INSIDE AGRICULTURE

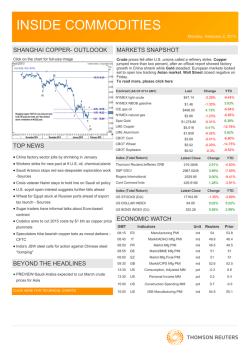

INSIDE AGRICULTURE Monday, February 2, 2015 CBOT WHEAT — TECH OUTLOOK TOP NEWS Click on the chart for full-size image U.S. soyoil open interest suggests further falls ahead Wheat for Egypt stuck at Russian ports ahead of export tax launch - sources Argentina to restrict wheat export permits if low prices paid China eyes food safety, modern farms in 2015 rural policy INTERVIEW-Dubai's Al Khaleej says has enough raw sugar for this year INTERVIEW-Mexico's state sugar mills see 2014/15 exports of 500,000 tonnes Illinois corn prices face more pain from West Coast port dispute Aggressive herd expansion reverses shrinking U.S. cattle supply Futures (as of 0730 GMT) Active Price Change YTD Volume CBOT Wheat MAR5 502 - 6/8 -14.75% 2,651 CBOT Corn MAR5 368 4/8 -1 4/8 -6.80% 4,229 CBOT Soybean MAR5 958 6/8 -2 2/8 -5.71% 4,573 CBOT Soybean Oil MAR5 $29.99 -$0.01 -6.16% 5,760 CBOT Soy Meal MAR5 $329.30 -$0.60 -9.52% 1,645 ICE Cotton MAR5 $59.04 -$0.32 -1.51% 859 ECONOMIC WATCH GMT Indicators Unit Reuters Prior 08:15 ES Manufacturing PMI ind 54 53.8 08:45 ind 48.8 48.4 08:50 FR Markit Mfg PMI ind 49.5 49.5 08:55 DE Markit/BME Mfg PMI ind 51 51 09:00 EZ Markit Mfg Final PMI ind 51 51 09:30 GB Markit/CIPS Mfg PMI ind 52.6 52.5 13:30 US Consumption, Adjusted MM pct -0.2 0.6 13:30 US Personal Income MM pct 0.2 0.4 15:00 US Construction Spending MM pct 0.7 -0.3 15:00 US ISM Manufacturing PMI ind 54.5 55.1 IT Markit/ADACI Mfg PMI CLICK HERE FOR TECHNICAL CHARTS TODAY’S MARKETS GRAINS: U.S. corn fell for a sixth consecutive session and wheat eased to trade near a four-month low, with grain markets starting February on a bearish note after a dismal performance last month under pressure from ample global supplies. "We saw a poor performance in January as low oil prices reduced demand for ethanol," said Phin Ziebell, agribusiness economist, National Australia Bank. "We are seeing more losses as the USDA estimates suggest that supply of major grains is likely to remain strong." SOFTS: ICE raw sugar fell to a 2-1/2 week low on Friday as expectations mounted that excess inventories will not erode as quickly as had been thought, while arabica coffee notched a daily gain but still had a fifth-straight monthly loss. "Talk of Indian exports, high crop forecasts for Brazil, calls for a higher surplus are all contributing to pressure," said James Liddiard of consultancy Agrilion in New York. EDIBLE OIL: Malaysian palm oil futures bounced back from their lowest since mid-December on Friday as traders closed short positions ahead of the long weekend, but were down for the third week in a row on weakness in demand for the edible oil. "It's up purely on short-covering for the long holiday," said a trader with a foreign commodities brokerage in Kuala Lumpur. "If you are short in the market, if you’ve got a good profit, definitely you are going to buy back. You are not going to wait for next week until Wednesday," the trader added. CLICK HERE FOR TENDERS STOCKS: European markets looked set to open lower tracking most of Asian stocks after soft data on China's factory sector activity raised concerns over the outlook for the world's second biggest economy. Wall Street closed negative on Friday. INSIDE AGRICULTURE February 2, 2015 TOP NEWS U.S. soyoil open interest suggests further falls ahead Wheat for Egypt stuck at Russian ports ahead of export tax launch - sources U.S. soyoil futures are likely to test recent six-year lows next week after investors extended bearish bets in a surge of trading after a policy decision that could boost Argentina's exports to the United States. Open interest in soyoil on Thursday expanded to 401,410 contracts, the most since mid-November, as prices tumbled to 29.32 cents per lb, the lowest levels since February 2009, CME Group data showed on Friday. Trading volume on Wednesday of 178,984 soyoil contracts was the most in nearly a year, the CME Group said. Open interest can be an indicator that investors are making short bets, or buying with the expectation prices will fall. Longhenry, who is not short soyoil after squaring his books before Friday, the final trading day in January, said prices could test 28 cents per lb - a level last seen in December 2008. Several vessels loading tens of thousands of tonnes of wheat for the state buyer of Egypt, the world's largest wheat importer, are stuck in Russia's Black Sea ports ahead of the launch of an export tax in Moscow, trade sources said. After the rouble's slump against the dollar spurred grain exports, driving up domestic prices, the Russian government was forced to curb exports with informal limits and announced an export tax that will come into force on Feb. 1. Due to the informal curbs, these supplies for Egypt's state grain buyer, the General Authority for Supply Commodities (GASC), have already missed deadlines of previously agreed contracts, but traders can not change the origin of supply. The tax, or a duty on wheat exports, will amount to 15 percent of the customs price plus 7.5 euros and will be no less. China eyes food safety, modern farms in 2015 rural policy Argentina to restrict wheat export permits if low prices paid Wheat exporters who buy the grain from Argentina's farmers will not be issued permits if they pay the growers significantly less than the international price for the crop, the government said on Friday. The announcement, by Economy Minister Axel Kicillof, followed complaints by local producers that government restrictions on wheat exports artificially suppressed local prices. The government said the quotas are to make sure local consumer prices are fair. "We will only give export permits when the price that these exporters pay the producer is near to the international price," Kicillof told journalists after a meeting with a leading farmers' association. Relations between farmers and two-term President Cristina Fernandez have been severely strained since massive farm protests six years ago over her tax policies. Leading grains exporters operating in Argentina include Bunge Ltd, Cargill Inc and Louis Dreyfus Commodities BV. "We understand that exporters are paying between 900-1,000 pesos per tonne of wheat while the selling price abroad is between 1,250-1,500 pesos per tonne," Kicillof said. China has listed food safety and modernising farms as among key priorities this year, its 2015 rural policy outline showed, as it tackles falling agricultural productivity that has raised concerns about its future food supply. The "number one document", issued every January and released by state news agency Xinhua on Sunday, showed China will also protect farmland and lend more to farmers to narrow a wealth gap between rural and urban areas. Attempts to clean up land that has been damaged by heavy metal mining and processing will be widened this year, and "permanent farmland" that is off-limit to industrial and urban development will be created, the document said. Modern farms will be set up, and regulation of the quality of food and other farm products will be enhanced, it said. On land reforms, aimed at allowing farmers to trade their land to alleviate poverty and create bigger and more efficient farms, the document said the focus is on expanding an experiment that registers land usage rights to cover entire provinces. INTERVIEW-Dubai's Al Khaleej says has enough raw sugar for this year Nine state-run Mexican sugar mills that produce 20 percent of the country's sugar expect to export around 500,000 tonnes in the current 2014/15 season, a similar level to last cycle, the director of the fund that administers the mills said on Friday. Carlos Rello, the director of the FEESA fund, also said 60,000 tonnes had been exported in January through sugar trader Sucres & Denrees (Sucden). "These have just gone out to the global market," Rello said in an interview, adding that 31,500 tonnes went to Morocco and 28,500 tonnes to a refinery in Canada. Rello said FEESA expects to produce 1.4 million tonnes in the current cycle, a figure similar to the previous cycle. Mexico expects to produce 6.15 million tonnes in the current harvest, according to government data. This cycle, however, Mexico's sugar producers, which have traditionally exported their sugar to the United States, will have to find new markets after their access to the U.S. market has been limited due to a trade spat. INTERVIEW-Mexico's state sugar mills see 2014/15 exports of 500,000 tonnes Dubai's Al Khaleej Sugar Refinery has 1.5 million tonnes of raw sugar, either stockpiled at the refinery or on its way to the refinery, enough to meet its demand until the end of 2015, Jamal Al Ghurair, managing director of the refinery, said on Sunday. "Currently we don't need to import anything. It depends on the price as we have enough stocks. It can take us until the end of this year," Ghurair told Reuters in an interview at the Kingsman Platts Dubai Sugar Conference. The origin of the sugar is mostly Brazilian but Ghurair said he would look to buy Indian and Pakistani sugar once they become available on the market if the price is right. Ghurair also said he expected the whites-over-raws premium, a measure of sugar refining profitability, to remain subdued for 2015 at a range of $50 to $60 a tonne. 2 INSIDE AGRICULTURE February 2, 2015 TOP NEWS (Continued) Illinois corn prices face more pain from West Coast port dispute Aggressive herd expansion reverses shrinking U.S. cattle supply Cargo backups due to a labor dispute at West Coast container ports are pushing down corn prices in Illinois and could cause importers to renege on deals, adding to record domestic stockpiles of the grain. With container shipment delays of two months or more at ports in California, grains handlers that transport supplies to the ports are slowing operations in the fastest-growing segment of agriculture exports. Corn buyers south of Chicago, where railroads converge in the country's busiest rail hub, are slashing their bids. The DeLong Company, one of the biggest shippers of "containerized" grain to destinations in Asia, is canceling a loading shift that was scheduled for Saturday in Minooka, Illinois. The company also reduced what it was willing to pay for corn by 7 cents, to $3.52 per bushel. A labor deal at 29 ports on the West Coast moved closer this week but it will take months to shift the backlog at ports in Los Angeles and Long Beach. Affordable feed and record-high spikes in cattle prices in 2014 encouraged ranchers to increase their herds at a faster pace than previously expected during the past year, analysts said in response to a government yearly cattle report on Friday. Expansion efforts by producers helped turnaround the sevenyear decline in the U.S. population from a 63-year low after severe drought hurt crops and forced ranchers to reduce the size of their herds. The U.S. Department of Agriculture's annual cattle inventory report showed the U.S. cattle herd as of Jan. 1 at 101.0 percent of a year earlier, or up 1 percent at 89.8 million head. Analysts, on average, expected a 0.1 percent decline from 88.5 million last year. Friday's USDA data showed the Jan. 1 cattle population was larger than in 2013 and 2014, but still the third smallest since 1952, said University of Missouri livestock economist Ron Plain. TENDER WHEAT TENDER: The Ethiopian government purchased 70,000 tonnes of milling wheat of optional origin in a tender issued in December, European traders said on Friday. WHEAT TENDER: Tunisia's state grains agency purchased some 117,000 tonnes of milling wheat and 50,000 tonnes of feed barley from optional origins in a tender for the same volume on Friday, European traders said. 3 INSIDE AGRICULTURE February 2, 2015 1-Month TECHNICAL CHARTS with 14 Days Moving Average CBOT Corn CBOT Wheat ICE Cocoa ICE Coffee CBOT Soybeans CBOT Soymeal (Inside Agriculture is compiled by Renuka Vijay Kumar in Bangalore) For more information: Learn more about our products and services for commodities professionals, click here Contact your local Thomson Reuters office, click here For questions and comments on Inside Agriculture, click here Your subscription: To find out more and register for our free commodities newsletters click here © 2015 Thomson Reuters. All rights reserved. This content is the intellectual property of Thomson Reuters and its affiliates. Any copying, distribution or redistribution of this content is expressly prohibited without the prior written consent of Thomson Reuters. Thomson Reuters shall not be liable for any errors or delays in content, or for any actions taken in reliance thereon. Thomson Reuters and its logo are registered trademarks or trademarks of the Thomson Reuters group of companies around the world. Privacy statement: To find out more about how we may collect, use and share your personal information please read our privacy statement here To unsubscribe to this newsletter, click here 4

© Copyright 2026