Weekly Wrap - India Infoline

Weekly Wrap

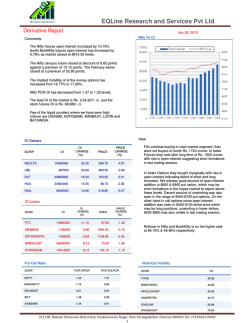

Derivative Note

January 30, 2015

Rollover Analysis – Jan 2015

Market Vs Nifty Rollover

Nifty/BankNifty starts the January expiry with a strong

9.4/10.8% gains (the best performance by Nifty in a month

over the past 1year). The rally which started with IT stocks

(after Infy result) got further ammunition by HDFC twins and

large cap private banks like Axis and ICICI. The undertone of

the market seems to be extremely positive as we see strong

rolls in Nifty, BankNifty and indices heavyweights despite

of run-up witnessed in January. The surge in India VIX was

mostly on account of increase in speculative position rather

than traders/investor buying option for a hedge.

90

Market rollover

Nifty Rollover

80

70

60

The Nifty index rolled ~2.5cr shares (~76%) into the next

contracts. The Nifty rolls contract wise was highest when

compared to the previous eighteen expiry. FIIs rollover has

been above five months average with long/short rolls being

83/38%. Market wide rolls were higher at 86.7% on back

of strong rolls in Cement, Pharma and Real Estate stocks.

Lower rolls were seen in Auto sector which stood at 81%

as against 84% (Dec) and 88% (Nov) in the previous two

expiry. Lower roll in Auto sector was due to below average

rolls in TVS and Ashok Leyland.

50

40

26-Jun 31-Jul 28-Aug 25-Sep 30-Oct 27-Nov 24-Dec 28-Jan

Source: Company, India Infoline Research

Nifty Options

4.0

The market has given signs of strong momentum in the

past two weeks. The past rally has been much swifter than

the street and our estimate. However, mid-cap stocks have

been laggard we expect some mid-caps to outperform the

broader indices in first half of the February series.

Call OI

(mn)

Put OI

3.5

3.0

2.5

2.0

Calls based on Rollover Strategy:

- Buy Divis Lab Feb Fut below `1794 with SL of `1750 for

target of `1860, 1880

1.5

1.0

9000

9100

Telecom

Others

8900

8800

8700

8600

8500

8400

0.0

8300

0.5

Source: Company, India Infoline Research

Sector-wise rollovers

100

Jan Expiry

Dec Expiry

Nov Expiry

90

80

70

60

Source: Company, India Infoline Research

Click here for the detailed note.

Textile

Power

Pharma

Oil & Gas

Metals

Media

Real estate

Infra

IT

FMCG

Fertilizer

Cement

Capital Goods

PSU Banks

Auto

40

Private Banks

50

India Infoline Weekly Wrap

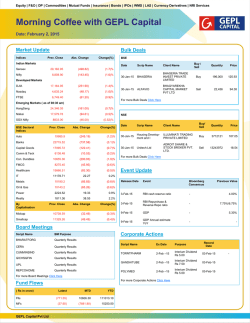

Market Outlook

A cracker of a rally was seen in the January series with the indices

gaining over 9% each. Expectations of pro-reform measures and a

market-friendly budget ensured that traders rolled over their bullish

positions confidently. The Coal OFS issue on Friday seems to have

taken the wind off the market rally. For the week, Nifty closed

marginally lower following profit booking on Friday.

The results of public banks announced so far have been

disappointing with asset quality deteriorating significantly. Gross

NPL ratio have seen a sharp jump on sequential basis along with

elevated restructuring activity. These trends are unlikely to reverse

meaningfully over the next couple of quarters. Fundamentally

private banks are better placed than public banks.

Technical View

The Indian indices have had a dream run with the Nifty gaining

~7% in January. Long - term bullish trend remains intact and

investors should be positioned on the long side. With Friday’s

decline, possibilities are index could begin a process of

consolidation or retracement back to previous breakout level

(6,650). In any of the scenarios, the trade should be to buy on

sharp dips, and it will be much better to focus on individual

stocks.

F&O View

In the coming week, all eyes will be fixed on RBI monetary policy.

Corporate results like ACC and Bharat Forge among others will be

on tap. While the direction of the policy is clear, the pace of further

easing would be dependent on continuance of disinflationary

trends, government’s performance on fiscal consolidation and

policy reforms with regards to key inputs that could ease supply

constraints in the economy. Also, the Budget would be a critical

input in central bank’s next discourse on rates. So we don’t think

that RBI would cut the repo rate again next week.

Nifty ended volatile week with profit taking on heavy weights,

huge shorts visible on PSU banking stocks after disappointing

results, Rollovers were in tune of 76% on index and 86 % on

market wide front, for February series. Rising VIX towards 20 levels

suggest traders anticipating wild moves to continue ahead of

budget event. On options front heavy call writing visible at 9000

Feb strike with addition of nearly 18.2 lakhs shares, suggesting

market to face resistance near 9000 levels.

FIIs/MFs activity

Advance/Decline

2,400

(Rs cr)

1,200

Net FIIs inflow

(No of stocks)

Advance

Decline

Net MFs Inflows

2,000

900

1,600

1,200

600

800

400

300

0

0

(400)

20-Jan 21-Jan 22-Jan 23-Jan 27-Jan 28-Jan 29-Jan

Global performance

Sectoral performance

(%)

Nikkei

Nifty

Realty

0.9

Oil & Gas

(0.3)

Sensex

FMCG

1.9

Power

1.7

1.0

(0.3)

IT

(0.4)

Auto

(1.6)

2

(0.6)

(1.2)

Metals (3.0)

(4.2)

(5.0)

0.0

Small Cap

Banks

Shanghai

0.5

BSE-200

(1.4)

Nasdaq

2.4

Capital Goods

(1.4)

Dow Jones

8.3

(%)

Health Care

(0.3)

Hangseng

20-Jan 21-Jan 22-Jan 23-Jan 27-Jan 28-Jan 29-Jan 30-Jan

(4.0)

(3.0)

(2.0)

(1.0)

0.0

1.0

2.0

(4.5) (3.0) (1.5) 0.0 1.5 3.0 4.5 6.0 7.5 9.0

India Infoline Weekly Wrap

Technical Check

Nifty 50 & CNX 500 top 10 Losers

Nifty 50 & CNX 500 top 10 gainers

NSE Nifty

Company

BPCL

HCL Tech

%

Chg

BOB

193 (13.4) Coal India

361

(8.6)

Coal India

361

(8.6) PNB

190

(8.4)

190

(8.4) Graphite India

78

(8.4)

%

Chg

Company

749

11.0 Geojit Bnp

49

28.2

35

18.8

170

Lupin

CMP

(`)

CMP

(`)

1,585

8.8 HCC

8.4 MRPL

59

16.9

PNB

6.4 GMR Infra

19

14.9

M&M

658

13.9

Cairn India

ITC

369

5.5 HPCL

BHEL

292

4.5 Praj Ind.

63

12.5

SBI

Axis Bank

588

4.1 Dishman Pharma.

153

12.3

Kotak Bank

3.3 Welspun

383

12.1

Zee Ent.

182

11.9

Hindalco

1,448

10.3

Dr. Reddy

HDFC Bank

1,077

Reliance

915

Tech M

2,869

3.2 Tribhovandas

3.2 Bajaj Fin.

Technically strong

CMP

(`)

Total

Traded Qty

(lacs)

10 days

Average

Traded Qty

(lacs)

Company

NTPC

144

142

205.3

77.5

Bajaj Hold

Century Tex

574

565

10.8

9.3

Dabur India

256

252

23.6

16.9

NHPC

18

18

53.1

17.7

GSPL

341

335

54.9

31.1

TCS

IVRCL

Adani Ports

CMP

(`)

1,265

1,687

(7.9)

233

(7.1) Persistant

(6.2) Redington

122

(7.8)

309

(5.6) Havells

258

(7.8)

1,322

377

140

3,233

(4.6) Gitanjali Gems

47

(7.8)

(3.6) Swaraj Eng.

873

(7.7)

(3.5) Gujarat Gas

658

(7.6)

(3.5) Vardhman Tex.

439

(7.5)

Technically weak

10 days

Moving

Average (`)

Company

CNX 500

%

Chg Company

%

Chg Company

1,792

DLF

NSE Nifty

CNX 500

CMP

(`)

Bulk deals

Crompton Grv

CMP

(`)

10 days

Moving

Average (`)

Total

Traded Qty

(lacs)

10 days

Average

Traded Qty

(lacs)

1,406

1,420

0.6

0.6

190

191

32.8

31.2

19

20

58.9

49.4

119

121

17.4

10.9

2,482

2,520

30.6

17.0

Book closure and record date

Qty

(lacs)

Price

(`)

Company

Date

Purpose

B/S

TORNTPHARM

02 Feb 2015

Interim Dividend - `.5.00

Zee Learn

B

25.0

31.0

MASTEK

03 Feb 2015

Interim Dividend - `.1.50

Fidelity Inv

Edelweiss

B

163.4

73.0

EDELWEISS

04 Feb 2015

Interim Dividend - `.0.80

Goldman Sachs

IBREAL

B

24.3

79.0

MRF

04 Feb 2015

Final Dividend - `.44.00

CHOLAFIN

05 Feb 2015

Interim Dividend - `.2.50

Date

Institution

Scrip name

27-Jan

JP Morgan

27-Jan

29-Jan

Nifty Future VWAP

Bank Nifty Future VWAP

Nifty Futs Close

Bank Nifty Futs Close

Nifty Vwap

Bank Nifty Vwap

21000

9100

20700

9000

20400

8900

20100

8800

19800

19500

8700

23-Jan

27-Jan

28-Jan

29-Jan

30-Jan

23-Jan

27-Jan

28-Jan

29-Jan

30-Jan

3

India Infoline Weekly Wrap

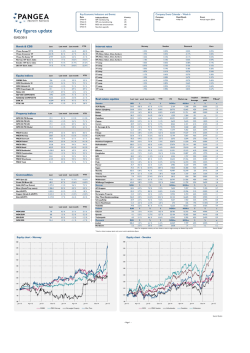

Commodity Corner

Base metals

Precious metals

Base metals continued to struggle, impacted by contracting

manufacturing activity in China. Economic activity in China has

not manifested any concrete signs of resurgence. Copper prices

categorically bore the brunt of aggressive selling. Copper has

been adversely influenced by the massive jump in LME warehouse

inventories. In this respect, LME stocks have risen by more than

50,000 tons so far this month. It seems that the palpable surplus in

the concentrate market is eventually finding its way into the refined

market. In addition, Copper prices failed to derive any support from

reports that China’s State Reserve Bureau plans to stockpile 200,000

metric tons of refined copper.

Precious metals witnessed retracement this week, failing to react to the

outcome of Greece elections. It seems the markets had already priced

in Syriza’s victory and ECB’s aggressive monetary stimulus somewhat

has overshadowed the uncertainty regarding Greece. On Greece

elections, the opposition Syriza party formed a coalition government.

In addition, FOMC policy statement was inferred to be hawkish with

the central bank not providing any indication that it will postpone the

initial interest rate hike decision inspite of the deflationary trends across

the globe. However, Fed stated that it will remain patient and monitor

the macroeconomic flow in US and international developments before

going ahead with the hike.

The broader price trajectory remains vulnerable to bearish

influence emanating from Chinese macroeconomic developments.

In the latest, Chinese government plans to cut its growth target

to around 7% in 2015, its lowest projection in some 11 years.

Inflation forecasts are also expected to be lowered till 3%. In terms

of prices outlook, we infer that Copper can still drift lower and in

the process exert downward pressure on other metals as well.

Market focus will be accentuated on US Q4 GDP readings, wherein

expectations are calling for a growth of 3.0%. A below par reading

can again roil the broader markets and in the process trigger an

upside in the precious pack. However, a healthy GDP reading can

turn the tables, with US dollar and equities proving to be the

beneficiary. On outlook, it is an onerous task to figure out the short

term price trajectory in gold, considering the fact that there are

various economic crosscurrents prevailing at the current juncture.

However, the development in Greece can prove supportive for the

precious pack. There are concerns regarding the functioning of

the new government. PM Alexis Tsipras is adopting a provoking

stance by stopping the privatization plans agreed under bailout

deals and is also planning to reinstate public sector employees that

were previously laid off.

Note: This market commentary is written at 12:00 PM IST

LME prices

Weekly inventory update

Base Metals (US$/ton)

High

Low

LTP*

Chg(%)

Copper

5,704

5,340

5,395

(2.3)

Tons

Abs Chg.

Chg (%)

Copper (LME)

248,125

12,975

Nickel

15,070

14,015

14,900

3.8

5.5

Nickel (LME)

426,240

3,204

0.8

Zinc

2,150

2,068

2,090

(0.1)

Zinc (LME)

Aluminium

1,887

1,812

1,819

(0.7)

Aluminium (LME)

Lead

1,890

1,816

1,860

0.8

630,750

(15,025)

(2.3)

4,048,900

(37,275)

(0.9)

215,000

(100)

(0.0)

11,810

(180)

(1.5)

137,042

2,905

2.2

85,639

9,286

12.2

187,114

1,043

0.6

Lead (LME)

Tin (LME)

Precious Metals (US$/ounce)

Gold

High

Low

LTP*

Chg(%)

1,303

1,252

1,263

(2.4)

Shanghai Zinc

18.5

16.7

17.0

(7.2)

Shanghai Aluminium

Silver

* Last Traded Price

LME Copper

10500

Shanghai Copper

COMEX Gold

US$/ ton

2050

Copper (LME)

US$/ ounce

Gold

1900

9500

1750

8500

1600

7500

1450

6500

4

Jan-15

Jul-14

Oct-14

Jan-14

Apr-14

Jul-13

Oct-13

Jan-13

Apr-13

Jul-12

Oct-12

Apr-12

Jan-12

Jul-11

Oct-11

Apr-11

Jan-11

Jan-15

Jul-14

Oct-14

Apr-14

Jan-14

Jul-13

Oct-13

Jan-13

Apr-13

Oct-12

Jul-12

Jan-12

Apr-12

Jul-11

Oct-11

1000

Jan-11

4500

Apr-11

1150

Oct-10

5500

Oct-10

1300

7

0

6

(2)

5

110

100

30

(%)

Six core Ind.

(INR/EURO)

(INR/USD)

(INR/GBP)

(INR/JPY)

IIP and Six core Industries

IIP

130

12

8

4

0

(4)

Currency Movements

90

60

40

120

40

95

80

90

70

85

70

Jul-12

Nymex Crude

Jan-14

Jan-15

Oct-14

Jul-14

Apr-14

10yr Gsec yield

3mth CP rate

Oct-13

Jul-13

Apr-13

Jan-13

4

Oct-12

6

Jan-12

8

Apr-12

12

Jul-11

10

(%)

Oct-11

13

Apr-11

14

Jan-11

MFG Products

Oct-10

Dec-14

Sep-14

Jun-14

Mar-14

Monthly Inflation

Dec-13

Sep-13

Jun-13

Mar-13

Dec-12

Sep-12

12

(%)

Jun-12

Mar-12

Dec-11

Sep-11

14

May-11

Jul-11

Sep-11

Nov-11

Jan-12

Mar-12

May-12

Jul-12

Sep-12

Nov-12

Jan-13

Mar-13

May-13

Jul-13

Sep-13

Nov-13

Jan-14

Mar-14

May-14

Jul-14

Sep-14

Nov-14

Jan-15

2

Jun-11

Inflation

May-11

Jul-11

Sep-11

Nov-11

Jan-12

Mar-12

May-12

Jul-12

Sep-12

Nov-12

Jan-13

Mar-13

May-13

Jul-13

Sep-13

Nov-13

Jan-14

Mar-14

May-14

Jul-14

Sep-14

Nov-14

Jan-15

(8)

May-11

Jul-11

Sep-11

Nov-11

Jan-12

Mar-12

May-12

Jul-12

Sep-12

Nov-12

Jan-13

Mar-13

May-13

Jul-13

Sep-13

Nov-13

Jan-14

Mar-14

May-14

Jul-14

Sep-14

Nov-14

16

Sep-11

Nov-11

Jan-12

Mar-12

May-12

Jul-12

Sep-12

Nov-12

Jan-13

Mar-13

May-13

Jul-13

Sep-13

Nov-13

Jan-14

Mar-14

May-14

Jul-14

Sep-14

Nov-14

Jan-15

India Infoline Weekly Wrap

Chartbook

Interest Rate

5yr AAA bond yield

11

10

9

8

Crude (Brent/ Nymex)

Brent Crude

110

100

90

80

70

60

50

Dollar Index

100

Dollar Index

50

80

75

Source: Bloomberg

5

6

Source: Bloomberg

50,000

29x

40,000

24x

30,000

18x

20,000

10,000

13x

7x

0

22.0

PE (x)

Cur. Yr

Sensex

24.0

Nasdaq

60,000

Mexico Bolsa

Sensex PE Band

1,550

PE Comparision

1-Yr Fwd

20.0

18.0

16.0

14.0

12.0

10.0

8.0

6.0

28-Jan

20-Jan

12-Jan

4-Jan

27-Dec

15

(Rs)

S&P 500

20

19-Dec

1,570

Dow Jones

25

FTSE

1,575

11-Dec

30

3-Dec

35

Straits

1,590

25-Nov

VIX

DAX

Volatility Index

17-Nov

250

Taiwan

40

9-Nov

300

Shanghai

Jan-15

Oct-14

Jul-14

Apr-14

Jan-14

Oct-13

Jul-13

Apr-13

Jan-13

Oct-12

Jul-12

Apr-12

Jan-12

Oct-11

Jul-11

50

Apr-11

60

Jan-11

China

1-Nov

PMI

Hang Seng

US

Jan-15

Germany

Dec-13

Euro Zone

Dec-12

India

Nov-11

Oct-10

Oct-09

40

Sep-08

Aug-07

Aug-06

Jul-05

(%)

Jun-04

Jun-03

10

May-02

Apr-01

45

Jan-13

Feb-13

Mar-13

Apr-13

May-13

Jun-13

Jul-13

Aug-13

Sep-13

Oct-13

Nov-13

Dec-13

Jan-14

Feb-14

Mar-14

Apr-14

May-14

Jun-14

Jul-14

Aug-14

Sep-14

Oct-14

Nov-14

Dec-14

65

Jan-10

Apr-10

Jul-10

Oct-10

Jan-11

Apr-11

Jul-11

Oct-11

Jan-12

Apr-12

Jul-12

Oct-12

Jan-13

Apr-13

Jul-13

Oct-13

Jan-14

Apr-14

Jul-14

Oct-14

Jan-15

India Infoline Weekly Wrap

Chartbook...

US Initial Jobless Claims

550

500

Initial Jobless Claims ('000)

55

450

400

350

Sensex Earning Estimates

FY15

1,585

1,580

1,565

1,560

1,555

India Infoline Weekly Wrap

News Recap

The Cabinet today approved a base price of `37.05bn per

megahertz (MHz) for 3G spectrum auction, a move which

would help the government garner over ` 1tn along with sale

of other mobile frequencies. (ET)

The government has taken a big step forward to assure the

foreign investors by not appealing against the Bombay High

Court order October last year, which ruled that Vodafone was

not liable to be taxed in India in a transfer pricing dispute with

the tax department. This will help other companies like Shell

that also won a similar reprieve in the Bombay High Court last

year. (BS)

The union government proposes to fund upto `10bn worth

infrastructure works in each of the cities selected under smart

city project over the next ten years. (BS)

Adani Enterprises, the holding company of the Adani Group,

is planning a mega restructuring of its businesses under which

the shareholders of holding firm, Adani Enterprises are likely to

get direct shares in its power and port subsidiaries. (BS)

The government today fixed ` 358 a share as the floor price

for up to 10% stake sale in Coal India, which may help the

exchequer garner about `226bn. (BS)

NTPC has restricted the building of three new solar power

projects to domestic manufacturers, even as India pushes for

overseas companies to lead fresh investments into a renewable

energy drive. (BS)

Japan's Suzuki group plans to set up three plants in Gujarat's

Hansalpur, which will exclusively supply to Maruti Suzuki India

Limited. (ET

Oil and Natural Gas Corp said its natural gas output will jump

81% to 116 mscmd by 2019 after it bring newer fields in

western and eastern offshore into production. (BS)

Targeting revenue of up to US$5bn from the digital vertical in

the next few years, TCS has hired 1,500 experienced hands in

the segment so far this fiscal. (BS)

Reliance Industries and its partner BP plc of UK will invest about

`60bn by 2016 to help sustain and improve recovery from the

two main gas fields in the eastern offshore KG-D6 block. (BL)

The government will sell up to 10% stake in the Coal India Ltd

through offer for sale on Friday and is expected to mop up

around `240bn at current market price. (BL)

Tata Motors intends to utilise `75bn, which it plans to raise via

rights issue, to fund various activities, including introduction

of more than 100 new commercial vehicles over next three

years and passenger vehicles on new modular platform from

FY 2016-17. (ET)

Terming the January 30 stake sale in Coal India as a “betrayal”

and “violation” of assurances given by the Coal Ministry after

their strike earlier this month, trade unions said they will hold

day-long protests and dharnas on Friday against 10% stake

sale in the public sector entity. (BL)

SpiceJet, under its revival plan, plans to increase its daily flights

by almost 30% to 280 within three months. (BS)

Bharti Airtel, through its wholly-owned subsidiary Airtel M

Commerce Services Ltd. (AMSL), is applying for a Payments

Bank licence with Kotak Mahindra Bank as a partner. (ET)

Tata Power will acquire group firm Nelco's defence business of

Unattended Ground Sensors for about `83mn. (ET)

SpiceJet is offering 0.5mn discounted seats in a three day sale

beginning, with tickets priced from ` 1,499 onwards. Discount

tickets are available for travel from February 15-June 30. (BS)

Jaiprakash Power Ventures Ltd said it was likely to default on

payments for convertible bonds worth US$200mn due on Feb

13 this year, as it could not generate enough revenue from its

operations. (BS)

Event Calendar

Period: 2nd Feb – 6th Feb 2015

US

• Personal income MoM (2 Feb)

•

Market Manufacturing PMI Final (2 Feb)

•

Construction spending (MoM (2 Feb)

•

Total Vehicle sales (4 Feb)

India

• HSBC Manufacturing PMI (2 Feb)

•

RBI interest rate decision (3 Jan)

•

HSBC India Services PMI (4 Jan)

China

• HSBC Manufacturing PMI Final (2 Feb)

•

HSBC China Services PMI (4 Feb)

Europe

• PPI MoM (3 Feb)

•

Retail sales MoM (4 Feb)

IIFL, IIFL Centre, Kamala City, Senapati Bapat Marg, Lower Parel (W), Mumbai 400 013

The information in this newsletter is generally provided from the press reports, electronic media, research, websites and other media. The information also includes information from interviews

conducted, analysis, views expressed by our research team. Investors should not rely solely on the information contained in this publication and must make their own investment decisions based on their

specific investment objectives and financial position and using such independent advisors as they believe necessary. The materials and information provided by this newsletter are not, and should not be

construed as an advice to buy or sell any of the securities named in this newsletter. India Infoline may or may not hold positions in any of the securities named in this newsletter as a part of its business.

Past performance is not necessarily an indication of future performance. India Infoline does not assure for accuracy or correctness of information or reports in the newsletter.

7

© Copyright 2026