Currency Updates

Daily Currency Update - 4 February 2015

DAILY CURRENCY UPDATE

4 February 2015

MARKET SUMMARY

The RBA board cuts its cash rate yesterday by 25 bps, taking it to a new generational

low of 2.25%. The tone of the Statement is more dovish than expected with concern

for underlying growth in domestic demand. The impact of the RBA rate cut is eclipsed

by a broad USD recovery overnight. Markets strike a more upbeat tone on the back

of a further rise in oil prices and after Greece’s Syriza government drops its calls for a

write-off of Greece’s foreign debt, proposing a debt swap plan instead.

The market reaction to the proposal is positive, with Greek 10-year bond yields falling

close to 140bps (to 9.26%). The boost to risk appetite sees US Treasuries sell off

across the curve, while core European sovereign bond yields are also higher. Equity

indices have another lift driven by the change in Greece’s stance and the rebound in

energy stocks. The Euro Stoxx 50 index moves up 1.3%, while in the US, the S&P 500

and the Dow rise 1.4% and 1.8% respectively. NZD is buoyed by a solid GDT auction

and fairly decent unemployment numbers.

Energy markets are stronger, with oil leading the gains. WTI jumped over 6% as

sentiment across the sector improved. A steady stream of news regarding falling

capital expenditure from the industry on both new and existing projects and a drop in

US oil rigs in operation appears to be the spark. A weaker USD also supports the

moves. However, while sentiment appears to have shifted, volatility remains high.

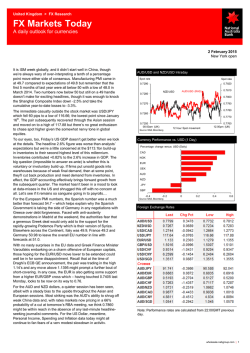

Price Action

1 Year Forward

Spot

1M High

1M Low

EUR/USD

1.1469

1.2252

1.1098

USD/JPY

117.49

120.74

115.86

GBP/USD

1.5160

1.5620

1.4952

USD/CHF

0.9247

1.0240

0.7406

USD/CAD

1.2428

1.2799

1.1565

AUD/USD

0.7782

0.8295

0.7626

Onshore

Offshore

AUD/JPY

91.43

98.42

89.38

NZD/USD

0.7355

0.7890

0.7177

USD/SGD

1.3458

1.3569

1.3201

USD/TWD

31.60

32.04

31.17

31.20

31.24

USD/KRW

1098

1112

1072

1104

1102

USD/CNY

6.2582

6.2604

6.1883

6.4558

6.4798

USD/INR

61.68

63.79

61.30

66.02

65.06

USD/IDR

12657

12773

12378

13485

13420

Base metals are higher, with copper experiencing strong buying as it benefits from

the improving sentiment towards commodity markets. The market is also supported

USD/PHP

44.14

45.11

44.04

44.60

44.36

by the rising prospect for monetary easing in China after the weak economic data

Source: Bloomberg

released this week. Despite the weaker USD, gold fails to move higher, with the

positive sentiment in commodities muting the recent safe haven buying demand. Bulk

commodity markets are higher, also benefiting from the shift in flows back into the commodity complex. The market is supported by data which shows a slight fall in

exports from Australia and Brazil.

USD & JPY

USD: Beaten On All Ends

USD/JPY High Low Chart

The USD declined broadly despite firmer US yields.

117.49

The main exception to general bias was USDJPY, which continues to consolidate ahead of the 117.80 resistance area.

US factory orders and NY ISM both disappointed. US factory orders decreased by 3.4% MoM in December, worse than the

115.86

120.74

forecasted 2.4% contraction.

Details are down across the board. This follows weak December durable and capital goods released earlier and adds to recent run of weak data out of the US.

Stabilizing oil prices also led to USD selling against G10 commodity and EM currencies.

Flow-wise, the leveraged community was very active fading these moves on our platforms. In G10, CitiFX Flows showed a net USD long against G10’s top performers NOK, EUR, SEK, NZD, and GBP.

Ahead, the market will see ADP, additional manufacturing gauges and trade balance data ahead of the all-important NFP.

JPY

USDJPY has officially entered the “conundrum” zone with a strict refusal to diverge from this increasingly messy 117.25-117.75 zone regardless of what is going on in

FI/Equities/Commodities and risk in general.

“There is little positioning in USDJPY,” says CitiFX Strategist Richard Cochinos. “But as attention turns to Friday's NFP, may be a favourite for those expecting higher

yields and strong print.”

In local news, Nikkei news reports that Yutaka Harada is to be proposed for the BoJ policy board, in place of Ryuzo Miyao whose term expires on March 25, 2015.

According to the WSJ, the nomination will be submitted to parliament on Wednesday, kicking off a week’s long process to gain approval from both the upper and lower

chambers of the Diet.

What happened in the past 24 hours

US

US

Indicator

Actual

Citi

ISM New York, Jan

Factory Orders, Dec, %

44.5

-3.4

--3.3

Consensus

Prior

--2.4

70.8

-1.7

What’s happening in the next 24 hours

US

Indicator

Citi

Real GDP

3

Consensus

Prior

3.1

5

EUR, GBP, CHF

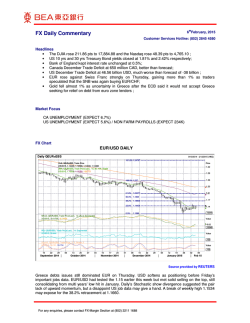

EUR: Greek Proposal Falls On Deaf Ears

A position squeeze hit global FX markets on Tuesday, leading EURUSD back above 1.1500.

Eurozone inflationary data continued to hint at deflation risks. PPI dropped further to -2.7% YoY in December, a fresh 5y

low and weaker than the forecasted -2.5%.

Greece’s Syriza government dropped its calls for a write-off of Greece’s foreign debt, proposing a debt swap plan instead.

Under the proposal outlined by Yanis Varoufakis, Greece’s Finance Minister, the outstanding debt would be swapped for

two types of bonds.

The first type would replace European rescue loans and be tied to nominal economic growth, while the second would be a

‘perpetual bond’ that would replace Greek bonds owned by the European Central Bank.

“The European Central Bank is resisting a key element of the Greek government’s new rescue plan, potentially leaving

Athens with no source of outside funding when its international bailout expires at the end of the month,” FT reports.

Greece’s finance minister apparently proposed that Greece raise EUR10bn via short-term Treasury bills (up to

3months) while broader negotiations continued.

“But the ECB is unwilling to approve the debt sale,” says sources. “…it will play hardball.”

EUR/USD High Low Chart

1.1469

1.1098

1.2252

GBP/USD High Low Chart

1.516

1.562

1.4952

USD/CHF High Low Chart

0.9247

0.7406

1.024

Page 1

Daily Currency Update - 4 February 2015

GBP: Cable Continues Range Trading

GBP was a bit more responsible to firm PMI data. Markit/CIPS UK construction PMI picked up from December’s 17m low to reach 59.7 in January, better than the

forecasted 57.0.

New business levels rose at an accelerated pace but job creation eased to its weakest for 13m.

Thanks to this and broader USD sentiment, cable has rallied from 1.5000 towards 1.5200.

What happened in the past 24 hours

Eurozone

Switzerland

Indicator

Actual

Citi

PPI YoY, Dec, %

Trade Balance, Dec

-2.7

1.52B

---

Consensus

Prior

-2.5

2.10B

-1.6

3.80B

What’s happening in the next 24 hours

Eurozone

Eurozone

Indicator

Citi

Services PMI, Final

Unemployment Rate

52.3

11.4

Consensus

Prior

52.3

11.5

51.6

11.5

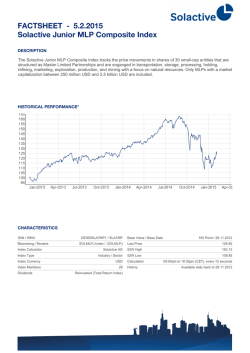

AUD, NZD, CAD

AUD: Gone Is The Period Of Stability

AUD/USD High Low Chart

RBA cuts the cash rate by 25bp to 2.25%, the first cut since August 2013, accompanied by a dovish statement. Key

highlights:

- AUD still above most estimates of fundamental value, lower AUD needed to achieve balanced growth.

- Rate cut to foster sustainable growth, as unemployment rate will peak a little higher and overall domestic demand

growth is quite weak (very dovish).

- Sees domestic economy operating with spare capacity for some time yet.

- Lower energy prices to temporarily lower CPI while terms of trade to likely reduce income growth as output growth to

remain below trend somewhat longer.

- Gone is the “period of stability” when referring to rates .

0.7783

0.7626

0.8295

NZD/USD High Low Chart

0.7356

0.7177

0.789

The key reason behind the rate cut appears to be the Bank pushing out the timing of its forecast of the return to trend or

USD/CAD High Low Chart

above economic growth.

In particular, the statement highlights a longer period of below trend growth that appears to reflect lower income growth.

1.2428

Hence, the RBA’s concern that AUD still “remains above most estimates of its fundamental value”.

1.1565

1.2799

Citi’s Australian economists think the statement doesn’t convey a sense of urgency. They don’t see March as a live

meeting, and will update their RBA call following the release of MPC statement on Friday which may provide more color on

the Bank’s forward thinking.

CitiFX G10 strategist Todd Elmer says: “The drop in AUD will have sticking power and the selling will continue in the London and New York session. Our flows data shows

that leveraged investors were initially buyers into recent AUD weakness, flipping to selling only over the past couple of weeks. With many investors caught behind the

curve, they may be forced to chase.”

AUDUSD recovered all of its RBA-inspired losses to the 0.7800 figure after briefly testing 0.7630 in early European trading.

The rest of the week brings retail sales and the RBA statement for AUD, though NFP will have the final say.

CitiFX Technicals

AUDUSD - Large Gap Ahead

The break through levels between 0.7990 and 0.8067 on a

weekly and monthly close basis confirmed the downtrend

Supports (not strong) are being tested today at 0.7675

Major supports below there are in the 0.7270-0.73 area

including the trend support from 2001 on the log scale chart.

CAD

Canadian PPI dropped further to -1.6% MoM in December versus the forecasted -0.6%.

Oil prices are back in focus once again as BP announced plans to cut capital expenditures by 13% to $20bn in 2015 – adding to the slew of cuts that we have seen from

the oil players.

Given that we have had close to no pullback all of Jan in USDCAD, positioning in the pair appears relatively stretched and we could well see a proper unwind of the trade

as leveraged and real money take chips off the table.

NZD: Kiwi Finds Its Wings On Unemployment Data & Better Milk Auction

The New Zealand unemployment rate unexpectedly rose from 5.4% to 5.7%, while 5.3% was expected. However, the underlying details are actually strong.

The unemployment rate change was driven by a rising participation rate - from 69.0% to 69.7%.

Net employment rose by +1.2%QoQ, while average hourly earnings beat consensus by one-tenth (at +0.4%QoQ).

NZDUSD tried to rally towards 0.7400 on first read of the data but is now coming off towards 0.7365.

The overall GDT price index rose by +9.4% (+1.0% previously), leaving average prices at 6m high.

Whole milk powder came in at +19.2% (+3.8% previously).

A speech from Governor Wheeler provides the next round of event risk.

What happened in the past 24 hours

Australia

New Zealand

Indicator

Actual

Citi

Trade Balance, Dec, Million

Unemployment Rate, Q4, %

-436

5.7

-850

5.2

Consensus

Prior

-850

5.3

-925

5.4

What’s happening in the next 24 hours

Canada

New Zealand

Indicator

Citi

Ivey PMI

Unemployment rate, %

-5.2

Consensus

53.7

5.3

Prior

55.4

5.4

Page 2

Daily Currency Update - 4 February 2015

DISCLAIMER

“Citi analysts” refers to investment professionals within Citi Research (“CR”), Citi Global Markets Inc. (“CGMI”) and voting members of the Citi Global

Investment Committee.

Citibank N.A. and its affiliates / subsidiaries provide no independent research or analysis in the substance or preparation of this document.

The information in this document has been obtained from reports issued by CGMI. Such information is based on sources CGMI believes to be reliable.

CGMI, however, does not guarantee its accuracy and it may be incomplete or condensed. All opinions and estimates constitute CGMI's judgment as of the

date of the report and are subject to change without notice. This document is for general information purposes only and is not intended as a

recommendation or an offer or solicitation for the purchase or sale of any security or currency. No part of this document may be reproduced in any

manner without the written consent of Citibank N.A. Information in this document has been prepared without taking account of the objectives, financial

situation, or needs of any particular investor. Any person considering an investment should consider the appropriateness of the investment having regard

to their objectives, financial situation, or needs, and should seek independent advice on the suitability or otherwise of a particular investment.

Investments are not deposits, are not obligations of, or guaranteed or insured by Citibank N.A., Citigroup Inc., or any of their affiliates or subsidiaries, or

by any local government or insurance agency, and are subject to investment risk, including the possible loss of the principal amount invested. Investors

investing in funds denominated in non-local currency should be aware of the risk of exchange rate fluctuations that may cause a loss of principal. Past

performance is not indicative of future performance, prices can go up or down. Some investment products (including mutual funds) are not available to

US persons and may not be available in all jurisdictions. Investors should be aware that it is his/her responsibility to seek legal and/or tax advice

regarding the legal and tax consequences of his/her investment transactions. If an investor changes residence, citizenship, nationality, or place of work,

it is his/her responsibility to understand how his/her investment transactions are affected by such change and comply with all applicable laws and

regulations as and when such becomes applicable. Citibank does not provide legal and/or tax advice and is not responsible for advising an investor on

the laws pertaining to his/her transaction.

COUNTRY SPECIFIC DISCLOSURES

Australia

:

Hong Kong

:

India

:

Indonesia

:

Korea

:

Malaysia

People's Republic of China

:

:

Philippines

:

Singapore

:

Thailand

:

United Kingdom

:

This document is distributed in Australia by Citigroup Pty Limited ABN 88 004 325 080, AFSL 238098. For a

full explanation of the risks of investing in any investment, please ensure that you fully read and understand the

relevant Product Disclosure Statement prior to investing.

This document is distributed in Hong Kong by Citibank (Hong Kong) Limited ("CHKL"). Prices and

availability of financial instruments can be subject to change without notice. Certain high-volatility investments

can be subject to sudden and large falls in value that could equal the amount invested.

This document is distributed in India by Citibank N.A. Investment are subject to market risk including that of

loss of principal amounts invested. Products so distributed are not obligations of, or guaranteed by, Citibank and

are not bank deposits. Past performance does not guarantee future performance. Investment products cannot be

offered to US and Canada Persons. Investors are advised to read and understand the Offer Documents carefully

before investing.

This report is made available in Indonesia through Citibank N.A., Indonesia Branch. Citibank N. A., Indonesia is a bank

that is licensed, registered and supervised by the Indonesia Financial Services Authority (OJK).

This document is distributed in South Korea by Citibank Korea Inc. Investors should be aware that

investment products are not guaranteed by the Korea Deposit Insurance Corporation and are subject to

investment risk including the possible loss of the principal amount invested. Investment products are not

available to US persons.

This document is distributed in Malaysia by Citibank Berhad.

This document is distributed by Citibank (China) Co., Ltd in the People's Republic of China (excluding the

Special Administrative Regions of Hong Kong and Macau, and Taiwan).

This document is made available in Philippines by Citicorp Financial Services and Insurance Brokerage Phils.

Inc, Citibank N.A. Philippines, and/or Citibank Savings Inc. Investors should be aware that Investment products

are not insured by the Philippine Deposit Insurance Corporation or Federal Deposit Insurance Corporation or

any other government entity.

This report is distributed in Singapore by Citibank Singapore Limited (“CSL”). Investment products are not

insured under the provisions of the Deposit Insurance and Policy Owners’ Protection Schemes Act 2011 of

Singapore and are not eligible for deposit insurance coverage under the Deposit Insurance Scheme.

This document contains general information and insights distributed in Thailand by Citigroup and is made

available in English language only. Citi does not dictate or solicit investment in any specific securities and similar

products. Investment contains certain risk, please study prospectus before investing. Not an obligation of, or

guaranteed by, Citibank. Not bank deposits. Subject to investment risks, including possible loss of the principal

amount invested. Subject to price fluctuation. Past performance does not guarantee future performance. Not

offered to US persons.

This document is distributed in U.K. by Citibank International plc., it is registered in England with number

1088249. Registered office: Citigroup Centre, Canada Square, London E14 5LB. Authorised and regulated by

the Financial Services Authority.

Page 3

© Copyright 2026