Oportunidades de la industria del gas natural en AMÉRICA

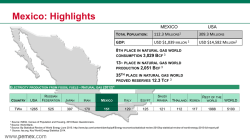

OPORTUNIDADES DE LA INDUSTRIA DEL GAS NATURAL EN AMÉRICA LATINA October 22, 2015 RENÉ RAMÍREZ ROMERO Market description • 49 Billion dollar market in 2015, world 3rd LPG , 6th gasoline, and 8th NG largest consumer markets, • Deficit in high value O&G products, net imports: gasoline (48%), diesel and jet fuel (29%), LPG (35%), NG (27%) and petrochemicals (>50%). • Expected growth in O&G products demand of about 3% per year for the next 5 years. • Strategically located in the North America Region, large northern border with the USA and a 200 km isthmus in the south that may capture the high price differential between the Pacific and the Atlantic oceans • Pemex has a competitive advantage in Production & Logistics through its existing infrastructure Producer Zone Diesel 10,833 Refinery Petrochemical Center Gas Processing Center Camargo Gasolines 23,137 2015 LPG 4,964 Sales Point Pipeline Reynosa Monterrey Burgos Maritime Route Cadereyta $48,637 MMUSD1 Natural gas 3,491 Madero Arenque Poza Rica Salamanca Guadalajara 1. The values for 2015 are annualized. Others, 614 Asphalts, 519 Petrochemicals 1,760 Kerosene Fuel oil 1,812 1,507 Tula Cd. México Matapionche Pajaritos Morelos La Venta San Martín Cd. Pemex Cosoleacaque Minatitlán N. Pemex Cangrejera Cactus Salina Cruz 1 Industry Transition …to a productive state enterprise • Asset manager. • Supply obligation. • Volumetric approach. • Business administrator. • Prices set by the Ministry of Finance. . • Economic supply with obligations. • Public debt. • Maximize company value. • Balance sheet and credit rating not linked. • Prices set by the market. • Free license to operate. • Link between balance sheet and credit rating. • Rigid regulatory framework. • Company debt. Efficiency • Operating license subject to performance. From state-owned monopoly… • Flexible regulatory framework. A cultural change is necessary to move from an oil monopoly to a productive enterprise. 2 Transforming PEMEX New Legal Framework New corporate governance New Tax Regime Autonomy budget Change Strategy New Procurement System PEMEX: A competitive business Change in Structure Autonomy managerial New compensation scheme New internal control regime Round zero Partnerships strategic A L I G N restructuring pension funds Cultural exchange 3 PEMEX Downstream • Natural gas • Natural gasoline • Benzene • Naphtha • Crude oil Gas Petrochemicals • Non associated gas • Associated gas • Condensates Processing Refining Project management Operating model Input • Sweetening • Cryogenics • Fractionating • Hydro desulfurization • Reforming • Aromatic fractionation • Reforming • Synthesis / reaction Products • Natural gas • LPG • Natural gasoline • Sulphur • Ethane • Styrene • Xylenes • Benzene • Toluene • HAO • Methanol • Petrochemicals • Gasoline • Jet fuel • Diesel • Fuel oil • Lubricants • Distillation • Reforming • Coking Our clients Residential • Asphalts • Coke • Sulphur • Propylene Industrial Power Infrastructure 6 Refineries 9 Gas Processing Centers 2 Petrochemicals Centers Transportation 4 Mexico Gas Natural: Highlights TOTAL POPULATION: 112,336,5381 GDP: USD $834,968 MILLON 2 8TH PLACE IN NATURAL GAS CONSUMPTION 3,029 BCF 3 WORLD 13TH PLACE IN NATURAL GAS PRODUCTION 2,051 BCF 3 WORLD 35TH PLACE IN NATURAL GAS WORLD PROVED RESERVES 12.3 TCF 3 ELECTRICITY PRODUCTION FROM FOSSIL FUELS - NATURAL GAS (2012)4 RUSSIAN COUNTRY USA FEDERATION JAPAN IRAN MEXICO ITALY EGYPT SAUDI ARABIA TWH 1265 525 397 170 151 129 125 121 1 REST OF THE THAILAND KOREA 112 117 WORLD WORLD 1988 5100 Source: INEGI. Census of Population and Housing, 2010 Basic Questionnaire. INEGI. 2nd semester 2014. http://www.inegi.org.mx/inegi/contenidos/espanol/prensa/comunicados/pibbol.pdf Exchage rate 02.10.2015: 16.81 Source Banxico. 3 Source: Bp Statistical Review of World Energy June 2015. http://www.bp.com/content/dam/bp/pdf/Energy-economics/statistical-review-2015/bp-statistical-review-of-world-energy-2015-full-report.pdf 4. Source: Iea.org, Key World Energy Statistics 2014. 2 Source: Natural gas consumption by sector Consumption Distribution By Sector (August 2015) TOTAL: 5,344 MMCFPD COMMERCIALS 352 SELF-GENERATION 141 7% 3% Pemex Exploración y Producción ELECTRICITY 1,410 26% 40% 7% 17% DISTRIBUTORS 388 INDUSTRIAL 894 SOURCE: BDI, SEPT 2015 PEMEX 2,159 1,262 Pemex Gas y Petroquímica Básica 390 Pemex Petroquímica 187 Pemex Corporativo 320 Estimate trends for mexican industrial demand of natural gas 3 000 2 500 MMcfpd 2 000 1 500 1 000 500 - 2013 Industrial 1 240 2014 1 366 2015 1 590 Source: SENER “Prospectiva de gas natural y gas LP 2014-2028” 2016 1 713 2017 1 804 2018 1 910 2019 1 973 2020 2 033 2021 2 100 2022 2 166 2023 2 234 2024 2 304 2025 2 383 2026 2 462 2027 2 546 2028 2 630 Natural gas forecast demand in Mexico 2014-2019 MMCFPD 11 300 9 300 7 300 5 300 3 300 1 300 -700 '14 '15 Domestic Supply AVERAGE ANNUAL GROWTH /2 It considers esports. Source: SENER “Prospectiva de gas natural y gas LP 2014-2028” -2.19% '16 '17 '18 Imports Demand 11% 4% '19 Connecting Mexico with better markets Tennesse zone 4-300 Leg USA Henry Hub NET Mexico Agua Dulce Los Ramones I EXPANSIONS ARE GIVING THE Los Ramones II North MEXICO THE MEXICAN PIPELINE POSSIBILITY TO Los Ramones II South ACCESS IN CHEAPER MARKETS IN THE EXISTING PIPELINES PROPOSED PIPELINES U.S. Related market prices HYDROCARBONS* CRUDE OIL (WTI, CUSHING OKLAHOMA NYMEX) HEATING OIL (DIESEL, NYMEX NEW YORK HARBOR) PROPANE (MONT BELVIEU, TX.) NATURAL GAS (HENRY HUB, NYMEX) FUEL OIL (HIGH SULFUR FUEL OIL, NYMEX) GASOLINE (NYMEX) ORIGINAL PRICES $46.14 USD/BARRIL $1.5 USD/GAL $43.8USD/GALÓN $2.5 USD/MMBTU $212 USD/GAL $1.27 USD/GAL EQUIVALENT PRICES $7.9 USD/MMBTU $11 USD/MMBTU $4.8 USD/MMBTU $2.5 USD/MMBTU $5.4 USD/MMBTU $10.1 USD/MMBTU USD/MMBtu 11 10.1 7,9 5.4 4.8 2.5 CRUDE OIL Crudo Information as of Oct 19, 2015 *Reference Prices HEATING Heating Oil OIL PROPANE Propano NATURAL Gas Natural GAS FUEL OIL Combustóleo Elaborated by Pemex Gas y Petroquímica Básica using Thomson Reuters prices . GASOLINE Gasolina PRICES OF NATURAL GAS Natural gas international prices PRICES AS OCTOBER 14TH 2015 (USD/MMBTU) $6.04/6.02 Dutch TTF $ 2.52/2.52 Nymex Henry Hub $2.57/2.58 $6.23/6.06 UK NBP $6.64/6.68 Italian PSV So Cal $6.65/6.60 $6.45/6.40 EUROPA Japón China ASIA $ 5.37/3.50 $6.06/6.04 Algonquin Germany EGT $2.45/2.46 Reynosa * Prices in green are from a previous week Source: Elaborated by Pemex Gas y Petroquímica Básica using Platts International Gas Reports. $6.65/6.60 $6.65/6.60 India Corea del Sur Net Gas Natural exports from US to Mexico (2014-2015) NET EXPORTS 2014-2015 (MMBTU/D) 1 2 2014 2015 1. WESTTEXAS 299,339 45,940 2. SOUTH TEXAS 979,800 1,227,949 1,279,139 1,273,889 TOTAL WEST TEXAS 2014 WEST TEXAS, AZ. CALIF. 2015 MMBTU/D SOUTH TEXAS TRANSPORTATION SOUTH TEXAS (MMBTU/D) 2014 2015 TENNESSEE 215,398 67,652 K.M. BORDER 216,192 173,816 SAMALAYUCA 89,718 0 CHIHUAHUA-CDJ 117,965 38,796 K.M. TEXAS 422,316 452,441 NACO 34,801 7,144 TENNESSEE RB 73,768 0 NORTE II 56,855 0 TETCO 41,818 2,712 0 0 NET 10,308 531,328 299,339 45,940 979,800 1,227,949 NORTH BAJA TOTAL: Source: BDI, Sept 2015 TOTAL: Net Gas Natural exports from US to Mexico (2014 - 2015) MMBTu/day 2015 2014 1 486 642 1 422 843 1 208 740 1 168 491 1 488 615 1 402 086 1 324 219 1 318 019 1 285 747 1 286 183 1 139 254 1 447 268 1 368 500 1 424 591 1 380 998 1 307 756 1 270 997 1 051 378 1 133 078 1 108 041 2014 2015 1 011 832 Ene Jan Feb Mar Abr Apr May Jun Jul Ago Aug Sep Oct Nov Dic Dec NET AVERAGE EXPORTS 2014 – 2015 (MMBTU/D) * Jan-Sep 2015 2014 2015* 1,279,139 1,273,889 Source: BDI 2015 September Natural gas infrastructure projects 2015-2019 Sásabe Pipelines 1.El Encino – La Laguna 2.Sur de Texas – Tuxpan (submarino) 3. Tula – Villa de Reyes 4. Tuxpan – Tula 5. Samalayuca – Sásabe 6. Colombia – Escobedo 7. Jáltipan – Salina Cruz 8. Los Ramones – Cempoala 9. Villa de Reyes - Aguascalientes – Guadalajara 10. La Laguna – Centro 11. Lázaro Cárdenas – Acapulco 12. Salina Cruz – Tapachula San Isidro 5 Samalayuca Puerto Libertad El Encino Colombia Guaymas 1 6 Camargo El Oro La Laguna Topolobampo Escobedo Los Ramones Durango Mazatlán LNG regasification terminals Pipelines in operation Concluded Pipelines (2013/2014/2015) Pipelines in construction (2015/2016) Zacatecas San Luis Potosí Aguascalientes Guadalajara 8 Altamira V. Reyes Tamazunchale 3 9 4 Naranjos Tuxpan Tula Apaseo el Alto Nativitas Cempoala Huexca Pipelines included at “Plan Quinquenal” Compression Station “El Cabrito” 2 10 Lázaro Cárdenas 11 Acapulco Ciudad Pemex Jáltipan Nuevo Pemex 7 Salina Cruz Source: SENER. Plan Quinquenal de Transporte y Almacenamiento Nacional Integrado de Gas Natural 2015-2019. 12 Tapachula Conclusions • PEMEX, as a Productive State Enterprise aims to maximize economic value and profitability for the Mexican state, by improving its productivity to maximize oil and gas revenues and contribute to national development. • PEMEX operation as the only producer of hydrocarbons in the country has changed by a new model of open competition. • PEMEX can take advantage of the opportunity to establish new legal framework with strategic partners to consider alliances or joint ventures to encourage the country's competitiveness to ensure industry and a national economy that transforms Mexico.

© Copyright 2026