RIT Capital Partners RCP

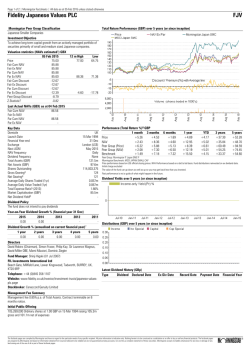

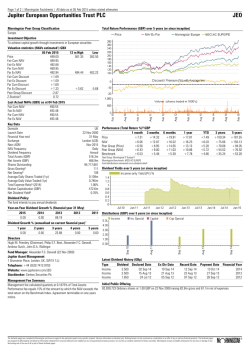

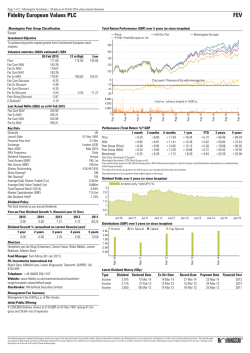

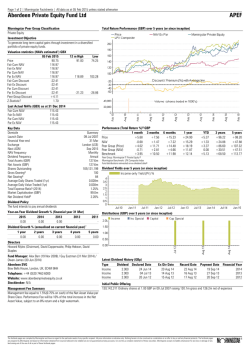

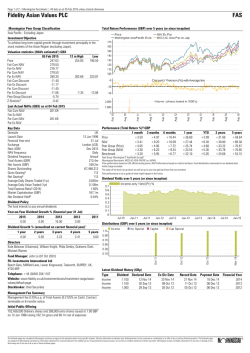

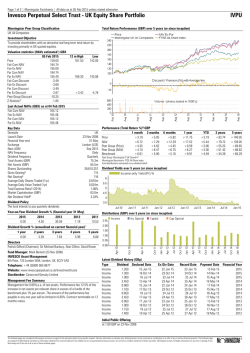

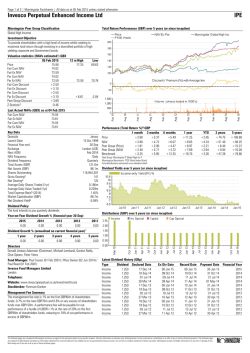

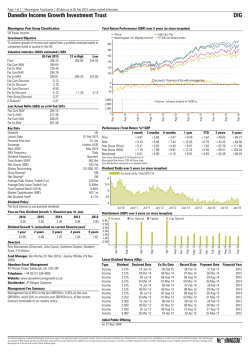

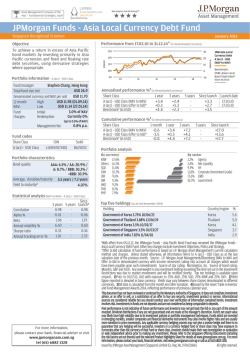

Page 1 of 2 | Morningstar Factsheets | All data as at 05 Feb 2015 unless stated otherwise RIT Capital Partners RCP Morningstar Peer Group Classification Global Total Return Performance (GBP) over 5 years (or since inception) Investment Objective To achieve long-term capital growth through investment in international quoted securities & unquoted holdings. Valuation statistics (NAVs estimated1) GBX 05 Feb 2015 Price 1,455.00 Fair Cum NAV 1,539.47 Fair Ex NAV 1,536.47 Par Cum NAV 1,539.47 Par Ex NAV 1,527.85 Fair Cum Discount -5.81 Fair Ex Discount -5.63 Par Cum Discount -5.81 Par Ex Discount -4.77 Peer Group Discount -5.78 -0.81 Z-Statistic2 12 m High 1,455.00 Low 1,242.00 1,539.22 1,331.76 -0.30 -8.39 Last Actual NAVs (GBX) as at 31 Dec 2014 Fair Cum NAV 1483.00 Fair Ex NAV Par Cum NAV 1483.00 Par Ex NAV Key Data Domicile Launch Date Financial Year-end Exchange Next AGM NAV Frequency Dividend Frequency Total Assets (GBP) Net Assets (GBP) Shares Outstanding Gross Gearing3 Net Gearing4 Average Daily Shares Traded (1yr) Average Daily Value Traded (1yr) Total Expense Ratio5 (2013) Market Capitalisation (GBP) Net Dividend Yield6 UK 15 Jun 1988 31 Dec London (LSE) Apr 2015 Monthly Semi-annual 2,534.3m 2,373.5m 155,351,431 107 121 0.120m 2.631m 1.25% 2,260.4m 2.02% Performance (Total Return %)8 GBP 1 month 3 months Price +4.30 +2.83 NAV +3.56 +7.40 Peer Group (Price) +3.67 +5.39 Peer Group (NAV) +3.56 +6.60 Benchmark +3.25 +5.95 6 months +10.50 +13.91 +12.31 +12.02 +12.35 1 year +19.72 +15.08 +16.85 +15.81 +19.70 YTD +4.15 +3.05 +2.96 +3.55 +3.26 3 years +26.34 +34.46 +48.89 +42.66 +47.28 5 years +61.47 +57.69 +86.48 +72.12 +78.66 Peer Group: Morningstar IT Global Growth P Morningstar Benchmark: FTSE World Index World Fund distributions reinvested on ex-dividend date8 Dividend Yields over 5 years (or since inception) Dividend Policy The fund intends to pay semi-annual dividends Year-on-Year Dividend Growth % (financial year 31 Dec) 2015 0.00 2014 5.00 2013 75.00 2012 300.00 2011 0.00 Distributions (GBP) over 5 years (or since inception) Dividend Growth % (annualised on current financial year)7 1 year 0.00 2 years 2.47 3 years 22.48 4 years 64.65 5 years 49.02 Directors Lord Rothschild (Chairman), John Cornish, Jean Laurent-Bellue, Lord Myners, John Makinson, Michael Marks CBE, Mike Power, Sandra Robertson, Hannah Rothschild, Baroness Rothschild, Mike Wilson Fund Manager: Not Disclosed (15 Jun 1988) J Rothschild Capital Management 27 St James's Place, London, UK, SW1A 1NR Telephone: +44 (0)20 7493 8111 Website: www.ritcap.co.uk Stockbroker: JP Morgan Cazenove Management Fee Summary Fee structures within the long-only equity funds, whether structured as segregated accounts or otherwise typically involve a 1% per annum management fee with a 0% to 10% performance fee. The hedged equity funds are slightly higher typically a 1% to 2% management fee and a 15% to 20% performance fee. Private equity fees are structured differently and will usually have a 1% to 2% annual charge as well as a 20% carried interest above an 8% hurdle. Latest Dividend History (GBp) Type Income Income Income Income Income Dividend Declared Date 14.700 15 Aug 14 14.700 06 Mar 14 14.000 16 Aug 13 14.000 07 Mar 13 28.000 01 Jun 12 Ex Div Date 01 Oct 14 02 Apr 14 02 Oct 13 03 Apr 13 13 Jun 12 Record Date 03 Oct 14 04 Apr 14 04 Oct 13 05 Apr 13 15 Jun 12 Payment Date 24 Oct 14 29 Apr 14 18 Oct 13 26 Apr 13 24 Aug 12 Initial Public Offering on 15 Jun 1988 The factbook pages are compiled by Morningstar and have no regard to the particular needs of any specific recipient. All price information is indicative only. Nothing herein is to be construed as a solicitation or an offer to buy or sell any financial products. The factbook pages are prepared by Morningstar and based on information obtained from sources believed to be reliable but are not guaranteed as being accurate, nor are they a complete statement of these securities. Morningstar accepts no liability whatsoever for any loss or damage of any kind arising out of the use of all or part of these factbook pages. Financial Year 2014 2014 2013 2013 2012 Page 2 of 2 | Morningstar Factsheets | All data as at 05 Feb 2015 unless stated otherwise RIT Capital Partners RCP Risk & Return9 Discrete Monthly Price & NAV Total Return % (GBP) Sector Breakdown (%) Discrete Yearly Price & NAV Total Return % (GBP) Geographic Breakdown (%) Risk & Correlation Alpha (NAV) 11 Beta (NAV)12 R-squared (NAV)13 Sharpe (NAV)14 Price Volatility15 NAV Volatility15 Benchmark Volatility15 Peer Group Price Volatility15 Peer Group NAV Volatility15 3 months 0.02 1.05 0.94 2.11 12 13 12 11 11 6 months 0.01 1.01 0.94 2.10 13 12 11 12 11 1 year 0.12 0.61 0.68 2.32 12 11 10 10 9 3 years 0.13 0.62 0.76 1.52 15 11 10 10 9 5 years 0.06 0.69 0.73 0.93 18 13 13 12 12 Additional Performance (Total Return%8) GBX Largest Holdings (% Portfolio10) as at 31 Dec 2013 BB Life Sciences Lansdowne Developed Markets Fund Limited Cedar Rock Capital Investment property Blackrock European Hedge Fund Tekne Offshore US Treasury Bill Viking Long Fund III Titan Partners Roche Holding AG Total Capital Structure Number of Shares 155,351,431 Loan CCY USD 3.2% 3.2% 2.5% 2.4% 2.3% 2.2% 2.2% 2.2% 2.2% 2.0% 24.4% Period 2015 2014 2013 2012 2011 2010 Since FTSE 2009 Low (13 Mar 09) Since Sub-Prime (20 Nov 07) Since FTSE 2007 Peak (13 Oct 07) Price +4.15 +13.30 +13.97 -5.37 +2.42 +15.17 +97.18 +43.97 +39.54 NAV Peer Price +3.05 +2.96 +9.39 +11.47 +18.61 +23.34 +5.58 +12.29 -8.37 -8.53 +19.28 +20.13 +89.70 +160.95 +49.65 +63.40 +42.83 +53.49 Peer NAV Benchmark +3.55 +3.26 +8.55 +11.29 +21.11 +22.36 +12.55 +11.83 -8.98 -5.79 +18.74 +16.28 +147.47 +160.36 +57.51 +77.14 +47.07 +64.56 Wind-up Provisions/Buy Back Policy The Company has no fixed life. The Company is authorised to purchase up to 14.99% of its issued share capital. Share Type Ord 100p £m 160.4 Redemption Coupon - Net Dividend Yield – This is calculated by dividing the current financial years dividends (this will include prospective dividends) by the current price. Dividend Growth – The annualised percentage growth in dividends. Based upon the current financial year, including any future estimates or forecasts. Performance – Calculated using start and end period Share Prices or NAV Dividends are reinvested on the ex-dividend date at the prevailing Share Price or NAV. Risk & Return – 1 Year ex income par NAV total return performance against 1 Year NAV volatility. Please see notes 8 and 15 for performance and volatility definitions respectively. 2 10 Portfolio – In order to calculate the portfolio value we deduct any holdings in cash only (Note that Fixed Interest is not included). 11 Alpha – The difference between the fund’s average excess total return and the benchmark’s average excess total return. 3 12 Beta – The sensitivity of the fund to broad market movements. A Beta of 0.5 would imply the fund will move by half as much as the index. 4 13 R-squared – A measure of correlation between the fund and index. A value of 0.8 means that 80% of the fund’s NAV changes can be explained by changes in the index. 14 Sharpe – A risk-adjusted return measure, calculated by dividing the fund’s average monthly excess total return over the risk-free rate by the standard deviation of those returns. 5 The figure shown is the annualized Sharpe Ratio. 15 Volatility – The annualized standard deviation of the logged daily returns, adjusting for distributions from capital. The factbook pages are compiled by Morningstar and have no regard to the particular needs of any specific recipient. All price information is indicative only. Nothing herein is to be construed as a solicitation or an offer to buy or sell any financial products. The factbook pages are prepared by Morningstar and based on information obtained from sources believed to be reliable but are not guaranteed as being accurate, nor are they a complete statement of these securities. Morningstar accepts no liability whatsoever for any loss or damage of any kind arising out of the use of all or part of these factbook pages. 1 NAV Estimation - Fair value of debt refers to the market price of the debt if it is traded or, if it is not traded, an estimation of its value calculated using points over gilt methodology. Cum Income NAVs include net revenue in the financial year to date. All estimates are fully diluted for the effects of warrants, convertibles or treasury shares. NAV estimations are created and maintained by Morningstar. For more detailed methodology document please contact [email protected] Z-Statistic 1y – Shows whether the fund’s current discount is significantly higher or lower than the average over the past year, calculated as (Current Discount – Mean) / Std Dev Gross Gearing – The ratio of estimated gross Assets to the Net Assets, expressed as a percentage Net Gearing – The ratio of estimated Gross Assets minus cash and fixed interest to the Net Assets, expressed as a percentage. Cash and fixed interest represents not-equity exposure. Total Expense Ratio – (Total Expenses – Performance Fees – Cost of Leverage – Tax – Restructuring Costs) / Average Net Assets 6 7 8 9

© Copyright 2026