download full article

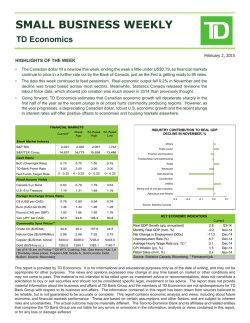

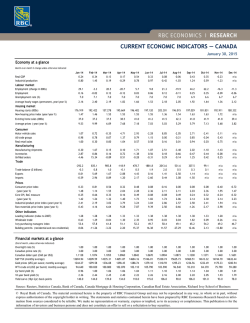

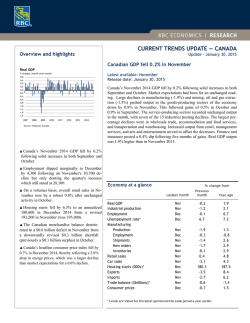

January 30th, 2015 WEEKLY MARKET INSIGHTS THE LATEST MARKET INSIGHTS FROM THE RICHARDSON GMP TEAM GDP at a glance Markets giveth and taketh with reckless abandon. After last week’s impressive rebound following a shaky start to the year, most markets are finishing the month in negative territory. The TSX is down –0.7% and the S&P 500 dropped –2.7%. Europe is down –0.9% with the initial reaction euphoria of the large scale QE worn off. Reality setting in with disappointing GDP numbers in both Canada and the U.S. TSX COMPOSITE 15,000 14,800 14,600 14,400 14,200 Energy commodities took a hit this week after inventory numbers came in higher than expected. Crude has rebounded this week finishing up +4.3% thanks to a 7% gain late Friday. Natural gas did not like the fact the ‘snowmageddon’ missed New York City and other highly populated areas. It dropped –10.3% to close well below $3. Most commodities are down this week. Moving onto the sectors, the Canadian Financials led to the downside dropping 3.1%. Next was Energy which is now very used to detracting value for investors. Consumer Staples have continued their strong run gaining +3.8% with most of the strength coming from the grocers and our lone convenience store behemoth. The Materials sector rose +2.9%, with gold names still doing well. Lumber producers such as Canfor, West Fraser, Interfor and Norbord all rose over 8%. Over in the U.S. all sectors were down. Technology (-4.1%) took the pole position with Staples (-3.5%) and Financials (-3.3%) rounding out the bottom three. Retailers gained this week, showing that it remains to be one of the hot areas benefitting from lower gas prices. If you’re saving $20-$30 per fill-up why not buy an extra pair of jeans? Other industry groups within the Consumer Discretionary (-1.3%) outperformed the broader index with the exception of media names. Tough time to be in the cable business. TSX One Week Sector Performance 14,000 M o n T u e W e d T u e W e d T h u S&P 500 2,065 2,045 2,025 2,005 1,985 M o n T h u Craig Basinger, CFA Chief Investment Officer 416.607.5221 [email protected] Director, Investment Management Group 416.969.3161 [email protected] 3.0% 2.0% Derek Benedet, CMT 1.0% Research Analyst 416.607.5021 [email protected] 0.0% -1.0% -2.0% Chris Kerlow, CFA -3.0% Cons Staples Health Care Materials Utilities Info Tech Cons Disc Industrials Telco Energy Financials -4.0% F r i Source: Bloomberg, Richardson GMP Limited Gareth Watson, CFA 4.0% F r i Research Analyst 416.943.6156 [email protected] 2 WEEKLY MARKET INSIGHTS GDP at a glance Canada It’s hard to find a reason to be excited about Canada. Today’s Gross Domestic Product (GDP) numbers were lower than expected and the loonie continues to fall. Should we be concerned about the Canadian economy? Before we touch on the overall health of the Canadian economy and our beloved loonie, let’s just briefly review the report this morning out of Statistics Canada announcing a monthly 0.2% decline for our country’s GDP in November. The weakness was mainly attributed to mining (down 2.5%), oil and gas extraction (down 0.7%) and manufacturing (down 1.9%), while the only bright spots included utilities (up 2.4%), retail (up 0.9%), agriculture & forestry (up 0.8%) and the public sector (education, health and public administration). We would note that this reading is for the month of November and there are some concerns that we saw activity in the oil & gas industry and manufacturing decline at the same time. However, the loonie actually averaged US$0.882 cents vs the U.S. dollar in November, so the impact of today’s lower currency had no material impact on manufacturing at that time. So if you’re wondering why manufacturing hasn’t benefited from a weakening loonie it’s because we won’t get GDP numbers for January for another couple of months and it can take time for a lower currency to actually influence manufacturing activity as it is not necessarily immediate. The market was not impressed by today’s report as economists were forecasting the monthly GDP indicator to increase 0.3% and not decline 0.2% (although the economy grew 1.9% year over year). Unfortunately the report will likely result in economists adjusting their GDP forecasts lower and currency traders reacted by selling the loonie. CAD/USD Bloomberg Consensus Forecasts $0.92 $0.90 $0.88 $0.86 $0.84 $0.82 $0.80 $0.78 $0.76 $0.74 $0.72 Spot Q1/15 Q2/15 Q3/15 Q4/15 2016 2017 Canadian Dollar (US$) $1.04 $1.01 $0.98 $0.95 $0.92 $0.89 $0.86 Jan-15 Oct-14 Jul-14 Apr-14 Jan-14 Oct-13 Jul-13 Apr-13 Jan-13 $0.83 Now let’s move on to the outlook for the Canadian economy. Yes, the GDP report missed expectations and yes, the loonie has tumbled in a very short period of time, $0.80 but are these indications of a pending recession? After all, didn’t the Bank of $0.77 Canada (BoC) cut interest rates this month to help stimulate the economy? Yes, the Bank of Canada took action on January 21 by cutting its key lending rate by 25 basis points from 1.00% to 0.75%; however, on that same day the central bank also released its monetary policy report where it forecasted GDP growth of 2.1% in 2015 and 2.4% in 2016 with the economy returning to full capacity by the end of 2016. These are not terrible numbers and even if they’re lowered in future forecasts it’s unlikely they will be lowered enough to put us in recession territory barring any unforeseen shock to the global economy such as material weakness in the United States. In fact while the BoC obviously highlighted lower energy prices as a concern in their latest interest rate statement, it also noted “outside the energy sector, we are beginning to see the anticipated sequence of increased foreign demand, stronger exports, improved business confidence and investment, and employment growth”. These are not the words of a central bank that is panicking. The decline in energy prices has been severe which will impact economic growth from coast to coast, thus taking the Canadian economy off of its planned trajectory and possibly putting downward pressure on inflation. To make up for these shortfalls the Bank of Canada realized that growth would have to come from other sectors of the economy resulting in the recent rate cut as some of these other sectors would benefit from a lower Canadian dollar. It’s unlikely rates were lowered to stimulate borrowing and purchasing from consumers as politicians and policy makers alike have highlighted our increasing personal debt levels. Instead, it’s likely the cut was directed to help industry keep our economy on trajectory even if the energy sector may struggle. So where does this leave the Canadian dollar? Let’s go through the usual checklist of reasons why traders would BUY the loonie over the U.S. dollar: 1) commodity prices strong or trending higher – NO, 2) Canadian economy outperforming the U.S. economy – NO, 3) Canadian interest rates forecast to increase before a similar move in the U.S. – NO. Is there any reason why currency traders would hold or purchase more Canadian dollars at the moment? Other than some thinking that the Canadian dollar is oversold, the answer is unfortunately NO. This tends to hold true for the Canadian dollar versus most other major currencies in the world as the loonie has underperformed in the month of January (down almost 8 cents against the U.S. dollar alone). The Canadian dollar has continued to fall even after the interest rate cut on January 21 as some economists are calling for a another 25 basis point cut as early as March (some WEEKLY MARKET INSIGHTS 3 of the same economists that weren’t expecting a rate cut at all this year…now they’re calling for two cuts in the first quarter…go figure!). And, the loonie took another hit today as the lower than expected GDP numbers increase the likelihood that a 25 basis point cut is coming on March 4, especially since all of the BoC’s forecasts have been made using a $60 oil price. Whether the additional rate cut comes, the damage has been done and the loonie will likely remain weak until that March meeting. Possible catalysts that could rekindle interest in our currency in the future include 1) no rate cut in March when the market is pricing one in, 2) a bounce in energy prices, and 3) the Federal Reserve delaying interest rate increases beyond what the market is expecting. So many moving parts to this equation will keep forecasts within a wide range between US$0.75 and US$0.85 for at least the first half of the year, but Bloomberg forecasts indicate that the market expects the loonie to regain some strength over time. So do we have a crystal ball that will tell us when the Canadian dollar will find a bottom and rebound? No we do not, but what’s important for investors to realize is that sentiment for the loonie is extremely poor, and will likely remain so until at least the next BoC meeting. Can the Canadian dollar go lower from here? If energy prices remain low, if rate cut chatter persists in Canada and if the Federal Reserve raises interest rates sooner than expected then yes, absolutely. U.S After the two best consecutive quarters of GDP growth since the great recession, the U.S. disappointed this morning expanding by just 2.6% in the fourth quarter. The chart below gives you an indication of the underlying drivers of GDP growth each quarter dating back to 2009. This past quarter was weighed down most heavily by net exports. The trade deficit widened to $471.5bb after imports grew 300% faster than exports. A strengthening U.S. dollar makes domestic exporters less competitive on a global scale and weighed on total output substantially in the past three months and which has likely continued this year. On a positive note the U.S. consumer added more to GDP than any other quarter in the past nine years. Savings at the pump and an improving labor environment is paying dividends to the economy as consumers are spending rather than investing their extra disposable income. In 2014, the U.S. economy added nearly 3mm jobs, the most this millennium. We took the opportunity to add to our U.S. consumer staple weightings this week and recommend taking a look at stocks that benefit from improved consumer spending. Another notable area was a pickup in inventories. A good sign that companies are seeing strong sales trends and stocking up for the growth ahead. Fixed private investment is showing continued signs of strength but investment into industrial and transportation equipment continues to lag. A surprising trend seeing that oil prices have been grinding lower for quite some time. Despite an improving economy and consumer confidence at an 11-year high, stock fell this week after earnings disappointments from almost any company that relies on high oil prices or international revenues as a large portion of their cash flow. The dislocation in stock performance and economic growth shows that the near term gyrations in the market have little to do with overall economic health. Contributions to % Change in Real GDP Bureau of Economic Analysis Q1 2013 Q2 2013 Q3 2013 Q4 2013 Q1 2014 Q2 2014 Q3 2014 Q4 2014 Personal Consumption Expenditures Goods Services Gross private domestic investment Fixed investment Nonresidential Structures Equipment Industrial equipment Transportation Equipment Other equipment Intellectual Property Products Residential Change in Private Inventories Net Exports Exports Imports Gov't consumption and gross investment Federal National defense Nondefense State and local Total Real GDP Research and Development Excluding Research and Development 2.45 1.35 1.11 1.12 0.42 0.2 -0.33 0.28 0.03 0.08 0.15 0.24 0.22 0.7 -0.08 -0.12 0.04 -0.75 -0.79 -0.55 -0.24 0.04 2.7 0.03 2.71 1.23 0.3 0.93 1.03 0.74 0.21 0.19 0.09 0 0.12 -0.12 -0.08 0.53 0.3 -0.54 0.82 -1.36 0.04 -0.26 -0.09 -0.17 0.31 1.8 0.01 1.76 1.39 0.8 0.59 2.5 1.01 0.67 0.29 0.27 0.2 0.05 -0.07 0.11 0.34 1.49 0.59 0.67 -0.09 0.04 -0.08 0.03 -0.11 0.13 4.5 -0.08 4.59 2.51 0.83 1.69 0.62 0.95 1.23 0.34 0.76 0.02 0.45 0.36 0.14 -0.28 -0.34 1.08 1.3 -0.22 -0.71 -0.79 -0.55 -0.24 0.07 3.5 -0.02 3.52 0.83 0.23 0.6 -1.13 0.03 0.2 0.08 -0.06 0.17 0 -0.09 0.18 -0.17 -1.16 -1.66 -1.3 -0.36 -0.15 -0.01 -0.18 0.17 -0.14 -2.1 0.07 -2.18 1.75 1.33 0.42 2.87 1.45 1.18 0.35 0.63 0.32 0.04 -0.14 0.21 0.27 1.42 -0.34 1.43 -1.77 0.31 -0.06 0.04 -0.1 0.38 4.6 0.09 4.51 2.21 1.06 1.15 1.18 1.21 1.1 0.14 0.63 0.35 0.45 -0.05 0.34 0.1 -0.03 0.78 0.61 0.16 0.8 0.68 0.66 0.01 0.13 5 0.16 4.8 2.87 1.2 1.67 1.2 0.37 0.24 0.08 -0.11 -0.19 -0.17 0 0.27 0.13 0.82 -1.02 0.37 -1.39 -0.4 -0.54 -0.58 0.04 0.14 2.6 0.13 2.51 WEEKLY MARKET INSIGHTS 4 Here and now with the Dow You hear it daily on the news, whether it is the six o’clock news on TV or the radio during the commute home. The Dow was up, down, up then down, or any type of permutation. Maybe it’s because our job is to watch the markets on a daily basis, but I’m astonished that anyone actually cares or quotes the Dow Jones Industrial Average. Perhaps it’s because it is the first index (technically an average) currently well over 100 years old or perhaps it’s used simply because of its name recognition. It really serves as a poor measure of overall stock performance as it tracks only 30 companies and the price weighted average totally ignores the size of the companies making the weighting very troubling. Regardless of its faults, like an annoying uncle sometimes we just have to live with it. With a 9.6% weighting, Visa has for some time made up a large portion of the Dow. Following yesterday’s remarkable earnings rise, Visa also announced a 4 for 1 stock split effective March 19th, 2015. Goldman Sachs Group Inc. will then become the most heavily weighted member on the Dow with a 7% weighting at today’s prices. The top five names will consist of Goldman, 3M, IBM, Boeing and United Technologies. Visa will fall to the 20 th spot with a mere 2.6%. The top five will now make up 30% of the total, down from 33.2% currently, which is a good thing. The Dow still remains very top heavy with an uneven overall sector allocation. It’s light on Energy, Staples and has no Utilities, and has double the Industrial weighting (note the name) compared to the S&P 500. Dow Sector Weights Sector Financials Industrials Information Technology Health Care Consumer Discretionary Energy Consumer Staples Materials Telecommunication Services Weight 15.3 19.6 19.1 11.2 14.2 7.0 7.9 2.7 2.9 While we’re on the topic let’s take a look at how the Dow has performed so far this year. Earnings season has definitely not been uniformly positive for the blue chips. Some of the household names are showing significant YTD losses. The average is down over 3.0% YTD. Six of the thirty names are down over 10%. Led by Caterpillar (-13.0%), JP Morgan (-12.6%), American Express (-12.5%), Microsoft (-11.8%), Chevron (-10.7%) and Goldman Sachs (-10.5%). Seven of thirty are positive YTD with Boeing (+12.2%), Merck (+7.5%) and United Health Group (+6.0%) being the only clear winners. For income investors it’s not a bad shortlist for quality dividend names with a third of the members paying over a 3% dividend. With bond yield tanking higher yielding stocks are increasingly attractive, although at this point in time with the C$ this weak it’s possible for the Loonie to easily erase a year’s worth of dividends. From a sector perspective adding some U.S. payers allows you to gain exposure to certain sectors which are terribly underrepresented on the TSX. One example is the lack of quality Canadian dividend payers in the Tech space. Names like IBM, Microsoft, Intel and Cisco would certainly have a place in a diversified portfolio with an income focus. The leader drops a weight class in the Dow Jone Industrial Average Name Price Weight (Old) Weight (New) RSI Yield GICS_SECTOR_NAME GOLDMAN SACHS GROUP INC 174.2 6.4 7.0 38.2 1.4 Financials 3M CO 164.2 6.1 6.6 60.8 2.5 Industrials INTL BUSINESS MACHINES CORP 154.1 5.7 6.2 47.2 2.9 Information Technology BOEING CO/THE 145.1 5.4 5.8 78.5 2.5 Industrials UNITED TECHNOLOGIES CORP 115.8 4.3 4.6 52.1 2.0 Industrials UNITEDHEALTH GROUP INC 108.4 4.0 4.3 61.3 1.4 Health Care HOME DEPOT INC 105.8 3.9 4.2 61.6 1.8 Consumer Discretionary TRAVELERS COS INC/THE 103.4 3.8 4.1 46.5 2.1 Financials CHEVRON CORP 102.4 3.8 4.1 38.9 4.2 Energy JOHNSON & JOHNSON 101.4 3.8 4.0 44.5 2.8 Health Care NIKE INC -CL B 93.5 3.5 3.7 49.5 1.2 Consumer Discretionary MCDONALD'S CORP 92.7 3.4 3.7 55.1 3.7 Consumer Discretionary WALT DISNEY CO/THE 92.3 3.4 3.7 47.0 1.2 Consumer Discretionary EXXON MOBIL CORP 88.0 3.3 3.5 37.9 3.1 Energy WAL-MART STORES INC 86.8 3.2 3.5 53.6 2.2 Consumer Staples PROCTER & GAMBLE CO/THE 84.6 3.1 3.4 31.6 3.0 Consumer Staples AMERICAN EXPRESS CO 81.9 3.0 3.3 28.0 1.3 Financials CATERPILLAR INC 79.8 3.0 3.2 27.2 3.5 Industrials DU PONT (E.I.) DE NEMOURS 72.3 2.7 2.9 47.9 2.6 Materials VISA INC-CLASS A SHARES 260.3 9.6 2.6 36.6 0.7 Information Technology MERCK & CO. INC. 61.4 2.3 2.5 55.8 2.9 Health Care JPMORGAN CHASE & CO 55.0 2.0 2.2 38.5 2.9 Financials VERIZON COMMUNICATIONS INC 45.8 1.7 1.8 38.6 4.8 Telecommunication Services COCA-COLA CO/THE 41.6 1.5 1.7 43.4 2.9 Consumer Staples MICROSOFT CORP 41.2 1.5 1.6 32.0 3.0 Information Technology INTEL CORP 33.6 1.2 1.3 35.9 2.9 Information Technology AT&T INC 32.9 1.2 1.3 41.5 5.7 Telecommunication Services PFIZER INC 31.6 1.2 1.3 46.2 3.5 Health Care CISCO SYSTEMS INC 26.9 1.0 1.1 46.0 2.8 Information Technology GENERAL ELECTRIC CO 24.0 0.9 1.0 42.8 3.8 Industrials YTD % (10.50) (0.32) (3.95) 12.25 0.13 6.05 0.47 (2.81) (10.73) (3.46) (3.17) (1.17) (2.19) (6.13) 0.58 (7.07) (12.50) (12.97) (2.35) (0.92) 7.54 (12.58) (1.50) (1.66) (11.80) (7.91) (1.53) 0.71 (4.01) (5.18) 3M % (7.30) 7.57 (6.36) 17.76 8.21 14.02 8.08 2.82 (14.57) (5.77) 0.03 (0.90) 2.01 (8.24) 12.92 (2.66) (8.31) (20.51) 6.65 9.78 6.51 (7.93) (7.74) 0.27 (11.10) 2.52 (4.26) 5.06 10.84 (6.70) WEEKLY MARKET INSIGHTS 5 This material is provided for general information and is not to be construed as an offer or solicitation for the sale or purchase of securities mentioned herein. Past performance may not be repeated. Every effort has been made to compile this material from reliable sources however no warranty can be made as to its accuracy or completeness. Before acting on any of the above, please seek individual financial advice based on your personal circumstances. However, neither the author nor Richardson GMP Limited makes any representation or warranty, expressed or implied, in respect thereof, or takes any responsibility for any errors or omissions which may be contained herein or accepts any liability whatsoever for any loss arising from any use or reliance on this report or its contents. Richardson GMP Limited is a member of Canadian Investor Protection Fund. Richardson is a trade-mark of James Richardson & Sons Limited. GMP is a registered trade-mark of GMP Securities L.P. Both used under license by Richardson GMP Limited.

© Copyright 2026