FX Daily Commentary - The Bank of East Asia

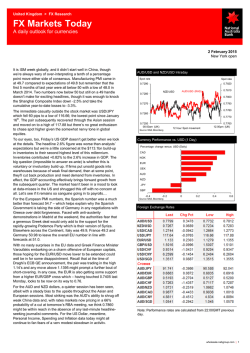

th 6 February, 2015 FX Daily Commentary Customer Services Hotline: (852) 2845 4580 Headlines • The DJIA rose 211.86 pts to 17,884.88 and the Nasdaq rose 48.39 pts to 4,765.10 ; • US 10 yrs and 30 yrs Treasury Bond yields closed at 1.81% and 2.42% respectively; • Bank of England kept interest rate unchanged at 0.5%; • Canada December Trade Deficit at 650 million CAD, better than forecast; • US December Trade Deficit at 46.56 billion USD, much worse than forecast of -38 billion ; • EUR rose against Swiss Franc strongly on Thursday, gaining more than 1% as traders speculated that the SNB was again buying EUR/CHF; • Gold fell almost 1% as uncertainty in Greece after the ECB said it would not accept Greece seeking for relief on debt from euro zone lenders ; Market Focus CA UNEMPLOYMENT (EXPECT 6.7%) US UNEMPLOYMENT (EXPECT 5.6%) / NON FARM PAYROLLS (EXPECT 234K) FX Chart EUR/USD DAILY Daily QEUR=EBS 9/10/2014 - 2/13/2015 (HKG) 161.8% 1.34797 Cndl, QEUR=EBS, Trade Price 2/5/2015, 1.13430, 1.14580, 1.13040, 1.14460 3MA, QEUR=EBS, Trade Price(Last), 10, 50, 100, Simple 2/5/2015, 1.13322, 1.19389, 1.22772 Price 1.32 1.29 1.26 100.0% 1.257 1.23 61.8% 1.20077 1.2 50.0% 1.1834 38.2% 1.16603 1.17 23.6% 1.14454 1.14 0.0% .12345 1.1098 MACD, QEUR=EBS, Trade Price(Last), 12, 26, 9, Exponential 2/5/2015, -0.01709, -0.01990 Value -0.02 .12345 RSI, QEUR=EBS, Trade Price(Last), 14, Exponential 2/5/2015, 50.444 Value StochS, QEUR=EBS, Trade Price, 5, 3, Simple, 3 2/5/2015, 58.701, 59.758 Value .123 .123 15 22 29 September 2014 06 13 20 October 2014 27 03 10 17 24 November 2014 01 08 15 22 December 2014 29 05 12 19 January 2015 26 02 09 Feb 15 Source provided by REUTERS Greece debts issues still dominated EUR on Thursday. USD softens as positioning before Friday’s important jobs data. EUR/USD had tested the 1.15 earlier this week but met solid selling on the top, still consolidating from multi years’ low hit in January. Daily’s Stochastic show divergence suggested the pair lack of upward momentum, but a disappoint US job data may give a hand. A break of weekly high 1.1534 may expose for the 38.2% retracement at 1.1660. For any enquiries, please contact FX-Margin Section at (852) 2211 1688 th Previous Daily Range (5 February, 2015) EUR/USD USD/JPY GBP/USD USD/CHF AUD/USD NZD/USD USD/CAD EUR/JPY EUR/GBP USD/CNH Last 1.1475 117.50 1.5328 0.9228 0.7806 0.7398 1.2435 134.83 0.7485 6.2440 High 1.1498 117.60 1.5344 0.9312 0.7825 0.7414 1.2585 135.13 0.7510 6.2655 Low 1.1304 117.02 1.5170 0.9210 0.7733 0.7341 1.2394 132.57 0.7450 6.2436 Technical Composite Page EUR/USD USD/JPY GBP/USD USD/CHF AUD/USD NZD/USD USD/CAD EUR/JPY EUR/GBP Resistance (3) 1.1540 118.50 1.5463 0.9361 0.7995 0.7474 1.2775 136.68 0.7574 Resistance (2) 1.1534 118.00 1.5426 0.9347 0.7942 0.7450 1.2645 135.81 0.7565 Resistance (1) 1.1499 117.67 1.5365 0.9310 0.7907 0.7428 1.2591 135.35 0.7526 Support (1) 1.1418 117.25 1.5283 0.9187 0.7781 0.7341 1.2389 133.91 0.7436 Support (2) 1.1391 117.02 1.5251 0.9168 0.7723 0.7275 1.2353 133.43 0.7406 Support (3) 1.1332 116.87 1.5215 0.9154 0.7720 0.7251 1.2314 132.73 0.7391 9-day RSI 49 45 64 51 32 42 56 47 38 10-day MA 1.1362 117.71 1.5158 0.9173 0.7822 0.7354 1.2520 133.76 0.7496 50-day MA 1.1920 118.78 1.5381 0.9564 0.8115 0.7664 1.1881 144.61 0.7752 Due to the fluctuation of interest rate market, we will make appropriate adjustment if necessary. Economic Calendar February Monday 2 Tuesday 3 US US ISM Mfg Index Construction spending 9 AU AU EU US 4 RBA Meeting Trade balance PPI Factory orders 10 JP Current a/c 16 JP 23 UK UK GER GER EU JP AU EU US US UK US US 19 Unemployment Building Permits PPI 25 GDP CPI UK AU CA US US NZ US For any enquiries, please contact FX-Margin Section at (852) 2211 1688 CA US US UK CA US US Trade balance Unemployment Unemployment Non-farm Payroll 13 Machinery Orders Unemployment Industrial production Retail Sales Jobless Claims EU EU HK holiday 20 PPI Jobless Claims 26 New home sales Friday 6 BOE Meeting Retail sales Trade balance Jobless Claims 12 18 CPI PPI ZEW index Thursday 5 Unemployment Retail sales ISM Non Mfg Index 11 24 IFO index Existing home sales NZ EU US Industrial production Wholesale Inventories 17 GDP GER US UK US Wednesday GER UK GDP Industrial production HK holiday PPI Retail sales 27 CPI CPI Jobless Claims JP UK US Retail sales GDP GDP Copyright and Disclaimer : This document has been issued by The Bank of East Asia, Limited (“BEA”) and is not directed at, or intended for distribution to or use by, any person or entity in any jurisdiction where doing so would be contrary to the laws or regulations or which would subject BEA to any additional registration or licensing requirement within such jurisdiction. Re-distribution or reproduction in whole or in part of this document by any means is strictly prohibited and BEA accepts no liability whatsoever for the actions of third parties in this respect. The information in this document has been obtained from sources we believe to be reliable but which it has not been independently verified. BEA makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy, completeness, or correctness. Expressions of opinions or estimates are those of BEA/the employee(s) of BEA who prepared this document only and are subject to change at any time without notice. This document has been prepared solely for information purposes and has no intention to solicit any action based upon it. Neither this document nor any information contained herein shall be construed as an offer, invitation, advertisement, inducement, representation of any kind or form whatsoever, or any advice or recommendation to buy or sell any financial products. The information contained in this document has not been reviewed in the light of the particular investment objectives, financial situation, or needs of individual recipients. Before entering into a transaction of this type, you should consider whether any investment products or services are suitable for your particular circumstances in view of your investment experience, objectives, financial resources, and other relevant circumstances. This document is not to be taken in substitution for the exercise of your own judgment and you should obtain independent professional advice where necessary. BEA does not accept any responsibility or liability whatsoever arising from or in connection with any person’s or entity’s use of or reliance on this document or any information and/or opinions contained herein or any further communication given in relation to this document. BEA, its related companies, and their directors and employees (collectively, the "Related Parties") may have positions in, and may effect transactions in, the products mentioned above. BEA may have alliances with the product providers to market their products, for which BEA may receive a fee. Product providers may also be BEA's related companies, who may receive fees from investors. BEA and the Related Parties may also perform or seek to perform broking, investment banking, and other financial services for the product providers. Investment involves risk. The value of an investment may move up or down, and may become valueless. Past performance figures shown are not indicative of future performance. Foreign investments carry additional risks not generally associated with securities in the domestic market, including but not limited to adverse changes in currency rate and foreign laws and regulations. This document does not identify all the risks (direct or indirect) or other considerations which might be material to you when entering into any transactions. For any enquiries, please contact FX-Margin Section at (852) 2211 1688

© Copyright 2026