Canadian Markets - Vermilion Credit Union Ltd.

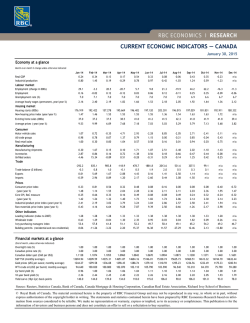

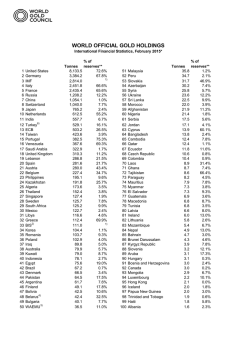

Canadian Markets For the week ending January 23, 2015 S&P/TSX jumps. The S&P/TSX Composite experienced its best week of the year as a surprise rate cut by the Bank of Canada more than offset any weak economic data release. By week’s end, Canada’s main index surged 470 points, or 3.3%, to close at 14,779. Equity investors rejoiced on the Bank’s news seeing reason to snap up energy and financial stocks following weeks of declines on plummeting oil prices. However, the rally may be short lived as many see the interest rate cut as a sign of possibly negative things to come for the Canadian economy. Loonie nose-dives. The Loonie was in damage control for the week, declining almost 3 U.S. cents. Of the five trading days, four saw declines to the Canadian dollar with most occurring after the Bank of Canada’s rate announcement. In the end, our currency free fell 2 and 92/100th of a U.S. cent for the week to close at US80.52 cents per Canadian dollar, a drop of 3.5% and to our lowest in five years. The continued strength of the U.S. dollar did little to help as investors fled to the greenback on the U.S. economic strength, the extent of the ECB’s QE program, and the uncertainty of the Greek elections and its future in the Eurozone. Gold glitters. The yellow metal rose higher for a third straight week increasing 1.1% on investor demand in the face of the Bank of Canada’s sudden rate move, the ECB’s monetary stimulus, and elections in Greece. Adding to the interest in gold was the International Monetary Fund’s revised lower projections for global growth in 2015 and 2016, as well as its urging of the world economies to maintain current monetary policy and refrain from raising interest rates. At week’s end, the precious metal gained US$14.60 to close at US$1,294.60. Gold remains well off its all-time high and is sought by investors as a safe haven and hedging instrument in times of uncertainty. Oil falls. West Texas Intermediate (WTI) crude, after momentary reprieve, continued its downward slide. The commodity lost another US$3.10 to close at US$45.38 a barrel, a decline of 6.4%. Despite the reprieve, WTI fell to a six year low as excess inventory continues to burden the supply-demand balance. Bank of Canada drops its key interest rate. Bank of Canada Governor Stephen Poloz enacted the Bank’s influence on monetary policy by shocking investors and the markets with a 25 basis point cut of its overnight lending rate to a historical low of 0.75%. This rate, the interest percentage paid by financial institutions for lending money to each other, had not been touched since September 2010. The move by the Bank may be bringing to light greater risks to the Canadian economy amidst a fall in oil, resource, and commodity prices as currency investors punished the Canadian dollar following Governor Poloz’s announcement. Ironically, the Bank’s efforts to rein in household debt from its all-time highs may falter as the lower interest rate makes it more attractive for consumers to continue to borrow. Inflation lower. As expected, the fall in oil prices led to cheaper gasoline prices at the pumps, dropping the monthly consumer price index by 0.7% in December with core inflation falling as well by 0.3%. On an annualized basis, the inflation rate fell to 1.5% from 2.0% on a 17% drop in gasoline with core inflation actually increasing 0.1% to 2.2%. The cost of living had not been at this level since the Spring of 2014 and places the annual rate well below the Bank of Canada’s target, resulting in a surprise interest rate cut. Omitting gas prices, the CPI would have increased to 2.3% annually. Manufacturing sales fall. Factory sales fell more than economists’ expected as November’s reading fell 1.4%. This was the third decline in four months doubling the expected decline and was blamed on lower auto, chemical, and food sales. Of the 21 industries tracked, 16 declined for the month. However, on a year-over-year basis, sales were higher by 5.2%. Retail sales edge up. Canadian retailers, on the backs of matching the U.S. Black Friday promotions, surprised economist estimates of a 0.2% decline by gaining 0.4% gain in November to a record high of $43B. Of the 11 subsectors tracked, five saw increases led by clothing (+5.2%) and electronic and appliances (+4.6%). Excluding autos, which fell, sales would have risen 0.7%. Annually, November’s reading was 4.8%, a notch lower than October’s 4.9%. S & P / TSX Composite Daily Index Change Friday 300.00 251.98 250.00 203.56 200.00 150.00 100.00 50.00 0.00 15.37 3.09 4.06 -50.00 Indices Week YTD S&P/TSX Composite 14,779.35 469.94 146.95 3.28% 1.0% Dow Jones Industrial Average 17,672.60 161.03 0.92% -150.47 -0.8% S&P 500 2,051.82 32.40 -7.08 1.60% -0.3% NASDAQ 4,757.88 123.50 2.66% 21.83 0.5% Hang Seng Index 24,850.45 746.93 1245.41 3.10% 5.3% FTSE 100 6,832.83 Source: Bloomberg 282.56 4.31% 266.73 4.1% U.S. & International Markets For the week ending January 23, 2015 U.S. market posts first weekly gain of the year. All three major U.S. indices posted their first weekly gain of year 2015 thanks to ECB stimulus announcement and some good earnings news. The broad-based S&P 500 index gained 32 points or 1.6% for the week, closing at 2,052. The Dow Jones Industrial Average moved up 161 points or 0.9% and closed the week at 17,673. Nasdaq was the biggest gainer among the three, gaining 124 points or 2.7% for the week to close at 4,758. Manufacturing slows. The Markit “Flash” manufacturing Purchasing Manager Index (PMI) dropped to 53.7 in January from 53.9 in December, pointing to a deceleration of manufacturing activities. Despite being still above the 50 separation line between expansion and contraction, the reading was the lowest in 12 months. It was believed the slowdown was led by a weakening inflow of new orders, which also hit a 12-month low. U.S. housing news: o Housing starts higher. Overall housing starts rose 4.4% in December to a seasonally-adjusted annual rate of 1.09 million units and starts on single-family homes rose to a 6 ½ year high of 728,000 units, offering hope that the housing market is on a solid recovery. Starts for all of 2014 rose 8.8% to 1.01 million units, the highest since 2007. o Existing home sales rise. Home resales rose slightly in December, another good sign for the housing market in the U.S. Existing home sales increased 2.4% to an annual rate of 5.04 million units in December, slightly lower than the forecast of 5.06 million unit pace by economists. For all of 2014, existing home sales dipped 3.1% to 4.93 million units, the first annual decline since 2010. ECB launches QE, finally. After much speculation since last year, the ECB finally launched its own version of QE program within the Euro-zone. ECB President Mario Draghi announced in an ECB policy meeting on Thursday that it would buy government bonds beginning this March until the end of September 2016. Together with other stimulus measures already in place, ECB will be pumping $60 billion euros a month into the economy; by the end of the program, $1 trillion euros will have been created. Sovereign bonds will be bought in proportion to the ECB’s capital key, meaning that large economies like Germany and France will see more of their bonds being purchased by the ECB. China’s GDP growth misses target. People finally got an answer to one of the most discussed topics in the investment world last year: Can China meet its growth target? The answer is, well no, but not too bad. China’s official GDP grew 7.4% in 2014, barely missing the 7.5% target. It was the slowest growth since 1990. Most economists expected China to not to meet the 7.5% target, but the official number turned out better than most expected after a slew of disappointing data in the last few months of 2014. China’s manufacturing improves. Although the Markit “Flash” manufacturing Purchasing Managers’ Index was still below 50, China’s manufacturing showed a little rebound as the reading was up from December’s reading, moving a bit closer to the 50 dividing line. The gauge was reported as 49.8 for January, beating economists’ forecast of 49.5 and was up from December’s 49.6. Central bank’s stimulus measures were believed to be the stabilizing force for the sector. IMF cuts global growth outlook. The International Monetary Fund (IMF) reduces its growth forecast for 2015. It forecasts global economy will grow 3.5% in 2015, a slash from its previous projection of 3.8% back in October last year. IMF saw weakness in most regions in the world, except for in the world’s largest economy— the U.S. It actually upgraded the U.S. growth forecast to 3.6% from the previous 3.1%. Elsewhere, IMF cut China’s forecast to 6.8%, 19-nation Eurozone to 1.2%, and Japan to 0.6%. DJIA Daily Index Change 300.00 259.70 250.00 200.00 150.00 100.00 50.00 0.00 39.05 3.66 0.00 -50.00 -100.00 -150.00 141.38 -200.00 S & P 500 Daily Index Change 35.00 31.03 30.00 25.00 20.00 15.00 9.57 10.00 5.00 0.00 0.00 3.13 -5.00 -10.00 -15.00 11.33 This commentary is brought to you by Talk to your Credential Investment Professional The information contained in this report was obtained from sources believed to be reliable; however, we cannot guarantee that it is accurate or complete. This report is provided as a general source of information and should not be considered personal investment advice or solicitation to buy or sell any mutual funds and other securities. Credential Securities Inc. is a Member of the Canadian Investor Protection Fund. ®Credential and Credential Securities are registered marks owned by Credential Financial Inc.

© Copyright 2026