FX Research - Easy Forex News

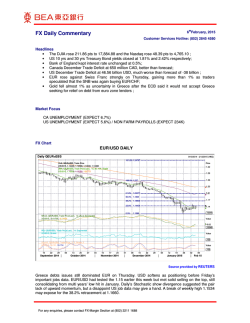

United Kingdom > FX Research FX Markets Today A daily outlook for currencies 2 February 2015 New York open It is ISM week globally, and it didn’t start well in China, though we’re always wary of over-interpreting a tenth of a percentage point move either side of consensus. Manufacturing PMI came in at 49.7 compared to expectations of 49.8 but remember that the first 5 months of last year were all below 50 with a low of 48.0 in March 2014. Two numbers now below 50 but still on a 49 handle doesn’t make for exciting headlines, though it was enough to knock the Shanghai Composite Index down -2.5% and take the cumulative year-to-date losses to -3.3%. The immediate casualty outside the stock market was USD/JPY which fell 60 pips to a low of 116.66; the lowest point since January 16th. The pair subsequently recovered through the Asian session and moved on to a high of 117.88 but there’s no great enthusiasm to chase spot higher given the somewhat nervy tone in global equities. To our eyes, too, Friday’s US GDP doesn’t get better when we look at the details. The headline 2.6% figure was worse than analysts’ expectations but we’re a little concerned at the $113.1bn build-up in inventories to their second highest level of this millennium. Inventories contributed +0.82% to the 2.6% increase in GDP. The big question (impossible to answer ex-ante) is whether this is voluntary or involuntary build-up. If firms put unsold goods into warehouses because of weak final demand, then at some point, they'll cut back production and meet demand from inventories. In effect, the GDP accounting effectively brings forward growth from the subsequent quarter. The market hasn’t been in a mood to look at data-misses in the US and shrugged this off with no concern at all. Let’s see if it remains so sanguine going in to payrolls… For the European PMI numbers, the Spanish number was a much better than forecast 54.7 – which helps explain why the Spanish Government is taking the side of Germany in any negotiations with Greece over debt forgiveness. Faced with anti-austerity demonstrations in Madrid at the weekend, the authorities fear that a generous Greek deal would only add to the support for the rapidly-growing Podemos Party which is their version of Syriza. Elsewhere across the Continent, Italy was 49.9, France 49.2 and Germany 50.98 to leave the overall EU number in line with forecasts at 51.0. AUD/USD and NZD/USD Intraday Spot rate Spot rate 0.7290 0.7280 0.7820 NZD/USD 0.7810 AUD/USD (RHS) 0.7800 0.7270 0.7790 0.7780 0.7260 0.7770 0.7250 00.00am (UK) Source: NAB, Bloomberg 12 hour Spot movement 0.7760 12.00pm (UK) Currency Performance vs. USD (1 Day) Percentage change versus USD (Daily) CAD NOK EUR SEK AUD NZD JPY GBP -0.4 -0.2 0 0.2 0.4 0.6 Source: NAB, Bloomberg Foreign Exchange Rates With no nasty surprises in the EU data and Greek Finance Minister Varoufakis embarking on a charm offensive of European capitals, those hoping for the EUR/USD move lower to be extended could well be in for some disappointment. Recall that at the time of Draghi’s ECB QE announcement, the pair was trading in the high 1.14’s and any move above 1.1395 might prompt a further bout of short-covering. In any case, the EUR is also getting some support from a higher EUR/GBP cross which – having touched 0.7405 last Monday, looks to be now on its way to 0.76. For the AUD and NZD dollars, a quieter session has been seen, albeit with a steady bias to the upside throughout the Asian and European sessions. Most striking was the AUD’s ability to shrug off weak China data and, with rates markets now pricing in a 66% probability of a cut at tomorrow’s RBA meeting, we think 0.7860 might be within reach in the absence of any last-minute headlineseeking journalist comments. For the US Dollar, meantime, Personal Income, Spending and Inflation data today might all continue to fan fears of a very modest slowdown in activity. Note: Performance rates are calculated from 22:00GMT previous day. wholesale.nabgroup.com | 1

© Copyright 2026