Asia Local Currency Debt Fund

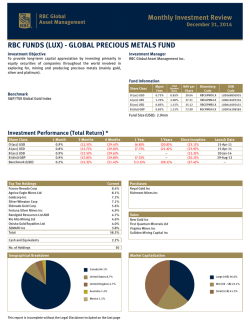

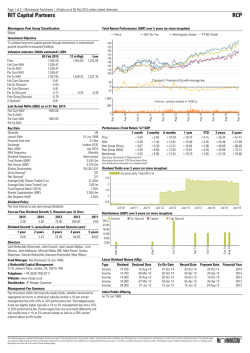

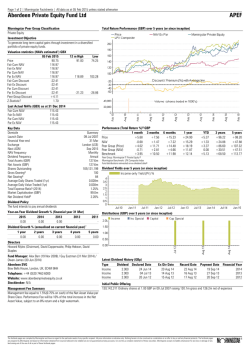

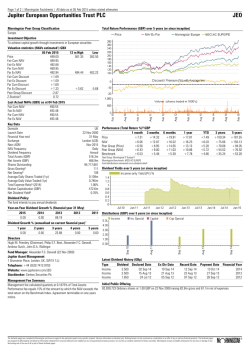

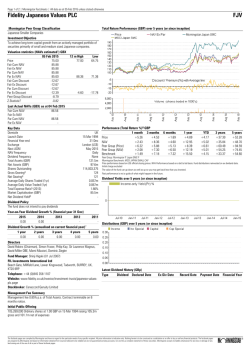

Morningstar Overall RatingsTM Asset Management Company of the Year – Fundamental Strategies, Asia4)3) Best Bond Group JPMorgan Funds - Asia Local Currency Debt Fund Singapore Recognised Schemes January 2015 REBASED Performance from 17.03.10 to 31.12.14 130 30 120 20 110 10 100 0 90 Portfolio information - A (acc) - USD Class Fund manager Stephen Chang, Hong Kong USD 26.9 Total fund size (m) Denominated currency and NAV per unit USD 11.70 USD 11.98 (01.09.14) 12 month High USD 11.14 (27.01.14) NAV:Low 3.0% of NAV Fund Initial Currently 0% charges:Redemption (up to 0.5% of NAV) Management fee 0.8% p.a. Fund codes Share Class ISIN Sedol A (acc) - USD Class LU0492071401B62SDS2 Portfolio characteristics Bond quality AAA: 6.5% / AA: 20.9% / A: 8.7% / BBB: 30.2% / <BBB: 30.9% Average: duration/maturity 5.5 years / 7.2 years Yield to maturity2) 4.07% Statistical analysis (NAV to NAV) - A (acc) - USD Class Since 3) 3 years 5 years launch 0.98 - 0.98 Correlation -0.01 - -0.06 Alpha % 1.06 - 1.19 Beta 6.60 - 8.60 Annual volatility % 0.33 - 0.36 Sharpe ratio Annual tracking error % 1.26 - 2.33 10 11 Annualised performance % Share Class A (acc) - USD Class (NAV to NAV) A (acc) - USD Class (offer to bid)* Benchmark1) (in USD) 12 13 -10 14 JPM Asia Local Currency Debt A (acc) - USD (NAV to NAV) Benchmark: HSBC Asian Local Bond Total Index1) (Since 01.07.10) (in denominated currency) 1 year 3 years 5 years Since launch Launch date +3.4+2.4 - +3.3 17.03.10 +0.3+1.3 - +2.7 17.03.10 +4.4+2.3 - +3.5 Cumulative performance % (in denominated currency) Share Class 1 month 1 year 3 years 5 years Since launch A (acc) - USD Class (NAV to NAV) -0.6 +3.4 +7.2 - +17.0 A (acc) - USD Class (offer to bid)*-3.5 +0.3 +4.1 - +13.6 Benchmark1) (in USD) -0.8 +4.4 +7.2 - +17.7 Portfolio analysis By currency By sector KRW Others SGD CNH IDR INR HKD THB PHP 2.2% 2.8% 9.9% 11.8% 17.6% 55.7% 17.6% 16.2% 11.4% 10.7% 9.6% 9.3% 9.2% 8.1% 7.9% Top five holdings (as at end November 2014) Holding Government of Korea 3.75% 10/06/22 Government of Thailand 3.88% 13/06/19 Government of Korea 3.5% 10/03/17 Government of Singapore 3.5% 01/03/27 Government of India 7.83% 11/04/18 Agency Net Liquidity HY Corporate (Investment Grade) EMD Government Country/region% Korea5.6 Thailand5.0 Korea4.1 Singapore3.7 India2.9 With effect from 05.12.12, the JPMorgan Funds – Asia Pacific Bond Fund was renamed the JPMorgan Funds – Asia Local Currency Debt Fund. Other key changes include investment Objectives, Policy and Strategy. *Offer to Bid calculation of fund performance is based on J.P. Morgan Asset Management's current calculation method and charges. Unless stated otherwise, all information refers to A (acc) - USD Class as at the last valuation date of the previous month. Source: J.P. Morgan Asset Management/Bloomberg (NAV to NAV and Offer to Bid in denominated currency with income reinvested, taking into account all charges which would have been payable upon such reinvestment). Source of star rating: Morningstar, Inc. Source of bond rating: Moody's, S&P and Fitch. Any overweight in any investment holding exceeding the limit set out in the Investment Restrictions was due to market movements and will be rectified shortly. Top ten holdings is available upon request. 1)Prior to 01.07.10, JACI with exposure to 25% AUD, 25% SGD, 25% KRW and 25% CNY. 2)Yield figure reported is denoted in base currency. Yields may vary between share classes denominated in different currencies. 3)All data is calculated from the month end after inception. 4)Issued by the Asset Triple A Investor and Fund Management Awards 2014, reflecting performance of previous calendar year. This document has not been reviewed or endorsed by the Monetary Authority of Singapore. It does not constitute investment advice, or an offer to sell, or a solicitation of an offer to buy any security, investment product or service. Informational sources are considered reliable but you should conduct your own verification of information contained herein. Investment involves risk. Investments in funds are not deposits and are not considered as being comparable to deposits. Past performance is not indicative of future performance and investors may not get back the full or any part of the amount invested. Dividend distributions if any are not guaranteed and are made at the manager's discretion. Fund's net asset value may likely have high volatility due to its investment policies or portfolio management techniques. Funds which are invested in emerging markets, smaller companies and financial derivative instruments may also involve higher risks and are usually more sensitive to price movements. Any applicable currency hedging process may not give a precise hedge and there is no guarantee that any hedging will be successful. Investors in a currency hedged fund or share class may have exposure to currencies other than the currency of their fund or share class. Investors should make their own investigation or evaluation or seek independent advice prior to making any investment. Please refer to the Singapore Offering Documents (including the risk factors set out therein) and the relevant Product Highlights Sheet for details at www.jpmorganam.com.sg. For more information, please contact your bank, financial adviser, visit www.jpmorganam.com.sg or call us at (65) 6882 1328. Issued by JPMorgan Asset Management (Singapore) Limited (Co. Reg. No. 197601586K). All rights reserved. # For more information, please contact your bank, financial adviser or visit www.jpmorganam.com.sg tel (65) 6882 1328 (in denominated currency) % CHANGE Objective To achieve a return in excess of Asia Pacific bond markets by investing primarily in Asia Pacific currencies and fixed and floating rate debt securities, using derivative strategies where appropriate.

© Copyright 2026