CURRENT TRENDS UPDATE — CANADA

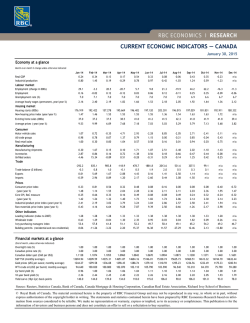

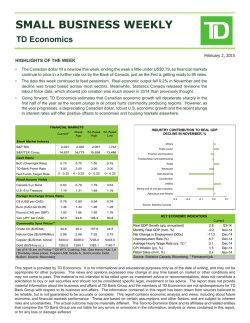

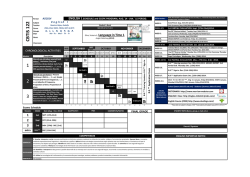

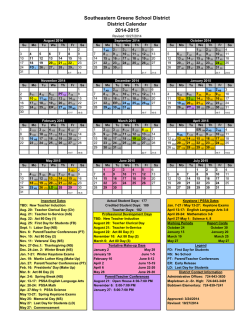

CURRENT TRENDS UPDATE — CANADA Overview and highlights Update - January 30, 2015 Canadian GDP fell 0.2% in November Real GDP % change, month-over-month Latest available: November Release date: January 30, 2015 0.8 0.6 0.4 0.2 0.0 -0.2 -0.4 -0.6 -0.8 -1.0 -1.2 -1.4 -1.6 2007 2008 2009 2010 2011 2012 2013 2014 Sourc e: Statistics Canada Canada’s November 2014 GDP fell by 0.2% following solid increases in both September and October. Market expectations had been for an unchanged reading. Large declines in manufacturing (-1.9%) and mining, oil and gas extraction (-1.5%) pushed output in the goods-producing sectors of the economy down by 0.8% in November. This followed gains of 0.5% in October and 0.9% in September. The service-producing sectors recorded unchanged output in the month, with seven of the 15 industries posting declines. The largest percentage declines were in wholesale trade, accommodation and food services, and transportation and warehousing. Increased output from retail, management services, and arts and entertainment served to offset the decreases. Finance and insurance posted a 0.4% dip following five months of gains. Real GDP output was 1.9% higher than in November 2013. ▲ Canada’s November 2014 GDP fell by 0.2% following solid increases in both September and October. ▲ Employment dipped marginally in December by 4,300 following on November's 10,700 decline but only denting the quarter's increase which still stood at 28,100. ▲ On a volumes basis, overall retail sales in November rose by a robust 0.8% after unchanged activity in October. ▲ Housing starts fell by 6.5% to an annualized 180,600 in December 2014 from a revised 193,200 in November (was 195,000). ▲ The Canadian merchandise balance deteriorated to a $0.6 billion deficit in November from a downwardly revised $0.3 billion shortfall (previously a $0.1 billion surplus) in October. ▲ Canada’s headline consumer price index fell by 0.7% in December 2014, thereby reflecting a 5.0% drop in energy prices, which was a larger decline than market expectations for a 0.6% decline. Economy at a glance Real GDP Industrial production Employment Unemployment rate* Manufacturing Production Employment Shipments New orders Inventories Retail sales Car sales Housing starts (000s)* Exports Imports Trade balance ($billlions)* Consumer prices % change from Lastest month Previous month Year ago Nov Nov Dec Dec -0.2 -1.2 -0.1 6.7 1.9 2.1 0.7 7.2 Nov Dec Nov Nov Nov Nov Nov Dec Nov Nov Nov Dec -1.9 -0.3 -1.4 -1.7 -0.1 0.4 -3.1 180.3 -3.5 -2.7 -0.6 -0.7 1.3 -0.8 2.6 2.9 2.9 4.8 4.3 187.5 8.4 6.2 -1.4 1.5 * Levels are shown for the latest period and the same period a year earlier. Canadian employment slipped and unemployment rate steady in December Employment Change in thousands, month-over-month 150 Latest available: December Release date: January 9, 2015 100 50 0 -50 -100 -150 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 Canadian employment surprised to the downside with the economy losing 4,300 jobs in December 2014 as forecasters looked for a 10,000 increase. The unemployment rate held steady at 6.6%. Losses were concentrated in the services sector where employment fell by 26,400, while goods-producing industries showed a 22,100 rise in the month. The unemployment rate ended 2014 at 6.6%; the participation rate inched downward to 65.9%. Source: Statistics Canada Unemployment rate % of labour force 9.0 8.5 8.0 Canadian November retail sales rise 0.4% in the month 7.5 7.0 Latest available: November Release date: January 23, 2015 6.5 6.0 5.5 5.0 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 So urce : Statistics Canada Retail sales % change, month-over-month 3.0 Nominal retail sales in November 2014 unexpectedly increased by 0.4% in the month following unchanged activity in October. Higher sales occurred despite declines in sales at gasoline stations (0.8%) and motor vehicle dealerships (0.3%). Excluding the auto and gasoline station components, so called core sales rose by a much stronger than expected 1.0%, thereby building further on a 0.5% gain in October. On a volumes basis, overall retail sales in November rose by a robust 0.8% after unchanged activity in October. 2.0 1.0 0.0 -1.0 -2.0 -3.0 -4.0 -5.0 2006 2007 2008 2009 2010 2011 2012 2013 2014 Canadian housing starts fall to a nine-month low in December Source: Statistics Canada Latest available: December Release date: January 9, 2015 Housing starts Thousands Housing starts fell by 6.5% to an annualized 180,600 in December 2014 from a revised 193,200 in November (was 195,000). Market expectations had been for a modest decline to 192,000 in December. The drop in overall housing starts reflected declines in both urban single-unit (-4.8%) and urban multiple-unit (7.0%) starts. Rural starts also declined (-9.8%) in the month. Weakness was concentrated in the Prairies (-10.2%), Quebec (-17.6%), and in Atlantic Canada (19.4%). In contrast, strength in the multiples component drove an overall increase in Ontario (2.0%) while starts in British Columbia also rose (1.9%) to provide some offset. 300 280 260 240 220 200 180 160 140 120 100 00 01 02 03 04 05 06 07 08 09 10 Source: Canadian Mortgage and Housing Corporation RBC ECONOMICS | RESEARCH 2 11 12 13 14 Canada trade balance posted a $0.6 billion deficit in November Latest available: November Release date: January 7, 2015 Merchandise trade C$ billions, annualized 550 Exports 500 450 The Canadian merchandise balance posted a $0.6 billion deficit in November 2014, which was down from a revised $0.3 billion shortfall (previously reported as a $0.1 billion surplus) in October. Market expectations had been for a $0.2 billion deficit in November. Nominal exports declined by 3.5% after falling 0.2% (previously up 0.1%) in October. Imports fell by 2.7% in November to retrace a revised 1.2% (was 0.5%) increase in October. Controlling for the effect of prices, the volume of exports, in chained 2007 dollars, declined by 2.2%. Imports declined as well but by a moderate 1.6%, thereby resulting in a fourth consecutive monthly deterioration in the real trade balance. 400 Imports 350 300 2006 2007 2008 2009 2010 2011 2012 2013 2014 Source: Statistics Canada Consumer price index % change, year-over-year Canadian headline inflation rate dropped on lower energy prices in December; core measure ticked up relative to December 2013 5 4 3 2 Latest available: December Release date: January 23, 2015 1 0 Canada’s headline consumer price index fell by 0.7% in December 2014, thereby reflecting a 5.0% drop in energy prices, which was a larger decline than market expectations for a 0.6% decline. Prices were 1.5% higher than a year earlier, which was a slower pace than November’s 2.0%. The Bank of Canada’s core measure slipped by 0.3% in December, thereby meeting market expectations. The annual core rate inched upward to 2.2% from 2.1% in November. -1 -2 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 Source: Statistics Canada The material contained in this report is the property of Royal Bank of Canada and may not be reproduced in any way, in whole or in part, without express authorization of the copyright holder in writing. The statements and statistics contained herein have been prepared by RBC Economics Research based on information from sources considered to be reliable. We make no representation or warranty, express or implied, as to its accuracy or completeness. This publication is for the information of investors and business persons and does not constitute an offer to sell or a solicitation to buy securities. ®Registered trademark of Royal Bank of Canada. ©Royal Bank of Canada. RBC ECONOMICS | RESEARCH

© Copyright 2026