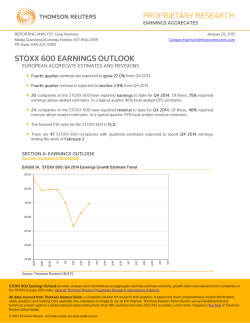

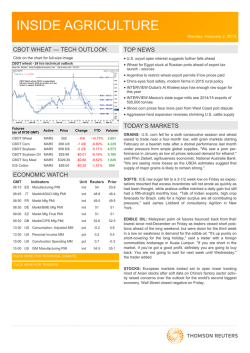

Conference call transcript