Cambium Global Timberland Limited

Cambium Global Timberland Limited

Interim Report and Unaudited Condensed Consolidated Interim Financial

Statements

for the six months ended 31 October 2014

Cambium Global Timberland Limited

Contents

Page

Chairman’s statement

2

Operations Manager’s report

3

Independent review report

4

Unaudited condensed consolidated interim statement of comprehensive income

5

Unaudited condensed consolidated interim statement of financial position

6

Unaudited condensed consolidated interim statement of changes in equity

7

Unaudited condensed consolidated interim statement of cash flows

8

Notes to the unaudited condensed consolidated interim financial statements

Key parties

9-26

27

1

Cambium Global Timberland Limited

Chairman’s statement

The Company’s Net Asset Value (“NAV”) as at 31 October 2014 was 33p per share compared with 40p at 30 April 2014. In

accordance with the active marketing programme of the assets and the negotiations currently underway, the forest assets are

shown on a held for sale basis allowing for 5% sales costs on the value of the plantations. The other reasons for this decline are

detailed in the Operations Manager’s Report.

There have been two significant post balance sheet events since 31 October 2014, both of which need to be highlighted here. In

December 2014 there was a major wind-storm in Hawaii that has severely damaged the Group's Pahala plantation. Since 31

October 2014, the Brazilian Real has continued to depreciate and economic conditions in Brazil remain very difficult. The

combination of these two factors has again reduced the value of the Minas Gerais and Tocantins plantations. The result is that the

Board estimates (based on the advice of the Operations Manager and all factors known to date) that the NAV as at the date of this

statement, taking into account the effect of the tender offer, is around 30p per share.

The distribution of £5 million by way of a tender offer at 25p per share approved by shareholder at the EGM on 27 January 2015 is

the first of what the Board plans as the remaining timberlands are sold in accordance with the approved policy of disposing of the

Group’s assets. However, difficulties in the markets for wood and plantations in both Hawaii and Brazil are creating continued

uncertainty in the amount and timing of value that can be realised and distributed to shareholders.

Within the constraints of good forest management and the requirements of a listed entity, the Company is cutting costs wherever

possible and managing cash prudently to ensure that if plantations cannot be sold in the immediate term, value can be realised

from wood harvesting.

On 16 October 2014, shareholders unanimously approved the appointment of Robert Rickman as Operations Manager of the

Group to replace Cogent Asset Management. On that date Robert Rickman and Martin Richardson stepped down from the Board.

The Board now comprises myself, Roger Lewis (who has become Chairman of the Audit Committee) and Svante Adde, and is

working on finding a new Chairman in Jersey, to enable me to step down before the AGM, as I undertook in 2014.

Donald Adamson

Chairman

29 January 2015

2

Cambium Global Timberland Limited

Operations Manager’s report

For the six months ended 31 October 2014

Total returns during the period covered by these financial statements were -17.6%. Of the total decline, net foreign exchange

losses due to sterling appreciation against the Brazilian Real and depreciation against the US dollar contributed -1.9%. Returns

from the investment portfolio contributed -13.1% to the total return with administrative expenses contributing the remaining -2.6%.

Portfolio returns were impacted by the decision to hold the forest assets on a “for sale basis” and the experience of limited market

demand in Brazil’s current economic environment. The sale of the Australian asset was completed at a modest premium to the

previous valuation. Subsequent to the balance sheet date there has been severe wind damage in the smaller Hawaiian plantation

and continued depressed conditions in Brazil.

Below is a summary of the results by each geographic area.

North America

The sales of the Group’s timberlands in Georgia were completed. Despite the improved economic growth in the USA, wood prices

have not increased, possibly due to increased volumes of timber being marketed. As a result the prices obtained for the properties

were below their previous valuations. US$1.0m held in escrow for the sale of Clinch County has now been received by the Group.

US$2.0m in escrow for environmental warranties for the Stewart County property is due to be released in July 2015.

Hawaii

The Group owns two properties in Hawaii, both leasehold, which represent 14.1% of total net assets. Total returns during the six

month period were -10.7%.

The key to realising the larger property, Pinnacle, is to develop a plan for harvesting and establishing access to the export port.

Progress has been made during the period in defining the costs involved in doing this.

The smaller and less valuable of the plantations is Pahala, which was devastated by serious wind damage after the period end in

December 2014 (see note 27). An early start to harvesting will be necessary if useable wood volumes are to be recovered. Heads

of terms had been agreed for the disposal of Pahala before the serious wind damage and, although discussions remain underway,

the options open to the Group are limited.

Asset values in Hawaii remain very sensitive to the availability of a local market for biomass wood for electricity generation, timber

prices in export markets, harvesting and transport. The 24 megawatt wood-using plant has progressed more slowly than originally

anticipated, but still appears to be progressing with an estimated start date during early 2017. Clarity on this plant is important to

underpin the value of both the Pahala and Pinnacle plantations.

Australia

The Tarrangower property in Australia has been sold. The return during the period was 21.8% in local currency terms, due to the

disposal of the property at a small premium to previous NAV, albeit an NAV which was well below earlier valuations.

Brazil

The Group owns two properties in Brazil, namely Minas Gerais and Tocantins 3R, which together represent 69.4% of total net

assets. Total returns during the period were -17.5%, of which -1.0% related to an increase of BRL 0.9 million in the provision

against Tocantins 3R. Note 21 sets out the position concerning the lien on this property by Banco da Amazonia, which is offset by a

security interest held on another property, Lizarda. The increased provision is the Board's best estimate of the liability following the

retention of legal and business advisers to hold discussions with the bank involved (and an assessment of the Group's ability to

enforce its offsetting lien in a realistic timescale.

Tree growth rates, as determined by recent inventories of both properties, are below expectations, probably due to below average

rainfall over the last two years. Rainfall has improved at 3R but remains below average in Minas Gerais. Small fires at both

properties did not result in economic damage and it is envisaged that fire insurance will offset the modest fire fighting costs

incurred. Small scale fertilisation and weed control programmes have been undertaken.

Although the Group is in discussions with buyers for both its Brazilian forests, as reported previously the market for timberland in

Brazil continues to be illiquid and there can be no certainty on the timing of when sales can be closed. Planning is underway to

commence harvesting as the crops mature from 2016 onwards, should the forests not be sold before this date.

Conclusion

Previously, under Cogent's management regime, valuations were based on the long term expectations for the individual forests, but

it is considered that a "held for sale" basis is more realistic given the Group's realisation strategy.

The portfolio continues to be managed to maximise shareholder return during this realisation process. Necessary investments in

the health and vigour of the forests continue to be made whilst at the same time seeking to minimise operating expenditures at the

properties.

Robert Rickman

Operations Manager

29 January 2015

3

Independent review report to Cambium Global Timberland Limited

We have been engaged by the Cambium Global Timberland Limited (the “Company”) to review the unaudited condensed

consolidated interim financial statements for the six months ended 31 October 2014 of the Company together with its subsidiaries

(together, the “Group”), which comprise the unaudited condensed consolidated interim statement of comprehensive income, the

unaudited condensed consolidated interim statement of financial position, the unaudited condensed consolidated interim statement

of changes in equity, the unaudited condensed consolidated interim statement of cash flows and the related explanatory notes.

We have read the other information contained in the interim report and considered whether it contains any apparent misstatements

or material inconsistencies with the information in the unaudited condensed consolidated interim financial statements.

This report is made solely to the company in accordance with the terms of our engagement as detailed in our letter of 10 December

2014. Our review has been undertaken so that we might state to the company those matters we are required to state to it in this

report and for no other purpose. To the fullest extent permitted by law, we do not accept or assume responsibility to anyone other

than the company for our review work, for this report, or for the conclusions we have reached.

Directors' responsibilities

The interim report and unaudited condensed consolidated interim financial statements are the responsibility of, and have been

approved by, the directors. The directors are responsible for preparing the interim report and the unaudited condensed

consolidated interim financial statements in accordance with the AIM Rules.

As disclosed in note 2, the annual financial statements of the Group are prepared in accordance with International Financial

Reporting Standards (“IFRSs”). The unaudited condensed consolidated interim financial statements included in this interim report

has been prepared in accordance with International Accounting Standard 34 Interim Financial Reporting.

Our responsibility

Our responsibility is to express to the Company a conclusion on the unaudited condensed consolidated interim financial statements

in the interim report based on our review.

Scope of review

We conducted our review in accordance with International Standard on Review Engagements (UK and Ireland) 2410 Review of

Interim Financial Information Performed by the Independent Auditor of the Entity issued by the Auditing Practices Board for use in

the United Kingdom. A review of interim financial information consists of making enquiries, primarily of persons responsible for

financial and accounting matters, and applying analytical and other review procedures. A review is substantially less in scope than

an audit conducted in accordance with International Standards on Auditing (UK and Ireland) and consequently does not enable us

to obtain assurance that we would become aware of all significant matters that might be identified in an audit. Accordingly, we do

not express an audit opinion.

Conclusion

Based on our review, nothing has come to our attention that causes us to believe that the unaudited condensed consolidated

interim financial statements for the six months ended 31 October 2014 are not prepared, in all material respects, in accordance with

International Accounting Standard 34 and AIM Rules.

Andrew P. Quinn

for and on behalf of KPMG Channel Islands Limited

Chartered Accountants

Jersey

29 January 2015

• The maintenance and integrity of the Cambium Global Timberland Limited website is the responsibility of the Directors; the work

carried out by KPMG Channel Islands Limited does not involve consideration of these matters. Accordingly, KPMG Channel Islands

Limited accept no responsibility for any changes that may have occurred to the financial statements or interim review report since

they were initially published on the website.

• Legislation in Jersey governing the presentation and dissemination of financial statements may differ from legislation in other

jurisdiction

4

Cambium Global Timberland Limited

Unaudited condensed consolidated interim statement of comprehensive income

For the six months ended 31 October 2014

Continuing operations

For the six

months ended

31 October 2014

Restated*

For the six

months ended

31 October 2013

Unaudited

Unaudited

Notes

£

£

Finance income

8

5,329

4,624

Finance costs

9

(3,169)

(1,638)

2,908

5,068

(4,001)

(1,015)

Net foreign exchange gains/(losses)

Net finance income/(costs)

(947,992)

(564,759)

(942,924)

(565,774)

4

23,303

74,002

15

290,609

-

3,15

(5,941,184)

(2,610,030)

Administrative expenses

5

(124,715)

(86,169)

Forestry management expenses

6

(60,644)

(106,261)

(758,182)

Administrative expenses

5

Loss for the period from continuing operations

Discontinued operations

Revenue

Profit on disposal of assets held for sale

Decrease in fair value of disposal groups held for sale, assets held for sale and

investment property and plantations

7

(569,718)

Increase in provision

21

(236,543)

(1,950,948)

Impairment of disposal group held for sale

15

(97,883)

(1,089,503)

(8,610)

(2,910,170)

(6,716,775)

(5,446,198)

Other operating forestry expenses

Operating loss from discontinued operations

Finance income

8

962

427

Finance costs

9

(183,621)

(131,926)

6,673

(175,986)

(5,774)

(137,273)

(6,892,761)

(5,583,471)

1,469,861

(5,422,900)

80,240

(5,503,231)

(6,365,824)

(6,069,005)

(763,910)

(763,910)

(5,343,054)

(5,343,054)

(7,129,734)

(11,412,059)

(6.23) pence

(5.94) pence

(0.92) pence

(0.55) pence

(5.31) pence

(5.39) pence

Net foreign exchange losses

Net finance costs

Loss before taxation from discontinued operations

Taxation credit

Loss for the period from discontinued operations

10

Total loss for the period

Other comprehensive income

Items that are or may be reclassified subsequently to profit or loss, net of tax

Foreign exchange losses on translation of discontinued foreign operations

Other comprehensive loss for the period

18

Total comprehensive loss for the period

Basic and diluted loss per share

11

Basic and diluted loss per share from

continuing operations

Basic and diluted loss per share from

discontinued operations

* See note 15

All losses from continuing and discontinued operations are attributable to the equity holders of the parent Company. There are no

minority interests.

The notes on pages 9 to 26 form an integral part of these unaudited condensed consolidated interim financial statements.

5

Cambium Global Timberland Limited

Unaudited condensed consolidated interim statement of financial position

At 31 October 2014

31 October

2014

30 April

2014

Unaudited

Audited

Notes

£

£

13

-

18,749,588

Non-current assets

Investment property

Plantations

13

-

16,678,494

Buildings, plant and equipment

14

-

183,823

35,611,905

15

28,106,145

10,404,052

Current assets

Assets held for sale

Trade and other receivables

16

90,412

215,737

Cash and cash equivalents

19

9,720,758

37,917,315

3,941,356

14,561,145

37,917,315

50,173,050

Total assets

Current liabilities

Liabilities held for sale

15

4,262,058

-

Bank loan

17

-

3,512,508

Trade and other payables

20

239,450

4,501,508

450,877

3,963,385

Non-current liabilities

Other payable

21

-

257,372

Provision

21

-

3,218,085

Deferred tax liabilities

10

-

2,188,667

5,664,124

Total liabilities

4,501,508

9,627,509

33,415,807

40,545,541

22

2,000,000

2,000,000

23

88,589,060

88,589,060

18,23

7,458,442

8,222,352

(64,631,695)

33,415,807

(58,265,871)

40,545,541

0.33

0.40

Net assets

Equity

Stated capital

Distributable reserve

Translation reserve

Retained loss

Total equity

Net asset value per share

12

These unaudited condensed consolidated interim financial statements were approved and authorised for issue on 29 January 2015

by the Board of Directors.

Donald Adamson

Chairman

Roger Lewis

Director

The notes on pages 9 to 26 form an integral part of these unaudited condensed consolidated interim financial statements.

6

Cambium Global Timberland Limited

Unaudited condensed consolidated interim statement of changes in equity

For the six months ended 31 October 2014

Share

Distributable

Translation

Retained

capital

reserve

reserve

loss

Total

£

£

£

£

£

2,000,000

88,589,060

8,222,352

(58,265,871)

40,545,541

Loss for the period

-

-

-

(6,365,824)

(6,365,824)

Other comprehensive loss

Foreign exchange losses on translation of

discontinued foreign operations (note 18)

Total comprehensive loss

-

-

(763,910)

(763,910)

(6,365,824)

(763,910)

(7,129,734)

2,000,000

88,589,060

7,458,442

(64,631,695)

33,415,807

Share

Distributable

Translation

Retained

capital

reserve

reserve

loss

Total

£

£

£

£

£

2,000,000

88,589,060

15,728,366

(45,960,926)

60,356,500

Loss for the period

-

-

-

(6,069,005)

(6,069,005)

Other comprehensive loss

Foreign exchange losses on translation of

discontinued foreign operations (note 18)

Total comprehensive loss

-

-

(5,343,054)

(5,343,054)

(6,069,005)

(867,788)

(11,412,059)

2,000,000

88,589,060

10,385,312

(52,029,931)

48,944,441

Unaudited

For the period 1 May 2014 to

31 October 2014

At 30 April 2014

Total comprehensive loss for the period

At 31 October 2014

Unaudited

For the period 1 May 2013 to

31 October 2013 (restated*)

At 30 April 2013

Total comprehensive loss for the period

At 31 October 2013

* See note 15

The notes on pages 9 to 26 form an integral part of these unaudited condensed consolidated interim financial statements.

7

Cambium Global Timberland Limited

Unaudited condensed consolidated interim statement of cash flows

For the six months ended 31 October 2014

For the six

months ended

31 October 2014

Restated*

For the six months

ended 31 October

2013

Unaudited

£

Unaudited

£

(6,365,824)

(6,069,005)

15

5,941,184

2,610,030

21

236,543

1,950,948

Note

Cash flows from operating activities

Loss for the period

Adjustments for:

Decrease in fair value of assets held for sale and investment property

and plantations

Increase in provision

7

-

623

Profit on disposal of assets held for sale

15

(290,609)

-

Impairment of disposal group held for sale

15

Depreciation

Net finance (income)/costs – continuing operations

Net finance costs – discontinued operations

Taxation credit

97,883

8,610

(5,068)

1,015

175,986

137,273

(1,469,861)

(80,240)

Increase in trade and other receivables

(117,049)

(80,266)

Decrease in trade and other payables

(153,817)

(589,710)

Tax paid

(1,950,632)

(98,211)

(2,110,722)

-

Net cash used in operating activities

(2,048,843)

(2,110,722)

15

11,407,692

-

15

(163,195)

11,244,497

(364,086)

(364,086)

Cash flows from investing activities – discontinued operations

Net proceeds from sale of assets held for sale

Costs capitalised to assets held for sale and investment property and

plantations

Net cash from/(used in) investing activities

Cash flows from financing activities

17

(3,512,508)

-

Finance income

8

6,291

5,051

Finance costs

Net cash used in financing activities

9

(186,790)

(3,693,007)

(133,564)

(128,513)

5,502,647

(2,603,321)

276,755

(86,458)

Repayment of bank loan – discontinued operations

Net increase/(decrease) in cash and cash equivalents

Foreign exchange movements

Balance at the beginning of the period

Balance at the end of the period

19

3,941,356

8,436,599

9,720,758

5,746,820

* See note 15

The notes on pages 9 to 26 form an integral part of these unaudited condensed consolidated interim financial statements.

8

Cambium Global Timberland Limited

Notes to the unaudited condensed consolidated interim financial statements

For the six months ended 31 October 2014

1. General information

The Company and its subsidiaries, including special purpose vehicles ("SPVs") controlled by the Company (together the "Group"),

own a global portfolio of forestry based properties which are managed on an environmentally and socially sustainable basis. Assets

are managed for timber production, with exposure to emerging environmental markets. As at the period end date, the Group owned

forestry assets located in Hawaii and Brazil.

The Company is a closed-ended company with limited liability, incorporated in Jersey, Channel Islands on 19 January 2007. The

address of its registered office is 26 New Street, St Helier, Jersey JE2 3RA.

These unaudited condensed consolidated interim financial statements (the “interim financial statements") were approved and

authorised for issue on 29 January 2015 and signed by Roger Lewis and Donald Adamson on behalf of the Board.

The Company is listed on AIM, a market of the London Stock Exchange. During the period the Company delisted from the Channel

Islands Securities Exchange (“CISE”).

2. Basis of preparation

The interim financial statements for the six months ended 31 October 2014 have been prepared in accordance with International

Accounting Standard (“IAS”) 34 "Interim Financial Reporting" and with applicable regulatory requirements of the AIM Rules. It does

not include all of the information required for full annual financial statements. The interim financial statements should be read in

conjunction with the Group’s annual report and financial statements for the year ended 30 April 2014, which were prepared in

accordance with International Financial Reporting Standards ("IFRS"). The comparative numbers used for the unaudited

condensed consolidated interim statement of comprehensive income, unaudited condensed consolidated interim statement of

changes in equity and unaudited condensed consolidated interim statement of cash flows are that of the period ended 31 October

2013, which is considered a comparable period as per IAS 34. The comparatives used in the unaudited condensed consolidated

statement of financial position are that of the previous financial year, 30 April 2014.

Except for the new accounting policies described below, the accounting policies applied by the Group in these interim financial

statements are the same as those applied by the Group in its financial statements as at and for the year ended 30 April 2014.

The interim financial statements have been prepared in Sterling, which is the presentational currency and functional currency of the

Company, and under the historical cost convention, except for investment property, plantations, buildings and assets and liabilities

held for sale, which are carried either at fair value, fair value less cost to sell or fair value less subsequent accumulated

depreciation and subsequent accumulated impairment loss.

The preparation of the financial statements requires Directors to make estimates and assumptions that affect the reported amounts

of revenues, expenses, assets and liabilities, and the disclosure of contingent liabilities at the date of the interim financial

statements. If in the future such estimates and assumptions, which are based on the Directors’ best judgement at the date of the

interim financial statements, deviate from actual circumstances, the original estimates and assumptions will be modified as

appropriate in the period in which the circumstances change.

In preparing the interim financial statements, the significant judgements made by management in applying the Group's accounting

policies and the key sources of estimation uncertainty were the same as those that applied to the financial statements as at, and for

the year ended, 30 April 2014. The main area of the interim financial statements where significant judgements have been made by

the Directors which has resulted in a significant change since the 30 April 2014 Annual Report is to account for the Group’s global

portfolio of forests on a held for sale basis under IFRS 5 ‘Non-current Assets Held for Sale and Discontinued Operations’. Details of

this change and the impact on the interim financial statements are disclosed below and in note 15.

The following exchange rates have been applied in these interim financial statements to convert foreign currency balances to

Sterling:

31 October 2014

31 October 2014

30 April 2014

31 October 2013

31 October 2013

closing rate

average rate

closing rate

closing rate

average rate

Australian Dollar

1.8182

1.8108

1.8167

1.6962

1.6582

Brazilian Real

3.9589

3.8048

3.7600

3.5880

3.4379

United States Dollar

1.5995

1.6657

1.6873

1.6040

1.5561

Going concern and assets and liabilities held for sale

On 30 November 2012, the Independent Directors announced the outcome of the strategic review initiated in June 2012. The

Directors proposed and recommended a change of investment policy with a view to implementing an orderly realisation of the

Group’s investments in a manner which maximises value for shareholders and returning surplus cash to shareholders over time

through ad hoc returns of capital. This proposal was approved by shareholders at an Extraordinary General Meeting (“EGM”) on 22

February 2013. There is no set period for the realisation of the portfolio, but the stated aim of the Directors is to complete the

process within 24 to 48 months of the date of that EGM.

Since the EGM, the portfolio has been reviewed by the Directors with a view to an orderly sale of the assets in such a manner as to

enable their inherent value to be realised. As part of this process, the assets in Georgia and Australia have been sold as at 31

October 2014 and the Directors have advanced plans in place to sell the remaining assets. As a result, as at 31 October 2014, the

portfolio of assets has been classified as held for sale (and its transactions for the period as discontinued operations) under IFRS 5

‘Non-current Assets Held for Sale and Discontinued Operations’, as disclosed in note 15.

9

Cambium Global Timberland Limited

Notes to the unaudited condensed consolidated interim financial statements (continued)

For the six months ended 31 October 2014

2. Basis of preparation (continued)

Going concern and assets and liabilities held for sale (continued)

As at the date of approval of these interim financial statements, the Directors have no intention to instigate a winding-up of the

Company, a course of action that would require the approval of shareholders. As a result, as at 31 October 2014 the assets and

liabilities of the Company pertaining to the Jersey operations have not been classified as held for sale and its operations continue

to be treated as continuing.

The Directors have reviewed the Group’s cash flow forecasts which cover the period to 31 July 2017 and estimate that the Group

has sufficient cash flow to cover a period of at least 12 months from the date of approval of these interim financial statements. On

this basis the interim financial statements have been prepared on a going concern basis.

New, revised and amended standards

At the date of authorisation of these interim financial statements, the following standards and interpretations, which have not been

applied in these interim financial statements, were in issue but not yet effective:

•

•

•

•

•

•

•

•

•

•

•

•

IAS 16 (amended), "Property, Plant and Equipment" (amendments effective for periods commencing on or after 1 January

2016);

IAS 19 (amended), "Employee Benefits" (amendments effective for periods commencing on or after 1 January 2016);

IAS 27 (amended), “Separate Financial Statements” (amendments effective for periods commencing on or after 1 January

2016);

IAS 28 (amended), “Investments in Associates and Joint Ventures” (amendments effective for periods commencing on or

after 1 January 2016);

IAS 38 (amended), “Intangible Assets” (amendments effective for periods commencing on or after 1 January 2016);

IAS 41 (amended), “Agriculture” (amendments effective for periods commencing on or after 1 January 2016);

IFRS 7 (amended), "Financial Instruments: Disclosures" (amendments effective for periods commencing on or after 1

January 2015);

IFRS 9, "Financial Instruments" (effective for periods commencing on or after 1 January 2018);

IFRS 10 (amended), "Consolidated Financial Statements" (amendments effective for periods commencing on or after 1

January 2016);

IFRS 11 (amended), "Joint Arrangements" (amendments effective for periods commencing on or after 1 January 2016);

IFRS 14, "Regulatory Deferral Accounts" (effective for periods commencing on or after 1 January 2016); and

IFRS 15, “Revenue from Contracts with Customers” (effective for periods commencing on or after 1 January 2017).

In addition, the IASB completed its Annual Improvements 2010-2012 Cycle, Annual improvements 2011-2013 Cycle and

September 2014 Annual Improvements to IFRS projects. These projects have amended a number of existing standards and

interpretations effective for accounting periods commencing on or after 1 July 2014 and 1 January 2016.

The Directors do not anticipate that the adoption of these standards in future periods will have a material impact on the financial

statements of the Group.

New accounting policies effective and adopted

The following new standards have been applied for the first time in these interim financial statements:

•

•

•

•

•

IAS 27 (amended) "Separate Financial Statements" (amendments effective for periods commencing on or after 1 January

2014);

IAS 32 (amended) "Financial Instruments: Presentation" (amendments effective for periods commencing on or after 1

January 2014);

IAS 36 (amended) “Impairment of Assets” (amendments effective for periods commencing on or after 1 January 2014);

IFRS 10, "Consolidated Financial Statements" (amendments effective for periods commencing on or after 1 January

2014); and

IFRS 12, "Disclosure of Interest in Other Entities" (amendments effective for periods commencing on or after 1 January

2014).

The adoption of these standards and amendments has had no material impact on the financial statements of the Group.

3. Operating segments

The Board of Directors is charged with setting the Company’s investment strategy in accordance with the Prospectus. The Board of

Directors, as the Chief Operating Decision Maker (”CODM”), has, until 16 October 2014, delegated the day to day implementation

of this strategy to its Investment Manager and, with effect from 16 October 2014, to its Operations Manager, but retains

responsibility to ensure that adequate resources of the Company are directed in accordance with its decisions. The investment

decisions of the Investment Manager and Operations Manager have been and are reviewed on a regular basis to ensure

compliance with the policies and legal responsibilities of the Board.

Whilst the Operations Manager may make the investment decisions on a day to day basis, any changes to the investment strategy,

major allocation decisions or any asset dispositions or material timber contracts have to be approved by the Board, even though

they may be proposed by the Operations Manager. The Board therefore retains full responsibility as to the major allocations

decisions made on an ongoing basis.

10

Cambium Global Timberland Limited

Notes to the unaudited condensed consolidated interim financial statements (continued)

For the six months ended 31 October 2014

3. Operating segments (continued)

The Operations Manager will always act under the terms of the Prospectus which cannot be radically changed without the approval

of the Board of Directors and shareholders. Details of the investment restrictions are set out in part 3 of the Admission Document

and the Investment Strategy, available on www.cambiumfunds.com.

As at 31 October 2014, the Group operates in five distinctly separate geographical locations, which the CODM has identified as one

non-operating segment, Jersey, and four operating segments. Timberlands are located in Hawaii and Brazil. Timberlands located in

North America and Australia were disposed of in the period. During the period, all four operating segments are classified as

discontinued operations (see note 15).

The accounting policies of each operating segment are the same as the accounting policies of the Group, therefore no

reconciliation has been performed.

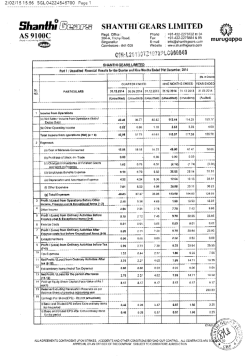

31 October 2014 (unaudited)

Jersey

£

Australia

£

North America

£

Hawaii

£

Brazil

£

Total

£

Assets and disposal groups held for

sale (note 15)

Other assets

-

-

-

4,698,030

23,408,115

28,106,145

6,266,791

1,172,524

1,974,930

106,825

290,100

9,811,170

Total assets

6,266,791

1,172,524

1,974,930

4,804,855

23,698,215

37,917,315

132,117

4,684

30,307

72,342

4,262,058

4,501,508

Jersey

£

Australia

£

North America

£

Hawaii

£

Brazil

£

Total

£

-

748,779

-

4,943,993

29,735,310

35,428,082

Total liabilities

30 April 2014 (audited)

Investment property and plantations

Assets held for sale (note 15)

-

-

10,404,052

-

-

10,404,052

Other assets

2,406,884

241,854

1,024,797

82,443

584,938

4,340,916

Total assets

2,406,884

990,633

11,428,849

5,026,436

30,320,248

50,173,050

Total liabilities

97,865

30,723

3,697,055

137,978

5,663,888

9,627,509

31 October 2014 (unaudited)

Jersey

£

Australia

£

North America

£

Hawaii

£

Brazil

£

Total

£

Segment revenue

-

11,505

7,558

-

4,240

23,303

Segment gross profit

Decrease in fair value of disposal

groups and assets held for sale

Forestry management expenses

-

11,505

7,558

-

4,240

23,303

-

4,970

21,999

(496,788)

6,454

(5,444,396)

27,221

(5,941,184)

60,644

Other operating forestry expenses

-

70,097

17,801

144,307

337,513

569,718

Jersey

£

Australia

£

North America

£

Hawaii

£

Brazil

£

Total

£

Segment revenue

-

15,077

49,517

-

9,408

74,002

Segment gross profit

(Decrease)/increase in fair value of

investment property and plantations

Forestry management expenses

-

15,077

49,517

-

9,408

74,002

-

(2,709,565)

17,428

652,643

58,123

(3,521,624)

3,519

2,968,516

27,191

(2,610,030)

106,261

Other operating forestry expenses

-

56,033

75,053

157,318

469,778

758,182

31 October 2013 (unaudited)

-

As at 31 October 2014, the Group owned six (30 April 2014: nine) distinct parcels of land across two (30 April 2014: four) main

geographical areas.

The majority of the revenues in the period ended 31 October 2014 arose from lease income received in Australia. In the period

ended 31 October 2013, the majority of the revenues arose from lease income received in North America.

11

Cambium Global Timberland Limited

Notes to the unaudited condensed consolidated interim financial statements (continued)

For the six months ended 31 October 2014

3. Operating segments (continued)

The Company’s investments will be realised in an orderly manner (that is, with a view to achieving a balance between returning

cash to shareholders and maximising value). In light of the realisation strategy, there will be no specific investment restrictions

applicable to the Company’s portfolio going forward.

This policy will involve a continuing evaluation of the portfolio in order to assess the most appropriate realisation strategy to be

pursued in relation to each investment. All assets related to the operating segments are being actively marketed and have been

reclassified in the current period as held-for-sale assets.

The strategy for realising individual investments will be flexible and may need to be altered to reflect changes in the circumstances

of a particular investment or in the prevailing market conditions. The Group will, in relation to each investment, seek to create

competition amongst a range of interested parties.

The net cash proceeds from realisations of assets will be applied to the payments of tax or other liabilities as the Board thinks fit

prior to making payments to shareholders.

4. Revenue

For the 6 months

ended 31 October

2014

Unaudited

£

For the 6 months

ended 31 October

2013

Unaudited

£

-

7,014

Lease income

19,063

63,979

Subsidies received

4,240

23,303

3,009

74,002

Sales - harvested timber and stumpage

The lease income arises mainly from hunting leases, which are for a term of two to three years. The income is recognised in the

period it relates to on an accruals basis.

5. Administrative expenses

For the 6 months

ended 31 October

2014

Unaudited

£

Restated*

For the 6 months

ended 31 October

2013

Unaudited

£

198,811

279,145

Directors' fees (note 26)

97,930

88,298

Auditor's fees

67,021

47,091

584,230

947,992

150,225

564,759

30,833

29,669

93,882

124,715

56,500

86,169

1,072,707

650,928

Continuing operations

Investment Manager's fees (note 26)

Professional & other fees

Discontinued operations

Professional & other fees

Administration of subsidiaries

Total administration expenses

Administration of subsidiaries includes statutory fees, accounting fees and administrative expenses in regard to the asset holding

subsidiaries.

* See note 15

12

Cambium Global Timberland Limited

Notes to the unaudited condensed consolidated interim financial statements (continued)

For the six months ended 31 October 2014

6. Forestry management expenses

Asset management fees

Appraisal fees

For the 6 months

ended 31 October

2014

Unaudited

£

For the 6 months

ended 31 October

2013

Unaudited

£

35,427

25,217

67,223

60,644

39,038

106,261

For the 6 months

ended 31 October

2014

Unaudited

£

For the 6 months

ended 31 October

2013

Unaudited

£

182,280

319,097

Property taxes

19,585

61,024

Lease payments

67,494

68,874

-

98,128

Repairs and maintenance

15,340

41,668

Trials, inventory and research

17,394

5,270

155,731

139,347

-

623

7. Other operating forestry expenses

Property management fees

Fertilisation

Pest control, forest protection and insurance

Depreciation

Selling and marketing expenses

Consultancy fees

Other

-

929

81,524

19,529

30,370

569,718

3,693

758,182

For the 6 months

ended 31 October

2014

Unaudited

£

For the 6 months

ended 31 October

2013

Unaudited

£

5,329

4,624

8. Finance income

Bank interest – continuing operations

Bank interest – discontinued operations

Total bank interest

962

427

6,291

5,051

For the 6 months

ended 31 October

2014

Unaudited

£

For the 6 months

ended 31 October

2013

Unaudited

£

3,169

1,638

3,169

1,638

21,303

114,426

160,111

14,244

9. Finance costs

Continuing operations

Other finance costs

Discontinued operations

Interest paid on bank loan

Loan fees

Other finance costs

Total finance costs

13

2,207

3,256

183,621

131,926

186,790

133,564

Cambium Global Timberland Limited

Notes to the unaudited condensed consolidated interim financial statements (continued)

For the six months ended 31 October 2014

10. Taxation

Taxation on profit on ordinary activities

The Group's tax credit for the period, which derives entirely from discontinued operations, comprises:

For the 6 months

ended 31 October

2014

Unaudited

£

For the 6 months

ended 31 October

2013

Unaudited

£

4,776

4,776

-

-

(225,436)

Brazil at 34%

(1,395,107)

1,008,251

United States at 15%-35%**

(79,530)

(1,474,637)

(863,055)

(80,240)

Tax credit

(1,469,861)

(80,240)

Current tax charge

Hungary at 19%

Deferred tax (credit)/charge

Australia at 30%

** Marginal corporate income taxes in the United States vary between 15% and 35% depending on the size of the profits.

For the 6 months

ended 31 October

2014

Unaudited

£

For the 6 months

ended 31 October

2013

Unaudited

£

Tax credit reconciliation

(942,924)

(565,774)

Loss for the period from discontinued operations before taxation

(6,892,761)

(5,583,471)

Total loss for the period before taxation

(7,835,685)

(6,149,245)

Tax credit using the average of the tax rates in the jurisdictions in which the Group operates

(2,351,942)

(1,773,407)

Loss for the period from continuing operations before taxation

Effects of:

Tax exempt income

(19,993)

(287,888)

Operating losses for which no deferred tax asset is recognised

676,019

1,306,257

Capital losses for which no deferred tax asset is recognised

556,819

849,702

Capital losses utilised

(91,702)

-

(239,062)

(1,469,861)

(174,904)

(80,240)

Other temporary differences

Tax credit for the period

The average tax credit rate is a blended rate calculated using the weighted average applicable tax rates of the jurisdictions in which

the Group operates. The average of the tax rates in the jurisdictions in which the Group operates in the period was 30.02% (2013:

28.84%).The effective tax rate in the period was 18.76% (2013: 1.30%).

At the period end date, the Group has unused operational and capital tax losses. No deferred tax asset has been recognised in

respect of these losses due to the unpredictability of future taxable profits and capital gains available against which they can be

utilised.

14

Cambium Global Timberland Limited

Notes to the unaudited condensed consolidated interim financial statements (continued)

For the six months ended 31 October 2014

10. Taxation (continued)

Operational tax losses for which deferred tax assets have not been recognised in the financial statements

For the 6 months

ended 31 October

2014

Unaudited

£

Balance at beginning of the period/year

Adjustments in respect of prior years

Current period/year operating losses for which no deferred tax asset is recognised

Exchange movements

Balance at the end of the period/year

For the

year ended

30 April 2014

Audited

£

12,805,832

15,789,924

-

(2,999,779)

1,194,812

1,790,968

(38,614)

13,962,030

(1,775,281)

12,805,832

Accumulated operating losses at the period end in the table above relate entirely to discontinued operations (30 April 2014:

£3,830,181). The value of deferred tax assets not recognised in respect of these operational losses amounted to £4,563,013 (30

April 2014: £4,173,144), all of which (30 April 2014: £1,302,261) related to discontinued operations.

Accumulated operating losses from continuing operations at the period end amounted to £29,239,724. No deferred tax assets

arose in respect of these losses.

At the period end the Group had accumulated capital losses of £13,228,938 (30 April 2014: £12,691,097), all of which (30 April

2014: £2,468,546) related to discontinued operations. The value of deferred tax assets not recognised in regard to these capital tax

losses amounted to £4,288,062 (30 April 2014: £4,044,974), all of which (30 April 2014: £839,306) related to discontinued

operations.

Deferred taxation

The following are the significant deferred tax liabilities and assets recognised by the Group and movements thereon:

Assets

Liabilities

Net balance

2014

2014

2014

31 October 2014 (unaudited)

£

£

£

Balance at the beginning of the period

-

(2,188,667)

(2,188,667)

Movement in fair value of disposal groups and assets held for sale

-

1,474,637

1,474,637

Total movements for the period

Exchange differences

-

1,474,637

50,694

1,474,637

50,694

Balance at the end of the period *

-

(663,336)

(663,336)

Assets

Liabilities

Net balance

Movements

2014

2014

2014

30 April 2014 (audited)

£

£

£

Balance at the beginning of the year

-

(2,846,672)

(2,846,672)

Increase in fair value of investment property and plantations

-

297,123

297,123

Total movements for the year

-

297,123

297,123

Exchange differences

Balance at the end of the year

-

360,882

(2,188,667)

360,882

(2,188,667)

Movements

* The deferred tax liability, which forms part of the Brazil disposal group, has, at the period end date, been reclassified in these

financial statements as a liability held for sale (see note 15).

15

Cambium Global Timberland Limited

Notes to the unaudited condensed consolidated interim financial statements (continued)

For the six months ended 31 October 2014

11. Basic and diluted loss per share

The calculation of the basic and diluted loss per share is based on the following data:

For the 6 months

ended 31 October

2014

Unaudited

£

Restated*

For the 6 months

ended 31October

2013

Unaudited

£

(6,365,824)

(6,069,005)

(942,924)

(565,774)

(5,422,900)

(5,503,231)

31 October

2014

Unaudited

31 October

2013

Unaudited

Issued shares brought forward and carried forward (note 22)

Weighted average number of shares in issue during the period

102,130,000

102,130,000

102,130,000

102,130,000

Basic and diluted loss per share

(6.23) pence

(5.94) pence

Basic and diluted loss per share from continuing operations

(0.92) pence

(0.55) pence

Basic and diluted loss per share from discontinued operations

(5.31) pence

(5.39) pence

Loss for the purposes of basic and diluted earnings per share being net loss for the period

Loss for the purposes of basic and diluted earnings per share being net loss for the period

from continuing operations

Loss for the purposes of basic and diluted earnings per share being net loss for the period

from discontinued operations

Weighted average number of shares

* See note 15

12. Net asset value

Total assets

Total liabilities

Net assets

Number of shares in issue (note 22)

Net asset value per share

31 October

2014

Unaudited

£

30 April

2014

Audited

£

37,917,315

4,501,508

50,173,050

33,415,807

9,627,509

40,545,541

102,130,000

102,130,000

0.33

0.40

13. Investment property and plantations

Total

Investment

timber

Premerchantable

timber

plantations

property

Total

£

£

£

£

£

4,943,992

11,734,502

16,678,494

18,749,588

35,428,082

(4,943,992)

-

(11,734,502)

-

(16,678,494)

-

(18,749,588)

-

(35,428,082)

-

Merchantable

31 October 2014 (unaudited)

Fair value as at 1 May 2014

Reclassification to disposal groups and

assets held for sale (note 15)

Fair value as at 31 October 2014

Total

Investment

timber

Premerchantable

timber

plantations

property

Total

£

£

£

£

£

Fair value as at 1 May 2013

13,600,377

17,224,668

30,825,045

28,494,485

59,319,530

Capitalised costs

13,600,377

364,086

17,588,754

364,086

31,189,131

28,494,485

364,086

59,683,616

(3,409,705)

(1,185,076)

(4,594,781)

1,984,751

(2,610,030)

(328,912)

9,861,760

(2,088,268)

14,315,410

(2,417,180)

24,177,170

(3,201,676)

27,277,560

(5,618,856)

51,454,730

Merchantable

31 October 2013 (unaudited)

Fair value (losses)/gains on land and

plantations

Foreign exchange effect

Fair value as at 31 October 2013

No harvested timber was held at the end of the period (30 April 2014: nil).

16

Cambium Global Timberland Limited

Notes to the unaudited condensed consolidated interim financial statements (continued)

For the six months ended 31 October 2014

13. Investment property and plantations (continued)

The Group engages external independent professional valuers to determine the fair values of the investment properties and

plantations on a six-monthly basis. The Group’s policy is to change the valuer of each property at least every three years.

The land and plantations are carried at their fair values as at 31 October 2014, as measured by external independent valuers

TerraSource Valuation LLC, Consufor Advisory & Research and Chandler Fraser Keating Limited. Each of the valuers uses similar

methodologies, though this can vary depending on the type of investment and local practices. The fair value measurements of

investment properties and plantations have been categorised as Level 3 fair values based on the inputs to the valuation techniques

used.

A commentary on the factors affecting the fair value of the land and plantations during the period is contained in the Operations

Manager’s Report on page 3.

The following tables show the valuation techniques used in measuring the fair values of investment properties and plantations, now

included in note 15, as well as the significant unobservable inputs used and their effects on the fair value measurements as at 31

October 2014:

Brazil – 3R Tocantins

Valuation technique

The 3R Tocantins property in Brazil was

valued by Consufor Advisory & Research.

Desktop valuations were carried out at 31

October 2014 and at 31 October 2013. A

full valuation was carried out at 30 April

2014. A desktop valuation does not include

a physical inspection of the property by the

valuer, however in the opinion of the

Directors, carrying out a full valuation as at

31 October 2014, as opposed to a desktop

valuation, would not have resulted in a

material difference in valuation. The

valuation method applied for the bare land

appraisal was the sales comparison

approach. The analysis considered the

bare land price from comparable

transactions, soil quality, topography of the

land, access and distance from cities and

the proportion of the property which could

be used for cultivation. Planted forests up

to 1 year old are valued using the

replacement cost method, however as at

31 October 2014 the property contained no

such forests. For the planted forests over 1

year old, the discounted cash flow method

was used to determine value. This method

considers the present value of the net cash

flows expected to be generated by the

plantation at maturity, the expected

additional biological transformation and the

risks associated with the asset; the

expected net cash flows are discounted

using a risk-adjusted discount rate. The

methodology used in the current period is

the same as that used at 30 April 2014 and

31 October 2013. There is a security

interest over this property, the details of

which are disclosed in note 21.

Significant unobservable inputs

• Comparable land sales prices per

hectare (BRL 2,400-BRL 5,500) (30

April 2014: BRL 2,310-BRL 5,074)

3

• Estimated future log prices per m ,

being standing prices with the buyer

absorbing all the costs of harvesting

and haulage (BRL 35.2-BRL 52.0,

national weighted average BRL 45.1)

(30 April 2014: BRL 31.6-BRL 50.0,

national weighted average BRL 46.0)

• Estimated future overhead costs per

planted hectare (BRL 190.0) (30 April

2014: BRL 190.0)

3

• Estimated yields in m per hectare per

year (20.0-30.0) (30 April 2014: 22.535.0)

• Estimated land opportunity costs per

planted hectare (BRL 160.0) (30 April

2014: BRL 160.0)

• Estimated total establishment costs per

hectare (BRL 7,115) (30 April 2014:

BRL 7,115)

• Risk-adjusted discount rate (9.0%) (30

April 2014: 8.69%)

• Estimate of costs to sell plantations

(5%) (30 April 2014: 2%)

17

Inter-relationship between key

unobservable inputs and fair value

measurement

The estimated fair value would

increase/(decrease) if:

• comparable land sales prices

were higher/(lower)

• estimated log prices were

higher/(lower)

• estimated future overhead costs

were lower/(higher)

• estimated yields were

higher/(lower)

• estimated land opportunity costs

were lower/(higher)

• estimated establishment costs

were lower/(higher)

• the risk-adjusted discount rate

were lower/(higher)

• estimated costs to sell

plantations were lower/(higher)

Cambium Global Timberland Limited

Notes to the unaudited condensed consolidated interim financial statements (continued)

For the six months ended 31 October 2014

13. Investment property and plantations (continued)

Brazil – Minas Gerais

Valuation technique

The three properties in Minas Gerais in

Brazil were valued by TerraSource

Valuation LLC. Desktop valuations were

carried out at 31 October 2014, 30 April

2014 and 31 October 2013, updating a full

valuation carried out at 30 April 2013. A

desktop valuation does not include a

physical inspection of the property by the

valuer, however in the opinion of the

Directors, carrying out a full valuation as at

31 October 2014, as opposed to a desktop

valuation, would not have resulted in a

material difference in valuation. The

valuation method applied at 31 October

2014, 30 April 2014 and at 31 October

2013 was a combination of the cost

approach and the income approach, with a

weighting of 75:25 in favour of the latter.

The cost approach consists of summation

of several elements, usually including bare

land,

pre-merchantable

timber

and

merchantable timber. The bare land

component is valued using the comparable

sales method. Timber is treated as an

improvement, and is valued by comparing

it with open market stumpage sales of

similar timber. The income approach is

based upon a valuation model: current land

value is derived using the comparable

sales method plus timber value derived

using discounted cash flow analysis. The

discounted cash flow analysis considers

the present value of the net cash flows

expected to be generated by the plantation

at maturity, the expected additional

biological transformation and the risks

associated with the asset; the expected net

cash flows are discounted using a riskadjusted discount rate.

Significant unobservable inputs

• Land value per hectare (BRL 1,742BRL 4,269) (30 April 2014: BRL

2,235-BRL 4,752)

3

• Estimated future log prices per m ,

being standing prices with the buyer

absorbing all the costs of harvesting

and haulage (BRL 48.5) (30 April

2014: BRL 53.5-BRL 55.5)

• Estimated future overhead costs per

planted hectare (BRL 117.0) (30

April 2014: BRL 122.1)

3

• Estimated yields in m per hectare

per year (30.0-35.0) (30 April 2014:

35.0-40.0)

• Estimated land opportunity costs per

planted

hectare

per

annum,

assuming no real land appreciation

(BRL 150.0) (30 April 2014: BRL

171.1)

• Risk-adjusted discount rate (9.0%)

(30 April 2014: 9.0%)

• Estimate of costs to sell plantations

(5%) (30 April 2014: 2%)

18

Inter-relationship between key

unobservable inputs and fair value

measurement

The estimated fair value would

increase/(decrease) if:

• land values were higher/(lower)

• estimated

log

prices

were

higher/(lower)

• estimated future overhead costs

were lower/(higher)

• estimated yields were higher/(lower)

• estimated land opportunity costs

were lower/(higher)

• the risk-adjusted discount rate were

lower/(higher)

• estimated costs to sell plantations

were lower/(higher)

Cambium Global Timberland Limited

Notes to the unaudited condensed consolidated interim financial statements (continued)

For the six months ended 31 October 2014

13. Investment property and plantations (continued)

Hawaii

Valuation technique

The properties in Hawaii, Pahala and

Pinnacle, are leasehold interests without

any ownership of the underlying land.

Valuations have been prepared on the

assumption that these leases will be

renewed on their expiry in 2015, and that

the Group is able to secure access to the

port. These investments were valued by

Chandler Fraser Keating Limited (“CFKL”)

in accordance with IFRS. Desktop

valuations were carried out by CFKL at 31

October 2014, 30 April 2014 and 31

October 2013, augmented by a limited

inspection of the forests at the time of the

31 October 2013 valuation. In the opinion

of the Directors, carrying out a full valuation

as at 31 October 2014, as opposed to a

desktop valuation, would not have resulted

in a material difference in valuation. For

these valuations the discounted cash flow

method was used. This method considers

the present value of the net cash flows

expected to be generated by the plantation.

The cash flow projections include specific

estimates for 8 years. The expected net

cash flows are discounted using a riskadjusted discount rate. The methodology

used in the current period is the same as

that used at 30 April 2014 and 31 October

2013.

Significant unobservable inputs

3

• Estimated future log prices per m ,

being domestic log prices of timber

delivered to mill or ports (US$47.75US$63.71) (30 April 2014:

US$42.41-US$69.29)

• Estimated future indirect costs per

hectare per year (US$33.5US$38.5) (30 April 2014: US$99.0US$101.1)

• Estimated future logging costs per

3

m (US$22.06-US$42.55) (30 April

2014: US$22.06-US$42.55)

3

• Estimated yields in m per hectare

(260-510) (30 April 2014: 55-675)

and estimated mix of grade quality

• Estimated future transportation

3

costs per m (US$11.88-US$27.67)

(30 April 2014: US$11.88US$27.67)

• Estimated road construction and

3

maintenance costs per m

(US$1.50-US$4.94) (30 April 2014:

US$1.50-US$4.94)

• Risk-adjusted discount rate (9.5%)

(30 April 2014: 9.5%)

• Estimate of costs to sell plantations

(5%) (30 April 2014: 3%)

• Development costs per hectare

(US$750) (30 April 2014: US$750))

• Availability of a suitable domestic,

and where applicable, global market

for the logs

Inter-relationship between key

unobservable inputs and fair value

measurement

The estimated fair value would

increase/(decrease) if:

• the estimated log prices were

higher/(lower)

• the estimated indirect costs were

lower/(higher)

• the estimated logging costs were

lower/(higher)

• the estimated yields were

higher/(lower) and the estimated

average grade quality were

higher/(lower)

• the estimated transportation costs

were lower/(higher)

• the estimated road construction

costs were lower/(higher)

• the risk-adjusted discount rate were

lower/(higher)

• estimated costs to sell plantations

were lower/(higher)

• development costs were

lower/(higher)

• domestic and/or global demand for

the logs were higher/(lower)

The Group is exposed to a number of risks related to its plantations:

Regulatory and environmental risks

The Group is subject to laws and regulations in various countries in which it operates. The Group has established environmental

policies and procedures aimed at compliance with local environmental and other laws. Management performs regular reviews to

identify environmental risks and to ensure that the systems in place are adequate to manage those risks.

Supply and demand risk

The Group is exposed to risks arising from fluctuations in the price and sales volume of trees. Management performs regular

industry trend analyses to ensure that the Group’s pricing structure is in line with the market and to ensure that projected harvest

volumes are consistent with the expected demand.

Climate and other risks

The Group’s plantations are exposed to the risk of damage from climatic changes, diseases, forest fires and other natural forces.

The Group has processes in place aimed at monitoring and mitigating those risks, including regular forest health inspections and

industry pest and disease surveys.

19

Cambium Global Timberland Limited

Notes to the unaudited condensed consolidated interim financial statements (continued)

For the six months ended 31 October 2014

14. Buildings, plant and equipment

31 October 2014 (unaudited)

Cost brought forward

Accumulated depreciation brought forward

Balance as at 1 May 2014

Movements

Reclassification to assets held for sale

(note 15)

Carrying value

Balance as at 31 October 2014

31 October 2013 (unaudited)

Cost brought forward

Accumulated depreciation brought forward

Balance as at 1 May 2013

Movements

Impairment - charged to statement of

comprehensive income

Furniture and

fittings

£

Buildings

£

Improvements

£

Motor vehicles

£

Total

£

1,513

199,680

7,640

14,977

223,810

(1,106)

407

(26,385)

173,295

(3,741)

3,899

(8,755)

6,222

(39,987)

183,823

(407)

(407)

(173,295)

(173,295)

(3,899)

(3,899)

(6,222)

(6,222)

(183,823)

(183,823)

-

-

-

-

-

Furniture

and fittings

£

Buildings

£

Improvements

£

Motor

vehicles

£

Total

£

1,830

217,184

4,730

18,168

241,912

(1,046)

784

217,184

4,730

(9,543)

8,625

(10,589)

231,323

-

(8,610)

-

-

(8,610)

Depreciation for the period

(132)

-

-

(491)

(623)

Foreign exchange effect

(99)

(231)

(27,284)

(35,894)

(554)

(554)

(998)

(1,489)

(28,935)

(38,168)

553

181,290

4,176

7,136

193,155

Carrying value

Balance as at 31 October 2013

15. Disposal groups and assets held for sale and discontinued operations

During the period, the Group sold land and plantations in two tracts in the state of Georgia and land in Tarrangower, Australia,

realising a profit of £290,609. The Group also undertook an active marketing process and implemented a disposal plan to locate

buyers for the remaining assets in Brazil and Hawaii. The assets and liabilities of the Australia, Hawaii and Brazil segments were

not previously classified as held for sale or as discontinued operations. The comparative condensed consolidated statement of

comprehensive income and the condensed consolidated statement of cash flows have been restated to show the discontinued

operations separately from continuing operations.

The assets in Brazil are likely to be sold through a disposal of the entities owning the assets. Accordingly, as at 31 October 2014,

the Group’s Brazil segment is presented as a disposal group held for sale. The Group’s accounting policy for a disposal group held

for sale is the same as the accounting policy for assets held for sale in the Group’s financial statements for the year ended 30 April

2014.

The Brazil disposal group comprises the following assets and liabilities held for sale:

Investment property and plantations

Assets

held for sale

Liabilities

held for sale

£

£

31 October

2014

Unaudited

£

23,165,741

-

23,165,741

242,374

-

242,374

Deferred tax liability

-

663,336

(663,336)

Provisions

-

3,283,740

(3,283,740)

23,408,115

314,982

4,262,058

(314,982)

19,146,057

Trade and other receivables

Trade and other payables

20

Cambium Global Timberland Limited

Notes to the unaudited condensed consolidated interim financial statements (continued)

For the six months ended 31 October 2014

15. Disposal groups and assets held for sale and discontinued operations (continued)

An impairment loss of £97,883 has been recognised in the unaudited condensed consolidated statement of comprehensive income

writing down the carrying amount of the disposal group to its estimated net realisable value, being fair value less costs to sell. The

impairment loss presented in the statement of comprehensive income has been applied to reduce the carrying amount of buildings,

plant and equipment within the disposal group to zero. A loss of £1,104,175 related to the disposal group, representing foreign

exchange translation of discontinued operations, is included in other comprehensive income (see note 18).

The plantations in Hawaii are likely to be sold as asset sales and are therefore presented as assets held for sale with a combined

carrying value of £4,698,030.

Total assets held for sale in the statement of financial position are as follows:

31 October 2014

Unaudited

£

30 April 2014

Audited

£

Balance brought forward

10,404,052

-

Reclassified from investment property and plantations (note 13)

35,428,082

12,348,580

Reclassified from buildings, plant and equipment (note 14)

183,823

-

Capitalised costs of assets held for sale

163,195

-

Reclassified from trade and other receivables

242,374

-

Proceeds of disposals of assets held for sale

(11,665,842)

-

290,609

Profit on disposal of assets held for sale

Decrease in the fair value of disposal groups and assets held for sale

Impairment of disposal groups

Foreign exchange effect

Assets held for sale by region

(5,941,184)

(1,014,837)

(97,883)

-

(901,081)

28,106,145

(929,691)

10,404,052

31 October 2014

Unaudited

£

30 April 2014

Audited

£

-

10,404,052

Brazil

23,408,115

-

Hawaii

4,698,030

28,106,145

10,404,052

North America

The fair value measurement of £28,106,145 has been categorised as a Level 3 fair value based on the appraised fair values of the

investment property and the appraised fair values of the plantations less costs to sell. These assets were measured using the

comparable sales method (for the investment property) and the discounted cash flow basis (for the plantations). The fair value of

other assets and liabilities within the disposal group is not significantly different from their carrying amounts.

21

Cambium Global Timberland Limited

Notes to the unaudited condensed consolidated interim financial statements (continued)

For the six months ended 31 October 2014

15. Disposal groups and assets held for sale and discontinued operations (continued)

Net cash flows attributable to the discontinued operations were as follows:

For the period

ended

31 October

2014

Unaudited

£

For the period

ended

31 October

2013

Unaudited

£

(6,892,761)

(5,583,471)

Operating activities

Loss for the year before taxation

Adjustments for:

Profit on disposal of assets held for sale

Decrease in fair value of disposal groups, assets held for sale and

investment property and plantations

(290,609)

-

5,941,184

2,610,030

Impairment of disposal groups and buildings, plant and equipment

97,883

8,610

236,543

1,950,948

-

623

Increase in provisions

Depreciation

Net finance costs

182,659

131,499

Increase in trade and other receivables

(79,534)

(67,963)

(188,069)

(591,533)

Taxation paid

Net cash used in operating activities

Net cash from/(used in) investing activities (sales proceeds of assets held for sale and capitalised

costs)

(98,211)

(1,090,915)

(1,541,257)

11,244,497

(364,086)

Net cash used in financing activities (net finance costs and repayment of bank loan)

(3,693,007)

(131,499)

271,512

6,732,087

(76,879)

(2,113,721)

31 October 2014

Unaudited

30 April 2014

Audited

£

£

Decrease in trade and other payables

Foreign exchange movements

Net cash flow for the period

16. Trade and other receivables

35,465

135,054

Trade receivables

-

23,698

Prepaid expenses

54,947

90,412

56,985

215,737

31 October 2014

Unaudited

30 April 2014

Audited

£

£

-

3,512,508

Goods and services tax receivable

17. Bank borrowings

Metropolitan Life Insurance Company (“Metropolitan Life”)

The loan was secured on approximately 15,100 acres of timber and timberland assets located in two tracts in the state of Georgia.

Following the disposal of these assets during the period, the loan was repaid in full.

22

Cambium Global Timberland Limited

Notes to the unaudited condensed consolidated interim financial statements (continued)

For the six months ended 31 October 2014

18. Foreign exchange effect

The translation reserve movement in the period, all of which was derived from discontinued operations, has arisen as follows:

Exchange

rate at

31 October

2014

31 October 2014

Exchange

rate at

30 April

2014

Translation

reserve

movement

Unaudited

Australian Dollar

1.8182

1.8167

(7,908)

Brazilian Real

3.9589

3.7600

(1,104,175)

United States Dollar

1.5995

1.6873

348,173

(763,910)

Exchange rate

at 31 October 2013

Exchange rate

at 30 April 2013

Translation

reserve

movement

Unaudited

Australian Dollar

1.6962

1.4976

(540,998)

Brazilian Real

3.5880

3.1082

(4,284,734)

United States Dollar

1.6040

1.5532

(517,322)

(5,343,054)

31 October 2014

Unaudited

£

30 April 2014

Audited

£

Cash held at bank

7,776,689

3,052,251