Daily Global Market Update - Fidelity Worldwide Investment

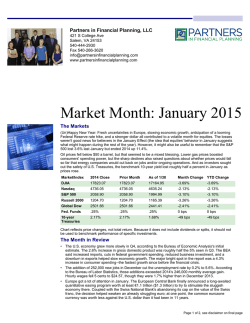

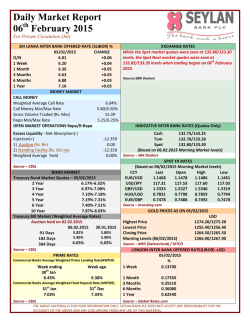

Daily Global Market Update 6 February, 2015 European markets were mixed on continued concerns over Greece Shares were mixed in Europe and the Asia Pacific regions but rallied on higher oil prices and earnings in the US. United States Stocks rallied Thursday, buoyed by a rebound in oil prices, M&A news and upbeat quarterly earnings. The Dow Jones industrials were up 1.2% and the S&P and Nasdaq added 1.0% each. Stocks extended gains in early trading after a better than anticipated weekly initial jobless claims report. Jobless claims in the week ended January 31 increased 11,000 to 278,000. Expectations were for 290,000 new claims. Rising crude oil prices sent materials and energy stocks higher. Health-care stocks also advanced after Pfizer agreed to buy Hospira, which makes injectable drugs and infusion technologies. Hospira shareholders will receive US$90 a share in cash, representing a premium of 39% to Wednesday’s closing price. Shares of Pfizer and Hospira were up on the day. E.I. DuPont de Nemours gained after it named two new directors to its board in a revamp. It excluded candidates nominated by activist investor Nelson Peltz Trian Fund Management. Verizon Communications is close to selling a package of wireline assets to Frontier Communications for around US$10 billion. Shares of Verizon slipped while those of Frontier advanced. Anthem was down after it said hackers broke into a database containing personal information for about 80 million customers and employees. Michael Kors declined after the luxury accessories retailer posted third quarter results and forecast a lower than expected profit for the current quarter. US shares shrugged off rising tensions in negotiations between Greece and its creditors Thursday though the indices took a hit from the news late in Wednesday’s session after the European Central Bank said it would stop accepting Greek bonds as collateral for regular central bank loans. Greece’s new leaders are seeking to ease conditions on its bailout program. Sprint’s quarterly revenue fell less than expected as the US mobile provider attracted more subscribers by cutting prices and offering promotions. Sprint managed to add 892,000 total wireless subscribers in the three months ended December 31. The company's net operating revenue declined 1.8% to US$8.97 billion, but beat analysts' average estimate. Sprint's net loss more than doubled to US$2.38 billion or 60 US cents per share from US$1.04 billion or 26 US cents per share a year earlier. Gold at the afternoon London fixing was down US$9.25 to US$1,259.25. Copper futures were up 0.35% to US$2.60. WTI spot crude was up US$2.25 to US$50.70. Dated Brent spot crude was up US$2.63 to US$56.79. The US dollar was down against the euro, pound, Swiss franc and the Canadian and Australian dollars. However, it advanced against the yen. The Dollar Index was down 1.4%. The yield on US Treasury 30 year bond was up 6 basis points to 2.42% while the yield on the 10 year note was up 4 basis points to 1.81%. Europe Trading was mixed Thursday. Investors continued to be concerned over the situation in Greece. Late in the Wednesday market day, the European Central Bank said it would no longer accept Greek bonds as collateral for loans to its commercial banks. The news overshadowed the stronger than expected German factory orders report. Energy stocks were among the best performing stocks as the price of oil rebounded from yesterday's sharp sell-off. The FTSE and CAC added 0.1% while the DAX slipped 0.1% and the SMI was down 0.7%. In a major blow to the new Greek government, the European Central Bank decided to suspend the waiver extended to Greek public securities used as collateral by financial institutions for central bank loans. The ECB said, "Suspension is in line with existing Eurosystem rules, since it is currently not possible to assume a successful conclusion of the program review." The ECB move has put the new Greek government in a spot as it had hoped to renegotiate the terms of the bailout program with its international lenders. The ECB announcement is seen as a move to pressure the new Greek government to adhere to its commitments with international creditors on the country's bailout program. December German factory orders rebounded at the fastest pace in five months underpinned by both domestic and foreign demand. Factory orders grew a seasonally and working-day adjusted 4.2% on the month after sinking a revised 2.4% in November. The Bank of England’s monetary policy committee kept its key bank rate at 0.5% and the size of its asset purchases at £375 billion. The rate has been at a record low since early 2009. Deutsche Telekom advanced after the BT Group said it has agreed to acquire mobile operator EE from Deutsche Telekom and French telecommunications operator Orange for £12.5 billion. BT Group surged but Orange declined. Daimler climbed after it reported a 10% increase in fourth quarter profit. BMW and Volkswagen also were up on the day. BNP Paribas declined after the lender warned that rising taxes and new regulations will impact its earnings next year. Sanofi climbed after the company said its fourth quarter profit increased from the prior year as sales improved amid strong performance in the US and the emerging markets. AstraZeneca declined after it reported a loss for the fourth quarter of 2014 and announced a deal to acquire the rights to Actavis's branded respiratory business in the US and Canada. Tullow Oil, BG Group, BP and Royal Dutch Shell gained. Asia Pacific Shares were mixed as renewed worries over Greece's debt woes kept investors nervous. Sentiment was dampened after the European Central Bank (ECB) toughened its stance with Greece by suspending the use of the country's debt as collateral for its liquidity operations, starting February 11, citing doubts over the new government's commitment to past reform pledges. Global growth worries also kept investors on edge. The Shanghai Composite reversed early gains to end 1.2% lower after a late-day selloff. The benchmark index jumped over 2% early in the session after China's central bank lowered banks' reserve requirement ratio by 0.5%age points to 19.5% effective from February 5 in a bid to boost liquidity and counter the country’s economic slowdown. The Hang Seng however, added 0.3%. The Nikkei retreated 1.0% fell after the ECB’s action. Hitachi dropped on disappointing earnings results. Panasonic, Sharp, and Canon retreated while Nikon gained. Toyota Motor declined even though the automaker raised its full year profit forecast to a record high. Mazda Motor tumbled on reporting a 4% decline in third quarter profit. Mitsubishi UFJ Financial Group advanced. Sony soared 12% after the electronics giant said its annual loss for the year that ends in March will likely be smaller than previously forecast thanks to cost cuts, a weaker yen and improving smartphone sales. Both the S&P/ASX and All Ordinaries added 0.6%. National Australia Bank was up after it reported a US$1.8 billion quarterly profit. ANZ, Commonwealth and Westpac also advanced. Miners were mixed with BHP Billiton, Rio Tinto and Fortescue Metals Group retreating. Newcrest Mining jumped after gold prices gained on Wednesday. Energy stocks such as Woodside Petroleum, Santos and Oil Search were down. The Kospi was down 0.5% as a renewed oil plunge and lingering concerns over the implications of political transition in Greece kept investors on the sidelines. The Sensex edged 0.1% lower. Global Stock Market Recap End 2014 Feb 4 Feb 5 Daily Change Dow NASDAQ S&P 500 S&P/TSX Comp** 16576.7 17673.0 17884.9 211.9 1.2 0.3 14.4 4176.6 4716.7 4765.1 48.4 1.0 0.6 17.5 1848.4 2041.5 2062.5 21.0 1.0 0.2 16.3 13621.6 14995.7 15124.9 129.3 0.9 3.4 10.3 FTSE 100 CAC XETRA DAX MIB Ibex 35 OMX Stockholm 30 SMI 6749.1 6860.0 6865.9 5.9 0.1 4.6 4.7 4296.0 4696.3 4703.3 7.0 0.1 10.1 12.3 Index North America United States Canada Europe UK France Germany Italy Spain Sweden Switzerland Asia/Pacific Australia All Ordinaries Japan Nikkei 225 Hong Kong Hang Seng S. Korea Kospi Singapore STI China Shanghai Comp India Sensex 30 Data Source — Haver Analytics 2015 Percent Change Daily 2015 Yr/Yr 9552.2 10911.3 10905.4 -5.9 -0.1 11.2 17.8 18967.7 20941.7 20819.1 -122.7 -0.6 9.5 6.7 9916.7 10577.8 10535.5 -42.3 -0.4 2.5 5.7 1333.0 1579.3 1586.1 6.8 0.4 8.3 21.3 8203.0 8608.2 8544.3 -63.9 -0.7 -4.9 4.0 5353.1 5733.7 5765.5 31.8 0.6 7.0 12.0 16291.3 17678.7 17504.6 -174.1 -1.0 0.3 23.7 23306.4 24679.8 24765.5 85.7 0.3 4.9 15.6 2011.3 1962.8 1952.8 -10.0 -0.5 1.9 2.4 3167.4 3417.6 3406.6 -11.0 -0.3 1.2 14.0 2116.0 3174.1 3136.5 -37.6 -1.2 -3.0 n.a. 21170.7 28883.1 28851.0 -32.1 -0.1 4.9 42.0 Looking forward* Germany reports December industrial production. France and the UK release December merchandise trade data. Canada reports the January labour force survey. The US releases the January employment situation report. *Note — all releases are listed in local time. The Longer-Term Perspective The table below demonstrates that while we may experience some short-term weakness in markets, the longer-term performance remains encouraging. Equity markets as at 05/02/2015 Market % change 12 mths to 05/02/2015 Source: Datastream, Price Index Returns in local currency % change 12 mths to 05/02/2014 % change 12 mths to 05/02/2013 % change 12 mths to 05/02/2012 % change 12 mths to 05/02/2011 US: Dow Jones 15.83 10.45 8.68 6.37 20.77 US: S&P 500 17.75 15.90 12.37 2.60 22.95 US: NASDAQ 18.78 26.48 9.15 4.92 29.34 MSCI Europe 11.36 9.21 8.86 -8.95 16.05 UK: FTSE All Share 6.29 5.20 8.20 -2.02 19.78 UK: FTSE 100 6.32 2.79 6.47 -1.61 18.50 Germany: DAX 19.63 18.94 13.27 -6.23 32.79 France: CAC 40 14.22 11.45 7.78 -15.30 13.57 Netherlands: All Share 19.19 8.89 4.67 -10.84 16.89 Italy: S&P MIB 9.17 14.11 1.66 -27.32 8.66 Switzerland: SMI 5.32 9.57 20.34 -6.55 5.11 Spain: IBEX 35 7.78 20.77 -8.66 -18.37 7.44 Sweden: OMX 22.72 9.95 8.98 -5.32 21.74 Japan: Nikkei 23.44 28.37 25.08 -16.23 4.84 MSCI Asia Pacific ex Japan 15.42 -2.46 9.29 -9.61 18.53 Hong Kong: Hang Seng 16.44 -8.12 11.52 -13.18 21.58 Australia: S&P/ASX 200 14.61 3.84 14.85 -12.58 7.72 China: Shanghai Shenzhen 300 52.87 -20.54 10.60 -18.56 -2.40 Anne D Picker Chief Economist Econoday Important Information Econoday Inc. is a US company that provides financial commentary and indicators to industry professionals. All information provided and views expressed are those of Econoday. Reference in this document to specific securities should not be construed as a recommendation to buy or sell these securities, but is included for the purposes of illustration only. Past performance is not a reliable indicator of future results. The value of investments can go down as well as up and investors may not get back the amount invested.

© Copyright 2026