Saudi Chartbook Summary - Saudi German Business Dialogue

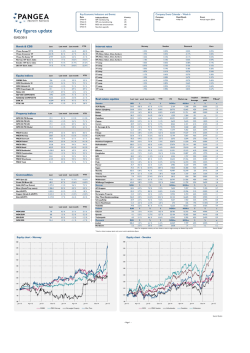

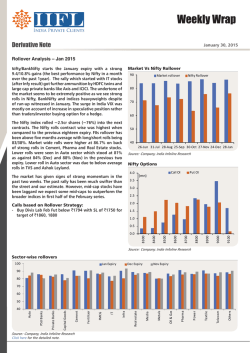

February 2015 Saudi Chartbook Summary Real Economy: December data showed healthy growth in consumer spending. Consumption growth in 2015 is likely to be strong following the recent Royal decrees. Income Distribution In 2014, real income per capita grew by 1 percent year-on-year. Income inequality declined between 2007 and 2013 as measured by the GINI index. Saudi Labor Market: The overall Saudi unemployment rate was unchanged at 11.7 in 2014. Annual growth in Saudi employment stood at 4.4 percent, mostly associated with employment growth by private rather than public entities. Bank lending: Bank lending to the private sector recorded its second consecutive monthly decline in December. Inflation: Data for December shows that CPI slowed for the fourth consecutive month. Trade: Both non-oil exports and imports rebounded in November following a fall in the previous month. Oil –Global: Oil prices dropped in January, month-on-month, as global oil balances remained in surplus. Oil –Regional: Saudi production remained unchanged, month-onmonth, in December. The policy of cutting prices to maintain/expand market share resulted in Saudi exports increasing in November. Exchange rates: In January, further quantitative easing (QE) by the European Central Bank (ECB) contributed to the euro approaching an 11 year low against US dollar. For comments and queries please contact: Fahad M. Alturki Chief Economist and Head of Research [email protected] Stock market: The TASI rose nearly 7 percent in January, month-onmonth. The recent Royal decrees, which reinforced the view that the government will not cut expenditure due to lower oil prices, will add renewed confidence to investors going forward. Asad Khan Senior Economist [email protected] Volumes: Average daily turnover declined 8 percent in January, month-on-month. Rakan Alsheikh Research Analyst [email protected] Valuations: TASI’s price-to-earnings (PE) trended upwards moving just beyond the two year average in January. Head office: Phone +966 11 279-1111 Fax +966 11 279-1571 P.O. Box 60677, Riyadh 11555 Kingdom of Saudi Arabia www.jadwa.com 1 Sectoral performance: A general uplift in investor sentiment saw all sectors, except for telecoms, performing positively in January. Full year 2014 results: Net income of listed companies totaled SR114.7 billion in 2014, up by 9 percent, year-on-year. February 2015 Real Economy December data showed healthy growth in both cash withdrawals from ATMs and point of sale transaction. Consumption growth in 2015 is likely to be strong following the recent Royal decrees. Cement sales reached an all time high in December, while sales for 2014 grew by 0.8 percent year-on-year. Indicators of consumer spending (year-on-year change) 65 55 45 (Percent) Cash withdrawals from ATMs reached SR 64.6 billion in December, growing by 14.7 year-onyear, while point of sale transactions stood at SR 15.7 billion. 35 25 15 5 -5 -15 Dec-10 Dec-11 Dec-12 Cash withdrawals from ATMs Dec-13 Dec-14 Point of sale transactions HSBC/Markit Purchasing Managers Index (PMI) PMI increased to 57.9 in December following a slowdown in the previous two months, pointing to a sustained growth and a continued expansion in the non-oil economy. 65 60 55 Increasing rate of growth 50 Increasing rate of contraction 45 Dec-09 Oct-10 Aug-11 Jun-12 Apr-13 Feb-14 Dec-14 Cement Sales 5.5 5.0 (mn tons) During December, cement sales reached an all time high of 5.5 million tons. Year-on-year growth of total cement sold stood at 0.8 percent in 2014. 4.5 4.0 3.5 3.0 2.5 2.0 2010 2011 2012 2013 2014 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec 2 February 2015 Income Distribution In 2014, real income per capita grew by 1 percent. For the first time, the Central Department of Statistics & Information (CDSI) published the GINI index for income inequality, showing a decline in inequality between 2007 and 2013. The kingdom is the first GCC country to publish its GINI index. Real income per capita (year-on-year change) Real income per capita 10 Real non-oil income per capita 8 6 (percent) After remaining flat in 2013, real income per capita grew by 1 percent, year-on-year to reach $21,101 in 2014. In contrast, real non-oil income per capita growth slowed to 2.4 percent in 2014, compared to a growth of 3.6 percent in the previous year. 4 2 0 -2 -4 2004 2006 2008 2010 2012 2014 Income inequality in Saudi Arabia (GINI index: 0 = Perfect Equality to 100 = Perfect Inequality) For the first time, CDSI published the GINI index for Saudi Arabia, showing a score of 46 in 2013, improving from 51 in 2007… 60 51.3 50 45.9 40 30 20 10 0 2007 2013 2012 2012 2011 2010 UK 2010 2011 China 2011 2010 Spain USA 2008 Italy 2009 2003 Australia Turkey 2012 Russia 2012 2008 Japan India 2005 France Canada 2011 S. Korea 40 2010 50 2011 60 2013 70 Germany ...placing the Kingdom at the far-end of inequality compared to most other G20 economies, but in line with other emerging markets. 2011 Income inequality in G-20 countries (Latest, GINI index: 0 = Perfect Equality to 100 = Perfect Inequality) 30 20 10 3 Note: Year refers to latest officially published GINI for each country South Africa Brazil Mexico Argentina Saudi Arabia Indonesia G20 Average 0 February 2015 Saudi Labor Market CDSI released its labor force survey for 2014, showing that overall unemployment rate was unchanged at 11.7 percent. However, the data showed that more females entered the labor force across all age groups. Annual growth in employment of Saudis stood at 4.4 percent, with most of the growth stemming from the private sector. Saudi unemployment rate Male 40 Female 35.7 33.4 35 Total 33.2 32.8 30 (percent) The overall Saudi unemployment rate was unchanged at 11.7 percent in 2014, with slight declines to both male and female unemployment... 25 20 12.4 15 10 7.4 12.1 6.1 11.7 6.1 11.7 5.9 5 0 2011 2012 2013 2014 Change in Saudi participation rates by age group (year-on-year) 5 4 (percentage point) … while more working-age Saudi females entered the labor force across all age groups (as shown by their improved participation rates). Male Female Total 3 2 1 0 -1 -2 Note: Participation rates are defined as the share of working age population in the labor force. Growth in employment and Saudization rates by sector 50 30 Non-Saudi Saudi Saudization Ratio 2013 (RHS) Saudization Ratio 2014 (RHS) 80 10 60 -10 40 -30 -50 -70 4 100 Note: * refers to public administration, defense, and compulsory social security 20 0 (percent) In 2014, Saudi employment growth stood at 4.4 percent, year-on-year, which was mostly associated with private rather than public entities. This has also resulted in an improvement to their Saudization rates. (percent, year-on-year) 70 February 2015 Bank lending Bank lending to the private sector recorded its second consecutive monthly decline in December, but sustained double digit annual growth. Credit to commerce and manufacturing was the highest during 2014. The loan-to-deposit ratio fell further to 79.4, dragged down by lower lending activity while growth in deposits was sustained. Credit to the private sector 3.0 15 2.0 1.5 13 1.0 0.5 11 0.0 9 (Percent) (percent) Month-on-month bank lending to the private sector fell for the second consecutive month, but sustained positive, double digit annual growth. 17 2.5 -0.5 7 -1.0 -1.5 5 -2.0 -2.5 Dec-10 Dec-11 Month-on-month change Dec-12 3 Dec-13 Dec-14 Year-on-year change - RHS Bank credit by economic sector (New credit issued during 2014) 24 2014 2013 20 16 (SR billion) Within the private sector, commerce and manufacturing have been the main recipients of new lending during 2014. 12 8 4 0 Services Agriculture & fishing Mining Finance Electricity & water Construction Transport & Communication Manufacturing Commerce -4 Loan to deposit ratio 85 83 81 (percent) The continued monthly fall in lending coupled with sustained growth in deposits has caused the loan-to-deposit ratio to further decline to 79.4. 79 77 75 73 Dec-09 5 Dec-10 Dec-11 Dec-12 Dec-13 Dec-14 February 2015 Inflation Data for December shows that CPI slowed for the fourth consecutive month. Both foodstuffs and housing components continued to slow, year-on-year, for the third consecutive month to reach 2.6 percent, and 2.5 percent respectively. Foodstuffs slowed as international food prices continued to decline at a faster rate. Inflation Other goods & services contribution (ppt) Housing and utilities contribution in (ppt) Food & beverages contribution (ppt) General Index, % y/y Core Index (excl. food and housing/rent, % y/y) 5 Data for December shows that CPI slowed for the fourth consecutive month to 2.4 percent, year-on-year. 4 3 2 1 0 Dec-12 Jun-13 Dec-13 Jun-14 Dec-14 Food, housing, and headline inflation (year-on-year change) Headline inflation Housing and utilities Food & beverages 7 6 5 (percent) Both foodstuffs and housing components continued to slow, year-on-year, for the third consecutive month to reach 2.6 percent, and 2.5 percent respectively. 4 3 2 1 Dec-12 Jun-13 Dec-13 Jun-14 Dec-14 Food price inflation (year-on-year change) Saudi food CPI inflation Global food price inflation (FAO index) Global food price inflation (IMF index) 12 8 (percent) Foodstuffs slowed as international food prices continued to decline at a faster rate. 4 0 -4 -8 -12 Dec-12 6 Apr-13 Aug-13 Dec-13 Apr-14 Aug-14 Dec-14 February 2015 Trade Latest data shows that non-oil exports rebounded in November following a fall in the previous month. Imports grew by 4.6 percent year-on-year in November. Import activity is likely to be strong in 2015 following the recent Royal decrees. New LOCs also suggest a continued increase in import activity in upcoming months. Non-oil exports 30 5 20 10 3 0 2 -10 1 0 May-12 (percent) 6 4 ($ billion) Non-oil exports rebounded in November following a fall in the previous month, increasing by 9.5 percent, month-on-month, but stayed unchanged in yearon-year terms at -0.3 percent... -20 Oct-12 Mar-13 Aug-13 Non-oil exports Jan-14 Jun-14 Nov-14 % change, y/y (RHS) Imports 16 30 14 20 ($ billion) 12 10 10 8 0 6 4 -10 2 0 May-12 (percent) ...while imports grew by 11.2 percent, month-onmonth and 4.6 percent year -on-year. -20 Oct-12 Mar-13 Imports Aug-13 Jan-14 Jun-14 Nov-14 % change, y/y (RHS) 17 6.0 16 5.5 15 5.0 14 4.5 13 4.0 12 3.5 11 3.0 Jun-12 Dec-12 Jun-13 Dec-13 Jun-14 Dec-14 Imports Letters of credit opened for private sector imports, RHS 7 ($ billion) New LOCs opened suggest a continued increase in import activity in upcoming months. ($ billion) Letters of credit opened by the private sector and imports February 2015 Oil - Global Oil prices dropped in January, month-on-month, as global oil balances remained in surplus. As future oil prices moved into contago, stocks of both crude and gasoline rose for the second consecutive month. Meanwhile, lower oil prices resulted in US land rigs being down for the third consecutive month in January. Oil Prices 120 Oil prices dropped again in January due to no slow down in supply and demand remaining subdued. ($ per barrel) 100 80 60 40 Jan-13 Brent WTI Jul-13 OPEC basket Jan-14 Jul-14 Jan-15 Change in US Commercial Crude and Gasoline Stock (average month-on-month change) 6 Crude Oil Gasoline The combination of ample supply and the oil price forward curve moving into contango resulted in steep increases in commercial stocks. (million barrels) 4 2 0 -2 -4 -6 -8 Jan-13 Jul-13 Jan-14 Jul-14 Jan-15 U.S Land Oil Rig Count (total at month end) 1,900 1,850 US land oil rigs dropped by 202, month-on-month, in January, the largest monthly drop in six years. (Land rigs) 1,800 1,750 1,700 1,650 1,600 1,550 1,500 Jan-13 8 Jul-13 Jan-14 Jul-14 Jan-15 February 2015 Oil - Regional Saudi production remained unchanged, month-on-month, in December. OPEC production held above 30 mbpd regardless of a sharp drop in Libyan supply, as this fall was compensated by a rise in Iraqi production. The policy of cutting prices to maintain/expand market share resulted in Saudi exports increasing in November. Saudi crude production Saudi production averaged 9.6 mbpd in December. (million barrels per day) 10.4 10.2 10.0 9.8 9.6 9.4 9.2 9.0 8.8 Dec-12 Dec-13 Dec-14 4.0 3.8 3.6 3.4 3.2 3.0 2.8 2.6 2.4 2.2 2.0 Dec-12 Jun-13 Iran 1.8 1.6 1.4 1.2 1.0 0.8 0.6 0.4 0.2 0.0 Jun-14 Dec-14 Libya (RHS) Dec-13 Iraq (million barrels per day) A decline in Libyan production was more than compensated by rises in Iraqi production in December. (million barrels per day) Iraq, Iran and Libya production Saudi crude exports by country Latest data shows that Saudi exports in November increased, month-onmonth, to back above 7 mbpd, which was last achieved in April 2014. (million barrels per day) (monthly average) 9 Singapore 7 6 Taiwan 5 India 4 S.Korea 3 Japan 2 China 1 0 Nov-12 9 Other 8 US May-13 Nov-13 May-14 Nov-14 February 2015 Exchange Rates In January, a combination of the further quantitative easing (QE) by the European Central Bank (ECB) and question marks over Greece’s membership to the European Union led to the euro approaching an 11 year low against US dollar. Speculative activity resulted in the one year forward US dollar/riyal rate rising sharply. Euro/US Dollar 1.40 1.35 The euro lost value as the ECB announced a record QE program, whilst elections in Greece brought in an anti-austerity government… 1.30 1.25 1.20 1.15 1.10 Jan-13 May-13 Sep-13 Jan-14 May-14 Sep-14 Jan-15 US Dollar/Swiss France 1.30 1.20 ...further pressure was piled on the euro as the Swiss National Bank (SNB) decided to end the policy of keeping a minimum exchange rate for the Swiss franc against the euro. 1.10 1.00 0.90 0.80 0.70 Jan-13 May-13 Sep-13 Jan-14 May-14 Sep-14 Jan-15 US Dollar/Riyal One Year Forward Rate 3.770 3.765 A generally lower oil price environment resulted in speculation against the Saudi riyal rising sharply. 3.760 3.755 3.750 3.745 3.740 Jan-13 10 Jul-13 Jan-14 Jul-14 Jan-15 February 2015 Stock Market The TASI rose nearly 7 percent in January, month-on-month. The recent Royal decrees, which reinforced the view that the government will not cut expenditure due to lower oil prices, will add renewed confidence to investors going forward. Retail sectors in particular will see better performance in the next few months. TASI The TASI rose by nearly 7 percent, month-on-month, in January… 11,200 10,600 10,000 9,400 8,800 8,200 7,600 7,000 6,400 5,800 5,200 4,600 4,000 Jan-09 Jan-10 Jan-11 Jan-12 Jan-13 Jan-14 Jan-15 Sep-14 Jan-15 TASI monthly performance (January 2015) (percent) ...after four consecutive months of falls… 9 7 5 3 1 -1 -3 -5 -7 -9 -11 -13 -15 Jan-13 May-13 Sep-13 Jan-14 May-14 Comparative stock market performance (monthly performance, January 2015) 25 (percent) 20 11 10 5 0 -5 Dubai Egypt Brazil Abu Dhabi MSCI EM Turkey Kuwait Oman Qatar Germany UK Bahrain US Japan TASI -10 China ...resulting in the TASI outperforming most comparative benchmarks, aside from China. 15 February 2015 Volumes Average daily turnover declined 8 percent in January, month-onmonth. Banks and insurance sectors dominated daily turnover but turnover was more prominent amongst the smaller sectors, when considering market capitalization, largely due to speculative activity. Daily average stock market turnover 16 Average daily turnover declined 8 percent in January, month-on-month. (SR billion) 14 12 10 8 6 4 2 0 Jan-13 Jul-13 Jan-14 Jul-14 Jan-15 Turnover by sector (daily average) Banks, insurance and petchems., again, dominated turnover… (SR billion) 1.5 1.0 0.5 Hotels Energy Transport Media Turnover as percent of market cap (January, 2015) 80 60 20 Bldg. & cons. Insurance Ind. invest Energy Multi. invest Retail Cement Real estate Agri. & food Telecoms Petchems 0 Banks ...but speculation amongst smaller stocks was apparent when considering the higher turnover to market capitalization. (percent) 40 Turnover to market cap by sector Market cap by sector as percent of total 12 Media Cement Hotels Transport Multi. invest Retail Agri. & food Telecoms Bldg. & cons. Real estate Ind. invest Petchems Insurance Banks 0.0 February 2015 Valuations The TASI’s price-to-earnings (PE) picked up in January, month-onmonth. PE trended upwards moving just beyond the two year average with TASI’s PE in line with comparative stock markets. TASI’s dividend yields remain moderate when compared globally, but on the lower end when compared regionally. TASI Price-to-Earnings ratio Price/Earnings Two year average 22 PE rose in January, monthon-month, to just above the two year average… 18 14 10 Jan-13 May-13 Sep-13 Jan-14 May-14 Sep-14 Comparative Price-to-Earnings ratios (end of month) 25 20 ...which is in line with major regional and global indices. 15 10 5 0 TASI Dividend Yield ratios (end of month) 6.0 5.0 4.0 Dividend yields are moderate, but on the lower end when compared against regional benchmarks. 13 3.0 2.0 1.0 0.0 Jan-15 February 2015 Sectoral Performance A general uplift in investor sentiment saw all sectors, except for telecoms, performing positively in January with smaller sectors gaining the most. Amongst the worst performers, energy and retail gains were modest whilst telecoms recorded negative performance. Performance by sector (rebased; 31 December = 100) 18 All sectors, except telecoms, were up in January… (percent) 14 10 6 2 -2 Telecoms Retail Energy Media & pub. Petchems Agri. & food Cement Banks Multi inv. Transport Bldg. & cons. Real estate Insurance Industrial inv. Hotels -6 Best Performing Sectors (rebased; 31 December = 100) 120 115 ...smaller sectors benefited most from renewed investor confidence… 110 Hotels Industrial inv. Insurance 105 100 95 31-Dec 4-Jan 8-Jan 12-Jan 16-Jan 20-Jan 24-Jan 28-Jan Worst Performing Sectors (rebased; 31 December = 100) 115 110 ...telecoms, energy and retail were affected by below par results in Q4 2014. Telecoms Retail Energy 105 100 95 90 31-Dec 4-Jan 14 8-Jan 12-Jan 16-Jan 20-Jan 24-Jan 28-Jan February 2014 Full year 2014 results Net income of listed companies totaled SR114.7 billion in 2014, up by 9 percent, year-on-year. Banks were the stand out performers with the largest increase in net income, year-on-year, up SR10 billion, whilst telecoms losses amounted to nearly SR5 billion, year-on-year. Net income of listed companies 120 110 (SR billion) Net income was up 9.2 percent year-on-year, but quarter-on-quarter was down 38 percent, due to losses in the petchems., telecom and energy sectors. 100 90 80 70 60 50 40 2006 2008 2010 2012 2014 Net Income by sector (year-on-year change) Telecoms Bldg. & cons. Petchems Transport Ind. Invest. Media Hotels Multi invest. Retail Cement Agri. & food Energy R-estate Insurance Banks (SR billion) Of the larger sectors petchems. and telecoms profit fared the worst in 2014, year-on-year… 12 10 8 6 4 2 0 -2 -4 -6 Net income by sector (2014 vs. 2013) Banks 10% ...resulting in their contribution to profits amongst all listed companies declining. 3% 3% 2% 8% 4% 4% 30% 36% 3% 5% 6% Outer circle: 2014 Inner circle: 2013 9% 14% Petrochems. Telecom. Cement Agri. & food Energy Real estate 33% 30% 15 Other February 2015 Key Data 2008 2009 2010 2011 2012 2013 2014 E 2015 F 2016 F Nominal GDP (SR billion) 1,949 1,609 1,976 2,511 2,752 2,791 2,822 2,759 2,875 ($ billion) (% change) 519.8 429.1 526.8 669.5 734.0 744.3 752.5 25.0 -17.4 22.8 27.1 9.6 1.4 1.1 735.8 -2.2 766.7 4.2 Real GDP (% change) Oil 4.3 -8.0 -0.1 12.2 5.1 -1.6 1.7 -0.6 -1.6 Non-oil private sector Government Total 11.1 6.2 8.4 4.9 6.3 1.8 9.7 7.4 4.8 8.0 8.4 10.0 5.5 5.3 5.4 7.0 5.1 2.7 5.7 3.7 3.6 5.3 3.5 2.5 4.7 3.3 1.8 Oil indicators (average) Brent ($/b) 97.2 61.7 79.8 112.2 112.4 109.6 99.5 79.0 83.0 Saudi ($/b) Production (million b/d) 94.0 9.2 60.4 8.2 77.5 8.2 103.9 106.1 104.2 9.3 9.8 9.6 95.5 9.7 75.0 9.6 79.0 9.4 Budgetary indicators (SR billion) Government revenue Government expenditure Budget balance 1,101 520 581 510 596 -87 742 654 88 1,118 1,247 1,156 1,046 827 873 976 1,100 291 374 180 -54 836 1,003 -167 737 968 -231 (% GDP) Domestic debt (% GDP) 29.8 235 12.1 -5.4 225 14.0 4.4 167 8.5 11.6 135 5.4 13.6 99 3.6 6.5 60 2.2 -1.9 44 1.6 -6.1 40 1.4 -8.0 38 1.3 6.1 4.1 3.8 3.7 2.9 3.5 2.7 2.6 2.9 2.5 2.0 2.0 2.0 2.0 2.0 2.0 2.0 2.25 External trade indicators ($ billion) Oil export revenues 284.1 166.9 215.2 317.6 337.5 323.1 270.3 214.1 191.4 Total export revenues Imports 313.5 192.3 251.1 364.7 388.4 377.0 325.8 100.6 86.4 97.4 120.0 141.8 152.7 150.4 272.1 154.7 254.8 158.6 Trade balance 212.8 105.9 153.7 244.7 246.6 224.3 175.4 117.4 96.1 Current account balance 132.3 158.5 164.8 134.3 125.1 27.1 2.5 (% GDP) Official reserve assets 25.5 4.9 12.7 23.7 22.4 18.0 16.6 442.7 410.1 445.1 544.0 656.6 725.7 765.9 3.7 779.0 0.3 796.1 Social and demographic indicators Population (million) Saudi unemployment (15+, %) 25.8 10.0 31.7 11.3 32.5 11.1 Monetary indicators (average) Inflation (% change) SAMA base lending rate (%, year end) GDP per capita ($) 21.0 26.7 10.5 66.8 27.6 11.2 28.4 12.4 29.2 12.0 30.0 11.7 30.8 11.7 20,157 16,095 19,113 23,594 25,139 24,816 24,454 23,213 23,537 Sources: Jadwa estimates for 2014 and forecasts for 2015-16. Saudi Arabian Monetary Agency for GDP, monetary and external trade indicators. Ministry of Finance for budgetary indicators. Central Department of Statistics & Information and Jadwa estimates for oil, social and demographic indicators. 16 February 2015 Disclaimer of Liability Unless otherwise stated, all information contained in this document (the “Publication”) shall not be reproduced, in whole or in part, without the specific written permission of Jadwa Investment. The data contained in this research is sourced from Reuters, Bloomberg, The World Bank, Tadawul and national statistical sources unless otherwise stated. Jadwa Investment makes its best effort to ensure that the content in the Publication is accurate and up to date at all times. Jadwa Investment makes no warranty, representation or undertaking whether expressed or implied, nor does it assume any legal liability, whether direct or indirect, or responsibility for the accuracy, completeness, or usefulness of any information that contain in the Publication. It is not the intention of the publication to be used or deemed as recommendation, option or advice for any action(s) that may take place in future. 17

© Copyright 2026