Download PDF version - Economic and Political Weekly

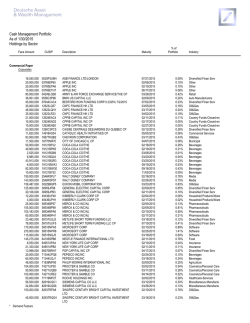

SPECIAL ARTICLE Rise and Fall of Industrial Finance in India Partha Ray Examining the sources of finance for Indian industry, this paper traces the transition from a state-owned and state-dictated financial sector to a regime of financial liberalisation. There are still a number of rough edges to this transition. With the initiation of financial sector reforms and the demise of development banking, there are indications that the industrial sector faces a credit crunch. While newer sources of finance could have compensated for the paucity of bank financing, the exit of development banks before establishing a successful corporate debt market has turned out to be costly for long-term financing. In this context, the experience of the Brazilian Development Bank could serve as a useful model for India. This paper was presented at the national conference on “India’s Industrialisation: How to Overcome the Stagnation” in New Delhi, 19-21 December 2013, organised by the Institute for Studies in Industrial Development. The author is indebted to the participants of the conference for their comments. The author thanks R Nagaraj in particular for his detailed comments on an earlier draft. The usual disclaimer applies. Partha Ray ([email protected]) teaches at the Indian Institute of Management Calcutta. Economic & Political Weekly EPW january 31, 2015 vol l no 5 1 Introduction D oes finance matter for growth and development? While the question seems to be at the heart of the process of growth and development, finance was a neglected issue in mainstream models of growth till recently. Was this a slip in the theories that look into complex realities? Or, was it because the mainstream growth literature as “a basic theoretical paradigm focuses on the fundamental mechanisms of the growth process, whereas finance is like the lubrication that reduces frictions and thereby enables the machinery to function” (Aghion and Howitt 2009)? Why would finance matter to growth? The literature distinguishes between two kinds of complementary channels. In the first channel, innovative financial technologies tend to lessen the informational asymmetries that act as impediments to the efficient allocation of funds, thereby improving total factor productivity (for example, Greenwood and Jovanovic 1990). The second channel, stemming from Gurley and Shaw (1955), focuses on the “spread of organised finance at the expense of self-finance and the former’s ability to overcome indivisibilities through the mobilisation of otherwise unproductive resources” (Bell and Rousseau 2001). Thus, it is based on the debt accumulation hypothesis (Bencivenga and Smith 1991). Apart from these theoretical models in the neoclassical tradition, there is a large literature on the role of finance in industrialisation in the historical context. For example, Gerschenkron’s writings on industrialisation in Europe tend to suggest that both the timing and character of growth might have conditioned the institutional structure in the 19th century, in which banks played a crucial role. The more “economically backward” a country is, the more active would be the role played by its government and large banks in supplying capital and entrepreneurship. In particular, it was shown how late industrialising countries of continental Europe created bank finance for long-term lending to overcome the lack of financial markets and speed up industrialisation (Gerschenkron 1962). At the risk of oversimplification, in the taxonomy of bankbased versus market-based financial systems, it is well known that the Indian economy emerged as a bank-based system over the years. After the nationalisation of leading commercial banks in 1969, detailed plan processes evolved for making finance available to different sectors of the economy. Industrial finance occupied a key role in this. While there were detailed norms for working capital finance from commercial banks, a number of term-lending institutions came into being, primarily under government auspices. This process has been reversed after the initiation of financial sector reforms. Moving 61 SPECIAL ARTICLE away from a regime of assured finance from commercial banks (for working capital) and development banks (for term finance), the Indian industrial sector has been accessing a variety of sources for finance since the late 1990s. Further, most of the term-lending institutions closed due to lack of government funding at concessional rates and re-emerged as full-fledged universal banks. An objective evaluation of the movement from a dirigisme financial regime to a more market-friendly regime is fraught with difficulties, and the assessment often tends to get caricatured in terms of a state versus market debate. The case of industrial finance is all the more complicated as Indian industrial growth has suffered since liberalisation, which has seen the service sector emerge as the key driver of growth. Now that questions are increasingly being asked about the sustainability of service-led growth, it is important to examine the constraints facing the industrial sector. How far is finance (or its lack) responsible for lacklustre industrial growth? How far is the lack of industrial/manufacturing dynamism in India due to the operation of a finance constraint? A number of authors have emphasised credit constraints and the way they have affected industrial growth in India. In an early evaluation of the effect of financial sector reform on the performance of the industrial sector, Khanna (1999) found that, contrary to expectations, there was a hardening of interest rates rather than an easy availability of credit. Using Annual Survey of Industries data at the threedigit level, Gupta, Hasan and Kumar (2008) pointed out that the post-reform performance of the manufacturing sector was heterogeneous across industries. In particular, industries that were dependent on infrastructure or external finance and were labour-intensive had not been able to reap the benefits of the reforms. More recently, Banerjee and Duflo (2012) have showed that a sample of firms under the ambit of directed credit programmes in 2000 were themselves creditconstrained. Analysing the significance of the credit constraint on Indian industries, Bhattacharjee and Chakrabarti (2013: 66) noted, The Indian manufacturing sector that was mainly credit-centric in the earlier years experienced a significant decline in the availability of loanable funds in the post-liberalisation period mainly due to the risk averse behaviour of the banking sector and the gradual withdrawal of the DFIs [development finance institutions]. Even official documents cite lack of credit as a factor responsible for subdued industrial growth. For instance, the Economic Survey (2012-13) noted, The moderation in industrial growth, particularly in the manufacturing sector, is largely attributed to sluggish growth of investment, squeezed margins of the corporate sector, deceleration in the rate of growth of credit flows and the fragile global economic recovery (195; emphasis added). Nevertheless, segregating the influence of financial factors impeding industrial growth from the other policy-induced factors (such as trade or investment policy) is difficult. This paper makes no such attempt. Instead, it attempts to present some broad stylised facts on industrial finance in a before-and-after 62 framework, and flag some contemporary issues facing industrial finance. Section 2 deals with the specialised institutions that were set up after Independence to deal specifically with providing industrial finance. Section 3 gives a synoptic view of the trends in industrial finance following bank nationalisation in 1969. Section 4 presents the story of industrial finance since the 1990s. Section 5 flags a few contemporary issues for industrial finance. Section 6 concludes the paper. 2 Industrial Finance and Specialised Institutions Looking at the history of industrial finance in India, one may note that despite the existence of a capital market, risk capital for the industrial sector was not very forthcoming in preIndependence days. The managing agency system also inhibited growth of the capital market as the managing agents acted both as promoting and marketing agencies. The capital market was characterised by an absence of special institutions to float new issues. Faced with the lukewarm response of the capital market, some princely states such as Mysore and Hyderabad founded state-supported banks to finance industrialisation. For example, the State Bank of Mysore was established in 1913 as Bank of Mysore under the patronage of the government of Mysore, at the instance of a committee headed by engineer-statesman M Visvesvaraya.1 Immediately after Independence, a “network of financial institutions” was “set up to fill the gaps in the supply of longterm finance to industry” (Rosen 1962: 83). The Industrial Finance Corporation of India (IFCI) was set up in 1948. In the next five years, a number of state governments, with the encouragement of the central government, set up their own state financial corporations (SFCs). In the initial years, the IFCI was empowered to extend loans above Rs 10 lakh and the SFCs were mandated to extend loans below this threshold. While the SFCs were created on the lines of the IFCI, they were intended to “serve the financial requirements of small- and medium-sized enterprises” (Gupta 1969: 88). Later, in 1954, the National Industrial Development Corporation (NIDC) was set up as an agency of the central government to provide both entrepreneurship and finance to the industrial sector, and it functioned till early 1963. The Industrial Credit and Investment Corporation of India (ICICI) was floated in 1955 as a public limited company with the support of the World Bank, the Government of India, and representatives of Indian industry. While its primary objective was to provide medium-term and long-term project financing to businesses, it emerged as the major source of foreign currency loans to Indian industry, and for underwriting corporate finance. Despite the involvement of the World Bank and the private sector, the central government played a significant role in the establishment of the ICICI. In 1964, the Industrial Development Bank of India (IDBI) was set up as an apex institution in the sphere of medium- and long-term finance. It took over the business of the Refinance Corporation for Industry (RCI), which was set up in 1958 for the SFCs. The control of the IFCI was transferred to the IDBI january 31, 2015 vol l no 5 EPW Economic & Political Weekly SPECIAL ARTICLE from the central government. The IDBI was constituted as a wholly-owned subsidiary of the Reserve Bank of India (RBI), which created a new long-term fund known as the National Industrial Credit (Long-term Operations) Fund with an initial contribution of Rs 10 crore. The RBI used to make annual allocations to the fund out of its surplus profits before they are transferred to the government. Following the model of “development central banking”, the RBI built up a three-pronged strategy of developing an institutional framework for industrial financing alongside extending rural credit and designing concessional financing schemes for economic development (Singh, Shetty and Venkatachalam 1982). The RBI played a key role in establishing the IFCI (1948), RCI (1958), IDBI (1964), and the Industrial Reconstruction Corporation of India (1971) alongside a network of SFCs to meet the term credit needs of local medium- and small-scale industries (SSI) and for funding land development banks. The RBI also subscribed 50% of the initial capital of the Unit Trust of India (UTI) (Jadhav et al 2005).2 As a result of all these developments, by the time the banking system was proceeding towards nationalisation, India already had a network of specialised institutions that were active in providing industrial finance (Table 1). Table 1: Loans Disbursed by Special Industrial Financing Institutions (Rs crore) Year IFCI SFCs ICICI 1948 0.7 - - Refinance to Banks - IDBI (Direct Loans) NIDC - - Total 1949 1.7 - - - - - 1.7 1950 2.2 - - - - - 2.2 1951 2.1 - - - - - 2.1 1952 2.1 - - - - - 2.1 1953 2.7 0.2 - - - - 2.9 1954 2.2 1.1 - - - - 3.3 1955 1.9 1.7 0.1 - - - 3.7 1956 6.0 2.7 0.4 - - 0.2 9.3 1957 9.1 3.5 1.4 - - 0.3 14.3 1958 7.9 3.4 1.4 - - 2.2 14.9 1959 8.0 3.8 2.4 0.8 - 1.9 16.9 1960 7.5 4.5 1.8 1.4 - 1.7 16.9 0.7 1961 8.7 7.3 4.5 4.7 - 2.3 27.5 1962 12.4 10.5 8.0 8.0 - 3.2 42.1 1963 15.1 12.3 8.8 15.4 - 2.6 54.2 1964 17.3 12.7 13.4 18.8 - - 62.2 1965 21.2 15.3 15.4 16.4 1.8 - 70.1 Source: Gupta (1969: 94). Apart from these specialised institutions catering exclusively to industries, investment institutions such as the Life Insurance Corporation (LIC), which had been set up in 1956, played an active role in purchasing industrial securities. Over the years, many more term-financing institutions were established and these institutions played a significant role in providing long-term finance to Indian industries. The broad structure that prevailed at the end of the last century consisted of various types of all-India financial institutions (AIFIs). They comprised (a) all-India development banks (IFCI, ICICI, IDBI, Small Industries Development Bank of India (SIDBI), and Industrial Investment Bank of India (IIBI)); (b) specialised Economic & Political Weekly EPW january 31, 2015 vol l no 5 institutions (Export-Import Bank of India (EXIM Bank), IFCI Venture Capital Funds (IVCF), ICICI Venture, Tourism Finance Corporation of India (TFCI), and Infrastructure Development Finance Company (IDFC)); (c) investment institutions (UTI, LIC, and General Insurance Corporation (GIC) and its subsidiaries); and (d) refinance institutions (National Bank for Agriculture and Rural Development (NABARD) and National Housing Board (NHB)). Besides, there were 18 SFCs and 26 state industrial development corporations (SIDCs). The spread of their activities was significant till the 1990s (Table 2). Table 2: Trends and Composition of Disbursements of Financial Institutions Period Total Shares of Disbursements as Percentage of Disbursements Total Disbursements as Percentage All-India Specialised Investment State-level Total of GDP Development Institutions Institutions Institutions Banks 1970-71 to 1974-75 1975-76 to 1979-80 1980-81 to 1984-85 1985-86 to 1989-90 0.5 0.8 1.4 1.9 66.0 71.5 68.8 66.1 0.0 0.0 0.0 0.1 8.5 7.8 10.2 15.0 25.5 20.7 21.0 18.9 100.0 100.0 100.0 100.0 Source: RBI, Report on Currency and Finance, 1999-2000. The DFIs have been an important source of long-term funds (mainly debt) for the industrial sector. Two of their specific achievements need to be mentioned. First, development banks such as the IDBI played an active role in promoting small enterprises in backward areas, particularly by supporting the technical consultancy organisations (TCOs) set up as autonomous corporate units in each backward state by financial institutions and the Technical Consultancy Service Centre (TCSC). By the end of 1980, there were 13 TCOs and many of them were successful (Bhatt 1981). Second, DFI lending to the Indian corporate sector was not governed by lobbying, precedence, or even sponsoring socially desirable projects that were not privately profitable. Rather, their primary role was to reduce the financial constraints faced by firms (Bhandari et al 2003).3 3 Finance for Industries Following Bank Nationalisation It may be useful to recall that Indian banking was entirely in the private sector at the time of Independence. The banking sector was fairly oligopolistic and, “in addition to the Imperial Bank, there were five big banks, each holding public deposits aggregating Rs 100 crore and more, viz, Central Bank of India, Punjab National Bank, Bank of India, Bank of Baroda, and United Commercial Bank” (RBI 2008).4 Most of the banks were owned by industry houses, and allegations of interconnected lending (whereby typically a bank used to lend to its owner) were rampant between 1947 and 1967. There were also largescale bank failures.5 The story of bank nationalisation is quite well known. Postnationalisation, the banking sector and monetary policies became increasingly subsumed under what came to be known as “credit planning”. The key features of the credit planning regime were as follows. First, an administrative interest rate structure, dictated by societal needs, emerged. Second, some sectors, primarily agriculture and the small-scale industrial sector, were designated “priority sectors” – commercial banks were obligated to extend a fixed proportion of their total credit to them.6 Third, since banking was seen as a source of 63 SPECIAL ARTICLE resources for planning, there was an increase in the statutory liquidity ratio, that is, the proportion of aggregate liabilities that a bank is supposed to hold in government securities and other safe/liquid assets. Fourth, for normal working capital loans, various parameters/norms were prescribed in 1975 (inventory and receivables) for an approach to lending, style of credit, and follow up (RBI 2008).7 Bank Credit for Industries What has been the effect of these policies? Notwithstanding claims of financial repression, it was apparent that the amount of credit increased at a spectacular rate during the postnationalisation years (Figure 1). The diverging trend between deposits and credit is due to the increasing investment of commercial banks during this period, reflecting among other things an increase in the statutory liquidity ratio. Figure 1: Commercial and Cooperative Banks Deposits and Credit, 1950 to 1990 (% of gross domestic product) 35 30 25 Deposits 20 15 10 Bank Credit 5 1990-91 1986-87 1988-89 1982-83 1984-85 1978-79 1980-81 1974-75 1976-77 1972-73 1970-71 1968-69 1966-67 1962-63 1964-65 1958-59 1960-61 1956-57 1952-53 1954-55 1950-51 0 What has happened to the industrial credit extended by commercial banks? As the main aim of nationalisation of banks was to channelise credit to agriculture and SSI, there was a marginal decline in the share of credit to medium- and large-scale industries. But taking the SSI sector into account, total industrial credit as a proportion to aggregate gross bank credit was very stable (Figure 2). Figure 2: Industrial Credit from 1979-80 to 1990-91 (% of total gross bank credit) 60 55 50 45 40 35 Total Industrial Credit 30 Credit to Medium and Large Industries 1990-91 1989-90 1988-89 1987-88 1986-87 1985-86 1984-85 1983-84 1982-83 1981-82 1980-81 Credit to SSI 1979-80 25 20 15 10 To sum up, a close look at the proportion of major sources of industrial finance establishes the primacy of bank credit. However, the development banks played a significant complementary role (Table 3). Table 3: Major Sources of Industrial Finance (% of GDP) Period Bank Credit Development Finance Institutions Capital Market Total 1970s 1980s 1990s 1.8 2.7 2.6 0.3 0.7 1.0 0.1 0.6 1.2 2.2 4.0 4.8 Source: Mohan (2009). 64 4 Trends in Industrial Finance since the 1990s Financial Sector Reforms: Broad Contours The story of economic liberalisation in India is well known.8 What is less well known is that industrial finance has been decreasing since the beginning of the new millennium. Monthly data on sectoral deployment of credit collected from 47 scheduled commercial banks, accounting for about 95% of the total non-food credit deployed by all scheduled commercial banks, are released by the RBI. Trends in these data are reported in Table 4. It appears that industrial credit as a proportion of nonfood credit or total credit has experienced a secular decline. Table 4: Sectoral Deployment of Gross Bank Credit: Old Format (Rs crore) Period Agriculture SmallScale Industries 1999-2000 44,400 2000-01 51,900 2001-02 60,800 2002-03 73,500 2003-04 90,500 2004-05 1,25,300 2005-06 1,74,000 2006-07 2,30,400 2007-08 2,75,300 2008-09 3,38,700 2009-10 4,16,100 2010-11 4,80,600 2011-12 5,48,400 2012–13 5,89,900 52,800 56,000 57,200 60,400 65,900 74,600 91,200 1,17,900 1,32,700 1,69,000 2,06,400 2,10,200 2,36,300 2,84,300 Medium and Large Industries Wholesale Trade Other Sectors 1,47,300 16,800 79,200 1,62,800 17,800 94,100 1,72,300 20,500 1,14,700 2,35,200 22,600 1,50,700 2,47,200 24,900 1,92,500 3,52,300 32,500 2,33,500 4,59,200 39,700 3,95,200 5,79,400 50,100 5,35,700 7,25,600 55,700 6,75,300 8,85,400 67,400 7,16,500 11,05,100 86,400 7,52,600 13,94,400 94,700 9,16,000 17,01,100 1,20,200 10,48,100 19,45,800 1,50,100 12,33,800 Non-Food Memo: Gross Aggregate Bank Credit to Credit Industry (NFC) as % of NFC 375,100 429,200 482,700 620,100 728,400 999,800 14,04,800 18,01,200 22,04,800 26,01,800 30,40,000 36,67,400 42,89,700 48,69,600 53.3 51.0 47.5 47.7 43.0 42.7 39.2 38.7 38.9 40.5 43.1 43.8 45.2 45.8 Source: Handbook of Statistics on the Indian Economy, RBI. The classification scheme of sectoral disaggregation could be somewhat archaic and not reflect existing reality. Thus, a new format for reporting the sectoral deployment of bank credit was devised in 2007-08. A look at these data reveals the emergence of personal loans in recent years, which accounted for nearly one-fifth of gross bank credit (Table 5, p 65). Personal loans, together with credit to the services sector, account for nearly 45% of gross bank credit. Nevertheless, as a proportion of manufacturing gross domestic product (GDP), industrial credit seemed to have gone up from 1.2% in 2007-08 to 1.7% in 2013. Demise of Development Banking Another major development after financial sector reform has been the gradual demise of development banking. Interestingly, this was in line with the recommendations of the Narasimham Committee II, which said, To provide the much needed flexibility in its operations, IDBI should be corporatised and converted into a Joint Stock Company under the Companies Act on the lines of ICICI, IFCI and IDBI. For providing focused attention to the work of State Financial Corporations, IDBI shareholding in them should be transferred to SIDBI which is currently providing refinance assistance to State Financial Corporations. To give it greater operational autonomy, SIDBI should also be delinked from IDBI (Chap V, para 5.34).9 january 31, 2015 vol l no 5 EPW Economic & Political Weekly SPECIAL ARTICLE But this recommendation was initially rejected by the government. Later, the RBI constituted a committee under the chairmanship of S H Khan to examine the concept of development financing, given the changed global challenges of 1999. The committee noted, A gradual elimination of extant boundaries between Commercial Banks and Development Financial Institutions (DFIs), both on the assets as well as on the liabilities side, is necessary if Indian financial institutions and commercial banks are to prepare themselves to compete in a deregulated and increasingly global marketplace. The Group therefore recommends a progressive move towards universal banking and the development of an enabling regulatory framework for the purpose.10 identified (Mathur 2003). First, some structural infirmities cropped up in the functioning of DFIs. The ownership of IDBI makes an interesting point. Illustratively, it has been noted: IDBI, in which government shareholding is 58.5%, has a 31.7% shareholding in IFCI which in turn has 19% shareholding in TFCI …. IDBI has its shareholding in SIDBI (49%), IDFC (5%) and NEDFi [North Eastern Development Finance Corporation] (25%) as well … in fact till end March 1999 IDBI had its shareholding in ICICI as well (1.4%) (Mathur 2003: 800). Essentially, such an interlinked ownership structure could give an incorrect idea about the extent of public ownership in these institutions and the government guarantee implicit in any rescue operation. Second, with RBI stopping the National Based on the recommendations of the Narasimham Com- Industrial Credit (Long-Term Operations) Fund and an inmittee II and the Khan Committee, the RBI released a “discus- crease in the non-performing assets of some of these institusion paper” in January 1999 for wider public debate and feed- tions, the sustainability of their business model was in quesback. Noting that “the feedback on the discussion paper indi- tion. Third, the complementary role of the stock market had cated that while universal banking is desirable from the point not materialised. Fourth, the incumbent policy regime (as epitomised in Narasimham Committee II) Table 5: Sectoral Deployment of Non-Food Gross Bank Credit in Recent Years (New Format) (Rs crore) was in favour of winding up the DFIs. 2008 2009 2010 2011 2012 2013 2014 While each of the development banks Non-food credit (1 to 4) 22,04,800 26,01,800 30,40,000 36,87,100 42,89,700 48,69,600 55,66,000 could have faced a unique set of restric1 Agriculture and allied activities 2,75,300 3,38,700 4,16,100 4,83,500 5,46,600 5,89,900 6,69,400 tions, each of them generically faced 2 Industry 8,58,300 10,54,400 13,11,500 16,13,200 19,37,300 22,30,200 25,22,900 some sort of a finance constraint when Micro and small 1,32,700 1,69,000 2,06,400 2,11,300 2,36,700 2,84,300 3,51,700 finances from the government budget Medium 1,10,800 1,22,200 1,32,600 1,17,000 1,24,800 1,24,700 1,27,400 (or from the RBI’s long-term operations Large 6,14,800 7,63,200 9,72,400 12,84,900 15,75,900 18,21,100 20,43,800 fund) dried up. As an RBI committee put 3 Services 5,49,300 6,46,300 7,26,800 8,90,800 10,23,000 11,51,900 13,37,000 it, “The change in operating environ4 Personal loans 5,21,800 5,62,500 5,85,600 6,99,700 7,82,800 8,976 10,36,700 ment coupled with high accumulation of of view of efficiency of resource use, there is need for caution in non-performing assets due to a combination of factors caused moving towards such a system by banks and DFIs”, the RBI’s an- serious financial stress to the term-lending institutions” (2004). nual policy statement of April 2000 spelt out the broad contours Thus, by end of the 1990s, despite their significant presence in of reforming DFIs to form universal banking institutions.11 all-India lending operations (Table 6), the viability of develop(a) The principle of “Universal Banking” is a desirable goal and ment banks was seriously in question.12 some progress has already been made by permitting banks to Table 6: Trends and Composition of Disbursements of Financial Institutions Total Shares of Disbursements as diversify into investments and long-term financing and the Period DisbursePercentage of Total Disbursements DFIs to lend for working capital, etc. ments as All-India Specialised Investment State-level Total Percentage Development Institutions Institutions Institutions (b) Though the DFIs would continue to have a special role in of GDP Banks the Indian financial system, until the debt market demon- 1990-91 to 1994-95 2.9 64.9 0.5 23.6 11.0 100.0 strates substantial improvements in terms of liquidity and 1995-96 to 1999-2000 3.3 75.1 0.4 16.8 7.6 100.0 depth, any DFI, which wishes to do so, should have the option All-India development banks comprise the IDBI, ICICI, IFCI, IIBI, and SIDBI; specialised to transform into bank (which it can exercise), provided the institutions comprise the RCTC, TDICI, and TFCI; investment institutions comprise the UTI, LIC, and GIC and its subsidiaries; and state-level institutions comprise SFCs and state prudential norms as applicable to banks are fully satisfied. To industrial development corporations (SIDCs). this end, a DFI would need to prepare a transition path in order Source: RBI, Report on Currency and Finance, 1999-2000. to fully comply with the regulatory requirement of a bank. The The next few years witnessed the demise of a number of DFI concerned may consult RBI for such transition arrange- DFIs and a move towards universal banking. In January 2001, ments. Reserve Bank will consider such requests on a case by the RBI permitted the reverse merger of the ICICI with its comcase basis. mercial bank subsidiary, and the ICICI became the first DFI to (c) The regulatory framework of RBI in respect of DFIs would convert itself into a bank. The reverse merger led to a sharp need to be strengthened if they are given greater access to increase in the market share of new private sector banks in the short-term resources for meeting their financing requirements, total assets of the banking sector. Later, on 1 October 2004, the IDBI was converted into a banking company. In April 2005, it which is necessary. (d) In due course, and in the light of evolution of the financial merged its banking subsidiary (IDBI Bank) with itself. While system, Narasimham Committee’s recommendation that ulti- both these banks still have some term-lending on their portmately there should be only banks and restructured NBFCs can folios, there has been a distinct change in the character of their lending operations. The IFCI, on the other hand, despite be operationalised. But what necessitated such a drastic change in favour of changing its status to a limited company in 1999, has been universal banking, abandoning DFIs? Four factors have been plagued by huge non-performing assets and issues related to Economic & Political Weekly EPW january 31, 2015 vol l no 5 65 SPECIAL ARTICLE corporate governance. In March 2002, the outstanding bal- financial liberalisation, which depended on increasing comance of DFIs, such as the IDBI, EXIM Bank, IIBI, and SIDBI, from petitiveness and the capacity of local enterprises to innovate the National Industrial Credit (Long-Term Operations) Fund and incorporate new technologies; and the insufficient scale of (Rs 3,791.75 crore) was transferred to the government in lieu operations on the domestic capital and credit markets for proof 10.25% of Government Stock, 2021 of an equal amount. The viding financing to firms (Hermann 2010). Such an experience RBI transferred its shareholding in the IDFC to the central gov- seems to have profound implications for India. ernment in 2004-05. The large annual allocations to statutory funds were also discontinued. While some of the development Diversification of Sources of Financing banks such as NABARD and SIDBI are still alive, the involvement With the demise of development banking and the limited ability of bank credit to keep pace with financing requirements, of the RBI in funding these institutions has been minimal. Is this demise of development banking indicative of a con- the Indian industrial sector has moved to alternative sources scious policy agenda dictated by the compulsions of neo-liberal of financing. Table 7 enumerates these alternative sources, and financial reforms? Or, had these institutions long lost their a number of interesting facts emerge from Table 8. First, bank relevance and were slated to expire in line with a Table 7: Resource Mobilisation by the Commercial Sector (Rs crore) 2009-10 2010-11 2011-12 2012-13 Schumpeterian process of creative destruction? 4,78,600 7,11,000 6,77,300 6,84,900 Opinions are divided. However, development A) Adjusted non-food bank credit (NFC) (45.0) (57.4) (55.7) (48.3) banks as term-finance institutions have survived (i) Non-food credit 4,67,000 6,81,500 6,52,700 6,33,500 all over the world. A World Bank Global (ii) Non-SLR investment by commercial banks 11,700 29,500 24,600 51,400 Survey of Development Banks in 2012 revealed B) Flow from non-banks (B1+B2) 5,85,000 5,28,600 5,38,300 7,33,500 (55.0) (42.6) (44.3) (51.7) that of 90 development banks in the world, B1) Domestic sources 3,65,200 2,95,600 3,07,900 4,21,200 nearly 40% were established during 1990-2011. (34.3) (23.8) (25.3) (29.7) Nearly 40% of them receive direct budgetary (1) Public issues by non-financial entities 32,000 28,500 14,500 11,900 support from the government, and more than (2) Gross private placements by 40% accept public deposits (Luna-Martinez and non-financial entities 1,42,000 67,400 55,800 1,03,800 Vicente 2012). (3) Net issuance of CPs subscribed to by non-banks 26,100 17,200 3,600 5,200 Internationally, there are successful instances (4) Net credit by housing finance companies 28,500 38,400 53,900 85,900 of development banking that are still active. (5) Total gross accommodation by four Hermann (2010) noted, “The fact that developRBI-regulated AIFIs* 33,800 40,000 46,900 51,500 ment banks also exist in G-7 countries – for ex(6) Systemically important non-deposit-taking ample, Germany’s Kredintaltanlt fur WeidarufNBFCs (net of bank credit) 60,700 67,900 91,200 1,18,800 (7) LIC’s net investment in corporate debt 42,200 36,100 41,900 44,100 ban (KfW), the Japan Development Bank and the B2) Foreign sources 2,19,800 2,33,000 2,30,400 3,12,300 Business Development Bank of Canada (BDC), all (20.7) (18.8) (19.0) (22.0) of which are wholly government owned – shows (1) External commercial borrowings/FCCBs 12,000 55,500 42,100 46,600 that they are not rendered obsolete by more ad(2) ADR/GDR issues, excluding banks and vanced levels of economic and financial developfinancial institutions 15,100 9,200 2,700 1,000 ment, but they merely adapt.” In this context, the (3) Short-term credit from abroad 34,900 50,200 30,600 1,17,700 (4) Foreign direct investment to India 1,57,800 1,18,100 1,55,000 1,47,000 experience of the Brazilian Development Bank 10,63,600 12,39,600 12,15,600 14,18,400 (Banco Nacional de Desenvolvimento Econô- C) Total flow of resources (A+B) (100.0) (100.0) (100.0) (100.0) mico e Social, or BNDES) deserves special men- Figures within brackets are percentages to total; * NABARD, NHB, SIDBI and EXIM Bank. tion. It is a federal public company associated Source: RBI. with the Ministry of Development, Industry and Foreign credit tends to explain only half Table 8: G-Sec and Corporate Bond Trade. Since its establishment on 20 June 1952, the BNDES has the aggregate financing. Second, Markets in Select Asian Countries: March 2013 (% of GDP) financed large-scale industrial and infrastructure projects, non-bank domestic resources Country Government Corporate Total with assets exceeding that of the World Bank Group. It contin- that include diverse components Bond Bond 77.5 126.2 ues to play a significant role in the support of investments in (such as public issues, private South Korea 48.7 62.4 43.1 105.5 agriculture, commerce, and the service industry, as well as in placements, commercial papers, Malaysia Singapore 53.1 37.0 90.1 13 small and medium-sized private businesses. To support its credit by housing finance comHong Kong 37.8 31.4 69.2 activities, the BNDES has depended on the following sources – panies, or the LIC’s net investThailand 58.6 15.9 74.5 (a) workers’ assistance fund (4% of the total); (b) Brazilian na- ment in corporate debt) account China 33.1 13.0 46.1 tional treasury (16% of the total); and (c) returns from financ- for nearly one-third of aggre- Philippines 32.2 4.9 37.1 ing operations, corporate shareholding, foreign fundraising on gate financing. Third, foreign Indonesia 11.4 2.3 13.7 international capitals market, and multilateral entities (77% of sources account for nearly one- India 40.2 2.4 42.6 the total). When financial liberalisation was initiated in Brazil fifth of aggregate resources. Source: FICCI (2013: 24). in the late 1980s, the BNDES could hold on to its turf. During Notwithstanding the emergence of these alternative sources, 1990-2006, there was a significant increase in its lending due the numbers are unable to shed any light on the presence or to two major factors – development challenges after trade and absence of a finance constraint in the industrial sector. 66 january 31, 2015 vol l no 5 EPW Economic & Political Weekly SPECIAL ARTICLE 5 Issues Facing Industrial Finance The paper has presented a set of stylised facts on industrial finance in India. Its broad findings may be summarised as follows. Since the initiation of financial sector reforms and the demise of development banking in India, there were initial indications that credit to the industrial sector could have declined (or increased at a very slow pace). But this is subject to two key caveats. First, as industrial and manufacturing GDP have not gone up substantially during this period, there is a chicken-egg problem in discerning causality between industrial credit and industrial growth. Was credit a constraint to subdued industrial growth? Or, did credit fail to pick up because of a lull in industrial growth? Second, the emergence of alternative sources of financing makes conducting any controlled experiment on finance and growth in India difficult. Against this backdrop, this section flags some emerging issues. Long-term/Infrastructure Financing Long-term/infrastructure finance has come to haunt India in recent years, and there are various unofficial estimates of it. Finance Minister P Chidambaram reportedly told the World Bank in Washington DC in April 2013 that India would have a $1 trillion infrastructure deficit over the next five years, which had to be financed by private sector participation (Economic Times, 21 April 2013). How far is this financing plan realistic? Corporate Bond Market in India It is difficult for commercial banks to provide long-term financing because of their asset-liability mismatch. And the standard private sector answer to such a problem has been the development of a vibrant corporate debt market. However, the development of corporate debt markets globally has not been uniform. Among the major countries in developing Asia, the size of the Indian corporate debt market is small (Table 8). In India’s case, the market for corporate debt is primarily a private placement market and it is heavily tilted in favour of big corporates. More importantly, even in this small corporate bond market, the share of manufacturing is typically less than 10% while finance occupies nearly three-fourths (FICCI 2013). Thus, contrary to the expectations of the Narasimham Committee II, corporate bonds are yet to emerge as a source of long-term finance.14 Infrastructure Finance EPW 6 Concluding Observations The Indian industrial sector is passing through a bad phase. Its inability to take off in recent years could be attributed to several factors such as poor infrastructure, regulatory bottlenecks, and neglect of demand factors. A financial constraint could be one factor on this list. While tracing the transition from a state-owned and state-dictated financial sector to a regime of financial liberalisation, this paper notes that the possibility of throwing away the baby with the bathwater cannot be ignored. New sources of finance could have compensated for the paucity of bank financing to a limited extent, but in the case of term financing the demise of development banks has turned out to be very costly. In this context, the Brazilian experience with the BNDES could serve as a useful model for India. Notes Another important issue is infrastructure financing. With the demise of development banks, it is pertinent to note that “outside of budgetary support, that accounts for about 45% of the total infrastructure spending, commercial banks are the second largest source of finance for infrastructure (about 24%)” (Chakrabarty 2013). The share of bank finance to infrastructure in gross bank credit increased from 1.63% in 2001 to 13.37% in 2013. Apart from commercial banks, two new institutions have been set up for infrastructure financing. First, the Infrastructure Economic & Political Weekly Development Finance Company (IDFC) was founded in 1997 on the recommendations of the Expert Group on Commercialisation of Infrastructure Projects (headed by Rakesh Mohan) as a joint venture between the central government, RBI, domestic financial institutions, and foreign investors such as the Asian Development Bank (ADB), and the International Finance Corporation (IFC), among others.15 The RBI contributed Rs 150 crore (Rs 20.30 crore in 1996-97 and Rs 130 crore in 1997-98) to the share capital of the IDFC. Second, the India Infrastructure Finance Company Ltd (IIFCL) was incorporated under the Companies Act as a wholly government-owned company in January 2006. It commenced operations from April 2006 to provide long-term finance to viable infrastructure projects. The sectors eligible for financial assistance from the IIFCL are transportation, energy, water, sanitation, communication, and social and commercial infrastructure. The IIFCL accords overriding priority to public-private partnership (PPP) projects.16 More than 80% of infrastructure projects are now financed by state-owned banks with increasing asset-liability mismatches. To address this issue and provide more infrastructure financing, the IIFCL has implemented a Takeout Financing Scheme to purchase infrastructure loans from public sector banks. The IIFCL is also considering plans to provide guarantees for bonds issued by infrastructure companies. Besides, the 2010-11 budget introduced a deduction of an additional Rs 20,000 on tax savings for investment in long-term infrastructure bonds. These are, however, piecemeal measures to handle a crisis of massive proportions. january 31, 2015 vol l no 5 1 In 1911, Visvesvaraya as chairman of the industrial and trade committee of the Mysore Economic Conference put up a proposal to start a bank by raising resources from the state for the development of trade and industries. 2 Such developmental activities by a central bank have a long history in the West; see Epstein (2005) for a discussion on the developmental activities of central banks across the world. 3 Bhandari et al (2003) evaluated the role of DFIs during 1989-97 by examining how firms’ investment decisions were affected by their ability to access DFIs. They found that firms that had prior access to DFIs continued to receive funds from these sources only if they could be classified as more financially constrained. 4 The RBI was also not fully state-owned until it was nationalised in 1948. 5 From a total of 566 banks in 1951, the number came down to 109 in 1965. The reduction in non-scheduled banks has been phenomenal – from 473 to 67 SPECIAL ARTICLE 6 7 8 9 10 11 12 13 14 15 68 merely three. The number of scheduled banks came down from 92 in 1951 to 76 in 1965. Under priority sector lending guidelines, domestic commercial banks have a target of 40% of their net bank credit for priority sectors. In this, sub-targets of 18% and 10% of net bank credit, respectively, have been stipulated for lending to agriculture and the weaker sections. A target of 32% of net bank credit has been stipulated for lending to the priority sector by foreign banks. See Roy (2006) for details. A maximum permissible limit on bank finance also became the basis for consortium arrangements, which have been in existence from 1972. Guidelines were also issued to commercial banks for supervising credit to ensure its proper use. See, for example, Ahluwalia (2002) for an account of Indian liberalisation, and Bhaduri and Nayyar (1996) for a critique. In some sense, the Narasimham report echoed the spirit in the World Development Report (1989), which commented, “Non-bank financial intermediaries, such as development finance institutions, insurance companies, and pension funds, are potentially important sources of long-term finance. Most of the existing development banks are insolvent, however” (4). Moreover, WDR (1989) saw a diminishing role of the Indian capital market in the functioning of development banks, “In the 1950s India’s capital markets helped to mobilise financial resources for the corporate sector. The importance of these markets then diminished, because subsidised credits were available from commercial and development banks, equities had to be issued at a discount substantially below market value, the capital market lacked liquidity, and investor safeguards were inadequate” (108). This sentiment favouring “universal banking” also echoed the spirit of WDR 1989. See http://www.rbi.org.in/scripts/BS_ViewMonetaryCreditPolicy.aspx?Id=2261#N3A. The Annual Report of the RBI for 2001-02 noted, “The National Industrial Credit (Long Term Operations) Fund was established by the Reserve Bank in July 1964 with an initial corpus of Rs 10 crore and annual contributions from the Reserve Bank’s disposable surplus in terms of Section 46-C(1) of the Reserve Bank of India Act, 1934 for the purpose of making loans and advances to eligible financial institutions. Consequent upon the announcement in the Union Budget for 1992-93, the Reserve Bank decided to discontinue the practice of crediting large sums to the said Fund. No further disbursements from the Fund have been made. It was decided in 1997-98 to transfer the unutilised balance in the Fund arising from repayments to Contingency Reserve (CR) on a yearto-year basis. Accordingly, an amount of Rs 4,224 crore has been transferred to CR in 2001-02 as against Rs 400 crore transferred in the preceding year.” From the next year, the RBI routinely transferred Rs 1 crore to the long-term fund out of its income. This continued till 2012-13 and the balance in the fund stood at Rs 22 crore on 30 June 2013. Interestingly, the Organisation for Economic Co-operation and Development (OECD) in its latest country report on Brazil (22 Oct 2013) has mentioned that the BNDES is crowding out private-sector banks from corporate credit markets, and that the government should phase out financial support for it. There are several reasons for the failure of the corporate debt market in India; see Mohan (2011) for a discussion on this. The basic strategy proposed in the report has been criticised by Ghosh, Sen and Chandrasekhar (1997) for its approach – “the government to retreat as investor, to provide space for private participation, even while continuing to facilitate and provide numerous financial crutches for the private sector.” They added, “But even all of these very expensive measures do not guarantee that the private sector would respond positively to invest in areas which are both risky and not-so-profitable.” 16 The authorised and paid-up capital of the company on 31 March 2013 was Rs 5,000 crore and Rs 2,900 crore, respectively. References Aghion, Philippe and Peter Howitt (2009): The Economics of Growth (Cambridge, Massachusetts: MIT Press). Ahluwalia, Montek S (2002): “Economic Reforms in India since 1991: Has Gradualism Worked?”, Journal of Economic Perspectives, 16 (3): pp 67-88. Banerjee, A and E Duflo (2004): “Do Firms Want to Borrow More? Testing Credit Constraints Using Directed Lending Programmes”, Massachusetts Institute of Technology, http://economics. mit.edu/files/2706 Bell, Clive and Peter L Rousseau (2001): “Post-independence India: A Case of Finance-led Industrialization?”, Journal of Development Economics, 65: pp 153-75. Bencivenga, V R and B D Smith (1991): “Financial Intermediation and Endogenous Growth”, Review of Economic Studies, 58: pp 195-209. Bhaduri, Amit and Deepak Nayyar (1996): The Intelligent Person’s Guide to Liberalization (Delhi: Penguin India). Bhandari, Laveesh, Sudipto Dasgupta and Shubhashis Gangopadhyay (2003): “Development Financial Institutions, Financial Constraints and Growth: Evidence from the Indian Corporate Sector”, Journal of Emerging Market Finance, 2: pp 83-121. Bhatt, V V (1981): “Financial Institutions and Technical Consultancy Services – Experiment in Small Enterprise Promotion”, Economic & Political Weekly, Vol 16, No 48. Bhattacharjee, S and Debkumar Chakrabarti (2013): “Financial Liberalisation, Financing Constraint and India’s Manufacturing Sector”, Economic & Political Weekly, Vol 48, No 6. Chakrabarty, K C (2013): “Infrastructure Financing by Banks in India: Myths and Realities”, Keynote Address, Annual Infrastructure Finance Conclave organised by SBI Capital Markets Limited, Agra, 9 August. Available at http:// www.rbi.org.in/scripts/BS_SpeechesView. aspx?Id=831, accessed on 27 January 2015. Epstein, Gerald (2005): “Central Banks as Agents of Economic Development”, University of Massachusetts Amherst (PERI) Working Paper, No 104. FICCI (2013): Financial Foresights, Vol 4, Issue 1, New Delhi: FICCI, http://www.ficci.com/sector/3/Add_docs/fin-digestpdf.pdf Gerschenkron, Alexander (1962): Economic Backwardness in Historical Perspective (Cambridge, Massachusetts: Harvard University Press). Ghosh, Jayati, Abhijit Sen and C P Chandrasekhar (1997): “All Dressed Up and Nowhere to Go: India Infrastructure Report”, Economic & Political Weekly, Vol 32, No 16. Gokarn, Subir (2004): “Future of Development Finance”, Economic & Political Weekly, Vol 39, No 6. Greenwood, J and B Jovanovic (1990): “Financial Development, Growth, and the Distribution of Income”, Journal of Political Economy, 98: pp 1076-107. Gupta, L C (1969): The Changing Structure of Industrial Finance in India (Oxford: Clarendon Press). Gupta, P, R Hassan and U Kumar (2008): “What Constrains Indian Manufacturing?”, ERD Working Paper Series 119, Asian Development Bank. Gurley, J G and E S Shaw (1955): “Financial Aspects of Economic Development”, American Economic Review, 45: pp 515-38. Hermann, Jennifer (2010): “Development Banks in the Financial Liberalization Era: The Case of BNDES in Brazil”, CEPEL Review, April. Jadhav, Narendra, Partha Ray, Dhritidyuti Bose and Indranil Sen Gupta (2005): “Financial Sector Reforms and the Balance Sheet of the RBI”, Economic & Political Weekly, Vol 40, No 12. Khanna, S (1999): “Financial Reforms and Industrial-Sector in India”, Economic & Political Weekly, Vol 34, No 45, pp 3231-40. Luna-Martínez, José De and Carlos Leonardo Vicente (2012): “Global Survey of Development Banks”, World Bank Policy Research Working Paper. Mathur, K B L (2003): “Development Financial Institutions at the Crossroads”, Economic & Political Weekly, Vol 38, No 8. Mohan, Rakesh (2009): Monetary Policy in a Globalized Economy: A Practitioner’s View (New Delhi: Oxford University Press). – (2011): Gr0wth with Financial Stability (New Delhi: Oxford University Press). Nagaraj, R (2005): “Industrial Growth in China and India: A Preliminary Comparison”, Economic & Political Weekly, Vol 40, No 21, pp 2163-71. Reserve Bank of India (1991): Report of the Committee on the Financial System (headed by M Narasimham), Mumbai: RBI, November. – (2004): Report of the Working Group on Development Financial Institutions, Mumbai: RBI, http://rbidocs.rbi.org.in/rdocs/PublicationReport/Pdfs/53674.pdf – (2006): Report on Currency and Finance 200405, Mumbai: RBI. – (2008): Report on Currency and Finance, Mumbai: RBI. Rosen, George (1962): Some Aspects of Industrial Finance in India (Bombay: Asia Publishing House). Roy, Mohua (2006): “A Review of Bank Lending to Priority and Retail Sectors”, Economic & Political Weekly, Vol 41, No 11. Schumpeter, J A (1911): A Theory of Economic Development (Boston: Harvard University Press). Shaw, Edward S (1973): Financial Deepening in Economic Development (New York: Oxford University Press). Singh, A, S L Shetty and T R Venkatachalam (1982): “Monetary Policy in India: Issues and Evidence”, Supplement to RBI Occasional Papers, 3. Wells, Stephen and Lotte Schou-Zibell (2008): “India’s Bond Market – Developments and Challenges Ahead”, ADB Working Paper (Series on Regional Economic Integration) No 22. january 31, 2015 available at Oxford Bookstore-Mumbai Apeejay House 3, Dinshaw Vacha Road Mumbai 400 020 Ph: 66364477 vol l no 5 EPW Economic & Political Weekly

© Copyright 2026