ACA Flowchart - CCH Small Firm Services

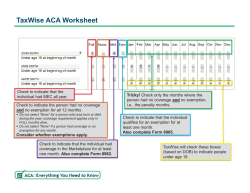

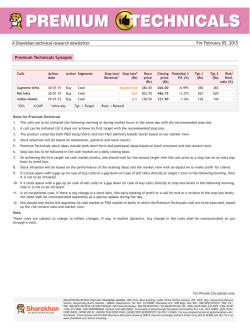

ACA Flowchart Insurance Part Year Start Here: Is there a tax return filing requirement? NO YES Do any of the individuals qualify for a coverage exemption for any part of the year? YES Does the insurance meet minimum coverage requirements*? NO Was the insurance purchased through the marketplace? NO No further action required and is exempt from the shared responsibility payment. Use form 8965 to identify coverage exemption for the part of the year the exemption applies (Continue to next step) NO Use 1040 ACA Wkt to calculate shared responsibility payment due for the non-covered part of the year. YES YES Use 1040 ACA Wkt to identify the calendar months not covered and calculate shared responsibly payment. Is the return reported as Married Filing Separately? YES Premium Tax Credit cannot be applied to the return, complete procedures to reconcile possible Advance Premium Tax Credit due. Was the form 1095-A received? NO Contact health insurance provider for coverage details. NO YES * Most health insurance obtained through the following resources meet the minimum coverage requirements: • Employer – sponsored coverage • Government – sponsored programs • Health insurance purchased through the Marketplace • Health insurance purchased directly from an insurance provider www.cchsfs.com ©2015 Wolters Kluwer, CCH Small Firm Services. All rights reserved. Indicate full coverage on 1040 ACA Wkt and identify Marketplace coverage. Use form 8962 to compute Premium Tax Credit or Advanced Premium Tax Credit

© Copyright 2026