Daily Bulletin

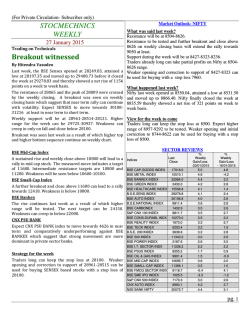

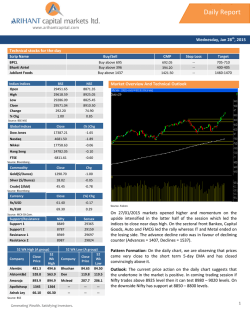

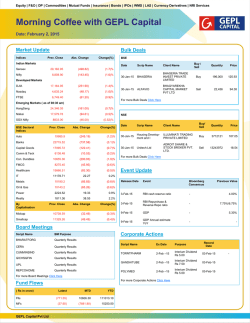

(For Private Circulation)- 1 STOCK MECHANICS DAILY 04 FEBRUARY 2015 For Private Circulation (Subscriber’s) only Correction is in progress and retracement level of 28552 to be tested. Pullback could resume above 29268. As the correction resumes, the SENSEX has tested 21 day EMA, 34 day EMA, 55 day EMA and 89 Day EMA. The 21 day EMA is placed at 28611 which is around the first retracement of 28552. Yearly Levels for Important index is below: Scrips NSE BANK NIFTY NF NIFTY FUTURE CUM. B.S.E.SENS.INDEX S&P CNX NIFTY INDEX Last Close Level 1 Level 2 Center Point 31/12/2014 18736.65 8337.85 27499.42 8282.70 WB 3833.0 3930.0 13175.0 3908.0 12812.6 6640.7 22034.2 6601.7 15868.1 7654.4 25428.3 7614.3 Level 3 Level 4 SP 21792.2 9351.5 30893.5 9295.3 SP 30771.8 12062.2 39752.7 11989.0 Relative Strength Yearly Reversal Value Up Trend Date 71.8 57.9 45.3 0.0 14198.7 6881.4 22698.9 6830.6 31-12-12 31-12-12 31-12-12 31-12-12 DISCLAIMER Trading and Investments decision taken on our trends are solely at the discretion of the traders/investors. We are not liable for any loss, which occurs as a result of our trends. This document has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. While we are not soliciting any action based upon this information, all care has been taken to ensure that the facts are accurate and opinions given fair and reasonable. Neither, Hitendra Vasudeo, Vasudeo Investments, www.stockmechanics.com, Profitak, Money Times, Times Communications (I) Ltd nor any of its employees shall be responsible for the contents. Our directors or employees, may from time to time, have positions in, or options on, and buy and sell securities referred in our reports. (For Private Circulation)- 2 SENTIMENT INDEX Date 06/01/2015 07/01/2015 08/01/2015 09/01/2015 12/01/2015 13/01/2015 14/01/2015 15/01/2015 16/01/2015 19/01/2015 20/01/2015 21/01/2015 22/01/2015 23/01/2015 27/01/2015 28/01/2015 29/01/2015 30/01/2015 02/02/2015 03/02/2015 Total Scrips 386 386 386 386 386 387 387 387 387 387 387 387 387 387 387 387 387 387 387 387 Breath 19 72 125 81 132 120 102 197 145 190 182 131 149 132 141 129 128 84 145 101 Remarks SENSEX SENTIMENT INDEX 4.92% 18.65% 32.38% 20.98% 34.20% 31.01% 26.36% 50.90% 37.47% 49.10% 47.03% 33.85% 38.50% 34.11% 36.43% 33.33% 33.07% 21.71% 37.47% 26.10% 26987.46 26908.82 27274.71 27458.38 27585.27 27425.73 27346.82 28075.55 28121.89 28262.01 28784.67 28888.86 29006.02 29278.84 29571.04 29559.18 29681.77 29182.95 29122.27 29000.14 Indices Indices Last Close Daily CV B.S.E. 200 INDEX B.S.E.SENS.INDEX NF NIFTY FUTURE CUM. CNX MIDCAP 200 NSE BANK NIFTY CNX IT INDEX CNX NIFTY JUNIOR 3621.62 29000.14 8809.90 13101.85 19382.95 11963.90 19552.40 3629.5 29064.0 8830.1 13129.9 19565.9 11943.6 19595.0 Daily Reversal Value 3648.7 29300.3 8867.7 13125.1 20082.3 11849.5 19555.6 4 Days High 3707.40 29844.16 9029.50 13283.05 20600.65 12003.35 19862.80 4 Days Low 3614.94 28900.41 8780.00 13064.85 19303.50 11728.75 19437.80 Trend Trend Date HS HS HS HL HS HL HL 2/2/2015 2/2/2015 3/2/2015 9/1/2015 30-01-15 9/1/2015 12/1/2015 Note- SA-Strong Above; DP-Demand Point; SP- Supply Point Fresh Down Trend Scrips FEDERAL BANK INFO EDGE (INDIA) NAVA BHARAT VENTURES NAGARJUNA CONSTRUCTI TRENT ELECTROSTEEL STEEL INDIAN OIL CORPORATI PUNJ LLOYD ICRA MULTI COMMODITY EXCH STRIDES ARCOLAB LAKSHMI MACHINE WORK Last Close 143.20 794.70 192.75 72.80 1419.00 4.17 331.25 36.35 3305.75 863.50 907.80 3919.00 Level 1 Level 2 Center Point Level 3 Level 4 SP DP DP SP SP 138.9 669.4 183.1 68.2 1333.7 3.9 313.7 34.5 3283.8 836.2 860.2 3820.0 142.0 750.0 189.9 71.5 1395.7 4.1 326.7 35.9 3298.8 856.1 895.2 3884.0 144.0 786.0 193.9 73.6 1434.3 4.2 335.1 36.7 3306.9 868.5 917.6 3913.0 145.2 830.7 196.7 74.8 1457.7 4.3 339.7 37.2 3313.8 876.0 930.2 3948.0 148.3 911.3 203.5 78.1 1519.7 4.5 352.7 38.6 3328.8 895.9 965.2 4012.0 Relative Strength Daily Reversal Value Down Trend Date 39.50 39.87 42.78 43.33 44.24 46.13 46.22 46.29 46.59 47.42 48.02 48.28 143.99 811.38 193.37 74.08 1449.75 4.25 337.51 36.61 3312.29 869.11 920.03 3940.25 3/2/2015 3/2/2015 3/2/2015 3/2/2015 3/2/2015 3/2/2015 3/2/2015 3/2/2015 3/2/2015 3/2/2015 3/2/2015 3/2/2015 DISCLAIMER Trading and Investments decision taken on our trends are solely at the discretion of the traders/investors. We are not liable for any loss, which occurs as a result of our trends. This document has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. While we are not soliciting any action based upon this information, all care has been taken to ensure that the facts are accurate and opinions given fair and reasonable. Neither, Hitendra Vasudeo, Vasudeo Investments, www.stockmechanics.com, Profitak, Money Times, Times Communications (I) Ltd nor any of its employees shall be responsible for the contents. Our directors or employees, may from time to time, have positions in, or options on, and buy and sell securities referred in our reports. (For Private Circulation)- 3 SHREE RENUKA SUGAR GUJARAT PIPAVAV PORT MINDTREE 28.23 HMT HIND.NATIONAL GLASS MARUTI SUZUKI INDIA LNT FH GLAXO SMITHKLINE PHA MARICO CESC CENTURY TEXT.& IND. BIRLA CORPORATION CIPLA EDELWEISS FINANCIAL INDIA CEMENTS SHREE CEMENT ASHOK LEYLAND APOLLO HOSPITALS ENT MOTILAL OSWAL FIN.SE JSW ENERGY 16.10 206.85 1296.95 63.95 126.00 3608.00 69.15 3338.00 348.95 714.00 557.00 517.85 678.00 70.55 104.65 10836.00 64.85 1302.00 307.30 113.15 15.4 195.7 1166.9 59.8 121.0 3479.7 65.3 3199.3 307.5 679.3 513.9 477.8 640.3 67.0 94.7 8679.0 61.2 1218.7 280.3 91.9 15.9 203.6 1253.0 62.8 124.0 3573.7 68.1 3299.3 336.1 704.3 544.9 505.5 667.3 69.5 101.8 10157.0 63.8 1278.7 300.0 107.3 16.2 208.2 1295.0 64.7 125.0 3633.3 69.8 3360.7 351.9 719.7 563.7 520.7 683.7 71.0 106.1 10956.0 65.4 1315.3 312.3 116.9 16.4 211.5 1339.0 65.9 127.0 3667.7 70.9 3399.3 364.7 729.3 575.8 533.1 694.3 72.0 108.9 11635.0 66.4 1338.7 319.6 122.7 16.9 219.4 1425.1 68.9 130.0 3761.7 73.7 3499.3 393.3 754.3 606.8 560.8 721.3 74.5 116.0 13113.0 69.0 1398.7 339.3 138.1 49.06 49.43 50.47 50.59 51.21 53.54 54.75 56.51 56.67 57.20 59.25 63.04 63.32 63.47 64.05 64.28 64.38 64.55 74.13 83.62 16.29 209.94 1310.81 64.97 128.16 3653.38 69.86 3358.88 355.76 720.25 566.23 533.08 687.75 71.33 108.98 10931.38 65.55 1326.50 315.73 116.57 3/2/2015 3/2/2015 3/2/2015 3/2/2015 3/2/2015 3/2/2015 3/2/2015 3/2/2015 3/2/2015 3/2/2015 3/2/2015 3/2/2015 3/2/2015 3/2/2015 3/2/2015 3/2/2015 3/2/2015 3/2/2015 3/2/2015 3/2/2015 Note- SA-Strong Above; DP-Demand Point; SP- Supply Point Super Query Down Trend Scrips ORIENTAL BANK OF COM BANK OF BARODA ALLAHABAD BANK SAIL (STEEL AUTHORIT PETRONET LNG HAVELL'S INDIA UNION BANK OF INDIA IPCA LABORATORIES PUNJAB NATIONAL BANK MPHASIS BAJAJ AUTO BANK OF INDIA MAHINDRA & MAHINDRA JINDAL SAW UCO BANK SYNDICATE BANK DR. REDDY'S LABORATO DIVI'S LABORATORIES KARNATAKA BANK RIL COMMUNICATONS MARICO Last Close Level 1 Level 2 Center Point Level 3 Level 4 SP DP DP DP SP SA 265.55 185.10 111.10 73.60 181.55 248.10 205.45 619.60 176.75 339.80 2260.10 260.85 1200.00 80.20 72.85 117.05 3091.00 1668.00 139.65 77.70 348.95 251.7 174.9 101.6 69.9 176.0 235.2 191.4 587.3 151.1 322.2 2127.1 236.9 1111.7 77.1 66.2 108.8 3030.3 1610.0 128.7 72.2 307.5 260.8 182.4 108.5 72.6 179.9 243.6 201.6 611.0 170.0 335.0 2226.1 254.5 1176.7 79.4 71.1 114.6 3072.3 1652.0 136.4 76.2 336.1 265.2 187.2 112.9 74.3 182.2 247.5 207.9 626.0 182.3 343.0 2291.0 265.8 1218.3 80.8 74.3 118.0 3095.7 1678.0 140.9 78.6 351.9 269.9 189.9 115.5 75.3 183.8 252.0 211.7 634.6 189.0 347.8 2325.1 272.2 1241.7 81.6 76.0 120.4 3114.3 1694.0 144.2 80.2 364.7 279.0 197.4 122.4 78.0 187.7 260.4 221.9 658.3 207.9 360.6 2424.1 289.8 1306.7 83.9 80.9 D E V E LO P .C R E D ITB A N K 3156.3 1736.0 151.9 84.2 393.3 Relative Strength Daily Reversal Value Down Trend Date 11.03 12.42 14.79 16.06 16.49 17.86 21.64 23.02 23.25 23.83 24.98 25.06 25.75 26.66 27.26 294.34 209.64 121.70 77.25 185.95 266.08 225.34 644.50 198.65 357.49 2386.94 282.03 1290.88 82.40 77.44 32.17 37.32 42.48 47.08 56.67 122.35 3247.50 1703.25 144.54 79.99 355.76 23-01-15 29-01-15 23-01-15 30-01-15 12/1/2015 28-01-15 27-01-15 15-01-15 27-01-15 8/1/2015 28-01-15 23-01-15 28-01-15 22-01-15 22-01-15 22-01-15 30-01-15 3/2/2015 27-01-15 29-01-15 3/2/2015 DISCLAIMER Trading and Investments decision taken on our trends are solely at the discretion of the traders/investors. We are not liable for any loss, which occurs as a result of our trends. This document has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. While we are not soliciting any action based upon this information, all care has been taken to ensure that the facts are accurate and opinions given fair and reasonable. Neither, Hitendra Vasudeo, Vasudeo Investments, www.stockmechanics.com, Profitak, Money Times, Times Communications (I) Ltd nor any of its employees shall be responsible for the contents. Our directors or employees, may from time to time, have positions in, or options on, and buy and sell securities referred in our reports. (For Private Circulation)- 4 Note- SA-Strong Above; DP-Demand Point; SP- Supply Point Fresh Up Trend Scrips Last Close DP DEWAN HOUSING FIN.CO CENTURY PLYBOARD EXIDE INDUSTRIES GRASIM INDUSTRIES FORBES & COMPANY ESSAR OIL 3M INDIA GODREJ INDUSTRIES NITIN FIRE PROTECTIO KALPATARU POWER TRAN SUNTECK REALTY & INF PAGE INDUSTRIES BALLARPUR INDUSTRIES NHPC ABAN OFFSHORES BLUE STAR KIRLOSKAR OIL ENGINE NTPC BRITANNIA INDUSTRIES NOVARTIS INDIA TATA CONSULTANCY SER BGR ENERGY SYSTEMS CAIRN INDIA SUPREME INDUSTRIES CMC SESA GOA CUMMINS INDIA BOMBAY RAYON FASHION MCLEOD RUSSEL (I) NATCO PHARMA INGERSOLL-RAND (IND) HINDUSTAN OIL EXPLOR RAYMOND VIDEOCON INDUSTRIES PRRANETA INDUSTRIES MONNET ISPAT & ENERG KAVERI SEED COMPANY M&M FINANCE SERVICE 507.80 184.75 197.55 3886.00 2340.00 112.85 6932.00 321.10 36.00 237.55 259.45 11985.95 15.95 20.00 498.00 343.75 269.05 143.95 1923.00 676.00 2554.80 159.70 245.05 615.15 1915.00 210.55 904.00 129.50 212.05 1382.00 885.00 37.45 515.25 172.10 0.19 62.15 759.10 256.55 Level 1 Level 2 Center Point Level 3 Level 4 WB DP DP SP SP 463.9 172.3 181.9 3714.0 2129.3 108.9 6672.0 302.6 34.1 232.0 242.9 11577.1 15.3 18.6 458.2 317.7 265.8 139.9 1885.7 638.3 2458.2 149.6 234.3 562.8 1841.7 190.8 833.7 114.6 204.0 1322.7 848.0 28.7 491.8 137.1 0.2 56.9 631.3 240.1 490.9 180.2 193.1 3820.0 2262.3 111.7 6834.0 314.1 35.4 235.8 253.5 11827.3 15.8 19.5 483.3 333.8 268.0 142.5 1911.7 665.3 2517.2 156.5 241.1 594.8 1890.7 202.9 878.7 124.2 209.1 1364.7 872.0 34.1 506.8 160.3 0.2 60.7 710.8 250.5 501.1 183.7 199.8 3860.0 2317.7 113.4 6898.0 318.5 36.1 237.9 258.0 11918.8 16.1 20.0 493.6 340.0 269.2 143.6 1926.3 681.7 2538.6 160.3 244.0 606.4 1915.3 207.5 898.3 128.4 211.1 1389.3 883.0 36.3 513.4 171.6 0.2 63.0 741.9 254.9 518.0 188.2 204.3 3926.0 2395.3 114.5 6996.0 325.6 36.7 239.6 264.0 12077.4 16.2 20.5 508.3 350.0 270.2 145.0 1937.7 692.3 2576.2 163.4 247.9 626.8 1939.7 215.1 923.7 133.8 214.1 1406.7 896.0 39.6 521.9 183.4 0.2 64.5 790.2 261.0 545.0 196.1 215.5 4032.0 2528.3 117.3 7158.0 337.1 38.0 243.4 274.6 12327.6 16.7 21.4 533.4 366.1 272.4 147.6 1963.7 719.3 2635.2 170.3 254.7 658.8 1988.7 227.2 968.7 143.4 219.2 1448.7 920.0 45.0 536.9 206.6 0.2 68.3 869.7 271.4 Relative Strength Daily Reversal Value Up Trend Date 57.8 56.9 54.0 53.8 53.0 52.9 52.6 51.7 51.3 50.2 49.6 49.3 49.0 46.0 44.6 43.9 42.4 42.3 41.2 40.7 40.4 40.4 40.0 39.6 37.0 36.6 36.5 35.1 33.9 33.9 33.4 31.8 30.7 29.8 29.5 27.7 27.1 25.0 482.8 183.5 195.4 3854.8 2271.3 112.1 6905.1 313.9 34.7 236.9 256.6 11815.2 16.0 19.7 486.0 335.9 268.7 142.5 1908.0 669.1 2517.7 158.4 238.6 592.6 1898.6 203.1 892.0 128.3 208.2 1377.1 872.6 33.5 512.5 162.1 0.2 61.8 746.3 252.6 3/2/2015 3/2/2015 3/2/2015 3/2/2015 3/2/2015 3/2/2015 3/2/2015 3/2/2015 3/2/2015 3/2/2015 3/2/2015 3/2/2015 3/2/2015 3/2/2015 3/2/2015 3/2/2015 3/2/2015 3/2/2015 3/2/2015 3/2/2015 3/2/2015 3/2/2015 3/2/2015 3/2/2015 3/2/2015 3/2/2015 3/2/2015 3/2/2015 3/2/2015 3/2/2015 3/2/2015 3/2/2015 3/2/2015 3/2/2015 3/2/2015 3/2/2015 3/2/2015 3/2/2015 DISCLAIMER Trading and Investments decision taken on our trends are solely at the discretion of the traders/investors. We are not liable for any loss, which occurs as a result of our trends. This document has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. While we are not soliciting any action based upon this information, all care has been taken to ensure that the facts are accurate and opinions given fair and reasonable. Neither, Hitendra Vasudeo, Vasudeo Investments, www.stockmechanics.com, Profitak, Money Times, Times Communications (I) Ltd nor any of its employees shall be responsible for the contents. Our directors or employees, may from time to time, have positions in, or options on, and buy and sell securities referred in our reports. (For Private Circulation)- 5 Note- SA-Strong Above; DP-Demand Point; SP- Supply Point Super Query Up Trend Scrips TEXMACO RAIL & ENGIN IFCI SUN PHARMA ADVAN. RE S.R.F. GREAVES COTTON FERTILISER CHEMICAL EXIDE INDUSTRIES FORBES & COMPANY DEVELOP. CREDIT BANK GODREJ INDUSTRIES PAGE INDUSTRIES NTPC Last Close Level 1 Level 2 Center Point Level 3 Level 4 DP WB DP DP SP SP 165.15 39.30 373.15 978.00 146.10 34.65 197.55 2340.00 119.60 321.10 11985.95 143.95 147.1 36.1 344.9 929.7 140.5 32.0 181.9 2129.3 113.2 302.6 11577.1 139.9 159.0 38.4 364.8 959.7 144.4 33.8 193.1 2262.3 117.9 314.1 11827.3 142.5 164.7 39.8 376.3 971.3 146.5 34.8 199.8 2317.7 120.8 318.5 11918.8 143.6 170.9 40.7 384.6 989.7 148.3 35.6 204.3 2395.3 122.5 325.6 12077.4 145.0 182.8 43.0 404.5 1019.7 152.2 37.4 215.5 2528.3 127.2 337.1 12327.6 147.6 Relative Strength Daily Reversal Value Up Trend Date 78.9 74.1 72.6 60.0 57.8 56.5 54.0 53.0 51.8 51.7 49.3 42.3 155.4 38.2 346.7 956.6 143.2 32.8 195.4 2271.3 119.1 313.9 11815.2 142.5 16-01-15 29-01-15 19-01-15 13-01-15 28-01-15 2/2/2015 3/2/2015 3/2/2015 27-01-15 3/2/2015 3/2/2015 3/2/2015 Note- SA-Strong Above; DP-Demand Point; SP- Supply Point Down Trend Indices Scrips S&P CNX NIFTY INDEX CNX PSU BANK INDEX BSE PSUS INDEX NSE BANK NIFTY BSE BANKEX INDEX CNX CONSUMER INDEX BSE SME IPO INDEX CNX MEDIA INDEX CNX METAL INDEX CNX SERVICE INDEX BSE METAL INDEX B.S.E.SENS.INDEX BSE GREEN INDEX BSE CARBONEX CNX PHARMA INDEX CNX 200 INDEX S&P CNX 500 INDEX BSE AUTO INDEX BSE DOLLEX-30 BSE 500 INDEX B.S.E. 200 INDEX S&P CNX DEFTY INDEX CNX MNC INDEX S&P CNX 100 INDEX B.S.E.NATIONAL INDEX CNX AUTO INDEX DOLLEX-100 INDEX DOLLEX INDEX Last Close Level 1 Level 2 Center Point Level 3 Level 4 SP DP DP DP SP SA 8756.55 3924.60 8144.71 19382.95 22188.53 3463.60 1028.88 2347.20 2521.80 11189.70 10223.15 29000.14 2390.42 1421.52 11520.00 4519.30 7137.45 19945.88 3857.44 11299.26 3621.62 4914.48 9723.20 8751.30 8849.75 8919.70 1483.25 976.88 8599.1 3683.8 7957.2 18476.2 21068.6 3398.2 1011.7 2312.3 2467.5 10878.8 9999.2 28496.7 2353.1 1396.9 11258.9 4440.6 7027.0 19375.0 3773.4 11119.1 3561.5 4914.5 9560.1 8599.2 8697.3 8673.0 1451.4 956.6 8709.7 3861.0 8094.2 19136.4 21885.2 3446.3 1022.1 2336.9 2502.6 11105.6 10144.8 28849.4 2380.0 1414.5 11444.0 4497.2 7106.5 19782.6 3831.4 11249.1 3604.9 4914.5 9677.8 8707.9 8806.3 8848.8 1473.7 970.9 8773.5 3974.7 8180.8 19550.0 22398.4 3477.1 1025.7 2351.3 2518.4 11248.2 10212.2 29051.2 2396.4 1424.9 11553.0 4531.6 7155.1 20027.0 3863.3 11328.9 3631.6 4914.5 9750.1 8773.3 8872.0 8953.8 1486.6 979.3 8820.4 4038.3 8231.3 19796.6 22701.8 3494.4 1032.5 2361.6 2537.7 11332.3 10290.5 29202.0 2406.9 1432.0 11629.1 4553.7 7186.1 20190.3 3889.4 11379.1 3648.4 4914.5 9795.5 8816.7 8915.4 9024.7 1496.1 985.3 8931.0 4215.5 8368.4 20456.8 23518.4 3542.5 1042.9 2386.2 2572.8 11559.1 10436.1 29554.7 2433.7 1449.5 11814.2 4610.3 7265.6 20597.9 3947.4 11509.0 3691.8 4914.5 9913.2 8925.4 9024.4 9200.5 1518.5 999.6 Relative Strength Daily Reversal Value Down Trend Date 0.00 15.83 18.65 27.83 28.25 31.84 33.46 34.18 35.17 35.33 37.54 46.78 47.77 50.45 52.85 53.55 53.95 54.65 54.90 54.91 55.48 55.86 56.11 56.39 56.80 57.25 59.66 60.14 8842.13 4233.79 8292.92 20082.32 22984.85 3533.06 1028.16 2383.21 2548.88 11406.26 10313.42 29300.26 2416.67 1433.86 11605.61 4555.10 7187.12 20089.97 3903.92 11372.77 3648.66 4972.35 9750.61 8823.65 8923.83 8980.53 1498.18 985.83 2/2/2015 29-01-15 30-01-15 30-01-15 30-01-15 2/2/2015 16-01-15 28-01-15 29-01-15 30-01-15 29-01-15 2/2/2015 2/2/2015 2/2/2015 3/2/2015 2/2/2015 2/2/2015 3/2/2015 2/2/2015 3/2/2015 2/2/2015 2/2/2015 2/2/2015 2/2/2015 2/2/2015 3/2/2015 2/2/2015 2/2/2015 DISCLAIMER Trading and Investments decision taken on our trends are solely at the discretion of the traders/investors. We are not liable for any loss, which occurs as a result of our trends. This document has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. While we are not soliciting any action based upon this information, all care has been taken to ensure that the facts are accurate and opinions given fair and reasonable. Neither, Hitendra Vasudeo, Vasudeo Investments, www.stockmechanics.com, Profitak, Money Times, Times Communications (I) Ltd nor any of its employees shall be responsible for the contents. Our directors or employees, may from time to time, have positions in, or options on, and buy and sell securities referred in our reports. (For Private Circulation)- 6 NF NIFTY FUTURE CUM. 8809.90 8628.2 8757.0 8832.9 8885.8 9014.6 61.62 8867.70 3/2/2015 Relative Strength Daily Reversal Value Up Trend Date 78.7 77.7 74.3 71.1 68.3 65.8 65.4 64.7 62.3 60.0 59.6 59.4 59.3 58.6 56.4 56.1 52.8 52.5 52.3 51.8 50.8 49.2 228.1 1740.1 17144.3 10592.7 8857.7 2204.8 10058.4 3293.4 19.3 11193.4 11849.5 5507.9 6162.7 2767.0 19555.6 3632.1 8199.8 13125.1 20972.5 10759.0 3471.5 11400.1 15-01-15 15-01-15 12/1/2015 15-01-15 15-01-15 15-01-15 15-01-15 15-01-15 16-01-15 9/1/2015 9/1/2015 2/2/2015 2/2/2015 15-01-15 12/1/2015 15-01-15 3/2/2015 9/1/2015 27-01-15 9/1/2015 12/1/2015 2/2/2015 Note- SA-Strong Above; DP-Demand Point; SP- Supply Point Up Trend Indices Last Close Scrips NSE CNX REALITY INDX BSE REALITY INDEX BSE CAP.GOODS INDEX BSE CONS.DURABL INDX CNX ENERGY INDEX BSE POWER INDEX BSE OIL & GAS INDEX NSE INFRASTRUCT.INDX INDIA'S VOLATILITY I BSE I.T. SECTOR INDX CNX IT INDEX CNX SMALLCAP INDEX BSE TECK INDEX CNX COMMODITIES INDE CNX NIFTY JUNIOR CNX PSE INDEX BSE FMCG SECTOR INDX CNX MIDCAP 200 CNX FMCG INDEX BSE MID-CAP INDEX CNX MIDCAP 50 BSE SMALL-CAP INDEX Level 1 Level 2 Center Point Level 3 Level 4 DP WB DP DP SP SP 234.85 1789.80 17314.25 10809.54 9037.15 2217.64 10288.58 3292.95 19.81 11307.93 11963.90 5543.75 6194.21 2777.40 19552.40 3649.50 8215.21 13101.85 21052.80 10768.23 3471.35 11426.78 226.0 1727.7 16886.9 10408.0 8827.6 2158.0 9990.0 3220.2 17.6 11065.6 11723.4 5434.1 6081.0 2737.3 19078.4 3581.8 8039.7 12846.7 20688.7 10612.9 3371.3 11262.4 232.4 1772.3 17167.0 10701.4 8958.1 2200.3 10175.3 3269.8 19.1 11218.3 11875.1 5511.0 6151.6 2764.9 19424.9 3628.8 8150.2 13034.1 20920.1 10725.7 3444.7 11382.0 236.3 1799.5 17300.0 10886.6 9009.6 2225.3 10247.4 3296.3 19.8 11281.4 11937.8 5555.1 6179.5 2780.0 19643.8 3655.2 8195.7 13153.8 21018.7 10796.0 3491.5 11456.9 238.8 1817.0 17447.2 10994.8 9088.7 2242.6 10360.7 3319.4 20.5 11371.0 12026.7 5587.9 6222.1 2792.5 19771.4 3675.9 8260.7 13221.6 21151.5 10838.5 3518.1 11501.6 245.2 1861.6 17727.4 11288.2 9219.2 2285.0 10546.0 3369.0 22.0 11523.7 12178.4 5664.8 6292.7 2820.1 20117.9 3722.9 8371.2 13409.0 21382.9 10951.3 3591.5 11621.3 Note- SA-Strong Above; DP-Demand Point; SP- Supply Point Up Trend Stocks Scrips BOSCH HOUSING DEVE. INFRA ADANI ENTERPRISES AXIS BANK DLF SIEMENS BAJAJ FINSE D B REALTY BHARAT PETR.COR(BPCL TEXMACO RAIL & ENGIN HCL TECHNOLOGIES DISH TV INDIA CHENNAI PETROL.CORP. Last Close 24567.00 105.05 641.00 586.50 169.85 1110.00 1464.95 89.65 727.00 165.15 1900.00 82.10 78.60 Level 1 Level 2 Center Point Level 3 Level 4 DP WB DP DP SP 22534.3 93.7 609.7 530.6 160.6 1039.3 1357.3 78.2 683.3 147.1 1835.7 78.2 72.4 24022.3 101.7 631.7 572.0 167.0 1083.3 1435.3 86.6 715.3 159.0 1876.7 80.9 76.9 24965.7 106.5 644.3 599.0 170.5 1100.7 1483.7 92.0 735.7 164.7 1894.3 82.3 79.6 25510.3 109.8 653.7 613.5 173.4 1127.3 1513.3 95.1 747.3 170.9 1917.7 83.5 81.3 26998.3 117.8 675.7 654.9 179.8 1171.3 1591.3 103.5 779.3 182.8 1958.7 86.2 85.8 Relative Strength Daily Reversal Value Up Trend Date 91.1 90.3 87.6 86.6 82.3 81.8 81.0 79.1 79.0 78.9 78.4 77.8 77.4 23334.4 93.8 588.8 588.0 163.0 1058.4 1412.9 85.6 710.0 155.4 1728.0 79.3 74.4 12/1/2015 15-01-15 19-01-15 15-01-15 15-01-15 24-12-14 20-01-15 20-01-15 23-01-15 16-01-15 30-01-15 8/1/2015 23-01-15 DISCLAIMER Trading and Investments decision taken on our trends are solely at the discretion of the traders/investors. We are not liable for any loss, which occurs as a result of our trends. This document has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. While we are not soliciting any action based upon this information, all care has been taken to ensure that the facts are accurate and opinions given fair and reasonable. Neither, Hitendra Vasudeo, Vasudeo Investments, www.stockmechanics.com, Profitak, Money Times, Times Communications (I) Ltd nor any of its employees shall be responsible for the contents. Our directors or employees, may from time to time, have positions in, or options on, and buy and sell securities referred in our reports. (For Private Circulation)- 7 WOCKHARDT GMR INFRASTRUCTURE RANBAXY LABORATORIES INDBULLS REAL ESATE HDFC BANK MAX INDIA IFCI AUROBINDO PHARMA BOMBAY DYEING & MFG. UNITECH JET AIRWAYS INDUSIND BANK PRISM CEMENT SUN PHARMA ADVAN. RE MERCK HEXAWARE TECHNOLOGIE TATA POWER CO. LARSEN & TOUBRO GVK POWER INFRASTRUC EICHER MOTORS UNITED PHOSPHEROUS WIPRO TITAN INDUSTRIES SUN PHARMACEUTICAL I IL&FS TRANSPORTION ADANI POWER TIMKEN INDIA BHARAT FORGE MONSANTO INDIA KAJARIA CERAMICS MRPL (MANG.REF.& PET POWER FINANCE CORPOR NATIONAL BLDG. CONST HT MEDIA SJVN ANANT RAJ INDUSTRIES TATA MOTORS SADBHAV ENGINEERING FEDERAL-MUGUL GOETZE BHARAT HEAVY EL(BHEL SPICE JET CLARIS LIFE ASAHI INDIA GLASS WABCO-TVS (INDIA) IRB INFRAST. DEVELOP APOLLO TYRES TATA CHEMICALS RELIGARE ENTERPRISES RELIANCE POWER RAJESH EXPORTS HINDUSTAN ZINC JAIPRAKASH ASSOCIATE 1182.00 19.05 726.00 81.50 1063.00 498.75 39.30 1227.00 83.10 18.75 495.45 864.00 106.00 373.15 975.00 234.35 87.30 1723.00 10.65 16320.00 415.75 621.80 432.85 941.00 215.35 49.90 542.45 1089.00 3486.00 729.00 54.85 287.90 878.60 135.00 25.95 48.45 602.05 291.20 445.00 297.00 22.45 193.50 145.25 5192.30 269.70 238.25 459.85 371.00 64.40 170.95 173.35 27.25 1111.3 16.9 689.7 74.7 1024.3 442.3 36.1 1148.0 78.5 17.2 453.8 814.3 101.5 344.9 944.0 225.7 80.8 1668.0 9.3 15661.7 368.2 607.0 410.6 902.0 205.9 46.6 520.9 1051.0 3218.7 696.3 51.4 250.5 842.1 127.1 24.8 44.6 577.4 273.5 413.4 285.5 21.0 183.0 135.4 4889.8 255.9 220.1 438.8 340.5 61.1 158.8 169.6 24.4 1162.3 18.4 712.7 79.6 1051.3 480.6 38.4 1205.0 81.7 18.3 484.2 849.3 104.5 364.8 964.0 232.0 85.6 1706.0 10.2 16132.7 397.3 617.2 427.0 926.0 212.8 49.0 536.2 1077.0 3412.7 719.3 53.9 278.1 868.1 132.8 25.7 47.4 594.2 284.5 436.4 292.7 22.0 190.5 141.5 5106.8 265.3 233.2 453.8 362.0 63.5 167.7 172.2 26.5 1193.7 19.3 722.3 82.7 1066.7 500.8 39.8 1240.0 83.6 19.0 503.4 869.7 106.1 376.3 973.0 236.0 88.7 1727.0 10.7 16416.3 408.0 622.9 437.5 935.0 217.1 50.5 545.3 1091.0 3533.3 732.7 55.5 295.8 883.5 136.4 26.2 49.2 603.1 288.7 450.7 295.5 22.6 195.0 143.9 5238.4 270.4 241.3 462.6 374.5 65.1 173.4 173.8 27.8 1213.3 20.0 735.7 84.6 1078.3 519.0 40.7 1262.0 84.9 19.4 514.6 884.3 107.6 384.6 984.0 238.4 90.4 1744.0 11.2 16603.7 426.4 627.5 443.4 950.0 219.7 51.4 551.5 1103.0 3606.7 742.3 56.4 305.7 894.1 138.6 26.5 50.2 611.0 295.5 459.3 299.8 23.1 198.0 147.6 5323.9 274.8 246.4 468.7 383.5 66.0 176.6 174.9 28.6 1264.3 21.5 758.7 89.5 1105.3 557.3 43.0 1319.0 88.1 20.5 545.0 919.3 110.6 404.5 1004.0 244.7 95.2 1782.0 12.1 17074.7 455.5 637.7 459.8 974.0 226.6 53.8 566.8 1129.0 3800.7 765.3 58.9 333.3 920.1 144.3 27.4 53.0 627.8 306.5 482.3 307.0 24.1 205.5 153.7 5540.9 284.2 259.5 483.7 405.0 68.4 185.5 177.5 30.7 77.2 76.9 75.9 75.7 75.6 75.5 74.1 74.0 74.0 73.9 73.5 73.1 73.1 72.6 72.3 72.0 72.0 71.7 71.7 71.6 71.3 71.2 70.5 69.7 69.5 69.4 69.4 69.2 68.9 68.6 68.3 68.0 67.9 67.9 67.8 67.6 67.4 67.3 67.2 67.0 67.0 66.8 66.2 66.0 65.7 65.5 65.3 65.3 65.2 65.2 65.1 64.9 1161.3 17.9 708.4 78.5 1063.9 478.0 38.2 1209.3 80.4 17.7 489.6 865.4 104.1 346.7 943.1 225.9 88.2 1710.4 10.2 16071.1 370.5 606.9 420.9 921.3 210.0 50.4 530.5 1036.4 3345.0 722.0 53.8 290.8 855.4 132.1 25.3 47.8 590.7 274.4 426.0 286.7 22.3 184.2 136.2 5214.4 262.4 234.2 449.1 360.4 64.1 169.3 171.0 26.9 19-01-15 29-01-15 9/1/2015 15-01-15 8/1/2015 9/1/2015 29-01-15 9/1/2015 15-01-15 29-01-15 27-01-15 12/1/2015 12/1/2015 19-01-15 2/1/2015 9/1/2015 15-01-15 12/1/2015 30-01-15 27-01-15 30-01-15 12/1/2015 15-01-15 9/1/2015 29-01-15 8/1/2015 21-01-15 12/1/2015 2/2/2015 12/1/2015 21-01-15 28-01-15 28-01-15 16-01-15 23-01-15 29-01-15 8/1/2015 15-01-15 29-01-15 29-01-15 2/2/2015 2/2/2015 13-01-15 9/1/2015 15-01-15 29-01-15 29-01-15 2/2/2015 15-01-15 15-01-15 19-01-15 30-01-15 DISCLAIMER Trading and Investments decision taken on our trends are solely at the discretion of the traders/investors. We are not liable for any loss, which occurs as a result of our trends. This document has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. While we are not soliciting any action based upon this information, all care has been taken to ensure that the facts are accurate and opinions given fair and reasonable. Neither, Hitendra Vasudeo, Vasudeo Investments, www.stockmechanics.com, Profitak, Money Times, Times Communications (I) Ltd nor any of its employees shall be responsible for the contents. Our directors or employees, may from time to time, have positions in, or options on, and buy and sell securities referred in our reports. (For Private Circulation)- 8 ROLTA INDIA RURAL ELECTRIFICATIO DABUR INDIA TECH MAHINDRA RADICO KHAITAN POWER TRADING CORP. RELIANCE INFRASTRUCT PHOENIX MILLS TATA TEA FDC EMAMI INFRA DEV FINANCE CO GAMMON INFRASTR. PRO BAJAJ FINANCE SUNDARAM FINANCE KEC INTERNATIONAL LUPIN HIND.PETR.CORP.(HPCL BHARAT ELECTRONICS J.M.FINANCIAL HUBTOWN BHARAT EARTH MOVERS GODREJ PROPERTY AKZO NOBEL INDIA CHOLAMANDALAM INVEST LANCO INFRATECH TUBE INVESTMENT OF I S.R.F. HONEYWELL AUTOMATION JUBILANT LIFE SCIENC GODFREY PHILLIPS AMARA RAJA BATTERIES CENTRAL BANK JYOTHY LABORATORIES SUN TV NETWORK KANANI INDUSTRIES TORRENT POWER MAH.TEL.NIGAM (MTNL) GUJARAT NRE COKE NATIONAL FERTILISER SINTEX INDUSTRIES DEWAN HOUSING FIN.CO GREAVES COTTON GRINDWEL NORTON VOLTAS ENT NETWORK (INDIA) MRF RELIANCE CAPITAL PROCTOR & GAMBLE HYG SHRIRAM TRANSPORT FI IVRCL INFRASTRUCTURE CENTURY PLYBOARD 117.05 336.40 265.80 2916.95 96.15 97.55 501.90 395.65 160.30 166.00 940.00 173.30 15.60 4178.00 1502.10 96.40 1545.00 599.60 3600.00 56.60 105.50 935.00 281.65 1476.00 566.75 6.17 362.90 978.00 7315.00 172.15 588.70 910.00 106.30 298.85 413.60 9.50 173.10 28.35 5.51 39.35 114.40 507.80 146.10 653.00 269.50 571.05 40595.00 482.30 6269.00 1176.00 17.60 184.75 105.0 312.3 257.5 2828.8 92.8 93.3 472.7 380.8 152.8 156.7 906.0 164.7 14.5 3991.7 1455.8 91.6 1468.7 548.0 3150.0 50.1 97.8 883.3 268.4 1420.0 497.0 5.8 345.3 929.7 7175.0 163.9 577.8 864.3 101.3 265.4 402.0 9.5 166.4 27.0 5.2 37.1 105.3 463.9 140.5 608.3 256.7 550.8 39316.7 457.0 5837.0 1116.7 16.0 172.3 112.4 329.8 262.8 2883.2 95.0 96.4 494.1 390.6 158.2 162.9 928.0 170.9 15.3 4117.7 1486.2 95.0 1520.7 585.6 3424.0 54.1 103.4 918.3 277.0 1461.0 543.4 6.1 358.0 959.7 7276.0 169.8 584.8 893.3 104.4 286.5 410.0 9.5 171.2 28.0 5.4 38.7 110.9 490.9 144.4 636.3 265.5 565.5 40194.7 475.0 6109.0 1157.7 17.2 180.2 115.1 340.7 265.2 2904.0 96.1 98.4 507.8 395.3 161.4 165.9 938.0 174.6 15.8 4183.3 1500.6 97.1 1548.3 609.1 3522.0 55.6 107.0 936.7 280.8 1487.0 566.3 6.2 365.7 971.3 7338.0 173.3 587.9 905.7 105.7 295.3 414.5 9.5 174.0 28.6 5.6 39.7 113.0 501.1 146.5 647.7 270.4 574.8 40672.3 485.6 6221.0 1180.3 18.0 183.7 119.8 347.3 268.1 2937.7 97.2 99.6 515.5 400.4 163.5 169.1 950.0 177.1 16.1 4243.7 1516.5 98.5 1572.7 623.1 3698.0 58.1 109.1 953.3 285.5 1502.0 589.7 6.3 370.7 989.7 7377.0 175.7 591.8 922.3 107.6 307.6 418.1 9.5 175.9 29.0 5.7 40.3 116.5 518.0 148.3 664.3 274.4 580.3 41072.7 492.9 6381.0 1198.7 18.4 188.2 127.2 364.8 273.4 2992.1 99.4 102.7 536.9 410.2 168.9 175.3 972.0 183.3 16.9 4369.7 1546.9 101.9 1624.7 660.7 3972.0 62.1 114.7 988.3 294.1 1543.0 636.1 6.6 383.4 1019.7 7478.0 181.6 598.8 951.3 110.7 328.7 426.1 9.5 180.7 30.0 5.9 41.9 122.1 545.0 152.2 692.3 283.2 595.0 41950.7 510.9 6653.0 1239.7 19.6 196.1 64.8 64.6 64.3 64.3 64.2 64.2 64.0 63.8 63.8 63.8 63.7 63.6 63.3 63.0 62.8 62.3 62.3 62.2 62.1 61.9 61.7 61.3 60.7 60.3 60.3 60.2 60.0 60.0 59.9 59.9 59.6 58.8 58.6 58.6 58.5 58.4 58.3 58.2 58.2 58.1 58.1 57.8 57.8 57.8 57.8 57.5 57.4 57.3 57.3 57.2 56.9 56.9 109.7 332.2 255.3 2852.8 92.3 97.4 491.7 392.0 159.8 162.1 919.0 173.4 15.6 4087.0 1490.8 92.1 1533.5 603.5 3368.0 53.6 105.3 916.6 274.9 1466.0 538.1 6.1 361.9 956.6 7300.8 170.7 575.2 879.3 103.6 283.4 405.0 9.5 172.6 28.1 5.3 37.7 110.9 482.8 143.2 622.7 265.6 568.7 39774.4 476.1 6215.9 1137.4 17.6 183.5 27-01-15 28-01-15 29-01-15 27-01-15 28-01-15 23-01-15 30-01-15 15-01-15 8/1/2015 20-01-15 12/1/2015 2/2/2015 15-01-15 13-01-15 9/1/2015 29-01-15 12/1/2015 23-01-15 27-01-15 14-01-15 30-01-15 2/2/2015 15-01-15 28-01-15 27-01-15 30-01-15 16-01-15 13-01-15 13-01-15 19-01-15 28-01-15 23-01-15 19-12-14 23-01-15 29-01-15 22-01-15 19-01-15 28-01-15 30-01-15 2/2/2015 15-01-15 3/2/2015 28-01-15 21-01-15 9/1/2015 2/2/2015 27-01-15 30-01-15 28-01-15 28-01-15 30-01-15 3/2/2015 DISCLAIMER Trading and Investments decision taken on our trends are solely at the discretion of the traders/investors. We are not liable for any loss, which occurs as a result of our trends. This document has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. While we are not soliciting any action based upon this information, all care has been taken to ensure that the facts are accurate and opinions given fair and reasonable. Neither, Hitendra Vasudeo, Vasudeo Investments, www.stockmechanics.com, Profitak, Money Times, Times Communications (I) Ltd nor any of its employees shall be responsible for the contents. Our directors or employees, may from time to time, have positions in, or options on, and buy and sell securities referred in our reports. (For Private Circulation)- 9 INDIAN HOTELS CO. SUZLON ENERGY FERTILISER CHEMICAL THERMAX PARSVNATH DEVELOPERS FAG BEARINGS INDIA DALMIA BHARAT ENTERP EXIDE INDUSTRIES GRASIM INDUSTRIES R.C.F.(RASHTRIYA CHE ARVIND FORBES & COMPANY ESSAR OIL ANDHRA BANK 3M INDIA RELIANCE INDUSTRIES HEIDELBERG CEMENT I KENNMETAL INDIA GODREJ INDUSTRIES DEEPAK FERT.& CHEM. NITIN FIRE PROTECTIO KSK ENERGY VENTURE MANAPPURAM FINANCE JAIPRAKASH HYDRO-POW KALPATARU POWER TRAN MAN INDUSTRIES (I) SUNTECK REALTY & INF PAGE INDUSTRIES PIPAVAV DEFENCE & OF BALLARPUR INDUSTRIES NMDC GTL INFRASTRUCTURE NEYVELI LIGNITE CORP HINDALCO INDUSTRIES PILANI INVESTMENT BIOCON UNITED BANK JAYPEE INFRATECH ASTRAL POLY TECHNIK NHPC WELSPUN CORPORATION FINANCIAL TECHNOLOGI GAIL (GAS AUTHORTY O SHRIRAM-CITY UNION ABAN OFFSHORES BLUE STAR AMTEK INDIA ONGC (OIL&NAT.GAS CO BALKRISHNA INDUSTRIE ITC KIRLOSKAR OIL ENGINE NTPC 121.55 17.15 34.65 1151.00 18.15 3903.00 497.50 197.55 3886.00 68.40 300.10 2340.00 112.85 91.75 6932.00 937.00 88.30 878.00 321.10 145.55 36.00 76.00 33.30 11.79 237.55 58.65 259.45 11985.95 49.35 15.95 141.30 2.39 79.90 146.35 1450.00 425.85 41.00 20.30 394.05 20.00 68.10 199.15 433.80 2085.00 498.00 343.75 68.00 359.25 645.05 366.15 269.05 143.95 117.9 15.1 32.0 1113.0 17.2 3511.3 464.2 181.9 3714.0 65.5 265.1 2129.3 108.9 86.6 6672.0 889.7 86.1 835.3 302.6 134.1 34.1 73.9 29.9 10.8 232.0 55.7 242.9 11577.1 47.1 15.3 137.3 2.2 77.1 137.9 1401.8 412.2 39.1 19.2 366.8 18.6 66.0 190.8 423.5 1970.0 458.2 317.7 65.9 344.5 623.5 354.8 265.8 139.9 120.4 16.5 33.8 1138.0 17.9 3754.3 484.7 193.1 3820.0 67.6 286.5 2262.3 111.7 90.3 6834.0 918.7 87.6 864.3 314.1 141.4 35.4 75.4 32.4 11.5 235.8 57.9 253.5 11827.3 48.7 15.8 140.1 2.3 79.0 143.4 1430.7 421.2 40.5 20.0 383.5 19.5 67.6 196.8 430.6 2045.0 483.3 333.8 67.4 353.8 637.3 361.8 268.0 142.5 121.9 17.1 34.8 1150.0 18.2 3848.7 492.3 199.8 3860.0 69.0 294.4 2317.7 113.4 92.6 6898.0 929.3 88.3 879.7 318.5 144.6 36.1 76.3 33.9 11.9 237.9 59.3 258.0 11918.8 49.7 16.1 141.6 2.4 79.9 145.9 1440.4 425.6 41.4 20.5 389.8 20.0 68.6 200.4 434.4 2080.0 493.6 340.0 68.4 357.6 643.5 364.4 269.2 143.6 123.0 17.8 35.6 1163.0 18.5 3997.3 505.2 204.3 3926.0 69.8 307.9 2395.3 114.5 94.0 6996.0 947.7 89.1 893.3 325.6 148.8 36.7 76.9 34.8 12.2 239.6 60.1 264.0 12077.4 50.4 16.2 142.9 2.5 80.9 148.9 1459.6 430.2 41.9 20.8 400.3 20.5 69.1 202.7 437.6 2120.0 508.3 350.0 69.0 363.1 651.2 368.7 270.2 145.0 125.5 19.2 37.4 1188.0 19.2 4240.3 525.7 215.5 4032.0 71.9 329.3 2528.3 117.3 97.7 7158.0 976.7 90.6 922.3 337.1 156.1 38.0 78.4 37.3 12.9 243.4 62.3 274.6 12327.6 52.0 16.7 145.7 2.6 82.8 154.4 1488.5 439.2 43.3 21.6 417.0 21.4 70.7 208.7 444.7 2195.0 533.4 366.1 70.5 372.4 665.0 375.7 272.4 147.6 56.8 56.8 56.5 56.3 56.0 54.5 54.1 54.0 53.8 53.6 53.1 53.0 52.9 52.7 52.6 52.4 52.1 52.0 51.7 51.4 51.3 51.1 51.1 51.0 50.2 49.9 49.6 49.3 49.1 49.0 48.6 48.5 47.7 46.9 46.8 46.7 46.5 46.4 46.4 46.0 45.9 45.4 45.3 44.9 44.6 43.9 43.6 43.5 42.9 42.9 42.4 42.3 119.4 16.1 32.8 1146.6 17.7 3794.6 481.5 195.4 3854.8 66.3 281.9 2271.3 112.1 91.7 6905.1 906.8 87.7 869.0 313.9 140.9 34.7 75.7 33.3 11.9 236.9 58.5 256.6 11815.2 49.4 16.0 140.3 2.4 78.7 143.1 1442.2 416.2 41.2 20.3 385.9 19.7 67.7 198.5 425.3 2068.3 486.0 335.9 67.8 352.2 645.0 360.9 268.7 142.5 21-01-15 30-01-15 2/2/2015 19-01-15 30-01-15 15-01-15 23-01-15 3/2/2015 3/2/2015 2/2/2015 29-01-15 3/2/2015 3/2/2015 2/2/2015 3/2/2015 15-01-15 2/2/2015 27-01-15 3/2/2015 29-01-15 3/2/2015 23-01-15 2/2/2015 30-01-15 3/2/2015 29-01-15 3/2/2015 3/2/2015 2/2/2015 3/2/2015 19-01-15 30-01-15 22-01-15 2/2/2015 2/2/2015 2/2/2015 2/2/2015 30-01-15 2/2/2015 3/2/2015 28-01-15 30-01-15 2/2/2015 27-01-15 3/2/2015 3/2/2015 2/2/2015 15-01-15 30-01-15 28-01-15 3/2/2015 3/2/2015 DISCLAIMER Trading and Investments decision taken on our trends are solely at the discretion of the traders/investors. We are not liable for any loss, which occurs as a result of our trends. This document has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. While we are not soliciting any action based upon this information, all care has been taken to ensure that the facts are accurate and opinions given fair and reasonable. Neither, Hitendra Vasudeo, Vasudeo Investments, www.stockmechanics.com, Profitak, Money Times, Times Communications (I) Ltd nor any of its employees shall be responsible for the contents. Our directors or employees, may from time to time, have positions in, or options on, and buy and sell securities referred in our reports. (For Private Circulation)- 10 BRITANNIA INDUSTRIES ALOK INDUSTRIES NOVARTIS INDIA TATA CONSULTANCY SER BGR ENERGY SYSTEMS CAIRN INDIA SUPREME INDUSTRIES CMC SESA GOA CUMMINS INDIA BOMBAY RAYON FASHION MCLEOD RUSSEL (I) NATCO PHARMA INGERSOLL-RAND (IND) HINDUSTAN OIL EXPLOR RAYMOND VIDEOCON INDUSTRIES PRRANETA INDUSTRIES MONNET ISPAT & ENERG KAVERI SEED COMPANY M&M FINANCE SERVICE 1923.00 9.96 676.00 2554.80 159.70 245.05 615.15 1915.00 210.55 904.00 129.50 212.05 1382.00 885.00 37.45 515.25 172.10 0.19 62.15 759.10 256.55 1885.7 9.6 638.3 2458.2 149.6 234.3 562.8 1841.7 190.8 833.7 114.6 204.0 1322.7 848.0 28.7 491.8 137.1 0.2 56.9 631.3 240.1 1911.7 9.9 665.3 2517.2 156.5 241.1 594.8 1890.7 202.9 878.7 124.2 209.1 1364.7 872.0 34.1 506.8 160.3 0.2 60.7 710.8 250.5 1926.3 10.0 681.7 2538.6 160.3 244.0 606.4 1915.3 207.5 898.3 128.4 211.1 1389.3 883.0 36.3 513.4 171.6 0.2 63.0 741.9 254.9 1937.7 10.1 692.3 2576.2 163.4 247.9 626.8 1939.7 215.1 923.7 133.8 214.1 1406.7 896.0 39.6 521.9 183.4 0.2 64.5 790.2 261.0 1963.7 10.4 719.3 2635.2 170.3 254.7 658.8 1988.7 227.2 968.7 143.4 219.2 1448.7 920.0 45.0 536.9 206.6 0.2 68.3 869.7 271.4 41.2 40.9 40.7 40.4 40.4 40.0 39.6 37.0 36.6 36.5 35.1 33.9 33.9 33.4 31.8 30.7 29.8 29.5 27.7 27.1 25.0 1908.0 10.0 669.1 2517.7 158.4 238.6 592.6 1898.6 203.1 892.0 128.3 208.2 1377.1 872.6 33.5 512.5 162.1 0.2 61.8 746.3 252.6 3/2/2015 2/2/2015 3/2/2015 3/2/2015 3/2/2015 3/2/2015 3/2/2015 3/2/2015 3/2/2015 3/2/2015 3/2/2015 3/2/2015 3/2/2015 3/2/2015 3/2/2015 3/2/2015 3/2/2015 3/2/2015 3/2/2015 3/2/2015 3/2/2015 Note- SA-Strong Above; DP-Demand Point; SP- Supply Point Down Trend Stocks Scrips ORIENTAL BANK OF COM BANK OF BARODA DEN NETWORK GUJARAT GAS CO. ALLAHABAD BANK DENA BANK SAIL (STEEL AUTHORIT PETRONET LNG L.G.BALAKRISHNAN & B GITANJALI GEMS REDINGTON (INDIA) HAVELL'S INDIA ABG SHIPYARD INDIAN BANK CASTROL INDIA PFIZER BANK OF MAHARASHTRA MAGMA FINCORP SHOPPERS STOP COAL INDIA UNION BANK OF INDIA MAHARASHTRA SEAMLESS IPCA LABORATORIES INDIA TOURISM DEV.CO Last Close Level 1 Level 2 Center Point Level 3 Level 4 SP DP DP DP SP SA 265.55 185.10 104.50 657.00 111.10 56.50 73.60 181.55 573.05 46.25 118.85 248.10 204.75 183.40 474.95 1990.00 41.45 98.10 472.45 356.70 205.45 208.35 619.60 131.75 251.7 174.9 99.3 623.7 101.6 54.4 69.9 176.0 542.8 43.6 111.8 235.2 191.2 170.2 460.6 1929.7 39.9 89.3 457.6 346.9 191.4 202.1 587.3 123.3 260.8 182.4 103.1 646.7 108.5 55.9 72.6 179.9 562.5 45.5 116.8 243.6 201.0 179.8 469.7 1973.7 41.0 95.6 467.5 353.4 201.6 206.6 611.0 129.2 265.2 187.2 105.4 659.3 112.9 56.9 74.3 182.2 571.6 46.7 119.6 247.5 207.0 185.9 473.5 2001.3 41.7 99.5 472.5 356.6 207.9 209.3 626.0 132.6 269.9 189.9 106.9 669.7 115.5 57.4 75.3 183.8 582.2 47.4 121.7 252.0 210.7 189.4 478.8 2017.7 42.1 102.0 477.4 359.9 211.7 211.1 634.6 135.2 279.0 197.4 110.7 692.7 122.4 58.9 78.0 187.7 601.9 49.3 126.7 260.4 220.5 199.0 487.9 2061.7 43.2 108.3 487.3 366.4 221.9 215.6 658.3 141.1 Relative Strength Daily Reversal Value Down Trend Date 11.03 12.42 12.89 12.91 14.79 15.29 16.06 16.49 16.89 17.29 17.32 17.86 18.28 19.60 19.70 20.00 20.58 21.03 21.30 21.62 21.64 22.58 23.02 23.05 294.34 209.64 113.82 682.75 121.70 57.79 77.25 185.95 615.24 48.95 125.82 266.08 206.05 199.68 483.04 2083.88 42.24 105.24 474.42 375.51 225.34 214.12 644.50 134.14 23-01-15 29-01-15 7/1/2015 15-01-15 23-01-15 6/1/2015 30-01-15 12/1/2015 23-01-15 16-01-15 22-01-15 28-01-15 6/1/2015 22-01-15 12/1/2015 28-01-15 22-01-15 23-01-15 21-01-15 28-01-15 27-01-15 22-01-15 15-01-15 19-01-15 DISCLAIMER Trading and Investments decision taken on our trends are solely at the discretion of the traders/investors. We are not liable for any loss, which occurs as a result of our trends. This document has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. While we are not soliciting any action based upon this information, all care has been taken to ensure that the facts are accurate and opinions given fair and reasonable. Neither, Hitendra Vasudeo, Vasudeo Investments, www.stockmechanics.com, Profitak, Money Times, Times Communications (I) Ltd nor any of its employees shall be responsible for the contents. Our directors or employees, may from time to time, have positions in, or options on, and buy and sell securities referred in our reports. (For Private Circulation)- 11 PUNJAB NATIONAL BANK BIRLA PACIFIC MEDSPA MPHASIS CLARIANT CHEMICALS ENGINEERS INDIA CADILA HEALTHCARE BAJAJ AUTO BLUE DART EXPRESS BANK OF INDIA COLGATE-PALMOLIVE (I MAHINDRA & MAHINDRA STATE BANK OF IN(NEW MOIL D B CORPORATION JINDAL SAW COROMANDEL INTERNATI HIMADRI CHEMICALS & ZEE ENTERTAINMENT V-GUARD INDUSTRIES GUJ.MINERAL DEV.CORP UCO BANK ICICI BANK HERO HONDA MOTORS JINDAL STAINLESS GRAPHITE INDIA SYNDICATE BANK VST INDUSTRIES JAI CORPORATION BALMER LAWRIE & CO. PIDILITE INDUSTRIES PERSISTENT SYSTEMS CITY UNION BANK ORISSA MINE SANOFI INDIA GNFC (GUJ.NAR.FER.CO TVS MOTOR COMPANY OMAXE ONELIFE CAPITAL ADVI IDBI (IND.DEV.BANK O SHIP.CORP.OF IN(SCI) JAGRAN PRAKASHAN GLENMARK PHARMACEUTI BAJAJ ELECTRICALS TATA STEEL EROS INTERN. MEDIA NATIONAL ALUMINIUM C CROMPTON GREAVES ABB INDIA LTD DR. REDDY'S LABORATO GLAXO SMITH.CONS.HEA JAMMU & KASHMIR BANK BHUSHAN STEEL 176.75 0.34 339.80 883.00 216.40 1544.00 2260.10 6932.00 260.85 1847.00 1200.00 300.15 291.10 383.95 80.20 271.15 23.35 372.80 1001.70 120.75 72.85 346.55 2812.00 33.60 81.95 117.05 1859.00 72.05 589.70 540.35 1649.50 92.85 2977.80 3379.00 82.05 285.60 125.30 129.00 69.50 55.85 132.20 706.00 225.90 380.95 367.05 46.75 178.75 1261.00 3091.00 5640.00 150.05 84.05 151.1 0.3 322.2 864.3 208.7 1404.3 2127.1 6596.3 236.9 1800.7 1111.7 282.8 287.3 372.4 77.1 249.7 22.1 364.9 970.9 113.3 66.2 330.9 2723.3 32.2 77.4 108.8 1819.3 68.0 558.1 523.8 1616.7 90.6 2841.4 3313.3 79.9 259.6 116.2 124.7 64.9 54.1 129.1 685.7 214.7 368.6 355.3 45.1 166.8 1230.7 3030.3 5460.0 143.3 81.5 170.0 0.3 335.0 877.3 214.1 1504.3 2226.1 6807.3 254.5 1833.7 1176.7 295.5 289.9 380.5 79.4 265.3 23.0 370.4 991.5 118.6 71.1 342.3 2785.3 33.2 80.3 114.6 1844.3 70.6 578.1 535.2 1640.5 92.2 2940.8 3358.3 81.5 277.8 123.0 127.7 68.3 55.3 131.4 700.7 222.7 377.3 363.0 46.2 175.4 1252.7 3072.3 5580.0 147.9 83.2 182.3 0.3 343.0 884.7 217.3 1564.7 2291.0 6893.7 265.8 1853.3 1218.3 303.6 291.2 385.2 80.8 274.9 23.5 373.5 1001.9 121.7 74.3 349.5 2820.7 33.7 81.6 118.0 1854.7 71.8 586.6 541.3 1655.2 93.2 3003.1 3382.7 82.5 288.2 127.4 129.3 70.4 56.0 132.8 710.3 227.6 382.4 366.6 46.8 180.6 1266.3 3095.7 5640.0 150.2 84.2 189.0 0.3 347.8 890.3 219.6 1604.3 2325.1 7018.3 272.2 1866.7 1241.7 308.2 292.5 388.6 81.6 280.8 23.8 375.9 1012.1 123.9 76.0 353.7 2847.3 34.2 83.2 120.4 1869.3 73.2 598.1 546.5 1664.3 93.8 3040.1 3403.3 83.1 296.0 129.7 130.7 71.6 56.5 133.7 715.7 230.7 386.0 370.7 47.4 184.0 1274.7 3114.3 5700.0 152.4 85.0 207.9 0.4 360.6 903.3 225.0 1704.3 2424.1 7229.3 289.8 1899.7 1306.7 320.9 295.1 396.7 83.9 296.4 24.7 381.4 1032.7 129.2 80.9 365.1 2909.3 35.2 86.1 126.2 1894.3 75.8 618.1 557.9 1688.1 95.4 3139.5 3448.3 84.7 314.2 136.5 133.7 75.0 57.7 136.0 730.7 238.7 394.7 378.4 48.5 192.6 1296.7 3156.3 5820.0 157.0 86.7 23.25 23.42 23.83 24.29 24.45 24.60 24.98 25.01 25.06 25.10 25.75 26.29 26.43 26.62 26.66 26.69 26.81 26.81 26.85 26.95 27.26 27.42 27.59 27.62 27.85 28.23 28.30 28.81 28.83 29.01 29.06 29.32 29.61 29.66 29.68 29.83 29.88 29.90 30.23 30.24 30.49 31.04 31.16 31.29 31.34 31.37 31.51 32.04 32.17 32.50 32.68 32.95 198.65 0.36 357.49 921.62 221.10 1631.88 2386.94 7117.00 282.03 1892.62 1290.88 320.09 293.96 389.65 82.40 288.69 23.87 382.96 1010.53 126.43 77.44 368.33 2851.38 34.35 81.80 122.35 1871.12 71.42 591.51 566.60 1728.59 93.98 3053.69 3408.25 87.17 302.14 127.44 131.87 73.36 56.76 134.39 724.87 233.41 392.44 369.07 46.62 188.75 1291.12 3247.50 5651.50 154.52 84.20 27-01-15 20-11-14 8/1/2015 19-01-15 23-01-15 30-01-15 28-01-15 23-01-15 23-01-15 20-01-15 28-01-15 30-01-15 8/1/2015 22-01-15 22-01-15 23-01-15 22-01-15 29-01-15 19-01-15 28-01-15 22-01-15 30-01-15 2/2/2015 5/1/2015 20-01-15 22-01-15 22-01-15 23-01-15 27-01-15 23-01-15 27-01-15 30-01-15 30-01-15 27-01-15 29-01-15 2/2/2015 30-01-15 20-01-15 27-01-15 21-01-15 19-01-15 28-01-15 23-01-15 28-01-15 23-01-15 28-01-15 28-01-15 30-01-15 30-01-15 28-01-15 30-01-15 22-01-15 DISCLAIMER Trading and Investments decision taken on our trends are solely at the discretion of the traders/investors. We are not liable for any loss, which occurs as a result of our trends. This document has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. While we are not soliciting any action based upon this information, all care has been taken to ensure that the facts are accurate and opinions given fair and reasonable. Neither, Hitendra Vasudeo, Vasudeo Investments, www.stockmechanics.com, Profitak, Money Times, Times Communications (I) Ltd nor any of its employees shall be responsible for the contents. Our directors or employees, may from time to time, have positions in, or options on, and buy and sell securities referred in our reports. (For Private Circulation)- 12 IDEA CELLULER ASIAN PAINTS OIL INDIA OPTO CIRCUITS (INDIA NIIT TECHONOLOGIES BATA INDIA HINDUSTAN COPPER EIH HATHWAY CABLE & DATA TATA INVESTMENT CORP KIRLOSKAR INDUSTRIES PUNJAB N SIND BANK SOUTH INDIAN BANK STATE BANK OF MYSORE MOTHERSON SUMI SYSTE CORE EDUCATION &TECH ARVIND REMEDIES E.I.D. PARRY (I) BAJAJ HOLDING GUJARAT STATE PETRON B.A.S.F. INDIA INDIAN OVERSEAS BANK CHAMBAL FERTILISERS ADITYA BIRLA NUVO ECLERX SERVICES DIVI'S LABORATORIES EDUCOMP SOLUTIONS YES BANK TATA COFFEE BHARTI AIRTEL BERGER PAINTS INDIA SWAN ENERGY GUJARAT IND.POWER CO VARDHMAN TEXTILES ZENSAR TECHNOLOGIES FEDERAL BANK STC (STATE TR.CORP.) ELANTAS BECK GILLETE INDIA MAHINDRA HOLIDAY RES INFO EDGE (INDIA) MIN.& MET.CORP.(MMTC RESPROSSIVE INDUSTRI JSW STEEL ESSAR PORTS JUBILANT FOODWORKS ALSTOM T & D INDIA KARUR VYSYA BANK ATUL BANNARI AMAN SUGARS PURVANKARA PROJECTS CANARA BANK 154.00 815.00 533.70 24.10 350.55 1374.00 70.00 111.65 63.60 562.10 565.00 59.50 27.50 550.05 446.90 10.81 21.70 182.80 1409.00 117.70 1232.00 56.45 61.00 1796.00 1285.70 1668.00 25.80 806.50 96.65 371.85 215.65 55.15 84.35 452.60 643.25 143.20 182.35 1156.00 3314.00 262.65 794.70 57.30 91.15 985.00 106.50 1388.25 493.20 583.10 1326.00 1195.00 81.60 438.80 147.8 780.3 516.2 23.1 344.6 1314.0 68.3 107.0 62.1 551.0 525.1 56.4 26.4 524.7 426.3 10.0 18.7 172.6 1378.3 113.5 1183.0 52.6 59.6 1764.0 1250.3 1610.0 24.8 752.0 89.8 347.4 202.3 52.6 81.6 433.9 624.4 138.9 174.8 1114.0 3151.0 258.1 669.4 55.2 83.9 948.3 103.1 1347.8 463.2 563.2 1270.7 1105.0 76.1 402.5 152.0 803.3 528.0 23.8 348.7 1356.0 69.5 110.1 63.1 558.8 554.0 58.7 27.2 542.7 441.1 10.5 20.9 180.0 1399.3 116.4 1215.0 55.4 60.6 1786.0 1274.2 1652.0 25.5 791.6 94.8 362.6 212.2 54.5 83.6 446.1 637.9 142.0 180.3 1144.0 3266.0 261.3 750.0 56.7 88.8 974.3 105.5 1374.8 482.2 577.6 1304.7 1159.0 79.7 428.8 154.2 814.7 534.0 24.3 351.0 1380.0 70.2 111.7 63.5 563.4 572.0 60.1 27.7 553.4 450.0 10.8 22.3 184.5 1410.7 117.9 1230.0 57.2 61.3 1798.0 1286.6 1678.0 25.9 816.2 97.9 368.4 218.5 55.7 84.9 451.8 645.9 144.0 183.6 1162.0 3333.0 263.2 786.0 57.7 91.4 989.7 106.8 1388.4 490.1 586.5 1317.3 1177.0 81.4 445.1 156.2 826.3 539.7 24.6 352.8 1398.0 70.7 113.3 64.0 566.7 582.9 61.0 28.0 560.7 455.8 11.1 23.1 187.3 1420.3 119.2 1247.0 58.3 61.7 1808.0 1298.1 1694.0 26.2 831.1 99.8 377.7 222.0 56.3 85.6 458.3 651.3 145.2 185.7 1174.0 3381.0 264.6 830.7 58.2 93.8 1000.3 107.8 1401.8 501.1 592.0 1338.7 1213.0 83.3 455.1 160.4 849.3 551.5 25.3 356.9 1440.0 71.9 116.4 65.0 574.5 611.8 63.3 28.8 578.7 470.6 11.6 25.3 194.7 1441.3 122.1 1279.0 61.1 62.7 1830.0 1322.0 1736.0 26.9 870.7 104.8 392.9 231.9 58.2 87.6 470.5 664.8 148.3 191.2 1204.0 3496.0 267.8 911.3 59.7 98.7 1026.3 110.2 1428.8 520.1 606.4 1372.7 1267.0 86.9 481.4 33.35 33.47 33.65 33.70 33.89 34.19 34.40 34.42 34.44 34.61 35.00 35.07 35.09 35.21 35.46 35.51 35.56 35.77 35.87 35.95 35.99 36.15 36.26 36.66 36.81 37.32 38.04 38.59 38.60 38.72 38.84 38.96 39.05 39.21 39.21 39.50 39.70 39.75 39.77 39.86 39.87 39.97 39.97 40.09 40.39 40.57 40.60 40.64 40.84 40.88 40.99 41.25 161.58 861.38 543.84 24.27 354.69 1431.88 70.15 112.36 63.82 568.42 575.87 61.17 27.80 559.01 461.20 11.27 23.12 189.45 1405.25 119.27 1252.38 58.53 62.63 1816.50 1288.67 1703.25 26.15 858.87 99.39 375.01 226.69 55.20 85.39 449.77 659.03 143.99 185.70 1180.25 3394.62 265.06 811.38 57.68 91.72 996.00 108.27 1405.21 497.12 597.36 1323.12 1202.00 81.94 460.56 29-01-15 30-01-15 30-01-15 21-01-15 21-01-15 30-01-15 21-01-15 23-01-15 19-01-15 30-01-15 2/2/2015 23-01-15 20-01-15 27-01-15 29-01-15 16-01-15 27-01-15 2/2/2015 16-01-15 2/2/2015 22-01-15 22-01-15 29-01-15 30-01-15 29-01-15 3/2/2015 19-01-15 30-01-15 28-01-15 30-01-15 2/2/2015 28-01-15 29-01-15 27-01-15 29-01-15 3/2/2015 30-01-15 21-01-15 2/2/2015 28-01-15 3/2/2015 22-01-15 27-01-15 29-01-15 23-01-15 30-01-15 30-01-15 30-01-15 21-01-15 30-01-15 2/2/2015 30-01-15 DISCLAIMER Trading and Investments decision taken on our trends are solely at the discretion of the traders/investors. We are not liable for any loss, which occurs as a result of our trends. This document has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. While we are not soliciting any action based upon this information, all care has been taken to ensure that the facts are accurate and opinions given fair and reasonable. Neither, Hitendra Vasudeo, Vasudeo Investments, www.stockmechanics.com, Profitak, Money Times, Times Communications (I) Ltd nor any of its employees shall be responsible for the contents. Our directors or employees, may from time to time, have positions in, or options on, and buy and sell securities referred in our reports. (For Private Circulation)- 13 J.K. LAKSHMI CEMENT OBEROI REALITY VIJAYA BANK TORRENT PHARMACEUTIC KARNATAKA BANK INDRAPRASTHA GAS NAVA BHARAT VENTURES KOTAK MAHINDRA BANK NAGARJUNA CONSTRUCTI STATE BANK OF BIKANE G.E.SHIPPING THOMAS COOK INDIA BALRAMPUR CHINI MILL CORPORATION BANK TRENT ABBOTT INDIA TATA TELESERVICES LIC HOUSING FINANCE JINDAL STEEL & POWER CONTAINER CORP.OF IN KANSAI NEROLAC PAINT HINDUSTAN UNILEVER A.C.C.(ASSOC.CEMENT INFOSYS ING VYSYA BANK ELECTROSTEEL STEEL INDIAN OIL CORPORATI PUNJ LLOYD ICRA SE INVESTMENT RIL COMMUNICATONS GODREJ CONSUMER PROD MULTI COMMODITY EXCH GATEWAY DISTRIPARKS NESTLE INDIA STRIDES ARCOLAB LAKSHMI MACHINE WORK SHREE RENUKA SUGAR GUJARAT PIPAVAV PORT MUTHOOT FINANCE MINDTREE HMT PRESTIGE ESTATE PROJ POWER GRID CORPORATI HIND.NATIONAL GLASS SOLAR INDUSTRIES IND UNITED BREWERIES WHIRLPOOL OF INDIA HDFC (HOUSING DEV.FI ULTRATECH CEMENT MARUTI SUZUKI INDIA LNT FH 386.35 278.90 49.35 1135.00 139.65 463.15 192.75 1308.00 72.80 655.00 352.50 190.40 60.70 66.80 1419.00 3999.00 9.09 470.10 152.20 1394.00 2397.00 911.00 1511.00 2120.00 913.00 4.17 331.25 36.35 3305.75 271.70 77.70 1085.00 863.50 381.15 7064.00 907.80 3919.00 16.10 206.85 207.55 1296.95 63.95 267.95 147.10 126.00 3080.20 981.00 709.00 1232.00 3105.00 3608.00 69.15 367.4 271.1 47.3 1066.0 128.7 448.7 183.1 1220.0 68.2 603.7 340.3 181.6 58.0 61.5 1333.7 3854.7 8.8 447.2 145.4 1337.0 2281.3 879.3 1412.3 2065.0 848.7 3.9 313.7 34.5 3283.8 259.6 72.2 1059.0 836.2 364.9 6733.3 860.2 3820.0 15.4 195.7 190.2 1166.9 59.8 256.2 143.3 121.0 2966.5 942.7 680.3 1173.3 2930.2 3479.7 65.3 381.3 276.7 48.7 1112.0 136.4 458.9 189.9 1284.0 71.5 640.7 349.1 187.9 59.9 65.4 1395.7 3955.7 9.0 463.5 150.2 1374.0 2353.3 902.3 1483.3 2102.0 895.7 4.1 326.7 35.9 3298.8 268.1 76.2 1076.0 856.1 376.8 6954.3 895.2 3884.0 15.9 203.6 202.6 1253.0 62.8 263.8 146.0 124.0 3048.5 968.7 700.3 1216.3 3051.3 3573.7 68.1 390.2 280.2 49.4 1135.0 140.9 464.9 193.9 1324.0 73.6 663.3 354.6 191.8 61.0 67.9 1434.3 4013.3 9.1 473.1 153.0 1391.0 2381.7 916.7 1526.7 2121.0 925.3 4.2 335.1 36.7 3306.9 273.1 78.6 1084.0 868.5 384.4 7065.7 917.6 3913.0 16.2 208.2 210.0 1295.0 64.7 267.1 147.7 125.0 3098.7 982.3 711.7 1243.7 3118.7 3633.3 69.8 395.2 282.3 50.0 1158.0 144.2 469.1 196.7 1348.0 74.8 677.7 358.0 194.3 61.8 69.3 1457.7 4056.7 9.2 479.7 155.0 1411.0 2425.3 925.3 1554.3 2139.0 942.7 4.3 339.7 37.2 3313.8 276.6 80.2 1093.0 876.0 388.7 7175.3 930.2 3948.0 16.4 211.5 214.9 1339.0 65.9 271.3 148.8 127.0 3130.5 994.7 720.3 1259.3 3172.4 3667.7 70.9 409.1 287.9 51.4 1204.0 151.9 479.3 203.5 1412.0 78.1 714.7 366.8 200.6 63.7 73.2 1519.7 4157.7 9.4 496.0 159.8 1448.0 2497.3 948.3 1625.3 2176.0 989.7 4.5 352.7 38.6 3328.8 285.1 84.2 1110.0 895.9 400.6 7396.3 965.2 4012.0 16.9 219.4 227.3 1425.1 68.9 278.9 151.5 130.0 3212.5 1020.7 740.3 1302.3 3293.5 3761.7 73.7 41.82 42.02 42.39 42.45 42.48 42.78 42.78 43.32 43.33 43.39 43.87 43.95 44.11 44.23 44.24 44.29 44.46 44.83 44.94 45.05 45.09 45.25 45.31 45.55 45.75 46.13 46.22 46.29 46.59 46.86 47.08 47.36 47.42 47.88 47.96 48.02 48.28 49.06 49.43 49.59 50.47 50.59 50.72 51.08 51.21 51.37 51.93 52.37 53.15 53.41 53.54 54.75 399.60 281.99 49.51 1147.50 144.54 468.84 193.37 1353.12 74.08 679.50 357.79 197.15 61.71 70.26 1449.75 4006.62 9.35 485.16 156.09 1412.12 2426.62 934.12 1543.88 2153.88 947.50 4.25 337.51 36.61 3312.29 276.44 79.99 1085.25 869.11 386.14 7174.12 920.03 3940.25 16.29 209.94 218.37 1310.81 64.97 272.59 148.57 128.16 3091.98 997.62 712.38 1288.62 3125.43 3653.38 69.86 27-01-15 29-01-15 27-01-15 30-01-15 27-01-15 30-01-15 3/2/2015 21-01-15 3/2/2015 29-01-15 2/2/2015 22-01-15 29-01-15 27-01-15 3/2/2015 29-01-15 23-01-15 30-01-15 2/2/2015 29-01-15 2/2/2015 30-01-15 2/2/2015 29-01-15 22-01-15 3/2/2015 3/2/2015 3/2/2015 3/2/2015 28-01-15 29-01-15 30-01-15 3/2/2015 29-01-15 30-01-15 3/2/2015 3/2/2015 3/2/2015 3/2/2015 29-01-15 3/2/2015 3/2/2015 2/2/2015 30-01-15 3/2/2015 2/2/2015 30-01-15 30-01-15 30-01-15 2/2/2015 3/2/2015 3/2/2015 DISCLAIMER Trading and Investments decision taken on our trends are solely at the discretion of the traders/investors. We are not liable for any loss, which occurs as a result of our trends. This document has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. While we are not soliciting any action based upon this information, all care has been taken to ensure that the facts are accurate and opinions given fair and reasonable. Neither, Hitendra Vasudeo, Vasudeo Investments, www.stockmechanics.com, Profitak, Money Times, Times Communications (I) Ltd nor any of its employees shall be responsible for the contents. Our directors or employees, may from time to time, have positions in, or options on, and buy and sell securities referred in our reports. (For Private Circulation)- 14 FORTIS HEALTHCARE GLAXO SMITHKLINE PHA MARICO CESC J K CEMENT CENTURY TEXT.& IND. BIRLA CORPORATION CIPLA EDELWEISS FINANCIAL INDIA CEMENTS SHREE CEMENT ASHOK LEYLAND APOLLO HOSPITALS ENT MOTILAL OSWAL FIN.SE JSW ENERGY 113.30 3338.00 348.95 714.00 698.15 557.00 517.85 678.00 70.55 104.65 10836.00 64.85 1302.00 307.30 113.15 109.7 3199.3 307.5 679.3 640.2 513.9 477.8 640.3 67.0 94.7 8679.0 61.2 1218.7 280.3 91.9 112.3 3299.3 336.1 704.3 679.1 544.9 505.5 667.3 69.5 101.8 10157.0 63.8 1278.7 300.0 107.3 113.8 3360.7 351.9 719.7 699.0 563.7 520.7 683.7 71.0 106.1 10956.0 65.4 1315.3 312.3 116.9 114.8 3399.3 364.7 729.3 718.1 575.8 533.1 694.3 72.0 108.9 11635.0 66.4 1338.7 319.6 122.7 117.4 3499.3 393.3 754.3 757.0 606.8 560.8 721.3 74.5 116.0 13113.0 69.0 1398.7 339.3 138.1 55.17 56.51 56.67 57.20 59.20 59.25 63.04 63.32 63.47 64.05 64.28 64.38 64.55 74.13 83.62 114.37 3358.88 355.76 720.25 702.18 566.23 533.08 687.75 71.33 108.98 10931.38 65.55 1326.50 315.73 116.57 2/2/2015 3/2/2015 3/2/2015 3/2/2015 2/2/2015 3/2/2015 3/2/2015 3/2/2015 3/2/2015 3/2/2015 3/2/2015 3/2/2015 3/2/2015 3/2/2015 3/2/2015 DISCLAIMER Trading and Investments decision taken on our trends are solely at the discretion of the traders/investors. We are not liable for any loss, which occurs as a result of our trends. This document has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. While we are not soliciting any action based upon this information, all care has been taken to ensure that the facts are accurate and opinions given fair and reasonable. Neither, Hitendra Vasudeo, Vasudeo Investments, www.stockmechanics.com, Profitak, Money Times, Times Communications (I) Ltd nor any of its employees shall be responsible for the contents. Our directors or employees, may from time to time, have positions in, or options on, and buy and sell securities referred in our reports.

© Copyright 2026