ah UPL Limited

2. Feb. 2015 13:08

No. 3719 P. 1

Share Dept.

: 8, Shri Klishni Commervial CeDge, Ground Floor, Opp. Raheja Solitaire,

6, Ud)'08 Nagar, Off S. V. Road. Oeregaon (W), Mumbai - 400 062, India.

(Formerly known as United Phosphoru8 Ltd.)

Reg(1. Off.

: 3-11, GIDC, Vapi- 396 195, GRIarit India. Tel

CIN: 624219031985PLC025132

Corporite Off : Uniphos House. Madhu Park, lith Road, Khar (W), Mumbai - 400 052. Iodia.

UPL Limited

ah

I::I

le).. 01«022) 2872 4862,2873 5486 Fax: (91-022) 2875 3483

(91-0260) 2400717. 2401118-19

Tel.. (91-02212646 8000 Fax : (91-022)2604 1010

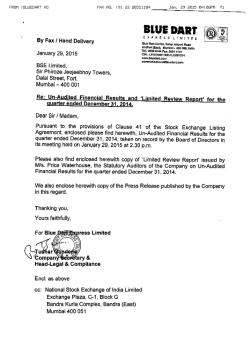

2nd February, 2015

Listing Department

National Stock Exchange of (I) Ltd.

Exchange Plaza, C/1, Block G,

Bandra Kurla Complex, Bandra (East)

MUMBAI 400 051

Dear Sir,

REG. : UPL Limited (Formerly United Phosphorus Limited)

SYMBOL : UPL

SUB.: UNAUDITED FINANCIAL RESULTS FOR THE OUARTER ENDED

31ST DECEMBER, 2014

This is to inform you that the Board of Directors at its meeting held on 2'id February,

2015, has taken on record the Unaudited Financial Results for the quarter ended 31

December, 2014.

The Statutory Auditors have carried out a "Limited Review"

Financial Results for the quarter ended 315 December, 2014,

of the Unaudited

We are enclosing herewith a copy of the Unaudited Financial Results along with

Statement of Segment-wise Revenue, Results and Capital Employed.

We are also enclosing herewith

the Company.

a

Limited Review Report of the Statutory Auditors of

May we request you to take the same on your record and inform all your constituents

accordingly.

Thanking you,

Yours faithfully,

for UPL Limited

C..

fi.-Cr.A- -7

M. B. Trivedi

Company Secretary

Encl : As above.

2. Feb. 2015 13:08

No. 3719 P. 2

SRBC&COLLP

14tn Floor, The Ruby

29 Senapati Bapat Marg

[lader (Wesl)

Chartered Accountants

Mumbai-400 028. India

Tel: +91 226192 0000

Fax. +91 226192 1000

Review Report to

The Board of Directors

UPL Limited

1. We have reviewed the accompanying statement of unaudlted financial results of UPL Limited

('the Company') for the quarter ended December 31, 2014 (the "Statement"), except for the

disclosures regarding 'Public ShareholdIng' and 'Promoter and Promoter Group ShareholdIng'

which have been traced from disclosures made by the management and have not been

reviewed by us. This Statement is the responsibility of the Company's management and has

been approved by the Board of Directors. Our responsibility Is to issue a report on the

Statement based on our review.

2. We conducted our review In accordance with the Standard on Review Engagements (SRE)

2410, Review of Interim Financial Information Performed by the Independent Auditor of the

Entity Issued by the Institute of Chartered Accountants of India. This standard requires that

we plan and perform the review to obtain moderate assurance as to whether the Statement

is free of material misstatement, A review is limited primarily to Inquiries of company

personnel and analytical procedures applied to financial data and thus provide less assurance

than an audit, We have not performed an audit and accordingly, we do not express an audit

opinion.

3. Based on our review conducted as above, nothing has come to our attention that causes us

to believe that the accompanying Statement of unaudited financial results prepared In

accordance with recognition and measurement principles laid down In Accounting Standard

25 "Interim Financial Reporting", specified under the Companies Act, 1956 (Which are

deemed to be applicable as per Section 133 of the Companies Act, 2013, read with Rule 7 of

the Companies (Accounts) Rules, 2014) and other recognised accounting practices and

policies, has not disclosed the information required to be disclosed In terms of Clause 41 of

the Listing Agreement Including the manner In which It Is to be disclosed, or that It contains

any material mlsitatement.

ForSRBC&COLLP

Chartered Accountants

ICAl Firm registration number: 324982W

'10 ( 1

/1 -' lei

*A

MUMBAj

pe

udhlr Soni

Partner

Membership No.: 41870

Place: Mumbal

Date: February 2, 2015

\71 44

11

, .4PDA e#n

\-0

S A B C& C O (a partnership b im) arlvefle(] inte S R B C& C O LLP <1 Limited Liability Paftnetihip with LLP Identity NO. AAS-4318) elfective lsI A *W. 2013

UPL Limited

(formerly known as United Phosphorus Limited)

r-D

-ll

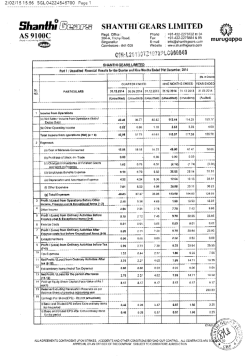

CONSOLIDATED UNAUDITED FINANCIAL RESULTS

FORTHE QUARTER ENDED 3lst December, 2014

Rs. i n la cs

Particulars

b) Other Operacing Incorne

Total Income frorn Operations Inet)

(Unaudited)

(Unauditedl

(Audited

Quaner ended

Quarter ended

Nine Months

31.12.2014

30.09.2014

31.1212013

emded

(Unaudited)

1 In.corne frorn Operations

al Net Sa es /Income from operstions (Net of Excise Duty)

Yearended

31.12.2014

Nine Months

ended

31.12.2013

Quarter ended

(Unau€[ited3

(Unaudited)

LO

728,364

14,843

1,057,996

846,619

743,Z07

1,077,088

132,437

415.583

371,460

26,192

77,201

72,283

544,080

94,687

304014

261,770

260,471

3,705

4,462

4,216

304,719

266,232

264,687

154,132

26,397

129,47&

25,472

834,809

11,810.

34

31.031014

19,092

2 Expenditure

a) Consumption of Raw Materials, Packing Material, Traded goods & In<rease / Decrease

in Stock

b) Employee benefits expenses

c) Depreciation and Amortisation expense

d) Other Expenses

Total Experiditure

10,856

10,915

10,434

32,107

28,749

40,694

66,733

63,230

59,553

196,066

164.735

236,363

258,118

229,095

228,616

720,957

637,227

915,824

46,601

37,137

36,071

125,662

105,980

161,264

357

1,711

5,007

4,653

10,493

13,135

5 Profk from Operations frorn ordinary activities before IFinance Cost, Prior Period

Adjustments and Exceptional iterns

47,958

38,848

41,078

130,315

116,473

174,399

6 Finance Cost

13AOS

14,013

10,954

39,444

36,655

48,660

34,150

24,835

30,124

90,371

79.318

125,739

1,603

1,020

3,974

5,960

8,530

241

664

0

905

0

1,555

32,30,6

23,151

26,150

90,928

73,858

115,654

5,983

4,617

5,213

19,427

17,813

22,169

26,323

18,534

20,937

71,501

56,045

93,485

3 Profit from Operat]ons bebre Other Income, Finance cost, Prior Period Adjustments

and Exceptional items

4 Other ]ncorne

7 Profit fra m ordinary activities after Finance Cost and before Prior Period Adjustrients

and Exceptional Items

8 Excel*ionaL Items (Incomel/Expense

19621

0

9 Prior Period Adjustments

10 Pira·ntfrom Ordinary

11 Tax

ActMties before Tax

expense

12 Net Profitfrom Ordinary Activities after Tax

tz

1

-IJ

LO

2

UPL Limited

(formerly known as United Phosphorus Limited)

r-D

CONSOUDATED UNAUDITED FINANCIAL RESULTS

FOR THE QUARTER ENDED Slst December, 2014

r-D

'Yl

Rs. in lacs

Quarter ended

Quarter ·efided

Particulars

30.09.2014

31.12.2014

[Unaudited;

13 Less : Minority Interest

15 Less

:

14 Add: Share of Prokt fTom Associate Ce

Exceptional Items - Associate Co

16 Net Profit After Taxes, Minor[ty Interest and Share

(Unaudited}

Quarter ended

31.12.2013

Nine Morrths

ended

Nine Months

Year ended

ended

31,03.2014

31.12.2014

31.12.2013

(Unaudited] (unaudited} (Unaudked

[Audited)

2,331

2,896

(139}

4,019

{837]

715

936

968

1,148

2,915

2,070

3,039

830

D

of Profit of Associates.

17 Paid up Equity Share Capital

(Face value ofthe share Rs 2/-each}

24,928

8,572

LO

16,606

8,572

22,224

8,852

70,397

8,572

58,952

94,979

8,572

8,852

516,170

18 Rese Nes exduding Reva[uation Rese rves as per Balance Sheet

19 Earningspershare (EPS

Basic and Diluted EPS before and after Extraordinary items for the year & for the

ore#otis year

Basic Earnings per share of Rs 2/-each (Rs}

Diluted Earnings per share of Rs 2/- each ERs)

20 Pubric Sharehold]ng

Number d Shares:

% of shareholding

5.81

3.88

5.02

16.42

13.32

5.81

3.88

5.02

16.42

13.32

300,875,933

70.20%

300,875,933

70.20%

314,851,495

71.14%

300,875,933

70.20%

314,851,495

71.14%

21.59

21.59

300,851,495

70.19%

Notes:

1 Share of Profit in Associate Company for the year is considered on the basis of Unaudited Consolidated results d Advanta Group far the Nine rnonths ended 30th September, 2014 and

Unaudited Standalone results ofall otherassociates .

2 The resu[ts for Hodogaya UPL Co Ltd which is a joint venture are proportionately consolidated.

3 Exceptic>nal item fbrthe quarter mainly indudes restructuring cost of Latin American Region4 Previous periods / Years figures have been regrouped / rearranged wherever necessary.

r

tz

.C>

-IJ

4-

*

r-D

-ll

.

A 5F

I.

P::2iZ

#7:85.1

lil//2 1*1*/3 i Ki i

·

)

1/

2&

R

3

.,

0

5

5

9

Q

f

1

9 2R

/9

T

i

W i i,i

i i

1 Z

w

&

litil

irp

6·

Re Z

i

r i

r W

"i

ii

:

1

i gro

*

,#

1

E

' i

=

i'

.1 i

11

-il

1

i 1-

3

26

EI

-

i

8

6/ C

i

g

5

i l '622

l i; 2,23

15= i

i i

i

i

r-D

i

CD

iii,„, i f i i

. 1 1 In

T

BFOT=&

.

1

2

1

34

23

1

iT

= 1

2

£

:

0

Q

2

f

8

i

M

n

-.

f K

;

i

i

i

E

1

.

a.

.

%

5

W

:

a-

:

19

i

iiI

/F12

r

1&SS

i#-GB

:ips:i<15

1B#ii

ta-R

/SE

:.

/

i

41

B

18/2 . . .8:

11'i

i

5 S

0

9

r

i:

t

2P

ie

I

i fi - j i= l- i sz ii Trete.i

i l 2i i

l i' ; t

i

1

2- i

r-1 9

\

i

i

0

0

s

lit it 1 i

13 i

a

2 2

i

=

0 I8

i

li

.'„-

i

:

1.

(0

11

=

i

g B

2

0

'*

'«

2.

9

a

6

n i

# at

1 F

2

1

5% 5

/2 Z9

#

'

*9 M

9

2

al

0

£:0

i; 15

D#

-----39000 5 :

9

tat

I

h s ,#,&M ME i, H i i l i-92.312.8

a f T:I. '

= -*,n -11,#3§ -#ra#,1 p :SE E

i S Sit g

xifii

tijiw & tia i

13=Ziri 9.:, & fine 2&2 6:ti

aeD

i8 #

2,1 /S

alizx

09.

.

1

5, Igra 8 11 11 1 £:1£1,2 2 1,- 0

/..5,

.

03

2-

2 2

t-<3

.

T.

ii, 8/6

=

1.

EMB

FEE

t.- .Ag

1

=

eJ

§iEE

EE

e

m fa

9

N

.Irl

O.Rn

Si

b2

g1

5 M i

iliglia

M i

M i s-

95, m

i E R

a

./er=

Mas,

I

M

g

a .

tti " :

:.

I

:*m

101%

T: I IE & 1 E

2EBU

GG

06 Eo

li

j.

9

ps-5

a

N ia

3 8

ik -#Ai

I'-„

W

ti/1

ii

E

B

m

/2/2.

££

I

i i

0

8 9/

EM:"1&

78Nts-„

. -*Ug

-

li

El.

2 41

:G

ihi //8

.

2 6

e*"

1#3

I

im

1,£56*,1

"-

0

El

85 -1 . go=

F*

3·4 <'·

'Eze

j *

0

a

E

* Ta

i/§

I

Za

2,«-

tz

S i

c £1 0 't bb

*

/h=

%

HigNE

& .f i U 8 1

i 3 q 6

=M F&8

M

I B.

E i

.C>

.E]

=

= 5

TE-&

""3 i"B

14

V=

eL

AJ

1:

P:

Im,

r:2 2:2

I

C.

Cn

n

m 3348i

949* ,; 8* E

2 F 9 m M:amen: 1 9 *

.

m

I

€>

.

imil

1-:5

/2:1

--I-

-IJ

'Yl

2. Feb. 2015 13:10

No. 3719 P. 6

NOIES

1

The obolre Skindalone Unaudled FInonclol Re:ulls wom ravlowod by 14* AUN C*mrtlill#* *rld 16*r,aller dpbrolred 01 Ihe MeeHng 01 Ihe 8oa d 01 Neclors hold on Mnd

Flb<hou. 2015. The :Ialufofy audllor# have coided oul a Iniled review 01 flie *landolobs MA#Mbl 1*,0115 01 Ihe Company 06 required under Clau. e 41 01 Ihe LI.Ilng

AN"MIA'.

2 Oiller 1,1**MI / Explnlls Includeirel exohange (galn)/10„ on accounlol foreign exchange of exparl#, Imp*,16 Mnd **0*rl Comir *n. Sugh (Moint/imi Gre Ri 181 Iccs,

RE 784 la¢*, antl RI (214 14#41) (Irl*IWd*d In Flher Ingernel lof Ihe quorter: ended 31 31 Decornber, 2014, 30th 5*plefmb*< 2014 *nd 3181 9**imber 2013 reweoliyely; h

1.0211ac and H, (13.135 1008) Onclud*% M *lhl< Income) fw ihe nine monlhi ended 3151 Oecembei 014 and 31,1 Doe•mber to : 644 RI (12.329 lacs) Oncludid Irl othei

Incomal foi lhe yearonded 310 Zarch. 2014.

3 FInanGe Cwls Inclwde nelexchange (gain)/lois or,Ing on foreign eurroneyloon*/ advable# *nd rllglld derAVaIive#. Such (goin)Bo„ i, h (6,008 lacs), h (1.042 lacs) and

Rl (1,144 Ig*,1 11 Ihe c:Ware(s ending 3181 December 2014, 30lh Seplember *014 and 31,1 DGe•mber 2012 rliplGIIyely' Rs (12.127 la i) arld R, 9,444 laci lor nine monlhs

end[Ig 3141 De#mb*U 2014 end 318£ DeGembe< 2013 respechely and a nel los of ks 6,538 laci for the yaa< 91,494 *111 M*Mh 2014,

4 The Company ha, revised Ihe deproclallon rolo on 20(1814 MA.d ".13 05 per Ihe V„M Ble *pecl ed In Schedule·11 ol lhe Conipanles Acl. 4013 w ru.ai,e#led hy Ihe

Company. Hod ihere nol been ony chang e In the uzeh,1 kfu d mi* 14, d*p,* clotion W th* 41##1(1,/ Wewid have been Bwer by Rs. 362 loci.

6 Rallo, have been computed m tolowl :-

Diblcomprts- Ling·Tarnlbormulngs. Bmt-Tllm berriwing, and CwnenimaMIieiollong kin bonodngi

babh $.rvfco Cmwgi R.Ho = Ear.Ing: 4*WI fnl,illl. Tax. De/eciallon arld AmodlidHon /(Inleferl on long Term borrodigi + prineipal repaym*All]

Interest $elvice Covaraga R„110 = 1*Inlne I,*IMI Inler,it and Tax/ Inleiesl and Olher Flnance Choiger on Dobl

& hev|ouipeilocfi/yeaf'I Rgures have boon rogroupwd/rewrollold whlriVer Mecessory.

•

rlog* ; Mumial

F*r U P 11411*4 (l*r *il known gs United Pho phort,i

U/Ated)

R D ShioN

% Chalimnand paglngure,l«

DMII : Olnd Flbtvory. 2015

SIGNED FOR IDENTIFICATION

BY

»

SRBC&COLLP

IUMBAI

2. Feb. 2015 13:10

No. 37 19

P. 7

UPL Limited

(formerly known as United Phosphorus Limited)

Regd. Office : 3-11, G.I.D.C., Vapl, Dist : Valsad, Gularat - 396195

Segmentwlse Revenue, Re5ults ind Capital Employed for the Qualterended 31st December, 2014

(Rs in lacs)

Partlculars

Sr.

No.

1

a

b

Income from Operations Cnet)

Agro Activities

Non Agro Activiles

o Unallocated

Total

Less: Inter - Segment Revenue

Net Sales from Operations

Quarter ended

Quarter ended

Quarteren[led

Nlne months

Nine month

Year ended

31.12.2014

30.09.2014

31.12.2013

ended

ended

31.03.2014

1Unaudited)

{Unau(liked)

(Unaudited)

31.12.2014

31.12.2013

(Audited)

CUnaudited)

CUnaudited)

116.960

130,015

104,375

374.545

343.984

451,418

22,033

132

23,477

65,266

61,402

132

19,700

1.183

395

1,821

80,555

1,879

138.125

10,781

127,334

153,624

125.354

440,206

15.378

10,794

35,472

407.207

29.815

533,852

37.025

138.246

114.580

404,734

377,392

496.827

2

Sooment Results

a

Agro Activilies

Non Agro Activities

13,301

11.915

15,792

45,098

72,218

82.349

2,822

1,304

752

5,979

3,483

4,126

Total

16.123

13.219

18,544

51,077

75.701

88,475

b

Less.

(i) FInance Gosts

(li) Unallocable Expenditum / Income (nal)

(lii) E:(ceptional item8

Total Profit before Tax

3

(1,920)

6.450

2,986

2,988

1,164

22,672

24,329

(10,995)

4,466

1,353

1 472

1,986

4,9iO

1.986

11,593

21,228

9.090

48,570

49,571

55,250

227,901

216,369

246,990

227.901

244990

201,550

58,605

41,176

36,218

58.605

36,219

84,145

105.173

362,718

92,580

84,145

92,580

38,188

91.028

376,789

370,BIll

375,789

330,764

Capital Employed

(Segmenl Assets Segment Llabilltles)

a

Aoro ACtivities

b

Non Agro Activilles

c Unallocated

Total

370,851

Note, i

1

The busine85 of the Company is divided Into hwo business segments. The6e segments are the basis for management conlrol and hence form the basis for

reporting. The business of each segment comprises of:

a) ABro activity - This is the main area of Ihe Company'$ opetation and includes the manufacture and marketing of conventional agrochemical products.

seeds and Other agrlcultural related products.

b) Non·agro activity - Non egro activities Include$ manufacture and marketing of Industrial chemicals end other non agriCultural related products.

2

Previous period's/ years figures have been regrouped/ rearranged wherever necessary.

SIGNED FOR IDENTIFICATION

BY

/3ob v

SRBC&COLLP

IAUMBAI

© Copyright 2026