Jan 29, 2015 - Moneycontrol

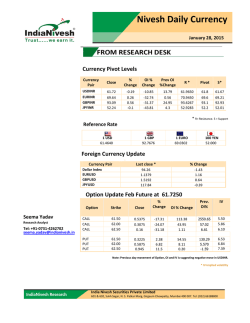

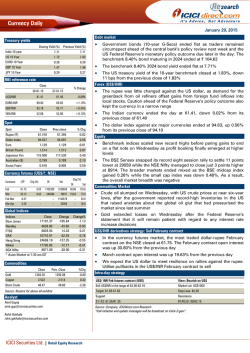

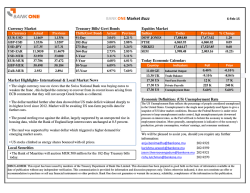

Currency Research Desk Currency Insight 2013 Thursday, 29 January 2015 -1.21% EURINR YTD USDINR YTD , 2013 USD/INR-NSE Contract S2 Feb 61.4600 S1 61.5650 -18.10% GBPINR YTD Close 61.6700 R1 61.8100 R2 61.9500 US dollar appreciated after fed policy statement displayed optimism backed by strong jobs growth. Euro failed to sustain its appreciation over the last 2 days falling to 1.1285 after the fed statement. Pound remained range bound yesterday but lost steam later in the evening trading below 1.5150. Concerns about international growth added some value to the Japanese Yen but comments about sold jobs and weak retail sales put pressure on the Japanese currency. -12.00% Recommendation RANGE 61.95-61.58 USDINR Jan Fut Technical Chart and Outlook Global Markets Review Global Currencies Markets -9.01% JPYINR YTD Global Commodity Markets Crude oil continued to slide trading below the $45 mark after record US stockpiles sending most of the Asian markets down. Metals bounced back in late trade before FOMC statement as traders took advantage of a weaker dollar. Gold has taken a breather yesterday helped by the optimism displayed through the FED Statement, Global Bonds Markets Global Equity Markets Indian 10 year benchmark bond yields remained unchanged at 7.706 US equity markets slumped 1.4% as concerns grew about international risks to the American earnings and multinational earnings. Summary Candle Stick Candlestick showcasing continued negative bias SMAs or EMAs Mother Chart Analysis US bond yields continued to remain volatile as yields Asian stocks are trading on a negative note following the US hovered around the 1.731 markets and also for oil trading mark. below the $45 mark. Fundamental Outlook FOMC’s unanimous agreement on Solid jobs growth has helped induce optimism in the markets but the mention of patience and consideration regarding international risks to the American earnings and multinational earnings sent markets lower. We expect Indian Equity index to open marginally lower for today’s session. Indian rupee is likely to open on a marginally negative note but the change is likely to be minimal. Expectations for rupee remain range bound for the rest of the day. Bullish/ Bearish/ Mixed Technical Tools Momentum Indicators Overall Intraday Bias Major EMAs of 8-13-21 days has already turned downward Spot price has found minor support near 61.30 and bounced back from there to break the falling trendline MACD(12/26/9) is hovering within negative territory near 0.215 exhibiting weakness in momentum Price may witness minor recovery towards 61.8/61.85 can be seen ahead of falling further Reference Rates Pair LAST 1 Day ago % Change USD/INR 61.41 61.46 -0.09 GBP/INR 93.18 92.77 0.45 JPY/INR 100 52.06 52.00 0.12 EUR/INR 69.82 69.03 1.15 Mail Us at [email protected] Currency Research Desk 1 Currency Insight Pair EUR/INR-NSE GBP/INR-NSE JPY/INR-NSE Contract S2 Feb 69.6850 Feb 92.9208 Feb 51.8925 S1 69.8700 93.3292 52.1275 Close 70.0550 93.7375 52.3625 R1 70.2475 94.0167 52.6175 R2 70.4400 94.2958 52.8725 Recommendation SELL NEAR 69.98 TGT 69.2 SL 70.15 SELL NEAR 93.72 TGT 93.4 SL 93.88 RANGE 52.05-52.55 Technical Charts USD Index EURINR Jan Futures GBPINR Jan Futures JPYINR Jan Futures Asian Currency Pairs Currency Debt Market Information LAST GIND5YR Index INDICATORS % Change LAST 1 Day ago % Change Chinese Yuan 9.8290 9.8360 -0.07 LIBOR 1Mth #N/A N/A 0.1680 #VALUE! Hongkong Dollar 7.9210 7.9210 0.00 LIBOR 3Mth #N/A N/A 0.2526 #VALUE! Indonesian Rupiah 0.4918 0.4925 -0.14 MIBOR 1Mth #N/A N/A 0.0100 #VALUE! Myanmar Ringgit 16.9701 17.0715 -0.59 MIBOR 3Mth #N/A N/A 0.0600 #VALUE! Philipinnes Peso 1.3924 1.3931 -0.05 U.S. 5Yr Bond Yield 1.2391 1.3354 -7.21 Singapore Dollar 45.4471 45.7208 -0.60 U.S. 10Yr Bond Yield 1.7207 1.8231 -5.62 Taiwan Dollar 1.9647 1.9641 0.03 India 10Yr Bond Yield 7.7060 7.7070 -0.01 Thailand Baht 1.8859 1.8892 -0.17 Call Rate 6.9000 7.8500 -12.10 Currency Research Desk Mail Us at [email protected] 2 Currency Insight Economic Data For The Day Date Time Country/Region Event Period Surv(M) Prior 01/29/15 12:30 UK Nationwide House PX MoM Jan 0.3% 0.2% 01/29/15 12:30 UK Nationwide House Px NSA YoY Jan 6.6% 7.2% 01/29/15 14:25 GE Unemployment Change (000's) Jan -6K -27K 01/29/15 14:25 GE Unemployment Rate Jan 6.5% 6.5% 01/29/15 14:30 EC M3 Money Supply YoY Dec 3.5% 3.1% 01/29/15 14:30 EC M3 3-month average Dec 3.1% 2.7% 01/29/15 15:30 EC Business Climate Indicator Jan -- 4.0% 01/29/15 15:30 EC Industrial Confidence Jan -4.8 -5.2 01/29/15 15:30 EC Consumer Confidence Jan F -- -8.5 01/29/15 15:30 EC Economic Confidence Jan 101.3 100.7 01/29/15 15:30 EC Services Confidence Jan 6.0 5.6 01/29/15 16:30 UK CBI Reported Sales Jan -- 61.0 01/29/15 18:30 GE CPI MoM Jan P -0.8% 0.0% 01/29/15 18:30 GE CPI YoY Jan P -0.2% 0.2% 01/29/15 19:00 US Initial Jobless Claims 45292 -- 307K 01/29/15 19:00 US Continuing Claims 42736 -- 2443K 01/29/15 20:30 US Pending Home Sales MoM Dec 0.5% 0.8% 01/29/15 20:30 US Pending Home Sales NSA YoY Dec -- 1.7% Forward Market (Onshore & Offshore) FORWARDS LAST 1 Day ago Major World Indices % Change Annu(%) INDICES LAST 1 Day ago % Change 1-Mth Forward 61.6975 61.7927 -0.15 -0.15% Nifty 8914.30 8910.50 0.04 3-Mth Forward 62.5313 62.6130 -0.13 -0.39% Sensex 29559.18 29571.04 -0.04 6-Mth Forward 63.6130 63.6847 -0.11 -0.68% Nasdaq 4637.99 4681.50 -0.93 12-Mth Forward 65.6350 65.7052 -0.11 -1.28% Dow jones Industrial 17191.37 17387.21 -1.13 1-Mth NDF 61.5800 61.6900 -0.18 -0.18% Shanghai Composite 3305.74 3352.96 -1.41 3-Mth NDF 62.2000 62.2000 0.00 0.00% Nikkei 225 17795.73 17768.30 0.15 6-Mth NDF 63.0100 63.0300 -0.03 -0.19% HangSeng 24861.81 24807.28 0.22 12-Mth NDF 64.7300 64.8000 -0.11 -1.30% Ftse Index 6825.94 6811.61 0.21 Prepared by:Aurobinda Prasad ([email protected]) – Research Head Jitendra K Parashar ([email protected]) – Technical Analyst Rakesh K Chelapareddy ([email protected]) – Fundamental Analyst Disclaimer The information and views presented in this report are prepared by Karvy Stock Broking Limited. The information contained herein is based on our analysis and up on sources that we consider reliable. We, however, do not vouch for the accuracy or the completeness thereof. This material is for personal information and we are not responsible for any loss incurred based upon it. The investments discussed or recommended in this report may not be suitable for all investors. Investors must make their own investment decisions based on their specific investment objectives and financial position and using such independent advice, as they believe necessary. While acting upon any information or analysis mentioned in this report, investors may please note that neither Karvy nor any person connected with any associated companies of Karvy accepts any liability arising from the use of this information and views mentioned in this document. The author, directors and other employees of Karvy and its affiliates may hold long or short positions in the above-mentioned companies from time to time. Every employee of Karvy and its associated companies are required to disclose their individual stock holdings and details of trades, if any, that they undertake. The team rendering corporate analysis and investment Currency Research Desk Mail Us at [email protected] 3 Currency Insight recommendations are restricted in purchasing/selling of shares or other securities till such a time this recommendation has either been displayed or has been forwarded to clients of Karvy. All employees are further restricted to place orders only through Karvy Stock Broking Ltd. Currency Research Desk Mail Us at [email protected] 4

© Copyright 2026