Feb 02, 2015 - Moneycontrol

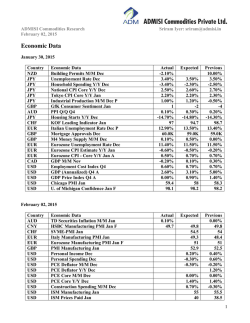

ADMISI Forex Research February 02, 2015 Sriram Iyer: [email protected] USDINR Recap NSE Feb-15 Mar-15 Apr-15 May-15 Jun-15 Previous Close Open High 62.16 62.54 62.95 63.30 63.63 62.24 62.61 63.00 63.38 63.72 62.19 62.53 62.93 63.31 63.55 62.35 62.73 63.13 63.46 63.82 Spread Feb-15 Mar-15 Apr-15 May-15 MCXSX Feb-15 Mar-15 Apr-15 May-15 Jun-15 62.24 62.61 63.01 63.40 63.81 62.16 62.45 62.84 63.20 63.50 62.35 62.73 63.12 63.40 63.81 Spread Feb-15 Mar-15 Apr-15 May-15 BSE Feb-15 Mar-15 Apr-15 May-15 Jun-15 Low 62.00 62.39 62.80 63.15 63.46 Mar-15 -0.37 Net Chg. 0.07 0.07 0.05 0.09 0.09 Apr-15 -0.77 -0.39 Net Chg. 0.08 0.08 0.09 0.13 0.38 Apr-15 -0.77 -0.40 Net Chg. 62.16 62.15 62.35 62.00 Unch 62.54 62.52 62.73 62.39 Unch 62.99 62.89 63.11 62.83 Unch 63.05 Unch 63.42 Unch Previous Close Open High 62.16 62.54 62.99 63.05 63.42 62.00 62.39 62.80 63.14 63.50 Mar-15 -0.37 Previous Close Open High 62.16 62.54 62.92 63.27 63.42 Low Spread Feb-15 Mar-15 Apr-15 May-15 Low Mar-15 -0.38 Apr-15 -0.83 -0.52 % Chg. 0.12 0.11 0.08 0.13 0.15 Volume 1630888 107827 20011 1100 1964 May-15 -1.15 -0.77 -0.38 % Chg. 0.13 0.12 0.14 0.21 0.61 % Chg. - 250107 7548 1363 88 142 OI Change -239404 36725 7021 156 311 % Vol. Chg. 11.37 -65.36 130.24 -13.73 -21.11 Open Interest 330658 93148 33623 3176 2099 OI Change -21230 1626 682 -20 127 % Vol. Chg. 16.91 -37.84 -47.51 - Open Interest 522358 119471 3001 604 310 OI Change -23748 3613 222 Unch Unch Jun-15 -1.57 -1.19 -0.80 -0.41 Volume 1168593 17178 264 - May-15 -0.74 -0.52 -0.06 Open Interest 1296912 339553 135929 39679 55845 Jun-15 -1.48 -1.11 -0.72 -0.34 Volume May-15 -1.16 -0.79 -0.39 % Vol. Chg. 9.65 -27.90 1.02 -45.73 -58.40 Jun-15 -1.26 -0.88 -0.43 -0.37 1 ADMISI Forex Research February 02, 2015 Sriram Iyer: [email protected] Currency Options NSE CALLS Put-Call Ratio O/I 22.20 26.00 30.35 1.60 13.98 17.98 2.47 0.91 0.43 0.34 0.25 0.30 0.04 0.83 0.17 Put-Call Ratio Vol 123.66 1.00 31.32 4.71 57.01 65.12 6.90 1.83 1.17 0.40 0.17 0.01 0.06 0.15 1.00 0.07 PUTS Strike OI Volume IV LTP Price 1597 216 12.63 2.345 60.00 10 10 0.00 1.848 60.25 408 308 10.67 1.850 60.50 506 17 4.66 1.420 60.75 4484 872 5.31 1.235 61.00 353 76 7.81 1.123 61.25 33627 10182 5.76 0.830 61.50 3112 3375 5.95 0.660 61.75 134241 51330 6.01 0.508 62.00 18252 22175 6.23 0.390 62.25 117990 80165 6.35 0.290 62.50 892 2865 6.78 0.230 62.75 72414 43074 6.66 0.155 63.00 352 3 7.18 0.128 63.25 71033 12119 7.20 0.088 63.50 12 10 7.74 0.075 63.75 24388 12344 7.43 0.0425 64.00 LTP IV Volume OI 0.010 0.010 0.025 0.048 0.060 0.095 0.145 0.215 0.320 0.445 0.598 0.828 0.960 1.290 1.575 1.8 6.85 6.18 6.54 6.72 6.24 6.20 6.15 6.13 6.32 6.44 6.62 7.77 7.00 0.00 3.86 6.62 6.2 26710 10 9648 80 49716 4949 70212 6170 59866 8871 13378 15 2573 1814 10 875 35455 260 12383 808 62671 6348 82960 2843 57467 6268 29249 21838 2562 10 4111 Currency Options BSE Put-Call Ratio O/I 257.500 1.000 0.750 5.656 35.417 6.941 3.399 1.426 0.085 0.151 0.143 0.027 0.000 1.000 Put-Call Ratio Vol 0.043 0.002 21.000 598.288 158.060 5.419 1.013 0.896 0.057 0.094 0.014 0.017 0.283 0.891 0.238 Call LTP Volume OI 2.235 1010 10 1.94 5210 10 ---1.3675 1 16 1.26 170 221 1.045 50 36 0.83 2750 1623 0.6625 2882 589 0.5125 10654 3645 0.3925 8492 3144 0.29 15644 10411 0.2375 52545 105 0.17 8766 2504 0.105 10610 348 0.0975 3380 3498 0.0875 8440 10 Strike Price 60.00 60.25 60.50 60.75 61.00 61.25 61.50 61.75 62.00 62.25 62.50 62.75 63.00 63.25 63.50 63.75 Put OI Volume LTP 2575 43 0.01 10 10 0.0125 1882 59948 0.0225 12 21 0.045 1250 101709 0.0575 1275 7903 0.0925 11265 14902 0.145 2002 2919 0.2225 5196 9549 0.32 268 482 0.41 1572 1467 0.5675 15 749 0.7575 67 152 0.8775 -3000 1.1525 1 3010 1.3575 10 2010 1.59 2 ADMISI Forex Research February 02, 2015 Sriram Iyer: [email protected] Major Currency Futures Currency Month Current/Close U.S. Dollar Index Mar-15 94.920 British Pound Mar-15 1.508 Canadian Dollar Mar-15 0.785 Japanese Yen Mar-15 0.851 Swiss Franc Mar-15 1.083 Euro FX Mar-15 1.132 Australian Dollar Mar-15 0.777 Mexican Peso Jun-15 0.066 New Zealand Dollar Mar-15 0.724 South African Rand Mar-15 0.085 Brazilian Real Mar-15 0.370 Source –Investing.com Other Currencies Pairs Pair Current/Close Chg. % EUR/USD 1.1317 0.27% GBP/USD 1.508 0.10% USD/JPY 117.56 0.05% USD/CHF 0.926 0.65% AUD/USD 0.7782 0.21% EUR/GBP 0.7504 0.11% USD/CAD 1.2733 0.01% NZD/USD 0.7268 0.19% EUR/JPY 133.05 0.29% GBP/JPY 177.29 0.16% Source –Investing.com Other Currencies vs. Dollar Current/Close Previous %Change Chinese Yuan 6.2589 6.2495 -0.15% Indonesian Rupiah 12705 12665 -0.32% Korean Won 1102.5 1101.4 -0.10% Thailand baht 32.66 32.72 0.18% South African Rand 11.626 11.6435 0.15% Brazilian Real 2.6814 2.6814 Russian Rouble 69.42 69.0825 -0.49% Source –Reuters Date 30/01/2015 29/01/2015 USD 61.76 61.50 RBI Reference rate GBP EURO 93.13 70.03 93.12 69.33 YEN 52.40 52.25 Source: RBI 3 ADMISI Forex Research February 02, 2015 Sriram Iyer: [email protected] Currency Rupee US $ 1 Rupee = 1 US $ = 1 Euro € = 1 UK £ = 1 Aus $ = 1 Japanese ¥ = 1 Singapore $= 1 Renminbi = 1 Taiwan $ = 1 0.0162 61.86 1 70.0011 1.1316 93.3032 1.5083 48.1147 0.7778 0.5262 0.0085 45.7409 0.7394 10.0266 0.1621 1.9543 0.0316 CURRENCY EXCHANGE RATE Taiwan Japanese Singapore Renminbi Euro € UK £ Aus $ $ ¥ $ 0.0143 0.0107 0.0208 1.9004 0.0219 0.0997 0.5117 0.8837 0.663 1.2857 117.56 1.3524 6.1696 31.654 1 0.7503 1.4549 133.0316 1.5304 6.9816 35.8198 1.3329 1 1.9392 177.3152 2.0398 9.3056 47.7436 0.6873 0.5157 1 91.4382 1.0519 4.7987 24.6205 0.0075 0.0056 0.0109 1 0.0115 0.0525 0.2693 0.6534 0.4902 0.9507 86.9269 1 4.562 23.4058 0.1432 0.1075 0.2084 19.0547 0.2192 1 5.1306 0.0279 0.0209 0.0406 3.7139 0.0427 0.1949 1 Source: Moneycontrol Currency USD EUR GBP JPY CHF CAD AUD CURRENCY EXCHANGE RATE USD EUR GBP JPY CHF 1 0.8836 0.6631 117.56 0.926 1.1317 1 0.7504 133.05 1.048 1.508 1.3325 1 177.29 1.3964 0.0085 0.0075 0.0056 1 0.5044 1.0799 0.9542 0.7162 126.98 1 0.7854 0.6939 0.5208 92.33 0.7272 0.7784 0.6878 0.5161 91.52 0.7208 CAD 1.2732 1.4409 1.9202 0.0108 1.3751 1 0.9912 AUD 1.2847 1.4538 1.9373 0.0067 1.3873 0.698 1 Source: Investing.com Equity Markets Dow 30 (Jan 30) S&P 500 (Jan 30) Nasdaq (Jan 30) Bovespa (Jan 30) DAX (Jan 30) FTSE 100 (Jan 30) CAC 40 (Jan 30) Nikkei 225 (Feb 02) S&P/ASX 200 (Feb 02) Shanghai (Feb 02) Hang Seng (Feb 02) Taiwan Weighted (Feb 02) STI (Feb 02) KOSPI (Feb 02) IDX Composite (Feb 02) CNX Nifty (Jan 30) BSE Sensex (Jan 30) Current/Close 17164.95 1994.99 4635.24 46907.68 10694.32 6749.40 4604.25 17579.78 5626.60 3145.53 24372.00 9373.84 3408.89 1947.09 5283.27 8808.90 29182.95 Change -251.90 -26.26 -48.17 -854.56 -43.55 -61.20 -27.18 -94.61 38.28 -64.83 -135.05 11.93 17.69 -2.17 -6.14 -143.45 -498.82 % Change -1.45% -1.30% -1.03% -1.79% -0.41% -0.90% -0.59% -0.54% 0.68% -2.02% -0.55% 0.13% 0.52% -0.11% -0.12% -1.60% -1.68% Source –Investing.com 4 ADMISI Forex Research February 02, 2015 Reporting Date Debt/ Equity Equity 30-Jan-15 Debt Investment Route Stock Exchange Primary market & others Sub-total Stock Exchange Primary market & others Sub-total Total Total for January Total for 2015 Sriram Iyer: [email protected] Gross Purchases (Rs Crore) Gross Sales (Rs Crore) Net Investment (Rs Crore) Net Investment US($) million 8775.21 6984.02 1791.19 291.25 34.71 0 34.71 5.64 8809.92 6984.02 1825.9 296.89 1666.11 696.9 969.21 157.6 922.7 126.8 795.9 129.42 2588.81 11398.73 141227.34 141227.34 823.7 7807.72 107539.15 107539.15 1765.11 3591.01 33688.19 33688.19 287.02 583.91 5452.88 5452.88 Conversion (1 USD TO INR)* Rs.61.4998 Source – NSDL, the data presented above constitutes trades conducted by FPIs/FIIs on and upto the previous trading day(s). Off shore INR/USD DGCX February CME February Current 160.43 160.60 Conversion in USDINR 62.33 62.27 Previous 160.75 160.63 Conversion in USDINR 62.21 62.25 Source – Reuters and CME Economic Data January 30, 2015 Country NZD JPY JPY JPY JPY JPY GBP AUD JPY CHF EUR GBP GBP EUR Economic Data Building Permits M/M Dec Unemployment Rate Dec Household Spending Y/Y Dec National CPI Core Y/Y Dec Tokyo CPI Core Y/Y Jan Industrial Production M/M Dec P GfK Consumer Sentiment Jan PPI Q/Q Q4 Housing Starts Y/Y Dec KOF Leading Indicator Jan Italian Unemployment Rate Dec P Mortgage Approvals Dec M4 Money Supply M/M Dec Eurozone Unemployment Rate Dec Actual -2.10% 3.40% -3.40% 2.50% 2.20% 1.00% 1 0.10% -14.70% 97 12.90% 60.0K 0.10% 11.40% Expected 3.50% -2.30% 2.60% 2.20% 1.20% -2 0.30% -14.80% 94.7 13.50% 59.0K 0.50% 11.50% Previous 10.00% 3.50% -2.50% 2.70% 2.30% -0.50% -4 0.20% -14.30% 98.7 13.40% 59.0K 0.00% 11.50% 5 ADMISI Forex Research February 02, 2015 EUR EUR CAD USD USD USD USD USD Economic Data Contd…. Eurozone CPI Estimate Y/Y Jan Eurozone CPI - Core Y/Y Jan A GDP M/M Nov Employment Cost Index Q4 GDP (Annualized) Q4 A GDP Price Index Q4 A Chicago PMI Jan U. of Michigan Confidence Jan F Sriram Iyer: [email protected] -0.60% 0.50% -0.20% 0.60% 2.60% 0.00% 59.4 98.1 -0.50% 0.70% 0.10% 0.70% 3.10% 0.90% 58 98.2 -0.20% 0.70% 0.30% 0.70% 5.00% 1.40% 58.3 98.2 Actual 0.10% 49.7 Expected Previous 0.00% 49.8 54 48.4 51 52.5 0.40% 0.60% -0.20% 1.20% 0.00% 1.40% -0.30% 55.5 38.5 February 02, 2015 Country AUD CNY CHF EUR EUR GBP USD USD USD USD USD USD USD USD USD Economic Data TD Securities Inflation M/M Jan HSBC Manufacturing PMI Jan F SVME-PMI Jan Italy Manufacturing PMI Jan Eurozone Manufacturing PMI Jan F PMI Manufacturing Jan Personal Income Dec Personal Spending Dec PCE Deflator M/M Dec PCE Deflator Y/Y Dec PCE Core M/M Dec PCE Core Y/Y Dec Construction Spending M/M Dec ISM Manufacturing Jan ISM Prices Paid Jan 49.8 54.5 49.3 51 52.9 0.20% -0.30% -0.30% 0.00% 1.40% 0.70% 55 40 Domestic Markets The Rupee fell a second consecutive session on Friday on continued purchases of Dollar from banks on behalf of oil marketing companies. Rupee’s fall also came after India’s fiscal deficit in the first nine months of the current financial year that began Apr. 1 totalled 5.32 trillion rupees, 100.2% of the full-year aim, government data showed today. Initially the Rupee had strengthened after government's sale of a 10% stake in Coal India Ltd was fully covered by mid-afternoon on Friday data from stock exchanges showed. Concluding the largest ever disinvestment, the Centre on Friday raised Rs 22,557.63 crore or Rs 225.6 billion from the sale of its 10% shareholding in Coal India (CIL). Foreign investors were net buyers of $583.91 million in Indian markets yesterday, according to the National Securities Depository Ltd. Data from NSDL showed so far in 2015, overseas investors' have purchased a total $5.452 billion worth of domestic shares and debt. Indian government bonds rose on Friday as investors stepped up purchases amid foreign fund inflows. The benchmark 8.40% bond maturing in 2024 closed at 104.71 rupees, yielding 7.69%, from its previous close of 104.58 rupees. 6 ADMISI Forex Research February 02, 2015 Sriram Iyer: [email protected] Investors now await the RBI’s bi-monthly monetary policy schedules tomorrow. Investors expect the central bank to keep rates steady. In other news, India’s economy expanded 6.9% in the last fiscal year ended Mar. 31 according to a new time- series data that was unveiled today, sharply higher than the previously estimated 4.7%, the government said. India's foreign exchange reserves fell to $322.04 billion as of January 23, from $322.14 billion in the previous week, the Reserve Bank of India said on Friday. The fall was driven by a $19.7 million decline in foreign-currency assets to $297.51 billion, according to the RBI data. The reserves rose to a record-high last week. International Markets The dollar remained broadly supported as the release of tepid U.S. data failed to dampen optimism over the strength of the country's economic recovery. In a report, Bureau of Economic Analysis said U.S. gross domestic product rose 2.6% in the last quarter of 2014, down from a previous estimate of 3.0% and from a growth rate of 5.0% in the three months to September. Separately, the University of Michigan said its consumer sentiment index ticked down to 98.1 in January from 98.2 the previous month, compared to expectations. While, Chicago purchasing managers' index rose to 59.4 this month from 58.8 in December. In the week ahead, investors will be turning their attention to Friday’s U.S. nonfarm payrolls report for further indications on the strength of the recovery in the labor market. The Euro ended lower after Eurostat reported that the annual rate of euro zone inflation fell by 0.6% in January, after a 0.2% slip in December. The downside was limited after euro zone’s unemployment rate ticked down to 11.4% in December from 11.5% the previous month. Meanwhile, Greece’s new government said it will not cooperate with the International Monetary Fund and the European Union and will not seek an extension to its bailout program, underlining fears over a clash with its international creditors. The yen weakened on Monday even though weaker-than-expected data for China and the U.S. underscored concerns that the world economy is stumbling. Meanwhile, the dollar rallied 1.74% against the Russian Ruble to end at 70.05 after Russia's central bank unexpectedly cut its benchmark interest rate to 15.0%, one month after surprising markets by hiking rates to 17.0%. Data from CFTC showed that speculators less bearish on Japanese Yen, while remaining slightly bearish on the Euro. 7 ADMISI Forex Research February 02, 2015 Sriram Iyer: [email protected] Source: Reuters USD Index (94.778) Trade Recommendation – None. Source: Reuters EURO (1.131) Trade Recommendation – None. DOLLAR INDEX AND EURO OUTLOOK – U.S. Dollar could trade range bound to firm. Support is at 94.30. Resistance is at 95.06. The Euro could trade range bound to weak. Key support is at 1.1208. Key resistance is at 1.1429. The Euro has remained oversold for some time and could witness some covering of shorts. 8 ADMISI Forex Research February 02, 2015 Sriram Iyer: [email protected] Source: Reuters USDINR (62.0523) Trade Recommendation – None. RUPEE OUTLOOK - Indian rupee could likely depreciate against the dollar tracking its Asian peers, as disappointing factory activity data from China fuelled concerns of a global economic slowdown and weighed on risk appetite. However, overall positive sentiments domestically and inflows could limit the depreciation. Key support level is at 61.71. Key resistance level is at 62.23. 9 ADMISI Forex Research February 02, 2015 Sriram Iyer: [email protected] DISCLAIMER: This document is not for public distribution and has been furnished to you solely for your information and must not be reproduced or redistributed to any other person. Persons into whose possession this document may come are required to observe these restrictions. This material is for the personal information of the authorized recipient, and we are not soliciting any action based upon it. This report is not to be construed as an offer to sell or the solicitation of an offer to buy any currency, commodity or currency/commodity derivative in any jurisdiction where such an offer or solicitation would be illegal. It is for the general information of clients of ADMISI Forex India Private Limited. It does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. We have reviewed the report, and in so far as it includes current or historical information, it is believed to be reliable though its accuracy or completeness cannot be guaranteed. Neither Archer Daniels Midland Company (ADM), nor ADMISI Forex India Private Limited, nor any person/entity connected with it, accepts any liability arising from the use of this document. The recipients of this material should rely on their own investigations and take their own professional advice. Price and value of the investments referred to in this material may go up or down. Past performance is not a guide for future performance. Certain transactions -including those involving futures, options and other derivatives as well as non-investment grade securities - involve substantial risk and are not suitable for all investors. Reports based on technical analysis centers on studying charts of a stock's price movement and trading volume, as opposed to focusing on a currency/commodity’s fundamentals and as such, may not match with a report on a currency/commodity's fundamentals. Opinions expressed are our current opinions as of the date appearing on this material only. While we endeavor to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. Prospective investors and others are cautioned that any forward-looking statements are not predictions and may be subject to change without notice. Our investment businesses may make investment decisions that are inconsistent with the recommendations expressed herein. No part of this material may be duplicated in any form and/or redistributed without ADMISI Forex India Private Limited prior written consent. 10

© Copyright 2026