Datastream Request Table Template 5.0

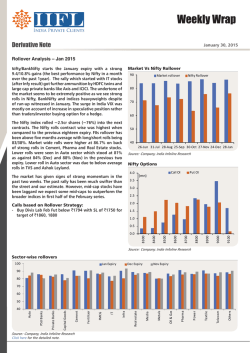

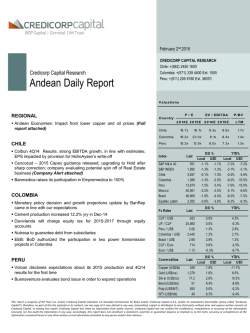

Key Economic Indicators and Events: Date 2-Feb-15 4-Feb-15 5-Feb-15 6-Feb-15 Key figures update Indicator/Event ISM manufacturing ISM non-manufacturing BOE rate announcement Non-farm payrolls Company Event Calendar - Week 6 Company Fabege Country US US UK US Date/Month 4-Feb-15 Event Annual report 2014 02/02/2015 Bonds & CDS Last Last week Last month YTD Interest rates Norway Sweden Denmark Euro iTraxx Europe 5Y 59.78 11.3 % -4.6 % -8.8 % Repo rate 1.25% 0.00% 0.05% 0.05% iTraxx Crossover 5Y 322.96 8.3 % -5.7 % -8.6 % 1M (Nibor, Stibor, Cibor, Euribor) 1.44% 0.05% -0.17% 0.00% iTraxx Fin Senior 5Y 67.97 16.5 % 2.2 % -4.1 % 3M (Nibor, Stibor, Cibor, Euribor) 1.32% 0.10% -0.11% 0.03% Norway 10Y Govt. index 1.3 % 1.4 % -18.6 % -18.5 % 6M (Nibor, Stibor, Cibor, Euribor) 1.18% 0.18% 0.06% 0.09% Sweden 10Y Govt. index 0.6 % -4.5 % -31.7 % -31.6 % 1Y swap 1.06% 0.06% -0.08% 0.14% UK 10Y Govt. index 1.4 % -7.7 % -24.0 % -22.4 % 2Y swap 0.97% 0.10% 0.10% 0.15% 3Y swap 1.00% 0.19% 0.18% 0.20% 4Y swap 1.07% 0.31% 0.27% 0.24% 5Y swap 1.17% 0.45% 0.37% 0.30% 6Y swap 1.29% 0.58% 0.47% 0.37% Equity indices OSEBX Oslo Last Last week Last month YTD 596 -1.2 % 3.5 % 3.5 % 7Y swap 1.41% 0.70% 0.57% 0.45% OMX Stockholm 30 1,574 2.4 % 7.5 % 7.5 % 8Y swap 1.52% 0.80% 0.66% 0.52% OMX Helsinki 25 3,261 -1.0 % 9.1 % 9.1 % 9Y swap 1.62% 0.90% 0.75% 0.60% 811 1.1 % 8.9 % 8.9 % 10Y swap 1.70% 0.98% 0.83% 0.67% OMX Copenhagen 20 Nikkei 225 17,674 0.9 % 1.3 % 1.3 % S&P 500 COMPOSITE 1,995 -2.8 % -4.1 % -3.1 % NASDAQ COMPOSITE 4,635 -2.6 % -3.0 % -2.1 % DAX 30 10,694 0.4 % 9.1 % 9.1 % FTSE 100 6,749 -1.2 % 3.1 % 2.8 % Implied leverage Dividend yield NOKm % % x 2,169 1,508 30% 0.00% 2.2 26,775 15,662 42% 2.44% 1.5 21,751 48% Real estate equities Last Last week Last month Sweden SEK % % % ALM Equity 124.0 -0.8 % 6.7 % 6.7 % Atrium Ljungberg 124.8 3.3 % 8.8 % 8.8 % Balder 119.9 41,692 YTD EV Market cap NOKm P/Book* Last week Last month YTD 1.6 % 8.8 % 8.8 % 0.00% 1.8 86.5 0.3 % -0.6 % -0.6 % 1,320 1,264 4% n.a. 2.1 GPR 250 PSI Europe 19.1 0.1 % 11.5 % 11.3 % Castellum 130.2 2.5 % 6.6 % 6.6 % 40,491 21,097 48% 3.53% 1.7 GPR 250 PSI US 30.5 -1.5 % 5.4 % 7.1 % Catena 109.0 2.3 % 3.1 % 3.1 % 5,632 2,633 53% 1.83% 1.4 GPR 250 PSI UK 19.1 -0.5 % 8.4 % 8.2 % Corem 28.9 0.3 % 0.7 % 0.7 % 8,062 3,181 61% 2.42% 1.0 GPR 250 PSI Global 15.4 -1.3 % 5.0 % 6.1 % D. Carnegie & Co 49.8 -1.4 % 9.7 % 9.7 % 9,595 3,068 68% 0.00% 1.1 Diös 62.3 3.8 % 7.8 % 7.8 % 11,544 4,382 62% 3.69% 1.4 Property indices Last Pangea Real Estate Indices (PREX) Besqab PREX Sweden 697.0 2.6 % 8.6 % 8.6 % Fabege 113.2 3.8 % 12.5 % 12.5 % 36,360 17,637 51% 2.65% 1.5 PREX Norway 238.7 3.2 % 13.6 % 13.6 % FastPartner 125.8 -1.0 % 15.6 % 15.6 % 13,194 7,067 46% 2.47% 2.1 PREX Denmark 195.5 1.0 % 6.1 % 6.1 % Heba 95.0 4.4 % -2.3 % -2.3 % 5,075 3,694 27% 1.26% 1.4 PREX Finland 245.4 2.9 % 14.1 % 14.1 % Hemfosa Fastigheter 178.0 3.2 % 7.9 % 7.9 % 20,873 11,020 47% 0.00% 1.7 PREX Office 353.8 3.0 % 9.4 % 9.4 % Hufvudstaden 108.5 2.1 % 6.8 % 6.8 % 27,074 22,114 18% 2.53% 1.5 PREX Retail 652.9 2.9 % 16.5 % 16.5 % JM 272.9 4.9 % 9.6 % 9.6 % 18,650 19,818 -6% 2.66% 4.8 PREX Residential 1,038.9 0.8 % 4.9 % 4.9 % Klövern 8.7 1.2 % 5.5 % 5.5 % 31,351 12,315 61% 3.29% 1.6 PREX Construction 334.1 1.2 % 9.3 % 9.3 % Kungsleden 63.5 7.2 % 12.4 % 12.4 % 21,236 10,887 49% 1.97% 1.6 PREX Mixed 334.1 1.2 % 9.3 % 9.3 % NP3 38.5 1.0 % 11.3 % 11.3 % 3,504 1,757 50% 0.00% 1.5 PREX Warehouse 614.0 2.8 % 9.0 % 9.0 % NCC 267.9 0.4 % 8.5 % 8.5 % 35,654 27,356 23% 4.48% 3.7 PREX Total 41.3 2.5 % 7.1 % 7.1 % Peab 59.5 1.0 % 8.3 % 8.3 % 23,756 16,594 30% 3.03% 2.2 Platzer 35.7 -0.6 % 6.6 % 6.6 % 6,982 3,220 54% 1.68% 1.2 Sagax 70.3 19.1 % 58.9 % 58.9 % 17,820 10,380 42% 0.78% 2.8 Skanska 183.5 0.8 % 9.3 % 9.3 % 70,987 72,590 -2% 3.41% 3.8 Tribona 37.9 -2.1 % -1.8 % -1.8 % 4,628 1,737 62% 1.32% 0.9 7.9 8.2 % 27.4 % 27.4 % 3,812 820 78% 0.00% 0.6 137.1 0.0 % 5.7 % 5.7 % 36,797 21,956 40% 1.46% 1.9 1.8 Commodities Last Last week Last month YTD WTI Spot ($) 47.8 5.6 % -11.7 % -10.6 % Wallenstam Crude Oil-Brent ($) Victoria Park 48.0 0.7 % -15.6 % -14.0 % Wihlborgs Fastigheter 162.0 3.8 % 13.5 % 13.5 % 24,862 11,729 53% 2.62% Gold (U$/Troy Ounce) 1,273.2 -1.5 % 5.6 % 7.3 % Norway NOK % % % NOKm NOKm % % x Silver (Cents/Troy ounce) 1,986.0 0.0 % 0.0 % 0.0 % AF Gruppen 84.5 4.3 % 7.0 % 7.0 % 7,650 7,497 2% 7.10% 5.7 Alu (U$/MT) 1,835.5 -0.5 % -1.2 % 1.8 % Entra 83.3 3.7 % Copper (Grade A U$/MT) 5,541.0 -0.1 % -13.4 % -13.0 % Norwegian Property Zink (U$/MT) 2,119.8 1.7 % -2.6 % -2.2 % Olav Thon Eiendomsselskap Currencies NOK/USD NOK/EUR 8.8 % 31,434 15,296 51% 0.00% 1.8 10.4 0.0 % 3.0 % 3.0 % 14,902 5,704 62% 0.00% 1.1 156.0 4.0 % 24.3 % 24.3 % 33,123 16,605 50% 0.90% 1.2 Selvaag Bolig 20.9 2.5 % 4.0 % 4.0 % 4,207 1,960 53% 2.39% 0.8 Storm Real Estate 12.3 -2.0 % -2.0 % -2.0 % 275 236 14% 13.06% 3.9 Veidekke 79.8 2.2 % 8.1 % 8.1 % 12,226 10,663 13% 3.76% 4.4 Finland EUR % % % NOKm NOKm % % x 3.0 1.3 % 16.5 % 16.5 % 28,783 15,755 45% 4.99% 1.4 4.1 5.3 % 4.0 Last Last week Last month YTD 7.8 0.5 % 5.1 % 5.1 % Citycon 8.8 % 8.8 1.5 % -2.3 % -2.2 % Sponda 12.7 % 12.7 % 10,202 56% 4.41% 0.8 SEK/EUR 9.4 0.0 % -1.5 % -1.5 % Technopolis 3.1 % 8.6 % 8.6 % 10,945 3,782 65% 2.49% 0.9 NOK/SEK 94.4 1.2 % -1.1 % -1.7 % Denmark DKK % % % NOKm NOKm % % Jeudan 586.0 1.0 % 6.2 % 6.2 % 22,069 7,709 65% 2.05% 1.4 2.2 3.3 % 2.8 % 2.8 % 3,638 31 n.a. n.a. n.a. Nordicom 23,104 Note: For comparison reasons, we have chosen to have a single currency on Market Cap and EV x Source: Reuters * Based on lastest company reports and current market capitalization figures Equity chart - Norway Equity chart - Sweden 180 180 170 170 160 160 150 150 140 140 130 130 120 120 110 110 100 Source: Reuters 100 90 80 Jan-13 Apr-13 Jul-13 OSEBX Oct-13 PREX Norway Jan-14 Apr-14 Norwegian Property Jul-14 Oct-14 Jan-15 90 Jan-13 Olav Thon Apr-13 Jul-13 OMX Oct-13 PREX Sweden Jan-14 Hufvudstaden Apr-14 Castellum Jul-14 Oct-14 Jan-15 Wallenstam Source: Reuters – Page 1 – Interest rate term structure – Nordic Sight deposit rates - Nordic 2.0 % 2.5 % 1.5 % 2.0 % 1.0 % 1.5 % 0.5 % 1.0 % 0.5 % 0.0 % 3m 1Y swap 2Y swap 3Y swap 4Y swap 5Y swap 7Y swap 10Y swap 0.0 % 2010 -0.5 % Norway Sweden Denmark 2011 2012 Norway Euro 2013 Sweden 2014 Denmark 2015 Euro Source: Reuters Short term interest rates - Nordic Long term interest rates (5y swaps) - Nordic 3.5 % 4.5 % 3.0 % 4.0 % 3.5 % 2.5 % 3.0 % 2.0 % 2.5 % 2.0 % 1.5 % 1.5 % 1.0 % 1.0 % 0.5 % 0.5 % 0.0 % 0.0 % Jan-10 Jan-11 Jan-12 NIBOR Jan-13 STIBOR CIBOR Jan-14 Jan-10 Jan-15 Jan-11 Jan-12 Norway EURIBOR Jan-13 Sweden Denmark Jan-14 Jan-15 Euro Source: Reuters Yield gap – Oslo office Yield gap – Stockholm office 8.0 % 8.0 % 7.0 % 7.0 % 6.0 % 6.0 % 5.0 % 5.0 % 4.0 % 4.0 % 3.0 % 3.0 % 2.0 % 2.0 % 1.0 % Jan-05 Jan-06 Jan-07 Jan-08 Jan-09 Jan-10 10Y swap Jan-11 Jan-12 Jan-13 Jan-14 Jan-15 1.0 % Jan-08 Jan-09 Oslo office yields Jan-10 Jan-11 10Y swap Jan-12 Jan-13 Jan-14 Jan-15 Stockholm office yields Source: Pangea Property Research Recent transactions – Norway and Sweden Norway Property Date Seller Type Estimated value (NOKm) Size (Sqm) Kalbakkveien 6, Oslo Jan-15 Gunnar Landgraff Eiendom AS / Cognito AS Private investor Buyer Retail 110 8,000 n.a. Adviser Portfolio of 6 properties in Lillestrøm, Moss and Fr. stad Jan-15 Entra ASA Hemfosa Fastigheter AB Office (public institutions) 1,375 63,000 Pangea, Newsec Nygårdskrysset Næringspark, Ås Jan-15 Coop Eiendom Syndicate Retail 300-400 n.a. n.a. Grenseveien 95, Helsfyr Jan-15 DNB Liv Aberdeen Eiendomsfond Norge 1 Office n.a. 10,500 n.a. Industrial property at Aurskog Jan-15 07 Aurskog AS Harlem Eiendom AS Industrial 55 n.a. Haslevangen 45/47, Oslo Jan-15 Haslelund Bygg AS Syndicate Office 195 6,000 n.a. Drammensveien 211-213, Oslo Jan-15 Egil Stenshagen DTZ Corporate Finance Office 220 11,000 Newsec (sell-side) Realia (sell-side) Sweden Property Date Seller Buyer Type Estimated value (SEKm) Size (Sqm) Metropol, Helsingborg Jan-15 Midroc Property Executive Property Hotel, office, retail n.a. 10,000 Leimdörfer (sell-side) Briggen 5, Överby Jan-15 Coop Fastigheter Thon Property Retail n.a. 10,000 n.a. Adviser Kålsered 1:36, Torslanda Gothenburg Jan-15 Göteborgs Stad Prologis Undeveloped land (logistics) n.a. 130,000 n.a. 9 properties, across southern and central Sweden Jan-15 Hemfosa Estancia Logistics, warehouse 900 116,000 n.a. Berga 11:94, Österåker Jan-15 Tegeltornet Tenant association Residential, office 155 8,800 n.a. Marievik 27 & 30, Stockholm Jan-15 Aberdeen Brostaden (Castellum) Office 324 11,500 n.a. Skärholmen Centrum (6 properties), Stockholm Jan-15 Centeni Grosvenor Retail 3,200-3,300 106,400 CBRE (sell-side), PwC (buy-side) Source: Pangea Property Research Contact details STOCKHOLM Pangea Property Partners KB Visiting: Norrlandsgatan 15, 7th floor Postal: Box 7740, 103 95 Stockholm Tel +46 8 545 25 780 www.pangeapartners.se OSLO Pangea Property Partners AS Tjuvholmen Allé 3-5, 8th floor N-0250 Oslo Tel +47 21 95 80 70 www.pangeapartners.no – Page 2 –

© Copyright 2026