957-9292 to be tested. Weaker opening and initial Breakout was seen last week as a result of which higher top correction to 8744-8622 can be used for buying with a stop loss of 8500. and higher bottom sequence continue on weekly chart. Breakout witnessed BSE Mid-Cap Index A sustained rise and weekly close above 10800 will lead to a rally in mid cap stock. The measured move indicates a target of 11680. Intermediate resistance targets are 10800 and 11200. Weakness will be seen below 10600-10100. BSE Small-Cap Index A further breakout and close above 11600 can lead to a rally towards 12418. Weakness is below 10800. BSE Bankex The rise continues last week as a result of which higher range will be tested. The next target can be 24150. Weakness can creep in below 22000. CNX PSU BANK Expect CNX PSU BANK index to move towards 4626 in near term and comparatively underperforming against BSE BANKEX which suggest that strong movement are more dominant in private sector banks. Strategy for the week Traders long can keep the stop loss at 28100. Weaker opening and correction to support of 28961-28515 can be used for buying SENSEX based stocks with a stop loss of 28100. SECTOR REVIEWS Indices BSE CAP.GOODS INDEX BSE METAL INDEX BSE BANKEX INDEX BSE GREEN INDEX BSE HEALTHCARE INDEX B.S.E.SENS.INDEX BSE AUTO INDEX B.S.E.NATIONAL INDEX BSE CARBONEX S&P CNX 100 INDEX BSE CONS.DURABL INDX BSE REALITY INDEX BSE TECK INDEX B.S.E. 200 INDEX BSE 500 INDEX BSE POWER INDEX BSE I.T. SECTOR INDX BSE PSUS INDEX BSE OIL & GAS INDEX BSE MID-CAP INDEX BSE SMALL-CAP INDEX BSE FMCG SECTOR INDX BSE SME IPO INDEX S&P CNX 500 INDEX CNX AUTO INDEX NSE BANK NIFTY Last Close 17016.0 10510.1 22984.0 2433.0 15506.8 29278.8 20106.8 8911.4 1432.9 8811.7 10270.0 1673.0 6203.4 3639.6 11343.2 2187.6 11228.3 8355.2 9901.4 10695.7 11366.1 8118.7 1025.5 7170.3 8983.1 20072.7 % Weekly Gain/Loss -23/01/2015 5.0 4.6 4.4 4.2 4.1 4.1 4.0 3.6 3.5 3.5 3.5 3.3 3.2 3.2 3.0 2.6 2.2 1.7 1.5 0.6 0.5 -0.4 -3.3 3.0 4.2 4.4 % Weekly Gain/Loss - 16/01/2015 4.8 -4.2 3.2 2.8 1.4 2.4 2.6 2.8 2.6 2.7 2.2 5.7 1.9 2.8 2.6 3.5 2.2 0.9 -0.9 2.0 1.0 4.1 -1.2 2.6 2.7 3.1 pg. 1 (For Private Circulation- Subscriber only) CNX COMMODITIES INDE CNX CONSUMER INDEX CPSE INDEX S&P CNX DEFTY INDEX CNX ENERGY INDEX CNX FINANCE CNX FMCG INDEX S&P CNX NIFTY INDEX NSE INFRASTRUCT.INDX CNX IT INDEX CNX NIFTY JUNIOR LIX 15 CNX MEDIA INDEX CNX METAL INDEX CNX MIDCAP 50 CNX MNC INDEX CNX PHARMA INDEX CNX PSE INDEX CNX PSU BANK INDEX NSE CNX REALITY INDX CNX SERVICE INDEX CNX SMALLCAP INDEX 2767.0 3559.1 2499.0 4978.2 8748.5 8046.3 20744.2 8835.6 3303.2 11885.2 19462.3 4030.6 2409.0 2602.9 3451.1 9774.2 11581.1 3603.6 4382.4 219.6 11427.2 5473.4 3.0 2.4 0.7 4.5 1.9 4.5 -1.1 3.8 5.8 1.9 2.1 5.3 0.2 4.3 0.7 1.8 4.3 1.2 2.9 3.4 4.2 1.5 0.9 2.8 -0.2 3.6 0.5 4.1 3.4 2.8 3.3 2.3 2.3 2.2 5.6 -4.0 2.5 3.9 1.5 0.7 3.0 6.2 3.3 2.2 BANK NIFTY FUTURES Hold long position with a stop loss of 19200. Weaker opening and correction to 19876-19565 can be used for buying with a stop loss of 19200. Expect higher level of 20430-21295 to be tested. Conclusion Strong Sectors: Bank Nifty, CNX SERVICE, CNX AUTO, CNX MNC, CNX PSU BANK, BSE HEALTCARE, CNX NIFTY JUNIOR, BSE CAP GOODS. Market Performer Sectors: BSE FMCG, CNX IT, BSE MID CAP and BSE SMALL CAP Weak Sectors: BSE REALTY CNX METAL, CNX ENERGY, BSE PSU, BSE METAL INDEX BSE MID-CAP INDEX B.S.E.NATIONAL INDEX BSE OIL & GAS INDEX BSE POWER INDEX BSE PSUS INDEX BSE REALITY INDEX B.S.E.SENS.INDEX BSE SMALL-CAP INDEX BSE SME IPO INDEX BSE TECK INDEX S&P CNX 100 INDEX CNX MIDCAP 200 S&P CNX 500 INDEX CNX AUTO INDEX NSE BANK NIFTY CNX COMMODITIES IN CNX CONSUMER INDE CPSE INDEX S&P CNX DEFTY INDEX CNX ENERGY INDEX CNX FINANCE CNX FMCG INDEX S&P CNX NIFTY INDEX NSE INFRASTRUCT.IND CNX IT INDEX CNX NIFTY JUNIOR LIX 15 CNX METAL INDEX CNX MIDCAP 50 CNX MNC INDEX CNX PHARMA INDEX CNX PSE INDEX CNX PSU BANK INDEX NSE CNX REALITY IND CNX SERVICE INDEX CNX SMALLCAP INDEX 10510.1 10695.7 8911.4 9901.4 2187.6 8355.2 1673.0 29278.8 11366.1 1025.5 6203.4 8811.7 13034.9 7170.3 8983.1 20072.7 2767.0 3559.1 2499.0 4978.2 8748.5 8046.3 20744.2 8835.6 3303.2 11885.2 19462.3 4030.6 2602.9 3451.1 9774.2 11581.1 3603.6 4382.4 219.6 11427.2 5473.4 10419.1 10650.4 8785.2 9865.0 2162.3 8304.8 1646.6 28828.4 11334.4 1040.5 6125.6 8688.7 12947.0 7081.7 8835.1 19733.4 2738.7 3519.3 2494.3 4887.8 8694.9 7901.2 20737.2 8704.8 3233.6 11776.5 19281.4 3956.2 2582.0 3434.0 9665.8 11401.3 3588.1 4333.5 215.9 11238.8 5434.0 10504.1 10571.2 8593.4 9853.3 2124.2 8257.2 1599.2 28186.8 11295.6 1062.7 6009.8 8503.1 12796.7 6945.3 8592.3 19247.7 2710.2 3444.9 2496.6 4735.4 8638.7 7686.7 20535.8 8507.3 3138.8 11579.1 19009.5 3864.7 2603.4 3403.2 9403.9 11143.1 3573.6 4273.4 209.3 10961.9 5376.2 10558.8 10782.1 8939.3 9997.0 2195.5 8429.2 1683.9 29408.7 11522.4 1087.7 6216.2 8834.2 13090.6 7191.9 9001.6 20167.7 2770.4 3563.2 2530.8 4978.2 8785.9 8148.9 21176.3 8866.4 3308.5 11921.0 19477.9 4052.4 2614.2 3474.6 9784.5 11645.7 3628.7 4453.9 221.2 11481.9 5549.3 9873.6 10416.4 8333.9 9527.6 2047.8 8015.9 1490.1 27203.3 11187.7 1004.5 5877.6 8247.4 12555.9 6759.6 8323.9 18517.9 2619.9 3367.3 2426.5 4614.7 8306.1 7332.4 20202.5 8236.7 2997.3 11378.8 18578.4 3726.4 2451.0 3330.1 9239.6 10866.7 3468.9 4110.1 194.8 10574.0 5266.7 HS HL HL HL HL HL HL HL HL HS HL HL HL HL HL HL HL HL HS HL HL HL HL HL HL HL HL HL HS HL HL HL HL HL HL HL HL THIS WEEK’S FRESH DOWN TREND-ND NEW (ND) Note: Keep 2 weeks High as stop loss or a weekly closing stop loss of Weekly Reversal Value. WEEKLY INDICES Scrips BSE 500 INDEX BSE AUTO INDEX BSE BANKEX INDEX BSE CAP.GOODS INDE BSE CARBONEX BSE CONSDURABL IND BSE FMCG SECTOR IN BSE GREEN INDEX BSE HEALTHCARE IND BSE I.T. SECTOR INDX Last Weekly Close CV 11343.2 20106.8 22984.0 17016.0 1432.9 10270.0 8118.7 2433.0 15506.8 11228.3 11203.3 19787.7 22598.4 16666.6 1413.0 10128.5 8092.4 2392.9 15278.0 11118.3 Weekly Reversal Value 10988.5 19276.4 22045.4 16109.7 1383.0 9915.5 7971.3 2327.8 14953.1 10923.2 2 Weeks High 11388.8 20154.4 23097.1 17140.7 1436.9 10481.3 8271.0 2436.9 15601.0 11265.8 2 Week Low 10699.9 18680.8 21213.6 15438.8 1340.7 9585.8 7857.6 2262.9 14610.6 10731.7 Scrips Close ABAN OFFSHORES AMTEK AUTO ASTRA ZENECA PH BAJAJ HOLDING BANK OF MAHARAS BERGER PAINTS IN BIOCON BOMBAY RAYON CADILA HEALTHCE CASTROL INDIA COX & KINGS 472.5 177.1 870.0 1400.0 42.9 225.0 412.7 127.5 1645.0 490.5 311.5 T HL HL HL HL HL HL HL HL HL HL Weekly Weekly Reversal CV Value 475.0 488.5 177.3 178.1 867.0 870.0 1410.6 1425.3 43.1 43.7 226.5 230.5 417.2 421.6 128.4 129.0 1644.0 1648.0 495.9 501.7 313.0 313.3 2 Weeks High 522.1 183.0 907.0 1545.0 45.0 245.4 436.3 138.0 1694.0 518.9 331.0 2 Weeks Low 464.0 173.0 851.0 1396.0 42.7 219.6 411.0 123.0 1575.0 490.0 310.0 R T ND ND ND ND ND ND ND ND ND ND ND 428.09 166.82 816.39 1303.92 41.20 203.66 395.40 113.73 1501.46 472.14 297.02 pg. 2 (For Private Circulation- Subscriber only) D B CORPORATION EDUCOMP SOLUTI GTL GUJARAT STAT PE INDIAN BANK INDIAN OIL CORPO IVRCL INFRASTR JAGRAN PRAKASH JAIPRAKASH ASS JAIPRAKASH HYD JAIN IRRIGATION JET AIRWAYS LANCO INFRATE L.G.BALAKRISHNN MMTC MPHASIS PATEL ENGINEERI POWER TRADING RAYMOND REI AGRO R R FINANCIAL CO SHRIRAM-CITY UNI SHRIRAM TRANS SJVN SUZLON ENERGY UNITED BANK VIDEOCON INDUS VIJAYA BANK 392.3 25.9 16.1 117.2 211.7 332.5 17.4 135.0 26.6 12.1 66.9 434.9 6.0 628.0 57.8 364.4 93.0 94.3 512.0 1.1 11.8 1991.0 1088.0 25.0 14.9 41.5 162.2 50.0 393.8 26.4 16.4 118.7 211.7 334.3 17.7 135.4 26.6 12.2 67.4 433.1 6.1 631.0 58.0 369.4 94.6 94.3 519.2 1.2 12.5 1999.2 1103.7 25.0 15.1 41.9 165.2 50.0 396.8 414.6 388.2 ND 371.92 26.7 30.7 25.7 ND 22.61 16.9 18.7 15.8 ND 13.96 119.5 131.4 115.3 ND 105.27 212.3 223.0 204.0 ND 192.26 336.6 345.0 323.0 ND 309.43 18.2 19.5 16.5 ND 14.65 135.5 150.5 133.9 ND 123.67 26.8 27.4 23.8 ND 21.49 12.2 12.8 11.3 ND 10.37 68.3 70.7 64.6 ND 60.78 434.2 475.0 426.1 ND 395.83 6.1 6.5 5.9 ND 5.45 638.3 678.0 623.0 ND 589.01 58.6 63.0 56.8 ND 52.92 378.9 390.0 360.2 ND 341.70 96.4 99.7 92.1 ND 87.43 94.6 95.9 91.0 ND 87.97 523.2 555.3 507.0 ND 477.18 1.3 1.6 1.1 ND 0.81 13.2 14.0 11.8 ND 10.41 2001.0 2080.0 1953.0 ND 1874.51 1105.3 1175.0 1020.0 ND 924.21 25.0 25.4 24.6 ND 24.11 15.2 18.6 14.2 ND 11.43 43.1 45.0 41.2 ND 38.85 170.0 199.8 161.7 ND 138.07 50.5 51.5 48.8 ND 47.13 SUPREME INDUSTR SURYALATA SPINNIN TATA INVESTMENT C THERMAX UNION BANK OF INDIA 594.0 121.3 576.0 1098.0 251.4 589.2 588.5 605.0 568.0 114.9 107.8 123.7 97.1 570.8 567.0 587.0 554.1 1077.4 1056.8 1143.0 1021.0 246.1 239.6 253.5 224.2 NU NU NU NU NU 627.9 140.1 607.4 1218.4 271.6 The review of the previous indication on request from some subscribers to give a follow up view on the stock’s after the indications. Traders and investors are advised to keep taking profit wherever possible as and when the opportunity arises. The views given are perspective and guide. It is not any stamping with authority to buy or sell. These are guidelines based trend and visual chart perception which will help traders and investors to take decisions. The views are not an end to make money. Trends/perception changes with market movements and stock movements and are not within our/writer’s control. Demand and Supply are created by FIIs and Mutual Funds which are based on various news flows, policy decision of the government which impact market and stock prices. Demand increases price rise and Supply increases price fall. The view and opinion are at static point based on weekly chart, trend and weekly high/low/close. We are not considering any views based on fundamental, corporate or industry scenarios. Always views are based on trend and price charts after taking into consideration various chart time frames understood to be best suited at the static point on week end. Investment and Trading is subject to THIS WEEK’S FRESH UP TREND (NEW UP-FU) market risk. Note: Keep 2 weeks low as stop loss or a weekly closing stop loss . of Weekly Reversal Value GODREJ IND Weekly 2 2 Weekly Hold long position with a stop loss of 260. Scrips Close Reversal Weeks Weeks R T CV BAJAJ AUTO BAJAJ FINSE BHARTI AIRTEL CAIRN INDIA CHAMBAL FERTILIS D B REALTY ESSAR OIL FORTIS HEALTHCARE GSFC GMDC ICICI BANK IDEA CELLULER JAMMU & KASHMIR BK JINDAL STEEL & POW J.K.PAPER KARNATAKA BANK MRPL R.C.F RIL COMMUNICATONS RELIANCE INDUSTRS RELIANCE POWER 2442.2 1308.8 383.7 247.7 65.1 83.8 111.1 113.7 121.9 131.4 370.5 168.5 154.1 158.4 34.7 148.1 50.5 67.1 82.1 887.0 64.7 Value High Low 2433.6 2424.3 2489.0 2319.0 NU 2594.1 1296.8 1282.8 1348.0 1249.5 NU 1408.9 371.7 361.9 387.7 339.3 NU 417.5 243.6 241.0 249.1 230.1 NU 260.8 63.5 62.2 66.8 59.4 NU 71.4 78.4 74.2 87.3 64.5 NU 101.3 109.3 106.8 114.8 100.0 NU 123.9 111.2 109.3 119.9 104.5 NU 129.4 115.5 107.9 124.2 101.6 NU 138.2 129.9 129.6 136.8 120.9 NU 146.7 364.3 357.3 375.9 335.0 NU 401.1 162.8 156.8 169.1 144.7 NU 184.2 152.4 151.1 161.1 147.7 NU 169.4 156.2 156.0 160.0 145.5 NU 169.0 33.6 32.8 37.5 30.9 NU 41.6 146.5 145.2 156.5 137.8 NU 168.1 49.6 49.0 51.6 46.5 NU 54.7 66.3 66.2 71.5 63.6 NU 76.3 80.9 80.1 82.7 75.1 NU 87.3 881.1 875.5 909.0 831.0 NU 957.2 63.6 62.6 65.4 58.9 NU 69.3 PIPAVAV DEFENCE Hold long position with a stop loss of 41. Resistance is at 56-61. Further rise can continue above 61. Buy on breakout and close above 61 with low of the day stop loss or 41 whichever is lower. ORIENTAL BANK Correction to 296-281-266 could happen and the same can be used for accumulation. Traders can buy on breakout and close above 345 with low of the week as the stop loss or 310 whichever is lower. RCF Buy whenever the breakout and close above 73 is witnessed. Long term investors can accumulate at 55-49-43 as and when the opportunity arises. pg. 3 (For Private Circulation- Subscriber only) ICICI BANK Expect higher range of 379-402 to be tested. LIC HOUSING Traders long can keep the stop loss at 430. Buy above 500 Traders long can keep the stop loss of 335. with low of the week as stop loss or 479 whichever is lower. The breakout potential implication for the stock can be 412. BATA UNITED PHOS- UPL Traders long can keep the stop loss at 1423. Use rise to 1455- Traders can hold long position with a stop loss of 315. 1500 to exit long as the opportunity arises. A breakout and close above 388 can lead to a rally to 475. GDL DEEPAK FERTILISER Traders long can keep the stop loss at 369. Use rise from 380 Traders and investors long can keep the stop loss of 125. Buy to 460 to exit long position. above 148 with low of the day stop loss or 125 whichever is lower. EXIDE IND Traders and short term investors can revise up the stop loss to TATA MOTORS 175. Expect higher range of 208-231. Weaker opening and Traders and short term investors can keep the stop loss at correction to 194-186 can be used for buying with a stop loss 520. of 175. Expect higher range of 611-678 to be tested. Traders can take profits at 611-678 as the opportunity arises. Support will be at 567-543 and the same is likely to be tested. TECH MAHTraders and investors long can maintain the stop loss of 2600. Buy above 2820 with a stop loss of 2750. TCS Short to medium term investors can keep the stop loss at 2348. DR.REDDY Traders and short term investors can hold long position with a stop loss of 3014. RELIANCE Use rise to 3412-3559 to take profits or exit long position. From long term angle, the stock is at critical level of 830 as per the quarterly chart. A fall and close below 830 can spell out a slide. Expect higher range of 911-961 to be tested. INFOSYS Traders and short term investors can keep the stop loss at 2000. Expect higher range of 2258-2384 to be tested. A rally to 2500 is likely to be tested in due course of time with MULTI BAGGER for 2015 CALENDAR YEAR- Long volatility. term accumulation at buy prices mentioned below Note: AC- Accumulation Point DIS- Distribution Point; WB- Weak Below. Accumulation Ratio can be 1:2:6 and SUN PHARMA ADVANCE Short term traders and investors can keep the stop loss at 195. plain volumes accordingly Last Book profits at 379-514 range as the opportunity arises. Last Level Level Center Level Level Scrips Close 1 2 Point 3 4 week we saw a big rise therefore higher range should be used 31/12/14 to take profits. AC WB AC AC DIS DIS TRENT: Long term investors can accumulate at 1318-1239-1159 whenever the opportunity arises. Use rise to 1390-1600 can be used to exit long and take profits. TITAN IND: Short term traders and investors can keep the stop loss at 345 and use rise to 408-427 range to exit long. M&M Hold long position with a stop loss of 1300. Expect higher range of 1389-1462 to be tested. NESTLE INDIA 6380.00 4536.0 EICHER MOTORS 15104.00 4405.0 DHANUKA AGRITE 546.15 179.1 BRITANNIA INDUS 1840.00 812.0 TORRENT PHARM 1131.00 461.0 BLUE DART EXPRE 6325.00 2962.0 GRUH FINANCE 273.15 122.9 AMARA RAJA BATT 823.00 313.0 VINATI ORGANICS 430.05 185.1 PIDILITE INDUSTRI 542.55 269.0 BAYER (INDIA) 3183.00 1378.0 ATUL 1386.00 395.0 STRIDES ARCOLA 960.15 278.5 DABUR INDIA 233.55 154.0 ABBOTT INDIA 3794.00 1590.0 5069.0 7748.3 285.5 1146.3 665.3 4000.7 170.5 477.3 255.4 358.2 1964.7 689.0 492.8 175.5 2301.0 5847.0 11760.7 439.8 1505.7 926.7 5286.3 225.5 658.7 359.7 453.3 2596.3 1092.0 745.9 212.1 3083.0 7158.0 19116.3 700.4 2199.3 1392.3 7610.7 328.2 1004.3 534.3 637.6 3814.7 1789.0 1213.3 270.1 4576.0 9247.0 30484.3 1115.4 3252.3 2119.3 11220.7 485.8 1531.3 813.2 917.0 5664.7 2889.0 1933.8 364.7 6851.0 pg. 4 (For Private Circulation- Subscriber only) BOSCH 19466.00 8843.0 11816.7 16492.3 24141.7 36466.7 MRF 37883.00 18600.0 24488.7 31994.3 45388.7 66288.7 SHREE CEMENT 9412.00 4100.0 5841.3 7670.7 11241.3 16641.3 INDUSIND BANK 803.00 369.0 511.7 660.3 951.7 1391.7 BAJAJ FINANCE 3481.00 1460.0 2119.0 2822.0 4184.0 6249.0 INDO COUNT IND 345.40 32.1 121.6 255.9 479.6 837.6 BATA INDIA 1306.00 895.0 996.3 1204.7 1514.3 2032.3 GLAXO SM. PHA 3197.00 2352.0 2618.7 2930.3 3508.7 4398.7 TIDE WATER OIL 18462.00 7005.0 10418.0 15049.0 23093.0 35768.0 HDFC BANK 952.00 618.0 722.0 848.0 1078.0 1434.0 GRINDWEL NORT 616.85 229.6 353.3 493.2 756.7 1160.1 SANOFI INDIA 3593.00 2500.0 2795.3 3297.7 4095.3 5395.3 MOTHERSON SUM 456.50 178.3 269.6 365.2 552.1 834.7 ING VYSYA BANK 869.00 493.0 612.3 749.7 1006.3 1400.3 FORBES & COMPA 1827.00 471.0 886.7 1411.3 2351.7 3816.7 KPIT TECHNOLOG 203.35 140.0 158.4 184.9 229.9 301.3 ULTRATECH CEME 2671.25 1642.5 1919.8 2393.9 3145.3 4370.8 TVS MOTOR COMP 268.30 64.1 130.8 201.6 339.1 547.3 GRANULES INDIA 827.00 189.0 363.7 652.3 1115.7 1867.7 SHILPA MEDICARE 713.00 240.0 387.3 565.7 891.3 1395.3 HATSUN AGRO PR 309.85 193.2 208.9 294.1 395.1 581.4 AARTI DRUGS 853.00 204.0 409.0 648.0 1092.0 1775.0 ISGEC HEAVY EN 5198.00 783.0 2203.3 3777.7 6772.3 11341.3 PIRAMAL ENTERP 832.00 508.0 603.0 737.0 966.0 1329.0 VESUVIUS INDIA 699.00 426.0 469.3 655.7 885.3 1301.3 SUNDARAM CLAY 1696.00 336.0 721.3 1310.7 2285.3 3849.3 KOTAK MAHINDR 1263.00 630.0 824.7 1068.3 1506.7 2188.7 B.A.S.F. INDIA 1286.00 566.0 772.0 1080.0 1594.0 2416.0 HDFC (HOUSING D 1135.00 756.0 868.3 1022.7 1289.3 1710.3 HITACHI HOME & LI 893.00 129.0 364.7 657.3 1185.7 2006.7 ZEE ENTERTAINM 380.75 254.7 289.8 345.7 436.7 583.6 ECLERX SERVICE 1302.25 1022.9 1068.4 1256.7 1490.6 1912.7 TECH MAHINDRA 2591.55 1677.7 1932.5 2336.7 2995.8 4059.2 AUROBINDO PHAR 1136.00 372.0 615.0 893.0 1414.0 2213.0 GABRIEL INDIA 89.30 19.5 39.4 69.3 119.2 199.0 HONEYWELL AU 6947.00 2492.0 3794.7 5644.3 8796.7 13798.7 AIA ENGINEERING 1084.20 448.1 611.9 920.4 1392.8 2173.7 GUJ.PIPAVAV POR 206.50 58.5 106.3 158.7 258.9 411.4 TIMKEN INDIA 512.70 155.0 268.1 399.6 644.1 1020.1 CAPITAL FIRST LT 366.55 125.0 201.1 290.5 455.9 710.8 GLOBAL OFFSHO 666.00 94.0 280.3 479.7 865.3 1450.3 TUBE INVESTMEN 355.00 152.6 212.5 295.1 437.7 662.9 CHOLAMANDALA 473.70 225.0 290.8 407.9 590.8 890.8 ICRA 3195.60 1499.1 1996.5 2698.3 3897.4 5798.4 SHANTI GEARS 136.20 59.9 82.6 113.5 167.1 251.6 BHARAT FORGE 942.00 319.0 502.0 759.0 1199.0 1896.0 MAH.SCOOTERS 1001.00 402.0 578.0 825.0 1248.0 1918.0 GATEWAY DISTRI 352.95 124.0 197.0 279.9 435.8 674.6 TRENT 1488.00 952.0 1095.0 1345.0 1738.0 2381.0 3M INDIA 6471.00 3500.0 4347.3 5623.7 7747.3 11147.3 WHIRLPOOL 652.00 172.0 317.7 506.3 840.7 1363.7 K.S.B. PUMPS 663.00 226.0 366.0 523.0 820.0 1274.0 CUMMINS INDIA 875.00 423.0 548.0 750.0 1077.0 1606.0 MAX INDIA 394.90 177.6 234.1 338.4 499.2 764.3 HIKAL 757.00 427.0 528.0 656.0 885.0 1242.0 VARDHMAN TEXT 456.40 326.2 345.4 437.2 548.2 751.0 AXIS BANK 502.05 216.6 310.4 408.2 599.8 889.2 ENT NETWORK GILLETE INDIA GATI SHRIRAM TRANS YES BANK AKZO NOBEL IND ESSEL PROPACK GUJARAT GAS CO NANDAN DENIM GIC HOUSING FIN TATA COMMUNIC HINDUSTAN ZINC GREAVES COTTON EROS INTERN. ME D B CORPORATION DEVELOP. CREDIT RURAL ELECTRIFI HATHWAY CABLE FEDERAL BANK EXIDE INDUSTRIES ESAB INDIA ADANI PORT THERMAX LIC HOUSING FIN ALSTOM T & D IND PETRONET LNG ABB INDIA LTD IGL APAR INDUSTRIES BHARAT ELECTRO CENTURY PLYBO REDINGTON (IND IRB INFRAST. DEV INDIAN HOTELS C BANK OF BARODA ASHOK LEYLAND SBI STATE BANK OF BI SJVN TATA INVESTMEN SIEMENS EIH ADANI ENTERPRIS ALSTOM INDIA LIM TATA CHEMICALS AHLUWALIA CONT 523.35 3284.00 281.75 1110.00 772.85 1384.00 131.15 764.00 69.80 214.45 439.40 170.35 151.00 369.20 405.70 121.10 335.05 349.80 151.60 178.00 692.00 318.45 1068.00 435.80 471.65 208.40 1286.00 453.45 409.05 2933.00 158.75 137.35 263.85 125.50 1085.00 51.35 311.85 657.00 24.50 572.95 907.00 127.20 485.25 637.30 434.30 224.40 315.6 377.9 461.0 606.4 834.8 1850.0 2187.7 2946.3 4042.7 5897.7 43.6 103.0 222.3 401.1 699.1 550.0 699.3 960.7 1371.3 2043.3 292.1 451.6 613.3 934.5 1417.4 758.0 944.7 1197.3 1636.7 2328.7 46.5 72.1 105.5 164.5 256.9 219.0 384.3 598.7 978.3 1572.3 27.2 40.4 56.7 86.1 131.9 93.3 132.6 175.2 257.1 381.7 260.1 308.2 391.3 522.4 736.6 114.8 128.8 156.4 198.0 267.2 56.5 86.4 121.1 185.7 285.0 136.5 210.0 295.7 455.0 700.0 267.7 312.3 361.1 454.6 596.9 49.7 72.6 98.3 146.8 221.1 166.6 206.7 295.0 423.4 640.2 221.0 252.0 318.8 416.6 581.2 72.5 98.4 125.7 178.9 259.5 99.1 123.7 153.4 207.7 291.8 415.0 485.3 621.7 828.3 1171.3 141.0 199.6 259.8 378.6 557.6 615.0 744.7 938.3 1261.7 1778.7 186.6 260.5 361.9 537.2 814.0 170.0 262.5 379.2 588.3 914.1 102.5 136.8 174.1 245.8 354.8 568.0 770.3 1083.7 1599.3 2428.3 238.9 302.5 389.8 540.7 778.8 110.1 190.0 329.1 548.1 906.2 895.0 1505.3 2322.7 3750.3 5995.3 22.1 61.7 119.2 216.3 370.9 63.1 84.4 116.0 169.0 253.5 68.1 124.8 207.1 346.2 567.5 53.2 76.7 102.0 150.8 224.8 509.0 687.3 906.7 1304.3 1921.3 14.9 25.5 40.8 66.7 108.0 145.6 195.9 261.5 377.4 558.9 281.0 389.7 548.3 815.7 1241.7 19.9 20.4 24.0 28.1 35.9 383.0 434.7 521.3 659.6 884.6 512.0 609.3 809.7 1107.3 1605.3 53.5 76.9 103.8 154.2 231.5 210.4 268.8 426.9 643.4 1018.0 307.0 414.7 529.6 752.1 1089.5 244.8 299.4 379.7 514.6 729.8 21.2 84.6 161.0 300.8 517.1 Already Weekly Chart Up Trend Weekly Last Weekly Reversal Close CV Value A.C.C.(ASSOC.CEMENT 1541.0 1520.8 1471.0 ADANI ENTERPRISES 562.7 541.5 515.1 ADANI POWER 50.8 49.0 46.6 ADITYA BIRLA NUVO 1825.0 1797.6 1755.5 ANANT RAJ INDUSTRIES 46.2 45.9 45.6 APOLLO HOSPITALS EN 1292.0 1250.0 1182.3 Scrips 2 2 Weeks Week T High Low 1568.0 1391.0 U 574.5 485.6 U 51.4 44.6 U 1856.0 1685.0 U 47.9 41.5 U 1302.0 1114.0 U pg. 5 (For Private Circulation- Subscriber only) APOLLO TYRES ASHOK LEYLAND ASIAN PAINTS AUROBINDO PHARMA AXIS BANK BANK OF BARODA BHARAT EARTH MOVER BGR ENERGY SYSTEMS BHARAT ELECTRONICS BHARAT FORGE BPCL BHEL CANARA BANK CENTRAL BANK CENTURY TEXT.& IND. CESC CIPLA CONTAINER CORP.OF IN CORPORATION BANK CROMPTON GREAVES DABUR INDIA DEWAN HOUSING FIN. DISH TV INDIA DLF DR. REDDY'S LABORATO EICHER MOTORS EMAMI EXIDE INDUSTRIES GLAXO SMITHKLINE PHA GODREJ INDUSTRIES GRASIM INDUSTRIES HCL TECHNOLOGIES HDFC (HOUSING DEV.FI HINDUSTAN UNILEVER HIND.PETR.CORP.(HPCL HMT HOUSING DEVE. INFRA IDBI (IND.DEV.BANK O INFRA DEV FINANCE CO IFCI IL&FS TRANSPORTION INDUSIND BANK INDIA CEMENTS INDBULLS REAL ESATE INFOSYS JSW ENERGY KANSAI NEROLAC PAINT KOTAK MAHINDRA BANK LAKSHMI MACHINE WOR LARSEN & TOUBRO LIC HOUSING FINANCE LUPIN MAHINDRA HOLIDAY RE MAHINDRA & MAHINDRA MARICO MARUTI SUZUKI INDIA MOTHERSON SUMI 225.8 64.3 862.0 1178.0 565.0 223.0 910.0 160.2 3217.0 1006.0 674.0 279.0 468.0 103.8 564.1 716.0 675.0 1420.0 72.0 193.8 249.6 483.0 79.3 156.3 3345.0 15186.0 896.0 201.1 3347.0 313.4 3787.0 1646.0 1290.0 963.0 576.5 66.0 79.9 75.8 174.3 37.9 203.6 858.0 107.8 75.9 2214.0 112.2 2474.0 1385.0 3899.0 1706.0 485.7 1489.0 271.4 1360.0 358.3 3609.0 473.7 225.5 62.5 850.6 1170.3 546.6 220.4 897.4 160.4 3220.5 1000.3 669.4 275.7 462.0 101.8 561.6 715.0 663.9 1403.6 70.8 192.1 248.0 477.2 75.6 152.0 3311.9 15177.9 877.6 195.9 3294.7 310.7 3712.0 1634.8 1250.1 943.4 575.4 66.1 78.7 75.4 170.4 37.7 203.0 845.8 103.9 74.4 2173.4 109.7 2378.5 1381.2 3905.8 1659.0 483.7 1468.3 268.6 1333.8 352.8 3590.1 465.1 224.8 59.2 823.5 1159.0 522.4 217.4 851.3 160.0 3160.3 974.3 663.3 270.8 452.8 98.3 549.1 702.0 646.1 1380.8 68.7 190.0 241.5 453.8 70.7 144.9 3251.5 15077.5 830.5 190.1 3217.3 301.9 3581.0 1608.5 1191.8 881.3 571.0 62.1 74.6 75.1 163.4 37.5 198.9 826.0 95.1 72.3 2103.8 105.2 2217.3 1353.8 3905.3 1583.5 478.0 1442.8 265.1 1281.8 340.0 3512.3 455.0 237.8 64.9 881.0 1192.0 577.2 228.9 946.0 169.6 3425.0 1039.0 691.0 288.3 475.4 105.9 579.9 751.0 684.0 1450.0 78.9 197.4 262.4 502.0 81.3 157.1 3400.0 15582.0 930.0 202.0 3525.0 318.0 3839.0 1720.0 1340.0 966.0 600.8 77.8 82.9 78.2 177.2 38.3 216.6 863.0 115.8 76.7 2222.0 114.5 2498.0 1440.0 4175.0 1713.0 499.8 1521.0 282.3 1374.0 369.2 3689.0 487.4 218.1 58.1 801.0 1122.0 492.0 211.0 784.0 151.0 3135.0 933.0 643.0 253.5 435.0 97.0 522.4 678.0 626.1 1343.0 64.9 182.4 229.0 422.0 66.2 132.1 3128.0 14600.0 775.0 179.2 3134.0 283.8 3398.0 1542.0 1099.0 865.0 555.0 61.0 65.4 71.8 153.8 35.6 186.7 797.0 83.5 63.7 2075.0 98.8 2175.0 1349.0 3800.0 1495.0 449.8 1410.0 259.7 1218.0 315.8 3448.0 432.6 U U U U U U U U U U U U U U U U U U U U U U U U U U U U U U U U U U U U U U U U U U U U U U U U U U U U U U U U U MRF 38730.0 38707.6 MAH.TEL.NIGAM (MTNL) 27.5 27.5 NESTLE INDIA 7235.0 7076.4 NHPC 19.8 19.6 OMAXE 128.6 128.1 PIDILITE INDUSTRIES 570.4 567.0 POWER GRID CORPO 149.5 147.7 PRISM CEMENT 102.9 98.8 RALLIS INDIA 232.5 227.3 RANBAXY LABORATO 706.0 684.5 SHREE RENUKA SUGAR 15.7 15.7 ROLTA INDIA 104.5 104.4 SHREE CEMENT 11058.0 10605.2 SIEMENS 1038.0 1006.8 SINTEX INDUSTRIES 106.4 103.2 SKS MICRO FINANCE 439.9 444.9 SPICE JET 22.3 21.4 S.R.F. 952.0 934.6 STATE BANK OF IN 327.4 322.4 SUN PHARMACEUTICAL 924.0 897.0 SUN TV NETWORK 397.4 397.9 TATA CHEMICALS 440.7 440.9 TATA MOTORS 587.9 566.1 TATA POWER CO. 88.8 86.5 TECH MAHINDRA 2783.7 2775.2 TITAN INDUSTRIES 398.4 393.3 TORRENT POWER 174.1 170.6 TUBE INVESTMENT OF I 348.4 349.7 TVS MOTOR COMPANY 306.2 306.9 ULTRATECH CEMENT 3143.2 3079.3 UNITED BREWERIES 1038.0 999.1 UNITED PHOSPHEROUS 357.5 358.0 VOLTAS 256.2 254.7 WHIRLPOOL OF INDIA 722.0 702.9 WIPRO 601.5 585.9 WOCKHARDT 1121.0 1094.1 YES BANK 875.3 847.3 ZEE ENTERTAINMENT 389.9 386.3 38434.5 27.5 6731.8 19.2 127.5 557.4 143.4 89.5 221.0 653.2 15.7 102.5 9879.8 957.3 99.0 439.7 19.7 911.0 315.4 857.8 386.3 440.6 536.8 83.6 2720.6 385.2 165.8 349.5 297.5 2921.2 929.3 353.1 250.6 681.0 566.9 1066.0 808.9 379.1 39966.0 29.1 7325.0 20.1 129.6 607.0 151.2 108.8 242.0 714.0 16.5 109.1 11199.0 1043.0 111.2 475.8 24.1 978.0 332.5 939.0 439.6 456.3 590.8 90.7 2820.0 409.0 175.6 366.7 322.3 3184.5 1049.0 375.4 263.8 740.0 603.5 1134.0 881.1 400.0 37657.0 27.2 6400.0 18.4 125.3 521.0 134.9 79.0 211.1 620.0 15.5 100.6 9179.0 907.0 93.4 429.7 17.7 843.0 301.1 818.0 353.0 436.8 512.1 78.3 2685.0 370.0 163.0 337.0 290.6 2690.0 898.0 328.7 240.0 653.0 548.1 1022.0 759.1 354.2 U U U U U U U U U U U U U U U U U U U U U U U U U U U U U U U U U U U U U U Already Weekly Chart Down Trend Scrips ALLAHABAD BANK ANDHRA BANK ARVIND BANK OF INDIA CMC CUMMINS INDIA DENA BANK DIVI'S LABORATOR EIH FEDERAL BANK FINANCIAL TECHNO GAIL GLENMARK PHARM GMR INFRASTRUCT Last Close 126.6 91.4 270.6 294.1 1894.0 882.0 58.7 1679.0 112.4 143.7 196.8 423.1 727.0 16.9 Weekly Reversal Value 127.0 128.2 91.8 93.1 271.2 273.1 295.8 299.0 1903.9 1926.8 883.6 891.5 59.2 60.6 1690.0 1711.3 113.6 116.1 144.4 146.6 199.0 203.4 425.0 431.8 728.0 737.8 17.0 17.3 Weekly CV 2 2 Weeks Weeks High Low 132.5 124.0 96.4 90.2 282.4 263.0 306.0 288.6 1977.0 1857.0 911.0 867.0 61.9 58.5 1750.0 1647.0 122.0 110.3 153.6 142.8 210.7 195.6 446.0 417.4 754.0 715.0 17.6 16.4 T D D D D D D D D D D D D D D pg. 6 (For Private Circulation- Subscriber only) GUJARAT GAS CO. 712.0 HERO HONDA MOTO 2860.0 HINDALCO INDUST 144.8 HINDUSTAN ZINC 165.9 INDIAN HOTELS CO. 118.3 IPCA LABORATORIES 639.0 IRB INFRAST. DEVEL 247.1 ITC 349.3 JAI CORPORATION 73.4 JINDAL SAW 84.6 JSW STEEL 1013.0 M&M FINANCE SERV 251.6 NAGARJUNA CONS 72.2 NMDC 139.4 NTPC 142.0 OIL INDIA 551.8 ONGC 348.6 OBC 321.9 PETRONET LNG 188.4 POWER FINANCE CO 281.1 PUNJ LLOYD 36.5 PUNJAB NATINAL BNK 207.2 RELIANCE INFRAS 484.2 RURAL ELECTRIF 318.2 SAIL IT 78.2 SESA GOA 205.1 SYNDICATE BANK 126.5 TCS 2501.7 TATA STEEL 402.7 UCO BANK 79.7 UNITECH 17.0 720.9 2886.8 144.6 163.8 117.8 666.1 246.8 352.8 73.6 85.2 1007.2 271.4 74.0 138.4 141.5 548.4 348.2 323.5 193.1 283.8 36.6 207.2 485.7 320.2 78.1 203.1 127.1 2511.0 398.2 80.3 17.0 736.5 2962.0 149.6 164.3 118.5 704.5 249.8 358.4 74.9 88.2 1018.0 301.5 77.4 139.3 141.8 555.8 348.8 326.2 202.7 289.5 37.0 209.6 493.3 323.4 79.2 206.9 128.9 2529.2 399.0 81.8 17.1 774.0 2990.0 156.0 168.0 122.3 750.0 258.7 373.6 78.8 92.8 1018.0 314.5 80.8 141.4 144.3 567.8 355.6 341.0 214.7 298.8 39.0 219.0 500.2 334.7 80.7 208.8 132.9 2583.5 411.4 83.8 17.7 704.0 2797.0 137.9 152.5 115.0 637.0 230.4 346.1 70.5 82.4 958.0 250.3 69.2 132.0 137.3 522.6 338.5 313.5 187.0 274.5 36.0 200.9 460.0 310.0 76.0 186.5 125.3 2480.3 372.6 78.7 15.5 D D D D D D D D D D D D D D D D D D D D D D D D D D D D D D D DISCLAIMER Trading and Investments decision taken on our trends are at the discretion of the traders/investors. We are not liable for any loss, which occurs as a result of our trends. This document has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. While we are not soliciting any action based upon this information, all care has been taken to ensure that the facts are accurate and opinions given fair and reasonable. Neither, Hitendra Vasudeo, Vasudeo Investments, www.stockmechanics.com, Profitak, Money Times, Times Communications (I) Ltd nor any of its employees shall be responsible for the contents. Our directors or employees, may from time to time, have positions in, or options on, and buy and sell securities referred in our reports pg. 7

© Copyright 2026