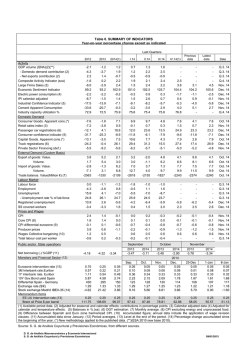

Selected Economic and Financial Indicators

PHILIPPINES SELECTED ECONOMIC AND FINANCIAL INDICATORS Item I. OUTPUT, EMPLOYMENT AND WAGES 03-Feb-15 2007 2008 2009 8:31:32 2010 2011 2012 2013 1 2014 1st - 3rd Qtr A. Gross National Income (GNI) (Constant 2000 prices, P Billion) 6276.0 annual % change 6.2 2 (constant 2000 prices, US$ Billion) 142.0 6590.0 5.0 149.1 6988.8 6.1 158.1 6851.1 r 8.2 r 155.0 7058.0 r 3.0 r 159.7 r 7507.6 r 6.4 r 169.9 r 8069.0 r 7.5 r 182.6 r 8576.3 6.3 194.1 B. GNI (Current Prices, P Billion) 8634.1 9776.2 10652.5 10852.4 r 11629.3 r 12631.3 r C. GDP (constant 2000 prices, P Billion) annual % change 2 (constant 2000 prices, US$ Billion) 5028.3 6.6 113.8 5237.1 4.2 118.5 5297.2 1.1 119.9 5701.5 7.6 129.0 5910.2 r 3.7 r 133.7 r D. GDP (Current Prices, P Billion) annual % change (current prices, US$ Billion) 6892.7 9.9 149.4 7720.9 12.0 173.6 8026.1 4.0 168.5 9003.5 12.2 199.6 9708.3 r 10567.3 r 7.8 r 8.8 r 224.1 r 250.2 r E. GDP by Expenditure Shares and Net Primary Income (constant 2000 prices) 1. Household Final Consumption Expenditure (P Billion) annual % change Percent share to total GNI Percent share to total GDP 3598.4 4.6 57.3 71.6 3730.9 3.7 56.6 71.2 3817.9 2.3 54.6 72.1 3945.8 3.4 57.6 69.2 4166.4 r 5.6 r 59.0 r 70.5 r 4442.5 r 6.6 r 59.2 r 70.4 r 4694.8 r 5.7 r 58.2 r 69.4 r 4948.3 5.4 57.7 68.9 2. Government Final Consumption Expenditure (P Billion) annual % change Percent share to total GNI Percent share to total GDP 492.9 6.9 7.9 9.8 494.4 0.3 7.5 9.4 548.3 10.9 7.8 10.4 570.2 4.0 8.3 10.0 582.1 r 2.1 r 8.2 r 9.8 r 672.2 r 15.5 r 9.0 r 10.6 r 723.6 r 7.7 r 9.0 r 10.7 r 736.7 1.8 8.6 10.3 3. Capital Formation (P Billion) annual % change (nominal as % of GNI) Percent share to total GNI Percent share to total GDP 798.3 -0.5 13.8 12.7 15.9 984.8 23.4 15.2 14.9 18.8 899.3 -8.7 12.5 12.9 17.0 1183.6 31.6 17.0 17.3 20.8 1216.9 r 2.8 r 17.1 r 17.2 r 20.6 r 1152.1 r -5.3 r 15.1 r 15.3 r 18.3 r 1496.8 r 29.9 r 16.4 r 18.5 r 22.1 r 1513.7 1.1 16.4 17.6 21.1 4. Exports (P Billion) annual % change Percent share to total GNI Percent share to total GDP 2659.7 6.7 42.4 52.9 2588.5 -2.7 39.3 49.4 2385.8 -7.8 34.1 45.0 2886.1 21.0 42.1 50.6 2813.0 r -2.5 r 39.9 r 47.6 r 3053.1 r 8.5 r 40.7 r 48.4 r 3019.6 r -1.1 r 37.4 r 44.6 r 3384.6 12.1 39.5 47.2 5. Imports (P Billion) annual % change Percent share to total GNI 2521.1 1.7 40.2 50.1 2561.5 1.6 38.9 48.9 2354.1 -8.1 33.7 44.4 2884.3 22.5 42.1 50.6 2868.2 r -0.6 r 40.6 r 48.5 r 3007.7 r 4.9 r 40.1 r 47.6 r 3169.3 r 5.4 r 39.3 r 46.8 r 3353.7 5.8 39.1 46.7 Percent share to total GDP 6. Net Primary Income (P Billion) annual % change Percent share to total GNI Percent share to total GDP F. GDP by Industrial Origin (constant 2000 prices) 1. Agriculture, Hunting, Forestry and Fishing (In P Billion) annual % change Percent share to total GNI Percent share to total GDP 2. Industry Sector (In P Billion) annual % change Percent share to total GNI Percent share to total GDP of which: Manufacturing (P Billion) annual % change Construction (P Billion) annual % change 3. Services Sector (In P Billion) annual % change Percent share to total GNI Percent share to total GDP of which: Trade (P Billion) annual % change Finance and Real Estate (P Billion) annual % change 6312.2 r 6.8 r 142.8 r 13850.9 r 15160.1 6765.5 r 7.2 r 153.1 r 7177.9 6.1 162.4 11548.2 r 12634.1 9.3 r 9.4 272.1 r 284.6 r 1247.7 4.4 19.9 24.8 1352.9 8.4 20.5 25.8 1691.5 25.0 24.2 31.9 1149.6 r n.c. 16.8 20.2 1147.8 r -0.2 r 16.3 r 19.4 r 1195.4 r 4.1 r 15.9 r 18.9 r 1303.6 r 9.0 r 16.2 r 19.3 r 1398.4 7.3 16.3 19.5 647.7 4.7 10.3 12.9 668.5 3.2 10.1 12.8 663.7 -0.7 9.5 12.5 662.7 -0.2 9.7 11.6 679.8 r 2.6 r 9.6 r 11.5 r 699.0 r 2.8 r 9.3 r 11.1 r 706.6 r 1.1 r 8.8 r 10.4 r 720.1 1.9 8.4 10.0 1621.2 5.8 25.8 32.2 1699.2 4.8 25.8 32.4 1666.6 -1.9 23.8 31.5 1859.5 11.6 27.1 32.6 1894.0 r 1.9 r 26.8 r 32.0 r 2031.4 r 7.3 r 27.1 r 32.2 r 2219.4 r 9.3 r 27.5 r 32.8 r 2386.8 7.5 27.8 33.3 1145.5 3.6 249.4 14.6 1194.9 4.3 266.8 7.0 1137.5 -4.8 285.0 6.8 1264.5 11.2 325.8 14.3 1324.3 r 4.7 r 294.6 r -9.6 r 1395.7 r 5.4 r 348.3 r 18.2 r 1538.9 r 10.3 r 381.7 r 9.6 r 1663.8 8.1 414.3 8.5 2759.4 7.6 44.0 54.9 2869.4 4.0 43.5 54.8 2966.9 3.4 42.5 56.0 3179.4 7.2 46.4 55.8 3336.4 r 4.9 r 47.3 r 56.5 r 3581.8 r 7.4 r 47.7 r 56.7 r 3839.4 r 7.2 r 47.6 r 56.8 r 4070.9 6.0 47.5 56.7 851.9 8.6 799.6 9.8 863.7 1.4 848.8 4.0 875.6 1.4 888.2 4.6 948.7 8.4 963.7 8.5 981.0 r 3.4 r 1032.6 r 7.2 r 1055.7 r 7.6 r 1105.7 r 7.1 r 1115.5 r 5.7 r 1218.6 r 10.2 r 1182.0 6.0 1310.4 7.5 PHILIPPINES SELECTED ECONOMIC AND FINANCIAL INDICATORS 03-Feb-15 page 2 Item 2007 2008 2009 2010 2011 2012 2013 2014 2013 2014 1 I. OUTPUT, EMPLOYMENT AND WAGES cont'd G. Per Capita GNI (constant 2000 prices; P) annual % change (at current prices) annual % change H. Per Capita GDP (constant 2000 prices; P) annual % change (at current prices) annual % change I. Per Capita GNI (constant 2000 prices; US$) annual % change (at current prices) annual % change J. Per Capita GDP (constant 2000 prices; US$) annual % change (at current prices) annual % change K. Per Capita GNI, PPP concept (at current prices, US$)3r annual % changer Per Capita GDP, PPP concept (at current prices, US$)3r annual % changer L. Savings Rate 4 M. Population (in million persons) 5 r r r r 70750 4.1 97334 7.4 72852 3.0 108075 11.0 76783 5.4 117034 8.3 73985 n.c. 117194 n.c. 74437 r 77796 r r r 0.6 4.5 r r 122648 130890 r r 4.7 6.7 82178 5.6 141063 7.8 85869 r r 4.5 r 151788 r 7.6 56684 4.5 77702 7.8 57896 2.1 85354 9.8 58199 0.5 88180 3.3 61570 n.c. 97227 n.c. 62332 r 65409 r 1.2 r 4.9 r r r 102389 109503 5.3 r 6.9 r 68902 5.3 117612 7.4 71867 r 71867 4.3 r 4.3 r 126496 126496 7.6 r 7.6 1601 4.1 2109 19.4 1648 3.0 2430 15.2 1737 5.4 2457 1.1 1674 r n.c. r 2598 n.c. 1684 r r 0.6 r 2832 9.0 r 1760 r r 4.5 r 3100 9.5 r 1859 5.6 3323 7.2 1943 r r 4.5 r 3419 2.9 r 1943 4.5 3419 2.9 0r r 0.0 r 3437 0.0 r 1283 4.5 1684 19.8 1310 2.1 1919 14.0 1317 0.5 1851 -3.5 1393 n.c. 2155 n.c. 1410 1.2 r r 2364 9.7 r r 1480 4.9 r r 2593 9.7 r r 1559 5.3 2771 6.9 1626 4.3 r r 2849 2.8 r r 1626 4.3 2849 2.8 0 0.0 r r 2850 0.0 r 6155 r r 6.9 4914 r 7.3 r 6479 r r 5.3 5117 r 4.1 r 6879 r r 6.2 5183 r 1.3 r 6690 r r -2.7 5550 r 7.1 r 6870 r r 2.7 5735 r 3.3 r 7323 r r 6.6 6126 r 6.8 r 7855 r r 7.3 6549 r 6.9 r 8272 5.3 6894 5.3 27.5 27.9 28.2 32.7 31.1 29.4 30.2 88.7 2.0 annual % change N. Unemployment Rate (Average; percent) New definition Annualized 85869 0r r 4.5 0.0 r 151788 152099 r 7.6 0.0 90.5 2.0 91.0 n.c. 92.6 1.7 r 94.8 r 2.4 r 96.5 r 1.8 r 98.2 1.7 P. Average Capacity Utilization, per MISSI r 0r r 0.0 0r 0.0 r 1st - 3rd Qtr 99.9 r 99.9 1.7 r 6 O. Wage Rates: Legislated Daily Wage Rate of Nonagricultural Workers in Metro Manila (Nominal,P) Real Wages 7 (end-of-period) 0r 0.0 r r 126142 0.0 r 8289 r r 5.5 6874 r 5.0 r 100.1 1.7 Oct 7.3 7.4 7.5 7.4 7.0 362.00 346.08 382.00 347.59 382.00 335.38 404.00 341.50 426.00 349.18 79.8 80.4 81.1 83.0 83.0 7.0 7.1 Dec 456.00 466.00 363.64 362.36 Jan - Nov 82.9 83.1 6.8 6.4 6.0 83.1 Dec 466.00 466.00 362.36 356.54 Jan - Nov 83.1 83.4 Jan - Dec 3.0 4.1 2.8 6.7 29.8 5.2 2.1 2.2 1.6 3.2 3.3 4.5 0.75 0.72 466.00 356.54 b II. PRICES 2.9 3.7 3.0 2.4 2.7 3.0 0.97 8.3 13.0 5.2 5.1 6.2 8.8 0.90 4.2 6.2 4.2 2.8 2.8 4.6 0.86 3.8 4.0 3.0 3.7 3.7 3.8 0.83 4.6 5.5 5.3 4.1 4.0 4.9 0.79 3.2 2.4 5.0 3.7 2.9 3.2 0.77 3.0 2.8 29.8 2.1 1.6 3.3 0.75 4.1 6.7 5.2 2.2 3.2 4.5 0.72 B. Core Inflation (2006=100) 2.9 5.8 4.2 3.6 4.3 3.7 2.9 3.0 C. GDP Deflator (% Change) 3.1 7.5 2.8 4.2 4.0 1.9 2.0 3.1 A. Headline Inflation, Philippines (2006=100) of which: Food and Non-Alcoholic Beverages Alcoholic Beverages, Tobacco and Narcotics Non-Food 1. NCR (all items, ave., % change) 2. AONCR (all items, ave., % change) 3. Purchasing Power of the Peso 2.9 1st - 3rd Qtr 3.1 3.0 1.5 III.MONEY AND INTEREST RATES A. Money (End-of-Period) 8 1. Money Supply (M1, P Billion) SRF-based 9 (% Change) Dec 918.5 18.1 1061.1 15.5 1217.7 14.8 1348.5 10.7 1494.7 10.8 1606.5 r 7.5 Dec Dec 2045.2 r 2335.4 P 2045.2 r 2335.4 p 27.3 14.2 27.3 14.2 2. Domestic Liquidity (M3, P Billion) Jul SRF-based 9 (% Change) (as % of GDP) 3. Expanded Liquidity (M4, P Billion) SRF-based 9 (% Change) (as % of GDP) 3371.1 15.5 3711.7 10.1 4077.5 9.9 4483.3 10.0 4802.4 7.1 5252.5 r 9.4 48.9 48.1 50.8 49.8 49.5 49.7 r 6925.0 r 7587.7 P 6925.0 r 7587.7 p 31.8 9.6 31.8 9.6 Dec 60.0 r 60.1 60.0 60.1 p 10 4173.7 9.8 4650.4 11.4 5117.4 10.0 5548.3 8.4 5821.5 4.9 6252.7 r 7.4 60.6 60.2 63.8 61.6 60.0 59.2 r 8054.2 r 8918.6 P 28.8 10.7 69.7 r 70.6 Jul Dec 8054.2 r 8918.6 p 28.8 10.7 Dec 69.7 70.6 p PHILIPPINES SELECTED ECONOMIC AND FINANCIAL INDICATORS 03-Feb-15 page 3 Item 2007 2008 2009 2010 2011 2012 2013 2014 1932.0 30.4 Dec 2326.9 20.4 2013 2014 2015 III. MONEY AND INTEREST RATES (cont'd) 4. Base Money (P Billion) 9 SRF-based (% Change) 880.5 10.1 5. Reserve Money (P Billion) 992.0 12.7 1082.6 9.1 1158.6 7.0 1335.3 15.3 1481.4 10.9 Dec P 11 9 SRF-based (% Change) 848.8 18.0 961.5 13.3 1047.9 9.0 1120.5 6.9 1323.0 18.1 1475.6 11.5 1926.2 30.5 p 2323.9 20.6 P 9 6. Domestic Claims (SRF-based ) (P Billion) (% Change) (as % of GDP) a. Net Claims on Central Government Nominal (P Billion) (% Change) 12 Real (P Billion) (% Change) b. Net Claims on Other Sectors Nominal (P Billion) (% Change) Real (P Billion) 12 (% Change) 7. Foreign Currency Deposits (P Billion; Resident) 9 SRF-based (% Change) 8. Loan Outstanding (UBs\KBs) (P Billion) 13 a. Total: Gross of RRPs (% Change) b. Net of RRPs (% Change) 9. Non-Performing Loans - UBs & KBS (P Billion) 14 As % of total loans 10. Capital Adequacy Ratio - Ubs & KBS (based on Circular No. 280 dated 29 March 2001) 5414.0 7.3 r 5988.7 10.6 r 6957.0 16.2 P 3336.1 10.2 3794.3 13.7 4112.2 8.4 4476.5 8.9 5046.4 12.7 48.4 49.1 51.2 49.7 52.0 51.2 r 51.9 r 55.1 793.3 3.5 753.6 -0.7 969.1 22.2 852.8 13.2 1078.0 11.2 916.3 7.5 1127.6 4.6 924.6 0.9 1161.6 3.0 906.0 -2.0 969.2 r -16.6 736.6 r -18.7 950.8 r -1.9 694.1 r -5.8 1161.2 P 22.1 824.4 18.8 1932.0 30.4 2326.9 20.4 Dec 1926.2 p 30.5 p 2323.9 p 20.6 Dec 5988.7 r 10.6 Dec 51.9 Dec 950.8 r -1.9 694.1 -5.8 6957.0 p 16.2 55.1 p 1161.2 p 22.1 824.4 r 18.8 Jul 3034.2 7.4 2579.1 3.7 4444.8 r 14.4 3378.0 r 11.5 5037.8 r 13.3 3677.6 r 8.9 5795.8 P 15.0 4115.0 11.9 5037.8 r 13.3 3677.6 r 8.9 5795.8 p 15.0 4115.0 p 11.9 1019.0 -4.3 1000.1 r -1.9 1129.2 r 12.9 1330.8 17.9 1129.2 r 12.9 1330.8 p 17.9 2591.0 8.9 2338.6 8.9 3014.9 16.4 2790.7 19.3 3480.4 r 15.4 3243.8 r 16.2 4048.1 r 16.3 3777.0 r 16.4 71.9 2.2 4048.1 r 16.3 3777.0 r 16.4 Nov 96.1 p 2.4 p 4666.2 p 15.3 4412.4 p 16.8 80.2 2.9 4666.2 P 15.3 4412.4 P 16.8 Dec 101.9 2.7 2542.8 12.5 2415.7 7.9 2825.3 11.1 2486.2 2.9 3349.0 10.4 2746.2 6.5 802.6 -9.1 938.7 17.0 1039.9 10.8 1064.9 2.4 1856.7 9.5 1618.6 8.3 2181.1 17.5 1951.0 20.5 2378.9 9.1 2146.7 10.0 97.6 4.4 88.2 3.5 80.9 3.0 3884.9 16.0 3030.2 10.3 100.6 2.8 r r 90.5 2.1 p p 95.5 2.0 p p Jun 15.9 15.7 16.0 17.3 17.7 18.4 17.7 19.2 16.7 Sep 11. Total Resources of the Fin'l Syst. (P Billion) (includes BSP) 12. Total Loans Portfolio, gross-net of amortization (P Billion) (% Change) 13. Deposit Liabilities (P Billion) (% Change) Loans to Deposit Ratio 8648.8 9729.2 10768.2 12241.7 13433.5 14598.3 17035.7 r 14598.3 15977.2 p 17632.4 r 5415.0 19.2 8016.8 16.6 67.5 p Sep 2601.7 7.2 3664.8 4.8 71.0 2924.4 3179.9 12.4 8.7 4195.1 4671.8 14.5 11.4 69.7 68.1 3303.5 3.9 5125.1 9.7 64.5 3761.9 13.9 5376.4 4.9 70.0 4228.6 12.4 5753.6 7.0 73.5 4897.0 15.8 7608.9 32.2 64.4 4542.00 14.0 6877.9 28.4 66.0 r p r r B. Interest Rates (% p.a., average) Jan - Sep Nominal Interest Rates 15 Jan 0.69 3.41 5.39 4.19 3.73 1.37 1.58 0.32 1.24 0.69 2. T-bills 364 days 4.92 6.49 4.59 4.26 2.26 1.97 0.72 1.79 3. Time Deposits (all maturities) 4. Lending Rates High Low 3.41 4.06 2.68 2.99 2.84 2.83 1.41 1.08 8.59 6.85 9.45 7.54 9.25 7.31 8.70 6.55 7.75 5.62 7.84 5.56 6.93 4.60 6.80 4.38 1.08 1.08 Jan - Dec 1.41 1.08 Jan 6.66 4.34 5. Bank Ave. Lending Rates (all maturities) 8.68 8.76 8.54 6.63 5.65 5.76 5.53 5.76 1. T-bills 91 days Real Interest Rates 7.67 16 5.53 Jan - Sep 1. T-bills 91 days 0.51 -2.91 0.09 -0.17 -3.23 -1.62 -2.69 -2.86 2. T-bills 364 days 2.02 -1.81 0.49 0.36 -2.34 -1.24 -2.28 -2.31 3. Time Deposits (all maturities) 4. Lending Rates High Low 0.51 -4.25 -1.42 -0.91 -1.76 -0.37 -1.59 -3.02 5.69 3.95 1.15 -0.76 5.15 3.21 4.80 2.65 3.15 1.02 4.64 2.36 3.93 1.60 2.70 0.28 5. Bank Ave. Lending Rates (all maturities) 5.78 0.46 4.44 3.77 2.03 2.45 2.76 1.43 Jan - Dec -2.69 -2.86 -2.28 Jan - Dec -1.59 Jan - Dec 3.93 1.60 Jan - Nov 2.76 -2.31 -3.02 2.70 0.28 1.43 0.00 b 0.00 b 6.89 4.54 PHILIPPINES SELECTED ECONOMIC AND FINANCIAL INDICATORS 03-Feb-15 page 4 Item 2007 2008 2009 2010 2011 2012 2013 IV. EXTERNAL SECTOR 2014 2013 r B. Trade Balance (US$ Million) 17, 18 C. Exports (Goods; US$ Million) 17, 18 (% Change) 8072 r 4.3 r 5.4 r 144 r 0.1 r 0.1 r 8448 r 3.8 r 5.0 r r -13966 r -18646 r -13860 r r 32803 r 6.7 r 34679 r 5.7 r 29143 r -16.0 r r r r 7179 3.0 3.6 r 5643 r 2.1 r 2.5 r r r 22.9 r 21391 6.3 22968 r 7.4 r Jan - Nov 20796 p 21991 p 7.1 p 5.7 p 23352 6.5 25351 r 8.6 r 6949 r 2.3 r 2.8 r -16859 r -20428 r 36772 r 26.2 r 10393 3.2 3.8 -18926 r -17702 r -18525 a 38276 r 4.1 r 46384 r 21.2 r 44512 r -4.0 r Jan - Dec (as % of GDP) D. Imports (Goods; US$ Million) 17, 18 (% Change) r 22.0 r 20.0 r 17.3 r 18.4 r 17.1 r 18.5 r 16.4 a r 46769 r 10.8 r 53324 r 14.0 r 43003 r -19.4 r 53631 r 24.7 r 58705 r 9.5 r 65310 r 11.3 r 62214 r -4.7 r r Jan - Mar \ r (as % of GDP) 31.3 r E. Cash Remittances (US$Million) (coursed through banks) (% Change) 14450 13.2 r Net Foreign Portfolio Investments 22 H. Overall BOP Position (US$ Million) \ 26.1 r 20117 7.2 \ \ \ 19078 5.6 r 20563 7.8 21922 6.6 1078 1.4 1236 14.7 1423 15.1 1471 3.4 1688 14.8 1802 r 6.8 r -170 r 2454 r -1575 r 288 r -1336 r 1370 r 630 r 1587 r 114 r -961 r -896 r -167 r -2054 r -30 r 1356 r -11491 r 1642 r -4890 r 194 r -8436 r -5319 r 342 r -3663 r -1005 r -993 r -6748 r 958 r -3205 r -14 r -4487 r r 2919 r 1340 r 2065 r 1070 r 2007 r 3215 r r 1717 r -3192 r 2288 r 6359 r 3100 r 4169 r r r r r r 23 8556 I. Net International Reserves, (MA-NIR) (end-of-period; in US$ Million) J. Total Foreign Assets, BSP-GIR (EOP, US$ Million) 24 (in months of imports of goods & payment for services and income) 25 as a % of short-term debt based on Original Maturity 26 27 as a % of short-term debt based on Residual Maturity 2009 18763 8.2 17348 5.6 \ 26.2 r 18064 r 13.9 r Deployment (in thousand persons) (% Change) Memo items: Net Foreign Direct Investments 21 26.9 r 15853 r 5.8 r r F. Investments, Net (US$ Million) 17, 20 of which: Net Direct Investments Net Portfolio Investments Financial Derivatives Other Investments 25.5 r 16427 13.7 \ Personal remittances 19 (% Change) 30.7 r r r K. External Debt (end-of-period; US$ Million) 28 89 6421 15243 r 11400 9236 22945 p 24366 p 8.1 p 6.2 p Jan - Dec 1836 r 1704 p 1.9 r -5.4 p Jan - Sep Jan - Sep 2140 p 0 395 5592 p 150 p 0 -252 -934 p -1001 p 0 -2119 368 p -88 p 0 -41 -16 p p 3079 p 0 2808 6174 0 Jan - Feb Jan - Oct 3664 p 0 3242 p 5320 p Jan - Sep Jan - Sep 363 p 0 1563 p 292 p Jan - Dec 5085 -2858 5085 r -2879 p end - Dec 79539 22945 8.1 33744 36036 44238 62370 75300 83829 83185 r 79539 83185 r 33751 6.7 37551 6.4 44243 9.2 62373 10.4 75302 11.6 83831 11.5 r 83187 r 79541 11.6 r 10.2 83187 11.6 r 988.2 645.7 741.9 r 560.4 r 741.9 560.4 r r 476.4 300.7 r 536.4 331.7 1105.5 503.8 r r r r 990.8 554.6 1073.8 712.4 r r 60442 r 60337 836.1 602.1 r r end - Sep 58506 60337 r r 79541 10.2 836.1 602.1 end - Sep 59053 57730 55470 54328 54856 60048 (as % of GNI) 29.6 24.7 24.5 25.0 22.5 r 20.2 17.9 r 20.2 18.3 17.2 (as % of GDP) 37.1 31.3 32.6 30.1 27.0 24.1 21.5 24.1 21.9 20.7 Jan - Oct 8.4 6.4 r 10.7 r 10.5 r 11.0 r 9.9 r 9.9 r 7.3 r 8.1 Jan 7.3 r 10.2 r 9.9 r 10.3 r 9.3 r 9.3 r 6.9 r 7.6 6.9 M. External Debt Service Burden (as % of GDP) r 4.7 r 4.1 r 4.1 r 3.7 r 3.5 r 2.6 r 2.7 2.6 8.0 6.0 Jan - Sep 3.0 2.4 N. Foreign Interest Payments (as % of GDP) r 1.9 r 1.7 r 1.5 r 1.3 r 1.3 r 1.2 r 1.1 1.2 1.2 1.0 O. Principal Payments (as % of GDP) 2.8 2.4 2.6 2.4 2.2 1.4 r 1.7 1.4 1.9 1.4 P. World Real GDP Growth 29 5.3 2.7 -0.4 5.2 3.9 3.2 3.0 L. External Debt Service Ratio (in %) (as % of Exports of Goods and Receipts from Services and Income) 17 (as % of Current Account Receipts) Q. Foreign Interest Rates 90-day LIBOR 180-day LIBOR 90-day US treasury bills 2015 Jan - Sep 5623 7017 6805 p 3.0 2.8 p 3.6 3.3 p Jan - Nov -5227 a -1539 a Jan - Nov 51738 a 57009 a 7.5 a 10.2 a Jan - Sep 21.5 22.8 Jan - Nov 56965 a 58549 a 0.2 a 2.8 a Jan - Sep 23.6 23.6 2669 A. Current Account Balance (US$ Million) 17 (as % of GNI) (as % of GDP) 2014 Jan 5.30 5.25 4.52 2.91 3.04 1.41 0.69 1.12 0.15 0.34 0.52 0.13 0.34 0.51 0.05 0.43 0.69 0.08 0.27 0.41 0.05 0.23 0.33 0.03 0.24 0.34 0.04 0.25 0.36 0.02 PHILIPPINES SELECTED ECONOMIC AND FINANCIAL INDICATORS 03-Feb-15 page 5 Item 2007 2008 2009 2010 2011 2012 2013 2014 2013 2014 2015 IV. EXTERNAL SECTOR (cont'd) R. Peso-Dollar Rate (P/US$) (Period average) (% Appreciation(+)/Depreciation(-)) (End-of-Period) (% Appreciation(+)/Depreciation(-)) Standard Deviation (Volatility) 46.148 11.19 41.401 18.67 2.0991 S. New Effective Exchange Rate Index of the Peso 30 Nominal Effective Exchange Rate Index (NEERI) Overall Advanced Developing Real Effective Exchange Rate Index (REERI) Overall Advanced Developing 15.06 12.07 24.17 44.475 3.76 47.485 -12.81 2.9141 15.07 11.75 24.75 76.17 78.99 65.74 67.35 106.20 111.23 47.637 45.110 43.313 -6.64 5.60 4.15 46.356 43.885 43.928 2.44 5.63 -0.10 0.7112 1.1125 0.5243 14.25 10.81 23.98 14.52 11.25 24.08 42.229 2.57 41.192 6.64 0.8150 42.446 -0.51 44.414 -7.25 1.370 Jan 44.927 44.604 -9.342 0.722 45.155 44.132 -9.970 2.318 0.312 0.356 44.395 -4.39 44.617 -0.45 0.571 14.42 11.12 23.98 14.92 11.61 24.67 15.26 12.38 24.45 r 77.68 80.56 81.08 64.84 69.50 70.63 111.54 113.02 112.97 84.60 75.09 116.35 87.44 81.57 115.85 r r r r r 14.91 12.22 23.72 Jan - Dec 14.91 12.22 23.72 87.16 82.36 114.37 87.16 82.36 114.37 r r r V. PUBLIC FINANCE A. National Government (NG) (P Billion) Revenues, of which: 31 (as % of GDP) Jan-Nov 1136.6 1202.9 16.5 15.6 1123.2 1207.9 14.0 13.4 1359.9 1534.9 1716.1 14.0 14.5 14.9 Jan - Oct Tax (as % of GDP) 932.9 1049.2 13.5 13.6 981.6 1093.6 12.2 12.1 1202.1 1361.1 1535.3 12.4 12.9 13.3 Jan - Apr Non-Tax Expenditures, of which: (as % of GDP) Surplus/Deficit(-) 203.6 153.7 1149.0 1271.0 141.6 114.3 157.9 173.9 180.8 1421.7 1522.4 1557.7 1777.8 1880.2 16.7 16.5 17.7 16.9 16.0 16.8 16.3 -12.4 -68.1 -298.5 -314.5 -197.8 -242.8 -164.1 Jan - Sep (as % of GDP) -0.2 -0.9 -3.7 -3.5 -2.0 -2.3 -1.4 Jan - Nov 1565.9 1735.5 Jan - Sep 15.3 15.8 Jan - Nov 1414.1 1558.7 Jan - Sep 13.7 14.1 Jan - Nov 151.8 176.8 1677.3 1762.3 Jan - Sep 16.5 16.1 Jan - Nov -111.5 -26.8 Jan - Sep -1.2 -0.3 B. Sources of Financing the NG Deficit 32 Jan - Nov Borrowings (Net) Domestic (Net) (P Billion) (as % to total NG Deficit) (as % of GDP) 99.1 42.9 345.2 160.1 169.3 248.6 229.8 77.4 25.9 351.6 218.6 69.5 115.3 64.1 32.4 538.2 468.1 192.8 319.1 402.9 245.6 0.6 2.2 1.0 2.4 0.7 4.4 3.5 Jan - Nov Foreign (Net) (P Billion) (as % to total NG Deficit) (as % of GDP) 56.2 451.4 -9.2 -13.5 152.5 51.1 133.0 42.3 51.2 25.9 70.0 28.8 -83.8 -51.1 0.8 -0.1 1.9 1.5 0.5 0.7 -0.7 Jan - Nov Change in Cash (Budgetary) (P Billion) (as % to total NG Deficit) (as % of GDP) C. NG Interest Payments as % of GDP D. Public Sector Borrowing Requirement (P Billion) 32 (as % of GDP) E. Consolidated Public Sector Financial Position 33 (CPSFP) Total Surplus/(Deficit) (P Billion) (as % of GDP) 86.7 696.6 92.0 135.0 -68.7 -23.0 37.2 11.8 -82.5 -41.7 295.3 121.6 155.1 94.5 1.3 1.2 -0.9 0.4 -0.8 2.8 1.3 3.9 3.5 3.5 3.3 2.9 3.0 2.8 47.9 -91.0 -329.8 -379.0 -220.1 0.7 -1.2 -4.1 -4.2 -2.3 21.4 29.2 -240.1 -355.8 -175.1 0.3 0.4 -3.0 -4.0 -1.8 -226.7 r -2.1 -192.1 r -1.8 r 0.0 Jan - Mar -92.0 r 0.0 Jan - Nov 333.3 143.2 415.0 132.7 372.3 495.8 Jan - Sep 4.1 1.0 Jan - Nov -81.8 10.5 -73.4 39.2 Jan - Sep -0.9 -0.2 Jan - Nov 221.8 116.5 199.0 434.9 Jan - Sep 2.0 0.9 3.1 2.8 -27.8 -30.9 -0.8 January-March-0.3 -0.3 Jan - Mar 19.2 r -1.3 33.1 114.6 0.2 r January-March 0.4 1.3 r r PHILIPPINES SELECTED ECONOMIC AND FINANCIAL INDICATORS 03-Feb-15 page 6 Item 2007 2008 2009 2010 2011 2012 2013 2014 2013 2014 2015 V. PUBLIC FINANCE (cont'd) F. Total Outstanding Debt of the National Government (P Billion) 34 3712.5 4220.9 4396.6 4718.2 4951.2 5437.1 5681.2 54.7 54.8 52.4 51.0 51.5 49.2 2201.2 2414.4 2470.0 2718.2 2873.4 3468.4 3733.4 31.3 30.8 30.2 29.6 32.8 32.3 1511.3 1806.5 1926.6 2000.0 2077.8 1968.7 1947.7 23.4 24.0 22.2 21.4 18.6 16.9 4773.6 5267.1 5689.7 6569.1 7593.4 7495.6 r 7654.2 r 68.2 70.9 73.0 78.2 70.9 r 66.3 r 71.3 64.3 2201.8 2332.0 2691.7 5219.9 r 5447.7 r 5540.3 5355.9 49.4 r 47.2 r 51.3 45.5 2152.1 2220.9 53.9 (as % of GDP) Domestic Debt (P Billion) 31.9 (as % of GDP) Foreign Debt (P Billion) 21.9 (as % of GDP) G. Total Public Sector Debt (P Billion) 35 69.3 (as % of GDP) Domestic (P Billion) 31.9 (as % of GDP) Foreign (P Billion) 30.2 33.5 2571.8 2935.1 2998.0 37.3 (as % of GDP) end - Nov 5675.2 5716.3 end - Sep 49.8 46.5 end - Nov 3744.8 3789.3 end - Sep 32.7 30.5 r end - Nov 1930.5 1927.0 end - Sep 17.2 16.0 end - Mar 7692.5 7576.8 38.0 37.4 3727.8 41.4 2841.3 31.6 4773.2 49.2 2820.2 29.0 2275.7 21.5 2206.5 19.1 19.9 18.9 Jan - Nov 527.0 479.8 296.7 292.3 230.3 187.5 Jan - Nov H. NG Debt Service Payments (P Billion) Interest Principal 614.1 267.8 346.3 612.7 272.2 340.5 622.3 278.9 343.4 689.8 294.2 395.6 722.8 279.0 443.8 729.8 312.8 417.0 559.0 323.4 235.6 VI. STOCK MARKET TRANSACTIONS 36 A. Volume (Total, million shares) 1157830 373007 540824 429566 1056596 1043119 515135 B. Value (Total, P Million) 1338252 763901 994157 1207384 1422591 1771711 2546183 C. Composite Index (Average) 3424 D. Stock Market Capitalization (in P Billion) 37 E. Price-Earning Ratio 37 2622 7962.4 4069.2 15.5 9.4 815193 515135 2130121 2546183 2475 3526 4188 5178 6471 6793 6471 6029.1 8866.1 8697.0 10930.1 11931.3 14251.7 11931.3 12.6 14.0 15.6 18.0 17.5 r 21.5 Jan 30872 p 50550 P 124860 p 221785 P 6008 p Dec 12101.7 p 7469 14530 P VII. SURVEYS 38 (in percent) A. Business Confidence Index 39 Q4 38.7 Q1 40.5 B. Consumer Confidence Index 40 -20.6 -14.7 C. Philippines' Purchasing Managers' Index 41 Oct 62.7 2013 Nov 63.3 2012 Q2 Q3 44.5 42.5 -19.5 Dec 54.0 -13.3 Jan 58.0 2013 2014 Q2 50.7 Q4 49.5 Q1 41.5 Q2 54.9 Q3 42.8 Q4 52.3 Q1 37.8 -10.4 -11.2 -5.7 -7.9 -21.3 -18.8 -17.3 -26.3 -21.8 Mar 62.1 2014 Apr 57.2 May 62.9 Jun 59.4 Jul 56.8 Aug 56.6 Sep 60.6 Oct Nov 59.9 60.7 Q3 26.9 Q4 25.7 20.2 22.5 Feb 58.2 Q3 34.4 Q4 48.3 VIII.(inPOVERTY AND SAVINGS INDICATOR percent) 2013 A. (inPercentage percent) of households with savings 42 B. Percentage of households with savings in banks, 42 cooperatives and associations C. CPI for bottom 30% Income Households in the Philippines (2000=100) 43 Philippines (% Change) Food (% Change) Non-food (% Change) Q1 24.5 Q2 22.4 Q3 24.5 Q4 26.2 Q1 28.9 2014 Q2 30.3 19.7 16.4 18.2 19.4 21.5 22.4 139.8 3.2 159.3 13.9 167.5 5.1 173.5 3.6 182.4 5.1 187.6 2.8 194.6 3.7 137.1 3.5 148.7 2.7 160.4 17.0 160.0 7.6 170.6 6.4 163.2 2.0 176.7 3.6 169.7 4.0 185.6 5.0 179.0 5.5 190.1 2.4 185.5 3.6 196.5 3.4 189.4 2.1 NCR (National Capital Region) (% Change) 142.6 2.7 157.9 10.7 162.8 3.1 168.2 3.3 175.1 4.1 178.2 1.8 182.1 2.2 Food (% Change) Non-food (% Change) 131.4 3.5 176.0 1.4 148.4 12.9 187.5 6.5 156.2 5.3 184.2 -1.8 159.3 2.0 196.7 6.8 164.3 3.1 208.9 6.2 166.7 1.5 213.2 2.1 170.8 2.5 213.0 -0.1 AONCR (Areas Outside of National Capital Region) (% Change) 139.8 3.3 159.3 13.9 167.6 5.2 173.6 3.6 182.6 5.2 187.7 2.8 194.8 3.8 Food (% Change) Non-food (% Change) 137.2 3.5 148.3 2.7 160.6 17.1 159.6 7.6 170.9 6.4 162.9 2.1 177.0 3.6 169.3 3.9 185.9 5.0 178.5 5.4 190.4 2.4 185.1 3.7 196.9 3.4 189.0 2.1 D. Annual Per Capita Poverty Incidence and 44 Poverty Threshold (Population) as of 4 July 2014 Poverty Incidence (PI), in percent Per Capita Poverty Threshold, in Pesos Per Capita Food Threshold, in Pesos 26.3 25.2 16871 11780 18935 13232 Annualized 24.9 19252 13416 206.3 6.0 191.7 5.3 206.5 6.0 Jan-Dec 187.6 194.6 0.0 3.7 Jan-Sep 194.9 209.9 2.9 7.7 188.7 193.5 2.1 2.5 Jan-Sep 177.6 182.1 0.0 2.2 Jan-Sep 169.2 181.9 1.9 7.5 212.4 216.8 -0.4 2.1 Jan-Sep 187.1 194.8 0.0 3.8 Jan-Sep 195.3 210.4 3.0 7.7 188.4 193.1 2.2 2.5 PHILIPPINES SELECTED ECONOMIC AND FINANCIAL INDICATORS 03-Feb-15 page 7 FOOTNOTES: (cont'd): 1 Data on Real GDP and its components are based on 2000 prices. The use of the terminology Gross National Income (GNI) in place of Gross National Product (GNP) has been adopted in the revised/rebased Philippine System of National Accounts (PSNA) in accordance with the 1993/1998 System of National Accounts prescribed by the United Nations. 2 Derived by dividing the peso GNI and GDP at constant 2000 prices by the peso/US$ rate in 2000 of P44.1938 3 Data are derived by dividing nominal per capita GDP/GNI in pesos by the implied Purchasing-Power-Parity (PPP) conversion rate of the International Monetary Fund World Economic Outlook (IMF WEO) as of October 2014. The GDP-PPP weights are based on benchmark surveys of national prices from 2011 released by the World Bank as part of the United Nation's International Comparison Project. Data on per capita GDP for 2008-2013 in the IMF WEO may differ slightly from the SEFI figures inasmuch as the latter is based on the revised Philippine Statistics Authority (formerly National Statistical Coordination Board) numbers on national accounts as of August 2014. The Philippine Statistics Authority (PSA) revision was due to the change in population data from the 2000 Census of Population and Housing (CPH) projections to the 2010 CPH projections. 4 Gross savings (net national savings plus depreciation) in percent of GNI at current prices; per NSCB. Depreciation is now termed as consumption of fixed capital. Data on savings from the Revised Rebased NIA is available for 2009 to 2012 only. 5 Prior to 2009, population estimates are based on NSCB population projections using the 2000, 1990 and 1980 Census of Population and Housing. Figures for 2009 - 2011 are based on the computations of the NSCB and the NSO using the results of the 2000 and 2010 CPH as start and end dates of the reference population. 6 Data are averages for January, April, July and October rounds of Labor Force Survey. Starting with the October 2000 Labor Force Survey results, the National Statistics Office (NSO) has shifted population projection benchmark in the Labor Force Survey (LFS) data from 1980-based Census of Population to 1995-based Census of Population. Population projection benchmark for household population 15 years old and over are used to estimate the levels (absolute no. of Labor Force, Employed, Underemployed & Unemployed in the LFS). Beginning April 2005, unemployment is based on the new definition. Starting January 2007, the population projections based on the 2000 Census of Population was adopted to generate the labor force statistics. 7 Nominal wage rate refers to basic pay and cost of living allowance (COLA). The figures are as of December of each year. Real wages are nominal wage rates deflated by the 2006 CPI. 8 Depository Corporations Survey (DCS) concept for item numbers 1-7. Beginning 15 November 2006, monetary data series based on the Monetary Survey (MS) concept was discontinued and replaced by the series based on the DCS concept, the expanded version of the MS concept. The DCS is a consolidation of the balance sheets of the deposit-generating banks namely the Monetary Authorities (MA) or the BSP and Other Depository Corporations (ODCs) [consisting of universal and commercial banks (UBs & KBs), thrift banks (TBs), rural banks (RBs), non-stock savings and loan associations (NSSLAs) and non-banks with quasi-banking functions (NBQBs)]. In the process, interbank loans, deposit transactions and other intrasystem accounts between BSP and ODCs are eliminated, whenever possible. 9 Based on the Standardized Report Forms (SRFs), a unified framework for reporting monetary and financial statistics to the International Monetary Fund (IMF). 10 Expanded Liquidity (M4) is calculated by adding Foreign Currency Deposits (FCDs) of residents to Domestic liquidity (M3). 11 This compilation is based on the new definition of reserve money which involves change in the classification of some accounts and enhanced sectorization of accounts. 12 Data from 2001-2005, derived by multiplying the nominal value by the purchasing power of the peso using CPI 2000=100. Data from 2006 - present, derived by multiplying the nominal value by the purchasing power of the peso using CPI 2006=100. 13 Other Depository Corporations (ODCs) consist of universal and commercial banks, thrift banks and rural banks. Excludes interbank loans and transactions of local banks' foreign offices; but includes banks under liquidation for monetary and financial compilation purposes. Starting March 2008, the data covered loans of universal/commercial banks. 2007 data were also revised for consistency with the new series. However, prior to 2007, the data included, apart from universal/commercial banks, thrift banks and rural banks. 14 For 2006 to 2011, NPL data are based on BSP Circular No. 351 which excludes loans classified as loss for both both Universal and Commercial banks. prescribed under BSP Circular No. 772. Gross NPL represents the actual level of NPL without any adjustment for loans treated as "loss" and fully provisioned. Starting January 2013, figures are computed as prescribed under BSP Circular No. 772. Gross NPL represents the actual level of NPL without any adjustment for loans treated as "loss" and fully provisioned. As a complementary measure to computing gross NPL, banks shall likewise compute their net NPLs, which shall refer to gross NPLs less specific allowance for credit losses on the total loan portfolio, provided, that such specific allowance for credit losses on the total loan portfolio shall not be deducted from the total loan portfolio. For comparability purposes, 2012 NPL values were computed based on Circular 772. 15 Averages on date of issue. 16 Real interest rates were derived by deducting CPI inflation rate from the nominal rate. The CPI inflation rate (2006=100) was used. 17 The conceptual framework of the Balance of Payments, 5th Edition (BPM5) was adopted for the Balance of Payments (BOP) data from 1999 - 2004. Beginning 2005, the BOP is based on the Balance of Payments and International Investment Position Manual, 6th Edition (BPM6). Following the BOP concept, trade in goods exclude consigned raw materials and exports of manufactures with consigned imported inputs, articles temporarily imported/exported, replacements and returned goods, and aircrafts and vessels purchased under operational lease agreements. Trade in goods is also adjusted for undercoverage to include fish caught and traded in high seas, aircrafts and vessels purchased under financial lease agreements, goods procured in ports by carriers, and remittances in kind by overseas Filipinos. The balance or the difference between consigned exports and consigned imports is recorded in the trade in services account as manufacturing service. 18 Starting 1999, PSA's import data have been adjusted to include valuation adjustment in raw materials imported on consignment basis for electronics and garment exports. 19 Personal remittances is computed as the sum of net compensation of employees, (i.e., gross earnings of overseas Filipino (OF) workers with work contracts of less than one year, including all sea-based workers, less taxes, social contributions and transportation and travel expenditures in their host countries), personal transfers, (i.e., all current transfers in cash or in kind by OF workers with work contracts of one year or more as well as other household-to-household transfers between Filipinos who have migrated abroad and their families in the Philippines) and capital transfers between households (i.e., the provision of resources for capital purposes, such as for the construction of residential houses, between resident and non-resident households without anything of economic value being supplied in return). 20 Balances in the financial account from 2005 onwards under BPM6 are derived by deducting net incurrence of liabilities from net acquisition of financial assets. Negative balances indicate net borrowing while positive balances indicate net lending. Prior to 2005, balances are derived by deducting assets from liabilities. 21 Net FDI flows refer to non-residents' net equity capital (i.e., placements less withdrawals) + reinvestment of earnings + net balance of debt instruments (i.e. borrowings less repayments). Beginning 2005, FDI data are based on BPM6. 22 Net foreign portfolio investments (BOP concept) refer to non-residents' net placements in equity and debt securities issued by residents. Beginning 2005, data are based on BPM6. 23 With the adoption of the Balance of Payments Manual 5th edition (BPM5), the balance of payments (BOP) position corresponds to the change in BSP-NIR that is purely due to economic transactions, excluding the effects of revaluation of reserve assets and gold monetization. Data for 2010 and 2013 were revised to reflect post-audit adjustments. 24 Includes Reserve Position in the Fund. Figures from 1994 to 2004 were revised to reflect the reclassification of released collaterals on Brady Bonds from non-IR to IR-eligible assets of the BSP. This is in line with the treatment of foreign investments under R.A. 7653 (New Central Bank Act), which allows investments in securities even for maturities over 5 years to be included as part of the GIR. 25 Starting 2005, computation of GIR import cover is based on the IMF's Balance of Payments and International Investment Position Manual, 6th Edition (BPM6). Prior to 2005, computation was based on Balance of Payments Manual, 5th Edition (BPM5). 26 Data reflect revised denominator using end-month outstanding short-term external debt (with a two-month lag), except for months that are not end of quarter where outstanding short-term external debt by banks are not yet available. 27 This refers to adequacy of reserves to cover outstanding short-term external debt based on original maturity plus principal payments on medium- and long-term loans of the public and private sectors falling due in the next 12 months. Figures were revised to reflect data based on debt service schedule on debt outstanding as of 30 June 2014, external debt report debt service burden and outstanding short-term debt of non-banks as of 30 September 2014. 28 Covers BSP approved/registered debt owed to non-residents, with classification by borrower based on primary obligor per covering loan/rescheduling agreement/document. 29 Based on the April 2014 Update of the World Economic Outook of the International Monetary Fund (IMF). PHILIPPINES SELECTED ECONOMIC AND FINANCIAL INDICATORS 03-Feb-15 page 8 FOOTNOTES (cont'd): 30 Using the chained geometric method and a basket of currencies of major trading partners of the Philippines - United States, Euro Area, Japan, Australia, China, Singapore, South Korea, 31 32 33 34 35 36 37 38 39 40 41 42 43 44 Hong Kong, Malaysia, Taiwan, Indonesia, Saudi Arabia, United Arab Emirates, and Thailand, and baskets for Advanced Countries (United States, Euro Area, Japan and Australia) and Developing Countries (China, Singapore, South Korea, Hong Kong, Malaysia, Taiwan, Indonesia, Saudi Arabia, United Arab Emirates, and Thailand). Reference period is at 1980 = 100. Breakdown on expenditures not available starting 2002. Ratio computed based on the absolute value of the NG deficit. Positive ratio of either/both net domestic borrowings or/and foreign borrowings mean contributing to financing the deficit. Negative ratio of domestic borrowings (foreign borrowings) means either or both foreign loans (domestic loans) and withdrawals from cash balance financed the payments of domestic borrowings (foreign borrowings). Based on the compilation by the Department of Finance (DOF). Based on the compilation by the Bureau of the Treasury; foreign debt refers to foreign currency denominated debt. Data as of end-period. The consolidated public sector comprises the general government sector, nonfinancial public corporations, and financial public corporations, after elimination of intra-debt holdings among these sectors. Following international standards, as recommended by the IMF's Government Finance Statistics Manual 2001, the government has made revisions to the official debt data. Data as of end-period. All figures are as of end-period, unless otherwise indicated. Computed as the share-price divided by earnings per share. The business and consumer Confidence Indices were computed based from the quarterly Business Expectations Survey (BES) and Consumer Expectations Survey (CES) being conducted by the BSP. Meanwhile, the purchasing managers' index is generated by the Philippine Institute for Supply Management (PISM). The Business Confidence Index (CI) represents the overall business outlook of firms belonging to the SEC's Top 7000 Corporations of the Philippines. The index is computed as the percentage of firms with "improving" business outlook less the percentage of firms with "deteriorating" business outlook. The Consumer Confidence Index (CI) represents the overall economic outlook of consumers across three indicators: economic conditions, family financial situation and family income. The index is computed as the average percentage of households with "improving" outlook less the percentage of households with "deteriorating" outlook. The Purchasing Managers' Index Philippines (PMI) is based on monthly interviews of purchasing and supply managers from top manufacturing, services and wholesale and retail trade firms about the current market conditions. The overall index represents the weighted average of PMI across these sectors. An index above 50 indicates expansion, and an index below 50 implies a contraction. Based on the results of the Consumer Expectations Survey. CPI for the bottom 30% income households measures the composite change over time of the retail prices of goods and services commonly purchased by households in this income category and provides a more appropriate deflator of income and inflator of food prices and other basic commodities for the lower-income group. The proportion of families/individuals with per capita income/expenditure less than the per capita poverty threshold to the total number of families/individuals, i.e., P=(Q/n)*100 where Q=number of families/individuals with per capita annual income/expenditures less than the per capita poverty threshold (the minimum income/expenditure required for a family/individual to meet the basic food and non-food requirements). The 2013 poverty estimates are based on the 2013 Annual Poverty Indicator conducted in July 2013, which adopted the income module of the FIES (with some modifications in the section containing the list of wage and salary workers in the family), and used one replicate of the 2003 Master Sample or approximately 12,000 sample. LEGEND a Per PSA* foreign trade statistics. b No Awards. All bids were rejected. r p Preliminary *** .. Not available n.c. Not computed E Revised to reflect data updates, post-audit adjustments or Estimate change in data source / methodology * Based on deployment report from NAIA terminal fee counters consolidated by POEA Labor Assistance Center Note: Annual percent changes were computed based on values in millions. Sources of Basic Data: Philippine Statistics Authority (PSA)*, National Wages and Productivity Commission (NWPC), Department of Labor & Employment (DOLE), Department of Finance (DOF), Bureau of Treasury (BTr), Bangko Sentral ng Pilipinas (BSP) and Philippine Stock Exchange (PSE). * Republic Act No. 10625 (RA10625) signed on 12 September 2013 mandated the reorganization of the Philippine Statistical System (PSS) and the creation of the Philippine Statistics Authority (PSA) which merged the major statistical agencies engaged in primary data collection and compilation of secondary data, namely:National Statistics Office (NSO), National Statistical Coordination Board (NSCB), Bureau of Agricultural Statistics (BAS), and Bureau of Labor and Employment Statistics (BLES)

© Copyright 2026