Price Report - January 30, 2015

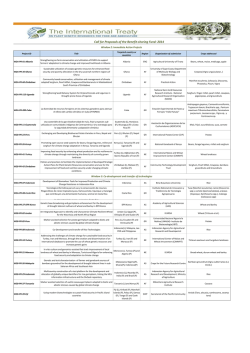

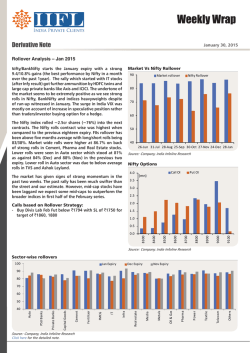

U.S. Wheat Associates Weekly Price Report January 30, 2015 Export Region Great Lakes Gulf of Mexico Pacific N. West JAN (H15) (nearbys) FOB $/bu Percent Protein 12% (Dry) Moisture Basis NS/DNS 13.0 (14.8) NS/DNS 13.5 (15.3) NS/DNS 14.0 (15.9) NS/DNS 13.0 (14.8) NS/DNS 13.5 (15.3) NS/DNS 14.0 (15.9) HRW Ord HRW 11.0 (12.5) HRW 11.5 (13.1) HRW 12.0 (13.6) HRW 12.5 (14.2) SRW NS/DNS 13.0 (14.8) NS/DNS 13.5 (15.3) NS/DNS 14.0 (15.9) HRW Ord HRW 11.5 ((13.1)) HRW 12.0 (13.6) HRW 13.0 (14.8) SW Unspecified SW 10.5 (11.9) Max SW 9.5 (10.8) Max WW with 10% Club WW with 20% Club M M M M M M K K K K K C M M M K K K K $ $ $ $ $ closed closed closed 7.57 7.87 8.17 6.60 6.65 6.70 6.75 6.80 6.38 7.02 7.12 7.32 6.55 6.60 6.65 6.90 6.50 7.25 7.75 7.45 7.70 JAN (H15) FEB (H15) MAR (H15) APR (K15) MAY (K15) JUN (N15) JUL (N15) $/bu $/MT $/MT ¢/bu $/MT ¢/bu $/MT ¢/bu $/MT ¢/bu $/MT ¢/bu $/MT ¢/bu $/MT ¢/bu Year Ago (nearbys) $/MT N/A N/A N/A -0.04 -0.04 -0.04 -0.24 -0.24 -0.24 -0.24 -0.24 -0.32 -0.64 -0.64 -0.54 -0.04 -0.04 -0.04 -0.04 -0.45 -0.70 -0.95 -0.45 -0.45 N/A N/A N/A -2 -2 -2 -9 -9 -9 -9 -9 -12 -24 -24 -20 -1 -1 -1 -1 -17 -26 -35 -17 -17 closed closed closed 278 289 300 243 244 246 248 250 234 258 262 269 241 243 244 254 239 266 285 274 283 N/A N/A N/A 200 230 260 120 125 130 135 140 135 145 155 175 115 120 125 150 6.50 7.25 7.75 7.45 7.70 closed closed closed 278 289 300 243 244 246 248 250 232 258 262 269 241 243 244 254 239 266 285 274 283 N/A N/A N/A 200 230 260 120 125 130 135 140 130 145 155 175 115 120 125 150 6.50 7.25 7.75 7.45 7.70 closed closed closed 278 289 300 243 244 246 248 250 231 258 262 269 241 243 244 254 246 274 292 281 290 N/A N/A N/A 200 230 260 120 125 130 135 140 125 145 155 175 115 120 125 150 6.70 7.45 7.95 7.65 7.90 239 252 265 280 291 302 244 245 247 249 251 230 259 263 271 242 244 245 255 250 277 296 285 294 90 125 160 200 230 260 120 125 130 135 140 120 145 155 175 115 120 125 150 6.80 7.55 8.05 7.75 8.00 239 252 265 280 291 302 244 245 247 249 251 230 259 263 271 242 244 245 255 250 277 296 285 294 90 125 160 200 230 260 120 125 130 135 140 120 145 155 175 115 120 125 150 6.80 7.55 8.05 7.75 8.00 242 255 268 283 294 305 245 247 248 250 252 227 262 266 273 243 245 247 256 250 277 296 285 294 90 125 160 200 230 260 120 125 130 135 140 105 145 155 175 115 120 125 150 6.80 7.55 8.05 7.75 8.00 242 255 268 283 294 305 245 247 248 250 252 227 262 266 273 243 245 247 256 250 277 296 285 294 90 125 160 200 230 260 120 125 130 135 140 105 145 155 175 115 120 125 150 6.80 7.55 8.05 7.75 8.00 N/A N/A N/A 327 352 363 279 281 283 285 290 256 314 321 332 305 307 309 325 281 285 292 287 301 week change FOB Basis FOB Basis FOB Basis FOB Basis FOB Basis FOB Basis FOB Basis Durum: a range of prices are available depending upon various quality attributes. Futures Settlements as of January 30, 2015 Chicago BOT SRW Kansas City BOT HRW Minneapolis MGE NS/DNS Chicago BOT Corn Chicago BOT Soybeans Legend: Cash: Convert: Grey positions not quoted on specific exchange MAR (H15) $/MT 186.20 199.42 206.22 149.03 353.10 MAR (H15) $/bu 5.0275 5.4025 5.5675 3.7000 9.6100 week change MAY (K15) $/bu $/bu (0.2725) 5.0675 (0.2375) 5.4275 (0.1925) 5.6125 (0.1675) 3.7850 (0.1175) 9.6775 week change JUL (N15) $/bu $/bu (0.2600) 5.1150 (0.2625) 5.4625 (0.2125) 5.6900 (0.1675) 3.8600 (0.1175) 9.7275 week change JUL (N15) $/bu $/bu (0.2500) 5.1150 (0.2600) 5.4625 (0.2175) 5.6900 (0.1675) 3.8600 (0.1250) 9.7275 week change SEP (U15) $/bu $/bu (0.2500) 5.1975 (0.2600) 5.5775 (0.2175) 5.7700 (0.1675) 3.9300 (0.1250) 9.5675 week week change NOV (X15) change DEC (Z15) $/bu $/bu $/bu $/bu (0.2450) 5.3225 (0.2600) 5.7225 (0.2150) 5.8775 (0.1625) 4.0075 (0.1425) 9.4575 (0.1400) M = Minneapolis Grain Exchange; K = Kansas City Board of Trade; C = Chicago Board of Trade; $ = cash price quote; N/A = quote not available; closed = Great Lakes are closed to vessels for winter; ¢/bu = cents per bushel; Futures Contract Month: H = March; K = May; N = July; U = September; Z = December NS/DNS=Northern Spring/Dark Northern Spring (subclasses of Hard Red Spring); HRW=Hard Red Winter; SRW=Soft Red Winter; SW=Soft White; WW=Western White (White Club & Soft White) F.O.B.= "Free on board" - Seller is responsible for placing grain at the end of the loading spout. Buyer is responsible for providing the ocean vessel and for all other costs after the grain is delivered on board. Basis: The difference between the cash price and futures month for specific quality, shipping period and geographical location. Durum, SW and WW are quoted in dollars per bushel ($/bu.) rather than basis for each contract month. To compute cash price, add basis level and current futures to get price per bushel. Multiply by 36.743 to get price per metric ton. Example: Basis = 70 and Future Price = $9.00, the price per bushel is $9.00 + .70 = $9.70/bu. Price per metric ton is $9.70 * 36.743 = $356/MT. All prices are based upon U.S. number two grade or better as certified by the Federal Grain Inspection Service (FGIS). week change JAN (F16) $/bu $/bu (0.2350) (0.2575) (0.2025) (0.1650) 9.5150 week change $/bu (0.1400) U.S. Wheat Associates Weekly Price Report (page 2) U.S. dollars/metric ton Handymax 40-46 TMT 15 40 Panamax 54+ TMT 31 38 35 50 40 39 30 31 70 65 60 65 39 42 25 32 52 36 30 29 30 35 28 28 28 Freight Index** Week Ending 1/23/2015 1/16/2015 1/9/2015 1/2/2015 12/26/2014 12/19/2014 12/12/2014 12/5/2014 11/28/2014 11/21/2014 11/14/2014 11/7/2014 10/31/2014 10/24/2014 10/16/2014 10/10/2014 10/3/2014 9/26/2014 9/19/2014 9/12/2014 9/5/2014 8/29/2014 8/22/2014 8/15/2014 8/8/2014 8/1/2014 7/25/2014 7/18/2014 7/11/2014 41705 Note: Rates for freight leaving the Great Lakes are quoted for 18,000 MT "Salties." General Index 358.2 363.0 372.8 382.1 381 9 381.9 384.3 409.3 416.8 422.6 415.5 431.0 436.1 433.4 422.5 415.5 422.7 425.3 425.5 428.8 425 3 425.3 433.0 430.6 427.6 420.1 418.9 415.9 415.2 418.0 426.0 451.1 Grain Freight Index 441.9 445.8 458.4 468.4 468 4 468.4 471.2 501.4 505.9 509.2 493.6 512.6 516.1 514.8 511.0 502.9 511.7 514.7 511.5 514.8 508 5 508.5 517.9 517.1 513.3 507.9 506.8 505.3 505.1 508.1 511.4 Number of Fixtures 552 571 507 204 250 453 555 476 453 634 484 534 613 585 608 523 517 469 530 480 474 424 487 499 503 470 556 543 543 540.4 Ocean Freight Rate Indices 600 550 500 450 400 350 300 Jan-14 Canada 1.255 1.236 1.195 1.182 1.115 1.067 12.58% 17.68% Egypt 7.556 7.397 7.173 7.174 6.980 5.505 8.25% 37.27% EU 0.885 0.866 0.854 0.847 0.732 0.718 20.90% 23.36% Japan 117.925 117.975 117.189 119.637 102.826 90.172 14.68% 30.78% Russia Sep-14 Nov-14 General 50 40 30 20 10 0 Jan-14 Mar-14 May-14 Jul-14 Sep-14 Gulf origin Nov-14 Jan-15 PNW origin Selected Exchange Rates 480 68.964 65.004 65.069 61.834 34.907 30.370 97.56% 127.08% Jul-14 Egyptian Freight Estimates 60 euro/US dollar xx Brazil 2.592 6.591 2.641 2.684 2.434 1.873 6.49% 38.39% May-14 Grain Sources: *Trade representatives and recent shipments, **Maritime Research, Inc., ***Nominal Major Currencies, Federal Reserve Board Summary of Foreign Currency Exchange Rates (versus $1 U.S. dollar) Week Ending Index*** Argentina Australia 1/30/15 N/A 8.636 1.277 1/23/15 113.37 8.619 1.236 1/16/15 112.27 8.600 1.219 1/9/15 112.08 8.583 1.234 1/30/14 103.49 8.018 1.140 1/30/10 102.79 3.825 1.122 1 year change 9.88 7.70% 12.10% 5 year change 10.58 125.75% 13.88% Mar-14 0.85 1.30 0.80 1.25 1.20 0.75 1.15 0.70 1.10 0 65 0.65 1.05 0.60 1.00 0.55 0.95 0.50 Jan-14 Mar-14 May-14 euro 0.90 Jul-14 Sep-14 Nov-14 Canadian dollar The weekly prices as reported by U.S. Wheat Associates are compiled through research from numerous market sources, including U.S. wheat exporters of all classes from various U.S. ports. The prices reported are representative of the value of number two grade and the proteins indicated. They are not intended to represent offers nor should importers of U.S. wheat rely upon them as such. Additional factors may alter these prices significantly. These factors may include: (1) payment terms (differing from cash against documents which are the terms used in the U.S. Wheat Associates price report); (2) various quality factors, and method of quality certification; (3) loading terms (USW prices represent Free on Board and do not include loading rate guarantees, stevedoring costs or other elevator tariff charges); (4) different delivery periods than indicated in monthly prices reported by U. S. Wheat Associates. U.S. Wheat Associates recommends regular contact with exporters of U.S. wheat in order to receive offers representative of your requirements. These contracts would allow importers to review contract terms and better understand the U.S. grading system, role and function of the Federal Grain Inspection Service (FGIS). Contact: For questions, please contact Casey Chumrau at (703) 650-0241 or [email protected]. dian/US dollar Canad Handy 25-30 TMT 16 37 40 16 30 49 34 33 $/m metric ton January 30, 2015 Ocean Freight Rate Estimates by Origin* Export Import Region Region US Gulf Mexico (Veracruz) W. South America (Peru/Ecu) S. South America (Chile) N. South America (Colombia) E South America (Brazil) E. West Africa (Nigeria) East Mediterranean (Italy) West Mediterranean (Morocco) Middle East (Egypt) Japan Mid Atlantic N. South America (Venezuela) West Africa (Nigeria) Middle East (Egypt) St. Lawrence N. South America (Venezuela) Europe/Rotterdam Middle East (Egypt) Great Lakes East Mediterranean (Italy) West Mediterranean (Spain) Rotterdam West Africa (Morocco/Algeria) PNW W. South America (Peru/Ecu) S. South America (Chile) N. South America (Colombia) Middle East (Egypt) East Africa (Djibouti/Mombasa) South Asia (Mal/Indon/Phil/Sing) Taiwan South Korea Japan Nearby Futures Contract Prices HRW Basis at PNW and Gulf Ports (ordinary protein) 10 240 220 9 200 cents/bushel XXl $/bushel 8 7 180 160 140 120 100 6 80 60 5 40 20 0 Jan-14 4 Jan-14 Mar-14 May-14 KBOT Jul-14 Sep-14 MGE Nov-14 Jan-15 Mar-14 May-14 Jul-14 Sep-14 PNW CBOT Nov-14 Jan-15 Gulf HRW Protein Premiums - PNW HRS Basis at Various Ports 260 500 240 220 400 200 350 180 cents/bushe el XX cents/bushel XX X 450 300 250 200 160 140 120 100 80 150 60 100 40 50 0 Jan-14 20 Mar-14 May-14 PNW HRS 14 Nov-14 0 Jan-14 Jan-15 Mar-14 May-14 Jul-14 ords G.L. HRS 14 Sep-14 Nov-14 Jan-15 Nov-14 Jan-15 12% protein HRW Cash Prices at the Gulf 370 12 350 10 330 8 310 $/bushel $/metric ton Weekly Price Report (page 3) Sep-14 SW and SRW Nearby Cash Prices January 30, 2015 U.S. Wh heat Associate es Gulf HRS 14 Jul-14 290 270 6 4 250 50 2 230 210 Dec-13 0 Feb-14 Apr-14 PNW SW Jun-14 Aug-14 Oct-14 Dec-14 Gulf SRW Custom graphs of historic nearby cash prices may be accessed at: http://www.uswheat.org/priceReports/nearbyCash http://www uswheat org/priceReports/nearbyCash Jan-14 Mar-14 May-14 Jul-14 KCBOT Futures Sep-14 Gulf HRW basis Basis and cash prices for different delivery months are also available at: http://www.uswheat.org/priceReports/deliverymonth http://www uswheat org/priceReports/deliverymonth U.S. Wheat Associates Weekly Price Report Highlights: January 30, 2015 Daily Settlement Prices (MAR15) * Wheat futures were pushed down early this week to a three month low due to continued news about plentiful global supplies, beneficial rains across the US Plains and Midwestern wheat belts, and continued strenghtening of the US Dollar versus competitors currencies. However, the market did find strength in the latter half of the week with stronger than expected exports and technical buying rallying the market from Wednesday lows. Overall the market closed down. Chicago dropped 27 cents to $5.03 per bushel, Kansas City dropped 24 cents to 5.40 per bushel, and Minneapolis dropped 19 cents to $5.57 per bushel. Chicago corn futures dropped 17 cents to $3.87 on large global supplies and weak exports. Soybeans followed suit, dropping 12 cents to $9.73, the market weakening as China shifts to cheaper South American supplies. 6.4 $/bu 6 5.6 5.2 * Current HRS price indications are for Northern Spring only. Premiums for Dark Northern Spring will 4.8 1/26/15 1/27/15 CBOT 1/28/15 KCBT 1/29/15 1/30/15 MGEX * vary. SRW indications are for a minimum falling number of 250. Higher minimum specifications will carry a premium. The HRS market continues to be plagued by low DHV levels. Trade sources indicate that a minimum DHV level of 65% can carry a premium of around $1.25 per bushel over normal NS/DNS prices. * Officials in both India and Pakistan announced plans to export wheat I order to clear government storage capacity before the upcoming harvests. Both countries hope to capitalize on the recent export curbs in both Russia and Ukraine. Wheat Futures Forward Curve 6.00 * Ocean freight rates continue to plunge downward on weak demand for ocean freight, especially out of China, and an oversupply of ships on the market. The Baltic Dry Index hit its lowest level since 1986 this week. 5.60 $/bu * According to the USDA's Export Sales Report, weekly sales of 544.4 TMT for delivery in the 2014/2015 marketing year were above trade expectations of 250 to 450 TMT. Total known outstanding sales and accumulated exports of all classes of wheat, through January 22, 2015 were 19.9 MMT, 24% lower than last year's year‐to‐date total of 26.1 MMT. HRW export sales were down 37%, SRW export sales down 53%, HRS export sales up 22%, SW export sales down 4%, and durum export sales up 21%. 5.20 * The Baltic Panamax Index closed this week at 508, down sharply from last week at 685. 4.80 DEC 14 MAR 15 CBOT KCBT MAY 15 MGEX JUL 15 * The US Dollar Index closed this week at 94.84, down slightly from last week at 94.99.

© Copyright 2026