Fidelity European Values PLC FEV

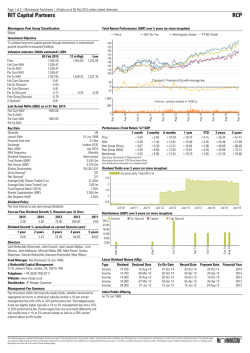

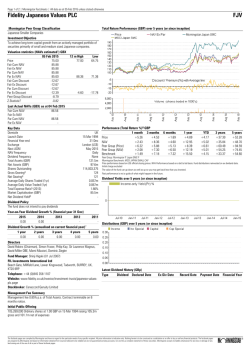

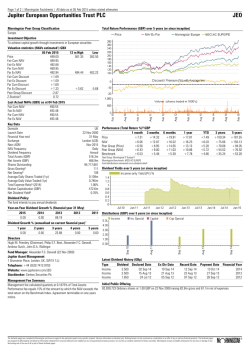

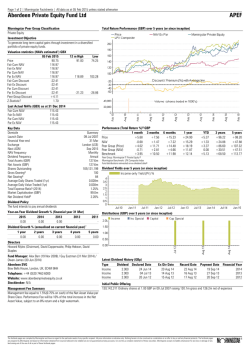

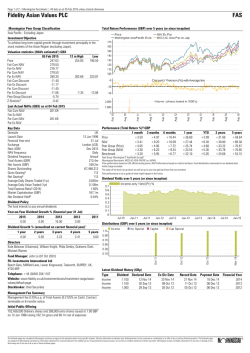

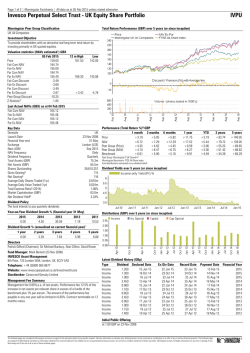

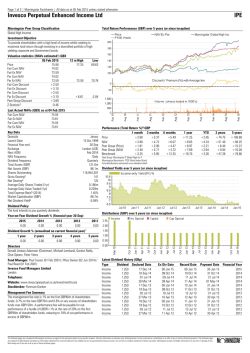

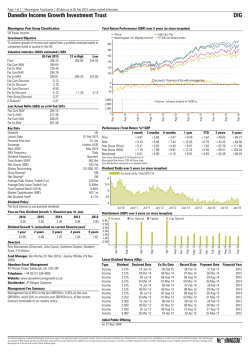

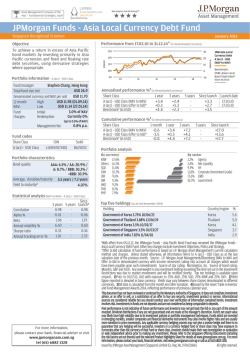

Page 1 of 2 | Morningstar Factsheets | All data as at 05 Feb 2015 unless stated otherwise Fidelity European Values PLC FEV Morningstar Peer Group Classification Europe Total Return Performance (GBP) over 5 years (or since inception) Investment Objective To achieve long-term capital growth from Continental European stock markets. Valuation statistics (NAVs estimated1) GBX 05 Feb 2015 Price 171.80 Fair Cum NAV 183.26 Fair Ex NAV 179.67 Par Cum NAV 183.26 Par Ex NAV 179.97 Fair Cum Discount -6.25 Fair Ex Discount -4.38 Par Cum Discount -6.25 Par Ex Discount -4.54 Peer Group Discount -2.87 2.15 Z-Statistic2 12 m High 173.90 Low 140.00 180.63 154.01 -3.55 -11.27 Last Actual NAVs (GBX) as at 04 Feb 2015 Fair Cum NAV 183.90 Fair Ex NAV 180.31 Par Cum NAV 183.90 Par Ex NAV 180.31 Key Data Domicile Launch Date Financial Year-end Exchange Next AGM NAV Frequency Dividend Frequency Total Assets (GBP) Net Assets (GBP) Shares Outstanding Gross Gearing3 Net Gearing4 Average Daily Shares Traded (1yr) Average Daily Value Traded (1yr) Total Expense Ratio5 (2013) Market Capitalisation (GBP) Net Dividend Yield6 UK 01 Nov 1991 31 Dec London (LSE) May 2015 Daily Annual 795.1m 749.5m 416,447,910 106 105 0.343m 0.866m 0.94% 715.5m 1.73% Performance (Total Return %)8 GBP 1 month 3 months Price +8.25 +8.80 NAV +6.92 +8.91 Peer Group (Price) +6.56 +8.95 Peer Group (NAV) +6.43 +9.00 Benchmark +6.25 +6.28 6 months +17.59 +11.41 +14.05 +11.03 +7.12 1 year +19.34 +14.36 +13.13 +10.86 +8.20 YTD +5.72 +5.62 +5.20 +5.72 +4.84 3 years +68.46 +50.84 +70.68 +54.52 +42.59 5 years +89.34 +72.42 +94.05 +76.92 +53.58 Peer Group: Morningstar IT Europe P Morningstar Benchmark: FTSE World Europe ex UK Price performance based on LSE official closing prices. NAV Performance based on a bid to bid basis. Fund distributions reinvested on ex dividend date. Initial charge excluded The value of the fund can go down as well as up so you may get back less than you invested. Past performance is not a guide of what might happen in the future. Dividend Yields over 5 years (or since inception) Dividend Policy The fund intends to pay annual dividends Year-on-Year Dividend Growth % (financial year 31 Dec) 2015 0.00 2014 0.00 2013 7.21 2012 4.72 2011 68.25 Dividend Growth % (annualised on current financial year)7 1 year 0.00 2 years 0.00 3 years 2.35 4 years 2.93 Distributions (GBP) over 5 years (or since inception) 5 years 13.56 Directors Humphrey van der Klugt (Chairman), Simon Fraser, Robin Niblett, James Robinson, Marion Sears Fund Manager: Sam Morse (01 Jan 2011) FIL Investments International Ltd Beech Gate, Millfield Lane, Lower Kingswood, Tadworth, SURREY, UK, KT20 6RP Telephone: +44 (0)845 358 1107 Website: www.fidelity.co.uk/investmenttrusts/investmentrange/european-values/default.page Stockbroker: Winterflood Securities Limited Latest Dividend History (GBp) Type Income Income Income Dividend Declared Date 2.975 10 Mar 14 2.775 27 Feb 13 2.650 06 Mar 12 Ex Div Date 19 Mar 14 13 Mar 13 14 Mar 12 Record Date 21 Mar 14 15 Mar 13 16 Mar 12 Payment Date 23 May 14 24 May 13 25 May 12 Management Fee Summary Management fee 0.85% p.a. of Net Assets. Initial Public Offering 41,500,000 Ordinary shares at 0.10 GBP on 01 Nov 1991 raising 41.5m gross and 39.6m net of expenses The factbook pages are compiled by Morningstar and have no regard to the particular needs of any specific recipient. All price information is indicative only. Nothing herein is to be construed as a solicitation or an offer to buy or sell any financial products. The factbook pages are prepared by Morningstar and based on information obtained from sources believed to be reliable but are not guaranteed as being accurate, nor are they a complete statement of these securities. Morningstar accepts no liability whatsoever for any loss or damage of any kind arising out of the use of all or part of these factbook pages. Financial Year 2013 2012 2011 Page 2 of 2 | Morningstar Factsheets | All data as at 05 Feb 2015 unless stated otherwise Fidelity European Values PLC FEV Risk & Return9 Discrete Monthly Price & NAV Total Return % (GBP) Sector Breakdown (%) Discrete Yearly Price & NAV Total Return % (GBP) Geographic Breakdown (%) Risk & Correlation Alpha (NAV) 11 Beta (NAV)12 R-squared (NAV)13 Sharpe (NAV)14 Price Volatility15 NAV Volatility15 Benchmark Volatility15 Peer Group Price Volatility15 Peer Group NAV Volatility15 3 months 0.05 0.93 0.94 2.36 17 14 15 11 13 6 months 0.04 0.92 0.95 1.51 17 14 15 13 14 1 year 0.55 0.91 0.94 1.20 15 12 13 11 12 3 years 0.23 0.94 0.89 1.12 16 15 16 12 14 5 years 0.22 0.96 0.93 0.65 20 19 20 16 18 Additional Performance (Total Return%8) GBX Largest Holdings (% Portfolio10) as at 31 Dec 2014 Nestle SA Roche Holding AG UBS AG Anheuser-Busch InBev SA Novo-Nordisk Sanofi Volkswagen AG Intesa Sanpaolo Total SA Zurich Insurance Group Ltd. Total Capital Structure Number of Shares 416,447,910 Loan CCY GBP 5.3% 4.9% 3.3% 3.1% 3.1% 3.0% 2.8% 2.8% 2.7% 2.6% 33.7% Share Type Ord 25p £m 45.6 Redemption Period 2015 2014 2013 2012 2011 2010 Since FTSE 2009 Low (13 Mar 2009) Since Sub-Prime (20 Nov 07) Since FTSE 2007 Peak (13 Oct 07) Price +5.72 +8.66 +20.80 +31.32 -8.58 -1.26 +152.38 +54.16 +40.50 NAV Peer Price +5.62 +5.20 +4.71 +6.06 +20.20 +28.83 +25.15 +29.84 -12.43 -11.63 +7.70 +6.49 +126.85 +187.31 +50.57 +62.43 +40.06 +49.86 Peer NAV Benchmark +5.72 +4.84 +2.88 +0.16 +26.80 +25.18 +22.46 +17.82 -12.83 -14.71 +11.02 +5.75 +157.96 +128.94 +54.81 +33.44 +44.50 +27.91 Wind-up Provisions/Buy Back Policy The Company renewed its authority to purchase up to 14.99% of its share capital at the last AGM. The Directors last submitted to Shareholders a continuation resolution at the 2013 AGM, this was duly passed. A similar resolution will be submitted every two years. Coupon - NAV Estimation - Fair value of debt refers to the market price of the debt if it is traded or, if it is not traded, an 6 Net Dividend Yield – This is calculated by dividing the current financial years dividends (this will include prospective dividends) by the current price. estimation of its value calculated using points over gilt methodology. 7 Dividend Growth – The annualised percentage growth in dividends. Based upon the current financial year, including any future estimates or forecasts. Cum Income NAVs include net revenue in the financial year to date. All estimates are fully diluted for the effects 8 Performance – Calculated using start and end period Share Prices or NAV Dividends are reinvested on the ex-dividend date at the prevailing Share Price or NAV. of warrants, convertibles or treasury shares. NAV estimations are created and maintained by Morningstar. For 9 Risk & Return – 1 Year ex income par NAV total return performance against 1 Year NAV volatility. Please see notes 8 and 15 for performance and volatility definitions respectively. more detailed methodology document please contact [email protected] 10 Portfolio – In order to calculate the portfolio value we deduct any holdings in cash and fixed interest which represent non-equity exposure. 2 Z-Statistic 1y – Shows whether the fund’s current discount is significantly higher or lower than the average over 11 Alpha – The difference between the fund’s average excess total return and the benchmark’s average excess total return. the past year, calculated as (Current Discount – Mean) / Std Dev 12 Beta – The sensitivity of the fund to broad market movements. A Beta of 0.5 would imply the fund will move by half as much as the index. 3 Gross Gearing – The ratio of estimated gross Assets to the Net Assets, expressed as a percentage 13 R-squared – A measure of correlation between the fund and index. A value of 0.8 means that 80% of the fund’s NAV changes can be explained by changes in the index. 4 Net Gearing – The ratio of estimated Gross Assets minus cash and fixed interest to the Net Assets, expressed 14 Sharpe – A risk-adjusted return measure, calculated by dividing the fund’s average monthly excess total return over the risk-free rate by the standard deviation of those returns. The as a percentage. Cash and fixed interest represents not-equity exposure. figure shown is the annualized Sharpe Ratio. 5 Total Expense Ratio – (Total Expenses – Performance Fees – Cost of Leverage – Tax – Restructuring Costs) / 15 Volatility – The annualized standard deviation of the logged daily returns, adjusting for distributions from capital. Average Net Assets The factbook pages are compiled by Morningstar and have no regard to the particular needs of any specific recipient. All price information is indicative only. Nothing herein is to be construed as a solicitation or an offer to buy or sell any financial products. The factbook pages are prepared by Morningstar and based on information obtained from sources believed to be reliable but are not guaranteed as being accurate, nor are they a complete statement of these securities. Morningstar accepts no liability whatsoever for any loss or damage of any kind arising out of the use of all or part of these factbook pages. 1

© Copyright 2026