Diversification is considered, by most studies, to

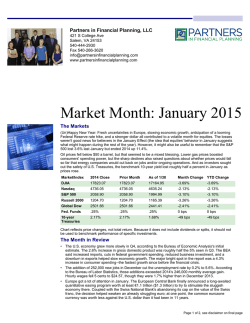

January 2015 End of Year Newsletter Diversification is considered, by most studies, to be the best way to reduce overall investment risk; “risk” being defined as a measure of portfolio volatility. In 2014, a portfolio invested only in the S&P 500 would have had a return of 13.7% with dividends included. On the other extreme, a portfolio invested only in the Bloomberg Commodity Index would have had a return of (-17.0%). In between these two extremes is where the Total Return of most asset classes fell last year. While there are always diverging returns from various asset classes in any given year, it was especially important to be aware of your diversification when reviewing the impact on one’s portfolio last year. Nearly all asset classes that a portfolio would have held last year outside of large U.S. companies greatly reduced portfolio return. The one exception was the Real Estate Market, which was up 28%, represented by the Nareit Equity REIT Index. For example, note the following: ASSET CLASS REPRESENTED BY how well the market did, and all the new highs the S&P 500 and Dow Jones Index set last year. As you can see from the Chart #1 (below), asset class returns can vary greatly from year to year, and you never know exactly where any one of them will fall in a particular time period. CHART #1 2014 TOTAL RATE OF RETURN Small Stocks Russell 2000 Index 4.9% International Stocks MSCI EAFE Index (-4.5%) Emerging Market Stocks MSC Emerging Index (-1.8%) The same holds true for most of the fixed income investments a portfolio may have held. The Barclays Aggregate Index had a return of 6.0% and that return was much better than short maturity bonds, floating rate note investments or most of the broad fixedincome category referred to as unconstrained, or flexible bond funds. All of this illustrates the fact that a well-diversified portfolio had a 2014 Total Return less than many people might expect when the news outlets rave about 2605 Nicholson Road, Building 2, Suite 103, Sewickley, PA 15143 724-934-8600 A somewhat unusual aspect of 2014 asset returns was that small cap stocks lagged the performance of large cap stocks by more than 8.5 %. While not unprecedented, you have to go back to 2011 for another instance of small underperforming large, and all the way back to 1998 to find a period where small underperformed by a larger margin. Of course, the big story in the markets for 2014 was the collapse in oil prices. The price of West Texas Intermediate crude has fallen by more than 50%, from a high price of over $100 per barrel to less than $50 per barrel in less than six months. This is only the sixth time since 1980 that the price of oil declined by 50% or more. It is, however, only the second time when the high was PAGE 1 January 2015 End of Year Newsletter making the decline seem even more dramatic. CHART #2 The impact of the decline in oil has been felt in both stocks and bonds. There has been the expected fall in the prices of stocks from the major integrated companies to the small exploration and production companies. The spillover has been seen in the bond market as well. A significant percentage of the high-yield bond market consists of small and mid-size energy companies that have borrowed to fund operations and expansion during the growth of the shale oil boom. Concern is now surfacing as to whether these companies will have the cash flow to sustain their debt service payments if the price of oil stays low for an extended time. Consequently, the interest rate spreads between yields of higher quality and lower quality debt has widened, making it more difficult and more expensive for companies to re-finance or issue new debt. This may provide an explanation why small-cap stocks had such a tough year versus their larger cap brethren. While diversification reduced potential returns last year, it also reduced the risk of picking the wrong market segment. At Medallion Wealth Management, we have always believed that diversification is an important component for the long-term investor. As can be seen from the wide dispersion of returns without being diversified in 2014, reward can be high if you are fortunate enough to select the right asset class, but a high threshold for pain would be required if you only had one or two of the losing asset classes. With few exceptions, international markets and economies underperformed the US in 2014. In spite of verbal encouragements from European Central Bank officials, most EU economies suffered from moribund growth. ECB President Draghi has indicated on several occasions that they would embark on a major quantitative easing program, but thus far the central bank’s balance sheet has not shown any expansion. Please see the following chart (Chart #2) on central bank balance sheets and note the lack of growth over the last three years of the ECB. As a result, GDP growth in most developed European economies has been barely above stall speed. Another blow like Russia’s intervention in Ukraine would probably be enough to drive most of Europe into recession. Many of the Asian countries are suffering from a similar malaise. Japan has made attempts to stimulate growth by embarking on a quantitative easing program of their own, but so far, little is available to prove its worth. To set the stage for 2015, most developed international economies are trying to drive down the value of their currencies relative to the US dollar. Growth in GDP among the industrialized world may again be a scarce commodity. Creating a relatively cheaper currency has been a way to stimulate trade. The US began efforts to lower the value of the dollar and simultaneously drive down interest rates in 2008 when it became clear that we were in the throes of a major recession. Those stimulation efforts, known as Quantitative Easing (QE), were designed to lower interest rates, provide additional liquidity and lower the value of the currency. Having achieved a measure of success, QE in the US ended at the end of 2014; it is, however, just beginning in most other parts of the world. Relative to the rest of the developed world, better GDP growth, the end of QE, and more attractive interest rates have made the US somewhat of a haven for capital flows, creating a stronger currency. We believe the dollar and the US equity markets are likely to continue to be the most attractive markets, on a risk/reward basis, of the developed world in 2015. International markets do have considerable upside if things would go their way, but still seem very questionable at this point. The potential for continued cash inflows into the US, coupled with a shrinking supply of available US shares for purchase due to the enormous amount of buy-backs that have occurred, could continue to provide a favorable backdrop for our stock market. PAGE 2 End of Year Newsletter Of course, earnings growth, stock valuation and alternative choices are always important considerations when analyzing the stock market. Let’s briefly examine these, with regard to earnings. S&P Capital IQ is estimating an 8-9% growth rate for 2015 S&P 500 earnings. Due to the extreme weakness in the energy sector, that estimate may get revised downward, but should still show a reasonable increase for next year. However, it is thought by many that 2015 will be the time that workers finally share some of the corporate profits in the form of slightly higher wages. This, along with the severe drop in the price of gasoline would provide additional spending power for the consumer. Corporate profit margins should stay near record levels. So any revenue growth should find its way to the bottom line of many sectors of the market. Current valuation of the S&P 500 looks fair, as measured by both the trailing 12month price/earnings ratio, which is 17.5, and the price/ earnings ratio based on next year’s estimated earnings, which is 15.8. With regard to alternative choices versus the stock market, you have extremely low interest rates on Treasuries, and only slightly higher on US investment grade corporate bonds. The current psychology of the professional money manager appears to be best described by saying they are reluctantly and cautiously invested. Despite strong returns from the S&P 500 in 5 of the last 6 years, there is still significant doubt that the Bull Market should have been this strong and will continue. This could provide a nice environment for stocks if the economy continues to improve and the lack of an alternative forces managers to put more money into stocks. In addition, the average retail investor still appears to be very cautious toward stocks and continues to buy bonds even in this extremely low rate environment. Chart #3 shows the CHART #3 January 2015 enormous cash reduction in domestic stock mutual funds over the last six years, while bond mutual funds have had inflows more than twice that amount. Even a slight reversal of this could provide some fuel for further market gains. In conclusion, our outlook is that the US economy is on a fairly strong footing, stocks are not extremely over-valued, and interest rates are not likely to be up significantly The Bull Market trend for US stocks appears to be intact. While International economies are not nearly as strong as the US, they do have the potential for financial and structural reform and improvements which could lead to improved stock market returns. While US small stocks significantly under-performed US large stocks in 2014, we feel they could show better relative returns in 2015 due to a strong dollar, which could put pressure on some of the foreign earnings in large companies. Regardless of the specific market, we feel 2015 will have much more volatility, with a wider dispersion between the winners and losers. As always, Medallion Wealth Management will focus on building client portfolios that are well diversified and have holdings that are well researched, and --most importantly – fit with client objectives and risk tolerances. A potential major impact to both the equity and fixed income markets around the world is the fact that so many markets are more intertwined and linked because of all the central bank action around the world in recent years. This has, in effect, not allowed interest rates, currencies and stock markets to find the levels they may have otherwise reached. This has greatly increased the volatility of many markets, and set up the potential for unintended consequences as various actions or non-actions are taken around the world. These dislocations may cause extreme swings in currencies, interest rates or stock markets. Securities offered through Cambridge Investment Research, Inc., a brokerdealer, member FINRA/SIPC. Advisory services offered through Cambridge Investment Research Advisors, Inc., a Registered Investment Adviser. Cambridge and Medallion Wealth Management, Inc. are not affiliated. Asset allocation and diversification strategies cannot assure profit or protect against loss in a generally declining market, and past performance does not guarantee future results. Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly. Material discussed herewith is meant for general illustration and/or informational purposes only. Please note that individual situations can vary; therefore, the information should be relied upon when coordinated with individual professional advice. PAGE 3

© Copyright 2026