EQUITY 360 February 02, 2015

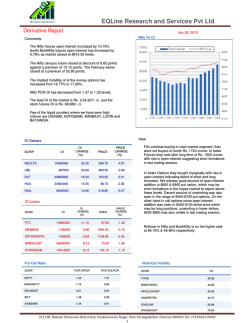

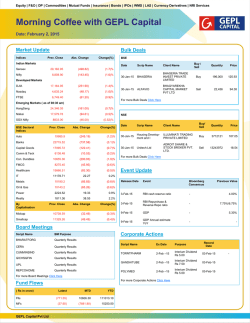

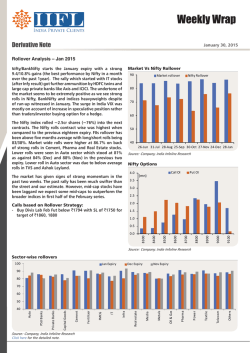

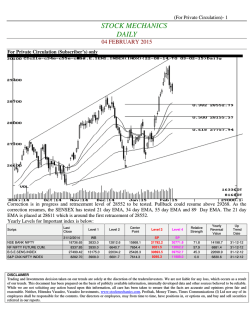

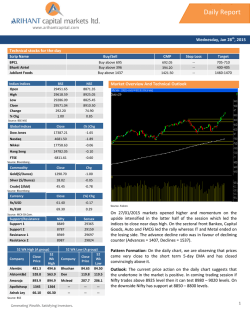

® February 02, 2015 EQUITY 360 Nifty level PREV. CLOSING % CHANGE NIFTY INDEX 8808.90 -1.60% NIFTY FUT. 8872.65 -1.28% SGX CNX NIFTY INDEX FUT. (8:15.am.) 8831.50 -0.54% Outlook for the day DAILY TREND Down International market The market is likely to open on a negative note following Asian counterparts. Asian markets fell due to global growth concerns for the fourth consecutive day. The concerns are supported by weak Chinese data. U.S. stocks also declined as earnings estimates revised downward. JSW Energy, Bharat Forge, Strides Arcolab, UPL, Shanthi Gears, Religare Enterprises, Omkar Speciality, Munjal Auto, Mcnally Bharat, Indian Bank and, Cummins India will announce its quarterly result today. As per provisional figures, foreign institutional investors (FIIs)/ Foreign Portfolio Investors (FPIs) sold shares worth a net Rs 771.5 crore on 30th January 2014. Domestic institutional investors sold shares worth Rs 37.6 crore on that day. INDEX CLOSING (SPOT) CHANGE (%) US MARKETS NASDAQ COMPOSITE 4635.24 -1.03% DOW JONES 17164.95 -1.45% NASDAQ 100 4147.00 +0.14% DOW JONES 17130.00 +0.19% HANG SENG INDEX 24604.17 +0.03% NIKKEI 225 17671.19 +0.37% SHANGHAI COMP. INDEX 3253.41 -0.27% US MARKETS (FUTURE) ASIAN MARKETS Sector to watch today Sectors to Outperform Sectors to Underperform Pharma and FMCG PSU Bank and Media Macro news Economic activity in the U.S. continued to increase in the final three months of 2014, according the Commerce Department, although the pace of growth slowed by more than economists had expected. The report said U.S. gross domestic product climbed by 2.6 percent in the fourth quarter following the 5.0 percent jump seen in the third quarter. Economists' consensus estimate had called for GDP to increase by a somewhat more substantial 3.2 percent during the quarter. 1 ® Nifty level Nifty outlook S1 S2 R1 R2 Today the markets are likely open on negative note. All emerging 8820 8750 8950 9000 markets are trading in red. The coming session is likely to witness a NIFTY LEVEL 8873 SGX Nifty 8,834 (-44) range of 8820 on declines and 8950 on advances. Nifty snapshot 30-Jan Stock is in ban period 29-Jan Nifty Spot 8808.90 8952.35 Nifty Feb 8872.65 8986.30 Nifty Mar 8931.25 9036.05 Chg. OI (Feb) (%) 3.07 21.15 Chg. OI (Mar) (%) -2.34 19.69 50 Day SMA 8433 8424 100 Day SMA 8260 8252 200 Day SMA 7831 7821 Sentiment indicator 30-Jan 29-Jan 28-Jan 27-Jan Nifty Discount/Premium Nifty option OI concentration 52.90 In lakhs 60.00 No Stock 50.00 63.75 33.95 52.80 76.75 COST OF CARRY% 0.69 0.70 0.70 0.68 0.63 0.95 1.09 1.05 1.10 1.03 PCR(VOL) 1.05 1.36 1.12 1.42 1.34 A/D RATIO(Nifty 50) 0.56 1.17 0.85 1.38 1.78 A/D RATIO(All FO Stock)* 0.62 1.04 0.80 1.07 1.19 Implied Volatality 18.57 17.50 17.09 15.69 15.90 VIX 20.17 19.43 19.77 18.09 18.09 HISTORY. VOL 19.74 19 19.43 20.02 20.2 *All Future Stock 25.83 Nifty v/s OI 1.69 5.41 14.97 22.53 1.42 13.84 21.32 18.32 20.14 21.64 15.47 20.92 10.08 12.48 8.54 16.74 3.79 10.00 23.77 26.84 12.31 20.00 0.00 8000 8400 8500 8600 8700 8800 Call 8900 9000 9100 9200 9500 Put Nifty option OI change Date Nifty % Change Open Intrest % Change 21-Jan 8792 0.3% 1761100 23.8% 22-Jan 8833 0.5% 2189650 24.3% 23-Jan 8899 0.7% 3264600 49.1% 27-Jan 8987 1.0% 12021500 268.2% 28-Jan 8967 -0.2% 20425950 69.9% 29-Jan 8986 0.2% 24746250 21.2% 30-Jan 8873 -1.3% 25504975 3.1% 18.20 In lakhs 20.00 15.00 0.02 3.61 5.69 1.80 0.44 1.26 0.50 1.92 1.14 1.46 2.04 1.06 2.90 6.05 Fund flow (FII/DII) 10.00 5.00 62.95 PCR(OI) 40.00 30.00 23-Jan -10.00 8000 8400 8500 8600 8700 8800 Call -0.02 -0.11 -6.69 -1.69 -7.83 -5.00 -0.18 -0.04 0.00 8900 9000 9100 9200 9500 Put Net investment (in cr) FII INDEX FUTURE 72 FII INDEX OPTION 1318 FII STOCK FUTURE -1608 FII STOCK OPTION 139 FII CASH -772 DII CASH -38 Trading ideas Scrip Trade Entry Sl Target Status Rpower 65 Feb Call Buy 3.5-3.8 1.5 5.5 Intraday Hdfc 1260 Feb Put Buy 40-41 30 60 Intraday 2 ® Nifty discount / premium 1867 1732 76.75 62.95 71.75 40.00 72 1372 50.00 56 1000 60.00 33.95 483 902 1749 2000 62.05 70.00 3000 69.75 80.00 71.90 3897 4000 69.80 90.00 5000 63.75 In Cr. 52.80 FII’S activity in Nifty future 30.00 0 20.00 -1000 10.00 - 1301 -2000 0.00 16-Jan 19-Jan 20-Jan 21-Jan 22-Jan 23-Jan 27-Jan 28-Jan 29-Jan 30-Jan 16-Jan 19-Jan 20-Jan 21-Jan 22-Jan 23-Jan 27-Jan 28-Jan 29-Jan 30-Jan Top 10 long build up LTP ANDHRABANK IBREALEST Indices to out perform % change Open interest % OI chng 92.0 1.21% 20784000 29.03% Closing % Change CNX Realty 237 2.31% 84.1 6.19% 38220000 20.54% CNX FMCG 21166 -0.60% HCLTECH 1798.9 8.77% 3527875 14.20% CNX Energy 8921 -0.40% ADANIENT 632.2 7.40% 7951000 13.29% CNX PSE 3647 -0.08% JPASSOCIAT 28.8 9.11% 125312000 10.93% CNX Pharma 11694 -0.50% OFSS 3422.7 1.62% 96625 10.59% NTPC 144.1 3.04% 43612000 10.48% APOLLOTYRE 244.4 3.19% 12470000 8.17% CROMPGREAV 190.7 0.71% 13606000 7.37% RELINFRA 512.2 6.00% 7259500 5.56% Top 10 short build up LTP % change Open interest % OI chng COALINDIA 360.8 -1.26% 21110000 87.20% BANKBARODA 194.9 -11.01% 22385000 23.76% Indices to under perform Closing % Change 4046 -5.88% CNX PSU Bank CNX Metal 2513 -1.07% CNX Media 2357 -1.45% BANK Nifty 19844 -3.34% CNX Service 11307 -2.03% Closing % Change Stocks to out perform TECHM 2891.5 -0.65% 1917750 19.38% HDIL 110.4 14.40% ALBK 116.4 -5.48% 10148000 17.18% GMRINFRA 19.5 11.75% TCS 2501.6 -2.33% 4811875 15.93% SBIN 311.5 -5.28% 62013750 14.20% HINDPETRO 660.2 3.10% UNIONBANK 210.6 -3.19% 8326000 13.96% ADANIENT 632.2 7.40% ICICIBANK 363.2 -4.78% 55141250 12.43% BPCL 750.4 1.98% UBL 982.8 -1.23% 485000 12.14% KOTAKBANK 1331.5 -0.71% 5680500 12.14% Closing % Change UNIONBANK 210.6 -3.19% BANKBARODA 194.9 -11.01% BANKINDIA 268.3 -5.16% PNB 191.1 -4.85% ALBK 116.4 -5.48% Stocks to under perform 3 ® Sector overview Scrips/Indexs Sector overview OI Volume Change Price Remark Scrips/Indexs Change (%) Change OI Volume Change Price Remark Change (%) Change Auto 3779375 -33.6% -1.1% Long Unwinding Infrastructure 2171000 -56.5% 5.6% Long Buildup Auto Ancillaries 312250 -20.4% -0.7% Long Unwinding Media -448000 30.4% -1.7% Long Unwinding PSU Banks 22633500 -45.5% -4.1% Long Unwinding Private Banks 9375250 -21.7% -2.0% Long Unwinding Metals 3903750 59.9% -0.1% Long Unwinding NBFC 5375000 26.6% 0.3% Long Buildup Oil & Gas 1032000 286.9% -0.2% Long Unwinding Capital goods 1373250 -37.4% -0.5% Short Buildup Cement 12924875 -48.2% -0.2% Short Buildup Fertilizers -170000 -30.9% 0.9% Long Buildup Pharma 1126875 329.9% -0.2% Long Unwinding FMCG 1034442 -29.7% -0.7% Short Buildup Power 12707500 5.6% 1.8% Long Buildup IT 1885125 -35.9% 1.4% Short Covering Textile -131500 54.4% -0.1% Long Unwinding Real Estate 9315000 -52.1% 6.9% Long Buildup Telecom 2385500 -61.3% -0.8% Short Buildup Change in sector open interest 226.34 In Lakhs 250.00 127.08 11.27 Pharma 23.86 10.32 Oil & Gas 53.75 39.04 21.71 18.85 IT 93.15 10.34 13.73 3.12 50.00 37.79 100.00 FMCG 93.75 150.00 129.25 200.00 Telecom -1.32 Textile Power NBFC Metals Media Infrastructure Real Estate Fertilizers Cement Capital goods Private Banks PSU Banks Auto Ancillaries Auto -50.00 -4.48 -1.70 0.00 Stocks trend on daily closing levels for short term STOCKS CLOSING PRICE TREND DATE TREND CHANGED RATE TREND CHANGED S&P Nifty 8809 UP 10.09.13 5897 CLOSING STOP LOSS 8250 CNX IT Index 11825 UP 14.01.15 11614 11100 CNX Bank Index 19844 UP 05.03.14 11099 18700 A.C.C 1563 UP 14.01.15 1484 1430 AMBUJA CEMENT 253 UP 07.03.14 182 195 ASIANPAINT* 858 UP 20.09.13 491 570 AXIS BANK 588 UP 02.12.13 236 350 4 ® Stocks trend on daily closing levels for short term STOCKS CLOSING PRICE TREND DATE TREND CHANGED RATE TREND CHANGED CLOSING STOP LOSS 2150 BAJAJ AUTO 2389 UP 19.08.14 2205 BANKBARODA* 192 UP 30.07.14 177 168 BHARTI ARTL 374 UP 23.01.15 383 355 BHEL 292 UP 02.01.15 276 265 BPCL * 751 UP 30.10.13 362 610 CAIRN 233 Down 23.09.14 315 345 CIPLA 697 UP 06.06.14 396 630 COALINDIA 361 Down 30.01.15 361 385 DLF 171 UP 23.01.15 157 140 DRREDDY 3227 UP 26.06.14 2506 2750 GAIL 424 Down 16.12.14 413 460 GRASIM 3875 UP 31.10.14 3505 3300 1550 HCL TECH 1794 UP 20.01.15 1668 H.D.F.C 1276 Up 19.09.13 832 970 HDFC BANK 1081 UP 11.10.13 660 790 HEROMOTOCO 2870 UP 30.07.14 2594 2550 HINDALCO 140 Down 12.12.14 154 160 HINDUNILVR 934 UP 30.05.14 597 680 ICICI BANK 360 UP 16.07.14 293 340 IDFC 173 UP 10.03.14 112 135 INDUSIND 869 UP 07.03.14 444 550 INFOSYS 2142 UP 14.01.15 2129 2000 ITC 369 Down 06.01.15 354 370 JIND STL & PWR 159 Down 09.07.14 298 220 KOTAK BANK 1318 UP 10.03.14 753 950 LT 1705 UP 16.01.15 1595 1560 LUPIN 1580 UP 10.06.14 975 1200 M&M 1267 Down 13.10.14 1267 1385 MARUTI 3633 UP 07.03.14 1735 3350 NMDC 140 Down 23.09.14 169 184 NTPC 144 Down 14.07.14 149 150 ONGC 352 Down 07.10.14 398 375 PNB 189 UP 17.11.14 193 176 POWERGRID 148 UP 25.03.14 106 120 RELIANCE 916 Down 06.06.14 1018 970 SBI 309 UP 26.03.14 177 235 SESAGOA 202 Down 07.10.14 259 285 SUN PHARMA 920 UP 25.10.11 250 750 TATA MOTORS 586 UP 19.08.13 302 450 TATA POWER 91 Down 01.08.14 95 100 TATA STEEL 391 Down 25.08.14 510 420 TCS 2484 UP 02.01.15 2588 2420 TECHM 2890 UP 28.03.14 - 2200 2400 ULTRACEMCO 3141 UP 31.10.14 2548 WIPRO 606 UP 12.06.14 531 530 ZEEL 378 UP 19.09.14 - 285 Note: These levels should not be confused with the weekly trendsheet which is sent in weekly magazine in the name of "Money Wise" 5 ® SMC Research Desk SMC Research also available on Reuters ® Corporate Office: 11/6B, Shanti Chamber, Pusa Road, New Delhi - 110005 Tel: +91-11-30111000 www.smcindiaonline.com E-mail: [email protected] Mumbai Office: Dheeraj Sagar, 1st Floor, Opp. Goregaon sports club, link road Malad (West), Mumbai - 400064 Tel: 91-22-67341600, Fax: 91-22-28805606 Kolkata Office: 18, Rabindra Sarani, "Poddar Court", Gate No. 4, 4th Floor, Kolkata - 700001 Tel: 91-33-39847000, Fax: 91-33-39847004 SMC Global Securities Ltd. (hereinafter referred to as “SMC”) is a registered Member of National Stock Exchange of India Limited, Bombay Stock Exchange Limited and its associate is member of MCX stock Exchange Limited. It is also registered as a Depository Participant with CDSL and NSDL. Its associates merchant banker and Portfolio Manager are registered with SEBI and NBFC registered with RBI. It also has registration with AMFI as a Mutual Fund Distributor. SMC is in the process of making an application with SEBI for registering as a Research Entity in terms of SEBI (Research Analyst) Regulations, 2014. SMC or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing /dealing in securities Market. SMC or its associates including its relatives/analyst do not hold any financial interest/beneficial ownership of more than 1% in the company covered by Analyst. SMC or its associates and relatives does not have any material conflict of interest. SMC or its associates/analyst has not received any compensation from the company covered by Analyst during the past twelve months. The subject company has not been a client of SMC during the past twelve months. SMC or its associates has not received any compensation or other benefits from the company covered by analyst or third party in connection with the research report. The Analyst has not served as an officer, director or employee of company covered by Analyst and SMC has not been engaged in market making activity of the company covered by Analyst. The views expressed are based solely on information available publicly available/internal data/ other reliable sources believed to be true. SMC does not represent/ provide any warranty express or implied to the accuracy, contents or views expressed herein and investors are advised to independently evaluate the market conditions/risks involved before making any investment decision. SMC Global Securities Limited is proposing, subject to receipt of requisite approvals, market conditions and other considerations, a further public offering of its equity shares and has filed the Draft Red Herring Prospectus with the Securities and Exchange Board of India (“SEBI”) and the Stock Exchanges. The Draft Red Herring Prospectus is available on the website of SEBI at www.sebi.gov.in and on the websites of the Book Running Lead Manager i.e., ICICI Securities Limited at www.icicisecurities.com and the Co- Book Running Lead Manager i.e., Elara Capital (India) Private Limited at www.elaracapital.com . Investors should note that investment in equity shares involves a high degree of risk and for details relating to the same, please see the section titled “Risk Factors” of the aforementioned offer document. Disclaimer: This report is for the personal information of the authorized recipient and doesn't construe to be any investment, legal or taxation advice to you. It is only for private circulation and use .The report is based upon information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied upon as such. No action is solicited on the basis of the contents of the report. The report should not be reproduced or redistributed to any other person(s)in any form without prior written permission of the SMC. The contents of this material are general and are neither comprehensive nor inclusive. Neither SMC nor any of its affiliates, associates, representatives, directors or employees shall be responsible for any loss or damage that may arise to any person due to any action taken on the basis of this report. It does not constitute personal recommendations or take into account the particular investment objectives, financial situations or needs of an individual client or a corporate/s or any entity/s. All investments involve risk and past performance doesn't guarantee future results. The value of, and income from investments may vary because of the changes in the macro and micro factors given at a certain period of time. The person should use his/her own judgment while taking investment decisions. Please note that we and our affiliates, officers, directors, and employees, including persons involved in the preparation or issuance if this material;(a) from time to time, may have long or short positions in, and buy or sell the securities thereof, of company (ies) mentioned here in or (b) be engaged in any other transaction involving such securities and earn brokerage or other compensation or act as a market maker in the financial instruments of the company (ies) discussed herein or may perform or seek to perform investment banking services for such company(ies) or act as advisor or lender/borrower to such company(ies) or (c) may have any other potential conflict of interest with respect to any recommendation and related information and opinions. All disputes shall be subject to the exclusive jurisdiction of Delhi High court. 6

© Copyright 2026