Speech by German Ambassador Michael Clauss at the 5th Caixin

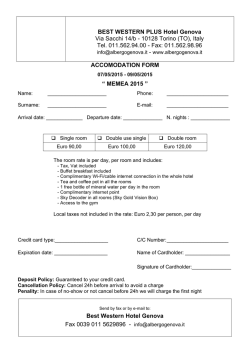

Speech by German Ambassador Michael Clauss at the 5th Caixin Summit “New Normal and Continuous Reform” December 19 - 20, 2014 Session on: “ World Economies Are Finding New Paths” Excellencies, Ladies and Gentlemen, thank you very much for the invitation to speak at the 5th Caixin Summit today, which allows me to give you a German and Eurozone perspective to the discussion. If you take a look at the state of world economy today, it is obvious that China is the only growth engine for the foreseeable future, despite its current economic slowdown. US unemployment is decreasing, growth is picking up, but is still well below before 2008 levels. Japan is struggling to boost growth, its economy has almost come to a halt. How does Europe come into this picture? If you look at the media, Europe seems to be in a state of permanent crises, underperforming. Sometimes it is even being portrayed as a risk to the world economy. But let us recall a few basic facts: a. Growth: For the first time since 2009 almost all Eurozone countries are back to growth . 2015 prospects are fairly good, especially in countries hardest hit by crisis. Compare 2014 to previous years: in 2009 Ireland was in a deep recession (-6.4%), Greece was badly hit in 2011 (-7.1%), Spain suffered from negative growth in 2012 (-1.6%), Cyprus went into recession in 2013 (-6%). The situation is very different today: Ireland is growing at an annual rate of 4-5%. Greece, which was hard hit, is expected to grow by 2% next year, also Spain, Portugal and Cyprus have returned to growth. b. The confidence of international financial markets has returned, spreads have gone down. In 2011 there was an almost 10%-gap between Portugal/Ireland 10-year government bonds and the German “bunds”. Today, the spreads have narrowed down to less than 1% in the case of Ireland and 2.3% in the case of Portugal. c. All Eurozone countries have carried out impressive and often painful reforms, for example on labour and fiscal spending. We can see that countries, which started reforms early, such as Ireland, Portugal and Spain, are in above1 average shape now: . But also France and Italy are taking bold steps in creating a more flexible labour market and reducing red tape. This will no doubt enhance their competitiveness and spur growth. But despite these positive developments there are discussions of a possible return of the Eurocrisis. Today, the focus is again on Greece. There is some concern of new political instability. How big is the risk of a return of the Euro-crisis? If the presidential elections in GRC, foreseen within the next four weeks, fail to produce a majority for the government in Parliament, general elections will have to be held. This causes some international concern, since Syriza, the radical party, leads the polls. But despite current jitters, there is little risk of contagion. Even if things went wrong in Greece, other former crisis countries, like Ireland, Portugal and Spain, are on a completely different track and not likely to be infected. Greece only stands for 2% of EU GDP. Furthermore, the Eurozone has drawn its lessons from the so-called Euro-crisis: it has put stable mechanisms in place to prevent the return of government debt as well as banking crises. Germany as Europe’s strongest economy played a crucial part in this. It struck a great bargain in this process: In exchange for Germany’s solidarity as the largest contributor to the rescue mechanisms, all Member States committed to reform in order to reestablish fiscal solidity and enhance their competitiveness. The Eurozone created a euro-firewall, the so-called European Stability Mechanism, which can step in anytime a new crisis might be looming.It is able to respond swiftly to possible new requests for financial assistance by euro area Member States. Its lending capacity is currently set at 500 billion euros. This amounts to about 4 trillion RMB. We have established a European banking union. Between 2008 and 2013, 1.6 trillion Euros, the equivalent of 13% of the US annual GDP, were committed to stabilize the ailing banking sector. After these “fire rescue type” operations we now have a durable institutional framework. The European Central Bank (ECB) has become the central supervisor for systemically important banks in the Euro area. The ECB now supervises all important banks with a balance sheet of above 30 billion euros or accounting for more than 20% of national GDP. Let me open a parenthesis here: The greatest challenge to the world economy at present is the Ukraine crisis. This has left a deep impact on Russia’s economy, which will probably shrink in 2015 also because of the dramatic fall of the oil price. Despite somewhat positive developments in recent days, the risk of a new Cold War has not been averted. Should the situation deteriorate further, no major economy will be able to shield itself from the effect. And it is certain that the deepest effect will be felt in Russia. Both China and the EU have a considerable interest in bringing Russia to respect the sovereignty and territorial integrity of Ukraine, to de-escalate and to prevent a new Cold War. 2 Returning to the EU: So what does successful EU reform mean for China and the world? The EU will not only remain crucial, but even has the potential to increase in importance to China and the world. If you compare to the other big economies China, USA, Japan, the EU is the number two in terms of polulation size (more than 500 million). The EU is the largest economy in the world, a 13.5 trillion Euro size economy. The EU is the biggest player in global trade. In 2013, it enjoyed a significant trade surplus of more than 227 billion Euro. At the same time, the EU is the largest source and destination of foreign direct investment in the world measured by both stocks and flows, attracting investments worth more than 327 billion Euro from the rest of the world in 2013 alone. On R&D the EU spends almost three times as much as China, almost double that of Japan and almost 90% of that of the US. Let me make a last remark on EU-China trade. EU-China trade in 2014 so far outstrips competitors and propels China’s growth. According to Chinese customs statistics, China’s exports to the EU increased by over 9% in the first ten months of 2014, faster than China’s exports to ASEAN and nearly twice as fast as China’s overall export growth. Among European countries, Germany is by far the strongest player: According to Chinese statistics, bilateral trade grew by 10% this year. I expect this trend to continue in the coming years. I am optimistic that the reform of the Chinese economy will offer more and better business opportunities especially for German and Chinese companies. Xiexie dajia. 3

© Copyright 2026

!["Minho - Le Nord" [no. 1 "Old Land Portugal"] - Free](http://s2.esdocs.com/store/data/000459019_1-763f6c95acdaf20bb3a9381d878beb51-250x500.png)