Interviewing the Taxpayer 1. Before thinking about ACA: First

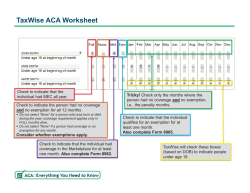

Interviewing the Taxpayer 1. Before thinking about ACA: First properly identify everybody that belongs on the return a. Review 13614-C with the client “in order” b. E.g., establish TP, SP, filing status, dependents in Parts I and II before you look at Part VI 2. While reviewing Part VI and taxpayer’s documentation with them, look for a. 1095-A b. Insurance information on Forms W-2, 1099-R, 1099-SSA c. Documentation from the Marketplace about an exemption 3. Ask questions: a. Many TPs will not have documentation of MEC or which months they had coverage i. Like any other tax issue: The return is their responsibility; take them at their word unless you have reason to believe otherwise b. Did you/SP/Dep have medicare or Medicaid all year? i. If only part, which months were covered? c. Did you/SP/Dep have other coverage that was “MEC” for all or part of the year? i. If only part, which months were covered? d. Did you/SP/Dep purchase insurance through the Marketplace? i. Do you have 1095-A? - Should receive by 1/31/2015 ii. Was TP married or divorced during the year?* iii. Did you pay for insurance for someone you could not claim? Or claim someone for whom insurance is paid for by another?* iv. Use 4012, ACA-11 & 12 to help with these questions e. Did you/SP/Dep get an exemption from the Marketplace? i. Need exemption certificate number(s) or exemption code(s) ii. Might receive this from the IRS f. PTC and some exemptions will require calculation of “household MAGI”: i. Does TP, SP or dependents have any MAGI ‘add-back’ income* ii. Does TP have dependent income information? iii. Or know if the dependent has a filing requirement? Or files just to get back withholding. *Add-back income = Untaxed portion of Social Security Income

© Copyright 2026

![[7.1.2] Compensation Payments in respect of Personal Injuries](http://s2.esdocs.com/store/data/000502603_1-53ac1a989b68853ba6f6b00260848dd2-250x500.png)