Ashok Leyland - Business Standard

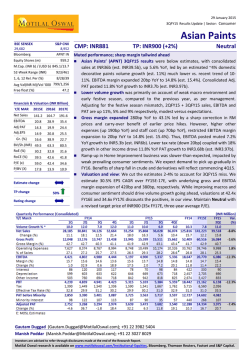

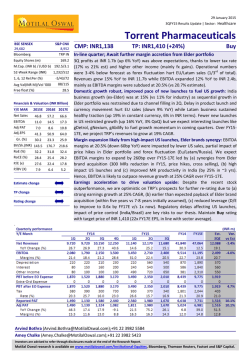

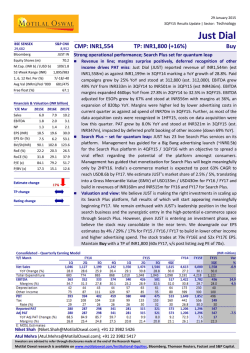

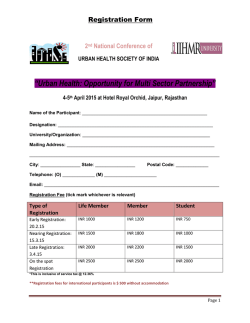

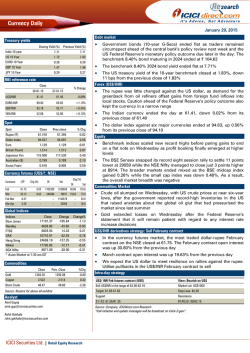

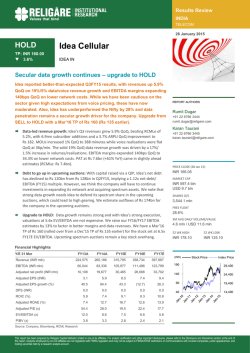

30 January 2015 3QFY15 Results Update | Sector: Automobiles Ashok Leyland BSE SENSEX 29,682 Bloomberg S&P CNX 8,952 AL IN CMP: INR66 TP: INR87 (+32%) Buy Significant beat; balance sheet continues to improve; Upgrade EPS/TP Recovery continues in 3QFY15 for AL, with second consecutive quarter of positive PAT, driven by fourth consecutive quarter of QoQ increase in ASP (despite rising 69/15 discounts) and operating leverage. Management’s focused approach is paying off in a) 1, 6, 12 Rel. Per (%) 21/78/266 market share gains, b) rising ASPs, c) controlled cost, d) reducing working capital, e) 733/19,295 AvgVal(INR M)/Vol ‘000 significant control on capex and f) debt reduction. Strong volume recovery coupled Free float (%) 61.2 with weak commodity prices would drive significant margin expansion and EPS growth. Maintain Buy with a target price of ~INR87 (9x FY17E EV/EBITDA). Financials & Valuation (INR Million) Net sales grew 72.1% YoY (+4.5% QoQ) to INR33.6b (est. INR31.74b) led by volume Y/E MAR 2015E 2016E 2017E growth of 38.1% YoY (flat QoQ), while realizations grew 24.6% YoY (up 4.3% QoQ) Net Sales 135,526 188,076 246,269 driven by higher M&HCV, Buses and Export contribution (despite moderately EBITDA 10,338 20,643 29,931 higher discounts). Adj PAT 3,110 10,077 16,956 EBTIDA margin of 7.1% (up 12pp YoY, down 20bp QoQ, v/s est. 6.7%) was aided by EPS (INR) 0.7 3.5 6.0 higher operating leverage, despite higher RM cost (adverse mix). Gr. (%) -140 399 68 Adj. PBT was at ~INR594m (v/s est. ~INR273m). Higher tax rate at 46% restricted BV/Sh.(INR) 18 21 25 PAT to ~INR321m (v/s est. INR205m). RoE (%) 4.2 18.0 26.0 Key takeaways from the call: a) Working capital moderation continues at 9 days or RoCE (%) 7.4 17.9 26.9 INR4b (v/s INR6.3b in 3QFY14 v/s INR7.8b in 2QFY15), b) 4QFY15 margins could be P/E (x) 93.0 18.6 11.1 higher by up to ~100bp due to the benefit of excise increase on excise-exempted P/BV (X) 3.6 3.2 2.6 Pantnagar plant (~35% volume contribution), c) capex (including investments) in 9MFY15 was ~INR900m (v/s guided capex of ~INR5b and d) EBITDA margin target of 12% in the medium term, led by lower discounts and operating leverage. Estimate change 29-34% Valuation and view: We are upgrading FY16/17E EPS by 34%/29% (see Pg.4 for TP change 42% details) AL trades at 11.1x FY17E EPS and EV/EBITDA of 6.9x. We now value AL at 9x EV/EBITDA (v/s 8x earlier), translating into a TP of ~INR87, to reflect the increasing Rating change confidence in management’s strategy and prudent capital allocation. Equity Shares (m) M.Cap. (INR b) / (USD b) 52-Week Range (INR) 2,845.9 187.8/3.0 Jinesh Gandhi ([email protected]); +91 22 3982 5416 Investors are advised to refer through disclosures made at the end of the Research Report. Motilal Oswal research is available on www.motilaloswal.com/Institutional-Equities, Bloomberg, Thomson Reuters, Factset and S&P Capital. Ashok Leyland Strong revenue growth led by volume uptick and realization improvement AL’s volume grew by 38% (flat QoQ), reflecting early cycle recovery in M&HCVs. MHCV volumes grew by ~71% YoY for, while LCV volumes declined by 5% YoY. AL’s market share gain continues, with ~26.6% market share of the industry (v/s 22.7% in 3QFY14), driven by doubling of network to over 620 touchpoints over last 3-4 years, new product launches (Boss , Captain, Neptune Engine, Rigid Dost, Jan Bus etc) and strong growth in exports. Average realizations improved by 24.6% YoY (up 4.3% QoQ) to INR1.32m/unit (est INR1.25m/unit) driven by higher M&HCV, Buses and Export contribution (despite moderately higher discounts). Discounts marginally higher at INR 170k/unit – 180k/unit (v/s ~INR160k/unit in 2QFY15). As a result net sales grew 72.1% YoY (+4.5% QoQ) to INR33.6b (est INR31.74b) Exhibit 1: AL’s MHCV volumes rise sequentially on better macro-environment Exhibit 2: MHCV volumes grow by 70.6% YoY 70.6 14.3 0.3 Source: Company, MOSL Exhibit 3: Share of LCVs (under Nissan JV) continue to be under pressure 3QFY15 2QFY15 1QFY15 4QFY14 3QFY14 2QFY14 1QFY14 4QFY13 3QFY13 2QFY13 3QFY15 2QFY15 1,323 1,268 1,240 1,181 1,062 1,103 1,088 1,077 1,050 1,105 1,094 1,253 1,184 42 28 25 28 28 26 29 35 32 31 31 1,305 Realization (INR '000/unit) Source: Company, MOSL 30 January 2015 Exhibit 4: Product mix change in favor of MHCV, drives realizations Dost 58 72 75 72 72 74 71 65 68 69 69 1QFY13 2QFY12 4QFY12 1 11 14 3QFY12 1QFY12 86 100 99 89 Source: Company, MOSL 1,303 Volumes (ex Dost) (20.2) 4QFY14 4QFY13 3QFY13 2QFY13 1QFY13 4QFY12 3QFY12 (27.1) 1QFY15 (26.4) (29.0) 2QFY12 (24.9) 3QFY14 (23.3) 2QFY14 4.6 5.0 (10.5) 1QFY14 -8.8 -3.2 1QFY12 18,252 3QFY15 18,187 2QFY15 14,949 1QFY15 18,829 4QFY14 10,698 3QFY14 15,913 2QFY14 14,897 1QFY14 23,603 4QFY13 14,681 3QFY13 21,175 2QFY13 20,239 13.3 1QFY13 30,776 4QFY12 20,685 3QFY12 23,659 2QFY12 1QFY12 19,277 MHCVs (units) 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q FY12 FY13 FY14 FY15 Source: Company, MOSL 2 Ashok Leyland Exhibit 6: AL largely maintains its share over last few years Exhibit 5: 3QFY15 registers gain in MHCV market share FY13 26.2 25.1 FY14 28.0 25.4 28.0 Dom. MHCV market share (%) FY15 26.5 22.5 23.1 26.2 25.4 29.7 29.7 23.1 22.5 28.0 22.4 27.8 25.1 28.0 26.5 1Q 2Q 27.8 22.4 1Q 2Q 3Q 4Q 1Q 2Q FY13 Q1 Q2 Q3 3Q 4Q FY14 3Q FY15 Q4 Source: Company, SIAM, MOSL Source: Company, SIAM, MOSL Highest EBITDA in 8 quarters; Higher tax rate restricts PAT EBITDA came in at INR 2.4b v/s EBITDA loss of INR 969m YoY, translating into EBTIDA margins of 7.1% (up 1210bp YoY, down 20bp QoQ, v/s est 6.7%). RM cost at 74.5% (-520bp YoY, +90bp QoQ, v/s est 74%;) was marginally higher on adverse mix. Whereas Staff cost at 8.2% (-90bp QoQ, -410bp YoY, v/s est 9%) was lower on both QoQ and YoY basis. Recurring PBT at ~INR594m (v/s est ~INR273m), a second consecutive quarter of positive PBT after 5 quarters of PBT loss. Higher tax rate at 46% restricted PAT to ~INR321m (v/s est INR205m). Exhibit 7: Strong rebound in margins on higher volumes, mix change FY13 1Q 2Q 6.0 7.1 2,381 -5.0 75.8 75.5 76.3 2,343 4Q 1,839 3Q 2.2 4.7 7.3 RM (% of net sales) 2Q 3Q -969 1,983 2Q 1.0 563 5.3 233 4.3 1,023 1Q 10.1 3,341 2,407 8.0 EBITDA Margins (%) 1,161 EBITDA (INR m) Exhibit 8: RM cost rise marginally on product mix change 3Q FY14 4Q 1Q FY15 72.8 72.8 1Q 2Q 79.7 75.3 71.9 3Q 4Q 1Q 2Q FY13 Source: Company, MOSL 3Q FY14 4Q 74.5 73.3 73.6 1Q 2Q 3Q FY15 Source: Company, MOSL Improved demand led to lower inventory pile up 30 January 2015 Working Capital moderation continues at 9 Days or INR4b (v/s INR6.3b in 3QFY14 v/s INR7.8b in 2QFY15). Inventory at 3,800 units (v/s 5,800 in 2QFY15 v/s 6,300 in 3QFY14). 3 Ashok Leyland Exhibit 9: Working Capital Moderation continues 12,379 Exhibit 10: Financial gearing reducing Trend in Working Capital (INR mn) Gross Debt (INR b) 55 57 54 47 45 43 40 4Q 1Q 2Q 3Q 7,781 6,300 4,570 4,000 2,240 1Q 2QFY14 3QFY14 4QFY14 1QFY15 2QFY15 3QFY15 2Q 3Q FY14 Source: Company, MOSL FY15 Source: Company, MOSL Highlights from the call Steep decline in diesel rates improved profitability of freight operators, as freight rates declined only 3-4% v/s diesel price drop of 15-17%. As a result, replacement demand has got a boost. AL is targeting 33% of its revenues from exports in 3-5 yrs, driven by new markets of Africa, SE Asia and Russia and deeper penetration into existing markets of ME, SL, Bangladesh, Nepal etc. 4QFY15 margins could be higher by 50-100bp just due to benefit of excise increase on excise exempt Pantnagar plant (~35% volume contribution). It is targeting Pantnagar to contribute 40-50% of volumes going forward, as it will help optimize freight cost for servicing North, East and Central markets. Targeting EBITDA margin of 12% in medium term, driven by demand recovery pricing power/discount moderation and operating leverage. Free Cash generation of INR3.2b in 3QFY15 and INR7.2b for 9MFY!5. Capex (incl investment) at INR230m in 3QFY15/ INR900m in9MFY15. FY15 capex (incl investments) to be significantly lower than guidance of ~INR5b. Capacity: 150k p.a for M&HCV and 50-60k capacity for LCVs. Gross debt at INR40b (v/s ~INR43b in 2QFY15 v/s ~INR54b in 3QFY14). Valuation and view: Upgrade EPS, Target Price 30 January 2015 Upgrade FY16-17 EPS by 29-34%: We are upgrading our FY15/16/17E EPS by 81%/34%/29% to INR0.7/3.5/6 to reflect a) stronger than estimated demand recovery, b) better pricing power, c) commodity price correction, d) faster than estimated debt reduction, and e) higher tax. MHCV demand bottomed-out; sharp recovery expected in 1HFY16 onwards: MHCV demand has bottomed-out with growth witnessed in 2QFY15 and 3QFY15 post 2 years of sharp decline of over 40%. Freight utilization levels and consequent freight rates have moved up over last 2-3 quarters, reflecting improving transporters’ cashflows. While domestic M&HCVs industry volumes grew for first time in Aug-14, AL’s M&HCV volumes grew by ~70.6% in 3QFY15 (~23% FY15YTD growth) given its higher exposure to South and West, as well as distribution expansion in North and East. Past CV cycles suggest 23% volume CAGR from bottom to top of cycle for MHCV industry: During the last two major CV cycles, MHCV volumes clocked a CAGR of ~23% from the bottom of the cycle to the top. EBITDA during such 4 Ashok Leyland recovery phases has grown at a faster pace, driven by margin expansion on operating leverage and enhanced pricing power. Interestingly, even after assuming 20% CAGR in MHCV volumes on the base of FY14, FY17 volumes would be marginally lower than FY12 levels. For AL, we are estimating ~27% CAGR in MHCV volumes over FY14-17E. Expect sharp improvement in operating performance: Rebound in industry demand should drive down discounts significantly from all time high levels of ~INR180k (v/s <INR60k in FY12). With recovery in demand coupled with cost reduction measures, we expect fixed cost (as percentage of sales) to reduce meaningfully, driving margins higher. We estimate EBITDA margins to improve by ~10.5pp over FY14-17E, to 12.2%. Aggressive focus on curtailing debt and generating cash: To emerge leaner and stronger from the downturn, AL has focused on generating cash and curtailing debt through working capital reduction, controlled capex and monetizing noncore assets. Further, capex for FY15 is expected to be significantly lower than guidance of INR 5b (v/s INR5.5b in FY14 v/s 15.4b in FY13). Rerating to continue: Management’s focused approach is paying-off in a) market share gains, b) rising ASPs, c) controlled cost, d) reducing working capital, e) significant control on capex and f) debt reduction. Strong volume recovery coupled with weak commodity prices would drive significant margin expansion and EPS growth. The stock trades at 11.1x FY17 EPS and EV/EBITDA of 6.9x. We now value AL at 9x EV/EBITDA (v/s 8x earlier), translating into TP of ~INR87, to reflect for increasing confidence in management’s strategy and prudent capital allocation. Exhibit 11: Revised Forecast (INR M) FY15E Old 102,063 128,520 7.2 1,116 0.39 Rev 104,316 135,526 7.6 2,020 0.71 Volumes (units) Net Sales EBITDA margins (%) Net Profit EPS (INR) Chg (%) 2.2 5.5 40bp 81.0 81.0 Rev 142,216 188,076 11.0 10,077 3.5 FY16E Old 135,584 172,595 9.9 7,520 2.6 Chg (%) 4.9 9.0 100bp 34.0 34.0 Rev 174,979 246,269 12.2 16,956 6.0 FY17E Old 166,690 223,278 11.1 13,146 4.6 Chg (%) 5.0 10.3 110bp 29.0 29.0 Source: Company, MOSL Exhibit 12: Valuations trading above historical average, reflecting improving fundamentals 52 EV/EBDITA Peak(x) Avg(x) Min(x) P/B (x) 5 Yrs Avg(x) 12.0 15 Yrs Avg(x) 10 Yrs Avg(x) 46.4 42 8.0 30 January 2015 Jan-15 Nov-13 Sep-12 Sep-04 Jul-03 May-02 Mar-01 Jan-00 Jan-15 Jan-14 Jan-13 Jan-12 Jan-11 Jan-10 Jan-09 Jan-08 Jan-07 Jan-06 Jan-05 Jan-04 Jan-03 Jan-02 Jan-01 Jan-00 Source: MOSL Aug-11 2.8 1.9 0.0 2 3.3 Jun-10 5.1 2.9 4.0 Apr-09 12 10.1 Feb-08 12.4 Dec-06 22 Oct-05 32 Source: MOSL 5 Ashok Leyland Exhibit 13: Comparative Valuation Auto OEM's Bajaj Auto Hero MotoCorp TVS Motor M&M Maruti Suzuki Tata Motors Ashok Leyland Eicher Motors# Auto Ancillaries Bharat Forge Exide Industries Amara Raja Batteries # Nos. are on CY basis 30 January 2015 CMP * (INR) 2,403 2,875 310 1,295 3,687 598 66 16,456 1,043 194 895 Rating TP (INR) Buy 2,832 Buy 3,375 Buy 289 Neutral 1,318 Buy 4,616 Buy 581 Buy 87 Buy 16,473 Buy Buy Buy 1,154 190 1,093 P/E (x) FY16E FY17E 15.8 13.6 16.3 13.6 21.4 17.2 16.5 13.2 21.3 16.0 8.0 6.8 18.6 11.1 42.1 26.3 26.2 21.2 27.9 20.3 17.9 20.5 EV/EBITDA (x) FY16E FY17E 10.1 8.3 11.4 9.2 13.4 10.6 14.2 11.6 11.4 9.0 3.4 2.7 10.6 6.9 25.3 16.6 14.0 12.8 15.8 11.1 10.5 11.8 RoE (%) FY16E FY17E 36.4 35.4 46.9 45.1 34.7 32.7 16.5 16.9 18.5 20.6 25.2 23.3 18.0 26.0 36.8 41.4 25.8 16.6 28.8 26.7 17.1 31.0 RoCE (%) FY16E FY17E 50.4 48.8 66.0 63.0 41.2 41.0 17.9 18.8 23.2 26.1 27.3 26.9 17.9 26.9 39.8 48.3 26.9 30.3 23.4 24.1 40.7 44.1 Source: Company, MOSL 6 Ashok Leyland Ashok Leyland | Story in Charts: Best play on CV cycle recovery Exhibit 14: Past cycle suggest ~23% volume CAGR from bottom to top of the cycle M&HCV Volumes ('000 units) 400 20 Volumes decline ~4% Volumes to grow CAGR ~23% CAGR Volumes went 3.5x or ~23% CAGR 300 IIP Growth (%) - RHS 15 FY17E FY16E FY15E FY14 FY13 FY12 FY11 FY10 FY09 FY08 FY07 FY06 FY05 FY04 FY03 FY02 FY01 FY00 0 FY99 0 FY98 5 FY97 100 FY96 10 FY95 200 Source: Company, MOSL Exhibit 16: Higher volumes, discount reduction to drive margins Exhibit 15: Revenue to grow at 35% CAGR Growth (%) FY17E FY12 FY13 1.7 FY14 29,931 FY16E 7.6 20,643 FY15E FY15E FY16E FY17E Source: Company, MOSL Exhibit 17: Capex/investments to moderate significantly Exhibit 18: Focused on reducing debt levels 6,438 43.4 46.8 38.8 32.3 33.5 21.5 FY17E FY16E FY15E FY14E 3,808 2,324 3,770 750 4,069 2,000 4,191 3,000 4,302 FY13 6,906 3,528 Net Debt (INR b) Source: Company, MOSL 30 January 2015 Source: Company, MOSL Depreciation FY12 FY11 FY10 2,041 3,501 2,674 6,844 7,579 1,784 FY09 1,774 6,095 FY08 FY07 1,506 6,704 Capex 12.2 10,338 8,765 FY14 13,175 FY13 11.0 7.0 (20.3) EBITDA Margins (%) 10.2 246,269 FY12 30.9 188,076 (3.3) 38.8 135,526 129,034 15.4 99,434 124,812 36.3 EBITDA (INR m) 1,666 Revenues (INR m) FY12 FY13 FY14 FY15E FY16E FY17E Source: Company, MOSL 7 Ashok Leyland Exhibit 19: ROE to improve with recovery in CV demand RoCE (%) 15.3 13.4 RoE (%) Exhibit 20: Focused on reducing debt/equity levels 26.9 26.0 Debt/Equity (x) 17.918.0 6.4 1.0 7.4 3.9 1.1 0.8 0.8 4.2 0.6 (1.5) 0.3 (10.7) FY12 FY13 FY14 FY15E FY16E FY17E Source: Company, MOSL 30 January 2015 FY12 FY13 FY14 FY15E FY16E FY17E Source: Company, MOSL 8 Ashok Leyland Corporate profile Company description Exhibit 21: Sensex rebased Ashok Leyland (AL), the flagship company of Hinduja Group, is the 2nd largest MHCV with ~26% market share and the largest Bus manufacturer in India. To expand its product offerings, AL has entered into 50:50 JV with Nissan for LCVs and John Deere for construction equipment. Exhibit 22: Shareholding pattern (%) Dec-14 Sep-14 Exhibit 23: Top holders Dec-13 Promoter 38.8 38.8 40.9 DII 13.2 13.3 12.3 FII 32.0 33.8 26.4 Others 16.0 14.1 20.3 Note: FII Includes depository receipts Exhibit 24: Top management Name Holder Name % Holding LIC of India Amansa Holdings Pvt Ltd JP Morgan Sicav Investment Company (Mauritius) Ltd JP Morgans India Fund IDFC Premier Equity Fund Kuwait Investment Authority - Fund No 208 7.3 1.9 1.6 1.1 1.1 1.1 Exhibit 25: Directors Designation Name Name D G Hinduja Chairman D G Hinduja D J Balaji Rao* Vinod K Dasari Managing Director R Seshasayee Sanjay K Asher* Gopal Mahadevan Chief Financial Officer Vinod K Dasari Shardul S Shroff* Rajive Saharia President – Trucks A K Das Andreas H Biagosch* T. Venkataraman Sr Vice President - Buses F Sahami Manisha Girotra* Jean Brunol* *Independent Exhibit 26: Auditors Exhibit 27: MOSL forecast v/s consensus Name Type Deloitte Haskins & Sells LLP M S Krishnaswami & Rajan Geeyes & Co Statutory Statutory Cost Auditor 30 January 2015 EPS (INR) MOSL forecast Consensus forecast Variation (%) FY15 FY16 FY17 0.7 3.5 6.0 0.5 2.3 3.7 54.2 52.2 64.1 9 Ashok Leyland Key Operating Metrics Exhibit 28: Snapshot of Revenue model 000 units HCV Passenger (units) Growth (%) HCV Goods (units) Growth (%) FY10 FY11 FY12 FY13 FY14 FY15E FY16E FY17E 18 25 26 23 19 24 31 39 -6.4 36.5 2.2 -8.9 -18.0 25.0 30.0 25.0 44 68 68 55 41 52 68 85 32.9 53.4 0.4 -18.8 -26.1 27.5 30.0 25.0 LCVs (units) 1 1 1 1 1 1 2 2 Growth (%) -17.1 -20.7 27.7 -29.7 0.9 30.0 50.0 50.0 0 0 8 35 27 24 35 40 359.9 -22.7 -11.1 45.8 15.0 0 1 3 7 8 0.0 1.2 0.3 0.3 DOST (units) Growth (%) Non-DOST JV (units) 0 0 0 Growth (%) Total volumes ex Dost (units) 64 94 95 80 61 77 101 126 17.4 47.2 1.1 -16.2 -23.5 26.7 30.3 25.4 Total Volumes incl Dost (units) 64 94 103 115 89 104 142 175 Growth (%) 0.0 47.2 9.2 11.6 -22.1 16.8 36.3 23.0 1,133 1,188 1,256 1,089 1,113 1,299 1,322 1,407 2.2 16.7 1.8 6.4 188 246 38.8 30.9 Growth (%) ASP (INR/unit) Growth (%) Net Sales (INR b) Growth (%) 72 112 129 125 99 136 21.1 54.3 15.4 -3.3 -20.3 36.3 Source: Company, MOSL 30 January 2015 10 Ashok Leyland Financials and valuations Income Statement Y/E March (INR Million) 2010 2011 2012 2013 2014 2015E 2016E 2017E 64 17.4 72,447 21.1 7,628 62.5 10.5 2,041 5,587 811 704 5,448 1,211 22.2 94 47.2 111,771 54.3 12,137 59.1 10.9 2,674 9,463 1,889 445 8,018 1,705 21.3 103 9.2 129,034 15.4 13,175 8.6 10.2 3,528 9,647 2,553 404 7,514 1,240 16.5 115 11.6 124,812 -3.3 8,765 -33.5 7.0 3,808 4,957 3,769 624 4,707 370 7.9 89 -22.1 99,434 -20.3 1,666 -81.0 1.7 3,770 -2,105 4,529 665 -912 (1,206) 132.2 104 16.8 135,526 36.3 10,338 520.7 7.6 4,069 6,269 3,842 925 4,442 1,333 30.0 142 36.3 188,076 38.8 20,643 99.7 11.0 4,191 16,452 3,179 1,123 14,395 4,319 30.0 175 23.0 246,269 30.9 29,931 45.0 12.2 4,302 25,629 2,393 988 24,223 7,267 30.0 4,237 108.2 4,269 109.8 6,313 49.0 6,313 47.9 6,274 -0.6 6,258 -0.9 4,337 -30.9 1,669 -73.3 294 -93.2 -4,763 -385.4 3,110 958.5 2,020 -142.4 10,077 224.0 10,077 398.8 16,956 68.3 16,956 68.3 2010 2011 2012 2013 2014 2015E 2016E (INR Million) 2017E Sources of Funds Share Capital Reserves Net Worth Loans Deferred Tax Liability Foreign currency translation Capital Employed 2,661 34,027 36,688 22,039 4,611 (125) 63,213 2,661 36,969 39,630 26,733 4,439 70,802 2,661 39,421 42,082 32,630 4,904 42 79,657 2,661 41,890 44,551 43,554 5,274 93,379 2,661 41,818 44,479 46,903 4,068 95,450 2,846 49,698 52,544 40,903 4,290 97,737 2,846 56,351 59,197 33,903 5,010 98,110 2,846 68,172 71,018 22,403 6,221 99,642 Application of Funds Gross Fixed Assets Less: Depreciation Net Fixed Assets Capital WIP Investments Curr.Assets, L & Adv. Inventory Sundry Debtors Cash & Bank Balances Loans & Advances 60,186 17,691 42,496 5,615 3,262 41,397 16,382 10,221 5,189 9,605 66,919 20,581 46,338 3,580 12,300 43,716 22,089 11,645 1,795 8,186 72,564 23,429 49,135 5,482 15,345 49,195 22,306 12,302 326 14,261 83,796 25,588 58,208 6,889 23,376 47,883 18,960 14,194 139 14,589 86,723 30,124 56,599 1,815 27,897 41,769 11,887 12,990 117 16,775 88,288 34,193 54,095 1,000 28,747 53,109 15,780 16,709 2,054 18,565 90,038 38,384 51,654 1,250 30,747 69,925 23,188 23,188 363 23,188 93,038 42,686 50,352 1,250 32,747 88,574 30,362 30,362 862 26,988 29,608 23,317 2,604 3,687 11,789 63,213 35,131 23,085 7,092 4,954 8,584 70,802 39,501 27,725 6,807 4,969 9,695 79,657 37,588 24,854 8,862 3,872 10,295 98,769 32,630 22,142 8,929 1,560 9,139 95,450 39,214 27,848 7,426 3,940 13,895 97,737 55,467 38,646 10,306 6,515 14,459 98,110 73,281 50,603 13,494 9,184 15,293 99,642 Volumes ('000 units) Growth (%) Net Sales Change (%) EBITDA Change (%) EBITDA Margins (%) Depreciation EBIT Interest & Fin. Charges Other Income PBT Tax Effective Rate (%) Rep. PAT Change (%) Adjusted PAT Change (%) Balance Sheet Y/E March Current Liab. & Prov. Sundry Creditors Other Liabilities Provisions Net Current Assets Application of Funds E: MOSL Estimates 30 January 2015 11 Ashok Leyland Financials and valuations Ratios Y/E March Basic (INR) EPS EPS Fully Diluted EPS Growth (%) Cash EPS Book Value per Share DPS Payout (Excl. Div. Tax) % 2010 2011 2012 2013 2014 2015E 2016E 2017E 1.6 1.6 109.8 1.2 6.9 0.4 23.4 2.4 2.4 47.9 1.7 7.4 0.5 21.1 2.4 2.4 -0.9 3.7 15.8 1.0 42.5 0.6 0.6 -73.3 2.1 16.7 0.6 95.6 -1.8 -1.8 -385.4 -0.4 16.7 0.0 0.0 0.7 0.7 -139.7 2.1 18.5 0.5 70.4 3.5 3.5 398.8 5.0 20.8 1.0 28.2 6.0 6.0 68.3 7.5 25.0 1.5 25.2 Valuation (x) P/E Cash P/E EV/EBITDA EV/Sales Price to Book Value Dividend Yield (%) 41.1 55.7 24.8 2.6 9.6 0.6 27.8 39.1 15.9 1.7 8.9 0.8 28.1 17.9 15.2 1.6 4.2 1.5 105.2 32.1 24.2 1.7 3.9 0.9 -36.9 -176.9 129.2 2.2 3.9 0.0 93.0 30.8 21.7 1.7 3.6 0.8 18.6 13.2 10.6 1.2 3.2 1.5 11.1 8.8 6.9 0.8 2.6 2.3 Profitability Ratios (%) ROE RoCE 12.0 10.5 16.5 14.8 15.3 13.4 3.9 6.4 -10.7 -1.5 4.2 7.4 18.0 17.9 26.0 26.9 Turnover Ratios Debtors (Days) Inventory (Days) Creditors (Days) Working Capital (Days) Fixed-Asset Turnover (x) 51 83 117 17 1.7 38 72 75 35 2.4 35 63 78 19 2.6 42 55 73 24 2.1 48 44 81 10 1.8 45 43 75 13 2.5 45 45 75 15 3.6 45 45 75 15 4.9 Leverage Ratio Debt/Equity (x) 0.6 0.7 0.8 1.0 1.1 0.8 0.6 0.3 2014 -912 191 3,789 -297 3,700 -462 6,008 6,008 -2,324 778 -1,546 1,827 -4,446 -1,868 -4,486 -24 52 28 2015E 6,269 925 4,069 -1,111 -2,819 0 7,334 8,424 -750 -850 -1,600 -6,000 -3,842 -1,712 -4,886 1,938 28 1,965 Cash flow Statement Y/E March OP/(Loss) before Tax Interest/Dividends Received Depreciation & Amortisation Direct Taxes Paid (Inc)/Dec in Working Capital Other Items CF from Oper. Activity CF after EO Items (Inc)/Dec in FA+CWIP (Pur)/Sale of Invest. CF from Inv. Activity Inc/(Dec) in Debt Interest Rec./(Paid) Dividends Paid CF from Fin. Activity Inc/(Dec) in Cash Add: Beginning Balance Closing Balance 30 January 2015 2010 5,448 387 2,041 -893 4,339 -34 11,289 11,289 -6,844 -1,375 -8,219 4,247 -1,458 -1,556 1,233 4,303 851 5,155 2011 8,018 139 2,674 -1,503 -4,914 1,638 6,053 6,053 -3,501 -5,816 -9,317 3,733 -1,542 -2,327 -136 -3,400 5,155 1,755 2012 6,900 168 3,528 -1,500 218 2,024 11,338 11,338 -6,906 -3,837 -10,743 3,239 -2,256 -3,092 -2,109 -1,513 1,755 241 2013 4,707 264 3,808 -1,100 -350 218 7,547 7,547 -6,438 -5,468 -11,907 11,004 -3,742 -3,092 4,170 -190 241 52 (INR Million) 2016E 2017E 16,452 25,629 1,123 988 4,191 4,302 -3,599 -6,056 -2,255 -335 0 0 15,911 24,527 15,911 24,527 -2,000 -3,000 -2,000 -2,000 -4,000 -5,000 -7,000 -11,500 -3,179 -2,393 -3,424 -5,135 -13,603 -19,028 -1,692 499 1,965 274 274 773 12 Ashok Leyland NOTES 30 January 2015 13 Disclosures This document has been prepared by Motilal Oswal Securities Limited (hereinafter referred to as Most) to provide information about the company(ies) and/sector(s), if any, coveredAshok in the report and may be Leyland distributed by it and/or its affiliated company(ies). This report is for personal information of the selected recipient/s and does not construe to be any investment, legal or taxation advice to you. This research report does not constitute an offer, invitation or inducement to invest in securities or other investments and Motilal Oswal Securities Limited (hereinafter referred as MOSt) is not soliciting any action based upon it. This report is not for public distribution and has been furnished to you solely for your general information and should not be reproduced or redistributed to any other person in any form. This report does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. Before acting on any advice or recommendation in this material, investors should consider whether it is suitable for their particular circumstances and, if necessary, seek professional advice. The price and value of the investments referred to in this material and the income from them may go down as well as up, and investors may realize losses on any investments. Past performance is not a guide for future performance, future returns are not guaranteed and a loss of original capital may occur. MOSt and its affiliates are a full-service, integrated investment banking, investment management, brokerage and financing group. We and our affiliates have investment banking and other business relationships with a some companies covered by our Research Department. Our research professionals may provide input into our investment banking and other business selection processes. Investors should assume that MOSt and/or its affiliates are seeking or will seek investment banking or other business from the company or companies that are the subject of this material and that the research professionals who were involved in preparing this material may educate investors on investments in such business. The research professionals responsible for the preparation of this document may interact with trading desk personnel, sales personnel and other parties for the purpose of gathering, applying and interpreting information. Our research professionals are paid on the profitability of MOSt which may include earnings from investment banking and other business. MOSt generally prohibits its analysts, persons reporting to analysts, and members of their households from maintaining a financial interest in the securities or derivatives of any companies that the analysts cover. Additionally, MOSt generally prohibits its analysts and persons reporting to analysts from serving as an officer, director, or advisory board member of any companies that the analysts cover. Our salespeople, traders, and other professionals or affiliates may provide oral or written market commentary or trading strategies to our clients that reflect opinions that are contrary to the opinions expressed herein, and our proprietary trading and investing businesses may make investment decisions that are inconsistent with the recommendations expressed herein. In reviewing these materials, you should be aware that any or all of the foregoing among other things, may give rise to real or potential conflicts of interest. MOSt and its affiliated company(ies), their directors and employees and their relatives may; (a) from time to time, have a long or short position in, act as principal in, and buy or sell the securities or derivatives thereof of companies mentioned herein. (b) be engaged in any other transaction involving such securities and earn brokerage or other compensation or act as a market maker in the financial instruments of the company(ies) discussed herein or act as an advisor or lender/borrower to such company(ies) or may have any other potential conflict of interests with respect to any recommendation and other related information and opinions.; however the same shall have no bearing whatsoever on the specific recommendations made by the analyst(s), as the recommendations made by the analyst(s) are completely independent of the views of the affiliates of MOSt even though there might exist an inherent conflict of interest in some of the stocks mentioned in the research report Reports based on technical and derivative analysis center on studying charts company's price movement, outstanding positions and trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamental analysis. In addition MOST has different business segments / Divisions with independent research separated by Chinese walls catering to different set of customers having various objectives, risk profiles, investment horizon, etc, and therefore may at times have different contrary views on stocks sectors and markets. Unauthorized disclosure, use, dissemination or copying (either whole or partial) of this information, is prohibited. The person accessing this information specifically agrees to exempt MOSt or any of its affiliates or employees from, any and all responsibility/liability arising from such misuse and agrees not to hold MOSt or any of its affiliates or employees responsible for any such misuse and further agrees to hold MOSt or any of its affiliates or employees free and harmless from all losses, costs, damages, expenses that may be suffered by the person accessing this information due to any errors and delays. The information contained herein is based on publicly available data or other sources believed to be reliable. Any statements contained in this report attributed to a third party represent MOSt’s interpretation of the data, information and/or opinions provided by that third party either publicly or through a subscription service, and such use and interpretation have not been reviewed by the third party. This Report is not intended to be a complete statement or summary of the securities, markets or developments referred to in the document. While we would endeavor to update the information herein on reasonable basis, MOSt and/or its affiliates are under no obligation to update the information. Also there may be regulatory, compliance, or other reasons that may prevent MOSt and/or its affiliates from doing so. MOSt or any of its affiliates or employees shall not be in any way responsible and liable for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. MOSt or any of its affiliates or employees do not provide, at any time, any express or implied warranty of any kind, regarding any matter pertaining to this report, including without limitation the implied warranties of merchantability, fitness for a particular purpose, and non-infringement. The recipients of this report should rely on their own investigations. This report is intended for distribution to institutional investors. Recipients who are not institutional investors should seek advice of their independent financial advisor prior to taking any investment decision based on this report or for any necessary explanation of its contents. Most and it’s associates may have managed or co-managed public offering of securities, may have received compensation for investment banking or merchant banking or brokerage services, may have received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past 12 months. Most and it’s associates have not received any compensation or other benefits from the subject company or third party in connection with the research report. Subject Company may have been a client of Most or its associates during twelve months preceding the date of distribution of the research report MOSt and/or its affiliates and/or employees may have interests/positions, financial or otherwise of over 1 % at the end of the month immediately preceding the date of publication of the research in the securities mentioned in this report. To enhance transparency, MOSt has incorporated a Disclosure of Interest Statement in this document. This should, however, not be treated as endorsement of the views expressed in the report. Motilal Oswal Securities Limited is under the process of seeking registration under SEBI (Research Analyst) Regulations, 2014. There are no material disciplinary action that been taken by any regulatory authority impacting equity research analysis activities Analyst Certification The views expressed in this research report accurately reflect the personal views of the analyst(s) about the subject securities or issues, and no part of the compensation of the research analyst(s) was, is, or will be directly or indirectly related to the specific recommendations and views expressed by research analyst(s) in this report. The research analysts, strategists, or research associates principally responsible for preparation of MOSt research receive compensation based upon various factors, including quality of research, investor client feedback, stock picking, competitive factors and firm revenues Disclosure of Interest Statement Analyst ownership of the stock Served as an officer, director or employee ASHOK LEYLAND No No Regional Disclosures (outside India) This report is not directed or intended for distribution to or use by any person or entity resident in a state, country or any jurisdiction, where such distribution, publication, availability or use would be contrary to law, regulation or which would subject MOSt & its group companies to registration or licensing requirements within such jurisdictions. For U.S. Motilal Oswal Securities Limited (MOSL) is not a registered broker - dealer under the U.S. Securities Exchange Act of 1934, as amended (the"1934 act") and under applicable state laws in the United States. In addition MOSL is not a registered investment adviser under the U.S. Investment Advisers Act of 1940, as amended (the "Advisers Act" and together with the 1934 Act, the "Acts), and under applicable state laws in the United States. Accordingly, in the absence of specific exemption under the Acts, any brokerage and investment services provided by MOSL, including the products and services described herein are not available to or intended for U.S. persons. This report is intended for distribution only to "Major Institutional Investors" as defined by Rule 15a-6(b)(4) of the Exchange Act and interpretations thereof by SEC (henceforth referred to as "major institutional investors"). This document must not be acted on or relied on by persons who are not major institutional investors. Any investment or investment activity to which this document relates is only available to major institutional investors and will be engaged in only with major institutional investors. In reliance on the exemption from registration provided by Rule 15a-6 of the U.S. Securities Exchange Act of 1934, as amended (the "Exchange Act") and interpretations thereof by the U.S. Securities and Exchange Commission ("SEC") in order to conduct business with Institutional Investors based in the U.S., MOSL has entered into a chaperoning agreement with a U.S. registered broker-dealer, Motilal Oswal Securities International Private Limited. ("MOSIPL"). Any business interaction pursuant to this report will have to be executed within the provisions of this chaperoning agreement. The Research Analysts contributing to the report may not be registered /qualified as research analyst with FINRA. Such research analyst may not be associated persons of the U.S. registered broker-dealer, MOSIPL, and therefore, may not be subject to NASD rule 2711 and NYSE Rule 472 restrictions on communication with a subject company, public appearances and trading securities held by a research analyst account. For Singapore Motilal Oswal Capital Markets Singapore Pte Limited is acting as an exempt financial advisor under section 23(1)(f) of the Financial Advisers Act(FAA) read with regulation 17(1)(d) of the Financial Advisors Regulations and is a subsidiary of Motilal Oswal Securities Limited in India. This research is distributed in Singapore by Motilal Oswal Capital Markets Singapore Pte Limited and it is only directed in Singapore to accredited investors, as defined in the Financial Advisers Regulations and the Securities and Futures Act (Chapter 289), as amended from time to time. In respect of any matter arising from or in connection with the research you could contact the following representatives of Motilal Oswal Capital Markets Singapore Pte Limited: Anosh Koppikar Kadambari Balachandran Email : [email protected] Email : [email protected] Contact : (+65)68189232 Contact : (+65) 68189233 / 65249115 Office Address : 21 (Suite 31),16 Collyer Quay,Singapore 04931 Motilal Oswal Securities Ltd 30 January 2015 Motilal Oswal Tower, Level 9, Sayani Road, Prabhadevi, Mumbai 400 025 Phone: +91 22 3982 5500 E-mail: [email protected] 14

© Copyright 2026